UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

10-Q

|

(Mark

One)

|

|

|

|

|

|

|

|

S

|

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

|

|

|

|

|

|

For

the quarterly period ended March 31, 2008

|

|

|

|

|

|

|

£

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

Commission

file number 0-8157

THE

RESERVE PETROLEUM COMPANY

(Exact

name of registrant as specified in its charter)

|

Delaware

|

73-0237060

|

|

(State

or other jurisdiction of incorporation or organization)

|

(IRS

Employer Identification No.)

|

6801

N. Broadway, Suite 300, Oklahoma City OK 73116-9092

(Address

of principal executive offices)

(405)

848-7551

(Registrant’s

telephone number, including area code)

Indicate

by check mark whether the registrant (1) filed all reports required to be filed

by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes

S

No

£

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting company (as

defined in Rule 12b-2 of the Exchange Act).

|

Large

accelerated filer

£

|

Accelerated

filer

£

|

|

|

|

|

Non-accelerated

filer

£

|

Smaller

reporting company

S

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes

£

No

S

As

of May 7, 2008, 162,336.64 shares of the Registrant’s $.50 par value

common stock were outstanding.

PART

1

FINANCIAL

INFORMATION

Item 1.

Financial Statements

(Unaudited)

THE

RESERVE PETROLEUM COMPANY

CONDENSED

BALANCE SHEETS

ASSETS

|

|

|

March 31,

|

|

|

December 31,

|

|

|

|

|

2008

|

|

|

2007

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

Current

Assets:

|

|

|

|

|

|

|

|

Cash

and Cash Equivalents

|

|

$

|

2,439,040

|

|

|

$

|

1,232,376

|

|

|

Available

for Sale Securities

|

|

|

12,488,389

|

|

|

|

12,445,531

|

|

|

Trading

Securities

|

|

|

289,009

|

|

|

|

337,201

|

|

|

Receivables

|

|

|

2,559,417

|

|

|

|

2,312,323

|

|

|

Prepaid

Expenses

|

|

|

55,662

|

|

|

|

103,373

|

|

|

|

|

|

17,831,517

|

|

|

|

16,430,804

|

|

|

Investments:

|

|

|

|

|

|

|

|

|

|

Equity

Investments

|

|

|

486,242

|

|

|

|

423,378

|

|

|

Other

|

|

|

15,298

|

|

|

|

15,298

|

|

|

|

|

|

501,540

|

|

|

|

438,676

|

|

|

Property,

Plant & Equipment:

|

|

|

|

|

|

|

|

|

|

Oil

& Gas Properties, at Cost Based on the Successful Efforts Method of

Accounting

|

|

|

|

|

|

|

|

|

|

Unproved

Properties

|

|

|

1,228,785

|

|

|

|

1,156,804

|

|

|

Proved

Properties

|

|

|

15,466,850

|

|

|

|

14,135,166

|

|

|

|

|

|

16,695,635

|

|

|

|

15,291,970

|

|

|

Less

- Valuation Allowance and Accumulated Depreciation, Depletion &

Amortization

|

|

|

8,085,457

|

|

|

|

7,731,266

|

|

|

|

|

|

8,610,178

|

|

|

|

7,560,704

|

|

|

Other

Property & Equipment, at Cost

|

|

|

377,135

|

|

|

|

376,843

|

|

|

Less

- Accumulated Depreciation & Amortization

|

|

|

254,779

|

|

|

|

244,510

|

|

|

|

|

|

122,356

|

|

|

|

132,333

|

|

|

Total

Property, Plant & Equipment

|

|

|

8,732,534

|

|

|

|

7,693,037

|

|

|

Other

Assets

|

|

|

315,587

|

|

|

|

320,667

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

Assets

|

|

$

|

27,381,178

|

|

|

$

|

24,883,184

|

|

See

Accompanying Notes

THE

RESERVE PETROLEUM COMPANY

CONDENSED

BALANCE SHEETS

LIABILITIES AND

STOCKHOLDERS’ EQUITY

|

|

|

March 31,

|

|

|

December 31,

|

|

|

|

|

2008

|

|

|

2007

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

Current

Liabilities:

|

|

|

|

|

|

|

|

Accounts

Payable

|

|

$

|

143,324

|

|

|

$

|

304,288

|

|

|

Income

Taxes Payable

|

|

|

210,246

|

|

|

|

153,094

|

|

|

Other

Current Liabilities -Deferred Income Taxes and Other

|

|

|

400,577

|

|

|

|

379,832

|

|

|

|

|

|

754,147

|

|

|

|

837,214

|

|

|

Long

Term Liabilities:

|

|

|

|

|

|

|

|

|

|

Dividends

Payable

|

|

|

322,281

|

|

|

|

324,930

|

|

|

Deferred

Income Taxes

|

|

|

1,294,805

|

|

|

|

1,168,685

|

|

|

|

|

|

1,617,086

|

|

|

|

1,493,615

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

Liabilities

|

|

|

2,371,233

|

|

|

|

2,330,829

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’

