Merge Reports Third Quarter Financial Results

October 30 2013 - 7:30AM

Merge Healthcare Incorporated (Nasdaq:MRGE), a leading provider of

clinical systems and innovations that seek to transform healthcare,

today announced its financial and business results for the third

quarter of 2013.

"Even though overall third quarter sales were down compared to

the prior year, we made tangible progress. We realized a

record-breaking quarter in cash collections, voluntarily repaid a

portion of our debt, streamlined our business operations, grew our

subscription-based backlog and implemented a company-wide strategy

for ICD-10 across all applicable solutions. Add the launch of the

new iConnect® Network for MU Stage 2, our recent award for 'Best in

Interoperability' by Frost & Sullivan and our leadership

standings in MU for radiology and vendor neutral archiving (VNA)

and we're very well positioned for 2014." said Justin Dearborn, CEO

of Merge Healthcare. "Further, while the debt refinancing last

quarter resulted in $24 million of one-time expenses and $20

million of cash expenditures, we are seeing the positive impacts

this quarter with lower interest, which will continue to decrease

as we make voluntary repayments."

Financial Highlights:

- Sales decreased to $57.2 million ($57.7 million on a pro forma

basis) in the third quarter of 2013, from $60.4 million ($61.0

million on a pro forma basis) in the third quarter of 2012;

- Subscription backlog grew 73% since the third quarter of 2012,

with growth in both Merge Healthcare and DNA segments;

- Adjusted EBITDA for the third quarter of 2013 was $7.2 million,

representing 13% of pro forma revenue for the quarter, compared to

$12.5 million and 21% in the third quarter of 2012 with the change

primarily a result of an unusually high mix of hardware sales (with

lower margins) and $2.3 of non-cash charges in the third quarter of

2013;

- Strong cash collections in the quarter drove an increase in

cash generated from business operations to $15.3 million in the

third quarter of 2013 from $9.2 million in the third quarter of

2012; and

- Utilized excess cash to voluntarily repay $6 million of debt

principal that resulted in a leverage ratio of 5.1 : 1, well within

the 5.5 : 1 loan agreement limit.

Business Highlights:

- Increased Merge Hemo™ record station sales by 40% year-to-date

in 2013 compared to 2012;

- Targeted a new white-space market opportunity for advanced

interoperability with the iConnect Network executing 15 early

adopter agreements, including two beta site customers, Radiology

Ltd. (Tucson, AZ) and Long Island Radiology Associates;

- Saw eClinical backlog increase $29.5 million (127%) to $52.8

million in the third quarter of 2013, from $23.3 million in the

third quarter of 2012;

- Accepted the 2013 North America Frost & Sullivan Award for

Product Leadership in Interoperability Solutions for the iConnect

Enterprise Clinical Platform;

- Received recognition from IHS for the second year in a row that

Merge, through its iConnect Enterprise Archive, is the leading

provider for vendor-neutral archive (VNA) solutions in both the

world and in the Americas; and

- Was acknowledged, according to data compiled by the U.S.

Department of Health and Human Services (HHS), as being the

provider of the most widely used Certified Electronic Health Record

Technology (CEHRT) by radiologists.

Quarter Results:

Results compared to the same quarter in the prior year on a GAAP

basis are as follows (in millions, except per share data):

| |

Q3 2013 |

Q3 2012 |

| Net sales |

$57.2 |

$60.4 |

| Operating income (loss) |

(0.5) |

6.0 |

| Net loss |

(4.1) |

(3.8) |

| Net loss per diluted share |

($0.04) |

($0.04) |

| |

|

|

| Cash balance at period end |

$20.3 |

$42.2 |

| Cash from business operations* |

15.3 |

9.2 |

| |

|

|

| *See table at the back of this earnings

release. |

|

|

Pro forma results and other, non-GAAP measures compared to the

same quarter in the prior year are as follows (in millions, except

percentages and per share data):

| |

Q3 2013 |

Q3 2012 |

| Pro forma results |

|

|

| Net sales |

$57.7 |

$61.0 |

| Adjusted net income |

1.7 |

0.9 |

| Adjusted EBITDA |

7.2 |

12.5 |

| |

|

|

| Adjusted net income per diluted share |

$0.02 |

$0.01 |

| Adjusted EBITDA per diluted share |

$0.07 |

$0.13 |

| |

|

|

| Non-GAAP and other

measures |

|

|

| Subscription, maintenance & EDI revenue

as % of net sales |

64.1% |

61.0% |

| Subscription and non-recurring backlog at

period end |

$91.9 |

$71.4 |

| Days sales outstanding |

104 |

106 |

A reconciliation of GAAP net income (loss) to adjusted net

income and adjusted EBITDA is included after the financial

information below.

