UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

þ

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended

January 31, 2011

or

o

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______To _______

Commission file number:

333-156059

Minerco Resources, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

27-2636716

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

16225 Park Ten Place, Suite 500

Houston, Texas 77084

(Address of principal executive offices)

(281) 994-4187

(Registrant’s telephone number, including area code)

_____________________________________________________

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes

þ

No

o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (of for such shorter period that the registrant was required to submit and post such files).

Yes

o

No

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Non-accelerated filer

|

o

|

|

Accelerated filer

|

o

|

Smaller reporting company

|

þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

o

No

þ

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes

o

No

o

APPLICABLE ONLY TO CORPORATE ISSUERS

As of March 17, 2011 the registrant had 412,802,202 outstanding shares of its common stock.

Table of Contents

|

PART I – FINANCIAL INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

Item 1. Financial Statements

|

|

|

1

|

|

|

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

|

8

|

|

|

Item 3. Quantitative and Qualitative Disclosures About Market Risk

|

|

|

12

|

|

|

Item 4. Controls and Procedures

|

|

|

13

|

|

|

|

|

|

|

|

|

PART II – OTHER INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

Item 1. Legal Proceedings

|

|

|

14

|

|

|

Item 2. Unregistered Sales of Equity Securities

|

|

|

14

|

|

|

Item 3. Defaults Upon Senior Securities

|

|

|

14

|

|

|

Item 4. Removed and Reserved

|

|

|

14

|

|

|

Item 5. Other Information

|

|

|

14

|

|

|

Item 6. Exhibits

|

|

|

15

|

|

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

The unaudited interim financial statements of Minerco Resources, Inc. follow. All currency references in this report are to U.S. dollars unless otherwise noted.

|

|

|

Index

|

|

|

Balance Sheets

|

|

|

2

|

|

|

Statements of Expenses

|

|

|

3

|

|

|

Statements of Cash Flows

|

|

|

4

|

|

|

Notes to the Unaudited Financial Statements

|

|

|

5

|

|

Minerco Resources, Inc.

(An Exploration Stage Company)

Balance Sheets

(unaudited)

|

|

|

January 31,

2011

|

|

|

July 31,

2010

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

1,506

|

|

|

$

|

20,916

|

|

|

|

|

|

|

|

|

|

|

Prepaid Expense

|

|

|

475

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

Current Assets

|

|

1,981

|

|

|

20,916

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Assets

|

|

|

|

|

|

|

|

|

|

Intangible asset - Chiligatoro rights

|

|

|

715,500

|

|

|

|

715,500

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$

|

717,481

|

|

|

$

|

736,416

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

$

|

52,681

|

|

|

$

|

7,841

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts Payable – Related Party

|

|

|

64,388

|

|

|

|

22,500

|

|

|

|

|

|

|

|

|

|

|

|

|

Advance from related party

|

|

|

39,351

|

|

|

|

14,935

|

|

|

|

|

|

|

|

|

|

|

|

|

Short Term Loan

|

|

|

200,000

|

|

|

|

100,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

|

356,420

|

|

|

|

145,276

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value, 1,200,000,000 shares authorized, 412,802,202 and 345,045,000 outstanding at January 31, 2011 and July 31, 2010, respectively

|

|

|

412,802

|

|

|

|

345,045

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value, 25,000,000 shares authorized, 10,000,000 and 0 outstanding at January 31, 2011 and July 31, 2010, respectively

|

|

|

10,000

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional paid-in capital

|

|

|

570,112

|

|

|

|

482,151

|

|

|

|

|

|

|

|

|

|

|

|

|

Deficit accumulated during the development stage

|

|

|

(631,853

|

)

|

|

|

(236,056

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total Stockholders’ Equity

|

|

|

361,061

|

|

|

|

591,140

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders’ Equity

|

|

$

|

717,481

|

|

|

$

|

736,416

|

|

The accompanying notes are an integral part of these unaudited financial statements

2

Minerco Resources, Inc.

(A Development Stage Company)

Statements of Expenses

(unaudited)

|

|

|

Three Months

Ended

January 31,

2011

|

|

|

Three Months

Ended

January 31,

2010

|

|

|

Six Months

Ended

January 31,

2011

|

|

|

Six Months

Ended

January 31,

2010

|

|

|

Period from

June 21, 2007

(Date of Inception)

to January 31,

2011

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and Administrative

|

|

$

|

319,414

|

|

|

$

|

15,891

|

|

|

$

|

395,150

|

|

|

$

|

29,123

|

|

|

$

|

566,006

|

|

|

Chiligatoro Operating Costs

|

|

|

-

|

|

|

|

-

|

|

|

|

15,500

|

|

|

|

-

|

|

|

|

61,000

|

|

|

Total Expense

|

|

|

319,414

|

|

|

|

15,891

|

|

|

|

410,650

|

|

|

|

29,123

|

|

|

|

627,006

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

,

|

|

|

|

|

|

|

|

|

|

|

|

,

|

|

|

|

,

|

|

|

Impairment of Note Receivable

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

32,700

|

|

|

Loan Recovery

|

|

|

–

|

|

|

|

(8,000

|

)

|

|

|

–

|

|

|

|

(13,000

|

)

|

|

|

(13,000

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Expense

|

|

|

-

|

|

|

|

-

|

|

|

|

82

|

|

|

|

|

|

|

|

82

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on settlement of debt

|

|

|

(14,935

|

)

|

|

|

(7,891

|

)

|

|

|

(14,935

|

)

|

|

|

(16,123

|

)

|

|

|

(14,935

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

|

$

|

(304,479

|

)

|

|

$

|

(7,891

|

)

|

|

$

|

(395,797

|

)

|

|

$

|

(16,123

|

)

|

|

$

|

(631,853

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss Per Common Share – Basic and Diluted

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

|

|

|

N/A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Common Shares Outstanding

|

|

|

384,593,175

|

|

|

|

331,545,000

|

|

|

|

365,145,175

|

|

|

|

331,545,000

|

|

|

|

N/A

|

|

The accompanying notes are an integral part of these unaudited financial statements

Minerco Resources, Inc.

