Spyglass Resources Corp. Announces 2013 Reserves, 2013 Full Year

and Fourth Quarter Results, 2014 Guidance and March Monthly

Dividend

All values are in Canadian dollars unless otherwise indicated.

Conversion of natural gas volumes to barrels of oil equivalent

(boe) are at 6:1.

CALGARY, ALBERTA--(Marketwired - Mar 11, 2014) - Spyglass

Resources Corp. (TSX:SGL)(OTCQX:SGLRF) ("Spyglass", or the

"Company") is pleased to announce annual financial and operating

results for the year ended December 31, 2013. Selected financial

and operational information for the full year and fourth quarter of

2013 is outlined below along with 2013 reserves evaluated in

accordance with National Instrument 51-101 - Standards of

Disclosure for Oil and Gas Activities ("NI 51-101") and should be

read in conjunction with Spyglass' Audited Consolidated Financial

Statements and Management's Discussion and Analysis for the years

ended December 31, 2013 and 2012 on www.sedar.com and also

available at www.spyglassresources.com.

The first quarter of 2013 was highlighted by the completion of a

Plan of Arrangement (the "Arrangement") combining Pace Oil and Gas

Ltd. ("Pace"), AvenEx Energy Corp. ("AvenEx") and Charger Energy

Corp. ("Charger"). For the following three quarters of the year,

Spyglass made substantial progress towards its objectives with the

successful execution of its low risk, high netback light oil

drilling and optimization program, completing key non-core

dispositions and ongoing initiatives to reduce operating and

administrative costs.

Fourth Quarter and 2013 Summary

- 2013 funds flow from operations was $60.6 million ($0.54 per

share).

- Funds flow from operations for the fourth quarter of 2013 was

$11.4 million ($0.09 per share), primarily reflecting wider

Canadian crude oil price differentials during the quarter.

- Capital expenditures (prior to dispositions) for 2013 were

$59.7 million which included successfully drilling 14 (10.9 net)

horizontal and 2 (2.0 net) vertical light oil wells in Southern and

Central Alberta.

- During the fourth quarter of 2013, capital expenditures (prior

to dispositions) were $15.0 million. In addition to other capital

activity, Spyglass drilled and completed 2 (2.0 net) Pekisko light

oil wells at Matziwin which came on production in December 2013. On

a combined basis, the 30 day initial production rates for these two

most recent wells was 450 boe/d, with current stabilized combined

production rates of approximately 420 boe/d.

- Production for 2013 increased by 15 percent to 15,215 boe/d

from 13,223 boe/d in 2012 as a result of the Arrangement and the

successful light oil drilling and optimization program.

- Production for the fourth quarter of 2013 averaged 15,873

boe/d, 49 percent oil and liquids. The quarter incorporates the

impact of successful non-core asset dispositions (approximately 275

boe/d), the shut in of uneconomic natural gas production

(approximately 200 boe/d) and a planned turn around at Dixonville

(approximately 140 boe/d). Severe winter weather and shut-ins

related to gas conservation also affected the Company's production

volumes in the fourth quarter and into the first quarter of

2014.

- Spyglass generated $22.7 million in net proceeds from non-core

property dispositions and $1.4 million from seismic sales in

2013.

- During 2013 Spyglass declared dividends of $0.2025 per share

resulting in an all-in payout ratio of 104% for the year.

- Operating costs for the fourth quarter of 2013 were $18.33 per

boe, in line with guidance, while cash general and administrative

expenses were $2.45 per boe, which was better than guidance.

- Net debt at December 31, 2013 was $300.5 million, comprised of

$287.0 million in long-term bank debt and a $13.5 million working

capital deficit.

