UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. __)*

MAGELLAN GOLD

CORPORATION

(Name of Issuer)

Common Stock, $0.001 par value per share

(Title of Class of Securities)

559078 100

(CUSIP Number)

John P. Ryan

6½ North 2nd Ave., Suite 201

Walla Walla, WA 99362

201-509-3797

With a copy to:

Joseph Walsh, Esq.

Troutman Pepper Hamilton Sanders LLP

875 Third Ave.

New York, New York 10022

(212) 704-6000

(Name, Address and Telephone Number of Person Authorized

to

Receive Notices and Communications)

January 3, 2023

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| 1 |

NAMES OF REPORTING PERSONS

Gold Express Mines, Inc.

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a)[_]

(b)[_] |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) OR 2(e)

[_] |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

7,959,402 (1) |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

7,959,402 (1) |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| |

|

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

7,959,402 (1) (2) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(SEE INSTRUCTIONS)

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

36.96% (32) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS

CO |

| (1) | John P. Ryan, Howard Crosby,

James Czirr and Terrence Dunne are the four directors of the Reporting Person. Any action by the Reporting Person with respect to the

shares, including voting and dispositive decisions, requires a vote of three out of the four directors of the board of directors. Under

the so-called “rule of three,” because voting and dispositive decisions are made by three out of the four directors

of the board of directors, none of the directors is deemed to be a beneficial owner of securities held by the Reporting Person. Accordingly,

none of the directors on the Reporting Person’s board of directors are deemed to have or share beneficial ownership of the shares

held by the Reporting Person. |

| | | |

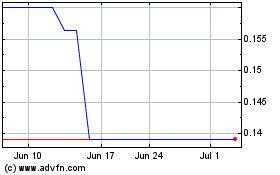

| (2) | Consists of (i) 6,250,000 shares of Common Stock and (ii) 1,709,402

shares of Common Stock issuable upon conversion of a Promissory Note at an exercise price of $0.0585, which is 90% of the $0.065, the

lowest trading price during the previous twenty (20) trading days prior to the filing of this Schedule 13D. |

| | | |

| (3) | Based on 21,536,474 shares of Common Stock outstanding on January

13, 2024. |

ITEM 1.

SECURITY AND ISSUER

This statement on Schedule 13D

(the “Schedule 13D”) relates to the common stock, par value $0.001 per share (the “Common Stock”), of Magellan

Gold Corporation, a Nevada corporation (the “Issuer”). The address of the Issuer’s

principal executive offices is 602 Cedar Street, Suite 205, Wallace, Idaho 83873.

ITEM 2.

IDENTITY AND BACKGROUND

(a)-(c)This Schedule 13D is

being filed by Gold Express Mines, Inc. (the “Reporting Person”).

The principal business of the Reporting

Person is the discovery, development and production of precious and base metal

assets and its business address is 6½ North 2nd Ave., Suite 201, Walla Walla, Washington 99362.

(d)The

Reporting Person has not, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar

misdemeanors).

(e)The

Reporting Persons has not, during the last five years, been a party to a civil proceeding of a judicial or administrative body of competent

jurisdiction where, as a result of such proceeding, it became subject to a judgment, decree or final order enjoining future violations

of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such

laws.

(f)The

Reporting Person is governed by the laws of Nevada.

ITEM 3.

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

On January 3, 2023, the Issuer

and the Reporting Person entered into a purchase agreement pursuant to which, among other things,

the Company agreed to purchase certain mineral assets owned and controlled by the Reporting Person for a purchase price equal to 5,000,000

shares of Common Stock. The transaction closed on January 5, 2023.

On March 23, 2023, the Issuer

completed a sale of 1,000,000 shares of Common Stock to the Reporting Person, for an aggregate purchase price of $140,000.

On December 29, 2023, the Issuer,

the Reporting Person and AJB Capital Investments LLC, a Delaware limited liability company (“AJB”),

entered into an assignment and assumption agreement (the “Assignment and Assumption Agreement”), pursuant to which, among

other things, AJB assigned to the Reporting Person all of AJB’s right, title, obligation, liability and interest in, to and under

that certain Promissory Note, dated February 2021 in the original principal amount of $200,000 (the “Promissory Note”) issued

by the Issuer to AJB. The aggregate principal amount of the Promissory Note outstanding is $100,000. The Promissory Note bears

interest at a rate of 10% per annum. The unpaid principal amount of the Promissory Note is convertible into shares of the Company’s

common stock during an Event of Default at the option of the holder of the Promissory Note, at a conversion price equal to the lesser

of 90% of the lowest trading price during the previous twenty (20) trading day period ending on the issuance date, or during the previous

twenty (20) trading day period ending on date of conversion of this note. Based on an estimated conversion price of $0.0585, which is

90% of $0.065, the lowest trading price during the previous twenty (20) trading days prior to the filing of this Schedule 13D, the Promissory

Note is convertible into 1,709,402 shares of Common Stock. The Promissory Note is past due and payable and an Event of Default has occurred

and is continuing.

On December 29, 2023, the

Issuer and the Reporting Person entered into an agreement (the “Agreement”), pursuant to which, among other things (i) the

Company consented to the assignment by AJB to the Reporting Person of al of AJB’s right, title, obligation, liability and interest

in, to and under the Promissory Note; (ii) the Issuer represented that it has taken all necessary corporate action to accept the resignations

of Mark Rodenbeck and Deepak Maholtra as members of the board of directors (the “Board”) of the Issuer and appoint John P.

Ryan, President, Chief Executive Officer and a director of the Reporting Person, and Howard Crosby, a director of the Reporting Person,

to the Board; (iii) the Issuer agreed that at any time prior to December 29, 2026, if the Reporting Person provides notice to the Issuer

to designate a person to serve as a member of the Board, the Issuer will use its reasonable best efforts to elect such person to the Board

as promptly as practicable following receipt of such notice; and (iv) the Issuer issued to the Reporting Person 250,000 shares of Common

Stock.

On January 7, 2024, the Issuer

and the Reporting Person entered into a purchase agreement, pursuant to which, among other things (i) the Company agreed to purchase certain

mineral assets owned and controlled by GEM for a purchase price equal to 5,500,000 shares of Common Stock; and (ii) GEM agreed to assign

to the Company a certain lease for mineral properties (the “Cuprum Lease”) for a purchase price of 500,000 shares of Common

Stock (collectively, the “Transactions”).

The Reporting Person expects

the closing of the Transactions to occur no later than January 31, 2024, subject to certain closing conditions, including, but not limited

to, (i) the Reporting Person delivering a quitclaim deed transferring the unpatented mining claims; and (ii) the Reporting Person receiving

all required consents to transfer Cuprum Lease.

The information set forth in

or incorporated by reference into Items 4, 5 and 6 of this Schedule 13D is hereby incorporated by reference in its entirety into this

Item 3.

ITEM 4.

