Current Report Filing (8-k)

April 28 2020 - 5:31PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): April 22, 2020

PUREBASE

CORPORATION

(Exact

name of registrant as specified in charter)

|

Nevada

|

|

000-55517

|

|

27-2060863

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

8625

State Hwy, 124

Ione,

CA 95640

(Address

of principal executive offices)

(855)

743-6478

(Registrant’s

telephone number, including area code)

|

N/A

|

|

(Former

name or former address, if changed since last report)

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

None

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Section

1 - Registrant’s Business and Operations

Item

1.01 Entry into a Material Definitive Agreement.

On

April 22, 2020, Purebase Corporation, a Nevada corporation (the “Company”), entered into a Materials Supply Agreement

(the “Agreement”) with U.S. Mine Corp. (“USMC”), pursuant to which the Company will fill all of its requirements

for certain raw clay materials from USMC. The Agreement amended the prior Materials Supply Agreement the parties had entered into

on October 12, 2018.

Pursuant

to the Agreement, all kaolin clay purchased by the Company from USMC shall be used exclusively by the Company for agricultural

products and supplementary cementitious materials. Notwithstanding the exclusive nature of the Agreement, the Company has the

right to obtain some or all of such materials from another source. USMC has the right to mine, process and sell certain raw clay

materials pursuant to its agreement with US Mine LLC (the “LLC”). Both USMC and the LLC are affiliates of the Company.

Under

the terms of the Agreement, the price to be paid by the Company for the kaolin clay for supplementary cementitious materials shall

be $25 per ton plus a $5 royalty to LLC, and the price to be paid for the clay for agricultural shall be $145 per ton for bagged

products plus a $5 royalty to LLC. USMC granted the Company a most-favored nation provision to the effect that if any other customer

of USMC obtains pricing which is more favorable than that provided to the Company, USMC shall adjust the cost to the Company to

conform to the more favorable terms.

The

term of the Agreement is three years, and the Agreement automatically renews for three successive one-year terms, unless either

party terminates the Agreement upon at least 60 days’ notice prior to the end of the term, as previously extended. Either

party has the right to terminate the Agreement for a material breach which is not cured within 90 days.

The

foregoing description of the Agreement is qualified in its entirety by reference to the full text of such agreement, a copy of

which is attached hereto as Exhibit 10.1 and incorporated herein in its entirety by reference.

Section

7 - Regulation FD

Item

7.01 Regulation FD Disclosure.

On

April 23, 2020, the Company issued a press release with respect to the Agreement. A copy of the press release is filed as Exhibit

99.1 to this report and incorporated herein by reference.

The

information in this Item 7.01 of this Report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed

“filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

nor shall it be deemed incorporated by reference in any of the Company’s filings under the Securities Act of 1933, as amended,

or the Exchange Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference

to this Report in such filing.

Cautionary

Note Regarding Forward-Looking Statements

This

Current Report on Form 8-K includes information that may constitute forward-looking statements. These forward-looking statements

are based on the Company’s current beliefs, assumptions and expectations regarding future events, which in turn are based

on information currently available to the Company. By their nature, forward-looking statements address matters that are subject

to risks and uncertainties. Forward looking statements include, without limitation, statements relating to projected industry

growth rates, the Company’s current growth rates and the Company’s present and future cash flow position. A variety

of factors could cause actual events and results, as well as the Company’s expectations, to differ materially from those

expressed in or contemplated by the forward-looking statements. Risk factors affecting the Company are discussed in detail in

the Company’s filings with the Securities and Exchange Commission. The Company undertakes no obligation to publicly update

or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent

required by applicable securities laws.

Section

9 - Financial Statements and Exhibits

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

|

Date:

April 28, 2020

|

PUREBASE

CORPORATION

|

|

|

|

|

|

|

By:

|

/s/

A. Scott Dockter

|

|

|

|

A.

Scott Dockter

Chief

Executive Officer

|

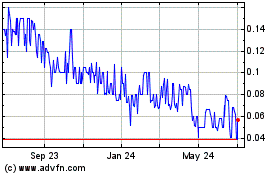

PureBase (PK) (USOTC:PUBC)

Historical Stock Chart

From Aug 2024 to Sep 2024

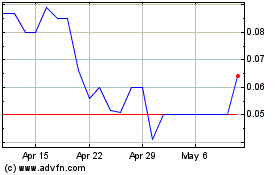

PureBase (PK) (USOTC:PUBC)

Historical Stock Chart

From Sep 2023 to Sep 2024