Selected Financial and Operating Information

| Operating |

Q4 2013 |

2013(1) |

2012(2) |

| Average daily production |

|

|

|

|

Oil (bbls/d) |

7,198 |

7,000 |

6,050 |

|

NGLs (bbls/d) |

647 |

450 |

324 |

|

Natural Gas (Mcf/d) |

48,164 |

46,588 |

41,093 |

| Total (boe/d) |

15,873 |

15,215 |

13,223 |

| Realized prices |

|

|

|

|

Oil ($/bbl) |

72.89 |

82.09 |

76.28 |

|

NGLs ($/bbl) |

43.46 |

50.96 |

58.36 |

|

Natural Gas ($/mcf) |

3.40 |

3.23 |

2.43 |

| Total Revenue ($/boe) |

45.13 |

49.16 |

43.88 |

| Netback ($/boe) |

|

|

|

|

Revenue |

45.13 |

49.16 |

43.88 |

|

Royalties |

(9.42) |

(10.21) |

(9.70) |

|

Operating expense |

(18.33) |

(18.89) |

(16.15) |

|

Transportation expense |

(2.29) |

(2.20) |

(2.09) |

| Operating Netback(3) |

15.09 |

17.86 |

15.94 |

|

Cash General & Administrative Expense |

(2.45) |

(3.01) |

(3.69) |

|

Realized hedging gain (loss) |

(2.01) |

(1.77) |

1.51 |

|

Interest & Financing & Other |

(2.80) |

(2.17) |

(1.60) |

| Cash Netback(3) |

7.83 |

10.91 |

12.16 |

|

|

|

|

| Financial ($000)(except per share

figures) |

Q4 2013 |

2013(1) |

2012(2) |

| Funds Flow from Operations(3) |

11,426 |

60,584 |

58,849 |

|

per share |

0.09 |

0.54 |

0.96 |

| Net Income (Loss) |

(16,866) |

43,331 |

(152,991) |

|

per share |

(0.13) |

0.39 |

(2.50) |

| Dividends |

8,645 |

25,934 |

- |

|

per share(4) |

0.0675 |

0.2025 |

- |

| Capital Expenditures |

14,991 |

59,654 |

83,217 |

| Capital Expenditures (net of dispositions) |

2,476 |

36,940 |

83,217 |

| All-in Payout Ratio (%)(3) |

97% |

104% |

- |

| Net Debt(3) |

300,508 |

300,508 |

215,817 |

|

|

|

|

| Share Information (000's) |

Q4 2013 |

2013(1) |

2012(2) |

| Common shares outstanding, end of period |

128,077 |

128,077 |

60,991 |

| Weighted average shares outstanding |

128,077 |

112,086 |

61,157 |

| (1) Year to date results for 2013 are presented as Pace

standalone from January 1 to March 28, 2013 and incorporate the

Arrangement and the combined financial and operating results for

the three companies from March 29 to December 31, 2013. |

| (2) 2012 results reflect Pace as a standalone

entity. |

| (3) See Non-GAAP measures. |

| (4) 2013 YTD dividends are calculated based on

128,076,720 shares outstanding on the initial record date of April

26, 2013. |

2013 Oil and Natural Gas Reserves

Spyglass' year ending December 31, 2013 reserves were evaluated

by independent reserves evaluator McDaniel & Associates

Consultants Ltd. ("McDaniel"). Reserves are stated on a gross

company working interest basis unless otherwise noted. The

evaluation of Spyglass' oil and gas properties was done in

accordance with the definitions, standards and procedures contained

in the Canadian Oil and Gas Evaluation Handbook ("COGE Handbook")

and National Instrument 51-101 - Standards of Disclosure for Oil

and Gas Activities ("NI 51-101"). In addition to the information

disclosed below more detailed information will be included in

Spyglass' AIF.

Highlights of the 2013 reserve evaluation include:

- December 31, 2013 proved plus probable reserves ("2P")

increased by 35 percent to 82.4 MMboe from 61.2 MMboe at December

31, 2012.

- December 31, 2013 total proved reserves ("TP") increased by 33

percent to 54.7 MMboe from 41.1 MMboe at December 31, 2012.