Pro Forma Operating Group Results:

Results (in millions) for our operating groups are as

follows:

| |

Three Months

Ended September 30, 2013 |

| |

Healthcare |

DNA |

Corporate/

Other |

Total |

| Net sales: |

|

|

|

|

| Software and other |

$ 11.5 |

$ 8.1 |

|

$ 19.6 |

| Service |

6.5 |

4.1 |

|

10.6 |

| Maintenance |

26.9 |

0.6 |

|

27.5 |

| Total net sales |

44.9 |

12.8 |

|

57.7 |

| Gross Margin |

25.4 |

5.6 |

|

31.0 |

| Gross Margin % |

56.6% |

43.8% |

|

53.7% |

| Expenses |

23.5 |

2.7 |

|

26.2 |

| Segment income (loss) |

$ 1.9 |

$ 2.9 |

|

$ 4.8 |

| Operating Margin % |

4% |

23% |

|

8% |

| Net corporate/other expenses (1) |

|

|

9.0 |

9.0 |

| Loss before income taxes |

|

|

|

(4.2) |

| Adj. EBITDA reconciling adjustments |

5.1 |

1.2 |

5.1 |

11.4 |

| Adjusted EBITDA |

$ 7.0 |

$ 4.1 |

$ (3.9) |

$ 7.2 |

| Adjusted EBITDA % |

15.6% |

32.0% |

|

12.5% |

| |

|

|

|

|

| (1) Net corporate/other expenses

include public company costs, corporate administration costs,

acquisition-related expenses and net interest expense. |

| |

|

|

|

|

| |

|

|

|

|

| |

Net Sales in the

Three Months Ended September 30, 2013 |

|

Backlog as of

September 30, 2013 |

|

| |

Healthcare |

DNA |

|

Healthcare |

DNA |

|

| Revenue Source |

$ |

% |

$ |

% |

Total |

$ |

% |

$ |

% |

Total |

| Maintenance & EDI (1) |

$ 26.9 |

59.9% |

$ 0.6 |

4.7% |

47.6% |

|

|

|

|

|

| Subscription |

1.5 |

3.3% |

8.0 |

62.5% |

16.5% |

$ 13.2 |

37.2% |

$ 56.4 |

100.0% |

75.7% |

| Non-recurring |

16.5 |

36.8% |

4.2 |

32.8% |

35.9% |

22.3 |

62.8% |

-- |

0.0% |

24.3% |

| Total |

$ 44.9 |

100.0% |

$ 12.8 |

100.0% |

100.0% |

$ 35.5 |

100.0% |

$ 56.4 |

100.0% |

100.0% |

| |

77.8% |

|

22.2% |

|

|

38.6% |

|

61.4% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| (1) Due to the variability in

timing and length of maintenance renewals, we do not believe

backlog for this revenue component is a meaningful disclosure. |

Explanation of Non-GAAP Financial Measures

We report our financial results in accordance with generally

accepted accounting principles or GAAP. This press release includes

certain non-GAAP financial measures to supplement its GAAP

information. Non-GAAP measures are not an alternative to GAAP and

may be different from non-GAAP measures used by other companies. A

quantitative reconciliation of GAAP net income available to common

shareholders to adjusted net income and adjusted EBITDA is included

after the financial information included in this press release.

Management believes that the presentation of non-GAAP results,

when shown in conjunction with corresponding GAAP measures,

provides useful information to it and investors regarding financial

and business trends related to results of operations, because

certain charges, costs and expenses reflect events that are not

essential to recurring business operations. In addition, management

believes these non-GAAP measures provide investors useful

information regarding the underlying performance of the

post-acquisition business operations when compared to the

pre-acquisition results of Merge and any significant acquired

company. Purchase accounting adjustments made in accordance

with GAAP can make it difficult to make meaningful comparisons of

the underlying operations of the business without considering the

non-GAAP adjustments that are provided and discussed herein.

