Swiss Voters Reject Corporate Tax Overhaul --2nd Update

February 12 2017 - 1:50PM

Dow Jones News

By Brian Blackstone

ZURICH -- Swiss voters Sunday rejected a corporate-tax-overhaul

plan backed by the government and business, in a blow to the

wealthy Alpine country's hopes to bring its tax policies in line

with international norms while maintaining its global

competitiveness.

In rebuffing the government's proposals, voters were swayed by

concerns the plan was too generous to corporations at the expense

of individual taxpayers. Proponents of the plan said its rejection

places Switzerland's economy -- home to global corporate giants

including Nestlé SA, Swatch Group AG and UBS Group AG -- at

risk.

According to preliminary results released by the government, 59%

of voters cast ballots against the reform plan, which parliament

approved in 2016, while 41% were in favor. The referendum results

are binding, meaning parliament must come up with a new tax reform

plan.

Swiss finance minister Ueli Maurer said at a press conference

Sunday that Switzerland is committed to changing its corporate tax

system but that there isn't much wiggle room to revise the plan

that was voted down. He said it was unlikely now that a new program

will be in place by January 2019, which the tax overhaul was slated

to go into effect.

Swissmem, an association of mechanical and electrical

engineering companies, said in a statement after the vote, "The

rejection of this reform leads to legal uncertainty which could

have negative consequences on the investment activities of

enterprises."

"The risk is that this weakens the Swiss industrial environment

and will lead to job losses, especially in a challenging economic

period," the association said.

Polls had given the pro-government side a sizable lead in

December, but they tightened ahead of Sunday as opponents

successfully cast the plan as a giveaway to business.

The rejection of the government's tax plan was widespread across

nearly all of Switzerland's 26 cantons. One of the few to vote in

favor was Vaud in western Switzerland, which is home to Nestlé.

Switzerland faces pressure from the European Union and other

international institutions to get rid of the special deals that

individual states, known as cantons, strike with multinational

companies that reduced their tax burden.

Switzerland's average corporate tax, of around 21%, is lower

than in other developed economies including the U.S., Germany and

Japan, according to data from the Organization for Economic

Cooperation and Development.

Switzerland isn't in the EU, but it agreed with the EU in 2014

to abolish the special arrangements that taxed foreign and domestic

revenue differently. If nothing is done, Swiss-based companies face

the prospect of retaliation from tax authorities in other countries

where they do business.

Parliament last year approved legislation eliminating these tax

preferences, while giving cantons leeway to adjust their rates.

Under the government's failed plan, the current patchwork system

would have been replaced by a corporate rate -- lower in most cases

-- that would apply across firms in a particular canton. Sweeteners

were added for patent-related revenue, research and development,

and capital taxes.

But opponents gathered the 50,000 signatures required to force

Sunday's referendum.

Write to Brian Blackstone at brian.blackstone@wsj.com

(END) Dow Jones Newswires

February 12, 2017 13:35 ET (18:35 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

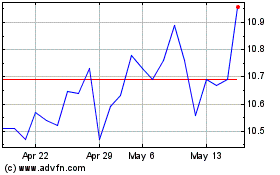

Swatch (PK) (USOTC:SWGAY)

Historical Stock Chart

From Jan 2025 to Feb 2025

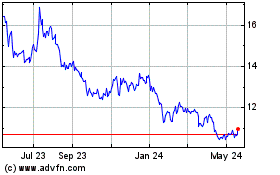

Swatch (PK) (USOTC:SWGAY)

Historical Stock Chart

From Feb 2024 to Feb 2025