0000924095

false

FY

No

No

Yes

Yes

Yes

0000924095

2022-07-01

2023-06-30

0000924095

2022-12-31

0000924095

2023-10-13

0000924095

2023-06-30

0000924095

2022-06-30

0000924095

us-gaap:RelatedPartyMember

2023-06-30

0000924095

us-gaap:RelatedPartyMember

2022-06-30

0000924095

us-gaap:NonrelatedPartyMember

2023-06-30

0000924095

us-gaap:NonrelatedPartyMember

2022-06-30

0000924095

MVCO:SeriesAConvertiblePreferredStockMember

2023-06-30

0000924095

MVCO:SeriesAConvertiblePreferredStockMember

2022-06-30

0000924095

us-gaap:ConvertibleNotesPayableMember

2023-06-30

0000924095

us-gaap:ConvertibleNotesPayableMember

2022-06-30

0000924095

2021-07-01

2022-06-30

0000924095

MVCO:LiquidityPoolFeesMember

2022-07-01

2023-06-30

0000924095

MVCO:LiquidityPoolFeesMember

2021-07-01

2022-06-30

0000924095

MVCO:MiningPoolFeesMember

2022-07-01

2023-06-30

0000924095

MVCO:MiningPoolFeesMember

2021-07-01

2022-06-30

0000924095

MVCO:StakingRewardsMember

2022-07-01

2023-06-30

0000924095

MVCO:StakingRewardsMember

2021-07-01

2022-06-30

0000924095

us-gaap:SalesMember

2022-07-01

2023-06-30

0000924095

us-gaap:SalesMember

2021-07-01

2022-06-30

0000924095

us-gaap:PreferredStockMember

MVCO:SeriesAConvertiblePreferredStockMember

2022-06-30

0000924095

us-gaap:CommonStockMember

2022-06-30

0000924095

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0000924095

MVCO:SharesToBeIssuedMember

2022-06-30

0000924095

us-gaap:RetainedEarningsMember

2022-06-30

0000924095

us-gaap:PreferredStockMember

MVCO:SeriesAConvertiblePreferredStockMember

2021-06-30

0000924095

us-gaap:CommonStockMember

2021-06-30

0000924095

us-gaap:AdditionalPaidInCapitalMember

2021-06-30

0000924095

MVCO:SharesToBeIssuedMember

2021-06-30

0000924095

us-gaap:RetainedEarningsMember

2021-06-30

0000924095

2021-06-30

0000924095

us-gaap:PreferredStockMember

MVCO:SeriesAConvertiblePreferredStockMember

2022-07-01

2023-06-30

0000924095

us-gaap:CommonStockMember

2022-07-01

2023-06-30

0000924095

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2023-06-30

0000924095

MVCO:SharesToBeIssuedMember

2022-07-01

2023-06-30

0000924095

us-gaap:RetainedEarningsMember

2022-07-01

2023-06-30

0000924095

us-gaap:PreferredStockMember

MVCO:SeriesAConvertiblePreferredStockMember

2021-07-01

2022-06-30

0000924095

us-gaap:CommonStockMember

2021-07-01

2022-06-30

0000924095

us-gaap:AdditionalPaidInCapitalMember

2021-07-01

2022-06-30

0000924095

MVCO:SharesToBeIssuedMember

2021-07-01

2022-06-30

0000924095

us-gaap:RetainedEarningsMember

2021-07-01

2022-06-30

0000924095

us-gaap:PreferredStockMember

MVCO:SeriesAConvertiblePreferredStockMember

2023-06-30

0000924095

us-gaap:CommonStockMember

2023-06-30

0000924095

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0000924095

MVCO:SharesToBeIssuedMember

2023-06-30

0000924095

us-gaap:RetainedEarningsMember

2023-06-30

0000924095

MVCO:SmallBusinessAdministrationMember

2014-05-27

2014-05-28

0000924095

MVCO:StockPurchaseAgreementMember

MVCO:RoranCapitalLLCMember

MVCO:RyanSchadelMember

2021-09-02

0000924095

MVCO:StockPurchaseAgreementMember

MVCO:RoranCapitalLLCMember

MVCO:RyanSchadelMember

us-gaap:RelatedPartyMember

2021-09-02

0000924095

MVCO:StockPurchaseAgreementMember

2021-09-01

2021-09-02

0000924095

2021-09-02

0000924095

2021-12-15

0000924095

MVCO:InterestPurchaseAgreementMember

MVCO:BoredCoffeeLabLLCMember

2023-06-12

2023-06-12

0000924095

MVCO:InterestPurchaseAgreementMember

MVCO:BoredCoffeeLabLLCMember

us-gaap:CommonStockMember

2023-06-12

2023-06-12

0000924095

MVCO:CoinbaseIncMember

2023-06-30

0000924095

MVCO:CoinbaseIncMember

2022-07-01

2023-06-30

0000924095

srt:MaximumMember

MVCO:CoinbaseIncMember

2023-06-30

0000924095

MVCO:ConversionOfWarrantsMember

2022-07-01

2023-06-30

0000924095

MVCO:ConversionOfWarrantsMember

2021-07-01

2022-06-30

0000924095

MVCO:BoringBrewLLCMember

MVCO:PurchaseAgreementMember

2023-06-12

2023-06-12

0000924095

MVCO:InterestPurchaseAgreementMember

MVCO:BoredCoffeeLabLLCMember

us-gaap:CommonStockMember

2023-06-12

0000924095

MVCO:BoringAndBoredMember

2023-06-30

0000924095

MVCO:DigitalAssetMember

2021-06-30

0000924095

MVCO:DigitalAssetMember

2021-07-01

2022-06-30

0000924095

MVCO:DigitalAssetMember

2022-06-30

0000924095

MVCO:DigitalAssetMember

2022-07-01

2023-06-30

0000924095

MVCO:DigitalAssetMember

2023-06-30

0000924095

MVCO:CryptocurrencyAPEMember

2022-07-01

2023-06-30

0000924095

MVCO:CryptocurrencyETHMember

2022-07-01

2023-06-30

0000924095

MVCO:CryptocurrencyBTCMember

2022-07-01

2023-06-30

0000924095

MVCO:CryptocurrencyJOEMember

2022-07-01

2023-06-30

0000924095

MVCO:CryptocurrencyUNIMember

2022-07-01

2023-06-30

0000924095

MVCO:CryptocurrencyRBNTMember

2022-07-01

2023-06-30

0000924095

MVCO:CryptocurrencyUSDCMember

2022-07-01

2023-06-30

0000924095

MVCO:CryptocurrencyOtherMember

2022-07-01

2023-06-30

0000924095

MVCO:CryptocurrencyMember

2022-07-01

2023-06-30

0000924095

MVCO:LiquidityPoolTokensUniswapMember

2022-07-01

2023-06-30

0000924095

MVCO:LiquidityPoolTokensCakeMember

2022-07-01

2023-06-30

0000924095

MVCO:LiquidityPoolTokensMember

2022-07-01

2023-06-30

0000924095

MVCO:NonFungibleTokensMutantApeYachtClubMember

2022-07-01

2023-06-30

0000924095

MVCO:NonFungibleTokensMeebitsMember

2022-07-01

2023-06-30

0000924095

MVCO:NonFungibleTokensBoredApeKennelClubMember

2022-07-01

2023-06-30

0000924095

MVCO:NonFungibleTokensNakamingosMember

2022-07-01

2023-06-30

0000924095

MVCO:NonFungibleTokensOnForceOneMember

2022-07-01

2023-06-30

0000924095

MVCO:NonFungibleTokensOtherNFTMember

2022-07-01

2023-06-30

0000924095

MVCO:NonFungibleTokenMember

2022-07-01

2023-06-30

0000924095

MVCO:CryptocurrencyAPEMember

2021-07-01

2022-06-30

0000924095

MVCO:CryptocurrencyETHMember

2021-07-01

2022-06-30

0000924095

MVCO:CryptocurrencCAKEMember

2021-07-01

2022-06-30

0000924095

MVCO:CryptocurrencyMKRMember

2021-07-01

2022-06-30

0000924095

MVCO:CryptocurrencyRLPMember

2021-07-01

2022-06-30

0000924095

MVCO:CryptocurrencyUSDCMember

2021-07-01

2022-06-30

0000924095

MVCO:CryptocurrencyLINKMember

2021-07-01

2022-06-30

0000924095

MVCO:CryptocurrencyMember

2021-07-01

2022-06-30

0000924095

MVCO:LiquidityPoolTokensUniswapMember

2021-07-01

2022-06-30

0000924095

MVCO:LiquidityPoolTokensMooEmpMember

2021-07-01

2022-06-30

0000924095

MVCO:LiquidityPoolTokensMember

2021-07-01

2022-06-30

0000924095

MVCO:NonFungibleTokensMutantApeYachtClubMember

2021-07-01

2022-06-30

0000924095

MVCO:NonFungibleTokensOtherDeedMember

2021-07-01

2022-06-30

0000924095

MVCO:NonFungibleTokensBoardApeKennelClubMember

2021-07-01

2022-06-30

0000924095

MVCO:NonFungibleTokensMeebitsMember

2021-07-01

2022-06-30

0000924095

MVCO:NonFungibleTokenMember

2021-07-01

2022-06-30

0000924095

MVCO:MiningEquipmentMember

2023-06-30