Further, management believes that these non-GAAP measures improve

its and investors' ability to compare Merge's financial performance

with other companies in the technology industry. Management also

uses financial statements that exclude these charges, costs and

expenses for its internal budgets. While GAAP results are more

complete, these supplemental metrics are offered since, with

reconciliations to GAAP, they may provide greater insight into our

financial results. Management does not intend the presentation of

these non-GAAP financial measures to be considered in isolation or

as a substitute for results prepared in accordance with GAAP.

Additional information regarding the non-GAAP financial measures

presented is as follows:

- Pro forma revenue consists of GAAP revenue as reported,

adjusted to add back the acquisition related sales adjustments (for

all significant acquisitions) recorded for GAAP purposes.

- Subscription revenue and the related backlog are comprised of

software, hardware and professional services (including

installation, training, etc.) contracted with and payable by the

customer over a number of years. Generally, these contracts

will include a minimum volume / dollar commitment. As such,

the revenue from these transactions is recognized ratably over an

extended period of time. These types of arrangements will

include monthly payments (including leases), long-term clinical

trials, renewable annual software agreements (with very high renew

rate), to specify a few contract methods.

- Non-recurring revenue and related backlog represents revenue

that we anticipate recognizing in future periods from signed

customer contracts as of the end of the period

presented. Non-recurring revenue is comprised of perpetual

software license sales and includes licenses, hardware and

professional services (including installation, training and

consultative engineering services).

- Adjusted net income consists of GAAP net income available to

common stockholders, adjusted to exclude (a) acquisition-related

costs, (b) debt extinguishment costs, (c) restructuring and other

costs, (d) share-based compensation expense, (e)

acquisition-related amortization (f) acquisition-related sales

adjustments, and (g) acquisition-related cost of sales

adjustments.

- Adjusted EBITDA adjusts GAAP net income available to common

stockholders for the items considered in adjusted net income as

well as (a) remaining depreciation and amortization, (b) net

interest expense and (c) income tax expense (benefit).

- Cash from business operations reconciles the cash generated

from such operations to the change in GAAP cash balance for the

period by reflecting payments of liabilities associated with debt

issuance and retirement activities, acquisitions, payments of

acquisition related fees, interest payments and other payments and

receipts of cash not generated by the business

operations.

Management has excluded certain items from non-GAAP adjusted net

income because it believes (i) the amount of certain expenses in

any specific period may not directly correlate to the underlying

performance of business operations and (ii) the adjustment

facilitates comparisons of pre-acquisition results to

post-acquisition results. In addition, the following

adjustments are described in more detail below:

- Debt extinguishment expense is comprised of both non-cash

expenses, such as the remaining unamortized balance of costs

associated with the issuance of the old debt and unamortized

balance of the discount when the old debt was issued, as well as

contractually owed cash charges to the holders of the old debt to

allow us to retire it early. Management excludes this expense

from non-GAAP net income because it believes such expense does not

directly correlate to the underlying performance of operations,

rather is an expense that is specific to a transaction that we

would expect to occur infrequently.

- Acquisition-related amortization expense is a non-cash expense

arising from the acquisition of intangible assets in connection

with significant acquisitions. Management excludes

acquisition-related amortization expense from non-GAAP net income

because it believes such expenses can vary significantly between

periods as a result of new acquisitions and full amortization of

previously acquired intangible assets.

- Share-based compensation expense is a non-cash expense arising

from the grant of stock awards to employees and is excluded from

non-GAAP net income because management believes such expenses can

vary significantly between periods as a result of the timing of

grants of new stock-based awards, including grants to new employees

resulting from acquisitions.

- Acquisition-related sales and costs of sales adjustments

reflect the fair value adjustment to deferred revenues acquired in

connection with significant acquisitions. The fair value of

deferred revenue represents an amount equivalent to the estimated

cost plus an appropriate profit margin to perform services-related

software and product support, which assumes a legal obligation to

do so, based on the deferred revenue balances as of the date the

acquisition of a significant company was completed. Management adds

back this deferred revenue adjustment, net of related costs, for

non-GAAP revenue and non-GAAP net income because it believes the

inclusion of this amount directly correlates to the underlying

performance of operations and facilitates comparisons of

pre-acquisition to post-acquisition results.