- Maintained a reserve life index of 14.2 years for 2P reserves

and 9.4 years for TP reserves, based on fourth quarter 2013

production of 15,873 boe/d.

- Finding, development and acquisition ("FD&A") costs were

$17.02 per 2P boe and $21.14 per TP boe, including technical

revisions and changes in FDC.

- Present value of reserves at a 10 percent discount rate

("PV10") was $868.5 million on a 2P basis, $642.5 million on a TP

basis and $555.8 million on a proved developed producing

basis.

- Net asset value on a 2P basis is approximately $626.4 million

or $4.89 per share.

Summary of Reserves

| Working Interest Reserves(1)(2) |

| Category |

Oil (Mbbl) |

Natural Gas (MMcf) |

NGL (Mbbl) |

Total (Mboe) |

| Proved producing |

22,801 |

90,565 |

763 |

38,658 |

| Proved non-producing |

530 |

17,813 |

118 |

3,617 |

| Proved Undeveloped |

5,737 |

38,582 |

233 |

12,400 |

|

Total Proved(3) |

29,068 |

146,960 |

1,114 |

54,675 |

| Probable |

13,540 |

81,268 |

687 |

27,771 |

|

Total proved plus probable(3) |

42,607 |

228,228 |

1,801 |

82,447 |

| (1) Based on the McDaniel January 1, 2014 forecast

prices. |

| (2) Working interest reserves are total working

interest before the deduction of any royalties. |

| (3) Numbers may not add due to rounding. |

| Summary of Before Tax Net Present Values ($MM)(1) |

| Category |

0% |

5% |

10% |

15% |

20% |

| Proved producing |

$1,049.9 |

$721.0 |

$555.8 |

$458.5 |

$394.4 |

| Proved non-producing |

63.2 |

44.2 |

33.4 |

26.5 |

21.7 |

| Proved Undeveloped |

181.6 |

99.2 |

53.3 |

25.5 |

7.7 |

|

Total Proved |

1,294.7 |

864.4 |

642.5 |

510.5 |

423.8 |

| Probable |

787.2 |

374.5 |

226.0 |

154.5 |

113.2 |

|

Total proved plus probable |

$2,081.9 |

$1,238.9 |

$868.5 |

$665.0 |

$537.0 |

| Summary of After Tax Net Present Values ($MM)(1) |

| Category |

0% |

5% |

10% |

15% |

20% |

| Proved producing |

$1,043.4 |

$719.5 |

$555.4 |

$458.4 |

$394.4 |

| Proved non-producing |

47.4 |

39.7 |

32.0 |

26.0 |

21.6 |

| Proved Undeveloped |

136.3 |

80.6 |

45.3 |

21.8 |

5.9 |

|

Total Proved |

1,227.0 |

839.8 |

632.7 |

506.3 |

421.9 |

| Probable |

590.7 |

289.8 |

181.6 |

128.7 |

97.3 |

|

Total proved plus probable |

$1,817.7 |

$1,129.6 |

$814.3 |

$635.0 |

$519.2 |

| (1) Based on the McDaniel January 1, 2014 forecast

prices. |

Reconciliation of Gross (Working Interest) Reserves by

Product

|

Proved Developed Producing |

|

Light & Medium Oil |

Heavy Oil |

Assoc & Non Assoc Gas |

NGL |

Total Oil Equivalent |

|

|

(Mstb) |

(Mstb) |

(MMcf) |

(Mstb) |

(Mboe) |

|

Opening balance as of Dec. 31, 2012(1) |

20,198 |

913 |

66,843 |

498 |

32,749 |

|

Production |

(2,155) |

(400) |

(17,005) |

(164) |

(5,554) |

|

Technical revisions |

254 |

137 |

3,263 |

62 |

996 |

|

Extensions and Improved Recovery(2) |

621 |

3 |

1,313 |

6 |

849 |

|

Acquisitions(3) |

2,295 |

1,093 |

36,609 |

387 |

9,876 |

|

Dispositions |

(103) |

0 |

(1,186) |

(26) |

(327) |

|

Economic factors |

(55) |

0 |

728 |

2 |

69 |

|

Closing Balance as of Dec. 31, 2013 |

21,055 |

1,746 |

