Filed pursuant to Rule 424(b)(3)

Registration No. 333-264346

PROSPECTUS SUPPLEMENT NO. 4

(to Prospectus dated June 9, 2023)

Proterra Inc

125,389,111 Shares of Common Stock

26,317,092 Shares of Common Stock Underlying Warrants and Convertible Notes

This prospectus supplement supplements the prospectus dated June 9, 2023, which forms a part of our registration statement on Form S-1 (File No. 333-264346) as supplemented by Prospectus Supplement No. 1, dated June 28, 2023 and as further supplemented by Prospectus Supplement No. 2, dated August 8, 2023 and Prospectus Supplement No. 3, dated August 9, 2023 (the “Prospectus”). This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our quarterly report on Form 10-Q for the quarter ended September 30, 2023, filed with the Securities and Exchange Commission on November 6, 2023 (the “Quarterly Report”). Accordingly, we have attached the Quarterly Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the offer and sale from time to time by the selling securityholders named in the Prospectus (the “Selling Securityholders”) of up to 125,389,111 shares of common stock, par value $0.0001 per share (“common stock”), consisting of (i) up to 16,334,868 shares of common stock issued in a private placement of 41,500,000 shares of common stock pursuant to subscription agreements entered into on January 11, 2021; (ii) up to 1,904,692 shares of common stock held by ArcLight CTC Holdings, L.P.; and (iii) up to 107,149,551 shares of common stock issued or issuable to certain former stockholders and other security holders of Legacy Proterra (the “Legacy Proterra Holders”) in connection with or as a result of the consummation of the Business Combination (as defined in the Prospectus), consisting of (a) up to 56,766,043 shares of common stock; (b) up to 26,316,200 shares of common stock (the “Note Shares”) issuable upon the conversion of outstanding convertible promissory notes (the “Convertible Notes”); (c) up to 892 shares of common stock issuable upon the exercise of certain warrants (the “Legacy Proterra warrants”); (d) 11,171,287 shares of common stock issued or issuable upon the exercise of certain equity awards; and (e) up to 12,895,129 shares of common stock (“Earnout Shares”), comprising both Earnout Shares that were issued to certain Legacy Proterra Holders in July 2021 and Earnout Shares that certain Legacy Proterra Holders have the contingent right to receive upon the achievement of certain stock price-based vesting conditions.

In addition, the Prospectus and this prospectus supplement relate to the offer and sale of (i) up to 892 shares of common stock issuable by us upon exercise of the Legacy Proterra warrants that were previously registered, and (ii) up to 26,316,200 Note Shares issuable by us upon conversion of the Convertible Notes, certain of which were previously registered. The number of shares issuable upon conversion of Convertible Notes is calculated assuming that the Convertible Notes convert pursuant to their mandatory conversion terms on December 31, 2022 pursuant to the terms of the Convertible Notes in effect as of that date and does not reflect the terms of the amended Convertible Notes Facility (as defined in the Prospectus). The actual number of shares issued upon conversion will depend on the actual date of conversion and will be pursuant to the terms of the amended Convertible Notes Facility (as defined in the Prospectus).

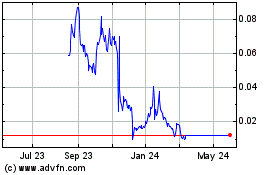

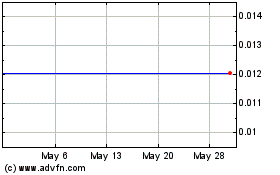

Our common stock trades on the over-the-counter market under the symbol “PTRAQ.” On November 2, 2023, the last reported sale price of our common stock was $0.0682 per share. Quotes of stock trading prices on any over-the-counter market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Investing in our common stock involves risks. See the section entitled “Risk Factors” beginning on page 7 of the Prospectus to read about factors you should consider before buying our common stock.

The registration statement to which the Prospectus and this prospectus supplement relates registers the resale of a substantial number of shares of our common stock by the Selling Securityholders. Sales in the public market of a large number of shares, or the perception in the market that the holders of a large number of shares intend to sell shares, could reduce the market price of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is November 6, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________

Commission file number 001-39546

Proterra Inc

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 90-2099565 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| |

1815 Rollins Road Burlingame, California | 94010 | |

(Address of Principal Executive Offices) | (Zip Code) | |

(864) 438-0000

Registrant's telephone number, including area code

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| | | | |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | o |

| | Emerging growth company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The registrant had outstanding 228.2 million shares of common stock as of November 2, 2023.

TABLE OF CONTENTS

Explanatory Note – Certain Defined Terms

Unless otherwise stated in this Quarterly Report on Form 10-Q (the “Quarterly Report”) or the context otherwise requires, references to:

•“ArcLight” means ArcLight Clean Transition Corp., a Cayman Islands exempted company, prior to the consummation of the Domestication;

•“Business Combination” means the Domestication, the Merger and the other transactions contemplated by the Merger Agreement, collectively, including the PIPE Financing;

•“Closing” means the closing of the Business Combination;

•“Closing Date” means June 14, 2021;

•“common stock” means the common stock, par value $0.0001 per share, of Proterra;

•“Convertible Notes” means the Secured Convertible Promissory Notes that Legacy Proterra issued in August 2020, as amended and restated on March 31, 2023;

•"Cowen Parties” means the Second Lien Agent, CSI I Prodigy Holdco LP, CSI Prodigy Co-Investment LP, and CSI PRTA Co-Investment L.P.;

•“Domestication” means the domestication of ArcLight as a corporation incorporated in the State of Delaware;

•“initial public offering” means ArcLight’s initial public offering that was consummated on September 25, 2020;

•“Legacy Proterra” means Proterra Inc (now known as Proterra Operating Company, Inc.), a Delaware corporation, prior to the consummation of the Business Combination;

•“Merger” means the merger of Phoenix Merger Sub with and into Legacy Proterra pursuant to the Merger Agreement, with Legacy Proterra as the surviving company in the Merger and, after giving effect to such Merger, Legacy Proterra becoming a wholly-owned subsidiary of Proterra;

•“Merger Agreement” means that certain Merger Agreement, dated as of January 11, 2021 (as may be amended, supplemented or otherwise modified from time to time), by and among ArcLight, Phoenix Merger Sub and Legacy Proterra;

•“Note Purchase Agreement” means the Note Purchase Agreement, dated as of August 4, 2020, by and among Legacy Proterra, the investors from time to time party thereto, the guarantors from time to time party thereto and CSI GP I LLC, as collateral agent, as amended on August 31, 2020 and further amended on March 31, 2023;

•“Phoenix Merger Sub” refers to Phoenix Merger Sub, Inc.;

•“PIPE Financing” means the transactions contemplated by the Subscription Agreements, pursuant to which the PIPE Investors collectively subscribed for 41,500,000 shares of common stock for an aggregate purchase price of $415,000,000 in connection with the Closing;

•“PIPE Investors” means the investors who participated in the PIPE Financing and entered into the Subscription Agreements;

•“Proterra” means ArcLight upon and after Closing;

•“Proterra OpCo” means Proterra Operating Company, Inc. (formerly known as Proterra Inc prior to the consummation of the Business Combination);

•"Second Lien Agent” means CSI GP I LLC, as collateral agent under the Note Purchase Agreement;

•“Senior Credit Facility” means the Loan, Guaranty and Security Agreement dated as of May 8, 2019, by and among Legacy Proterra, the lenders from time to time party thereto and Bank of America, N.A., as administrative agent, as amended on August 4, 2020, June 16, 2021, and April 3, 2023; and

•“Subscription Agreements” means the subscription agreements, entered into by ArcLight and each of the PIPE Investors in connection with the PIPE Financing.