PURPOSE OF TRANSACTION

Effective December 27, 2023,

(i) John P. Ryan, President, Chief Executive Officer and a director of the Reporting Person, was appointed Chief Financial Officer and

a Director of the Issuer, and (ii) Howard Crosby, a director of the Reporting Person, was appointed a Director of the Issuer. Because

of the foregoing, the Reporting Person may have influence over the corporate activities of the Issuer, including activities which may

relate to items described in subparagraphs (a) through (j) of Item 4 of Schedule 13D and may propose or take action in relation to the

business of the Issuer that relate to or would result in any of the transactions described in subparagraphs (a) through (j) of Item 4

of Schedule 13D, including, changes in the present

board of directors or management of the Issuer, including any plans or proposals to change the number or term of directors or to fill

any existing vacancies on the board; the business and operations of the Issuer; share repurchases by the Issuer; distributions by the

Issuer, including the amounts, makeup and timing thereof; the terms of any new issuances of an existing or new class of securities by

the Issuer; sales of assets; changes in the Issuer's charter or by-laws or instruments corresponding thereto or other actions which may

impede the acquisition of control of the Issuer by any person; and any such other matters. Any such proposals or actions by the

Reporting Person may be based on the Reporting Person’s views of its best interest, its obligations to the Issuer (to the

extent required by applicable law or agreement), and other factors in light of (i) the Issuer's financial position, future actions taken

by the Board, price levels of the Common Stock or other equity or debt securities of the Issuer and (ii) general economic, political,

or industry conditions, including conditions in the securities market, or changes in laws, rules, regulations or customs, and any other

conditions or changes thereto, in the Reporting Person’s sole determination.

The Reporting Persons may, from

time to time, purchase additional securities of the Issuer either in the open market or in privately negotiated transactions, depending

upon the Reporting Person’s evaluation of the Issuer’s business, prospects and financial condition, the market for such securities,

other opportunities available to the Reporting Person, general economic conditions, stock market conditions and other factors. Depending

upon the factors noted above, the Reporting Person may also decide to hold or dispose of all or part of their investments in securities

of the Issuer and/or enter into derivative transactions with institutional counterparties with respect to the Issuer’s securities.

The information set forth in

or incorporated by reference into Items 3, 5 and 6 of this Schedule 13D is hereby incorporated by reference in its entirety into this

Item 4.

ITEM 5.

INTEREST IN SECURITIES OF THE ISSUER

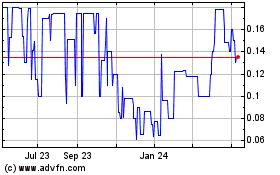

(a)-(b) As of the date of

this Schedule 13D, the aggregate number of shares of Common Stock beneficially owned by the Reporting Persons is 7,959,402, which represents

36.96% of the issued and outstanding shares of Common Stock. Of these shares of Common Stock, (i) 6,250,000 shares of Common Stock are

held by the Reporting Person and (ii) 1,709,402 shares of Common Stock are issuable upon conversion of the Promissory Note, at an exercise

price of $0.0585, which is 90% of the $0.065, the lowest trading price during the previous twenty (20) trading days prior to the filing

of this Schedule 13D.

John

P. Ryan, Howard Crosby, James Czirr and Terrence Dunne are the four directors of the Reporting Person. Any action by the Reporting Person

with respect to the shares of Common Stock, including voting and dispositive decisions, requires a vote of three out of the four directors

of the board of directors. Under the so-called “rule of three,” because voting and dispositive decisions are made

by three out of the four directors of the board of directors, none of the directors is deemed to be a beneficial owner of securities held

by the Reporting Person.

(c)Except

as set forth in Item 3 and 4 above, which descriptions are incorporated herein by reference, there

have been no transactions with respect to the shares of Common Stock during the sixty (60) days prior to the date hereof by any of the

Reporting Person.

(d)No

person is known to have the right to receive, or the power to direct the receipt of dividends from, or proceeds from the sale of, the

shares of the Common Stock beneficially owned by any of the Reporting Person, other than the Reporting Person itself.

(e)Not

applicable.

ITEM 6. CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

Not applicable.

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS

Exhibit 1 – Asset

Purchase Agreement, dated December 15, 2022, between Magellan Gold Corporation and Gold Express Mines, Inc.

Exhibit 2 – Subscription Agreement, dated March 23, 2023, between Magellan Gold Corporation and Gold Express Mines, Inc.

Exhibit 3 – Agreement, dated as of December 29, 2023, between Magellan Gold Corporation and Gold Express Mines, Inc. (incorporated

by reference to Exhibit 10.1 to Magellan Gold Corporation’s Current Report on Form 8-K filed with the Securities and Exchange Commission

on January 8, 2024)

Exhibit 4 – Assignment and Assumption Agreement, dated as of January 2, 2024, among AJB Capital Investment LLC, Gold Express Mines, Inc. and Magellan Gold Corporation

Exhibit 5 – Purchase Agreement, dated January 7, 2024, between Magellan Gold Corporation and Gold Express Mines, Inc. (incorporated by reference to Exhibit 10.1 to Magellan

Gold Corporation’s Current Report on Form 8-K filed with the Securities and Exchange Commission on January 11, 2024).

Exhibit 6 – Promissory Note of Magellan Gold Corporation dated February 2021.

Exhibit 7 – Modification of Promissory Note, dated February 9, 2022.

Exhibit 8 – Modification of Promissory Note, dated May 11, 2022.

Exhibit 9 – Modification of Promissory Note, dated August 9, 2022.

Exhibit 10 –

Modification of Promissory Note, dated January 11, 2023.

Exhibit 11 – Modification of Promissory Note, dated August 9, 2023.

SIGNATURE

After reasonable inquiry and

to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: January 16, 2024

GOLD EXPRESS MINES, INC.

By: _/s/ John P. Ryan____________________________

Name: John P. Ryan

Title: Chief Executive Officer

ATTENTION: INTENTIONAL MISSTATEMENTS OR OMISSIONS OF FACT CONSTITUTE

FEDERAL CRIMINAL VIOLATIONS (See 18 U.S.C. 1001).

Exhibit 1

Asset Purchase Agreement

THIS AGREEMENT is made on January 3, 2023 between Gold Express

Mines, Inc., with its principal place of business at 6 1/2 N. 2nd Ave. Suite 201, Walla Walla, Washington,

99362 hereinafter the "Seller", and Magellan Gold Corporation ("Buyer") with its principal place of business at 602

Cedar St., Ste. 205 Wallace, Idaho 83873

IN CONSIDERATION of the mutual covenants and agreements

hereinafter set forth, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the

parties agree as follows:

1. Purchase of Assets.

A) Mineral Projects: Seller shall sell to Buyer

and Buyer shall purchase from Seller, on the terms and conditions set forth in this Agreement, the mineral properties listed in Appendix

A attached herein.