Equity:

|

|

|

|

|

|

|

|

|

|

Common

Stock

|

|

|

92,368

|

|

|

|

92,368

|

|

|

Additional

Paid-in Capital

|

|

|

65,000

|

|

|

|

65,000

|

|

|

Retained

Earnings

|

|

|

25,440,679

|

|

|

|

22,957,809

|

|

|

|

|

|

25,598,047

|

|

|

|

23,115,177

|

|

|

Less

– Treasury Stock

|

|

|

588,102

|

|

|

|

562,822

|

|

|

Total

Stockholders’ Equity

|

|

|

25,009,945

|

|

|

|

22,552,355

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

Liabilities and Stockholders’ Equity

|

|

$

|

27,381,178

|

|

|

$

|

24,883,184

|

|

See

Accompanying Notes

THE

RESERVE PETROLEUM COMPANY

CONDENSED

STATEMENTS OF OPERATIONS

(Unaudited)

|

|

|

Three

Months Ended

|

|

|

|

|

March 31,

|

|

|

|

|

2008

|

|

|

2007

|

|

|

|

|

|

|

|

|

|

|

Operating

Revenues:

|

|

|

|

|

|

|

|

Oil

and Gas Sales

|

|

$

|

4,337,069

|

|

|

$

|

2,797,278

|

|

|

Lease

Bonuses and Other

|

|

|

225,453

|

|

|

|

146,750

|

|

|

|

|

|

4,562,522

|

|

|

|

2,944,028

|

|

|

Operating

Costs and Expenses:

|

|

|

|

|

|

|

|

|

|

Production

|

|

|

420,416

|

|

|

|

359,607

|

|

|

Exploration

|

|

|

60,801

|

|

|

|

2,646

|

|

|

Depreciation,

Depletion, Amortization and Valuation Provisions

|

|

|

413,681

|

|

|

|

320,242

|

|

|

General,

Administrative and Other

|

|

|

310,966

|

|

|

|

291,844

|

|

|

|

|

|

1,205,864

|

|

|

|

974,339

|

|

|

Income

from Operations

|

|

|

3,356,658

|

|

|

|

1,969,689

|

|

|

Other

Income, Net

|

|

|

95,247

|

|

|

|

121,169

|

|

|

Income

Before Income Taxes

|

|

|

3,451,905

|

|

|

|

2,090,858

|

|

|

Provision

for Income Taxes:

|

|

|

|

|

|

|

|

|

|

Current

|

|

|

857,170

|

|

|

|

480,684

|

|

|

Deferred

|

|

|

111,865

|

|

|

|

197,803

|

|

|

Total

Provision for Income Taxes

|

|

|

969,035

|

|

|

|

678,487

|

|

|

Net

Income

|

|

$

|

2,482,870

|

|

|

$

|

1,412,371

|

|

|

Per

Share Data

|

|

|

|

|

|

|

|

|

|

Net

Income, Basic and Diluted

|

|

$

|

15.29

|

|

|

$

|

8.66

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted

Average Shares Outstanding, Basic and Diluted

|

|

|

162,437

|

|

|

|

163,109

|

|

See

Accompanying Notes

THE

RESERVE PETROLEUM COMPANY

CONDENSED

STATEMENTS OF CASH FLOW

(Unaudited)

Increase

(Decrease) in Cash and Cash Equivalents

|

|

|

Three

Months Ended

|

|

|

|

|

March 31,

|

|

|

|

|

2008

|

|

|

2007

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

Cash Provided by Operating Activities

|

|

$

|

2,717,467

|

|

|

$

|

1,841,208

|

|

|

Cash

Flows Applied to Investing Activities:

|

|

|

|

|

|

|

|

|

|

Purchases

of Available for Sale Securities

|

|

|

(2,245,092

|

)

|

|

|

(2,769,815

|

)

|

|

Maturity

of Available for Sale Securities

|

|

|

2,202,234

|

|

|

|

2,704,499

|

|

|

Proceeds

from Disposal of Property

|

|

|

960

|

|

|

|

1,170

|

|

|

Purchase

of Property, Plant & Equipment

|

|

|

(1,397,360

|

)

|

|

|

(387,829

|

)

|

|

Cash

Distribution from Equity Investment

|

|

|

875

|

|

|

|

3,750

|

|

|

Purchase

of Equity Investment in Gathering System

|

|

|

(44,491

|

)

|

|

|

—

|

|

|

Net

Cash Applied to Investing Activities

|

|

|

(1,482,874

|

)

|

|

|

(448,225

|

)

|

|

Cash

Flows Applied to Financing Activities:

|

|

|

|

|

|

|

|

|

|

Dividends

Paid to Stockholders

|

|

|

(2,649

|

)