90,565 |

763 |

38,658 |

|

|

|

Total Proved |

|

Light & Medium Oil |

Heavy Oil |

Assoc & Non Assoc Gas |

NGL |

Total Oil Equivalent |

|

|

(Mstb) |

(Mstb) |

(MMcf) |

(Mstb) |

(Mboe) |

|

Opening balance as of Dec. 31, 2012(1) |

22,489 |

985 |

101,809 |

635 |

41,077 |

|

Production |

(2,155) |

(400) |

(17,005) |

(164) |

(5,554) |

|

Technical revisions |

173 |

138 |

3,084 |

61 |

886 |

|

Extensions and Improved Recovery(2) |

603 |

64 |

1,544 |

23 |

947 |

|

Acquisitions(3) |

6,019 |

1,309 |

58,843 |

597 |

17,731 |

|

Dispositions |

(103) |

0 |

(2,418) |

(52) |

(558) |

|

Economic factors |

(55) |

1 |

1,103 |

15 |

145 |

|

Closing Balance as of Dec. 31, 2013 |

26,971 |

2,097 |

146,960 |

1,114 |

54,675 |

|

|

|

Total Proved plus Probable |

|

Light & Medium Oil |

Heavy Oil |

Assoc & Non Assoc Gas |

NGL |

Total Oil Equivalent |

|

|

(Mstb) |

(Mstb) |

(MMcf) |

(Mstb) |

(Mboe) |

|

Opening balance as of Dec. 31, 2012(1) |

31,507 |

1,337 |

164,598 |

942 |

61,220 |

|

Production |

(2,155) |

(400) |

(17,005) |

(164) |

(5,554) |

|

Technical revisions |

(330) |

67 |

2,212 |

54 |

(578) |

|

Extensions and Improved Recovery(2) |

728 |

81 |

1,963 |

32 |

1,169 |

|

Acquisitions(3) |

10,175 |

1,682 |

89,215 |

992 |

27,719 |

|

Dispositions |

(145) |

0 |

(3,332) |

(70) |

(770) |

|

Economic factors |

58 |

1 |

(4,999) |

15 |

(759) |

|

Closing Balance as of Dec. 31, 2013 |

39,838 |

2,769 |

228,228 |

1,801 |

82,447 |

| (1) Opening balance at December 31, 2012 represents

reserves of Pace, the continuing reporting issuer following the

Arrangement. |

|

(2) Extensions: Reserves added as a result of the development of an

oil or gas pool by drilling wells which extend the pool boundaries.

Improved Recovery: Reserves added by improving the recovery from a

pool by infill drilling, installation of a secondary or tertiary

recovery scheme or installation of field facilities such as

compression, line looping, etc. |

|

(3) Reserve additions from wells drilled on acquired lands are

included in Acquisitions volumes. |

Finding and Development Costs

Finding and development costs (F&D costs) include all costs

to develop reserves, including land and seismic costs. The

methodology to calculate F&D costs under NI 51-101 requires

that F&D costs incorporate changes in the future development

capital (FDC), which is included in the reserve evaluation. This

development capital is part of the ongoing development process to

bring production on stream and generate cash flow. Since the major

business activity of the Company during 2013 was the Arrangement,

finding, development and acquisition (FD&A) costs are more

representative metric of the Company's 2013 activity. The reserves

of AvenEx and Charger are reported as acquisitions in the reserves

reconciliation table. FD&A costs for 2013 were $22.17/boe

proved and $16.67/boe proved plus probable. Including technical

revisions, FD&A costs were $21.14/boe proved and $17.02/boe

proved plus probable. The following table presents the details of

the 2013 FD&A cost calculations.