All of the assets listed in the Appendix A shall be

referred to herein as the "Purchased Assets".

2. Purchase Price and Reimbursements

The purchase price for the assets shall be 5,000,000 (five million)

shares of the common stock of the Buyer.

3. Shares Valuation.

The shares issued in this transaction shall be valued at $0.20 per

share based upon recent market quotes on the common stock of the Buyer.

4. Closing and Escrow.

a.

The Closing date shall be January 5, 2023, provided there are no unforeseen delays. Closing shall not be later than 10 calendar

days after the designated closing date unless a further extension is agreed upon in writing between the Buyer and Seller.

b.

Within thirty days of the closing date all of the purchased claims shall be transferred to the Buyer by quitclaim deed and an assignment

of the "Big-It" mineral lease shall have been completed.

d.Buyer shall issue

to the Seller 5,000,000 shares of the common stock of Buyer valued at $1,000,000 in the form of a physical stock certificate. The Buyer

may hold the physical certificate until all of the claims and the mineral lease have been successfully transferred by the Seller to the

Buyer.

5. Representations of Seller.

Seller covenants and represents:

a.That Seller

is the sole Owner of the Purchased Assets with full right to sell or dispose of it as Seller may choose. Seller has the right to assign

the Big-It lease to the Buyer.

b.

That Seller has no undischarged obligations affecting the Purchased Assets being sold under this Agreement.

c.

That there are presently and will be at the time of closing, no liens or security interests against the Purchased Assets being

transferred herein, and all claim fees shall have been paid to date and all lease payments shall be current and paid to date.

d.

Consents. A majority of the Board of Directors of the Seller have approved this agreement.

h.

Licenses. Permits and Consents. There are no licenses or permits currently required by the Seller for the satisfaction of the sale

of Assets or execution of this Agreement.

i.

Litigation. There are no actions, suits, proceedings, or investigations pending or, to the knowledge of the Seller, threatened

against or involving Seller or brought by Seller or affecting any of the purchased property at law or in equity or admiralty or before

or by any federal, state, municipal, or other governmental department, commission, board, agency, or instrumentality, domestic or foreign.

j.

Compliance with Laws. To the best of its knowledge, Seller has complied with and is operating its business in compliance with all

laws, regulations, and orders applicable to the business conducted by it, and the present uses by the Seller of the purchased property

do not violate any such laws, regulations, and orders. Seller has no knowledge of any material present or future expenditures that will

be required with respect to any of Seller's facilities to achieve compliance with any present statute, law, or regulation, including those

relating to the environment or occupational health and safety.

k.

Disclosure. No representation or warranty by the Seller contained in this Agreement, and no statement contained in any certificate

or other instrument furnished or to be furnished to Buyer pursuant hereto, or in connection with the transactions contemplated hereby,

contains or will contain any untrue statement of a material fact or omits or will omit to state any material fact that is necessary in

order to make the statements contained therein not misleading.

m.Environmental. To

the best of the knowledge of the Seller there presently is not, nor ever has been, any dumping or storage of toxic or hazardous wastes

on the premises of the Purchased Assets. Seller is not aware nor has Seller been notified by any private parties or government agencies

of any environmental or reclamation requirements or responsibilities with respect to the properties or any liabilities with respect to

Superfund laws.

6. Representations of Buyer.

The Buyer covenants and represents to the Seller as follows:

| a. | The shares to be issued to the Seller to be delivered at the closing date are validly issued and properly

approved by the Board of Directors of the Buyer and issued pursuant to a validly existing exemption from registration. |

| b. | The transaction contemplated by this agreement has been approved by a majority of the Members of the

Board of Directors of the Buyer. |

7. Appendices.

The Appendices

and other documents attached or referred to in this Agreement are an integral part of this Agreement.

8. Entire Agreement.

This Agreement constitutes the sole and only agreement between

Buyer and Seller respecting the Business or the sale and purchase of it. This Agreement correctly sets forth the obligations of Buyer

and Seller to each other as of its date. Any additional agreements or representations respecting the Business or its sale to Buyer not

expressly set forth in this Agreement are null and void, unless otherwise required by law. Both parties agree to waive rights as to any

conflicting laws which may nullify this Agreement to the full extent allowable by law.

9. Conditions Precedent of Buyer.

The obligations

of the Buyer hereunder are subject to the conditions that on or prior to the closing date:

a.

Representations and Warranties True at Closing. The representations and warranties of the Seller contained in the Agreement or

any certificate or document delivered pursuant to the provisions hereof or in connection with the transactions contemplated hereby shall

be true on and as of the closing date as though such representations and warranties were made at and as of such date, except if such representations

and warranties were made as of a specified date and such representations and warranties shall be true as of such date.

b.

Seller's Compliance with Agreement. The Seller shall have performed and complied with all agreements and conditions required

by this Agreement to be performed or complied with by it prior to or at the closing of the Agreement.

c.

Adverse Change. There shall have been between the purchase date and the closing date no material adverse change in the purchased

assets.

10. Arbitration.

In the event the parties are not able to resolve any dispute

between them arising out of or concerning this Agreement, or any provisions hereof, whether in contract, tort, or otherwise at law or

in equity for damages or any other relief, then such dispute shall be resolved only by final and binding arbitration pursuant to the Federal

Arbitration Act and in accordance with the American Arbitration Association rules then in effect, conducted by a single neutral arbitrator

and administered by the American Arbitration Association in a location mutually agreed upon by the parties. The arbitrator's award shall

be final, and judgment may be entered upon it in any court having jurisdiction. In the event that any legal or equitable action, proceeding

or arbitration arises out of or concerns this Agreement, the prevailing party shall be entitled to recover its costs and reasonable attorney's

fees. The parties agree to arbitrate all disputes and claims in regards to this Agreement or any disputes arising as a result of this

Agreement, whether directly or indirectly, including Tort claims that are a result of this Agreement. The parties agree that the Federal

Arbitration Act governs the interpretation and enforcement of this provision. The entire dispute, including the scope and enforceability

of this arbitration provision shall be determined by the Arbitrator. This arbitration provision shall survive the termination of this

Agreement.

11. Costs and Expenses.

Except as expressly provided to the contrary in this Agreement,

each party shall pay all of its own costs and expenses incurred with respect to the negotiation, execution and delivery of this Agreement

and the exhibits hereto.

12. Miscellaneous Provisions.

a.

Applicable Law and

Forum. This Agreement shall be construed under and in accordance with the laws of the State of Idaho. Both parties agree that the jurisdiction

of any disputes between the parties shall be resolved in the courts of the State of Idaho, and that any arbitration between the parties

shall be undertaken as indicated in paragraph 10 above.

b.

Parties Bound. This Agreement shall be binding on and inure to the benefit of the parties to this Agreement and their respective

heirs, executors, administrators, legal representatives, successors and assigns as permitted by this Agreement.

c.