0000924095

MVCO:MiningEquipmentMember

2022-06-30

0000924095

currency:USD

2022-08-22

0000924095

MVCO:WebsiteDevelopmentMember

2023-06-30

0000924095

MVCO:WebsiteDevelopmentMember

2022-06-30

0000924095

MVCO:DesignMember

2023-06-30

0000924095

MVCO:DesignMember

2022-06-30

0000924095

MVCO:WebsiteMember

MVCO:BoringBrewLLCAndBoredCoffeeLabLLCMember

2023-06-12

0000924095

MVCO:DesignMember

MVCO:BoringBrewLLCAndBoredCoffeeLabLLCMember

2023-06-12

0000924095

MVCO:WebsiteMember

2023-06-30

0000924095

MVCO:ConvertibleLoanAgreementMember

MVCO:RoranCapitalLLCMember

2017-09-18

2017-09-19

0000924095

MVCO:ConvertibleLoanAgreementMember

MVCO:RoranCapitalLLCMember

2017-09-19

0000924095

MVCO:ConvertibleLoanAgreementMember

MVCO:RoranCapitalLLCMember

2019-06-17

0000924095

MVCO:ConvertibleLoanAgreementMember

MVCO:RoranCapitalLLCMember

2019-06-16

2019-06-17

0000924095

2019-09-30

0000924095

MVCO:ConvertibleLoanAgreementMember

MVCO:RoranCapitalLLCMember

2019-12-13

0000924095

MVCO:ConvertibleLoanAgreementMember

MVCO:RoranCapitalLLCMember

2019-12-12

2019-12-13

0000924095

MVCO:ConvertibleLoanAgreementMember

MVCO:RoranCapitalLLCMember

2020-06-08

0000924095

MVCO:ConvertibleLoanAgreementMember

MVCO:RoranCapitalLLCMember

2020-06-07

2020-06-08

0000924095

MVCO:LoanAgreementAndPromissoryNoteMember

MVCO:RoranCapitalLLCMember

2020-06-08

0000924095

MVCO:LoanAgreementAndPromissoryNoteMember

MVCO:RoranCapitalLLCMember

2020-06-07

2020-06-08

0000924095

us-gaap:RelatedPartyMember

2021-06-30

0000924095

MVCO:RoranCapitalLLCMember

2021-07-01

2022-06-30

0000924095

MVCO:StockPurchaseAgreementMember

MVCO:RoranCapitalLLCMember

MVCO:RyanSchadelMember

2021-09-02

2021-09-02

0000924095

us-gaap:RelatedPartyMember

MVCO:StockPurchaseAgreementMember

2021-09-02

2021-09-02

0000924095

MVCO:StockPurchaseAgreementMember

us-gaap:RelatedPartyMember

us-gaap:AdditionalPaidInCapitalMember

2021-09-02

2021-09-02

0000924095

MVCO:ConvertibleNotePayableMember

2021-09-01

2021-09-02

0000924095

MVCO:InterestonConvertibleNotePayableMember

2021-09-01

2021-09-02

0000924095

MVCO:AdvancefromRelatedPartyMember

2021-09-01

2021-09-02

0000924095

2021-09-01

2021-09-02

0000924095

MVCO:PromissoryNoteFourMember

MVCO:TomZarroMember

2022-08-12

0000924095

MVCO:PromissoryNoteFourMember

MVCO:TomZarroMember

2022-08-11

2022-08-12

0000924095

us-gaap:WarrantMember

2022-08-11

2022-08-12

0000924095

MVCO:ConvertiblePromissoryNoteMember

2022-07-01

2023-06-30

0000924095

MVCO:ConvertiblePromissoryNoteMember

2021-07-01

2022-06-30

0000924095

MVCO:ConvertiblePromissoryNoteMember

2023-06-30

0000924095

MVCO:ConvertiblePromissoryNoteMember

2022-06-30

0000924095

MVCO:PromissoryNoteOneMember

2021-10-18

0000924095

MVCO:PromissoryNoteOneMember

2022-08-28

2022-08-29

0000924095

MVCO:PromissoryNoteOneMember

2022-08-29

0000924095

MVCO:PromissoryNoteOneMember

MVCO:RyanSchadelMember

2022-08-28

2022-08-29

0000924095

MVCO:PromissoryNoteOneMember

2022-07-01

2023-06-30

0000924095

MVCO:PromissoryNoteOneMember

2021-07-01

2022-06-30

0000924095

MVCO:PromissoryNoteOneMember

2023-06-30

0000924095

MVCO:PromissoryNoteOneMember

2022-06-30

0000924095

MVCO:PromissoryNoteTwoMember

2022-06-29

0000924095

MVCO:PromissoryNoteTwoMember

2022-07-01

2023-06-30

0000924095

MVCO:PromissoryNoteTwoMember

2023-06-30

0000924095

MVCO:PromissoryNoteTwoMember

2022-06-30

0000924095

MVCO:PromissoryNoteThreeMember

MVCO:ChiefExecutiveOfficierMember

2022-08-12

0000924095

MVCO:PromissoryNoteThreeMember

MVCO:ChiefExecutiveOfficierMember

2022-08-11

2022-08-12

0000924095

MVCO:PromissoryNoteThreeMember

2022-07-01

2023-06-30

0000924095

MVCO:PromissoryNoteThreeMember

2023-06-30

0000924095

MVCO:PromissoryNoteThreeMember

2022-06-30

0000924095

MVCO:ConvertiblePromissoryNoteMember

2022-05-10

0000924095

MVCO:ConvertiblePromissoryNoteMember

2022-05-07

2022-05-10

0000924095

MVCO:ConvertiblePromissoryNoteMember

MVCO:HolderMember

2022-07-01

2023-06-30

0000924095

MVCO:ConvertiblePromissoryNoteMember

MVCO:HolderMember

2021-07-01

2022-06-30

0000924095

MVCO:ConvertiblePromissoryNoteOneMember

2023-06-30

0000924095

MVCO:ConvertiblePromissoryNoteOneMember

2022-06-30

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyMember

2022-03-04

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyMember

2022-03-03

2022-03-04

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyMember

2022-07-01

2023-06-30

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyMember

2021-07-01

2022-06-30

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyMember

2023-06-30

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyMember

2022-06-30

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyOneMember

2022-03-10

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyOneMember

2022-03-09

2022-03-10

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyOneMember

2022-07-01

2023-06-30

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyOneMember

2021-07-01

2022-06-30

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyOneMember

2023-06-30

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyOneMember

2022-06-30

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyTwoMember

2022-05-06

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyTwoMember

2022-05-06

2022-05-06

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyTwoMember

2022-07-01

2023-06-30

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyTwoMember

2021-07-01

2022-06-30

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyTwoMember

2023-06-30

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyTwoMember

2022-06-30

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyThreeMember

2022-05-09

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyThreeMember

2022-05-09

2022-05-09

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyThreeMember

2022-07-01

2023-06-30

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyThreeMember

2021-07-01

2022-06-30

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyThreeMember

2023-06-30

0000924095

MVCO:ConvertiblePromissoryNoteRelatedPartyThreeMember

2022-06-30

0000924095

MVCO:SeriesAConvertiblePreferredStockMember

2022-03-11

0000924095

MVCO:SeriesAConvertiblePreferredStockMember

2022-03-05

2022-03-11

0000924095

us-gaap:CommonStockMember

MVCO:WebsiteDevelopmentServicesMember

2023-04-07

2023-04-07

0000924095

us-gaap:CommonStockMember

MVCO:BoringBrewLLCAndBoredCoffeeLabLLCMember

2023-06-12

2023-06-12

0000924095

MVCO:StockPurchasesAgreementsMember

MVCO:SeriesAConvertiblePreferredStockMember

2022-03-16

0000924095

MVCO:WarrantOneMember

2022-03-15

2022-03-16

0000924095

MVCO:WarrantOneMember

2022-03-16

0000924095

MVCO:WarrantTwoMember

2022-03-15

2022-03-16

0000924095

MVCO:WarrantTwoMember

2022-03-16

0000924095

MVCO:WarrantThreeMember