In addition, unless otherwise indicated or the context otherwise requires, references in this Quarterly Report to the “Company,” “we,” “us,” “our” and other similar terms refer to Legacy Proterra prior to the Business Combination and to Proterra and its consolidated subsidiaries after giving effect to the Business Combination.

Forward-Looking Statements

This Quarterly Report contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This Quarterly Report contains forward-looking statements regarding, among other things, our plans, strategies and prospects, both business and financial. These statements are based on the beliefs and assumptions of our management. We also may provide forward-looking statements in oral statements or other written materials released to the public. Although we believe that our plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. These statements may be preceded by, followed by or include the words “believes”, “estimates”, “expects”, “projects”, “forecasts”, “objectives”, “goals”, “aims”, “continue”, “predict”, “would”, “could’, “may”, “will”, “should”, “seeks”, “plans”, “scheduled”, “anticipates” or “intends” or similar expressions. Forward-looking statements contained in this Quarterly Report may include, for example, and without limitation, statements about:

•Bankruptcy Court rulings in the Chapter 11 Cases and the outcome of the Company’s Chapter 11 Cases in the Bankruptcy Court, including our ability to successfully market and sell all, substantially all or some of our assets and to develop, negotiate, confirm and consummate a Chapter 11 plan;

•whether the period over which we anticipate our existing cash and cash equivalents will be sufficient to fund our Chapter 11 Cases, operating expenses and capital expenditure requirements;

•the length of time that we will operate under Chapter 11 protection and the continued availability of operating capital during the pendency of Chapter 11;

•the effects of the Chapter 11 Cases, including increased legal and other professional costs and the diversion of management’s attention and consumption of resources as a result of the Chapter 11 Cases;

•our ability to meet our financial obligations during the Chapter 11 process;

•risks relating to the trading price and volatility of the Company’s common stock as a result of the Chapter 11 Cases and the effects of the delisting of the Company’s common stock from the Nasdaq Global Select Market;

•possible proceedings that may be brought by third parties in connection with the Chapter 11 process or any potential asset sale and risks associated with third-party motions in Chapter 11;

•the result of our post-petition marketing process is unknown, and there may be insufficient proceeds, if any, to make distributions to equity holders;

•the timing or amount of distributions, if any, to our stakeholders;

•employee attrition and our ability to retain senior management and other key personnel due to the distractions and uncertainties of the Chapter 11 Cases;

•our ability to maintain relationships with suppliers, customers, employees and other third parties as a result of the Chapter 11 Cases;

•our financial and business performance, including business metrics;

•our ability to continue as a going concern;

•availability of additional capital to support our ability to maintain adequate operational and financial resources and generate sufficient cash flows;

•changes in our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects and plans;

•regulations that we are subject to, the impact of unfavorable changes to such regulations, or our ability to comply with such regulations;

•expectations regarding corporate, state, federal and international mandates/commitments to clean energy;

•our success in retaining or recruiting, or changes required in, our officers, key employees or directors, and our ability to attract and retain key personnel;

•forecasts regarding long-term end-customer adoption rates and demand for our products in markets that are new and rapidly evolving and our ability to meet demand for our products;

•our ability to compete successfully against current and future competitors in light of intense and increasing competition in the commercial vehicle electrification market, including battery systems for transit buses and other commercial vehicle uses;

•our ability to improve operational efficiency, streamline supply chain and distribution logistics, reduce organizational complexity and reduce facility costs;

•the availability of government economic incentives and government funding for commercial vehicle electrification, including public transit upon which our transit business is significantly dependent, and other commercial uses for our battery systems;

•willingness of corporate and other public transportation providers and other commercial vehicle end users to adopt and fund the purchase of electric vehicles for mass transit and other commercial uses;

•availability of a limited number of suppliers for our products and services and their desire and/or ability to satisfy our supply demands, and our dependence on our business suppliers, particularly as we build out new facilities;

•material losses and costs from product warranty claims, recalls, or remediation of electric transit buses or our battery systems for real or perceived deficiencies or from customer satisfaction campaigns;

•increases in costs, disruption of supply, or shortage of materials, particularly lithium-ion cells and wiring harnesses, and drivetrain components;

•our dependence on a small number of customers that fluctuate from year to year, and ability to add new customers or expand sales to our existing customers;

•rapid evolution of our industry and technology, and related unforeseen changes, including developments in alternative technologies and powertrains or improvements in the internal combustion engine that could adversely affect the demand for our electric transit buses;

•development, maintenance and growth of strategic relationships in the Proterra Powered or Proterra Energy business, identification of new strategic relationship opportunities, or formation strategic relationships;

•accident or safety incidents involving our buses, battery systems, electric drivetrains, high-voltage systems or charging solutions;

•product liability claims, which could harm our financial condition and liquidity if we are not able to successfully defend or insure against such claims;

•changes to U.S. trade policies, including new tariffs or the renegotiation or termination of existing trade agreements or treaties;

•various environmental and safety laws and regulations that could impose substantial costs upon us and negatively impact our ability to operate our manufacturing facilities; outages and disruptions of our services if we fail to maintain adequate security and supporting infrastructure as we scale our information technology systems;

•ability to protect our intellectual property and defend intellectual property rights claims made by third parties;

•developments and projections relating to our competitors and industry;

•the potential for our business development efforts to maximize the potential value of our portfolio and our related plans and strategy;

•our estimates regarding expenses, future revenue, capital requirements and needs for additional financing;

•our ability to develop and maintain effective internal controls and procedures and remediate the material weaknesses we have identified in our internal controls;

•our expectations with respect to tax treatment, including with respect to tax incentives and credits;

•cyber-attacks and security vulnerabilities; and

•the continuing impacts of the macroeconomic conditions, such as rising inflation and interest rates, uncertain credit and global financial markets, including recent and potential bank failures, and supply chain disruptions, and geopolitical events, such as the conflict between Russia and Ukraine and related sanctions, on the foregoing.

These forward-looking statements are based on information available as of the date of this Quarterly Report, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Important factors could cause actual results to differ materially from those indicated or implied by forward-looking statements such as those contained in documents we have filed with the U.S. Securities and Exchange Commission (the “SEC”) and financial reporting to the Bankruptcy Court. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, investments or similar transactions.

As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. For a discussion of the risks involved in our business and investing in our common stock, see Part II, Item 1A. titled “Risk Factors.”

Should one or more of these risks or uncertainties materialize, or should any of the underlying assumptions prove incorrect, actual results may vary in material respects from those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements.

Summary of Risk Factors

The below summary of risk factors provides an overview of many of the risks we are exposed to in the normal course of our business activities. As a result, the following summary of risks does not contain all of the information that may be important to you, and you should read the summary of risks together with the more detailed discussion of risks set forth in Part II, Item 1A under the heading “Risk Factors,” and elsewhere in this Quarterly Report. Additional risks, beyond those summarized below or discussed elsewhere in this Quarterly Report, may apply to our activities or operations as currently conducted or as we may conduct them in the future or in the markets in which we operate or may in the future operate. Consistent with the foregoing, we are exposed to a variety of risks, including, without limitation, risks associated with the following:

•We are subject to the risks and uncertainties associated with Chapter 11 proceedings, including restrictions on our use of cash collateral, and operating as Debtors in the Chapter 11 Cases for a long period of time may harm our business.