Notice of Conference Call

Merge will host a conference call at 8:30 AM ET on Wednesday,

October 30, 2013. The call will address third quarter results and

will provide a business update on the company's market outlook and

strategies for the remainder of 2013.

Participants may preregister for this teleconference at

http://emsp.intellor.com?p=413570&do=register&t=8. Upon

registration, a confirmation page will display dial-in numbers and

a unique PIN, and the participant will also receive an email

confirmation with this information.

A replay via the Internet or phone will be available after the

call at

http://www.merge.com/Company/Investors/Conference-Call-Info.aspx.

About Merge

Merge is a leading provider of clinical systems and innovations

that seek to transform healthcare. Merge's enterprise and

cloud-based solutions for image intensive specialties provide

access to any image, anywhere, any time. Merge also provides

clinical trials software and other health data and analytics

solutions that engage consumers in their personal health. With

solutions that are used by providers and consumers and include more

than 25 years of innovation, Merge is helping to reduce costs and

improve the quality of healthcare worldwide. For more information,

visit merge.com.

Cautionary Notice Regarding Forward-Looking

Statements

The matters discussed in this press release may include

forward-looking statements, which could involve a number of risks

and uncertainties. When used in this press release, the words

"will," "believes," "intends," "anticipates," "expects" and similar

expressions are intended to identify forward-looking statements.

Actual results could differ materially from those expressed in, or

implied by, such forward-looking statements. The potential risks

and uncertainties include those risks and uncertainties included

under the captions "Risk Factors" and "Management's Discussion and

Analysis of Financial Condition and Results of Operations" in our

Annual Report on Form 10-K for the year ended December 31, 2012 and

our most recent Quarterly Report on Form 10-Q for the quarter ended

June 30, 2013 which are on file with the SEC and are available on

our investor relations website at merge.com and on the SEC website

at www.sec.gov. Additional information will also be set forth in

our Quarterly Report on Form 10-Q for the quarter ended September

30, 2013. Except as expressly required by the federal securities

laws, Merge undertakes no obligation to update such factors or to

publicly announce the results of any of the forward-looking

statements.

| |

| |

| |

| MERGE HEALTHCARE

INCORPORATED AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED

BALANCE SHEETS |

| (in

thousands) |

| |

|

|

| |

September 30, |

December 31, |

| |

2013 |

2012 |

| |

(Unaudited) |

|

| Current assets: |

|

|

| Cash (including restricted cash) |

$ 20,281 |

$ 35,875 |

| Accounts receivable, net |

65,054 |

72,065 |

| Inventory |

5,556 |

5,979 |

| Prepaid expenses |

5,340 |

4,972 |

| Deferred income taxes |

3,898 |

3,135 |

| Other current assets |

19,017 |

21,621 |

| Total current assets |

119,146 |

143,647 |

| |

|

|

| Property and equipment, net |

5,298 |

4,964 |

| Purchased and developed software, net |

15,486 |

19,007 |

| Other intangible assets, net |

28,393 |

35,628 |

| Goodwill |

214,269 |

214,312 |

| Deferred tax assets |

3,568 |

7,041 |

| Other assets |

7,657 |

12,254 |

| Total assets |

$ 393,817 |

$ 436,853 |

| |

|

|

| Current liabilities: |

|

|

| Accounts payable |

$ 25,089 |

$ 24,438 |

| Current maturities of long-term debt |

2,550 |

-- |

| Interest payable |

-- |

4,944 |

| Accrued wages |

5,657 |

5,881 |

| Restructuring accrual |

2,014 |

222 |

| Other current liabilities |

8,570 |

12,606 |

| Deferred revenue |

55,471 |

52,355 |

| Total current liabilities |

99,351 |

100,446 |

| |

|

|

| Long-term debt, less current maturities, net

of unamortized discount |

243,374 |

250,046 |

| Deferred income taxes |

3,321 |

3,046 |

| Deferred revenue |

627 |

894 |

| Income taxes payable |

1,149 |

1,040 |

| Other liabilities |

1,667 |

3,920 |

| Total liabilities |

349,489 |

359,392 |

| Total Merge shareholders' equity |

43,906 |

77,011 |

| Noncontrolling interest |

422 |

450 |

| Total shareholders' equity |

44,328 |

77,461 |

| Total liabilities and shareholders'