2022-03-15

2022-03-16

0000924095

MVCO:WarrantThreeMember

2022-03-16

0000924095

2022-08-12

0000924095

2022-07-14

2022-07-15

0000924095

srt:MinimumMember

2022-07-01

2023-06-30

0000924095

srt:MaximumMember

2022-07-01

2023-06-30

0000924095

MVCO:RestoreFranchiseGroupLLCMember

us-gaap:SubsequentEventMember

2023-07-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

| ☒ |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR

THE FISCAL YEAR ENDED JUNE 30, 2023

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission

File Number: 811-08387

METAVESCO,

INC.

(Exact

name of registrant as specified in its charter)

| nevada |

|

54-1694665 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(IRS

Employer

Identification

Number) |

410

Peachtree Pkwy, Suite 4245, Cumming, GA 30041

(Address of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (678) 241-5898

Securities

registered under Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Securities

registered pursuant to section 12(g) of the Act:

None

Title

of Class

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES

☒ NO ☐

Indicate

by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act

of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has

been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (ss. 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was

required to submit such files). YES ☒ NO ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. YES ☒ NO ☐

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| |

|

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

|

| |

Emerging

growth company ☐ |

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b)

of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of

an effort to previously issued financial statements. ☐

Indicate by check mark whether any of those error

corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s

executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ☐ NO ☒

The

aggregate market value of the registrant’s voting stock held by non-affiliates, computed on the basis of the closing price of the

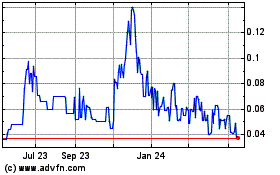

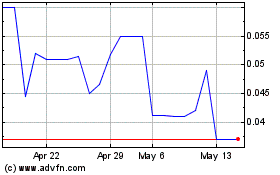

registrant’s common stock on the OTC Pink on December 31, 2022, was approximately $2,633,599 (60,822,140 shares at $0.0433 per

share).

As

of October 13, 2023, there were 66,322,140 shares of the registrant’s common stock, $0.0001 par value per share, outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

None.

OTHER

INFORMATION

As

used in this Annual Report on Form 10-K, the terms “we”, “us”, “our”, “Metavesco” and

the “Company” refer to Metavesco, Inc., a Nevada corporation, unless otherwise stated. “SEC” refers to the Securities

and Exchange Commission.

TABLE

OF CONTENTS

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Except

for historical information, this Annual Report contains forward-looking statements within the meaning of the federal securities laws.

Such forward-looking statements are based on management’s current expectations, assumptions, and beliefs concerning future developments

and their potential effect on our business, and are subject to risks and uncertainties that could negatively affect our business, operating

results, financial condition, and stock price. We have attempted to identify forward-looking statements by terminology including “anticipates,”

“believes,” “can,” “continue,” “could,” “estimates,” “expects,”

“intends,” “may,” “plans,” “potential,” “predicts,” “should,”

“will,” “would”, “if, “shall”, “might”, “will likely result, “projects”,

“goal”, “objective”, or “continues”, or the negative of these terms or other comparable terminology,

although the absence of these words does not necessarily mean that a statement is not forward-looking. Additionally, statements concerning

future matters such as our business strategy, development of new products, sales levels, expense levels, cash flows, future commercial

and financing matters, future partnering opportunities and other statements regarding matters that are not historical are forward-looking

statements.

Although

the forward-looking statements in this Annual Report reflect our good faith judgment, based on currently available information, they

involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance,

or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied

by these forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions,

including those described in the section titled “Risk Factors.” It is not possible for our management to predict all risks,

nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual

results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties

and assumptions, the forward-looking events and circumstances discussed in this Annual Report may not occur and actual results could

differ materially and adversely from those anticipated or implied in the forward-looking statements. You should not rely upon forward-looking

statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the

forward-looking statements will be achieved or occur. Moreover, except as required by law, neither we nor any other person assumes responsibility

for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update publicly any forward-looking

statements for any reason after the date of this Annual Report to conform these statements to actual results or to changes in our expectations.

You should, however, review the factors and risks we describe in the reports we will file from time to time with the SEC after the date

we file this Annual Report. Readers are urged to carefully review and consider the various disclosures made in this Annual Report.

CERTAIN

REFERENCES AND NAMES OF OTHERS USED HEREIN

This

Annual Report may contain additional trade names, trademarks, and service marks of others, which are the property of their respective

owners. We do not intend our use or display of other companies’ trade names, trademarks, or service marks to imply a relationship

with, or endorsement or sponsorship of us by, these other companies.

PART

I

ITEM

1. BUSINESS

The

Company was incorporated in the Commonwealth of Virginia on July 13, 1993, and was a closed-end investment company licensed by the Small

Business Administration (the “SBA”) as a Small Business Investment Company (“SBIC”). The Company previously made

equity investments in and provided loans to small businesses to finance their growth, expansion, and development. Under applicable SBA

regulations, the Company was restricted to investing only in qualified small businesses as contemplated by the Small Business Investment

Act of 1958. As a registered investment company under the Act, the Company’s investment objective was to provide its shareholders

with a high level of income, with capital appreciation as a secondary objective. The Company made its first investment in a small business

in October 1996.