|

|

|

(445

|

)

|

|

Purchase

of Treasury Stock

|

|

|

(25,280

|

)

|

|

|

(72,320

|

)

|

|

Total

Cash Applied to Financing Activities

|

|

|

(27,929

|

)

|

|

|

(72,765

|

)

|

|

Net

Change in Cash and Cash Equivalents

|

|

|

1,206,664

|

|

|

|

1,320,218

|

|

Cash

and Cash Equivalents,

Beginning of Period

|

|

|

1,232,376

|

|

|

|

1,321,707

|

|

Cash

and Cash Equivalents,

End of Period

|

|

$

|

2,439,040

|

|

|

$

|

2,641,925

|

|

|

Supplemental

Disclosures of Cash Flow Information,

|

|

|

|

|

|

|

|

|

Cash Paid During the Periods

for:

|

|

|

|

|

|

|

|

|

|

Interest

|

|

$

|

3,850

|

|

|

$

|

3,750

|

|

|

Income

Taxes

|

|

$

|

800,018

|

|

|

$

|

500,000

|

|

See

Accompanying Notes

THE

RESERVE PETROLEUM COMPANY

NOTES TO

CONDENSED FINANCIAL STATEMENTS

March 31,

2008

(Unaudited)

Note

1 – BASIS OF PRESENTATION

The

accompanying condensed balance sheet as of December 31, 2007, which has been

derived from audited financial statements, the unaudited interim condensed

financial statements and these notes have been prepared pursuant to the rules

and regulations of the Securities and Exchange

Commission. Accordingly, certain disclosures normally included in

financial statements prepared in accordance with the accounting principles

generally accepted in the United States of America (“GAAP”) have been

omitted. The accompanying condensed financial statements and notes

thereto should be read in conjunction with the financial statements and notes

thereto included in the Company’s 2007 Annual Report on Form

10-KSB.

In the

opinion of Management, the accompanying financial statements reflect all

adjustments (consisting only of normal recurring accruals) which are necessary

for a fair statement of the results of the interim periods

presented. The results of operations for the current interim periods

are not necessarily indicative of the operating results for the full

year.

Note 2 –

OTHER INCOME, NET

The

following is an analysis of the components of Other Income, Net for the three

months ended March 31, 2008 and 2007:

|

|

|

Three

Months Ended

|

|

|

|

|

March 31,

|

|

|

|

|

2008

|

|

|

2007

|

|

Realized

and Unrealized Gain (Loss)

On Trading

Securities

|

|

$

|

(48,581

|

)

|

|

$

|

7,254

|

|

|

Gain

on Asset Sales

|

|

|

960

|

|

|

|

585

|

|

|

Interest

Income

|

|

|

125,858

|

|

|

|

109,828

|

|

|

Equity

Earnings in Investees

|

|

|

19,249

|

|

|

|

6,823

|

|

|

Other

Income

|

|

|

1,695

|

|

|

|

593

|

|

|

Interest

and Other Expenses

|

|

|

(3,934

|

)

|

|

|

(3,914

|

)

|

|

Other

Income, Net

|

|

$

|

95,247

|

|

|

$

|

121,169

|

|

Note 3

-

INVESTMENTS AND

RELATED COMMITMENTS AND CONTINGENT LIABILITIES INCLUDING GUARANTEES

The

carrying value of Equity Investments consist of the following:

|

|

|

|

|

|

March 31,

|

|

|

December 31,

|

|

|

|

|

Ownership %

|

|

|

2008

|

|

|

2007

|

|

|

Broadway

Sixty-Eight, Ltd.

|

|

33%

|

|

|

$

|

396,278

|

|

|

$

|

378,624

|

|

|

JAR

Investment, LLC

|

|

25%

|

|

|

|

(6,182

|

)

|

|

|

(6,901

|

)

|

|

Bailey

Hilltop Pipeline, LLC

|

|

10%

|

|

|

|

44,491

|

|

|

|

—

|

|

|

OKC

Industrial Properties, LLC

|

|

10%

|

|

|

|

51,655

|

|

|

|

51,655

|

|

|

|

|

|

|

|

$

|

486,242

|

|

|

$

|

423,378

|

|

Broadway

Sixty-Eight, Ltd., an Oklahoma limited partnership (the Partnership), owns and

operates an office building in Oklahoma City,

Oklahoma. Although the Company invested as a limited

partner, along with the other limited partners, it agreed jointly and severally

with all other limited partners to reimburse the general partner for any losses

suffered from operating the Partnership. The indemnity agreement provides no

limitation to the maximum potential future payments.

The

Company leases its corporate office from the Partnership. The

operating lease under which the space was rented expired December 31, 1994, and

the space is currently rented on a year-to-year basis under the terms of the

expired lease.