2013 FD&A Costs:

|

Working Interest Reserves Changes, Mboe |

Total Proved |

Total Proved plus Probable |

|

Drilling Extensions & Improved Recovery |

947 |

1,169 |

|

Acquisitions |

17,731 |

27,718 |

|

Dispositions |

(558) |

(770) |

|

Total Reserve Additions, Acquisitions & Dispositions |

18,120 |

28,117 |

|

|

|

|

|

Capital (000s) |

|

|

|

2013 Capital |

$248,877 |

$248,877 |

|

Change in FDC |

152,834 |

219,892 |

|

Total Capital |

$401,711 |

$468,769 |

|

FD&A ($/boe) |

$22.17 |

$16.67 |

|

|

|

|

|

FD&A including Technical Revisions |

|

|

|

Working Interest Reserve Changes, Mboe |

|

|

|

Drilling Extensions & Improved Recovery |

947 |

1,169 |

|

Acquisitions |

17,731 |

27,718 |

|

Dispositions |

(558) |

(770) |

|

Technical Revisions |

886 |

(578) |

|

Total Reserve Additions, Acquisitions, Dispositions & Technical

Revisions |

19,006 |

27,539 |

|

|

|

|

|

Capital (000s) |

|

|

|

2013 Capital |

$248,877 |

$248,877 |

|

Change in FDC |

152,834 |

219,892 |

|

Total Capital |

$401,711 |

$468,769 |

|

FD&A including Technical Revisions ($/boe) |

$21.14 |

$17.02 |

| Notes: |

| 1. The 2013 capital expenditures include the announced

purchase price of corporate acquisitions rather than the amounts

allocated to property, plant and equipment for accounting purposes.

The capital expenditures also exclude capitalized administration

and office costs. |

| 2. The aggregate of the exploration and development

costs incurred during the most recent financial year and the change

during that year in estimated future development costs generally

will not reflect total finding and development costs related to

reserve additions for that year. |

| 3. Finding and development costs are calculated on the

basis of barrels of oil equivalent. BOEs may be misleading

particularly if used in isolation. A boe conversion ratio of 6

Mcf:1 bbl is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead. |

|

Net Asset Value as at Dec. 31, 2013 |

TP |

2P |

|

BTAX NPV10 |

$

642.5 |

$

868.5 |

|

Net Debt(1) |

(300.5) |

(300.5) |

|

Undeveloped Land(2) |

58.4 |

58.4 |

|

NAV |

$ 400.4 |

$ 626.4 |

|

per Share |

$ 3.13 |

$ 4.89 |

| (1) Net debt at December 31, 2013. |

| (2) Undeveloped land value is based on an internally

generated estimate of $100 / acre. |

2014 Capital Program and Outlook

The capital program continues to focus on low risk development

opportunities intended to increase overall liquids weighting and

improve netbacks. Management anticipates the 2014 capital program

will total approximately $60 million (prior to property

dispositions) and will include approximately $40 million for

drilling 21 gross (19.6 net) development wells, primarily in

Southern and Central Alberta. In 2014, Spyglass plans to direct

additional capital towards the Viking play at Halkirk-Provost while

also following up on its successful southern Alberta drilling

program targeting the Pekisko and Glauconite zones at Matziwin,

Cessford and Retlaw/Enchant. Capital activity will be weighted

towards the first and third quarters of 2014.

Further detail on the 2014 capital program is presented in the

below table:

|

2014 Drilling Locations |

Gross |

Net |

|

Halkirk-Provost Viking |

10 |

10.0 |

|

Southern Alberta Pekisko |

5 |

4.3 |

|

Southern Alberta Glauconite |

6 |

5.3 |

|

Total |

21 |

19.6 |

The drilling program for the year is underway with 2 (1.3 net)

vertical wells targeting the Glauconite zone at Retlaw/Enchant, 1

(1 net) horizontal Glauconite oil well in Enchant/Retlaw, 1 (1 net)

horizontal Glauconite oil well in Cessford and 1 (1 net) horizontal

Pekisko oil well at Matziwin drilled to date in 2014 in southern

Alberta. These new wells are expected to be put on production late

in the first quarter of 2014.