Legal Construction. This Agreement shall be construed as to effectuate the intended purpose of the Agreement. In the event any

one or more of the provisions contained in this Agreement shall for any reason be held invalid, illegal, or unenforceable in any respect,

this Agreement shall be modified to otherwise effectuate the sale under the original intentions of the Parties. This may include striking

the invalid, illegal, or unenforceable provision as if they had never been contained in this Agreement, or modifying the invalid, illegal

or unenforceable provisions to make them compliant without modifying the original purpose of the Parties.

d.

Amendments. This Agreement may be amended by the Parties only by a written agreement.

e.

Attorneys' Fees. Should any arbitration or litigation be commenced between the parties to this Agreement concerning the rights

and duties of either party in relation to the Business or this Agreement, the prevailing party in the arbitration or litigation shall

be entitled to (in addition to any other relief that may be granted) a reasonable sum and attorneys' fees in the arbitration or litigation,

which sum shall be determined by the court or other person presiding in the arbitration or litigation or in a separate action brought

for that purpose.

f.

Board Seat. The Seller shall be granted the right to nominate one board member to the Board of Directors of the Buyer for a period

of four years. The four-year period shall run from the date of the nomination of Directors for the next annual meeting of the Buyer in

2023 continuing to the date of the nomination of Directors for the annual meeting of the Buyer in 2026.

f.Signatories.

This Agreement shall be executed on behalf of Magellan Gold Corporation by Mike Lavigne and on behalf of Gold Express Mines, Inc. by John

Ryan.

The Agreement shall be effective as of the date first written

above.

Seller:

Gold Express Mines, Inc.

Buyer:

Magellan Gold Corporation

INERAL PROJECTS

("Purchased Assets")

| 1) | GOLDEN, IDAHO PROJECT — located in Idaho County, Idaho and consisting

of seventy-two unpatented mining claims. |

| 2) | SEAFOAM DISTRICT - located in Custer County, Idaho and consisting of five unpatented mining claims. |

| 3) | BLACKTAIL DISTRICT — located in Lemhi County, Idaho and consisting of eight unpatented

mining claims. |

| 4) | BIG-IT PROJECT — located in Shoshone County, Idaho consisting of twenty-five unpatented mining claims and a mineral lease

over three unpatented mining claims and 94.86 acres of real property. |

| 5) | TERROR GULCH (CAPPARELLI GROUP) located in Shoshone County, Idaho consisting

of twelve unpatented mining claims. |

DETAILED LIST OF CLAIMS AND/OR

MINERAL LEASES OF EACH

PROJECT

GOLDEN PROJECT - 72 CLAIMS TOTAL

ICM 1-13, 20-37 2

| CLAIM NAME |

BLM SERIAL # |

| ICM 1 |

ID101958937 |

| ICM 2 |

ID101958938 |

| ICM 3 |

ID101958939 |

| ICM 4 |

ID101958940 |

| ICM 5 |

ID101958941 |

| ICM 6 |

ID101958942 |

| ICM 7 |

ID101958943 |

| ICM 8 |

ID101958944 |

| ICM 9 |

ID101958945 |

| ICM 10 |

ID101958946 |

| ICM 11 |

ID101958947 |

| ICM 12 |

ID 105278070 |

| ICM 13 |

ID105278071 |

| ICM 20 |

ID 105278072 |

| ICM 21 |

ID105278073 |

| ICM 22 |

ID 105278074 |

| ICM 23 |

ID 105278075 |

| ICM 24 |

ID 105278076 |

| ICM 25 |

ID 105278077 |

| ICM 26 |

ID105278078 |

| ICM 27 |

ID 105278079 |

| ICM 28 |

ID105278080 |

| ICM 29 |

ID105278081 |

| ICM 30 |

ID 105278082 |

| ICM 31 |

ID105278083 |

| ICM 32 |

ID 105278084 |

| ICM 33 |

ID105278085 |

| ICM 34 |

ID105278086 |

| ICM 35 |

ID 105278087 |

| ICM 36 |

ID105278088 |

| ICM 37 |

ID105278089 |

(GOLDEN PROJECT, Cont'd)

IL 1-13, 15, 17, 19, 21, 23, 27-31 (23)

| CLAIM NAME |

BLM SERIAL # |

| IL 1 |

ID101830376 |

| IL 2 |

ID101830377 |

| IL 3 |

ID101830378 |

| IL 4 |

ID101830379 |

| IL 5 |

ID101830380 |

| IL 6 |

ID101830381 |

| IL 7 |

ID101830382 |

| IL 8 |

ID101830383 |

| IL 9 |

ID101830384 |

| IL 10 |

ID101830385 |

| IL 11 |

ID101830386 |

| IL 12 |

ID101830387 |

| IL 13 |

ID101830388 |

| IL 15 |

ID101830389 |

| IL 17 |

ID101830390 |

| IL 19 |

ID101830391 |

| IL 21 |

ID101578180 |

| IL 23 |

ID101578181 |

| IL 27 |

ID101578182 |

| IL 28 |

ID101578183 |

| IL 29 |

ID101578184 |

| IL 30 |

ID101578185 |

| IL 31 |

ID101578180 |

HM 1-6 (6)

| CLAIM NAME |

BLM SERIAL # |

| HM1 |

ID101578181 |

| HM2 |

ID101578182 |

| HM3 |

ID101578183 |

| HM4 |

ID101578184 |

| HM5 |

ID101578185 |

| HM6 |

ID101578180 |

(GOLDEN PROJECT, Cont'd)

PM 1-12 (12

| CLAIM NAME |

BLM SERIAL # |

| PM1 |

ID101922038 |

| PM2 |

ID101922039 |

| PM3 |

ID 101922040 |

| PM4 |

ID101922041 |

| PM5 |

ID 101922042 |

| PM6 |

ID 101922043 |

| PM7 |

ID 101922044 |

| PM8 |

ID 101922045 |

| PM9 |

ID 101922046 |

| PM10 |

ID 101922047 |

| PM11 |

ID 101922048 |

| PM12 |

ID 101922049 |

GA 1-2 (2)

| CLAIM NAME |

BLM SERIAL # |

| GA 1 |

ID101958395 |

| GA 2 |

ID101958396 |

SEAFOAM DISTRICT - 5

CLAIMS TOTAL

CLAIMS (5)

| CLAIM NAME |

BLM SERIAL # |

| GOLDEN PROMISE |

ID105221836 |

| LONGSHOT #1 |

ID105221837 |

| LONGSHOT #3 |

ID105221838 |

| BETTY RUTH #1 |

ID 105221839 |

| INDEPENDENCE |

ID 105221840 |

BLACKTAIL DISTRICT - 8 CLAIMS TOTAL

FOURTH OF JULY 1-2 (2

| CLAIM NAME |

BLM SERIAL # |

| FOURTH OF JULY 1 |

ID 105221841 |

| FOURTH OF JULY 2 |

ID 105221842 |

SUNSET 1-3 (3)