On

March 30, 2010, the SBA notified the Company that its account had been transferred to liquidation status and that the outstanding debentures

of $16.1 million-plus accrued interest (the “Debentures”) were due and payable within fifteen days of the date of the letter.

The Company did not possess adequate liquid assets to make this payment. The Company negotiated terms of a settlement agreement with

the SBA effective September 1, 2010. The Debentures were repurchased by the SBA in September 2010, represented by a Note Agreement between

the SBA and the Company. The Note Agreement had a maturity of March 31, 2013. In the event of a default, the SBA had the ability to seek

receivership.

On

May 24, 2012, the SBA delivered to the Company a notice of an event of default for failure to meet the principal repayment schedule under

the Note Agreement (the “Notice”). Under the terms of the Notice and the Note Agreement, the SBA maintained a continuing

right to terminate the Note Agreement and appoint a receiver to manage the Company’s assets.

On

November 20, 2013, the SBA filed a complaint in the United States District Court for the Eastern District of Virginia (the “District

Court”) seeking, among other things, receivership for the Company and judgment in the amount outstanding under the Note Agreement

plus continuing interest. The complaint alleged that as of October 31, 2013, there remained an outstanding balance of $11,762,634.58

under the Note Agreement, including interest, which continued to accrue at the rate of $2,021.93 per day. In filing the complaint, the

SBA requested that the District Court take exclusive jurisdiction of the Company and all of its assets wherever located and appoint the

SBA as permanent receiver of the Company to liquidate all of the Company’s assets and satisfy the claims of its creditors in the

order of priority as determined by the District Court.

On

May 28, 2014, the District Court entered a Consent Order and Judgment Dismissing Counterclaim, Appointing Receiver, Granting Permanent

Injunctive Relief and Granting Money Judgment (the “Order”). The Order appointed the SBA as receiver of the Company,

and the SBA designated Charles Fulford as its principal agent to act on its behalf as the receiver (the “Receiver”). The

Order authorized the Receiver to marshal and liquidate all of the Company’s assets in an orderly manner. The Order also served

to enter judgment in favor of the United States of America, on behalf of the SBA, against the Company for $11,770,722. Such amount represented

$11,700,000 in principal and $70,722 in accrued interest. The District Court assumed jurisdiction over the Company, and the SBA was appointed

Receiver effective May 28, 2014.

The

Company effectively stopped conducting an active business upon the appointment of the SBA as Receiver and the commencement of the receivership

ordered by the District Court (the “Receivership”). Over the course of the Receivership, the activity of the Company

was limited to the liquidation of the Company’s assets by the Receiver and the payment of the proceeds therefrom to the SBA and

for the expenses of the Receivership.

The

SBIC license granted to the Company by the SBA was revoked by the SBA effective March 20, 2017, in conjunction with the entry by the

District Court of the Order Approving the Procedures for Winding Up and Terminating the Receivership Estate. On June 28, 2017, the Receivership

was terminated pursuant to the entry of a Final Order by the District Court, further discharged all claims and obligations of the Company

other than the judgment held by SBA (the “Final Order”). Prior to the Final Order, the Receiver provided notice to

all shareholders of the Company. The Receiver also initiated separate contact with the largest shareholders of the Company in an attempt

to identify a shareholder willing to assume responsibility for the control of the Company on behalf of the Company’s shareholders.

Roran Capital, LLC (“Roran”), was the only shareholder willing to assume such control. As such, at the direction of the Receiver,

paragraph 4 of the Final Order specifically stated that “Control of Waterside shall be unconditionally transferred and returned

to its shareholders c/o Roran Capital, LLC (“Roran”) upon notification of entry of this Order”. At that time Roran

owned 510,000 shares of the Company which represented 2.7% of the issued and outstanding common stock at that time (and owns 42,476,660

shares currently which represents 64.05% of the issued and outstanding shares of the Company at this time). 99% of the equity interests

in Roran were at the time, and remain, beneficially owned by Yitzhak Zelmanovitch. At the time of the Final Order, the Company had no

assets, and a sole remaining liability owed to the SBA in an amount exceeding $10,000,000.

Upon

termination of the Receivership, Roran took possession of all books and records made available to it by the Receiver. The termination

of the Receivership, and the termination of the power and authority of the Receiver, left the Company with no Board of Directors and

no officers. It was impossible to convene a shareholders meeting as there were no corporate officers or directors to provide (i) notice,

or (ii) the administrative oversight required for such a meeting. Roran, in reliance on and in compliance with the Final Order, sought

to appoint a new board of directors (the “New Board”). Without a New Board, the Company would be unable to operate

as a viable business, and appointment by Roran was the only manner in which the New Board could be constituted.

Roran

expended a good faith effort to seek out qualified third parties to serve on the New Board. Because of the liability exposure inherent

in serving on the board of a public company, the Company’s lack of financial resources, and the Company’s loss of its SBIC

license, Roran was unable to locate any qualified individuals to serve on the New Board and thus appointed Zindel Zelmanovitch, the father

of Yitzhak Zelmanovitch, as the sole director and officer of the Company. Zindel is an experienced business person who has previously

served as the CEO and director of a public company; thus, although related to the 99% owner of Roran, he has objectively acceptable qualifications

to serve in this dual position. Zindel Zelmanovitch has never owned any shares of stock of the Company and has not been compensated for

any of his services as a director or officer of the Company to date.

In

his capacity as the sole director and officer of the Company, Zindel Zelmanovitch considered a variety of options for the Company, including

bankruptcy and liquidation, neither of which would have yielded any economic benefit for the Company’s shareholders. Thus, Zindel

Zelmanovitch negotiated with Roran to provide a loan or loans to fund reasonable expenses of the Company, on arm’s length terms,

so long as progress was being made to reorganize the Company and to identify either (i) a new business to enter into; or, (ii) an active

business with which to merge or otherwise acquire, which would benefit from operating as a public entity. The New Board (Zindel Zelmanovitch)

has continued to work toward achieving that goal. With no assets and no SBIC license from the SBA, no income, and liabilities in excess

of $10,000,000 (which has now been forgiven in full, as stated below), the New Board (Zindel Zelmanovitch) concluded that continuing

to operate as a registered investment company was impossible; furthermore, the consistent feedback from third parties with which the

New Board has sought to consummate a transaction to commence a new business or acquire or merge a new business into the Company has been

that until the Company’s Application Pursuant to Section 8(f) of the Investment Company Act of 1940 for an order declaring that

the Company has ceased to be an Investment Company is approved, no such transaction was feasible. On April 22, 2020, the SEC issued an

order declaring that the Company had ceased to be an investment company.

Since

the entry of the Final Order (June 28, 2017) and the termination of the Receivership, the Company has been maintained for the benefit

of its shareholders and pursuant to, and in compliance with, the Final Order. The Company has no assets, and the Company no longer has

the SBIC license from the SBA. The Company is no longer operating as a registered investment company under the Investment Company Act.

While it would have been possible for the Company to merely dissolve, the Company has instead decided to endeavor to reconstitute itself

as a viable business. The Company has engaged and intends to continue to engage, qualified professionals and personnel to bring the Company

current in its SEC filings and audits. The Company filed a Form 10-K for the period ending June 30, 2017 and has subsequently timely

filed all periodic reports on Forms 10-Q and Forms 10-K.