equity |

$ 393,817 |

$ 436,853 |

| |

| |

| |

| MERGE HEALTHCARE

INCORPORATED AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS |

| (in thousands, except

for share and per share data) |

|

(unaudited) |

| |

|

|

|

|

| |

Three Months

Ended |

Nine Months

Ended |

| |

September

30, |

September

30, |

| |

2013 |

2012 |

2013 |

2012 |

| Net sales |

|

|

|

|

| Software and other |

$ 19,357 |

$ 21,232 |

$ 60,807 |

$ 69,251 |

| Professional services |

10,447 |

11,277 |

34,122 |

30,573 |

| Maintenance and EDI |

27,441 |

27,885 |

83,143 |

84,434 |

| Total net sales |

57,245 |

60,394 |

178,072 |

184,258 |

| Cost of sales |

|

|

|

|

| Software and other |

11,702 |

9,006 |

33,107 |

29,003 |

| Professional services |

6,248 |

6,524 |

19,175 |

18,522 |

| Maintenance and EDI |

6,875 |

7,277 |

22,328 |

23,840 |

| Depreciation and amortization |

1,804 |

2,049 |

5,425 |

5,829 |

| Total cost of sales |

26,629 |

24,856 |

80,035 |

77,194 |

| Gross margin |

30,616 |

35,538 |

98,037 |

107,064 |

| Operating costs and expenses: |

|

|

|

|

| Sales and marketing |

8,526 |

10,808 |

28,982 |

32,473 |

| Product research and development |

8,017 |

8,266 |

24,988 |

24,251 |

| General and administrative |

9,654 |

7,783 |

25,567 |

23,822 |

| Acquisition-related expenses |

173 |

(762) |

600 |

2,444 |

| Restructuring and other expenses |

2,054 |

830 |

3,856 |

830 |

| Depreciation and amortization |

2,652 |

2,651 |

7,899 |

8,183 |

| Total operating costs and expenses |

31,076 |

29,576 |

91,892 |

92,003 |

| Operating income (loss) |

(460) |

5,962 |

6,145 |

15,061 |

| Other expense, net |

(4,119) |

(8,104) |

(41,614) |

(23,219) |

| Loss before income taxes |

(4,579) |

(2,142) |

(35,469) |

(8,158) |

| Income tax expense (benefit) |

(478) |

1,684 |

3,249 |

3,410 |

| Net loss |

(4,101) |

(3,826) |

(38,718) |

(11,568) |

| Less: noncontrolling interest's

share |

4 |

(12) |

(28) |

(30) |

| Net loss available to common

shareholders |

$ (4,105) |

$ (3,814) |

$ (38,690) |

$ (11,538) |

| |

|

|

|

|

| Net loss per share - basic |

$ (0.04) |

$ (0.04) |

$ (0.41) |

$ (0.13) |

| Weighted average number of common shares

outstanding - basic |

93,707,856 |

92,177,703 |

93,502,456 |

91,800,824 |

| |

|

|

|

|

| Net loss per share - diluted |

$ (0.04) |

$ (0.04) |

$ (0.41) |

$ (0.13) |

| Weighted average number of common shares

outstanding - diluted |

93,707,856 |

92,177,703 |

93,502,456 |

91,800,824 |

| |

| |

| |

| MERGE HEALTHCARE

INCORPORATED AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS |

| (in

thousands) |

| |

|

|

| |

Nine Months

