UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

Check the appropriate box:

|

x

|

Preliminary Information Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

¨

|

Definitive Information Statement

|

|

Right On Brands, Inc.

|

|

(Name of Registrant as Specified in its Charter)

|

Payment of Filing Fee (Check the appropriate box):

|

x

|

No fee required

|

|

|

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

|

|

|

1) Title of each class of securities to which transaction applies:

|

|

|

|

|

|

2) Aggregate number of securities to which transaction applies (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

|

|

|

|

|

|

4) Proposed maximum aggregate value of securities::

|

|

|

|

|

|

5) Total fee paid:

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

1) Amount Previously Paid:

|

|

|

|

|

|

2) Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

3) Filing Party:

|

|

|

|

|

|

4) Date Filed:

|

RIGHT ON BRANDS, INC.

1925 Century Park East, Suite 1380

Los Angeles, CA 90067

November__, 2018

On November 6, 2018, the board of directors and holders of a majority of the voting capital stock of Right On Brands, Inc., a Nevada corporation (the “Company”), acted by written consent in lieu of a special meeting of stockholders to approve an amendment to the Company’s Articles of Incorporation to increase its authorized shares of common stock. The Company’s Board of Directors fixed November 6, 2018 as the record date (the “Record Date”), for determining the holders of its voting capital stock entitled to notice of these actions and receipt of this Information Statement.

This Information Statement is first being mailed on or about November __, 2018. The actions to be taken pursuant to the written consents dated as of November 6, 2018 shall be taken on or about December ___, 2018, twenty (20) days after the mailing of this Information Statement. You are urged to read the Information Statement in its entirety for a full description of the actions approved by the holders of a majority of the Company’s outstanding voting capital stock.

THIS IS NOT A NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER WHICH IS DESCRIBED HEREIN.

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE NOT REQUESTED TO SEND US A PROXY

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

|

|

By:

/s/ Ashok Patel

|

|

|

|

Name: Ashok Patel

|

|

|

|

Its: President and Chief Executive Officer

|

|

INFORMATION STATEMENT PURSUANT TO SECTION 14

OF THE SECURITIES EXCHANGE ACT OF 1934

AND REGULATION 14C AND SCHEDULE 14C THEREUNDER

NOTICE OF ACTIONS TO BE TAKEN PURSUANT TO THE WRITTEN CONSENT OF STOCKHOLDERS

To The Stockholders of Right On Brands, Inc.:

NOTICE IS HEREBY GIVEN that the Board of Directors has received approval, pursuant to the written consent of stockholders in lieu of a special meeting, dated November 6, 2018 (the “Written Consent”) to amend the Company’s Articles of Incorporation to: increase the number of authorized shares of common stock from 100,000,000 shares to 500,000,000 shares.

This Information Statement is being mailed on or about November ___, 2018. The above action will be taken on or about December ___, 2018, twenty (20) days after the mailing of this Information Statement.

OUTSTANDING SHARES AND VOTING RIGHTS

As of the Record Date, the Company’s authorized capitalization consisted of 100,000,000 shares of common stock, of which 66,583,869 shares were issued and outstanding. Holders of common stock of the Company have no preemptive rights to acquire or subscribe to any of the additional shares of common stock. In addition, as of the Record Date, the Company’s authorized capitalization included 10,000,000 shares of preferred stock. 5,000,000 shares of Series A Preferred Stock was issued and outstanding as of the Record Date. Series A Preferred Stock is the only issued and outstanding class of preferred stock with voting rights.

Each share of common stock entitles its holder to one vote on each matter submitted to the shareholders, and each share of Series A Preferred Stock entitles its holder to 16 votes on each matter submitted to the shareholders. However, because shareholders holding at least a majority of the voting rights of all outstanding shares of capital stock as of November 6, 2018 have voted in favor of the foregoing proposal by written consent, and having sufficient voting power to approve such proposal through their ownership of capital stock, no other shareholder consents will be solicited in connection with this Information Statement.