With continued improvement and stability in forward natural gas

prices, Spyglass' Cadomin resource play at Noel has become

economically competitive with the Company's light oil

opportunities. Should natural gas pricing remain strong, the

Company may add one or more Noel locations to the 2014 drilling

program. Spyglass has an extensive drilling inventory at Noel, with

over 90 Cadomin horizontal locations identified.

Management anticipates that the planned level of development

activity coupled with the Company's 20 percent base decline rate is

expected to result in 2014 average production of approximately

15,000 boe/d. Management continues to anticipate operating expenses

of $17.00 to $18.50 per boe and cash general and administrative

expenses of approximately $3.00 per boe.

Spyglass' capital program is expected to result in a target

all-in payout ratio of approximately 100 percent.

The Company will continue to pursue non-core asset dispositions

throughout 2014 to reduce debt, accelerate capital spending and

further focus operations. To date in 2014, Spyglass has completed

dispositions totaling approximately $3.9 million (prior to closing

adjustments).

Management continues to evaluate opportunities that would

improve financial flexibility and allow the Company to accelerate

the development of its large inventory of low risk light oil and

natural gas drilling locations.

March Dividend

The Board has approved the March cash dividend of $0.0225 per

share payable on April 15, 2014 to shareholders of record on March

27, 2014. The ex-dividend date will be March 25, 2014.

The dividend policy of Spyglass is at the discretion of the

Board and is reviewed monthly in the context of a number of factors

including current and forecast commodity prices, foreign exchange

rates, an active commodity price risk management program, status of

current operations and future investment opportunities.

Risk Management Update

Spyglass uses a commodity price risk management program to

mitigate the impact of crude oil and natural gas price volatility

on cash flow which is intended to support the dividend and capital

program. Spyglass hedges production up to 24 months forward, using

a combination of fixed price and participating products. Please

refer to the Company's website at www.spyglassresources.com under

Investors for a detailed list of the Company's risk management

contracts.

For calendar 2014, Spyglass has approximately 47 percent of its

estimated crude oil production hedged at an average fixed price of

WTI CDN$94.50/bbl. In addition, Spyglass has hedged the Western

Canadian Select ("WCS") oil differential at CDN$23.35/bbl for 2014

on 1,000 bbls/day. The company has hedged approximately 56 percent

of its estimated natural gas production at an average fixed price

of $3.79/Mcf. Spyglass has protected an additional 4 percent of its

estimated natural gas production by purchasing put options with an

average floor price of $3.59/Mcf.

For calendar 2015, Spyglass currently has approximately 12

percent of its estimated crude oil production hedged at an average

fixed price of WTI CDN$98.12/bbl. In addition, the Company has

hedged WCS at CDN$22.80/bbl for 2015 on 500 bbls/day. The Company

has hedged approximately 4 percent of its estimated natural gas

production at an average fixed price of $4.24/Mcf.

Power costs are a significant driver of operating costs and as a

result, the Company has hedged power usage in order to reduce

operating cost volatility. Currently, 50 percent of 2014 power

requirements are hedged at $54.12 per Megawatt hour ("MWH") and 40

percent of 2015 power requirements are hedged at $51.33/MWH.

The Company's mature, low decline producing assets coupled with

its extensive capital efficient light oil development opportunities

provide the scale, stability and diversification to support a

sustainable monthly cash dividend to shareholders.

Non-GAAP Measures

This press release includes terms commonly referred to in the

oil and gas industry that are considered non-GAAP measures. These

non-GAAP measures do not have a standardized meaning prescribed by

International Financial Reporting Standards ("IFRS" or,

alternatively, "GAAP") and therefore may not be comparable with the

calculation of similar measures by other companies.

