Current Report Filing (8-k)

December 05 2017 - 10:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

November 2, 2017

Date of

Report

Q BioMed Inc.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

000-55535

|

46-4013793

|

|

(State

or other jurisdiction of incorporation)

|

(Commission

File Number)

|

(IRS

Employer Identification No.)

|

|

c/o Ortoli Rosenstadt LLP

501 Madison Ave. 14

th

Floor

New York, NY 10022

|

|

10022

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

(212) 588-0022

Registrant’s

telephone number, including area code

Check

the appropriate box below if the Form 8-K is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

|

Item 1.01

Entry into a Material Definitive Agreement

On November 23, 2017, we entered into a Conversion Agreement with

CMGT, the purchaser, of $33,000 of convertible notes that we sold

pursuant to a Securities Purchase Agreement, dated November 22,

2016.

On November 29, 2016, we entered into a Securities Purchase

Agreement for the sale of $4 million of convertible notes (the

“Convertible Notes”). On November 29, 2017, we entered

into a Conversion Agreement with the holder (the “Note

Holder”) of the remaining Convertible Note. Prior to the

Conversion Agreement, $3 million of principal and approximately

$109,000 of interest had been converted on the Convertible Notes.

Pursuant to the Conversion Agreement, we agreed with the Note

Holder to convert the remaining $1,000,000 in principal under the

Convertible Notes into shares of common stock at a per share price

of $3.70, which was above the per share price of $3.5088 that the

Note Holder would have been able to convert at pursuant to the

terms of the remaining Convertible Note. Upon the conversion, we

and the Note Holder released and waived any claims and rights that

the other, including accrued but unpaid interest

thereon.

On November 29, 2017, we entered into a Conversion Agreement with

the purchaser (the “Note Holder”) of $4 million of

convertible notes (the “Convertible Notes”) that we

sold pursuant to a Securities Purchase Agreement, dated November

29, 2016. Prior to the Conversion, the Note Holder had converted $3

million of principal and approximately $109,000 of interest on the

Convertible Notes.

Item 3.02

Unregistered Sale of Equity Securities

On November 2, 2017, the Company issued 46,875 shares of its common

stock in full settlement of $150,000 in principal and interest due

to CMGT as a result of promissory notes issued by it in November

2016.

On November 22, 2017, we issued 166,592 shares of our common stock

to the holder of convertible notes issued on November 29, 2016 and

March 10, 2017 upon the conversion of $551,771.22 of principal and

interest of such notes.

As discussed above, on November 23, 2017, we issued 13,200 shares

of our common stock to CMGT upon the conversion of the principal

$30,000 of the Convertible Note plus $3,000 of

interest.

As discussed above, on November 29, 2017, we issued 270,270 shares

of our common stock to the Note Holder upon the conversion of

$1,000,000 of principal of the remaining Convertible Note and the

waiver and release of any other amounts or obligations, including

interest, due under such note.

The shares issued above were issued in reliance on exemptions from

registration under Section 4(2) of the Securities Act of 1933, as

amended (the “

Act

”). This transaction qualified

for exemption from registration because among other things, the

transaction did not involve a public offering, the investors were

accredited investors, the investors had access to information about

our company and its investment and the investors took the

securities for investment and not resale.

Item

7.01

Regulation FD

Disclosure.

On December 5, 2017, we issued a press release entitled “Q

BioMed Announces Full Settlement of All Convertible Debt” A

copy of the press release is furnished herewith as

Exhibit 99.1.

The information in this Item 7.01 of this Form 8-K is being

furnished and shall not be deemed “filed” for the

purposes of Section 18 of the Securities Exchange Act of 1934, or

otherwise subject to the liabilities of that

section. The information in this Item 7.01 of this Form

8-K also shall not be deemed to be incorporated by reference into

any filing under the Act or the Securities Exchange Act of 1934,

except to the extent that we specifically incorporate it by

reference.

Item 9.01

Financial Statements and Exhibits.

Exhibits.

|

99.1

|

Press

Release entitled “

Q BioMed

Announces Full Settlement of All Convertible

Debt

”

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

Q BioMed Inc.

|

|

Date: December 5, 2017

|

By:

/s/ Denis Corin

Name: Denis

Corin

Title: President

|

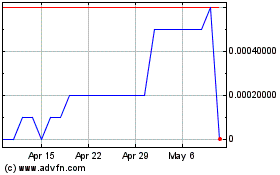

Q BioMed (CE) (USOTC:QBIO)

Historical Stock Chart

From Oct 2024 to Nov 2024

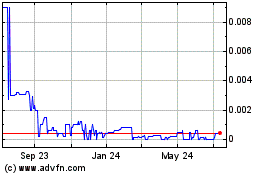

Q BioMed (CE) (USOTC:QBIO)

Historical Stock Chart

From Nov 2023 to Nov 2024