Ended |

| |

September

30, |

| |

2013 |

2012 |

| |

(unaudited) |

(unaudited) |

| Cash flows from operating

activities: |

|

|

| Net loss |

$ (38,718) |

$ (11,568) |

| Adjustments to reconcile net loss to net cash

provided by operating activities: |

|

|

| Depreciation and amortization |

13,324 |

14,012 |

| Share-based compensation |

4,192 |

4,245 |

| Change in contingent consideration for

acquisitions |

-- |

1,250 |

| Amortization of debt issuance costs &

discount |

1,243 |

2,010 |

| Loss on extinguishment of debt |

23,822 |

-- |

| Provision for doubtful accounts

receivable and allowances, net of recoveries |

(2,068) |

1,287 |

| Deferred income taxes |

2,985 |

2,700 |

| Realized and unrealized loss (gain) on

equity security |

645 |

(982) |

| Loss on acquisition settlement |

1,345 |

-- |

| Stock issued for lawsuit settlement |

885 |

-- |

| Change in assets and liabilities, net of

effects of dispositions: |

|

|

| Accounts receivable |

9,078 |

(193) |

| Inventory |

423 |

263 |

| Prepaid expenses |

(1,263) |

(4,507) |

| Accounts payable |

774 |

(2,703) |

| Accrued wages |

(223) |

(1,031) |

| Restructuring accrual |

1,792 |

(650) |

| Deferred revenue |

2,849 |

(4,402) |

| Accrued interest and other

liabilities |

(10,022) |

9,694 |

| Other |

(3,742) |

(4,280) |

| Net change in assets and liabilities (net of

effects of acquisitions) |

(334) |

(7,809) |

| Net cash provided by operating

activities |

7,321 |

5,145 |

| Cash flows from investing

activities: |

|

|

| Cash paid for acquisitions, net of cash

acquired |

-- |

(876) |

| Purchases of property, equipment and

leasehold improvements |

(1,658) |

(1,976) |

| Proceeds from sale of equity investment |

1,785 |

-- |

| Change in restricted cash |

60 |

(38) |

| Net cash provided by (used in) investing

activities |

187 |

(2,890) |

| Cash flows from financing

activities: |

|

|

| Proceeds from exercise of stock options and

employee stock purchase plan |

1,056 |

924 |

| Proceeds from debt issuance |

252,450 |

-- |

| Retirement of debt |

(252,000) |

-- |

| Penalty for early extinguishment of debt |

(16,863) |

-- |

| Principal payments on long-term debt |

(6,646) |

(35) |

| Principal payments on capital leases |

(878) |

(267) |

| Net cash provided by (used in) financing

activities |

(22,881) |

622 |

| Effect of exchange rate changes on cash |

(161) |

24 |

| Net increase (decrease) in cash and cash

equivalents |

(15,534) |

2,901 |

| Cash and cash equivalents, beginning of

period (net of restricted cash) (1) |

35,062 |

38,566 |

| Cash and cash equivalents, end of period (net

of restricted

cash)