JAR

Investment, LLC, (JAR) an Oklahoma limited liability company, previously held

Oklahoma City metropolitan area real estate that was sold in June

2005. JAR also owns a 70% management interest in Main-Eastern, LLC

(M-E), also an Oklahoma limited liability company. JAR and M-E

established a joint venture and developed a retail/commercial center on a

portion of JAR’s real estate.

The

Company has a guarantee agreement limited to 25% of JAR’s 70% interest in M-E’s

outstanding loan plus all costs and expenses related to enforcement and

collection, or $146,982 at March 31, 2008. This loan matures November

27, 2008. Because the guarantee of the M-E loan has not been

modified subsequent to December 31, 2002, no liability for the fair value of the

obligation is required to be recorded by the Company. The maximum

potential amount of future payments (undiscounted) the Company could be required

to make under the M-E guarantee at March 31, 2008 was $169,750 plus costs and

expenses related to enforcement and collection.

In March

2008, the Company purchased a 10% interest in the Bailey Hilltop Pipeline, LLC

(Bailey) an Oklahoma limited liability company. Bailey was formed to

construct and operate a gathering system for gas produced from wells drilled on

the Bailey Hilltop prospect in Grady County, Oklahoma.

Note 4 –

PROVISION FOR INCOME TAXES

In 2008

and 2007, the effective tax rate was less than the statutory rate as the

combined result of allowable depletion for tax purposes in excess of depletion

for financial statements and the corporate graduated tax rate

structure.

|

Item

2.

|

MANAGEMENT’S DISCUSSION AND

ANALYSIS

(Unaudited)

|

This

discussion and analysis should be read with reference to a similar discussion in

the Company’s December 31, 2007, Form 10-KSB filed with the Securities and

Exchange Commission, as well as the condensed financial statements included in

this Form 10-Q.

Forward Looking

Statements.

This

discussion and analysis includes forward looking statements within the meaning

of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. Forward looking statements give the Company’s

current expectations of future events. They include statements

regarding the drilling of oil and gas wells, the results of drilling and

production which may be obtained from oil and gas wells, cash flow and

anticipated liquidity and expected future expenses.

Although

management believes the expectations in these and other forward looking

statements are reasonable, we can give no assurance they will prove to have been

correct. They can be affected by inaccurate assumptions or by known

or unknown risks and uncertainties. Factors that would cause actual

results to differ materially from expected results are described under “Forward

Looking Statements” on page 9 of the Company’s Form 10-KSB for the year ended

December 31, 2007.

We

caution you not to place undue reliance on these forward looking statements,

which speak only as of the date of this report, and we undertake no obligation

to update this information. You are urged to carefully review and

consider the disclosures made in this and our other reports filed with the

Securities and Exchange Commission that attempt to advise interested parties of

the risks and factors that may affect our business.

Financial Conditions and

Results of Operations

|

1.

|

Liquidity and Capital

Resources.

|

Please

refer to the Condensed Balance Sheets on pages 2 and 3 and the Condensed

Statements of Cash Flow on page 5 of this Form 10-Q to supplement the following

discussion. In the first quarter of 2008, the Company continued

to fund its business activity through the use of internal sources of

cash. The Company had cash provided by operations of $2,717,467 and

cash provided by the maturities of available for sale securities of $2,202,234.

Property dispositions and equity investment distributions combined, provided an

additional $1,835 of cash for total cash provided by internal sources of

$4,921,536. The Company utilized cash for the purchase of available

for sale securities of $2,245,092, for oil and gas property additions of

$1,441,851 (including gathering system equity investment) and financing

activities of $27,929. Cash and cash equivalents increased $1,206,664

(98%) to $2,439,040.

Discussion of Significant

Changes in Working Capital.

In addition to the changes in cash

and cash equivalents discussed above, there were other changes in working

capital line items from December 31, 2007. A discussion of these

items follows.

Trading

securities decreased $48,192 (14%) to $289,009 from $337,201. All of

the decrease is due to a $58,864 decline in unrealized gains which represent the

change in the market value of the securities over their original

cost. This decline was offset by a $10,672 increase that represents

the earnings from the securities plus the net realized gains for the first

quarter of 2008. All earnings and net realized gains are reinvested

in additional securities.

Receivables

increased $247,094 (11%) to $2,559,417 from $2,312,323. The increase

was due mostly to a $193,100 increase in purchaser receivables due to increased

average monthly sales for the first quarter of 2008 compared to the fourth

quarter of 2007. The remaining $53,994 increase was due to an

increase in interest and other receivables.

Prepaid

expenses decreased $47,711 (46%) to $55,662 from $103,373. This decline was due

to seismic expense associated with work performed in the first quarter of 2008

on the Harper County, Kansas prospect. These expenses were prepaid at December

31, 2007. See “Exploration Costs” in the “Results of Operations”

section below for more discussion of this activity.