•We may not be able to obtain confirmation of a Chapter 11 plan of reorganization or complete any Bankruptcy Court-approved sales of our Company or assets, or we may not be able to realize adequate consideration for such sales.

•We may be subject to claims that will not be discharged in the Chapter 11 proceedings, which could have a material adverse effect on our financial conditions and results of operations.

•We have, and may continue, to experience increased levels of employee attrition as a result of the Chapter 11 proceedings.

•Our post-bankruptcy capital structure has yet to be determined, and any changes to our capital structure may have a material adverse effect on existing debt and security holders, including holders of our common stock.

•The Chapter 11 proceedings has caused and may continue to cause our common stock to decrease in value materially or may render our common stock worthless. Trading in shares of our common stock during the pendency of the Chapter 11 proceedings is highly speculative and investors could lose all or part of their investments.

•There is substantial doubt about our ability to continue as a going concern for a period of 12 months from the date of this Quarterly Report on Form 10-Q.

•If our estimates or judgments relating to our critical accounting policies prove to be incorrect or financial reporting standards or interpretations change, our operating results could be adversely affected.

•We have identified material weaknesses in our internal control over financial reporting and may identify additional material weaknesses in the future.

•We have a history of net losses and negative cash flows from operations, have experienced rapid growth and may not achieve or sustain positive gross margin or profitability in the future.

•Our operating results have fluctuated and may continue to fluctuate from quarter to quarter, which makes our future results difficult to predict.

•Because many of the markets in which we compete are new and rapidly evolving, including as a result of consolidation of industry players, it is difficult to forecast long-term end-customer adoption rates and demand for our products, and our ability to meet demand for our products.

•Our business is significantly dependent on government funding and economic incentives for public transit and commercial electric vehicles, and the unavailability, reduction, or elimination of government economic

incentives would have an adverse effect on our business, prospects, financial condition, and operating results.

•Our business is dependent on the continued adoption of electrification in the commercial vehicle market and the continued development of infrastructure to support increased electrification by governments, utilities and end users.

•We face intense and increasing competition in the transit bus market and may not be able to compete successfully against current and future competitors, which could adversely affect our business, revenue growth, and market share.

•We have been and may continue to be impacted by macroeconomic conditions such as the rising inflation and interest rates, uncertain credit and global financial markets, including the recent and potential bank failures, and supply chain disruption and geopolitical events, such as the conflict between Russia and Ukraine and related sanctions.

•The growth of our business is dependent upon the willingness of corporate and other public transportation providers to adopt and fund the purchase of electric vehicles.

•Our dependence on a limited number of suppliers for certain product inputs introduces significant risk that could have adverse effects on our financial condition and operating results.

•We have a long sales, production, and technology development cycle for new public transit customers, which may create fluctuations in whether and when revenue is recognized and may have an adverse effect on our business.

•We could incur material losses and costs from product warranty claims, recalls, or remediation of electric transit buses for real or perceived deficiencies or from customer satisfaction campaigns.

•Our revenue has in the past depended, and will likely continue to depend, on a small number of customers that fluctuate from year to year, and failure to add new customers or expand sales to our existing customers could have an adverse effect on our operating results for a particular period.

•Our business is subject to substantial regulations and compliance programs, which are evolving, and unfavorable changes or failure by us to comply with these regulations and compliance programs could have an adverse effect on our business.

•Our business could be adversely affected from an accident or safety incident involving our battery systems, electrification and charging solutions, fleet and energy management systems, electric transit buses or defaults in the materials or workmanship of our composite bus bodies or other components.

Part I. Financial Information

Item 1. Financial Statements

PROTERRA INC

(DEBTOR-IN-POSSESSION)

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except per share data)

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| (Unaudited) | | * |

| Assets: | | | |

| Cash and cash equivalents | $ | 112,814 | | | $ | 73,695 | |

| Accounts receivable, net | 80,854 | | | 130,337 | |

| Short-term investments | 17,899 | | | 224,359 | |

| Inventory | 263,610 | | | 169,567 | |

| Prepaid expenses and other current assets | 33,532 | | | 50,893 | |

| Deferred cost of goods sold | 4,706 | | | 4,304 | |

| Restricted cash, current | 25,546 | | | 12,565 | |

| Total current assets | 538,961 | | | 665,720 | |

| Property, plant, and equipment, net | 108,409 | | | 107,552 | |

Operating lease right-of-use assets | 15,326 | | | 20,274 | |

| | | |

| Long-term inventory prepayment | 10,000 | | | 10,000 | |

| Other assets | 38,729 | | | 36,913 | |

| Total assets | $ | 711,425 | | | $ | 840,459 | |

| Liabilities and Stockholders’ Equity: | | | |

| Accounts payable | $ | 7,379 | | | $ | 57,822 | |

| Accrued liabilities | 30,328 | | | 33,551 | |

| Deferred revenue, current | 768 | | | 30,017 | |

| Operating lease liabilities, current | — | | | 6,876 | |

| Debt, current | 178,992 | | | 122,692 | |

| | | |

| Total current liabilities | 217,467 | | | 250,958 | |

| | | |

| Deferred revenue, non-current | 5 | | | 37,381 | |

| Operating lease liabilities, non-current | — | | | 18,098 | |

| Other long-term liabilities | 4,999 | | | 17,164 | |

| Total liabilities not subject to compromise | 222,471 | | | 323,601 | |

| Liabilities subject to compromise | 213,745 | | | — | |

| Total liabilities | 436,216 | | | 323,601 | |

Commitments and contingencies (Note 7) | | | |

| Stockholders’ equity: | | | |

Common stock, $0.0001 par value; 1,000,000 shares authorized and 228,167 shares issued and outstanding as of September 30, 2023 (unaudited); 500,000 shares authorized and 226,265 shares issued and outstanding as of December 31, 2022 | 22 | | | 22 | |

Preferred stock, $0.0001 par value; 10,000 shares authorized and zero shares issued and outstanding as of September 30, 2023 (unaudited); 10,000 shares authorized, zero shares issued and outstanding as of December 31, 2022 | — | | | — | |

Additional paid-in capital | 1,641,123 | | | 1,613,556 | |

Accumulated deficit | (1,365,930) | | | (1,096,175) | |

| Accumulated other comprehensive loss | (6) | | | (545) | |

Total stockholders’ equity | 275,209 | | | 516,858 | |

Total liabilities and stockholders’ equity | $ | 711,425 | | | $ | 840,459 | |

*: Derived from audited Consolidated Financial Statements.

See accompanying notes to unaudited condensed consolidated financial statements.