(2) |

$ 19,528 |

$ 41,467 |

| |

|

|

| (1) Restricted cash of $813

and $707 as of December 31, 2012 and 2011, respectively. |

| (2) Restricted cash of $753

and $745 as of September 30, 2013 and 2012, respectively. |

| |

| |

| |

| MERGE HEALTHCARE

INCORPORATED AND SUBSIDIARIES |

| RECONCILIATION OF NET

INCOME (LOSS) AVAILABLE TO COMMON SHAREHOLDERS TO ADJUSTED

EBITDA |

| (in thousands, except

for share and per share data) |

|

(unaudited) |

| |

|

|

|

|

| |

Three Months

Ended |

Nine Months

Ended |

| |

September

30, |

September

30, |

| |

2013 |

2012 |

2013 |

2012 |

| Net loss available to common shareholders of

Merge |

$ (4,105) |

$ (3,814) |

$ (38,690) |

$ (11,538) |

| Acquisition-related costs |

173 |

(762) |

600 |

2,444 |

| Debt extinguishment costs |

-- |

-- |

23,822 |

-- |

| Restructuring and other |

2,054 |

830 |

3,856 |

830 |

| Share-based compensation expense |

697 |

1,429 |

3,998 |

4,245 |

| Amortization of significant acquisition

intangibles |

2,506 |

2,727 |

7,519 |

8,179 |

| Acquisition-related sales

adjustments |

412 |

563 |

1,155 |

1,620 |

| Acquisition-related cost of sales

adjustments |

(38) |

(123) |

(154) |

(326) |

| Adjusted net income |

$ 1,699 |

$ 850 |

$ 2,106 |

$ 5,454 |

| Depreciation and amortization |

1,950 |

1,973 |

5,805 |

5,833 |

| Net interest expense |

4,001 |

8,143 |

16,957 |

24,023 |

| Income tax expense |

(478) |

1,684 |

3,249 |

3,410 |

| Adjusted EBITDA |

$ 7,172 |

$ 12,650 |

$ 28,117 |

$ 38,720 |

| |

|

|

|

|

| Adjusted net income per share - diluted |

$ 0.02 |

$ 0.01 |

$ 0.02 |

$ 0.06 |

| Adjusted EBITDA per share - diluted |

$ 0.07 |

$ 0.13 |

$ 0.29 |

$ 0.41 |

| |

|

|

|

|

| Fully diluted shares (if net income) |

95,730,488 |

94,178,002 |

95,345,059 |

94,419,712 |

| |

|

|

|

|

| |

Pro Forma Three

Months Ended September 30, |

Pro Forma Nine

Months Ended September 30, |

| |

2013 |

2012 |

2013 |

2012 |

| Net loss available to common shareholders of

Merge |

$ (3,731) |

$ (3,374) |

$ (37,689) |

$ (10,244) |

| Acquisition-related costs |

173 |

(762) |

600 |

2,444 |

| Debt extinguishment costs |

-- |

-- |

23,822 |

-- |

| Restructuring and other |

2,054 |

830 |

3,856 |

830 |

| Share-based compensation expense |

697 |

1,429 |

3,998 |

4,245 |

| Amortization of significant acquisition

intangibles |

2,506 |

2,727 |

7,519 |

8,179 |

| Adjusted net income |

$ 1,699 |

$ 850 |

$ 2,106 |

$ 5,454 |

| Depreciation and amortization |

1,950 |

1,973 |

5,805 |

5,833 |

| Net interest expense |

4,001 |

8,143 |

16,957 |

24,023 |

| Income tax expense |

(478) |

1,684 |

3,249 |

3,410 |

| Adjusted EBITDA |

$ 7,172 |

$ 12,650 |

$ 28,117 |

$ 38,720 |

| |

|

|

|

|

| Adjusted net income per share - diluted |

$ 0.02 |

$ 0.01 |

$ 0.02 |

$ 0.06 |

| Adjusted EBITDA per share - diluted |

$ 0.07 |

$ 0.13 |

$ 0.29 |

$ 0.41 |

| |

|

|

|

|

| Fully diluted shares (if net income) |

95,730,488 |

94,178,002 |

95,345,059 |

94,419,712 |

| |

| |

| |

| MERGE HEALTHCARE

INCORPORATED AND SUBSIDIARIES |

| CASH FROM BUSINESS

OPERATIONS |

|

(unaudited) |

| |

|

|

|

|

| |

Three Months

Ended September 30, |

Nine Months Ended

September 30, |

| |

2013 |

2012 |

2013 |

2012 |

| |

(amounts in millions) |

| Cash received from (paid for): |

|

|

|

|

| Issuance of debt, net of OID of $2.5 |

$ -- |

$ -- |

$ 252.5 |

$ -- |

| Debt principal reduction |

(6.6) |

-- |

(6.6) |

-- |

| Debt issuance costs |

(0.9) |

-- |

(4.8) |

-- |

| Retirement of debt, including prepayment

penalty of $16.8 |

-- |

-- |

(268.9) |

-- |

| Interest paid |

(4.0) |

-- |

(21.0) |

(14.8) |

| Acquisitions |

-- |

-- |

-- |

(0.9) |

| Restructuring initiatives |

(1.0) |

(0.7) |

(2.0) |

(1.2) |

| Acquisition related costs |

(0.6) |

(0.3) |

(0.8) |

(0.8) |

| Sale of investment |

1.8 |

-- |

1.8 |

-- |

| Proceeds from stock option exercises |

0.3 |

-- |

0.9 |

0.7 |

| Property and equipment purchases |

(0.8) |

0.3 |

(1.7) |

(2.0) |

| Business operations |

15.3 |

9.2 |

35.0 |

21.9 |

| Increase (decrease) in cash |

$ 3.5 |

$ 8.5 |

$ (15.6) |

$ 2.9 |

CONTACT: Media Contact:

Jennifer Jawor

Director, Corporate Marketing

312.565.6825 | jennifer.jawor@merge.com

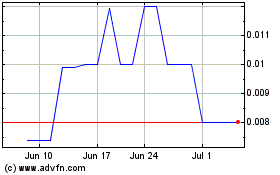

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Jul 2023 to Jul 2024