Current Report Filing (8-k)

April 01 2021 - 8:31AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 28, 2021

SUGARMADE,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

000-23446

|

|

94-3008888

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer

Identification

No.)

|

|

750

Royal Oaks Dr., Suite 108

Monrovia,

CA

|

|

91016

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (888) 982-1628

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

8.01. Other Events.

On

March 28, 2021, Sugarmade, Inc. (the “Company”) entered into a letter of intent (the “LOI”) by and between

the Company and Lemon Glow Company (“Lemon Glow”). Under the terms of the LOI, the Company and Lemon Glow agreed to

enter into an acquisition agreement pursuant to which the Company would acquire Lemon Glow for a purchase price of $23,280,000,

$4,656,000 of which will be paid in cash and $18,624,000 of which will be paid in equity. Pursuant to the terms of the LOI, the

Company must pay $680,000 as an earnest money deposit. To date, the Company has paid Lemon Glow $400,000 of the earnest money

deposit.

Lemon

Glow is the owner of a 640 acre property located in Lake Country, California. Lemon Glow is in the process of improving 32 acres

of the 640 acres for use as a regulated cannabis cultivation site. The Company and Lemon Glow expect that the annual potential

cultivation yield at the property is approximately 4,000 pounds per acre of dry trimmed cannabis flower, although there can be

no assurance that the property will yield this amount or any at all.

The

LOI contemplates that the Company will conduct due diligence and that Lemon Glow will cooperate with the Company in its due diligence.

The LOI is valid for 30 days from March 28, 2021.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

SUGARMADE,

INC.

|

|

|

|

|

|

Date:

April 1, 2021

|

By:

|

/s/

Jimmy Chan

|

|

|

Name:

|

Jimmy

Chan

|

|

|

Title:

|

Chief

Executive Officer and Chief Financial Officer

|

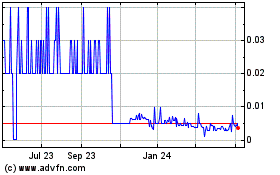

Sugarmade (PK) (USOTC:SGMD)

Historical Stock Chart

From Aug 2024 to Sep 2024

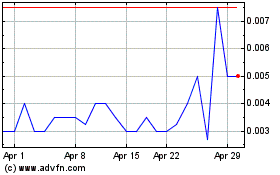

Sugarmade (PK) (USOTC:SGMD)

Historical Stock Chart

From Sep 2023 to Sep 2024