| CLAIM NAME |

BLM SERIAL # |

| SUNSET 1 |

ID 105221843 |

| SUNSET 2 |

ID105221844 |

| SUNSET 3 |

ID 105221845 |

BLACKTAIL 1-3 (3

| CLAIM NAME |

BLM SERIAL # |

| BLACKTAIL 1 |

ID 105221846 |

| BLACKTAIL 2 |

ID 105221847 |

| SUNSET 3 |

ID 105221848 |

BIG IT PROJECT (LEASED CLAIMS)-

*28 CLAIMS

TOTAL BIG EXT LEASED (25

| CLAIM NAME |

BLM SERIAL # |

| BIG EXT 11 |

ID105771063 |

| BIG EXT 12 |

ID105771064 |

| BIG EXT 15 |

ID105771065 |

| BIG EXT 16 |

ID 105771066 |

| BIG EXT 19 |

ID105771067 |

| BIG EXT 20 |

ID105771068 |

| BIG EXT 23 |

ID 105771069 |

| BIG EXT 24 |

ID105771070 |

| BIG EXT 27 |

ID105771071 |

| BIG EXT 28 |

ID 105771072 |

| BIG EXT 47 |

ID 105771073 |

| BIG EXT 48 |

ID105771074 |

| BIG EXT 49 |

ID105771075 |

| BIG EXT 50 |

ID105771076 |

| BIG EXT 51 |

ID 105771077 |

| BIG EXT 52 |

ID105771078 |

| BIG EXT 53 |

ID105771079 |

| BIG EXT 54 |

ID 105771080 |

| BIG EXT 55 |

ID 105278081 |

| BIG EXT 56 |

ID 105771082 |

| BIG EXT 57 |

ID105771083 |

| BIG EXT 59 |

ID105771084 |

| BIG EXT 60 |

ID105771085 |

| BIG EXT 61 |

ID 105771086 |

| BIG EXT 65 |

ID105771087 |

LEASED CLAIMS (3)

| CLAIM NAME |

BLM SERIAL # |

| BIG IT # 1 |

ID 101487684 |

| BIGIT# 2 |

ID101487685 |

| DELLA 1 |

ID 101487686 |

BIG IT PROJECT (LEASED CLAIMS)- *28 CLAIMS TOTAL

PARCELS (2) *See exclusions below

*Shoshone County Parcel #48N02E-28-6100 (66.412 acres) *see

exclusion below

Shoshone County Parcel #48N02E-33-2600 (28.452 acres) further

legally described as:

Government Lots 6 and 7, Section 28,

and Government Lots 5, 6, 7, and 8, Section 33, all in Township 48 North, Range 2 E., B.M. Shoshone County, State of Idaho; Except a

tract of ground situated in the NW1/4 NW1/4 of Section 33, T48N, R2E, B.M. Shoshone County,

State of Idaho, more particularly described as follows: Beginning at the NE corner of the tract whence the claim corner marked 1 Big

It No. 1 and 4 - Della Bears N. 14° 57' W., 925.14' distant and the NW corner of Section 33, Township 48 North, R2E, B.M., bears

N. 49° 22' W., 1354.39' distant, running thence N. 82° 14' W., 219.95' distant to the SW corner; thence S. 82° 14' E., 220.6'

distant to the SE corner; thence N. 20° O' W., 170.12' distant to a point; thence N. 24° 54' W., 299.08' distant to the NE corner

and the place of beginning (EXCLUDING surface rights for portion shown in RED). The Lessee will NOT have the right to perform the activities

described in Article 4 of this Lease document on the surface of the excluded area. Lessee will be granted mineral rights to excluded

area, and in the event extractable minerals are identified under this area, Lessee will have the right to extract them utilizing underground

methods from points of access outside of the excluded area.

TERROR GULCH (CAPPARELLI GROUP)

- 12 CLAIMS TOTAL ROYAL CAP (12

| CLAIM NAME |

BLM SERIAL # |

| ROYAL CAP 1 |

ID105787871 |

| ROYAL CAP 31 |

ID 105793605 |

| ROYAL CAP 32 |

ID105793606 |

| ROYAL CAP 33 |

ID105793607 |

| ROYAL CAP 34 |

ID105793608 |

| ROYAL CAP 35 |

ID 105793609 |

| ROYAL CAP 36 |

ID105793610 |

| ROYAL CAP 37 |

ID105793611 |

| ROYAL CAP 38 |

ID105793612 |

| ROYAL CAP 39 |

ID105793613 |

| ROYAL CAP 40 |

ID105793614 |

| ROYAL CAP 41 |

ID105793615 |

Exhibit 2

Exhibit 4

ASSIGNMENT AND ASSUMPTION AGREEMENT

THIS ASSIGNMENT AND ASSUMPTION

AGREEMENT (this “Agreement”), dated as of January 2, 2024, by and between, (i) AJB CAPITAL INVESTMENTS LLC,

a limited liability company organized and existing under the laws of the State of Delaware (the “Assignor”), (ii) GOLD

EXPRESS MINES, INC., a corporation incorporated and existing under the laws of the State of Nevada (the “Assignee”)

and (iii) MAGELLAN GOLD CORPORATION, a corporation incorporated and existing under the laws of the State of Nevada (the “Company”).

W I T N E S E T H

WHEREAS, reference

is made to (i) that certain Securities Purchase Agreement, dated February 2021 (the “Purchase Agreement”), by and between

the Assignor and the Company, (ii) that certain Promissory Note dated February 2021 in the original principal amount of $200,000 issued

by Assignor in favor of Assignor pursuant to the Purchase Agreement (as amended by extensions thereto 1-5, the “Note”),

attached hereto as Exhibit A, and (iii) the related Transaction Documents;

WHEREAS, as of

the date hereof the amounts outstanding in respect of the Note to the Assignor consists of outstanding principal amount of $100,000.00

and accrued and unpaid interest of $23,086.66 and the Note accrues an accrued interest at a rate of $40.00 per day (collectively, the

“Debt”);

WHEREAS, the Assignor wishes

to irrevocably sell, grant, assign, transfer and set over unto Assignee the entire right, title, obligation, liability and interest of

the Assignor in, to and under the Note and the Debt, except as otherwise provided herein, and Assignee wishes to purchase and accept the

same, upon the terms and conditions contained in this Agreement;

NOW THEREFORE, in consideration

of the premises and the mutual covenants set forth herein, and for other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged and agreed, Assignor and Assignee hereby covenant and agree as follows:

1.

Recitals. The recitations set forth in the preamble of this Agreement are true and correct and are incorporated herein by

this reference.

2.

Defined Terms. Capitalized terms used herein but not otherwise defined shall the meanings ascribed to them in the Purchase

Agreement or Note, as applicable.