(A Development Stage Company)

Statements of Cash Flows

(unaudited)

|

|

|

Six Months Ended

January 31,

2011

|

|

|

Six Months Ended

January 31,

2010

|

|

|

Period from

June 21, 2007

(Date of Inception)

To January 31,

2011

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from Operating Activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the period

|

|

$

|

(395,797

|

)

|

|

$

|

(16,123

|

)

|

|

$

|

(631,853

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain/Loss on settlement of debt

|

|

|

(14,935)

|

|

|

|

-

|

|

|

|

(14,935)

|

|

|

Sharebased compensation

|

|

|

29,718

|

|

|

|

|

|

|

|

29,718

|

|

|

Shares issued for services-Third party

|

|

|

136,000

|

|

|

|

-

|

|

|

|

136,000

|

|

|

Impairment of notes receivable

|

|

|

-

|

|

|

|

-

|

|

|

|

30,000

|

|

|

Prepaid expense

|

|

|

(475)

|

|

|

|

|

|

|

|

(475)

|

|

|

Accounts payable and accrued liabilities

|

|

|

44,840

|

|

|

|

(13,672

|

)

|

|

|

52,681

|

|

|

Accounts payable- related party

|

|

|

41,888

|

|

|

|

-

|

|

|

|

64,388

|

|

|

Net Cash Used in Operating Activities

|

|

|

(158,761

|

)

|

|

|

(29,795

|

)

|

|

|

(334,476

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from Investing Activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan to third party

|

|

|

-

|

|

|

|

-

|

|

|

|

(10,000

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Cash Used in Investing Activities

|

|

|

-

|

|

|

|

-

|

|

|

|

(10,000

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flows from Financing Activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital contribution

|

|

|

-

|

|

|

|

-

|

|

|

|

1,182

|

|

|

Proceeds from issuance of common stock

|

|

|

-

|

|

|

|

-

|

|

|

|

90,514

|

|

|

Proceeds from loan

|

|

|

100,000

|

|

|

|

-

|

|

|

|

200,000

|

|

|

Proceeds from related party debt

|

|

|

39,351

|

|

|

|

14,935

|

|

|

|

54,286

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Cash Provided by Financing Activities

|

|

|

139,351

|

|

|

|

14,935

|

|

|

|

345,982

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net change in cash

|

|

|

(19,410

|

)

|

|

|

(14,860

|

)

|

|

|

1,506

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash, Beginning of Period

|

|

|

20,916

|

|

|

|

18,524

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash, End of Period

|

|

$

|

1,506

|

|

|

$

|

3,664

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosures of cash flow information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for interest

|

|

|

82

|

|

|

|

-

|

|

|

|

82

|

|

|

Cash paid for income taxes

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non cash investing and financing activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock issued for Chiligatoro rights

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

715,500

|

|

|

Common stock issued for note receivable

|

|

$

|

-

|

|

|

$

|

20,000

|

|

|

$

|

20,000

|

|

The accompanying notes are an integral part of these unaudited financial statements

Minerco Resources, Inc.

(A Development Stage Company)

Notes to the Financial Statements

(unaudited)

1. Basis of Presentation

The accompanying unaudited interim financial statements of Minerco Resources, Inc. (“Minerco”), have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules of the Securities and Exchange Commission (the “SEC”), and should be read in conjunction with the audited financial statements and notes thereto contained in Minerco’s Annual Report filed with the SEC on Form 10-K. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of financial position and the results of operations for the interim periods presented have been reflected herein. The results of operations for interim periods are not necessarily indicative of the results to be expected for the full year. Notes to the financial statements which substantially duplicate the disclosure contained in the audited financial statements for fiscal 2010 as reported in Minerco’s Form 10-K have been omitted.

2. Going Concern

These financial statements have been prepared on a going concern basis, which implies the Company will continue to realize it assets and discharge its liabilities in the normal course of business. During the period ended January 31, 2011, the Company has an accumulated deficit and no revenue. The Company is in the business of developing, producing and providing clean, renewable energy solutions in Central America. The Company participates in and invests in development projects with other companies in clean, renewable energy projects. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations, and the attainment of profitable operations. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

The Company intends to fund operations through equity and debt financing arrangements, which may be insufficient to fund its capital expenditures, working capital and other cash requirements for the year ending July 31, 2012.

3. Common Stock

On October 14, 2010, the Company issued 2,000,000 shares in consideration for documentation preparation services performed. These shares were not expensed since they were incurred prior to raising financing and hence considered as deferred financing costs.

On December 6, 2010, the Company issued 16,000,000 shares of its common stock pursuant to a consulting agreement.

On December 6, 2010, the Company issued 1,750,000 shares of its common stock as a sign on bonus to various employees.

On December 16, 2010, the Company issued 30,000,000 shares of its common stock to its Chief Financial Officer pursuant to an employment agreement. The compensation expense for the stock grant will be amortized evenly over the 5 year employment agreement based on the closing stock price of the Company’s common stock on the date of the grant.

On December 16, 2010, the Company issued 18,007,202 shares as a commitment fee pursuant to the Investment Agreement between Centurion Private Equity LLC and the company dated December 2, 2010, these shares were not expensed since they were incurred prior to raising financing and hence considered as deferred financing costs.

4. Preferred Stock

The preferred stock may be divided into and issued in series. The Board of Directors of the Company is authorized to divide the authorized shares of preferred stock into one or more series, each of which shall be so designated as to distinguish the shares thereof from the shares of all other series and classes.