PROTERRA INC

(DEBTOR-IN-POSSESSION)

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Product revenue | $ | 79,957 | | | $ | 89,769 | | | $ | 227,056 | | | $ | 214,196 | |

| Parts and other service revenue | 6,191 | | | 6,454 | | | 24,335 | | | 15,172 | |

| Total revenue | 86,148 | | | 96,223 | | | 251,391 | | | 229,368 | |

| Product cost of goods sold | 92,950 | | | 91,408 | | | 264,391 | | | 217,743 | |

| Parts and other service cost of goods sold | 4,628 | | | 6,091 | | | 17,375 | | | 15,349 | |

| Total cost of goods sold | 97,578 | | | 97,499 | | | 281,766 | | | 233,092 | |

Gross loss | (11,430) | | | (1,276) | | | (30,375) | | | (3,724) | |

| Research and development | 10,992 | | | 18,165 | | | 44,438 | | | 44,871 | |

| Selling, general and administrative | 37,419 | | | 38,554 | | | 108,867 | | | 98,646 | |

| Total operating expenses | 48,411 | | | 56,719 | | | 153,305 | | | 143,517 | |

| Loss from operations | (59,841) | | | (57,995) | | | (183,680) | | | (147,241) | |

| Interest expense, net | 152 | | | 7,361 | | | 11,344 | | | 21,191 | |

| (Gain) loss on debt extinguishment | — | | | — | | | 177,939 | | | (10,201) | |

Gain on revaluation of derivative liability | (81,300) | | | — | | | (114,878) | | | — | |

Asset impairment charge | 1,600 | | | — | | | 1,600 | | | — | |

| Other expense (income), net | (1,900) | | | (295) | | | (6,321) | | | (1,271) | |

| Reorganization items, net | 16,391 | | | — | | | 16,391 | | | — | |

Income (loss) before income taxes | 5,216 | | | (65,061) | | | (269,755) | | | (156,960) | |

| Provision for income taxes | — | | | — | | | — | | | — | |

Net income (loss) | $ | 5,216 | | | $ | (65,061) | | | $ | (269,755) | | | $ | (156,960) | |

Net income (loss) per share of common stock: | | | | | | | |

| Basic | $ | 0.02 | | | $ | (0.29) | | | $ | (1.19) | | | $ | (0.70) | |

| Diluted | $ | 0.02 | | | $ | (0.45) | | | $ | (1.19) | | | $ | (0.79) | |

| Weighted average shares used in per share computation: | | | | | | | |

| Basic | 227,869 | | | 225,291 | | | 227,192 | | | 223,782 | |

| Diluted | 227,869 | | | 250,704 | | | 227,192 | | | 248,637 | |

See accompanying notes to unaudited condensed consolidated financial statements.

PROTERRA INC

(DEBTOR-IN-POSSESSION)

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS (UNAUDITED)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

Net income (loss) | $ | 5,216 | | | $ | (65,061) | | | $ | (269,755) | | | $ | (156,960) | |

| Other comprehensive income (loss), net of taxes: | | | | | | | |

| Available-for-sales securities: | | | | | | | |

| Unrealized gain (loss) on available-for-sale securities | 25 | | | 625 | | | 539 | | | (1,481) | |

| Other comprehensive income (loss), net of taxes | 25 | | | 625 | | | 539 | | | (1,481) | |

Total comprehensive income (loss), net of taxes | $ | 5,241 | | | $ | (64,436) | | | $ | (269,216) | | | $ | (158,441) | |

See accompanying notes to unaudited condensed consolidated financial statements.

PROTERRA INC

(DEBTOR-IN-POSSESSION)

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (UNAUDITED)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Common Stock | | Additional Paid-in Capital | | Accumulated Deficit | | Accumulated Other Comprehensive Loss | | Total |

| Nine Months Ended September 30, 2023 | | | | | | Shares | | Amount | | | | |

| Balance, December 31, 2022 | | | | | | 226,265 | | | $ | 22 | | | $ | 1,613,556 | | | $ | (1,096,175) | | | $ | (545) | | | $ | 516,858 | |

| Issuance of stock upon exercise of options and RSU release | | | | | | 588 | | | — | | | 113 | | | — | | | — | | | 113 | |

| | | | | | | | | | | | | | | | |

| Stock-based compensation | | | | | | — | | | — | | | 4,314 | | | — | | | — | | | 4,314 | |

| Debt extinguishment fair value adjustment | | | | | | — | | | — | | | (7,200) | | | — | | | — | | | (7,200) | |

| Net loss | | | | | | — | | | — | | | — | | | (243,977) | | | — | | | (243,977) | |

| Other comprehensive income, net of taxes | | | | | | — | | | — | | | — | | | — | | | 608 | | | 608 | |

| Balance, March 31, 2023 | | | | | | 226,853 | | | 22 | | | 1,610,783 | | | (1,340,152) | | | 63 | | | 270,716 | |

| Issuance of stock upon RSU release | | | | | | 331 | | | — | | | — | | | — | | | — | | | — | |

| Stock issuance for employee stock purchase plan | | | | | | 586 | | | — | | | 662 | | | — | | | — | | | 662 | |

| Reclassification of liability upon charter amendment | | | | | | — | | | — | | | 20,800 | | | — | | | — | | | 20,800 | |

| Stock-based compensation | | | | | | — | | | — | | | 4,405 | | | — | | | — | | | 4,405 | |

| Net loss | | | | | | — | | | — | | | — | | | (30,994) | | | — | | | (30,994) | |

| Other comprehensive loss, net of taxes | | | | | | — | | | — | | | — | | | — | | | (94) | | | (94) | |

| Balance, June 30, 2023 | | | | | | 227,770 | | | 22 | | | 1,636,650 | | | (1,371,146) | | | (31) | | | 265,495 | |

Issuance of stock upon RSU release, net of payment of tax withholding obligations | | | | | | 397 | | | — | | | (9) | | | — | | | — | | | (9) | |

| Stock-based compensation | | | | | | — | | | — | | | 4,482 | | | — | | | — | | | 4,482 | |

Net income | | | | | | — | | | — | | | — | | | 5,216 | | | — | | | 5,216 | |

Other comprehensive income, net of taxes | | | | | | — | | | — | | | — | | | — | | | 25 | | | 25 | |

| Balance, September 30, 2023 | | | | | | 228,167 | | | $ | 22 | | | $ | 1,641,123 | | | $ | (1,365,930) | | | $ | (6) | | | $ | 275,209 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Common Stock | | Additional Paid-in Capital | | Accumulated Deficit | | Accumulated Other Comprehensive Loss | | Total |

| Nine Months Ended September 30, 2022 | | | | | | Shares | | Amount | | | | |

| Balance, December 31, 2021 | | | | | | 221,960 | | | $ | 22 | | | $ | 1,578,943 | | | $ | (858,225) | | | $ | (588) | | | $ | 720,152 | |

| Issuance of stock upon exercise of options and RSU release | | | | | | 743 | | | — | | | 1,833 | | | — | | | — | | | 1,833 | |

| Stock issuance for employee stock purchase plan | | | | | | — | | | — | | | — | | | — | | | — | | | — | |

| Stock-based compensation | | | | | | — | | | — | | | 4,642 | | | — | | | — | | | 4,642 | |

| Net loss | | | | | | — | | | — | | | — | | | (50,078) | | | — | | | (50,078) | |

| Other comprehensive loss, net of taxes | | | | | | — | | | — | | | — | | | — | | | (1,641) | | | (1,641) | |

| Balance, March 31, 2022 | | | | | | 222,703 | | | 22 | | | 1,585,418 | | | (908,303) | | | (2,229) | | | 674,908 | |

| Issuance of stock upon exercise of options and RSU release | | | | | | 1,951 | | | — | | | 6,011 | | | — | | | — | | | 6,011 | |

| Stock issuance for employee stock purchase plan | | | | | | 325 | | | — | | | 1,502 | | | — | | | — | | | 1,502 | |

| Stock-based compensation | | | | | | — | | | — | | | 6,315 | | | — | | | — | | | 6,315 | |

| Net loss | | | | | | — | | | — | | | — | | | (41,821) | | | — | | | (41,821) | |

| Other comprehensive loss, net of taxes | | | | | | — | | | — | | | — | | | — | | | (465) | | | (465) | |

| Balance, June 30, 2022 | | | | | | 224,979 | | | 22 | | | 1,599,246 | | | (950,124) | | | (2,694) | | | 646,450 | |

| Issuance of stock upon exercise of options and RSU release | | | | | | 553 | | | — | | | 1,125 | | | — | | | — | | | 1,125 | |

| Stock-based compensation | | | | | | — | | | — | | | 5,356 | | | — | | | — | | | 5,356 | |

| Net loss | | | | | | — | | | — | | | — | | | (65,061) | | | — | | | (65,061) | |

Other comprehensive income, net of taxes | | | | | | — | | | — | | | — | | | — | | | 625 | | | 625 | |

| Balance, September 30, 2022 | | | | | | 225,532 | | | $ | 22 | | | $ | 1,605,727 | | | $ | (1,015,185) | | | $ | (2,069) | | | $ | 588,495 | |

See accompanying notes to unaudited condensed consolidated financial statements.