Accounts

payable decreased $160,964 (53%) to $143,324 from $304,288. This

decrease was primarily due to an increase in prepaid or advance well drilling

billings for the first quarter of 2008 compared to the fourth quarter of

2007. Actual current drilling activity and billings are charged

against these advances which are included in the “Property, Plant and Equipment”

section of the Balance Sheet. Due to the increased drilling activity in the

first quarter of 2008, the advance billings balance has increased about $600,000

from $300,000 at the end of 2007 to about $900,000 at the end of the first

quarter of 2008. See “Exploration Costs” in the “Results of Operations” section

below for more discussion of the current drilling activity.

Income

taxes payable increased $57,152 (37%) to $210,246 from $153,094. This increase

was due to timing and larger estimated tax payments as a result of the increased

current Federal and State income taxes for the first quarter of 2008 compared to

the fourth quarter of 2007.

Deferred

income taxes and other liabilities increased $20,745 (5%) to $400,577 from

$379,832. The increase is due to an increase of $35,000 in ad valorem tax

accruals offset by a decrease in current deferred taxes payable of

$14,255. Ad valorem (property) taxes are mostly for Texas properties

and are accrued for the first three quarters each year and usually paid in the

fourth quarter.

Discussion of Significant

Changes in the Condensed Statement of Cash Flows.

As noted in the above

paragraph, net cash provided by operating activities was $2,717,467 in 2008, an

increase of $876,259 (48%) from the comparable period in 2007. The

increase was primarily the result of an increase in revenue from oil and gas

sales offset by an increase in operating expense. For more information see,

“Operating Revenues” and “Operating Costs and Expenses” below.

Available

for sale securities at March 31, 2008 and December 31, 2007 are comprised

entirely of US Treasury Bills with six month maturities. During the

quarter ended March 31, 2008, $2,202,234 of these securities matured and the

cash was used to purchase new securities.

Cash

applied to the purchase of property additions in 2008 was $1,397,360, an

increase of $1,009,531 (260%) from cash applied in 2007 of

$387,829. In both 2008 and 2007, all cash applied to property

additions was related to oil and gas exploration and development activity. The

increase in property additions for 2008 is due to the increased exploration and

development drilling activity. See the subheading “Exploration Costs”

in the “Results of Operations” section below for additional

information.

Conclusion.

Management

is unaware of any additional material trends, demands, commitments, events or

uncertainties which would impact liquidity and capital resources to the extent

that the discussion presented in Form 10-KSB for December 31, 2007, would not be

representative of the Company’s current position.

|

2.

|

Material Changes in

Results of Operations Three Months Ended March 31, 2008, Compared with

Three Months Ended March 31,

2007.

|

Net

Income increased $1,070,499 (76%) to $2,482,870 in 2008 from $1,412,371 in

2007. Net income per share, basic and diluted, increased $6.63 to

$15.29 per share in 2008 from $8.66 per share in 2007.

A

discussion of revenue from oil and gas sales and other significant line items in

the condensed statements of operations follows.

Operating

Revenues

. Revenues from oil and gas sales

increased $1,539,791 (55%) to $4,337,069 in 2008 from $2,797,278 in

2007. Of the $1,539,791 increase, crude oil sales contributed

$763,162, natural gas sales contributed $747,275 and miscellaneous oil and gas

product sales increased $29,354.

The

$763,162 (82%) increase in oil sales to $1,689,444 in 2008 from $926,282 in 2007

was the result of an increase in the volume sold and the average price per

barrel (Bbl). The volume of oil sold increased 1,440 Bbls to 18,916

Bbls in 2008 resulting in a positive volume variance of $76,322. The

average price per Bbl increased $36.31 to $89.31 per Bbl in 2008 resulting in a

positive price variance of $686,840. The increase in oil volumes sold was mostly

due to production from the Harding County, South Dakota and Woods County,

Oklahoma wells, for new oil production added in the last half of 2007 and early

2008.

The

$747,275 (41%) increase in gas sales to $2,584,923 in 2008, from $1,837,648 in

2007, was the result of an increase in the volume sold and the average price per

thousand cubic feet (MCF). The volume of gas sold increased

31,231 MCF to 346,480 MCF in 2008 from 315,249 MCF in 2007, for a positive

volume variance of $182,051. The average price per MCF increased

$1.63 to $7.46 per MCF in 2008, from $5.83 per MCF in 2007, resulting in a

positive price variance of $565,224.

The

increase in gas volumes sold in 2008 was due primarily to increased sales from

the Robertson County, Texas royalty interest properties. These properties

provided approximately 58% of the Company’s first quarter 2008 gas sales volumes

and about 50% of the first quarter 2007 gas sales volumes. See

sub-heading “Operating Revenues” on page 15 of the Company’s 2007 Form 10-KSB

for more information about these properties.

For both

oil and gas sales, the price change was mostly the result of a change in the

spot market prices upon which most of the Company’s oil and gas sales are

based. These spot market prices have had significant fluctuations in

the past and these fluctuations are expected to continue.