On January 11, 2011, the Company designated 25,000,000 shares of its preferred stock as Class A Convertible Preferred Stock (“Class A Stock”). Each share of Class A Stock is convertible into 10 shares of common stock, has 100 votes, has no dividend rights except as may be declared by the Board of Directors, and has a liquidation preference of $1.00 per share.

On January 11, 2011, the Company issued 10,000,000 shares of its Class A Convertible Preferred stock to its Chief Executive Officer pursuant to an employment agreement. The compensation expense for the stock grant will be amortized evenly over the 5 year employment agreement based on the closing stock price of the Company’s common stock on the date of the grant.

5. Accounts Payable – Related Parties

As of January 31, 2011, the Company was indebted to the current Chief Executive Officer for $38,134($16,000 at July 31, 2010) relating to accrued salary and $23,310 for the expenses paid on behalf of the Company. The Company is also indebted to the current Chief Financial Officer for $26,254 ($6,500 at July 31, 2010) relating to accrued salary and $16,041 for the expenses paid on behalf of the company for a total of $103,739. The former president is no longer a related party therefore this amount is classified under short term loan as of January 31, 2011.

6. Loan Payable

On October 12, 2010, the Company granted a promissory note to an unrelated third party in the amount of $200,000 in consideration for monies loaned to the Company. The promissory note is non-interest bearing and due on demand. As of January 31, 2011, the balance of this indebtedness to this party was $200,000 ($100,000 at July 31, 2010).

Minerco Resources, Inc.

(A Development Stage Company)

Notes to the Financial Statements

(unaudited)

7. Equity Funding Facility

The Company entered into the Investment Agreement with Centurion Private Equity, LLC (“Centurion”) on December 2, 2010. Pursuant to the Investment Agreement, Centurion committed to purchase up to $5,000,000 of our common stock, over a period of time terminating on the earlier of: (i) 24 months from the effective date of this registration statement; or (ii) 30 months from the date of the Investment Agreement (the “Line”). The aggregate number of shares issuable by us and purchasable by Centurion the Investment Agreement is $5,000,000 worth of stock, which was determined by our Board of Directors.

We may draw on the facility from time to time, as and when we determine appropriate in accordance with the terms and conditions of the Investment Agreement. The maximum amount that we are entitled to put in any one notice is such number of shares of Common Stock as equals $300,000 provided that the number of shares sold in each put shall not exceed a share volume limitation equal to the lesser of: (i) 10 million shares; or (ii) 15% of the aggregate trading volume of the Common Stock traded on our primary exchange during any pricing period for such put excluding any days where the lowest intra-day trade price is less than the trigger price (which is the greater of (i) the floor price plus a fixed discount of $.0025, subject to adjustment in certain circumstances (ii) the floor price if any set by us divided by 0.95 or (iii) $.01, the greater of all three clauses being referred to as the “Trigger Price”). The offering price of the securities to Centurion will equal 95% of the of the average of the three lowest daily volume weighted average prices, or “ VWAPs, ” of our common stock during the fifteen trading day period beginning on the trading day immediately following the date Centurion receives our put notice. However, if, on any trading day during a pricing period, the daily VWAP of the common stock is lower than the Trigger Price, then the put amount is automatically suspended for each such trading day during the pricing period, with only the balance of such put amount above the minimum acceptable price being put to Centurion. There are put restrictions applied on days between the put notice date and the closing date with respect to that particular put. During such time, we are not entitled to deliver another put notice.

Logistically in terms of timing of each put the Investment Agreement provides that at least one business day but no more than 5 business days prior to any intended put date, we must deliver a put notice to Centurion, stating the number of shares included in the put and the put date

There are circumstances under which we will not be entitled to put shares to Centurion, including the following:

|

●

|

we will not be entitled to put shares to Centurion unless there is an effective registration statement under the Securities Act to cover the resale of the shares by Centurion;

|

|

●

|

we will not be entitled to put shares to Centurion unless our common stock continues to be quoted on the OTC Bulletin Board and has not been suspended from trading;

|

|

●

|

we will not be entitled to put shares to Centurion if an injunction shall have been issued and remain in force against us, or action commenced by a governmental authority which has not been stayed or abandoned, prohibiting the purchase or the issuance of the shares to Centurion;

|

|

●

|

we will not be entitled to put shares to Centurion if the issuance of the shares will violate any shareholder approval requirements of the OTC BB;

we will not be entitled to put shares to Centurion if we have not complied with our obligations and are otherwise in breach of or in default under, the Investment Agreement, the Registration Rights Agreement or any other agreement executed in connection therewith with Centurion; and

|

|

●

|

we will not be entitled to put shares to Centurion to the extent that such shares would cause Centurion’s' beneficial ownership to exceed 9.99% of our outstanding shares;

|

In connection with the preparation of the Investment Agreement and the registration rights agreement, we issued Centurion 2,000,000 shares of common stock as a document preparation fee in the amount of $20,000 and 18,007,202 shares of our common stock as a commitment fee.

Minerco Resources, Inc.

(A Development Stage Company)

Notes to the Financial Statements

(unaudited)

8.

Subsequent Event

On February 3, 2011, the Company entered into a Securities Purchase Agreement and Convertible Promissory Note between the Company and Asher Enterprises for $53,000. The convertible note carries an 8% rate of interest and is convertible into common stock at a variable conversion price of 58% of the market price which shall be calculated as the average of the lowest 3 days during the proceeding 10 days before conversion. The Promissory Note is due on November 7, 2011.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward Looking Statements

This annual report on Form 10-K contains forward-looking statements that involve risks and uncertainties. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology including “could”, “may”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “predict”, “potential” and the negative of these terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested in this report.