The

Company’s outstanding judgment payable owed to the SBA was purchased by Roran from the SBA in July 2017. As such, all amounts due

under the outstanding judgment payable were owed to Roran rather than the SBA. Upon purchase, the Company began to accrue interest that

was due under the original terms of the judgment payable. The statutory interest rate was 0.094%. The Company accrued $163,991 in interest

on the judgment payable as of March 31, 2019. On May 16, 2019, Roran forgave the entire principal amount and interest due thereon of

$10,609,635.

On

September 19, 2017, the Company issued a Convertible Promissory Note in an amount up to $150,000 in favor of Roran which was increased

to $200,000 on June 17, 2019 and $250,000 on December 13, 2019 (the “Note”), and as of June 30, 2021, $149,838 has

been drawn by the Company under the Note (exclusive of accrued interest). The Note was issued pursuant to a Convertible Loan Agreement

with Roran (the “Loan Agreement”). All outstanding principal and accrued interest on the Note is due and payable on

the maturity date, which was March 19, 2019 and then extended to September 19, 2019 and then June 19, 2020. Roran has agreed to extend

the loan and advance additional funds until further negotiations regarding the loan have concluded. Amounts borrowed under the Note bear

interest at 12% per annum. Roran has the right to convert all or any portion of the Note into shares of the Company’s common stock

at a conversion price equal to 60% of the 20 day trailing lowest share price. The use of proceeds of this loan has been and continues

to be the payment by the Company of its reasonable operational expenses payable to third-party service providers (consisting solely of

third party expenses such as legal, accounting, transfer agent and edgarization costs, all at the actual cost for such services). The

loan is not a senior or a secured instrument.

On

June 8, 2020, Roran converted $124,500 principal amount of its promissory note with the Company and $25,500 of accrued and unpaid interest

thereon, totaling $150,000, into 41,666,660 shares of Company Common Stock at the stated conversion price per share of $0.0036. The remaining

balance due on the promissory note, as of the conversion date, was $104,838 in principal and $19,988 in interest.

On

September 2, 2021, the Company entered into a Stock Purchase Agreement (the “SPA”) by and between (i) the Company (ii) Ryan

Schadel (“Buyer”) and (iii) Roran. Roran agreed to sell to the Buyer 42,476,660 shares of common stock of the Company held

by Roran for a total purchase price of $385,000. In conjunction with the SPA, Roran agreed to forgive all amounts due to Roran by the

Company totaling $207,644, which is comprised of convertible note payable – related party, accrued interest payable – related

party, and advances from related party. The Buyer acquired 42,476,660 shares of the Company’s Common Stock, representing 69.7%

of the issued and outstanding shares of Common Stock. As such, the SPA resulted in a change of control of the Company.

Effective

November 29, 2021, the Company converted from a Virginia corporation to a Nevada corporation.

On

December 15, 2021, the Company filed with the Nevada Secretary of State amended and restated articles of incorporation. The amended and

restated articles had the effect of (i) increasing the Company’s authorized common stock to 100 million shares, (ii) increasing

the Company’s authorized preferred stock to 20 million shares, and (iii) reducing the par value of each of the Company’s

common stock and preferred stock to $0.0001 per share. Common stock and additional paid-in capital for all periods presented in these

financial statements have been adjusted retroactively to reflect the reduction in par value.

On

December 17, 2021, the majority shareholder and board of directors approved an amendment to the amended and restated articles of incorporation

that would change the Company’s name from Waterside Capital Corporation to Metavesco, Inc. The name change was cleared by Financial

Industry Regulatory Authority (“FINRA”) and was effective June 3, 2022.

In

March 2022, the Company commenced operations as a web3 enterprise. The Company generates income as a liquidity provider, via decentralized

exchanges such as Uniswap. Additionally, the Company farms tokens via Proof of Stake protocols on decentralized exchanges as well as

centralized exchanges including Coinbase exchange. The Company also invests in promising NFT projects and virtual land, primarily on

EVM protocols.

On

June 12, 2023, the Company entered into a Limited Liability Company Interest Purchase Agreement (the “Purchase Agreement”)

with Eddy Rodrigeuz (the “Seller”). The Seller is the sole owner of Boring Brew LLC (“Boring”) and Bored Coffee

Lab, LLC (“Bored”). Under the terms of the Purchase Agreement, the Seller sold to the Company, all of the outstanding limited

liability company interests in Boring and Bored. The Company paid the Seller total consideration with a fair value of $249,245, paid

as follows: (i) $9,245 in cash and (ii) 5,000,000 shares of the Company’s common stock at a fair value of $240,000 ($0.048 per

share based on the closing price of the Company common stock on June 12, 2023).

The

Company is currently authorized to issue twenty million (20,000,000) shares of preferred stock, with a par value of $0.0001 per share.

There are twenty two (22) shares of Series A Convertible Preferred Stock issued. The Company is also authorized to issue one hundred

million (100,000,000) shares of common stock, with a par value of $0.0001 per share. As of June 30, 2023, and currently, 66,322,140 shares

of common stock of the Company were outstanding. These shares are quoted over the counter with Pink OTC Markets Inc. under the ticker

symbol “MVCO” and are held by 25 shareholders of record as of September 30, 2023. The Company does not have any other equity

securities outstanding.

Current

Business Strategy and Operations

On

April 22, 2020, the SEC issued an order declaring that the Company had ceased to be an investment company. The Company’s common stock continues to be quoted on the Pink OTC Markets for the benefit of its shareholders.

Our

Business

On

September 2, 2021, the Company entered into a Stock Purchase Agreement (the “SPA”) by and between (i) the Company (ii) Ryan

Schadel (“Buyer”) and (iii) Roran Capital, LLC (“Roran”). Roran agreed to sell to the Buyer 42,476,660 shares

of common stock of the Company held by Roran for a total purchase price of $385,000. In conjunction with the SPA, Roran agreed to forgive

all amounts due to Roran by the Company totaling $207,644 which is comprised of convertible note payable – related party, accrued

interest payable – related party and advances from related party. The Buyer acquired 42,476,660 shares of the Company’s Common

Stock, representing 69.7% of the issued and outstanding shares of Common Stock. As such, the Schadel SPA resulted in a change of control

of the Company.

In

March 2022, the Company commenced operations as a web3 enterprise. The Company generates income as a liquidity provider, via decentralized

exchanges such as Uniswap. Additionally, the Company farms tokens via Proof-of-Stake (“PoS”) protocols on decentralized exchanges,

as well as centralized exchanges, including Coinbase. The Company also invests in non-fungible token (“NFT”) projects and

virtual land that it believes are promising, primarily on EVM protocols.

The

Company has three areas of focus:

| ● |

Liquidity

Provider - In decentralized finance (DeFi), the ability to trade assets from one to another is facilitated by Liquidity Pools (“LPs”)

which generally contain a 50/50 balance between both underlying tokens. The Company expects to invest substantially in LPs to generate

ongoing revenue. We expect that this revenue will fuel our other initiatives as we build the Company. |

| |

|

| ● |

Staking

- Like LPs, staking can provide potential passive revenue to the Company. Purchasing large blocks of lucrative PoS assets to grow

the passive income portfolio is expected to be a major cornerstone to our success. This is a much greener approach to the traditional

Proof of Work model, which is used by Bitcoin and Ethereum. Ethereum 2.0 is expected to be on PoS in the near future and our goal

is to eventually become a validator on the network. |

| |

|

| ● |

NFTs

- The Company holds NFTs for capital appreciation and for potential income from IP licensing. |

On

August 29, 2022, the Company announced its plan to begin Bitcoin mining operations. Bitcoin mining has been part of the Company roadmap

since entering the web3 space in March of 2022, although our plans have been accelerated with the recent decrease in the price of Bitcoin.