3.

Assignment and Assumption. The Assignor does hereby sell, grant, assign, transfer and set over unto the Assignee, the Assignor’s

entire right, title, obligation, liability and interest in, to and under the Note and the Debt, except for the Reset Right (as defined

below) to the Assignee, and the Assignee hereby (i) accepts and receives Note and the Debt and (ii)

agrees to issue to the Assignor a Promissory Note, in the initial principal amount of $$123,086.66,

in the form Exhibit B attached hereto (the “Consideration Note”). Nothing herein shall be deemed to be a transfer or

assign to the Assignee the Assignor’s right to receive additional shares of Common Stock from the Company pursuant to Section 4(p)(i)

of the Purchase Agreement (the “Reset Right”), which the Assignor explicitly retains.

4.

Selling Restriction. The Assignor agrees that during the period commencing on the date hereof and ending on the one-year

anniversary of the date hereof, the Assignor shall not:

| a. | offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or

contract to sell, grant any option, right or warrant to purchase, lend or otherwise transfer or dispose of any shares of common stock

of the Company or other capital stock of the Company or any securities convertible into or exercisable or exchangeable for common stock

of the Company or other capital stock of the Company, in each case, for a price per share of less than $0.30; or |

| b. | enter into any swap or other agreement, arrangement, hedge or transaction that transfers to another, in

whole or in part, directly or indirectly, any of the economic consequences of ownership of common stock of the Company or other capital

stock of the Company or any securities convertible into or exercisable or exchangeable for common stock of the Company or other capital

stock of the Company. |

5.

Representations and Warranties. The Assignor hereby represents and warrants to Assignee as follows:

| a. | The Assignor has not executed any prior or superior assignment, pledge or conveyance of any of Note or

the Debt in favor of any party other than the Assignee. |

| b. | The Assignor is the owner and holder of the indebtedness evidenced by the Note. |

| c. | The Assignor may legally and validly assign the Note and the Debt without penalty or default or otherwise. |

| d. | The execution and delivery of this Assignment and the performance of Assignor’s obligations hereunder,

have been duly authorized by all necessary and appropriate action of Assignor. |

| e. | The outstanding principal balance under the Note, on the date hereof, is $100,000 and the accrued and

unpaid interest on the Note, on the date hereof, is $23,086.66. |

6.

Consent and Acknowledgement of Rights. The Company acknowledges and agrees

that effective as of the date hereof, (i) the Company hereby consents to the assignment of all of

Assignor’s right, title, obligation, liability and interest in, to and under the Note and the Debt, except for the Reset

Right to the Assignee, (ii) all obligations of the Company under the Note and Debt other than the

Reset Right are validly assigned to Assignee, constitute valid and existing debt obligations of the Company, (iii) the Company has no

defenses to its obligations to pay its obligations under the Note and Debt, and (iv) the

Company has no right to any offset or other deduction from its obligations under the Note and Debt.

7.

Governing Law. Except in the case of the Mandatory Forum Selection clause set forth herein, this AGREEMENT shall be construed

and interpreted in accordance with the laws of the State of WYOMING without regard to the principles of conflicts of laws.

8.

MANDATORY FORUM SELECTION. ANY DISPUTE ARISING UNDER, RELATING TO, OR IN CONNECTION WITH THIS AGREEMENT OR RELATED TO ANY

MATTER WHICH IS THE SUBJECT OF OR INCIDENTAL TO THIS AGREEMENT (WHETHER OR NOT SUCH CLAIM IS BASED UPON BREACH OF CONTRACT OR TORT) SHALL

BE SUBJECT TO THE EXCLUSIVE JURISDICTION AND VENUE OF THE STATE AND/OR FEDERAL COURTS LOCATED IN NEW YORK, NEW YORK. THIS PROVISION IS

INTENDED TO BE A “MANDATORY” FORUM SELECTION CLAUSE AND GOVERNED BY AND INTERPRETED CONSISTENT WITH NEW YORK LAW.

9.

Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective

successors and assigns.

10.

Headings. The headings of the paragraphs of this Agreement have been included only for convenience, and shall not be deemed

in any manner to modify or limit any of the provisions of this Agreement or used in any manner in the interpretation of this Agreement.

11.

Interpretation. Whenever the context so requires in this Agreement, all words used in the singular shall be construed to

have been used in the plural (and vice versa), each gender shall be construed to include any other genders, and the word “Person”

shall be construed to include a natural person, a corporation, a firm, a partnership, a joint venture, a trust, an estate or any other

entity.

12.

Partial Invalidity. Each provision of this Agreement shall be valid and enforceable to the fullest extent permitted by law.

If any provision of this Agreement or the application of such provision to any Person or circumstances shall, to any extent, be invalid

or unenforceable, then the remainder of this Agreement, or the application of such provision to Persons or circumstances other than those

as to which it is held invalid or unenforceable, shall not be affected by such invalidity or unenforceability.

13.

Execution. In the event that any signature is delivered by facsimile transmission or by e- mail delivery of a “.pdf”

format file or other similar format file, such signature shall be deemed an original for all purposes and shall create a valid and binding

obligation of the party executing same with the same force and effect as if such facsimile or “.pdf” signature page was an

original thereof.

[Signatures

on the following page]

IN WITNESS WHEREOF, the parties hereto have executed

this Assignment and Assumption Agreement as of the date first above written.

ASSIGNOR:

AJB CAPITAL INVESTMENTS LLC

Re:_/s/ Ari Blaine____________________________

Name: Ari Blaine

Title:President

[Signature Page to Assignment and Assumption

Agreement]

ASSIGNEE:

GOLD EXPRESS MINES, INC.

Re: /s/ John P. Ryan

Name: John P. Ryan

Title:President

MAGELLAN GOLD CORPORATION

Re: /s/ Michael Lavigne

Name:Michael Lavigne

Title: CEO

[Signature Page to Assignment and Assumption

Agreement]

EXHIBIT A

NOTE

EXHIBIT B

FORM OF CONSIDERATION NOTE

Exhibit 6

NEITHER THE ISSUANCE AND SALE OF THE SECURITIES

REPRESENTED BY THIS CERTIFICATE NOR THE SECURITIES INTO WHICH THESE SECURITIES ARE CONVERTIBLE HAVE BEEN REGISTERED UNDER THE SECURITIES

ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED

(I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR (B)

AN OPINION OF COUNSEL (WHICH COUNSEL SHALL BE SELECTED BY THE HOLDER), IN A GENERALLY ACCEPTABLE FORM, THAT REGISTRATION IS NOT REQUIRED

UNDER SAID ACT OR (II) UNLESS SOLD PURSUANT TO RULE 144 OR RULE 144A UNDER SAID ACT OR OTHER APPLICABLE EXEMPTION. NOTWITHSTANDING THE

FOREGOING, THE SECURITIES MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT OR OTHER LOAN OR FINANCING ARRANGEMENT SECURED

BY THE SECURITIES.

| Principal Amount: US$200,000.00 |

Issue Date: February

___, 2021 |

| Purchase Price: US$184,000.00 |

|

PROMISSORY NOTE

FOR VALUE RECEIVED, MAGELLAN

GOLD CORPORATION, a Nevada corporation (hereinafter called the “Borrower”) (Trading Symbol: MAGE), hereby promises to pay

to the order of AJB Capital Investments LLC, a Delaware limited liability company, or registered assigns (the “Holder”) the

sum of US$200,000.00 (the “Principal”) together with guaranteed interest (the “Interest”) on the Principal balance

hereof in the amount of ten percent (10%) (the “Interest Rate”) per calendar year from the date hereof (the “Issue Date”).