Business Overview

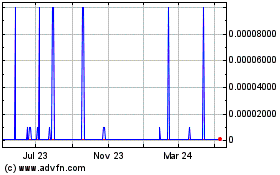

Minerco Resources, Inc. (“Minerco”, “we”, “our” or “us”) was incorporated as a Nevada company on June 21, 2007. We were engaged in the acquisition of interests and leases in oil and natural gas properties since our inception until May 27, 2010. As of May 27, 2010 we changed our focus away from the oil and gas business to that of the development of production and provision of clean, renewable energy solutions in Central America. We have no subsidiaries. Our common stock is quoted on the Other OTC Market under the symbol “MINE”.

Our registration statement on Form S-1 registering an aggregate of 142,545,000 shares of our common stock became effective on February 6, 2009. The 142,545,000 shares offered for resale by the 35 selling security holders include 12,000,000 shares owned by Wisdom Resources, Inc., a company controlled by Michael Too, our former President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Secretary, Treasurer and sole director. We will not receive any proceeds from the resale of these shares by the selling security holders. We incurred all costs associated with the registration statement. Our registration statement on Form S-1 registering an aggregate of 60,600,734 shares of our common stock became effective on January 6, 2011. There 60,600,734 shares offered for sale are from 2 selling security holders.

The Projects

On May 27, 2010, we acquired 100% of the 6 mega-watt per hour (MWh) Chiligatoro Hydro-Electric Project (“Chiligatoro”) in Intibuca, Honduras. The Project is classified as a run-of-the-river project (not a conventional retention dam) and is currently in the Feasibility Stage of development. Acquisition in this phase of development allows Minerco Resouces, Inc. (“Minerco”) to have full control of the Final Design and Construction. To date, the construction of the Chiligatoro has not started, and we have not received any revenues from the project. There is no assurance that the Chiligatoro will be completed in a timely manner, if at all. Additionally, if the Chiligatoro is completed, there is no guarantee that it will be successfully used to create electricity or that it will generate a consistent revenue stream for us.

The Project has received approval from the National Energy Commission, signed the 30 Year Operations Contract with SERNA and is currently negotiating its Power Purchase Agreement (PPA) with ENEE. The Project is awaiting final approval from the Honduran National Congress. This Congressional Approval acts as a “defacto” guarantee. This approval makes Chiligatoro’s Power Purchase Contracts a recorded law in the Honduran National Congress. Final approval and start of construction is anticipated by late 2011.

The revenue for the Chiligatoro Project (or any hydro project) is expected to be generated from the following; however there can be no guarantee that such anticipated revenue level or any revenue at all will be generated:

|

Ø

|

Power Generation Sales

|

|

§

|

Chiligatoro Example: 6 MWh x 24 hr/day x $115.97 /MWh = US$ 16,700 / day or US$ 6,095,000 per year of Gross Energy Generation Revenue

|

|

Ø

|

Carbon Credits

|

|

§

|

Carbon Emission Reduction (CER) Credits can be pre-sold or traded on the open market. The spot price is currently over US$ 10 per Credit. Carbon Credits are relatively new but are measured in tonnes of CO

2

.

|

|

§

|

The Chiligatoro Project is expected eliminate approximately 27,000 tonnes of CO

2

.per year, or earn 27,000 CER Credits annually. 27,000 CER /year x $10 /CER = US$ 270,000 per year.

|

|

Ø

|

Reforestation in Project Buffer Zone

|

|

§

|

Reforestation generates revenue directly and indirectly. Planting tropical hardwood trees such as mahogany will generate direct revenue in less than 20 years. Current prices yield more than US$ 8,000 per tree.

|

|

§

|

More importantly, reforestation of the Project’s Buffer Zone (water supply zone) increases the Projects total efficiency within a couple years adding additional power generation revenue. This increase in efficiency is typically 2 – 3%. Additional CER Credits are also realized with reforestation.

|

The Agreement with ROTA INVERSIONES S.DE R.L

We acquired the rights to the Chiligatoro Project from ROTA INVERSIONES S.DE R.L., a Corporation formed under the laws of Honduras (the “Seller”), pursuant to the terms of an acquisition agreement we entered into with the Seller on May 27, 2010. We agreed to pay the Seller at total of 18,000,000 shares of common stock consisting of 9,000,000 shares of our common stock within 3 days of closing, 4,500,000 shares of our common stock within 180 days of closing and 4,500,000 shares of our common stock upon the Company’s raising of $12,000,000 no later than 24 months after closing. We also agreed to pay the Seller a royalty of 10% of the adjusted gross revenue, derived after all applicable taxes, from the Project prior to completion of the payment of the foregoing. Further, we agreed to pay the Seller a royalty of 20% of the adjusted gross revenue, derived after all applicable taxes, from the Project after the completion of the payout for the life of the Project, including any renewal, transfer or sale, if any, in perpetuity. “Payout” is defined as, all associated costs related to the development of the Project. If the Company is unable to obtain the financing requirements of this agreement, Seller shall have the right to terminate this agreement with full rights of rescission, and all rights, title and interest to the Project shall be transferred back to the Seller.

On January 5, 2011, we acquired 100% of the 4 mega-watt per hour (MWh) Iscan Hydro-Electric Project (“Chiligatoro”) in Olancho, Honduras. The Project is classified as a run-of-the-river project (not a conventional retention dam) and is currently in the Feasibility Stage of development. Acquisition in this phase of development allows Minerco Resouces, Inc. (“Minerco”) to have full control of the Final Design and Construction. To date, the construction of the Iscan has not started, and we have not received any revenues from the project. There is no assurance that the Iscan will be completed in a timely manner, if at all. Additionally, if the Iscan is completed, there is no guarantee that it will be successfully used to create electricity or that it will generate a consistent revenue stream for us.