Mining equipment has become much more affordable as overleveraged miners are forced to sell equipment at reduced prices.

In

February 2023, the Company commenced bitcoin mining operations at a hosted facility in Texas.

On

June 12, 2023, the Company entered into a Limited Liability Company Interest Purchase Agreement the (“Purchase Agreement”)

with Eddy Rodrigeuz (the “Seller”). The Seller is the sole owner of Boring Brew LLC (“Boring”) and Bored Coffee

Lab, LLC (“Bored”) and collectively known a Boring Brew. Under the terms of the Purchase Agreement, the Seller sold to the

Company, all of the outstanding limited liability company interests in Boring and Bored for a total purchase price of $9,245 in cash

and 5,000,000 shares of common stock of the Company. Boring Brew, a web3 startup known for its unique and limited edition coffee bags.

Boring Brew partners with influential NFT holders to transform their intellectual property into an exquisite collection of specialty

coffee.

Government

Regulations

The

Company is no longer a registered investment company.

The

Company’s common stock is a “penny stock,” as defined in Rule 3a51-1 under the Exchange Act. The penny stock rules

require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk

disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer

also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its

salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s

account. In addition, the penny stock rules require that the broker-dealer, not otherwise exempt from such rules, must make a special

written determination that the penny stock is suitable for the purchaser and receive the purchaser’s written agreement to the transaction.

These disclosure rules have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject

to the penny stock rules. So long as the Company’s common stock is subject to the penny stock rules, it may be more difficult to

sell our common stock.

Patents,

Trademarks, Franchises, Royalty Agreements or Labor Contracts

We

have no current plans for any registrations such as patents, trademarks, copyrights, franchises, concessions, royalty agreements, or

labor contracts. We will assess the need for any copyright, trademark, or patent applications on an ongoing basis.

Competition

Our

current and future competition includes other digital assets focused companies, such as Coinshares International Limited and private

operators that are in the same business as us.

Many

of our current and potential competitors have greater resources and longer histories, and greater brand recognition. They may devote

more resources to technology, infrastructure, marketing and may be able to more rapidly develop their solutions. Other companies also

may enter into business combinations or alliances that strengthen their competitive positions. Our small team and relative lack of capital

is a competitive disadvantage.

Employees

The

Company currently has one employee, the sole officer and director of the Company. We generally work remotely and we anticipate as we

hire additional staff they will also work remotely.

Available

Information

The

Company expects to continue to file annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, proxy

statements and other information with the SEC. Any materials filed by the Company with the SEC may be read and copied at the SEC’s

Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the SEC’s Public Reference Room

is available by calling the SEC at 1-800-SEC-0330. The SEC maintains a website that contains annual, quarterly and current reports, proxy

statements and other information that issuers (including the Company) file electronically with the SEC. The Internet address of the SEC’s

website is http://www.sec.gov. At some point in the future, we intend to make our reports, amendments thereto, and

other information available, free of charge, on a website for the Company. Our website can be found at www.metavesco.com.

Our

corporate offices are located at 410 Peachtree Pkwy, Suite 4245, Cummings, GA 30041. Our telephone number is 678-241-5898.

ITEM

1A RISK FACTORS

You

should carefully consider the risks described below, together with the other information set forth in this report, which could materially

affect our business, financial condition, and future results. The risks described below are not the only risks facing our Company. Risks

and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business,

financial condition, and operating results.

Risks

Related to Our Business

Our

holdings are controlled by one shareholder which owns approximately 70% of our issued and outstanding stock.

70%

of our issued and outstanding common stock is controlled by Mr. Schadel, our sole officer and director. As a result, Mr. Schadel can

direct the affairs of the Company as the majority shareholder and there is no assurance that any decisions made through a shareholder

vote will be the same decisions that one or more minority shareholders would make.

The

Company has a limited operating history.

The

Company has a limited history of operations and is in the early stage of development. As such, the Company will be subject to many risks

common to such enterprises, including undercapitalization, cash shortages, limitations with respect to personnel, financial and other

resources and lack of revenues. There is no assurance that the Company will be successful in achieving a return on shareholders’

investment and the likelihood of success must be considered in light of its early stage of operations. There can be no assurance that

the Company will be able to develop any of its projects profitably or that any of its activities will generate positive cash flow.

The

Company’s compliance and risk management programs may not be effective.

The

Company’s ability to comply with applicable laws and rules will be largely dependent on the establishment and maintenance of compliance,

review and reporting systems, as well as the ability to attract and retain qualified compliance and other risk management personnel.

The Company cannot provide any assurance that its compliance policies and procedures will always be effective or that the Company will

be successful in monitoring or evaluating its risks. In the case of alleged non-compliance with applicable laws or regulations, the Company

could be subject to investigations and judicial or administrative proceedings that may result in substantial penalties or civil lawsuits,

including by customers, for damages, restitution or other remedies, which could be significant. Any of these outcomes, individually or

together, may among other things, materially and adversely affect the Company’s reputation, financial condition, investment and

trading strategies, and asset value and the value of any investment in the Company’s common stock.

The

Company may require additional funds to finance its operations.

Additional

funds, raised through debt or equity offerings, may be needed to finance the Company’s future activities. There can be no assurance

that the Company will be able to obtain adequate financing in the future or that the terms of such financing will be favorable. Failure

to obtain such additional financing could cause the Company to reduce or terminate its operations.

If

additional funds are raised through further issuances of equity or securities convertible into equity, existing shareholders could suffer

significant dilution, and any new equity securities issued could have rights, preferences and privileges superior to those of holders

of the Company’s common stock. Any debt financing secured in the future could involve restrictive covenants relating to capital

raising activities and other financial and operational matters, which may make it more difficult for the Company to obtain additional

capital and to pursue business opportunities.

Market

adoption of digital assets has been limited to date and further adoption is uncertain.

Currently,

there is relatively small use of digital assets in the retail and commercial marketplace in comparison to relatively large use by speculators,

thus contributing to price volatility that could adversely affect an investment in the Company’s common stock. Digital assets have

only recently become accepted as a means of payment for goods and services by certain major retail and commercial outlets and use of

digital assets by consumers to pay such retail and commercial outlets remains limited. Conversely, a significant portion of digital asset

demand is generated by speculators and investors seeking to profit from the short- or long-term holding of tokens. A lack of expansion

by digital assets into the retail and commercial markets, or a contraction of such use, may result in increased volatility or a reduction

in the market price of these assets. Further, if fees increase for recording transactions on these blockchains, demand for digital assets

may be reduced and prevent the expansion of the networks to retail merchants and commercial businesses, resulting in a reduction in the

price of these assets.

The

value of digital assets may be subject to momentum pricing risk.

Momentum

pricing typically is associated with growth stocks and other assets whose valuation, as determined by the investing public, accounts

for anticipated future appreciation in value. Market prices of digital assets are determined primarily using data from various exchanges,

over-the-counter markets, and derivative platforms. Momentum pricing may have resulted, and may continue to result, in speculation regarding

future appreciation in the value of digital assets, inflating and making their market prices more volatile. As a result, they may be

more likely to fluctuate in value due to changing investor confidence in future appreciation (or depreciation) in their market prices,

which could adversely affect the value of the Company’s digital asset holdings and the value of the Company’s common stock.