All Principal and Interest owing hereunder, along with any and all other amounts, shall be due and owing on July , 2021

(the “Maturity Date”). A lump-sum interest payment for six months shall be immediately due on the Issue Date and shall be

added to the principal balance and payable on the first of each month following the Issue Date or upon acceleration or by prepayment or

otherwise, notwithstanding the number of days which the Principal is outstanding. Notwithstanding the forgoing, the final payment of Principal

and Interest shall be due on the Maturity Date. This Note may be prepaid in whole or in part as set forth herein. Any amount of Principal

or Interest on this Note which is not paid when due shall bear interest at the rate of the lesser of (i) twelve percent (12%) per annum

and (ii) the maximum amount permitted under law from the due date thereof until the same is paid (the “Default Interest”).

Default Interest shall commence accruing upon an Event of Default and shall be computed on the basis of a 360-day year and the actual

number of days elapsed. All payments due hereunder (to the extent not converted into common stock, $0.001 par value per share (the “Common

Stock”) in accordance with the terms hereof) shall be made in lawful money of the United States of America. All payments shall be

made at such address as the Holder shall hereafter give to the Borrower by written notice made in accordance with the provisions of this

Note. Whenever any amount expressed to be due by the terms of this Note is due on any day which is not a business day, the same shall

instead be due on the next succeeding day which is a business day and, in the case of any interest payment date which is not the date

on which this Note is paid in full, the extension of the due date thereof shall not be taken into account for purposes of determining

the amount of interest due on such date. As used in this Note, the term “business day” shall mean any day other than a Saturday,

Sunday or a day on which commercial banks in the city of New York, New York are authorized or required by law or executive order to remain

closed. Each capitalized term used herein, and not otherwise defined, shall have the meaning ascribed thereto in that certain Securities

Purchase Agreement dated the date hereof, pursuant to which this Note was originally issued (the “Purchase Agreement”). The

Maturity Date may be extended by mutual consent of the Holder and the Borrower to up to six (6) months following the date of the Original

Maturity Date hereunder. In the event that the Maturity Date is extended, the interest rate shall equal fifteen percent (15%) per annum

for any period following the Original Maturity Date, payable monthly.

This Note carries an original

issue discount of $16,000 (the “OID”), to cover the Holder’s monitoring costs associated with the purchase and sale

of the Note, which is included in the principal balance of this Note. Thus, the purchase price of this Note shall be $184,000 computed

as follows: the Principal Amount minus the OID.

This Note is free from all

taxes, liens, claims and encumbrances with respect to the issue thereof and shall not be subject to preemptive rights or other similar

rights of shareholders of the Borrower and will not impose personal liability upon the holder thereof.

The following terms shall

also apply to this Note:

Article

I. CONVERSION RIGHTS UPON EVENT OF DEFAULT

1.1.

Conversion Right. The Holder shall have the right from time to time following an Event of Default, and ending on the date

of payment of the Default Amount (as defined in Article III) pursuant to Section 1.6(a) or Article III, each in respect

of the remaining outstanding principal amount of this Note to convert all or any part of the outstanding and unpaid principal, interest,

penalties, and all other amounts under this Note into fully paid and non-assessable shares of Common Stock, as such Common Stock exists

on the Issue Date, or any shares of capital stock or other securities of the Borrower into which such Common Stock shall hereafter be

changed or reclassified at the Conversion Price (as defined below) determined as provided herein (a “Conversion”); provided,

however, that in no event shall the Holder be entitled to convert any portion of this Note in excess of that portion of this Note

upon conversion of which the sum of (1) the number of shares of Common Stock beneficially owned by the Holder and its affiliates

(other than shares of Common Stock which may be deemed beneficially owned through the ownership of the unconverted portion of the Notes

or the unexercised or unconverted portion of any other security of the Borrower subject to a limitation on conversion or exercise analogous

to the limitations contained herein) and (2) the number of shares of Common Stock issuable upon the conversion of the portion of this

Note with respect to which the determination of this proviso is being made, would result in beneficial ownership by the Holder and its

affiliates of more than 4.99% of the outstanding shares of Common Stock. For purposes of the proviso to the immediately preceding sentence,

beneficial ownership shall be determined in accordance with Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and Regulations 13D-G thereunder, except as otherwise provided in clause (1) of such proviso. The number of shares of Common

Stock to be issued upon each conversion of this Note shall be determined by dividing the Conversion Amount (as defined below) by the applicable

Conversion Price then in effect on the date specified in the notice of conversion, in the form attached hereto as Exhibit A (the “Notice

of Conversion”), delivered to the Borrower or Borrower’s transfer agent by the Holder in accordance with Section 1.4

below; provided that the Notice of Conversion is submitted by facsimile or e-mail (or by other means resulting in, or reasonably expected

to result in, notice) to the Borrower or Borrower’s transfer agent before 11:59 p.m., New York, New York time on such conversion

date (the “Conversion Date”). The term “Conversion Amount” means, with respect to any conversion of this Note,

the sum of (1) the principal amount of this Note to be converted in such conversion plus (2) at the Holder’s option, accrued

and unpaid interest, if any, on such principal amount at the interest rates provided in this Note to the Conversion Date, provided however,

that the Borrower shall have the right to pay any or all interest in cash plus (3) at the Holder’s option, Default Interest,

if any, on the amounts referred to in the immediately preceding clauses (1) and/or (2) plus (4) at the Holder’s option, any

amounts owed to the Holder pursuant to Sections 1.3 and 1.4(g) hereof.

1.2.

Conversion Price.

