Companies in Cuba Face Legal Risks as U.S. Changes Stance on Seized Property

May 02 2019 - 5:59AM

Dow Jones News

By Mengqi Sun

The Trump administration's decision to implement a

long-suspended provision of a 23-year-old federal law is expected

to pose legal quandaries for companies operating in Cuba.

The administration is ending the suspension of Title III of the

1996 Helms-Burton Act, which sought to strengthen the U.S.'s

embargo against Cuba's Communist government. The provision that

goes into effect Thursday allows certain U.S. nationals with claims

to properties confiscated by the Cuban government to sue companies

that are operating on that property for compensation. The law

applies to properties confiscated in or after 1959.

There are nearly 6,000 claims for property confiscated in Cuba

certified by the U.S. Justice Department's Foreign Claims

Settlement Commission with a value of about $2 billion, or roughly

$8 billion with interest, according to U.S. Assistant Secretary of

State for Western Hemisphere Affairs Kimberly Breier. Based on a

1996 estimate, the number of uncertified claims could be as high as

200,000, with a value in the tens of billions of dollars, Ms.

Breier said.

It is unclear how many of those claims will translate to

lawsuits, but several companies -- including Belgium brewer

Anheuser-Busch InBev SA and Canadian nickel producer Sherritt

International Corp. -- already have disclosed risks related to the

end of the suspension. And lawyers say clients have received

letters notifying them of alleged claims of rights to the property

the companies are using.

Any company potentially could be a target, said Aymee Valdivia,

a partner at law firm Holland & Knight LLP who works with

companies on international transactions.

Title III was suspended by President Clinton shortly after it

became law in 1996. The suspension was in response to complaints by

the European Union that the law overreached its jurisdiction and

restricted the EU's trade with Cuba. The suspension had been

renewed by every president, including previously by Mr. Trump.

The Trump administration said April 17 that it would lift the

suspension to apply more pressure to Cuba over alleged human-rights

violations and for its support of the Nicolás Maduro regime in

Venezuela. The U.S., which says Mr. Maduro is a corrupt and

illegitimate president, has used sanctions to pressure Mr. Maduro

to hand over power to Washington-backed opposition leader Juan

Guaidó, who called for this week's uprising against the

president.

Title III could apply to any company that is profiting from the

use of a confiscated property in Cuba. Such companies could face

litigation and may have to compensate a U.S. individual or company

that owned the property before confiscation. Compensation could

include the fair market value of the property, among other

things.

For example, take a restaurant company that is operating on

property seized by the Cuban government in 1963. If a U.S. citizen

owns a claim to the property, the restaurateur could be sued in

U.S. court by the citizen under Title III. The same concept could

apply to a mining company or a hotel -- just about any

industry.

And it isn't only real estate. Intellectual property also could

be affected.

AB InBev, the world's largest brewer, began disclosing to

investors in 2010 that it received a notice of a claim related to

the use of a trademark by Cervecería Bucanero SA, a Cuban brewer.

Cervecería Bucanero is indirectly owned by AB InBev, according to a

March AB InBev filing. The other half is owned by the Cuban

government, the filing said.

The claim alleged that the trademark has been confiscated by the

Cuban government and trafficked by AB InBev, the filing said.

Cervecería Bucanero in 2018 sold 1.6 million hectoliters of beer,

which was about 0.3% of AB InBev's global volume for the year,

according to the filing.

AB InBev, which declined to comment for this article, said in

the filing that it has attempted to evaluate the validity of the

claim. "Due to the uncertain underlying circumstances, we are

currently unable to express a view as to the validity of such claim

or as to the claimants' standing to pursue it," the company said in

the filing.

Sherritt International, which has worked in Cuba since 1993 and

has extensive oil and power operations there, doesn't expect the

U.S. law to have a material impact, said Joe Racanelli, a Sherritt

spokesman.

The company disclosed in February that its indirect, 50%

interest in Moa Nickel SA, a joint venture with a Cuban state-owned

company, has been deemed by the U.S. a form of trafficking under

the Helms-Burton Act. Under another provision of the same law, the

company's senior management, including its chief executive and

chief financial officer, are restricted from traveling to the U.S.,

according to a regulatory filing.

The company hasn't received any notice of claims under the law.

"For us, " Mr. Racanelli said, "its business as usual."

Write to Mengqi Sun at mengqi.sun@wsj.com

(END) Dow Jones Newswires

May 02, 2019 05:44 ET (09:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

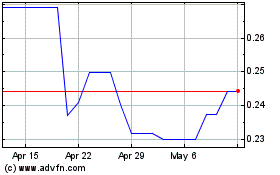

Sherritt (PK) (USOTC:SHERF)

Historical Stock Chart

From Nov 2024 to Dec 2024

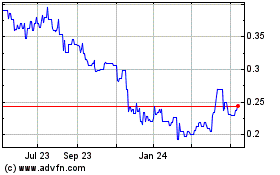

Sherritt (PK) (USOTC:SHERF)

Historical Stock Chart

From Dec 2023 to Dec 2024