Swatch Shares Slump on Profit Warning--Update

July 15 2016 - 5:18AM

Dow Jones News

By Brian Blackstone

ZURICH-- Swatch Group AG warned Friday that sales and profit

slid during the first half of 2016, sending its shares sharply

lower and suggesting that the luxury goods sector faces major

headwinds in an uncertain global economic environment.

The Biel-based company, which is known not only for its cheap

plastic Swatch watches but also its more expensive brands,

including Omega, Blancpain and Breguet, said its net sales are

expected to have declined 12% in the first half of 2016 compared

with the same period in 2015, due to weaker sales in key markets

such as Hong Kong and Europe. It also said that profit likely fell

by 50-60%.

The decline was "obviously due to the decrease in sales but also

to the tradition and the industrial long-term philosophy of the

Swatch Group to consider its employees not just as a cost factor

but to keep them...to maintain investments in new products and

marketing and to pursue a defensive price increase policy," Swatch

said in a statement.

In addition to Hong Kong, the company cited weakness in France

and its home market, Switzerland, though is said that developments

in mainland China were positive.

Swatch said it would release details of its first-half results

on July 21.

"It has to be seen what reactions the company will announce next

week, but estimates will see a marked reduction and investors

confidence will be shaken," wrote analysts at Vontobel.

Swatch was the biggest decliner by far among major Swiss

companies. At 0830 GMT, its share were down 11% after plunging

nearly 13% in early European trading.

Shares in other luxury goods companies were also down.

Richemont--the Geneva-based owner of Cartier jewelry and

watchmakers including IWC, Piaget and Jaeger-LeCoultre--saw it

share price fall nearly 3.5% in early trading.

"The weak set of figures were widely expected, however, more

severe in magnitude," said analysts at Baader Helvea Equity

Research, in a research note referring to the Swatch warning.

"Only the full-set of figures will give the picture to what

extent the figures include one-offs," they added.

Swatch receives around 45% of its sales from high-end brands

like Omega, which retail for more than $7,000, and 20% from its

upper-end brands like Longines and Rado, which sell from around

$1,200.

Write to Brian Blackstone at brian.blackstone@wsj.com

(END) Dow Jones Newswires

July 15, 2016 05:03 ET (09:03 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

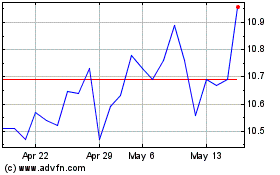

Swatch (PK) (USOTC:SWGAY)

Historical Stock Chart

From Jan 2025 to Feb 2025

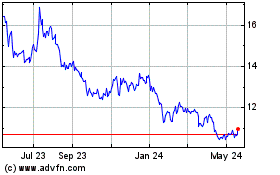

Swatch (PK) (USOTC:SWGAY)

Historical Stock Chart

From Feb 2024 to Feb 2025