Merge Misses by a Penny, Margins Up - Analyst Blog

November 03 2011 - 11:15AM

Zacks

Merge Healthcare

(MRGE) reported adjusted EPS of 6 cents in the third quarter of

fiscal 2011, surpassing the prior-year quarter level of 4 cents but

missing the Zacks Consensus Estimate by a penny.

Solid growth across all the

company’s segments triggered a 33% year-over-year increase in total

revenue to $60.1 million in the quarter, almost in line with the

Zacks Consensus Estimate. The increased adoption of Meaningful Use

solutions coupled with growing demand for enterprise imaging

solutions were primarily responsible for the growth.

Merge derives revenues from three

sources – software and others, professional services, and

maintenance and EDI. The three segments registered annualized

growth of 55.1% to $20.1 million, 75.8% to $11.9 million and 10.2%

to $28.0 million, respectively, during the quarter. Recurring

revenues were nearly 57.5% of net sales during the quarter,

compared with 65% in the year-ago quarter.

Gross margin during the quarter

increased 600 basis points (bps) to 60.1% from 54.1% in the

year-ago quarter. The adjusted operating margin (excluding the

impact of certain one-time expenses) expanded 310 bps to 18.6%

during the quarter.

Merge exited the quarter with cash

(including restricted cash) of $44.6 million compared with $41.0

million at the end of fiscal 2010. Cash from core business

operations was $8.8 million compared with $8.0 million in the

year-ago quarter.

Outlook

Merge provided revenue guidance for

fiscal 2012. The company expects to report revenues in the range of

$288– $300 million. The Zacks Consensus Estimate of $268 million is

within the guidance range.

Merge’s growth prospect is highly

dependent on capital investments by hospitals for advanced imaging

solutions, which are in turn tied to the general economic

condition. The presence of many big players like General

Electric Co (GE) and McKesson Corporation

(MCK) has made the diagnostic imaging market highly competitive.

However, there is immense potential in the diagnostic imaging

market, especially with government’s emphasis on HIT and an ageing

population.

GENL ELECTRIC (GE): Free Stock Analysis Report

MCKESSON CORP (MCK): Free Stock Analysis Report

MERGE HEALTHCAR (MRGE): Free Stock Analysis Report

Zacks Investment Research

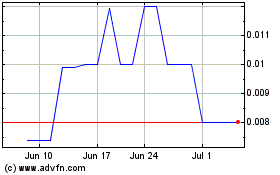

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Jul 2024 to Aug 2024

Mirage Energy (PK) (USOTC:MRGE)

Historical Stock Chart

From Aug 2023 to Aug 2024