PROTERRA INC

(DEBTOR-IN-POSSESSION)

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (269,755) | | | $ | (156,960) | |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | |

| Depreciation and amortization | 15,045 | | | 9,583 | |

Asset impairment charge | 1,600 | | | — | |

| Stock-based compensation | 13,201 | | | 16,313 | |

| Amortization of debt discount and issuance costs | (922) | | | 10,497 | |

| Accretion of debt PIK interest | 8,015 | | | 5,559 | |

| (Gain) loss on debt extinguishment | 177,939 | | | (10,007) | |

Gain on revaluation of derivative liability | (114,878) | | | — | |

Non-cash reorganization items | (1,139) | | | — | |

| Others | (3,959) | | | (688) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 48,579 | | | (20,717) | |

| Inventory | (94,043) | | | (49,762) | |

| Prepaid expenses and other current assets | 17,360 | | | (13,508) | |

| Deferred cost of goods sold | (401) | | | (1,761) | |

| Operating lease right-of-use assets and liabilities | (537) | | | 412 | |

| Other assets | (3,522) | | | (13,042) | |

| Accounts payable and accrued liabilities | 41,880 | | | 19,922 | |

| Deferred revenue, current and non-current | 16,420 | | | 5,100 | |

| Other non-current liabilities | 9,859 | | | 1,473 | |

| Net cash used in operating activities | (139,258) | | | (197,586) | |

| Cash flows from investing activities: | | | |

| Purchase of investments | (164,468) | | | (395,596) | |

| Proceeds from maturities of investments | 375,832 | | | 512,000 | |

| Purchase of property and equipment | (16,486) | | | (41,833) | |

Net cash provided by investing activities | 194,878 | | | 74,571 | |

| Cash flows from financing activities: | | | |

| | | |

| | | |

| | | |

| Repayment of government grants | — | | | (700) | |

| Proceeds from exercise of stock options | 113 | | | 8,969 | |

| Proceeds from employee stock purchase plan | 662 | | | 1,502 | |

| Other financing activities | (4,295) | | | 2,815 | |

| Net cash provided by (used in) financing activities | (3,520) | | | 12,586 | |

Net increase (decrease) in cash and cash equivalents, and restricted cash | 52,100 | | | (110,429) | |

| Cash and cash equivalents, and restricted cash at the beginning of period | 86,260 | | | 182,604 | |

| Cash and cash equivalents, and restricted cash at the end of period | $ | 138,360 | | | $ | 72,175 | |

| Supplemental disclosures of cash flow information: | | | |

| Cash paid for interest | $ | 4,400 | | | $ | 6,289 | |

| Cash paid for income taxes | — | | | — | |

| Non-cash investing and financing activity: | | | |

| Accrued capital expenditures in accounts payable and accrued liabilities | $ | 3,299 | | | $ | 4,798 | |

| Non-cash transfer of assets to inventory | — | | | 515 | |

| Reclassification of derivative liability upon charter amendment | $ | 20,800 | | | $ | — | |

See accompanying notes to unaudited condensed consolidated financial statements.

PROTERRA INC

(DEBTOR-IN-POSSESSION)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. Summary of Significant Accounting Policies

Organization and Description of Business

Proterra Inc (“Proterra” or the “Company") is a leading developer and producer of zero-emission electric vehicle and EV technology solutions for commercial application. Proterra designs, develops, manufactures, and sells electric transit buses as an original equipment manufacturer for North American public transit agencies, airports, universities, and other commercial transit fleets. It also designs, develops, manufactures, sells, and integrates proprietary battery systems and electrification solutions for global commercial vehicle manufacturers. Additionally, Proterra provides fleet-scale, high-power charging solutions for its customers. Proterra is headquartered in Burlingame, California. The Company has consolidated bus production to Greenville, South Carolina and battery production to Greer, South Carolina as of September 30, 2023.

Proterra Operating Company, Inc. (“Proterra OpCo” and formerly known as Proterra Inc prior to the consummation of the Business Combination (“Legacy Proterra”)) was originally formed in June 2004 as a Colorado limited liability company and converted to a Delaware corporation in February 2010. On June 14, 2021, Legacy Proterra consummated the transactions contemplated by the Merger Agreement (the “Merger Agreement”), dated as of January 11, 2021, by and among ArcLight Clean Transition Corp. (“ArcLight”), (and, after the domestication of ArcLight as a corporation incorporated in the State of Delaware, (the “Domestication”), Proterra), Phoenix Merger Sub, Inc. (the “Phoenix Merger Sub”), and Legacy Proterra, whereby Phoenix Merger Sub merged with and into Legacy Proterra, and Legacy Proterra being the surviving corporation and a wholly owned subsidiary of Proterra. Legacy Proterra changed its name to “Proterra Operating Company, Inc.” and continues as a Delaware corporation and wholly-owned subsidiary of Proterra (the “Merger”). Unless otherwise specified or unless the context otherwise requires, references in these notes to the “Company,” “we,” “us,” or “our” refer to Legacy Proterra prior to the Domestication, the Merger and other transactions contemplated by the Merger Agreement (the “Business Combination”) and to Proterra following the Business Combination.

Voluntary Filing under Chapter 11

As previously disclosed, on August 7, 2023 (the “Petition Date”), Proterra Inc and its direct subsidiary, Proterra Operating Company, Inc. (collectively, the “Debtors”), filed voluntary petitions (the “Bankruptcy Petitions”) for reorganization under Chapter 11 (“Chapter 11) of the United States Bankruptcy Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (such court, the “Bankruptcy Court” and such cases, the “Chapter 11 Cases”). The Chapter 11 Cases are jointly administered under the caption In re Proterra Inc, Case No. 23-11120 (BLS) (Bankr. D. Del. 2023). The Debtors continue to operate their business as “debtors-in-possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court. To ensure their ability to continue operating in the ordinary course of business, the Debtors sought from the Bankruptcy Court, various forms of “first-day” relief”, including, among other things, authority to use cash collateral, pay employee wages and benefits, pay vendors and suppliers in the ordinary course for all goods and services provided after the Petition Date and continue customer programs. On August 10, 2023, the motions filed by the Debtors seeking this “first-day” relief were approved by the Bankruptcy Court and, to the extent such relief was granted on an interim basis, the Debtors have subsequently obtained orders granting such relief on a final basis. For detailed discussion about the Chapter 11 Cases, refer to Note 2, Chapter 11 Filing and Other Related Matters.