The following shareholders (holding the indicated number of shares) voted in favor of the proposal outlined in this Information Statement:

|

Shareholder

|

Class of Stock

|

Number of

Shares

|

Number of

Votes

|

Percentage of Voting Power

(2)

|

|

Daniel Crawford

|

Series A Preferred Stock

|

5,000,000

|

80,000,000

(1)

|

54.58%

|

|

Daniel Crawford

|

Common Stock

|

23,507,536

|

23,507,536

|

16.03%

|

|

Totals

|

|

|

103,507,536

|

70.61%

|

(1) Holders of Series A Preferred Stock are entitled to vote together with the holders of our common stock on all matters submitted to shareholders at a rate of 16 votes for each share held. Holders of Series A Preferred Stock are also entitled, at their option, to convert their shares into shares of our common stock on a 5 for 1 basis.

(2) Calculations based on 146,583,869 total possible votes, consisting of 66,583,869 shares of common stock casting one vote each, and 5,00,000 shares of Series A Preferred Stock casting 80,000,000 total votes.

Pursuant to Rule 14c-2 under the Securities Exchange Act of 1934, as amended, the actions described herein will not be implemented until a date at least 20 days after the date on which this Information Statement has been mailed to the shareholders. The Company anticipates that the actions contemplated herein will be effected on or about the close of business on December __, 2018.

The Company has asked brokers and other custodians, nominees and fiduciaries to forward this Information Statement to the beneficial owners of the Common Stock held as of the Record Date by such persons and will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

This Information Statement will serve as written notice to stockholders of the Company pursuant to Section 78.320(2) of the Nevada Revised Statutes.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets forth as of the Record Date, certain information known to us with respect to the beneficial ownership of the Company's voting securities by (i) each person who is known by us to own of record or beneficially more than 5% of the outstanding common stock, (ii) each of the Company's directors and executive officers, and (iii) all of the Company's directors and its executive officers as a group.

|

Title of class

|

Name and address of beneficial owner

(1)

|

Amount of

beneficial ownership

|

Percent of class

(2)

|

Percent of Voting Power

(3)

|

|

Current Executive Officers & Directors:

|

|

|

Common Stock

|

Daniel Crawford

1925 Century Park East, Suite 1380

Los Angeles, CA 90067

|

48,507,536

(4)

|

52.97%

|

70.61%

|

|

Common Stock

|

Ashok Patel

1925 Century Park East, Suite 1380

Los Angeles, CA 90067

|

700,000

|

0.76%

|

0.48%

|

|

Common Stock

|

David Youssefyeh

1925 Century Park East, Suite 1380

Los Angeles, CA 90067

|

4,000

|

--

|

--

|

|

Common Stock Total of All Current Directors and Officers:

|

49,211,536

|

53.73%

|

71.09%

|

|

|

|

|

|

|

More than 5% Beneficial Owners

|

|

|

|

|

None

|

|

|

|

|

(1)

As used in this table, "beneficial ownership" means the sole or shared power to vote, or to direct the voting of, a security, or the sole or shared investment power with respect to a security (i.e., the power to dispose of, or to direct the disposition of, a security). In addition, for purposes of this table, a person is deemed, as of any date, to have "beneficial ownership" of any security that such person has the right to acquire within 60 days after such date.

(2)

Based on 91,583,869 total shares, consisting of: (i) 66,583,869 shares of common stock issued and outstanding as of November 6, 2018; and (ii) 5,000,000 shares of Series A Preferred Stock convertible to 25,000,000 shares of common stock.

(3)

Based on a total of 146,583,869 possible votes, consisting of: (i) 66,683,869 shares of common stock issued and outstanding as of November 6, 2018; and (ii) 5,000,000 shares of Series A Preferred Stock, which are entitled to vote together with the holders of our common stock on all matters submitted to shareholders at a rate of 16 votes for each share held.