Sales of

miscellaneous oil and gas products were $62,702 in 2008, as compared to $33,348

in 2007.

Lease

bonuses of $185,151 for the first quarter of 2008 were for leases and lease

extensions for Company owned minerals (primarily in Texas). Lease

bonuses for the first quarter of 2007 were $100,335.

Coal

royalties were $40,302 for the first quarter of 2008 compared to $46,415 for the

first quarter of 2007, for coal mined during this period on

some North Dakota leases. See sub-heading “Operating Revenues”

on page 15 of the Company’s 2007 Form 10-KSB for more information about these

properties.

Operating Costs and

Expenses

. Operating costs and expenses increased

$231,525 (24%) to $1,205,864 in 2008 from $974,339 in 2007. Material

line item changes will be discussed and analyzed in the following

paragraphs.

Production

Costs.

Production costs increased $60,809 (17%) in 2008

to $420,416 from $359,607 in 2007. Of this increase, $75,529 was due

to lease operating expense and transportation and compression expense increases.

The transportation and compression expense increased $22,000 to $104,575 in 2008

from $82,575 in 2007. Most of this increase is associated with

Robertson County, Texas production. Lease operating expense increased

$53,529 to $198,220 in 2008 from $144,691 in 2007. Most of this

increase was due to operating expenses on new wells in Harding County, South

Dakota and Woods County, Oklahoma which first produced after March 31,

2007. Production taxes decreased $14,720 (11%) to $117,621 in 2008

from $132,341 in 2007. This decline was due to production tax refunds

of previous year’s taxes on the Robertson County wells. See

sub-heading “Production Costs” on page 16 of the Company’s 2007 Form 10-KSB for

more information about these refunds.

Exploration

Costs.

Total exploration expense increased $58,155 to

$60,801 in 2008 from $2,646 in 2007. The increase was due mostly to

increased geological and geophysical expense in 2008 versus 2007.

The

following is a summary as of May 7, 2008, updating both exploration and

development activity from December 31, 2007.

The

Company participated with its 18% working interest in the drilling of two

step-out wells on a Barber County, Kansas prospect. Both wells were

started in January 2008 and completed in March 2008 as commercial oil and gas

producers. Capitalized costs were $176,106 for the period

ended March 31, 2008, including $9,473 in prepaid drilling costs.

The

Company participated with its 18% working interest in the drilling of two

step-out wells on a Woods County, Oklahoma prospect. The first well

was started in January 2008 and the second in February 2008. Both

were completed in March 2008 as commercial oil and gas wells. The

Company participated with a 17.4% working interest in the drilling of another

development well which was started in March 2008. A completion

attempt is currently in progress. Capitalized costs totaled $340,903

as of March 31, 2008, including $231,818 in prepaid drilling costs.

In 2007

the Company participated in the drilling and completion of an exploratory well

on a Grady County, Oklahoma prospect in which it has a 10%

interest. Sales commenced in April 2008 following the construction of

a pipeline, with gas and gas condensate flowing at a commercial

rate. Another exploratory well was started in February 2008 and a

completion attempt is currently in progress. Two additional

exploratory wells have been proposed. Total capitalized costs for the

period ended March 31, 2008 were $190,113.

The

Company participated with a 12% working interest in the drilling of a

development well on a Woods County, Oklahoma prospect. The well was

started in December 2007 and completed in January 2008 as a commercial oil and

gas producer. Two additional development wells (16% and 14% working

interests) are planned for the second quarter of 2008. Total costs

for this well through March 31, 2008 were $85,800, including $15,747 in prepaid

drilling costs.

In 2007

the Company participated with a 16% interest in the drilling and completion of

an exploratory well on a Woods County, Oklahoma prospect. Sales

commenced in February 2008 with oil and gas flowing at a commercial

rate. The Company participated with an 8% working interest in the

drilling of another exploratory well in March 2008. A completion

attempt is currently in progress. Total prepaid drilling costs for

the period ended March 31, 2008 were $51,200.

The

Company participated with an 18% interest in the development of nine prospects

along a trend in Comanche and Kiowa Counties, Kansas. An exploratory

well (Company working interest 18%) was drilled in April 2008 and is currently

awaiting a completion attempt. A second exploratory well (16.2%

interest) was started in April 2008 and is currently drilling. Total leasehold

costs through March 31, 2008 were $225,180.

A 3-D

seismic survey was started in February 2008 on a Harper County, Kansas prospect

in which the Company has a 16% interest. Weather delays forced the

suspension of the survey prior to completion; however, data was acquired over

most of the prospect acreage. Two potential structures have been

identified and two exploratory wells will be drilled starting in June or July

2008. The seismic survey will be completed later in the

year. At March 31, 2008, $55,662 in prepaid seismic expense was

carried as a current asset and $47,711 was expensed in the first quarter of

2008.