We acquired the rights to the Iscan Project from Energetica de Occidente S.A. de C.V., a Corporation formed under the laws of Honduras (the “ Iscan Seller”), pursuant to the terms of an acquisition agreement we entered into the Iscan Seller on January 5, 2011. We agreed to pay the Iscan Seller a total of 1,000,000 shares of common stock consisting of 500,000 shares of our common stock within 30 days of closing and 500,000 shares of our common stock upon us raising of $8,500,000 no later than 36 months after closing. We also agreed to pay the Iscan Seller a royalty of 10% of the adjusted gross revenue, derived after all applicable taxes, from the Project prior to completion of the payment of the foregoing. If we are unable to obtain the financing requirements of this agreement, the Iscan Seller shall have the right to terminate this agreement with full rights of rescission, and all rights, title and interest to the Project shall be transferred back to the Iscan Seller.

On January 10, 2011, we entered into a binding letter of intent with Sesacepa Energy Company S.A. de CV (“SENCO”), a corporation formed and operated under the laws of Honduras (“the Caserio Seller”) for the acquisition of a 30% interest in a Hydro – Electric Project known as “Caserio Rio Frio Hydro – Electric Project” in Honduras in Central America (the “Project”). The Agreement also provides for us to obtain a minimum 30% interest and a maximum 80% interest in the remaining 2 phases of the Project known as “El Chaguiton and El Palmar.” Actual ownership will be determined at the actual equity placement for the projects. We will pay the Caserio Seller the following consideration $562,028 over the course of a twelve (12) month period.

On January 18, 2011, we acquired 100% of the 100 mega-watt per hour (MWh) Sayab Wind Project (“Sayab”) in Choluteca, Honduras. The Project is currently in the Feasibility Stage of development. Acquisition in this phase of development allows us to have full control of the Final Design and Construction. To date, the construction of the Sayab has not started, and we have not received any revenues from the project. There is no assurance that the Sayab will be completed in a timely manner, if at all. Additionally, if the Sayab is completed, there is no guarantee that it will be successfully used to create electricity or that it will generate a consistent revenue stream for us.

We acquired the rights to the Sayab Project from Energia Renovable Hondurenas S.A., a Corporation formed under the laws of Honduras (the “ Sayab Seller”), pursuant to the terms of an acquisition agreement we entered into the Sayab Seller on January 18, 2011. We agreed to pay the Sayab Seller a total of 1,000,000 shares of common stock consisting of 500,000 shares of our common stock within 30 days of closing and 500,000 shares of our common stock upon us raising of $10,000,000 no later than 18 months after closing. We also agreed to pay the Sayab Seller a royalty of 6% of the adjusted gross revenue, derived after all applicable taxes, from the Project prior to completion of the payment of the foregoing. Further, we agreed to pay the Sayab Seller a royalty of 12% of the adjusted gross revenue, derived after all applicable taxes, from the Project after the completion of the payout for the life of the Project, including any renewal, transfer or sale, if any, in perpetuity. “Payout” is defined as, all associated costs related to the development of the Project. As additional consideration for this Agreement, the Sayab Seller will have the right to, upon written notice delivered tous , to purchase back from us up to an additional 8% of the Project. The buyback purchase price will be determined by actual costs incurred by us relating to the Project. The Sayab Seller can buyback or obtain 0.5% increments until a maximum 20% total interest is obtained. If we are unable to obtain the financing requirements of this agreement, the Sayab Seller shall have the right to terminate this agreement with full rights of rescission, and all rights, title and interest to the Project shall be transferred back to the Sayab Seller.

On January 24, 2011, we entered into a binding letter of intent with Sesacepa Energy Company S.A. de CV (“SENCO”), a corporation formed and operated under the laws of Honduras (“the Rio Sixe Seller”) for the acquisition of a minimum 30% interest and a maximum of 80% interest in a Hydro – Electric Project known as “Rio Sixe Hydro – Electric Project” in Honduras in Central America (the “Project”). We will pay the Rio Sixe Seller the following consideration of $12,800 over the course of a five (5) month period.

Results of Operations

Our results of operations are presented below:

|

|

|

Six Months

Ended

January 31,

2011

|

|

|

Six Months

Ended

January 31,

2010

|

|

|

Period from

June 21, 2007

(Date of Inception) to

January 31,

2011

|

|

|

Loan Recovery

|

|

$

|

-

|

|

|

$

|

(13,000

|

)

|

|

$

|

(13,000

|

)

|

|

Impairment of Note Receivable

|

|

|

-

|

|

|

|

|

|

|

|

32,700

|

|

|

General and Administrative Expenses

|

|

|

395,150

|

|

|

|

29,123

|

|

|

|

566,006

|

|

|

Chiligatoro Operating Expenses

|

|

|

15,500

|

|

|

|

-

|

|

|

|

61,000

|

|

|

Interest Expense

|

|

|

82

|

|

|

|

-

|

|

|

|

82

|

|

|

Sale of discontinued operations

|

|

|

(14,935)

|

|

|

|

|

|

|

|

(14,935)

|

|

|

Net Loss

|

|

$

|

(395,797

|

)

|

|

$

|

(16,123

|

)

|

|

$

|

(631,853

|

)

|

|

Net Loss per Share –Basic and Diluted

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

|

N/A

|

|

|

Weighted Average Shares Outstanding

|

|

|

365,145,175

|

|

|

|

331,545,000

|

|

|

|

N/A

|

|

Results of Operations for the Six Months Ended January 31, 2011

During the six months ended January 31, 2011 we incurred a net loss of $395,797, compared to a net loss of $16,123 during the same period in fiscal 2010. The increase in our net loss during the six months ended January 31, 2011 was primarily due to increased General and Administrative Expense due to a change in business operations, the hiring of employees and consultants and Chiligatoro Operating Expense.