(4)

Consists of 23,507,536 shares of common stock, and 5,000,000 shares of Series A Preferred Stock convertible to 25,000,000 shares of common stock.

AMENDMENT TO THE ARTICLES OF INCORPORATION

INCREASE IN AUTHORIZED SHARES OF COMMON STOCK

The Board of Directors and stockholders of the Company have approved an increase in the number of the Company’s authorized shares of common stock from 100,000,000 shares to 500,000,000 shares, by means of an amendment to the Company’s Articles of Incorporation.

The terms of the additional shares of common stock will be identical to those of the currently outstanding shares of Common Stock. However, because the holders of common stock do not have preemptive rights to purchase or subscribe for any new issuances of common stock, the authorization and subsequent issuance of additional shares of common stock will reduce the current stockholders’ percentage ownership interest in the total outstanding shares of common stock. This amendment and the creation of additional shares of authorized common stock will not alter current stockholders’ relative rights and limitations.

The Articles of Amendment to the Company's Articles of Incorporation that reflects the increase in the authorized Common Stock is attached hereto as Exhibit A. The increase in the authorized common stock will become effective upon the filing of the Articles of Amendment with the Secretary of State of the State of Nevada, which is expected to occur as soon as is reasonably practicable on or after the twentieth (20th) day following the mailing of this Information Statement to the Company's stockholders.

Reason for Increase

In order to permit us to raise capital or issue our common stock for other business purposes, we need to increase the number of shares of our common stock authorized for issuance under our Articles of Incorporation. As a result of the increase in authorized common stock, the Company will be able to issue shares from time to time as may be required for proper business purposes, such as raising additional capital for ongoing operations, establishing strategic relationships with corporate partners, acquiring or investing in complementary businesses or products, providing equity incentives to employees, and effecting stock splits or stock dividends. Currently, the Company has no such plans or agreements.

Effects of Increase

In general, the issuance of any new shares of common stock will cause immediate dilution to the Company’s existing stockholders, may affect the amount of any dividends paid to such stockholders and may reduce the share of the proceeds of the Company that they would receive upon liquidation of the Company. Another effect of increasing the Company’s authorized common stock may be to enable the Board of Directors to render it more difficult to, or discourage an attempt to, obtain control of the Company by means of a merger, tender offer, proxy contest or otherwise, and thereby protect the continuity of present management. The Board of Directors would, unless prohibited by applicable law, have additional shares of common stock available to effect transactions (such as private placements) in which the number of the Company's outstanding shares would be increased and would thereby dilute the interest of any party attempting to gain control of the Company, even if such party is offering a significant premium over the current market price of the common stock. Such an issuance of shares of common stock would increase the number of outstanding shares, thereby possibly diluting the interest of a party attempting to obtain control of the Company. The Board of Directors is not aware of any attempt, or contemplated attempt, to acquire control of the Company, and this resolution was not presented with the intent that the increase in the Company's authorized common stock be utilized as an anti-takeover measure.

Vote Required

The affirmative vote of the holders of a majority of the outstanding shares of the voting capital stock of the company is required for the approval of the increase in the number of shares of the authorized common stock. On the Record Date, the increase from 100,000,000 shares to 500,000,000 shares of authorized common stock, was approved by the holders of approximately 70.61% of the voting power.

No Dissenters’ Right of Appraisal

Neither Nevada law nor our Articles of Incorporation provides our shareholders with dissenters’ rights in connection with the amendment to our Articles. This means that no shareholder is entitled to receive any cash or other payment as a result of, or in connection with the amendment to our Articles of Incorporation, even if a shareholder has not been given an opportunity to vote.

Interests of Certain Persons in or Opposition to Matters to be Acted Upon

No persons have any substantial interest in the increase in our authorized shares of common stock.