NASDAQ Delisting

On August 8, 2023, the Company received written notice from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that, as a result of the Chapter 11 Cases and in accordance with Nasdaq Listing Rules 5101, 5110(b) and IM-5101-1, Nasdaq had determined to delist the Company’s common stock from the Nasdaq Global Select Market. The Company did not appeal this determination. On August 17, 2023, Nasdaq suspended the trading of the Company’s common stock at the opening of business. On September 9, 2023, Nasdaq applied to the U.S. Securities and Exchange Commission (the “SEC”) pursuant to Form 25 to remove the common stock of the Company from listing and registration on the Nasdaq Global Select Market at the opening of business September 20, 2023. As a result of the suspension and

PROTERRA INC

(DEBTOR-IN-POSSESSION)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

delisting, the Company’s common stock began trading exclusively on the over-the-counter market (“OTC market”) on August 17, 2023 under the symbol PTRAQ. We will remain subject to SEC reporting obligations.

Application of ASC 852

Beginning on the Petition Date, the Company applied Financial Accounting Standards Board Codification Topic 852, Reorganizations (“ASC 852”) in preparing the consolidated financial statements. ASC 852 requires the financial statements, for the periods subsequent to the Petition Date and up to and including the period of emergence from Chapter 11, to distinguish transactions and events that are directly associated with the reorganization from the ongoing operations of the business. Accordingly, certain charges incurred during the bankruptcy proceedings, such as legal and other professional fees incurred directly as a result of the bankruptcy proceeding are recorded as Reorganization items, net in the Condensed Consolidated Statements of Operations and Comprehensive Loss. In addition, prepetition obligations that may be impacted by the Chapter 11 process have been classified on the Consolidated Balance Sheet as of September 30, 2023 as liabilities subject to compromise. These liabilities are reported at the amounts the Company anticipates will be allowed by the Bankruptcy Court, even if they may be settled for lesser amounts. See Note 2, Chapter 11 Filing and Other Related Matters, for more information.

Basis of Presentation

The unaudited condensed consolidated financial statements and accompanying notes have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) and the rules and regulations of the SEC.

Certain information and footnote disclosures normally included in consolidated financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to such rules and regulations. Accordingly, these condensed consolidated financial statements should be read in conjunction with the audited financial statements for the year ended December 31, 2022 and the related notes incorporated by reference in the Company’s Annual Report (the “Annual Report”) on Form 10-K, filed with SEC on March 17, 2023 and amended on May 1, 2023, which provides a more complete discussion of the Company’s accounting policies and certain other information. The information as of December 31, 2022 was derived from the Company’s audited financial statements. The condensed consolidated financial statements were prepared on the same basis as the audited financial statements and, in the opinion of management, reflect all adjustments, which include only normal recurring adjustments necessary for a fair presentation of the Company’s financial position as of September 30, 2023 and the results of operations and cash flows for the nine months ended September 30, 2023 and 2022. The results of operations for the nine months ended September 30, 2023 are not necessarily indicative of the results that may be expected for the year ending December 31, 2023.

Liquidity and Going Concern

Under ASC Subtopic 205-40, Presentation of Financial Statements—Going Concern (“ASC 205-40”), the Company has the responsibility to evaluate whether conditions and/or events raise substantial doubt about the Company’s ability to meet our future obligations as they become due within one year of the financial statements being issued in this Quarterly Report on Form 10-Q. These financial statements have been prepared by management in accordance with U.S. GAAP and this basis assumes that the Company will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. These financial statements do not include any adjustments that may result from the outcome of this uncertainty.

The Company has incurred net losses and negative cash flows from operations since inception. As of September 30, 2023, the Company has an accumulated deficit of $1.4 billion, and cash and cash equivalents and short-term investments of $130.7 million. The Company has funded operations primarily through a combination of equity and debt financing.

Beginning on the Petition Date, the Company’s ability to continue as a going concern is contingent upon, among other things, its ability to, subject to the Bankruptcy Court’s approval, implement a Chapter 11 plan, emerge from the Chapter 11 Cases and generate sufficient liquidity to meet its contractual obligations and

PROTERRA INC

(DEBTOR-IN-POSSESSION)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

operating needs. As a result of risks and uncertainties, the delisting of our common stock and the effects of potential disruption resulting from the Chapter 11 Cases making it more difficult to maintain business, financing and operational relationships, together with the Company’s recurring losses from operations and accumulated deficit, substantial doubt exists regarding our ability to continue as a going concern for the next 12 months. See Note 2, Chapter 11 Filing and Other Related Matters for additional details on the Chapter 11 Cases.

The Company expects to continue to operate in the normal course for the duration of the Chapter 11 Cases. The Bankruptcy Court has approved a bidding process that may result in the sale of all or substantially all of its assets during the Chapter 11 Cases.

Use of Estimates

In preparing the condensed consolidated financial statements and related disclosures in conformity with U.S. GAAP and pursuant to the rules and regulations of the SEC, the Company must make estimates and judgments that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. Actual results may differ materially from these estimates.

Significant Accounting Policies

There have been no changes to the Company’s significant accounting policies described in the Annual Report, except for the accounting policies related to the Secured Convertible Promissory Notes that Legacy Proterra issued in August 2020 (as amended and restated, the “Convertible Notes”) and derivative liability described in Note 5, Debt, adopted during the three months ended March 31, 2023, and application of ASC 852 during the three months ended September 30, 2023, that have had a material impact on the Company’s condensed consolidated financial statements and related notes. See Note 2, Chapter 11 Filing and Other Related Matters, for more information on application of ASC 852.

Segments

The Company operates in the United States and has sales to the European Union, Canada, United Kingdom, Australia, Japan and Türkiye. Revenue disaggregated by geography, based on the addresses of the Company’s customers, consists of the following (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| United States | $ | 68,480 | | | $ | 82,040 | | | $ | 201,585 | | | $ | 195,680 | |

| Rest of World | 17,668 | | | 14,183 | | | 49,806 | | | 33,688 | |

| $ | 86,148 | | | $ | 96,223 | | | $ | 251,391 | | | $ | 229,368 | |

The Company’s chief operating decision maker is its Chief Executive Officer (CEO) who reviews financial information presented on a consolidated basis for purposes of making decision on allocating resources and assessing financial performance. Accordingly, the Company has determined that it has a single reportable segment.

Accounts Receivable and Allowance for Credit Losses

Accounts receivable are recorded at the invoiced amount and do not bear interest. The Company determines the allowance for credit losses based on historical write-off experience, an analysis of the aging of outstanding receivables, customer payment patterns and expectations of changes in macroeconomic conditions that may affect the collectability of outstanding receivables. The allowance for credit losses was not material as of September 30, 2023 and December 31, 2022.

Credit Risk and Concentration

The Company’s financial instruments that are potentially subject to concentrations of credit risk consist primarily of cash, cash equivalents, restricted cash, short-term investments, and accounts receivable. Cash and

PROTERRA INC

(DEBTOR-IN-POSSESSION)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

cash equivalents and short-term investments are maintained primarily at one financial institution as of September 30, 2023 and December 31, 2022, and deposits exceed federally insured limits. Risks associated with cash and cash equivalents, and short-term investments are mitigated by banking with creditworthy financial institutions. The Company has not experienced any losses on its deposits of cash and cash equivalents or its short-term investments.

Cash equivalents and short-term investments consist of short-term money market funds, corporate debt securities, and debt securities issued by the U.S. Treasury, which are deposited with reputable financial institutions. The Company’s cash management and investment policy limits investment instruments to securities with short-term credit ratings at the timing of purchase of P-2 and A-2 or better from Moody’s Investors Service and Standard & Poor’s Financial Services, LLC, respectively, with the objective to preserve capital and to maintain liquidity until the funds can be used in business operations.