In March

2008 the Company participated with its 18% interest in the drilling of an

exploratory well on a Logan County, Oklahoma prospect. A completion

attempt is currently in progress. Capitalized costs for the period ended March

31, 2008 were $81,890, including $77,928 in prepaid drilling costs.

The

Company participated with its 16% working interest in the drilling of two

development wells on a Woods County, Oklahoma prospect. Both were

started in November 2007 and completed in February 2008 as commercial oil and

gas wells. Total costs for these wells through March 31,

2008 were $228,800, including $119,903 in prepaid drilling costs.

The

Company participated with a 21.5% working interest in the drilling of a step-out

well on a Woods County, Oklahoma prospect. The well was started in

November 2007 and completed in February 2008 as a commercial gas

producer. It also makes some oil. An additional

development well is planned for the second quarter of

2008. Total costs for this well though March 31,

2008 were $147,375, including $9,545 in prepaid drilling

costs.

In March

2008 the Company purchased a 21% interest in 637.5 net acres of leasehold on a

Lincoln County, Oklahoma prospect for $13,388. A step-out dual

lateral horizontal well was started in March 2008. Drilling

difficulties were encountered and neither lateral reached its planned total

depth; however, a completion attempt is currently in

progress. Prepaid drilling costs as of March 31, 2008 were

$448,481.

In April

2008 the Company purchased a 2.75% interest in 2,064 net acres of leasehold on a

Garvin County, Oklahoma prospect for $14,795, including $3,300 for

seismic. An exploratory well was started in May 2008 and is currently

drilling.

The

Company participated with an 18% interest in the development of a McClain

County, Oklahoma prospect. Acreage has been acquired and it is likely

that an exploratory well will be drilled in the second half of

2008. Leasehold costs to date are $6,579.

The

Company is participating with a 50% interest in the development of another

McClain County, Oklahoma prospect. Acreage is being acquired and a

3-D seismic survey is likely. The Company will sell down its interest

prior to any drilling. Leasehold costs to date are

$55,908.

Depreciation, Depletion,

Amortization and Valuation Provision (DD&A).

DD&A

increased $93,439 (29%) to $413,681 in 2008 from $320,242 in

2007. The change was mostly the result of an increase of

$89,395 in the depreciation of lease and well equipment and amortization of

intangible drilling costs on successful wells. The increase in

depreciation of lease and well equipment and amortization of intangible drilling

costs on successful wells is due to costs related to wells which first produced

after March 31, 2007, as the Company uses the units of production method for

calculating these expenses.

General, Administrative and

Other (G&A).

G&A increased $19,122 (7%) to $310,966 in

2008 from $291,844 in 2007. Ad valorem and other tax increases

accounted for about $5,000 of the increase. Salaries and

benefits increases accounted for most of the remaining $14,122 of the

increase.

Other Income,

Net

. This line item decreased $25,922 to

$95,247 in 2008 from $121,169 in 2007. See Note 2, to the

accompanying financial statements for the analysis of the various components of

this line item.

Trading

securities losses in 2008 were $(48,581), as compared to gains of $7,254 in

2007, a decrease of $55,835. In 2008, the Company had realized gains

of $10,283 and unrealized losses of $(58,864) from adjusting the securities to

estimated fair market value. In 2007, the Company had realized gains

of $8,225 and unrealized losses of $(971).

Interest

income increased $16,030 to $125,858 in 2008 from $109,828 in

2007. The increase was mostly the result of an increase in the

balance of these investments in 2008 versus 2007.

Equity

earnings (losses) in investees increased $12,426 to net earnings of $19,249 in

2008 from net earnings of $6,823 in 2007 The following is the

Company’s share of earnings (losses) for 2008 and 2007 per review of the

entities’ unaudited financial statements for the three months ended March 31,

2008 and 2007:

|

|

|

Earnings/(Losses)

|

|

|

|

|

2008

|

|

|

2007

|

|

|

Broadway

Sixty-Eight, Ltd.

|

|

$

|

17,654

|

|

|

$

|

24,517

|

|

|

JAR

Investments, LLC

|

|

|

1,595

|

|

|

|

1,148

|

|

|

Millennium

Golf Properties, LLC (Sold 12/2007)

|

|

|

—

|

|

|

|

(18,842

|

)

|

|

|

|

$

|

19,249

|

|

|

$

|

6,823

|

|

See Note

3, to the condensed statements, for additional information, including

guarantees, pertaining to Broadway Sixty-Eight, Ltd., and to JAR Investments,

LLC.