Our total general and administrative expenses for the six months ended January 31, 2011 were $395,150, compared to operating expenses of $29,123 during the same period in fiscal 2010. Our total general and administrative expenses during the six months ended January 31, 2011 consisted of $134,540 in compensation expense, $14,844 in stock compensation expense, $48,127 in professional fees, $144,000 in consulting fees and $53,639 in general and administrative expense and during the six months ended January 31, 2010 consisted entirely of general and administrative expenses, and we did not incur any foreign exchange losses, management fees, rent expenses or other operating expenses.

Our general and administrative expenses consist of professional fees, transfer agent fees, investor relations expenses and general office expenses. Our professional fees include legal, accounting and auditing fees.

Results of Operations

Our results of operations are presented below:

|

|

|

Three Months

Ended

January 31,

2011

|

|

|

Three Months

Ended

January 31,

2010

|

|

|

Period from

June 21, 2007

(Date of Inception) to

January 31,

2011

|

|

|

Loan Recovery

|

|

$

|

-

|

|

|

$

|

(8,000

|

)

|

|

$

|

(13,000

|

)

|

|

Impairment of Note Receivable

|

|

|

-

|

|

|

|

|

|

|

|

32,700

|

|

|

General and Administrative Expenses

|

|

|

319,414

|

|

|

|

15,891

|

|

|

|

566,006

|

|

|

Chiligatoro Operating Expenses

|

|

|

-

|

|

|

|

-

|

|

|

|

61,000

|

|

|

Interest Expense

|

|

|

-

|

|

|

|

-

|

|

|

|

82

|

|

|

Sale of discontinued operations

|

|

|

(14,935)

|

|

|

|

|

|

|

|

(14,935)

|

|

|

Net Loss

|

|

$

|

(304,479

|

)

|

|

$

|

(7,891

|

)

|

|

$

|

(631,853

|

)

|

|

Net Loss per Share –Basic and Diluted

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

|

N/A

|

|

|

Weighted Average Shares Outstanding

|

|

|

384,593,175

|

|

|

|

331,545,000

|

|

|

|

N/A

|

|

Results of Operations for the Three Months Ended January 31, 2011

During the three months ended January 31, 2011 we incurred a net loss of $304,797, compared to a net loss of $7,891 during the same period in fiscal 2010. The increase in our net loss during the three months ended January 31, 2011 was primarily due to increased General and Administrative Expense due to a change in business operations and the hiring of employees and consultants.

Our total general and administrative expenses for the three months ended January 31, 2011 were $319,414, compared to operating expenses of $15,891 during the same period in fiscal 2010. Our total general and administrative expenses during the three months ended January 31, 2011 consisted of $91,040 in compensation expense, $14,844 in stock compensation expense, $37,108 in professional fees, $144,000 in consulting fees and $32,422 in general and administrative expense and during the three months ended January 31, 2010 consisted entirely of general and administrative expenses, and we did not incur any foreign exchange losses, management fees, rent expenses or other operating expenses.

Our general and administrative expenses consist of professional fees, transfer agent fees, investor relations expenses and general office expenses. Our professional fees include legal, accounting and auditing fees.

Results of Operations for the Period from June 21, 2007 (Date of Inception) to January 31, 2011

From our inception on June 21, 2007 to January 31, 2011 we did not generate any revenues and we incurred a net loss of $631,853. We may not generate significant revenues from our interest in our Hydro-Electric or Wind Projects or any other properties in which we acquire an interest, and we anticipate that we will incur substantial losses for the foreseeable future.

Our total operating expenses from our inception on June 21, 2007 to January 31, 2011 were $566,006, and consisted entirely of $187,809 in compensation expense, $138,333 in professional fees, $144,000 in consulting fees and $95,864 in general and administrative expenses. We have not incurred any foreign exchange losses, management fees, rent expenses or other operating expenses since our inception.

Our general and administrative expenses consist of professional fees, transfer agent fees, investor relations expenses and general office expenses. Our professional fees include legal, accounting and auditing fees.

From our inception on June 21, 2007 to January 31, 2011 we also received $13,000 in the form of proceeds from loan recovery and incurred $32,700 in expenses related to the impairment of a note receivable.

Liquidity and Capital Resources

As of January 31, 2011 we had $1,506 in cash and $717,481 in total assets, $356,420 in total liabilities and a working capital deficit of $354,439. Our accumulated deficit from our inception on June 21, 2007 to January 31, 2011 was $631,853 and was funded primarily through advances from related parties, equity and debt financing.

From our inception on June 21, 2007 to January 31, 2011 we spent net cash of $334,476 on operating activities. During the six months ended January 31, 2011 we spent net cash of $158,761 on operating activities, compared to net cash spending of $29,795 on operating activities during the same period in fiscal 2010. The increase in expenditures on operating activities for the six months ended January 31, 2011 was primarily due to a change in business operation and in connection therewith the acquisition of several development projects.

From our inception on June 21, 2007 to January 31, 2011 we spent net cash of $10,000 on investing activities, all of which was in the form of a loan to a third party. We did not spend any net cash on investing activities during the six months ended January 31, 2011 or during the same period in fiscal 2010.

From our inception on June 21, 2007 to January 31, 2011 we received net cash of $345,982 from financing activities, which consists of $90,514 from the issuance of our common stock, $200,000 from debt financing, $54,286 in proceeds from a related party and $1,182 in capital contributions. During the six months ended January 31, 2011 we did receive $139,351 net cash from financing activities, compared to net cash received of $14,935 during the same period in fiscal 2010. The increase in receipts from financing activities for the six months ended January 31, 2011 was primarily due to a loan from an unrelated third party.

During the six months ended January 31, 2011 our monthly cash requirements to fund our operating activities was approximately $26, 460. Our cash of $1,506 as of January 31, 2011 is not sufficient to cover our current monthly burn rate for a full month.