Accounts receivable are typically unsecured and are generally derived from revenue earned from transit agencies, universities and airports in North America and global commercial vehicle manufacturers in North America, the European Union, the United Kingdom, Australia, Japan and Türkiye. The Company periodically evaluates the collectability of its accounts receivable and provides an allowance for potential credit losses as necessary.

Given the large order value for customers and the relatively low number of customers, revenue and accounts receivable have typically been concentrated with a limited number of customers.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue | | Accounts Receivable |

| Three Months Ended September 30, | | Nine Months Ended September 30, | | September 30, | | December 31, |

| 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 |

| Number of customers accounted for 10% or more | 3 | | 2 | | 1 | | 2 | | 3 | | 2 |

Total % of customers accounted for 10% or more | 62% | | 40% | | 24% | | 27% | | 52% | | 48% |

Single source suppliers provide the Company with a number of components that are required for manufacturing of its current products. Although there may be multiple suppliers available, many of the components that the Company’s manufacturing process requires are purchased from one single source. If these single source suppliers fail to meet the Company’s requirements on a timely basis at competitive prices or are unable to provide components for any reason, the Company could suffer manufacturing delays, a possible loss of revenue, or incur higher cost of sales, any of which could adversely impact the Company’s operating results. As part of the Chapter 11 proceedings, the Company rejected the existing contract with TPI Composites, Inc., the single source supplier for bus bodies, and the Company may be unable to negotiate another agreement on better terms. As of September 30, 2023, the Company has sufficient bus bodies in inventory to meet its near term production plan.

Impairment of Long-Lived Assets

The Company evaluates the recoverability of property, plant, and equipment and right-of-use assets for possible impairment whenever events or circumstances indicate that the carrying amount of such assets may not be recoverable. Recoverability of these assets is measured by a comparison of the carrying amounts to the future undiscounted cash flows the assets are expected to generate. If such review indicates that the carrying amount of long-lived assets is not recoverable, the carrying amount of such assets is reduced to fair value.

In addition to the recoverability assessment, the Company periodically reviews the remaining estimated useful lives of property, plant, and equipment. If the estimated useful life assumption for any asset is reduced, the remaining net book value is depreciated over the revised estimated useful life.

The Company reviews long-lived assets for impairment at the lowest level for which separate cash flows can be identified. On October 17, 2023, Volta Trucks, a Proterra Powered customer, announced that it will file for administration in the United Kingdom and insolvency proceedings in other relevant jurisdictions. The Company

PROTERRA INC

(DEBTOR-IN-POSSESSION)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

recorded a $1.6 million impairment charge in the three months and nine months ended September 30, 2023 to the long-term investments recorded in other assets in the condensed consolidated balance sheets. See Note 12, Subsequent events, for details. No impairment charge was recognized in the three and nine months ended September 30, 2022.

Deferred Revenue

Deferred revenue consists of billings or payments received in advance of revenue recognition that are recognized as revenue once the revenue recognition criteria are met. In some instances, progress billings are issued upon meeting certain milestones stated in the contracts. Accordingly, the deferred revenue balance does not represent the total contract value of non-cancelable arrangements. Invoices are typically due within 30 to 40 days. The current portion of deferred revenue represents the amount that is expected to be recognized as revenue within one year from the balance sheet date.

The changes in deferred revenue inclusive of the balance recorded in the liabilities subject to compromise, consisted of the following (in thousands):

| | | | | |

Deferred revenue as of December 31, 2022 | $ | 67,398 | |

Revenue recognized from beginning balance during the nine months ended September 30, 2023 | (17,336) | |

Deferred revenue added during the nine months ended September 30, 2023 | 33,756 | |

Deferred revenue as of September 30, 2023 | $ | 83,818 | |

Liabilities Subject to Compromise

Since filing the Chapter 11 petitions, the Company has operated as debtor-in-possession under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code. The liabilities subject to compromise balance is reflective of expected allowed claim amounts in accordance with ASC 852 and are subject to change materially based on the proceedings and continued consideration of claims that may be modified, allowed, or disallowed. Refer to Note 2, Chapter 11 Filing and Other Related Matters, for details.

Revenue Recognition

The Company derives revenue primarily from the sale of vehicles and charging systems, the installation of charging systems, the sale of battery systems and powertrain components to other vehicle manufacturers, as well as the sale of spare parts and other services provided to customers. Product revenue consists of revenue earned from vehicles and charging systems, battery systems and powertrain components, installation of charging systems, and revenue from leased vehicles, charging systems, and batteries under operating leases. Parts and other service revenue includes revenue earned from spare parts, the design and development of battery systems and powertrain systems for other vehicle manufacturers, and extended warranties.

The Company recognizes revenue when or as it satisfies a performance obligation by transferring control of a product or service to a customer. Revenue from product sales is recognized when control of the underlying performance obligations is transferred to the customer. Revenue from sales of vehicles is typically recognized upon delivery when the Company can objectively demonstrate that the criteria specified in the contractual acceptance provisions are achieved prior to delivery. In cases, where the Company cannot objectively demonstrate that the criteria specified in the contractual acceptance provisions have been achieved prior delivery, revenue is recognized upon acceptance by the customer. Revenue from sales of charging systems is recognized at a point in time, generally upon delivery or commissioning when control of the underlying performance obligations are transferred to the customer. Under certain contract arrangements, the control of the performance obligations related to the charging systems is transferred over time, and the associated revenue is recognized over the installation period using an input measure based on costs incurred to date relative to total estimated costs to completion. Spare parts revenue is recognized upon shipment. Extended warranty revenue is recognized over the life of the extended warranty using the time elapsed method. Development service contracts typically include the delivery of prototype products to customers. The performance obligation associated with the development of prototype products as well as battery systems and powertrain components to other vehicle manufacturers, is satisfied at a point in time, typically upon shipping.

PROTERRA INC

(DEBTOR-IN-POSSESSION)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Revenue derived from performance obligations satisfied over time from charging systems and installation was $0.9 million and $3.7 million for the three months ended September 30, 2023 and 2022, respectively, and $3.7 million and $5.8 million for the nine months ended September 30, 2023 and 2022, respectively. Leasing revenue and extended warranty revenue recognized over time was immaterial for the three and nine months ended September 30, 2023 and 2022, respectively.

As of September 30, 2023 and December 31, 2022, the contract assets balance was $3.2 million and $26.1 million, respectively, and these balances are recorded in the prepaid expenses and other current assets on the consolidated balance sheets. The contract assets are expected to be billed within the next twelve months.

As of September 30, 2023, the amount of remaining performance obligations that have not been recognized as revenue was $417.4 million. As the Company is in the process of a Bankruptcy Court-approved bidding process that may result in the sale of all or substantially all of its assets during the Chapter 11 Cases, the timing of satisfaction of these performance obligations is not estimable as of September 30, 2023. This amount excludes the value of remaining performance obligations for contracts with an original expected length of one year or less.

Our business has the following commercial offerings each addressing a critical component of commercial vehicle electrification.

•Proterra Transit designs, develops, manufactures, and sells electric transit buses as an original equipment manufacturer (“OEM”) for North American public transit agencies, airports, universities, and other commercial transit fleets.

•Proterra Powered & Energy includes Proterra Powered, which designs, develops, manufactures, sells, and integrates proprietary battery systems and electrification solutions into vehicles for global commercial vehicle OEMs, and Proterra Energy, which offers turnkey fleet-scale, high-power charging solutions and software services, ranging from fleet and energy management software-as-a-service, to fleet planning, hardware, infrastructure, installation, utility engagement, and charging optimization.