Provision for Income

Taxes

. The provision for income taxes increased $290,548

(43%) to $969,035 in 2008 from $678,487 in 2007. The increase was due

to the increase in income before income taxes of $1,361,047 to $3,451,905 in

2008 from $2,090,858 in 2007. Of the 2008 income tax provision, the

estimated current tax expense was $857,170 and the estimated deferred tax

expense was $111,865. Of the 2007 income tax provision, the current

and deferred expenses were $480,684 and $197,803 respectively. See

Note 4, to the condensed statements for additional information on income

taxes.

Off-Balance Sheet

Arrangements

The

Company’s off-balance sheet arrangements consists of JAR Investments, LLC, an

Oklahoma limited liability company and Broadway Sixty-Eight, Ltd., an Oklahoma

limited partnership. The Company does not have actual or effective

control of either of these entities. Management of these entities

could at any time make decisions in their own best interest which could

materially affect the Company’s net income or the value of the Company’s

investments.

For more

information about these entities, see Note 3, to the accompanying financial

statements and this management’s discussion and analysis subheading, “Other

Income, Net”.

|

Item

4.

|

CONTROLS AND

PROCEDURES

|

|

a)

|

Evaluation of

Disclosure Controls and

Procedures.

|

The

effectiveness of the Company’s disclosure controls and procedures were evaluated

by the Principal Executive Officer and the Principal Financial Officer as of the

end of the period covered by this

10-Q. Based on their evaluation

it is their conclusion that the Company’s disclosure controls and procedures are

effective in ensuring that information required to be disclosed by the Company

in this report is recorded, processed, summarized and reported within the time

periods specified in the SEC’s rules and forms.

|

b)

|

Changes in Internal

Controls.

|

There

were no changes in the Company’s internal controls or in other factors that

could significantly affect these controls that occurred during the first quarter

of 2008, including any corrective actions with regard to significant

deficiencies and material weakness. All internal control systems have

inherent limitations, including the possibility of circumvention and overriding

of controls, and therefore, can provide only reasonable assurance as to

financial statement preparation and safeguarding of Company

assets.

PART

II

OTHER

INFORMATION

Item

2.

Unregistered Sales of Equity

Securities and Use of Proceeds

|

|

c)

|

SMALL BUSINESS ISSUER PURCHASES

OF EQUITY SECURITIES

|

|

Period

|

|

Total

Number of Shares Purchased

|

|

|

Average

Price Paid Per Share

|

|

|

Total

Number of Shares Purchased as Part of Publicly Announced Plans or Programs

(1)

|

|

|

Approximate

Dollar Value of Shares that May Yet Be Purchased Under the Plans or

Programs (1)

|

|

|

Jan 1

to Jan 31, 2008

|

|

60

|

|

|

$

160

|

|

|

-

|

|

|

-

|

|

|

Feb 1

to Feb 29, 2008

|

|

18

|

|

|

$

160

|

|

|

-

|

|

|

-

|

|

|

Mar 1

to Mar 31, 2008

|

|

80

|

|

|

$

160

|

|

|

-

|

|

|

-

|

|

|

Total

|

|

158

|

|

|

$

160

|

|

|

-

|

|

|

-

|

|

|

|

(1)

|

The

Company has no formal equity security purchase program or

plan. The Company acts as its own transfer agent and most

purchases result from requests made by shareholders receiving small odd

lot share quantities as the result of probate

transfers.

|

The

following documents are exhibits to this Form 10-Q. Each document

marked by an asterisk is filed electronically herewith.

|

|

Exhibit

Number

|

Description

|

|

|

|

Chief

Executive Officer’s Certification pursuant to Section 302 of the

Sarbanes-Oxley Act of 2002

|

|

|

|

Chief

Financial Officer’s Certification pursuant to Section 302 of the

Sarbanes-Oxley Act of 2002.

|

|

|

|

Chief

Executive Officer’s and Chief Financial Officer’s Certification pursuant

to Section 906 of the Sarbanes-Oxley Act of

2002

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has

duly caused this report to be signed on its behalf by the undersigned thereto

duly authorized.

|

|

THE RESERVE PETROLEUM

COMPANY

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

Date:

May 9,

2008

|

/s/ Mason

McLain

|

|

|

Mason

McLain

|

|

|

Principal

Executive Officer

|

|

|

|

|

|

|

|

Date:

May 9,

2008

|

/s/ James L.

Tyler

|

|

|

James

L. Tyler

|

|

|

Principal

Financial and Accounting Officer

|

16

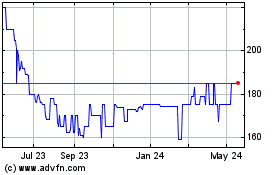

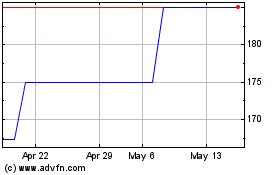

Reserve Petroleum (PK) (USOTC:RSRV)

Historical Stock Chart

From Jun 2024 to Jul 2024

Reserve Petroleum (PK) (USOTC:RSRV)

Historical Stock Chart

From Jul 2023 to Jul 2024