We estimate our planned expenses for the next 24 months (beginning March 2011) to be approximately $13,001,000, as summarized in the table below.

|

Description

|

|

Potential completion date

|

|

Estimated

Expenses

($)

|

|

|

Complete Feasibility & Environmental Studies

|

|

6 months

|

|

|

200,000

|

|

|

Project Permitting

|

|

6 months

|

|

|

85,000

|

|

|

Lease/Land Purchase

|

|

6 months

|

|

|

500,000

|

|

|

Final Construction Design

|

|

6 months

|

|

|

150,000

|

|

|

Engineering & Construction Consultants

|

|

6 months

|

|

|

200,000

|

|

|

Mobilization of Equipment

|

|

6 months

|

|

|

200,000

|

|

|

Stage 1 Construction

|

|

12 months

|

|

|

2,600,000

|

|

|

Stage 2 Construction

|

|

18 months

|

|

|

2,800,000

|

|

|

Stage 3 Construction

|

|

24 months

|

|

|

3,700,000

|

|

|

Professional Fees (legal and accounting)

|

|

12 months

|

|

|

100,000

|

|

|

Project Supervision

|

|

12 months

|

|

|

150,000

|

|

|

Project Socialization

|

|

12 months

|

|

|

75,000

|

|

|

General and administrative expenses

|

|

12 months

|

|

|

1,150,000

|

|

|

Contingencies (10%)

|

|

24 months

|

|

|

1,091,000

|

|

|

Total

|

|

|

|

|

13,001,000

|

|

Our general and administrative expenses for the year will consist primarily of transfer agent fees, investor relations expenses and general office expenses. The professional fees are related to our regulatory filings throughout the year.

Based on our planned expenditures, we require additional funds of approximately $12,998,494 (a total of $13,001,000 less our approximately $1,506 in cash as of January 31, 2011) to proceed with our business plan over the next 24 months. If we secure less than the full amount of financing that we require, we will not be able to carry out our complete business plan and we will be forced to proceed with a scaled back business plan based on our available financial resources.

We anticipate that we will incur substantial losses for the foreseeable future. Although we acquired a 100% interest in the various Hydro-Electric and Wind Projects, there is no assurance that we will receive any revenues from this interest. Meanwhile, even if we purchase other non-operated interests in hydro-electric projects or begin construction activities on any properties we may acquire, this does not guarantee that these projects or properties will be commercially exploitable.

Our activities will be directed by V. Scott Vanis, our President, Chief Executive Officer and a member of the Board of Directors and Sam J Messina III, our Chief Financial Officer, Secretary, Treasurer and a member of the Board of Directors, who will also manage our operations and supervise our other planned acquisition activities.

Future Financings

Our financial statements for the six months ended January 31, 2011 have been prepared on a going concern basis and there is substantial doubt about our ability to continue as a going concern. We have not generated any revenues, have achieved losses since our inception, and rely upon the sale of our securities to fund our operations. We may not generate any revenues from our interest in the various Hydro-Electric and Wind Projects, or from any of the hydro-electric or wind projects in which we acquire an interest. Accordingly, we are dependent upon obtaining outside financing to carry out our operations and pursue any acquisition and exploration activities.

Of the $13,001,000 we require for the next 24 months, we had approximately $1,506 in cash as of January 31, 2011. We intend to raise the balance of our cash requirements for the next 24 months (approximately $12,998,494) from the equity line that we entered into with Centurion, private placements, shareholder loans or possibly a registered public offering (either self-underwritten or through a broker-dealer). If we are unsuccessful in raising enough money through such efforts, we may review other financing possibilities such as bank loans. At this time we do not have a commitment from any broker-dealer to provide us with financing other than the equity line, and there is no guarantee that any financing will be successful. We intend to negotiate with our management and any consultants we may hire to pay parts of their salaries and fees with stock and stock options instead of cash.

If we are unable to obtain the necessary additional financing, then we plan to reduce the amounts that we spend on our acquisition and exploration activities and our general and administrative expenses so as not to exceed the amount of capital resources that are available to us. Specifically, we anticipate that we will defer drilling programs and certain acquisitions pending the receipt of additional financing. Still, if we do not secure additional financing our current cash reserves and working capital will be not be sufficient to enable us to sustain our operations and for the next 12 months, even if we do decide to scale back our operations.

Product Research and Development

We do not anticipate spending any material amounts in connection with product research and development activities during the next 12 months.

Acquisition of Plants and Equipment and Other Assets

Apart from our interest in the various Hydro-Electric and Wind Projects, we do not anticipate selling or acquiring any material properties, plants or equipment during the next 12 months unless we are successful in obtaining additional financing.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

Inflation

The amounts presented in the financial statements do not provide for the effect of inflation on our operations or financial position. The net operating losses shown would be greater than reported if the effects of inflation were reflected either by charging operations with amounts that represent replacement costs or by using other inflation adjustments.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

ITEM 4. CONTROLS AND PROCEDURES

Disclosure Controls

We maintain disclosure controls and procedures (as defined in Rule 13a-15(e) and Rule 15d-15(e) under the Exchange Act) designed to provide reasonable assurance the information required to be reported in our Exchange Act filings is recorded, processed, summarized and reported within the time periods specified and pursuant to Securities and Exchange Commission rules and forms, including controls and procedures designed to ensure that this information is accumulated and communicated to our management, including our Principal Executive Officer and Principal Financial Officer, as appropriate, to allow timely decisions regarding required disclosure.