"Funds from operations" represents cash flow from operating

activities adjusted for changes in non-cash working capital,

transaction costs and decommissioning expenditures.

"Operating netbacks" are determined by deducting royalties,

operating and transportation expenses from oil and gas revenue,

calculated on a per boe basis.

"Cash netbacks" are determined by deducting cash general and

administrative, realized hedging losses, interest expense and other

income from Operating netbacks, calculated on a per boe basis.

"Cash dividends per share" represents cash dividends declared

per share by Spyglass.

"Basic Payout ratio" is calculated as cash dividends declared

divided by funds from operations.

"All-in payout ratio" is calculated as cash dividends declared

plus capital expenditures (net of dispositions) divided by funds

from operations.

"Net debt" is calculated as bank debt plus working capital

deficiency excluding current portion of risk management contracts

and liabilities associated with assets held for sale.

Information Regarding Disclosure on Oil and Gas Reserves,

Resources and Operational Information

In accordance with NI 51-101, McDaniel evaluated, as at December

31, 2013, the oil, natural gas and NGL reserves attributable to the

properties of Spyglass. The tables contained in this press release

are a summary of the oil, natural gas and NGL reserves attributable

to the properties of Spyglass and the net present value of future

net revenue attributable to such reserves as evaluated by McDaniel

based on forecast price and cost assumptions. The tables summarize

the data contained in the McDaniel Report and, as a result, may

contain slightly different numbers than such report due to

rounding. Also due to rounding, certain columns may not add

exactly. The net present value of future net revenue attributable

to reserves is stated without provision for interest costs and

general and administrative costs, but after providing for estimated

royalties, production costs, development costs, other income,

future capital expenditures and well abandonment costs for only

those wells assigned reserves by McDaniel. It should not be assumed

that the undiscounted or discounted net present value of future net

revenue attributable to reserves estimated by McDaniel represent

the fair market value of those reserves. The recovery and reserve

estimates of oil, NGL and natural gas reserves provided herein are

estimates only. Actual reserves may be greater than or less than

the estimates provided herein.

All amounts in this news release are stated in Canadian dollars

unless otherwise specified. Where applicable, natural gas has been

converted to barrels of oil equivalent ("BOE") based on 6 Mcf:1

BOE. The BOE rate is based on an energy equivalent conversion

method primarily applicable at the burner tip and does not

represent a value equivalent at the wellhead. Use of BOE in

isolation may be misleading. All reserves volumes in this press

release (and all information derived therefrom) are based on

company gross reserves, before deduction of Crown and other

royalties, unless otherwise stated. Spyglass' oil and gas reserves

statement for the year-ended December 31, 2013, which will include

complete disclosure of our oil and gas reserves and other oil and

gas information in accordance with NI 51-101, will be contained

within our Annual Information Form which will be available on our

SEDAR profile at www.sedar.com.

Reader Advisory and Note Regarding Forward Looking

Information

Certain statements contained within this press release, and in

certain documents incorporated by reference into this document

constitute forward looking statements. These statements relate to

future events or future performance. All statements, other than

statements of historical fact, may be forward looking statements.

Forward looking statements are often, but not always, identified by

the use of words such as "seek", "anticipate", "budget", "plan",

"continue", "estimate", "expect", "forecast", "may", "will",

"project", "predict", "potential", "targeting", "intend", "could",

"might", "should", "believe" and similar expressions. These

statements involve known and unknown risks, uncertainties and other

factors that may cause actual results or events to differ

materially from those anticipated in such forward looking

statements.