Forward-Looking Statements and Information

This Information Statement includes forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. You can identify our forward-looking statements by the words "expects," "projects," "believes," "anticipates," "intends," "plans," "predicts," "estimates" and similar expressions.

The forward-looking statements are based on management’s current expectations, estimates and projections about us. The Company cautions you that these statements are not guarantees of future performance and involve risks, uncertainties and assumptions that we cannot predict. In addition, the Company has based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Accordingly, actual outcomes and results may differ materially from what the Company has expressed or forecast in the forward-looking statements.

You should rely only on the information the Company has provided in this Information Statement. The Company has not authorized any person to provide information other than that provided herein. The Company has not authorized anyone to provide you with different information. You should not assume that the information in this Information Statement is accurate as of any date other than the date on the front of the document.

ADDITIONAL INFORMATION

The Company will provide upon request and without charge to each shareholder receiving this Information Statement a copy of the Company's annual report on Form 10-K for the fiscal year ended June 30, 2016, including the financial statements and financial statement schedule information included therein, as filed with the SEC. Reports and other information filed by us can be inspected and copied at the public reference facilities maintained at the SEC at 100 F Street, N.E., Washington, DC 20549. Copies of such material can be obtained upon written request addressed to the Commission, Public Reference Section, 100 F Street, N.E., Washington, D.C. 20549, at prescribed rates. The SEC maintains a web site on the Internet (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC through the Electronic Data Gathering, Analysis and Retrieval System.

EXHIBIT INDEX

Exhibit A Form of Articles of Amendment to the Articles of Incorporation

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors recommended approval of the Amendment to the Articles of Incorporation to the shareholders holding majority of the voting power.

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

|

|

By:

/s/ Ashok Patel

|

|

|

|

Name: Ashok Patel, President and CEO

|

|

EXHIBIT A

BARBARA K. CEGAVSKE

Secretary of State

202 North Carson Street

Carson City, Nevada 89701-4201

(775) 684-5708

Website: www.nvsos.gov

Certificate of Amendment

(PURSUANT TO NRS 78.385 and 78.390)

|

USE BLACK INK ONLY-DO NOT HIGHLIGHT

|

ABOVE SPACE IS FOR OFFICE USE ONLY

|

|

|

|

|

Certificate of Amendment to Articles of Incorporation

|

|

For Nevada Profit Corporations

|

|

(Pursuant to NRS 78.385 and 78.390—After Issuance of Stock)

|

|

|

|

1.

|

Name of corporation:

|

|

|

Right On Brands, Inc.

|

|

|

|

|

2.

|

The articles have been amended as follows (provide article numbers, if available):

|

|

|

Article 3 of the Articles of Incorporation is amended such that the Corporation’s authorized common stock is increased to 500,000,000 shares.

|

|

|

|

|

3.

|

The vote by which the stockholders holding shares in the corporation entitling them to exercise at least a majority of the voting power, or such greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may be required by the provisions of the articles of incorporation* have voted in favor of the amendment is:

|

|

|

70.61%

|

|

|

|

|

4.

|

Effective date of filing (optional):

|

|

|

|

|

5.

|

Signatures (required)

|

|

|

|

X

/s/ Ashok Patel

|

|

|

|

Signature of Officer

|

|

|

* If any proposed amendment would alter or change any preference or any relative or other right given to any class or series of outstanding shares, then the amendment must be approved by vote, in addition to the affirmative vote otherwise required, of the holders of shares representing a majority of the voting power of each class or series affected by the amendment regardless to limitations or restrictions on the voting power thereof.

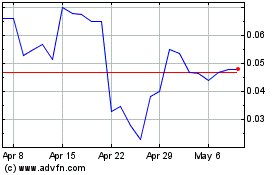

Right On Brands (PK) (USOTC:RTON)

Historical Stock Chart

From Oct 2024 to Nov 2024

Right On Brands (PK) (USOTC:RTON)

Historical Stock Chart

From Nov 2023 to Nov 2024