A

decline in the adoption and use of digital assets could materially and adversely affect the performance of the Company.

Because

digital assets are a relatively new asset class and a technological innovation, they are subject to a high degree of uncertainty. As

a related but separate issue from that of the regulatory environment, the adoption, growth and longevity of any digital asset will require

growth in its usage and in the blockchain for various applications. A lack of expansion in use of digital assets and blockchain technologies

would adversely affect the financial performance of the Company. In addition, there is no assurance that any digital assets will maintain

their value over the long term. Even if growth in the use of any digital assets occurs in the near or medium term, there is no assurance

that such use will continue to grow over the long term. A lack of expansion of digital assets into the retail and commercial markets,

may result in increased volatility or a reduction in the market price of these assets. Further, if fees increase for recording transactions

on these blockchains, demand for digital assets may be reduced and prevent the expansion of the networks to retail merchants and commercial

businesses, resulting in a reduction in the price of these assets. A contraction in use of any digital asset may result in increased

volatility or a reduction in prices, which could materially and adversely affect the Company’s investment and trading strategies,

the value of its assets and the value of any investment in the Company’s common stock.

We

may invest or spend our cash in ways with which you may not agree or in ways which may not yield a significant return.

Mr.

Schadel, our sole officer and director and a significant stockholder, has considerable discretion in the use of our cash. Our cash may

be used for purposes that do not increase our operating results or market value. Until the cash is used, it may be placed in investments

that do not produce significant income or that may lose value. The failure of our management to invest or spend our cash effectively

could result in unfavorable returns and uncertainty about our prospects, each of which could cause the price of our common stock to decline.

Our

digital assets may be subject to concentration risk.

Concentration

risk is the risk of amplified losses that may occur from having a large portion of our holdings in digital assets. Digital assets returns

may be highly corelated and may also be Illiquid. Investments within the same industry, geographic region or security type tend to be

highly correlated, meaning that what happens to one investment is likely to happen to the others. Digital assets may also be difficult

to sell off quickly. Should we need quick access to cash and are heavily invested in illiquid securities, we may not be able to tap this

money in a timely or cost-efficient manner.

Risks

Related to our Operations

Cyber-attacks,

data breaches or malware may disrupt our operations and trigger significant liability for us, which could harm our operating results

and financial condition, and damage our reputation or otherwise materially harm our business.

As

a publicly traded company, we may experience cyber-attacks and other attempts to gain unauthorized access to our systems on a regular

basis. There is a risk that some or all of our cryptocurrencies could be lost or stolen as a result of one or more of these incursions.

As we increase in size, we may become a more appealing target of hackers, malware, cyber-attacks or other security threats, and, despite

our implementation of strict security measures and it is impossible to eliminate all such vulnerability. For instance, we may not be

able to ensure the adequacy of the security measures employed by third parties, such as our service providers. Efforts to limit the ability

of malicious actors to disrupt the operations of the internet or undermine our own security efforts may be costly to implement and may

not be successful. Such breaches, whether attributable to a vulnerability in our systems or otherwise, could result in claims of liability

against us, damage our reputation and materially harm our business.

We

have not to date experienced a material cyber-event; however, the occurrence of any such event in the future could subject us to liability

give rise to legal and/or regulatory action, which could damage our reputation or otherwise materially harm our business, operating results,

and financial condition.

Incorrect

or fraudulent digital assets transactions may be irreversible and we could lose access to our digital assets.

Digital

asset transactions are not, from an administrative perspective, reversible without the consent and active participation of the recipient

of the digital assets from the transaction. Because of the decentralized nature of the blockchain, once a transaction has been verified

and recorded in a block that is added to the blockchain, an incorrect transfer of a digital or a theft thereof generally will not be

reversible, and we may not have sufficient recourse to recover our losses from any such transfer or theft. It is possible that, through

computer or human error, or through theft or criminal action, our rewards or fees could be transferred in incorrect amounts or to unauthorized

third parties, or to uncontrolled accounts. Though recent high profile enforcement actions against individuals laundering stolen digital

assets have demonstrated some means of bringing malicious actors to justice for their theft, the stolen digital assets is likely to remain

unrecoverable. Furthermore, we must possess both the unique public and private keys to our digital wallets to gain access to our digital

assets and the loss of a private key required may be irreversible. Therefore, if we lose, or if a malicious actor successfully denies

us access to our private keys, we may be permanently denied access to the digital assets held in the wallet corresponding to the lost,

stolen or blocked keys. Though we have taken and continue to take reasonable steps to secure our private keys. if we were to lose access

to our private keys or otherwise experience data loss relating to our digital wallets, we could effectively lose access to and the ability

to use our digital assets. Moreover, we may be unable to secure insurance policies for our digital assets at rates or on terms acceptable

to us, if at all. To the extent that we are unable to recover our losses from such action, error or theft, such events could have a material

adverse effect on our business, results of operations and financial condition.

Our

business could be harmed by prolonged power and internet outages, shortages, or capacity constraints.

Our

operations require access to high-speed internet to be successful. If we lose internet access for a prolonged period, we may be required

to reduce our operations or cease them altogether. If this occurs, our business and results of operations may be materially and adversely

affected.

Risks

Related to Governmental Regulation and Enforcement

A

particular digital asset’s status as a “security” in any relevant jurisdiction is subject to a high degree of uncertainty,

and if we are unable to correctly characterize a digital asset, we may be subject to regulatory scrutiny, investigations, fines, sanctions,

penalties and other adverse consequences, including potentially becoming subject to the Investment Company Act of 1940 which would impose

significant regulatory burdens and compliance costs.

The

SEC and its staff have taken the position that certain digital assets fall within the definition of a “security” under the

U.S. federal securities laws. The legal test for determining whether any given digital asset is a security is a highly complex, fact-driven

analysis that evolves over time, and the outcome is difficult to predict. The SEC generally does not provide advance guidance or confirmation

on the status of any particular digital asset as a security. Furthermore, the SEC’s views in this area have evolved over time and

it is difficult to predict the direction or timing of any continuing evolution. It is also possible that a change in the governing administration

or the appointment of new SEC commissioners could substantially impact the views of the SEC and its staff. Public statements by senior

officials at the SEC indicate that the SEC does not intend to take the position that Bitcoin or Ethereum are securities (in their current

form). Bitcoin and Ethereum are the only digital assets as to which senior officials at the SEC have publicly expressed such a view.

Moreover, such statements are not official policy statements by the SEC and reflect only the speakers’ views, which are not binding

on the SEC or any other agency or court and cannot be generalized to any other digital asset. With respect to all other digital assets,

there is currently no certainty under the applicable legal test that such assets are not securities, notwithstanding the conclusions

we may draw based on our risk-based assessment regarding the likelihood that a particular digital asset could be deemed a “security”

under applicable laws. Similarly, though the SEC’s Strategic Hub for Innovation and Financial Technology published a framework

for analyzing whether any given digital asset is a security in April 2019, this framework is also not a rule, regulation or statement

of the SEC and is not binding on the SEC.

The

classification of a digital asset as a security under applicable law has wide-ranging implications for the regulatory obligations that

flow from the offer, sale, trading, and clearing of such assets. For example, a digital asset that is a security in the U.S. may generally

only be offered or sold in the U.S. pursuant to a registration statement filed with the SEC or in an offering that qualifies for an exemption

from registration. Persons that effect transactions in digital assets that are securities in the U.S. may be subject to registration

with the SEC as a “broker” or “dealer.” Platforms that bring together purchasers and sellers to trade digital

assets that are securities in the U.S. are generally subject to registration as national securities exchanges, or must qualify for an

exemption, such as by being operated by a registered broker-dealer as an alternative trading system, or ATS, in compliance with rules

for ATSs. Persons facilitating clearing and settlement of securities may be subject to registration with the SEC as a clearing agency.