In particular, this press release contains the following forward

looking statements pertaining to, without limitation, the

following: Spyglass' (i) future production volumes and the timing

of when additional production volumes will come on stream;

Spyglass' (ii) realized price of commodities in relation to

reference prices; (iii) future commodity mix; (iv) future commodity

prices; (v) expectations regarding future royalty rates and the

realization of royalty incentives; (vi) expectation of future

operating costs on a per unit basis; (vii) the relationship of

Spyglass' interest expense and the Bank of Canada interest rates;

(viii) future general and administrative expenses; future

development and exploration activities and the timing thereof; (ix)

deferred tax liability; (x) estimated future contractual

obligations; (xi) future liquidity and financial capacity of the

Company; (xii) ability to raise capital and to add to reserves

through exploration and development; (xiii) ability to obtain

equipment in a timely manner to carry out exploration and

development activities; (xiv) ability to obtain financing on

acceptable terms, and (xv) ability to fund working capital and

forecasted capital expenditures. In addition, statements relating

to "reserves" or "resources" are deemed to be forward looking

statements, as they involve assessments based on certain estimates

and assumptions that the resources and reserves described can be

profitably produced in the future.

We believe the expectations reflected in the forward looking

statements are reasonable but no assurance can be given that our

expectations will prove to be correct and consequently, such

forward looking statements included in, or incorporated by

reference into, this press release should not be unduly relied

upon. These statements speak only as of the date of this press

release or as of the date specified in the documents incorporated

by reference in this press release. The actual results could differ

materially from those anticipated as a result of the risk factors

set forth below and elsewhere in this press release which include:

(i) volatility in market prices for oil and natural gas; (ii)

counterparty credit risk; (iii) access to capital; (iv) changes or

fluctuations in production levels; (v) liabilities inherent in oil

and natural gas operations; (vi) uncertainties associated with

estimating oil and natural gas reserves; (vii) competition for,

among other things, capital, acquisitions of reserves, undeveloped

lands and skilled personnel; (viii) stock market volatility and

market valuation of Spyglass' stock; (ix)geological, technical,

drilling and processing capabilities; (x) limitations on insurance;

(xi) changes in environmental or legislation applicable to our

operations, (xii) our ability to comply with current and future

environmental and other laws; (xiii) changes in tax laws and

incentive programs relating to the oil and gas industry, and (xiv)

the other factors discussed under "Risk Factors" in the Company's

2012 Annual Information Form.

Readers are cautioned that the foregoing lists of factors are

not exhaustive. The forward looking statements contained in this

press release and the documents incorporated by reference herein

are expressly qualified by this cautionary statement. The forward

looking statements contained in this press release speak only as of

the date thereof and Spyglass does not assume any obligation to

publicly update or revise them to reflect new events or

circumstances, except as may be required pursuant to applicable

securities laws.

Barrel of oil equivalents or BOEs may be misleading,

particularly if used in isolation. A BOE conversion ratio of 6 mcf:

1 bbl is based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value

equivalency at the wellhead. As the value ratio between natural gas

and crude oil based on the current prices of natural gas and crude

oil is significantly different from the energy equivalency of 6:1,

utilizing a conversion on a 6:1 basis may be misleading as an

indication of value.

This press release shall not constitute an offer to sell, nor

the solicitation of an offer to buy, any securities in the United

States, nor shall there be any sale of securities mentioned in this

press release in any State in the United States in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities law of any such State.

Spyglass Resources Corp.Tom BuchananCEOIR#

403.930.3524investor.relations@spyglassresources.comwww.spyglassresources.comSpyglass

Resources Corp.Dan O'ByrnePresidentIR#

403.930.3524investor.relations@spyglassresources.comwww.spyglassresources.comSpyglass

Resources Corp.Dallas McConnellVP Corporate Development &

Investor RelationsIR#

403.930.3524investor.relations@spyglassresources.comwww.spyglassresources.com

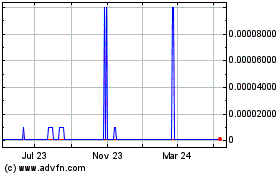

Spyglass Resources (CE) (USOTC:SGLRF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Spyglass Resources (CE) (USOTC:SGLRF)

Historical Stock Chart

From Dec 2023 to Dec 2024