Revenue of these commercial offerings are as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Proterra Transit | | $ | 25,770 | | | $ | 56,363 | | | $ | 91,745 | | | $ | 142,563 | |

| Proterra Powered & Energy | | 60,378 | | | 39,860 | | | 159,646 | | | 86,805 | |

| Total | | $ | 86,148 | | | $ | 96,223 | | | $ | 251,391 | | | $ | 229,368 | |

Product Warranties

Warranty expense is recorded as a component of cost of goods sold. Activity of the accrued warranty inclusive of the balances in the liabilities subject to compromise, consisted of the following (in thousands):

| | | | | |

| Nine Months Ended September 30, 2023 |

| Warranty reserve- beginning of period | $ | 25,513 | |

| Warranty costs incurred | (2,991) | |

| Net changes in liability for pre-existing warranties, including expirations | (3,000) | |

| Provision for warranty | 13,501 | |

| Warranty reserve- end of period | $ | 33,023 | |

PROTERRA INC

(DEBTOR-IN-POSSESSION)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Adopted Accounting Guidance and Accounting Pronouncements Not Yet Effective

There have been no recent accounting pronouncements, changes in accounting pronouncements or recently adopted accounting guidance during the nine months ended September 30, 2023 that are of significance or potential significance to the Company.

2. Chapter 11 Filing and Other Related Matters

The Chapter 11 Cases

Events Leading to Chapter 11

As previously disclosed, the Company has incurred net losses and negative cash flows from operations since inception and has funded operations primarily through a combination of equity and debt financing. The Company’s (i) existing Convertible Notes include a requirement that the Company maintain minimum liquidity and (ii) existing loan facilities include a requirement that the Company deliver financial reports without a going concern qualification, which have been waived or modified as the Company pursued various strategies designed to improve liquidity and cash generated from operations, such as expense reduction and cash savings initiatives that included streamlining facilities, initiating working capital initiatives, and efforts to reduce overall selling, general and administrative expenses, including a workforce reduction announced in January 2023, that included the closure of the City of Industry facility by December 31, 2023 to improve operational efficiency, and the cessation of battery production in the Burlingame facility in June 2023 to consolidate all battery production in our Powered 1 battery factory in the second half of 2023. Additionally, the Company explored potential options for raising additional funds through the issuance of equity, equity-linked, and/or debt securities, debt financings or other capital sources and/or strategic transactions. However, as discussed in the Declaration of Gareth T. Joyce in Support of Chapter 11 Petitions and First Day Pleadings [Docket No. 16] (the “First Day Declaration”) filed by the Debtors’ in the Chapter 11 Cases, these prepetition capital raising efforts were unsuccessful.

Voluntary Filing for Chapter 11 Protections

As previously disclosed, on the Petition Date, the Debtors filed the Bankruptcy Petitions for reorganization under Chapter 11 of the United States Bankruptcy Code in the Bankruptcy Court. The Chapter 11 Cases are jointly administered under the caption In re Proterra Inc, Case No. 23-11120 (BLS) (Bankr. D. Del. 2023). The Debtors continue to operate their business as “debtors-in-possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court. To ensure their ability to continue operating in the ordinary course of business, the Debtors sought, from the Bankruptcy Court, various forms of “first-day” relief, including, among other things, authority to use cash collateral, pay employee wages and benefits, pay vendors and suppliers in the ordinary course for all goods and services provided after the Petition Date and continue customer programs. On August 10, 2023, the motions filed by the Debtors seeking this “first-day” relief were approved by the Bankruptcy Court and, to the extent such relief was granted on an interim basis, the Debtors have subsequently obtained orders granting such relief on a final basis.

As previously disclosed by the Company, the filing of the Bankruptcy Petitions constituted an event of default that accelerated the Company’s obligations under the Senior Credit Facility and the Convertible Notes. As a result of the bankruptcy filing, the outstanding principal and interest thereunder became immediately due and payable. Any efforts to enforce such payment obligations under the debt instruments set forth above are automatically stayed under the Bankruptcy Code. However, the Convertible Notes continue to accrue PIK and cash interest under the cash collateral order. See Note 5, Debt for details.

Debtors-In-Possession

The Debtors are currently operating as debtors-in-possession in accordance with the applicable provisions of the Bankruptcy Code. In general, as debtors-in-possession under the Bankruptcy Code, the Debtors are authorized to continue to operate as an ongoing business, but may not engage in transactions outside the ordinary course of business without the prior approval of the Bankruptcy Court. The Debtors have obtained relief from the Bankruptcy Court authorizing the Debtors to conduct their business activities in the ordinary course,

PROTERRA INC

(DEBTOR-IN-POSSESSION)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

including, among other things and subject to the terms and conditions of such orders, authorizing the Debtors to, among other things: (i) pay employees’ wages and related obligations; (ii) pay pre-petition claims of certain lien claimants and critical vendors; (iii) continue to operate their cash management system in a manner substantially similar to pre-petition practice (iv) continue to maintain and administer certain existing customer programs; (v) pay taxes in the ordinary course; (vi) maintain their insurance program and surety bond program in the ordinary course; (vii) pay utility providers for post-petition services in the ordinary course; and (viii) to use cash collateral. In addition, the Bankruptcy Court has entered an order limiting trading of the Company’s equity securities to protect the Company’s net operating losses.

Marketing Process

In addition to the aforementioned first-day motions, the Debtors received Bankruptcy Court approval of certain procedures related to a marketing and bidding process for one or more potential sales or reorganization of all or certain assets of the Debtors, including the assets of Debtors’ Proterra Transit, Proterra Powered, and Proterra Energy business lines.

Prepetition Key Employee Retention Plan

As previously disclosed by the Company, on August 3, 2023, the compensation committee of the board of directors of the Company (the “Compensation Committee”) granted retention awards (each, a “Retention Award”) to certain of the Company’s employees. The Retention Awards, memorialized in an award letter (“Retention Award Letter”), are subject to clawback if the participant is terminated for cause or voluntarily resigns before the earlier of either the six-month anniversary or one-year anniversary of the date of grant, as applicable, or any potential transaction involving the Company (including through a merger, recapitalization or sale of substantially all of the assets of the Company) or any sale, disposition or winding down of any business unit, business division or asset of the Company that the participant provides substantially all of his or her services to.

As previously disclosed, the Company granted Retention Awards to named executive officers Julian Soell and Chris Bailey. Messrs. Soell and Bailey each received a Retention Award of approximately $0.5 million, which was paid on August 4, 2023, subject to certain clawback provisions. Under the terms of Messrs. Soell’s and Bailey’s Retention Award Letters, if the executive is terminated by the Company for “cause” (as defined in the Retention Award Letter) or by the executive without “good reason” (as defined in the executive’s employment or severance agreement) prior to the earlier of (i) August 4, 2024 and (ii) a “corporate transaction” (as defined in the Retention Award Letter), the executive will be required to repay the Company the after-tax amount of the Retention Award within 90 days following his termination date. Such repayment obligation does not apply in the event of a termination due to a death or disability, or due to a leave of absence because of a disability.

Automatic Stay

Subject to certain specific exceptions under the Bankruptcy Code, the Debtors’ filing of the Bankruptcy Petitions resulted in most judicial or administrative actions against the Debtors and efforts by creditors to collect on or otherwise exercise rights or remedies with respect to pre-petition claims being subject to the automatic stay under the Bankruptcy Code.

Executory Contracts