Foreign jurisdictions may have similar licensing, registration, and qualification requirements.

While

we do not currently, nor do we plan to, offer, sell, trade, and clear digital assets or take custody of others digital assets as part

of any potential Staking-as-a-Service operations we may undertake, however, digital assets we stake and validate transactions for could

be deemed to be a “security” under applicable laws. Our blockchain infrastructure operations which entails securing blockchains

by processing and validating blockchain transactions (most analogous to Bitcoin mining or operating a Bitcoin mining pool) could be construed

as facilitating transactions in digital assets; as such we could be subject to legal or regulatory action in the event the SEC, a foreign

regulatory authority, or a court were to determine that a blockchain we secure is a “security” under applicable laws. Because

our platform is not registered or licensed with the SEC or foreign authorities as a broker-dealer, national securities exchange, or ATS

(or foreign equivalents), and we do not seek to register or rely on an exemption from such registration or license to secure blockchains.

Further,

if any digital asset is deemed to be a security under any U.S. federal, state, or foreign jurisdiction, or in a proceeding in a court

of law or otherwise, it may have adverse consequences for such digital asset. For instance, the networks on which such digital assets

are utilized may be required to be regulated as securities intermediaries, and subject to applicable rules, which could effectively render

the network impracticable for its existing purposes. Further, it could draw negative publicity and a decline in the general acceptance

of the digital asset. Also, such a development may make it difficult for such supported digital asset to be traded, cleared, and custodied

as compared to other digital asset that are not considered to be securities.

Regulatory

changes or actions may alter the nature of an investment in us or restrict the use of digital assets in a manner that adversely affects

our business, prospects, or operations.

As

digital assets have grown in both popularity and market size, governments around the world have reacted differently to digital assets;

certain governments have deemed them illegal, and others have allowed their use and trade without restriction, while in some jurisdictions,

such as in the U.S., subject the mining, ownership and exchange of digital assets to extensive, and in some cases overlapping, unclear

and evolving regulatory requirements. Ongoing and future regulatory actions could have a material adverse effect on our business, prospects

or operations.

Our

interactions with a blockchain may expose us to SDN or blocked persons and new legislation or regulation could adversely impact our business

or the market for cryptocurrencies.

The

Office of Financial Assets Control (“OFAC”) of the U.S. Department of Treasury requires us to comply with its sanction program

and not conduct business with persons named on its specially designated nationals (“SDN”) list. However, because of the pseudonymous

nature of blockchain transactions we may inadvertently and without our knowledge engage in transactions with persons named on OFAC’s

SDN list. Our Company’s policy prohibits any transactions with such SDN individuals, but we may not be adequately capable of determining

the ultimate identity of the individual with whom we transact with respect to selling cryptocurrency assets. Moreover, the use of cryptocurrencies,

including Bitcoin, as a potential means of avoiding federally-imposed sanctions, such as those imposed in connection with the Russian

invasion of Ukraine. For example, on March 2, 2022, a group of United States Senators sent the Secretary of the United States Treasury

Department a letter asking Secretary Yellen to investigate its ability to enforce such sanctions vis-à-vis Bitcoin, and on March

8, 2022, President Biden announced an executive order on cryptocurrencies which seeks to establish a unified federal regulatory regime

for cryptocurrencies. We are unable to predict the nature or extent of new and proposed legislation and regulation affecting the cryptocurrency

industry, or the potential impact of the use of cryptocurrencies by SDN or other blocked or sanctioned persons, which could have material

adverse effects on our business and our industry more broadly. Further, we may be subject to investigation, administrative or court proceedings,

and civil or criminal monetary fines and penalties as a result of any regulatory enforcement actions, all of which could harm our reputation

and affect the value of our common stock.

Digital

assets may be made illegal in certain jurisdictions which could adversely affect our business prospects and operations.

Although

we do not anticipate any material adverse regulations on digital assets in our jurisdictions of operation, it is possible that state

or federal regulators may seek to impose harsh restrictions or total bans on digital assets which may make it impossible for us to do

business. Further, although digital assets in general are largely unregulated in most countries (including the United States), regulators

in certain jurisdictions may undertake new or intensify existing regulatory actions in the future that could severely restrict the right

to mine, acquire, own, hold, sell, or use digital assets or to exchange it for traditional fiat currency such as the United States Dollar.

Such restrictions may adversely affect us as the large-scale use of digital assets as a means of exchange is presently confined to certain

regions globally. Such circumstances could have a material adverse effect on us, which could have a material adverse effect on our business,

prospects or operations and potentially the value of digital assets we acquire and thus harm investors.

The

Company will have to adapt to respond to evolving security risks.

As

technological change occurs, the security threats to the Company’s digital assets will likely adapt, and previously unknown threats

may emerge. The ability of the Company and Coinbase to adopt technology in response to changing security needs or trends may pose a challenge

to the safekeeping of their assets. To the extent that the Company or Coinbase is unable to identify and mitigate or stop new security

threats, The Company’s assets may be subject to theft, loss, destruction or other attack.

The

majority of the Company’s digital assets are held in Self Custody (Non-Custodial) wallets. The Company holds the majority of its

digital assets in Self Custody (Non-Custodial) wallets. These wallets are used to interact with Decentralized Exchanges and other DeFi

focused protocols. Mr. Schadel, our sole officer and director and our majority stockholder, is currently the holder of the private keys

that provide access to these wallets.

Additionally,

the Company from time to time holds assets at Coinbase, a SOC 1/ SOC 2 certified digital asset custodian. If Coinbase were to be subject

to a malicious attack or otherwise cease its operations, the Company will be at risk of losing the majority of its digital assets. There

is no assurance that Coinbase will not be subject to any such attack and there is no guarantee that Coinbase won’t cease its operations.

Banks

may not provide banking services, or may cut off banking services, to businesses that provide digital asset-related services.

A

number of companies that provide digital asset-related services have been unable to find banks that are willing to provide them with

bank accounts and banking services. Similarly, a number of such companies have had their existing bank accounts closed by their banks.

Banks may refuse to provide bank accounts and other banking services to digital asset-related companies, or companies that accept digital

assets, for a number of reasons, such as perceived compliance risks or costs. The difficulty that many businesses that provide digital

asset-related services have and may continue to have in finding banks willing to provide them with bank accounts and other banking services

may decrease the usefulness of digital assets as a payment system and harm public perception of digital assets. Similarly, the usefulness

of digital assets as a payment system and the public perception of digital assets could be damaged if banks were to close the accounts

of many or of a few key businesses providing digital asset-related services. This could decrease the market prices of digital assets,

and adversely affect the value of the Company’s digital asset holdings and the Company’s common stock.

The

Company’s business is exposed to the potential misuse of digital assets and malicious actors.

Since

the existence of digital assets, there have been attempts to use them for speculation or malicious purposes. Although lawmakers increasingly

regulate the use and applications of digital assets, and software is being developed to curtail speculative and malicious activities,

there can be no assurances that those measures will sufficiently deter those and other illicit activities in the future. Advances in

technology, such as quantum computing, could lead to a malicious actor or botnet (a voluntary or hacked collection of computers controlled

by networked software coordinating the actions of the computers) being able to alter the blockchain on which digital asset transactions