As of the end of the period covered by this report, our management, with the participation of our Principal Executive Officer and Principal Financial Officer, carried out an evaluation of the effectiveness of our disclosure controls and procedures. Inasmuch as we only have two individuals serving as officers, directors and employees we have determined that the company has, per se, inadequate controls and procedures over financial reporting due to the lack of segregation of duties despite the fact that the duties of the Chief Executive Officer and Chief Financial Officer are performed by two different individuals. Management recognizes that its controls and procedures would be substantially improved if there was a greater segregation of the duties of Chief Executive Officer and Chief Financial Officer and as such is actively seeking to remediate this issue. Management believes that the material weakness in its controls and procedures referenced did not have an effect on our financial results. Based upon this evaluation, our Principal Executive Officer and our Principal Financial Officer concluded that our disclosure controls and procedures were ineffective.

Changes in Internal Control

There were no changes in our internal control over financial reporting (as defined in Rule 13a-15(e) and Rule 15d-15(e) under the Exchange Act) during the six months ended January 31, 2011 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting. other than the improvement to our controls resulting from the segregation of duties of the Principal Executive Officer and the Principal Financial Officer in July 2010 when we hired a new Principal Financial Officer on July 26, 2010 to oversee the internal controls over financial reporting.

PART II – OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

We are not aware of any legal proceedings to which we are a party or of which our property is the subject.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES

On October 14, 2010, the Company issued 2,000,000 shares in consideration for documentation preparation services performed. These shares were not expensed since they were incurred prior to raising financing and hence considered as deferred financing costs.

On December 6, 2010, the Company issued 16,000,000 shares pursuant to a consulting agreement. The issuance of stock was exempt from registration under Section 4 (2) of the Securities Act. No underwriter was involved in the offer of sale of the shares.

On December 6, 2010, the Company issued 1,750,000 shares to various employees as a sign on bonus. The issuance of stock was exempt from registration under Section 4 (2) of the Securities Act. No underwriter was involved in the offer of sale of the shares.

On December 16, 2010, the Company issued 30,000,000 shares of its common stock to its Chief Financial Officer pursuant to an employment agreement. The issuance of stock was exempt from registration under Section 4 (2) of the Securities Act. No underwriter was involved in the offer of sale of the shares.

On January 11, 2011, the Company issued 10,000,000 shares of its Class A Convertible Preferred stock to its Chief Executive Officer pursuant to an employment agreement. The issuance of stock was exempt from registration under Section 4 (2) of the Securities Act. No underwriter was involved in the offer of sale of the shares.

On December 16, 2010, the Company issued 18,007,202 shares as a commitment fee pursuant to the Investment Agreement between Centurion Private Equity LLC and the company dated December 2, 2010, these shares were not expensed since they were incurred prior to raising financing and hence considered as deferred financing costs.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. REMOVED AND RESERVED

N/A

ITEM 5. OTHER INFORMATION

None.

ITEM 6. EXHIBITS

EXHIBIT INDEX

|

|

|

|

|

Incorporated by reference

|

|

|

|

|

Exhibit

|

|

Document Description

|

|

Form

|

|

Date

|

|

Number

|

|

Filed herewith

|

|

|

10.1

|

|

Employment Agreement for V. Scott Vanis

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.2

|

|

Employment Agreement for Sam J Messina III

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.3

|

|

Asset Purchase Agreement for Iscan Hydro-Electric Project

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.4

|

|

Asset Purchase Agreement for Sayab Wind Project

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.5

|

|

Binding Letter of Intent for Caserio Rio Frio

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.6

|

|

Binding Letter of Intent for Rio Sixe

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.7

|

|

Securities Purchase Agreement

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31.1

|

|

Certification of Principal Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31.2

|

|

Certification of Principal Financial Officer and pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32.1

|

|

Certification of Chief Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32.2

|

|

Certification of Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

|

|

|

X

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

MINERCO RESOURCES INC.

|

|

|

|

|

|

|

March 17, 2011

|

BY:

|

|

|

|

|

|

V. Scott Vanis

President

(Principal Executive Officer)

|

|

|

|

|

|

|

|

March 17, 2011

|

BY:

|

|

|

|

|

|

Sam Messina III

Chief Financial Officer

(Principal Financial Officer)

|

|

EXHIBIT INDEX

|

|

|

|

|

Incorporated by reference

|

|

|

|

|

Exhibit

|

|

Document Description

|

|

Form

|

|

Date

|

|

Number

|

|

Filed herewith

|

|

|

10.1

|

|

Employment Agreement for V. Scott Vanis

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.2

|

|

Employment Agreement for Sam J Messina III

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.3

|

|

Asset Purchase Agreement for Iscan Hydro-Electric Project

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.4

|

|

Asset Purchase Agreement for Sayab Wind Project

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.5

|

|

Binding Letter of Intent for Caserio Rio Frio

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.6

|

|

Binding Letter of Intent for Rio Sixe

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.7

|

|

Securities Purchase Agreement

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31.1

|

|

Certification of Principal Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31.2

|

|

Certification of Principal Financial Officer and pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32.1

|

|

Certification of Chief Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32.2

|

|

Certification of Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

|

|

|

X

|

|

22

Exhibit 10.1

EMPLOYMENT AGREEMENT

This Employment Agreement (the

"Agreement"

) is entered into as of the 11

th

day of January, 2011 between V. Scott Vanis (

"Employee"

) and Minerco Resources, Inc., a Nevada Corporation, its affiliates, predecessors and subsidiaries (the

"Company”)

.

WHEREAS, Employee and the Company desire to enter into this Agreement setting forth the terms and conditions for the employment relationship of Employee with the Company during the Employment Term (as defined below).

NOW, THEREFORE, in consideration of the mutual promises contained herein, the parties to this Agreement hereby agree as follows:

1.1

Employment

.

During the Employment Term (as defined below), the Company hires Employee to perform such services as the Company may from time to time reasonably request consistent with Employee's position with the Company (as set forth in Section 1.1 and 1.5 hereof) and Employee's stature and experience as a Certified Public Accountant(the

"Services"