(a)

Calculation of Conversion Price. Subject to the adjustments described herein, the conversion price (the “Conversion

Price”) shall equal the lesser of 90% (representing a 10% discount) multiplied by the lowest trading price (i) during the previous

twenty (20) Trading Day period ending on the Issuance Date, or (ii) during the previous twenty (20) Trading Day period ending on date

of conversion of this Note. To the extent the Conversion Price of the Borrower’s Common Stock closes below the par value per share,

the Borrower will take all steps necessary to solicit the consent of the stockholders to reduce the par value to the lowest value possible

under law. The Borrower agrees to honor all conversions submitted pending this adjustment. Furthermore, the Conversion Price may be adjusted

downward if, within three (3) business days of the transmittal of the Notice of Conversion to the Borrower or Borrower’s transfer

agent, the Common Stock has a closing bid which is 5% or lower than that set forth in the Notice of Conversion. If the shares of the Borrower’s

Common Stock have not been delivered within three (3) business days to the Borrower or Borrower’s transfer agent, the Notice of

Conversion may be rescinded. At any time after the Closing Date, if in the case that the Borrower’s Common Stock is not deliverable

by DWAC (including if the Borrower’s transfer agent has a policy prohibiting or limiting delivery of shares of the Borrower’s

Common Stock specified in a Notice of Conversion), an additional 10% discount will apply for all future conversions under all Notes. If

in the case that the Borrower’s Common Stock is “chilled” for deposit into the DTC system and only eligible for clearing

deposit, an additional 15% discount shall apply for all future conversions under all Note. If in the case of both of the above, an additional

cumulative 25% discount shall apply. Additionally, if the Borrower ceases to be a reporting company pursuant to the 1934 Act or if the

Note cannot be converted into free trading shares after one hundred eighty-one (181) days from the Issue Date, an additional 15% discount

will be attributed to the Conversion Price. If the trading price cannot be calculated for such security on such date in the manner provided

above, the trading price shall be the fair market value as mutually determined by the Borrower and the holders of a majority in interest

of the Notes being converted for which the calculation of the trading price is required in order to determine the Conversion Price of

such Notes. “Trading Day” shall mean any day on which the Common Stock is tradable for any period on the OTC Pink, OTCQB or

on the principal securities exchange or other securities market on which the Common Stock is then being traded. The Borrower shall be

responsible for the fees of its transfer agent and all DTC fees associated with any such issuance. Holder shall be entitled to deduct

$750.00 from the conversion amount in each Notice of Conversion to cover Holder’s deposit fees associated with each Notice of Conversion.

While this Note is outstanding,

each time any 3rd party has the right to convert monies owed to that 3rd party (or receive shares pursuant to a

settlement or otherwise), including but not limited to under Section 3(a)(9) and Section 3(a)(10), at a discount to market greater than

the Conversion Price in effect at that time (prior to all other applicable adjustments in the Note), then the Holder, in Holder’s

sole discretion, may utilize such greater discount percentage (prior to all applicable adjustments in this Note) until this Note is no

longer outstanding. While this Note is outstanding, each time any 3rd party has a look back period greater than the look back

period in effect under the Note at that time, including but not limited to under Section 3(a)(9) and Section 3(a)(10), then the Holder,

in Holder’s sole discretion, may utilize such greater number of look back days until this Note is no longer outstanding. The Borrower

shall give written notice to the Holder within one (1) business day of becoming aware of any event that could permit the Holder to make

any adjustment described in the two immediately preceding sentences.

(b)

Conversion Price During Major Announcements. Notwithstanding anything contained in Section 1.2(a) to the contrary,

in the event the Borrower (i) makes a public announcement that it intends to consolidate or merge with any other corporation (other than

a merger in which the Borrower is the surviving or continuing corporation and its capital stock is unchanged) or sell or transfer all

or substantially all of the assets of the Borrower or (ii) any person, group or entity (including the Borrower) publicly announces a tender

offer to purchase 50% or more of the Borrower’s Common Stock (or any other takeover scheme) (the date of the announcement referred

to in clause (i) or (ii) is hereinafter referred to as the “Announcement Date”), then the Conversion Price shall, effective

upon the Announcement Date and continuing through the Adjusted Conversion Price Termination Date (as defined below), be equal to the lower

of (x) the Conversion Price which would have been applicable for a Conversion occurring on the Announcement Date and (y) the Conversion

Price that would otherwise be in effect. From and after the Adjusted Conversion Price Termination Date, the Conversion Price shall be

determined as set forth in this Section 1.2(b). For purposes hereof, “Adjusted Conversion Price Termination Date” shall

mean, with respect to any proposed transaction or tender offer (or takeover scheme) for which a public announcement as contemplated by

this Section 1.2(b) has been made, the date upon which the Borrower (in the case of clause (i) above) or the person, group or entity

(in the case of clause (ii) above) consummates or publicly announces the termination or abandonment of the proposed transaction or tender

offer (or takeover scheme) which caused this Section 1.2(b) to become operative.

(c)

Pro Rata Conversion; Disputes. In the event of a dispute as to the number of shares of Common Stock issuable to the Holder

in connection with a conversion of this Note, the Borrower shall issue to the Holder the number of shares of Common Stock not in dispute

and resolve such dispute in accordance with Section 4.13.

(d)

If at any time the Conversion Price as determined hereunder for any conversion would be less than the par value of the Common Stock,

then the Conversion Price hereunder shall equal such par value for such conversion and the Conversion Amount for such conversion shall

be increased to include Additional Principal, where “Additional Principal” means such additional amount to be added to the

Conversion Amount to the extent necessary to cause the number of conversion shares issuable upon such conversion to equal the same number

of conversion shares as would have been issued had the Conversion Price not been subject to the minimum price set forth in this Section

1.2(c).

1.3.

Authorized Shares. The Borrower covenants that during the period while any outstanding balance is owing hereunder or any

conversion of the Note is available, the Borrower will reserve from its authorized and unissued Common Stock a sufficient number of shares,

free from preemptive rights, to provide for the issuance of Common Stock upon the full conversion of this Note issued pursuant to the

Purchase Agreement. The Borrower is required at all times to have authorized and reserved ten (10) times the number of shares that is

actually issuable upon full conversion of the Note (based on the Conversion Price of the Notes in effect from time to time) (the “Reserved

Amount”). The Reserved Amount shall be increased from time to time in accordance with the Borrower’s obligations pursuant

to Section 3(d) of the Purchase Agreement. The Borrower represents that upon issuance, such shares will be duly and validly issued, fully

paid and non-assessable. In addition, if the Borrower shall issue any securities or make any change to its capital structure which would

change the number of shares of Common Stock into which the Notes shall be convertible at the then current Conversion Price, the Borrower

shall at the same time make proper provision so that thereafter there shall be a sufficient number of shares of Common Stock authorized

and reserved, free from preemptive rights, for conversion of the outstanding Notes. The Borrower (i) acknowledges that it has irrevocably

instructed its transfer agent to issue certificates for the Common Stock issuable upon conversion of this Note, and (ii) agrees that its

issuance of this Note shall constitute full authority to its officers and agents who are charged with the duty of executing stock certificates

to execute and issue the necessary certificates for shares of Common Stock in accordance with the terms and conditions of this Note. Notwithstanding

the foregoing, in no event shall the Reserved Amount be lower than the initial Reserved Amount, regardless of any prior conversions.

If, at any time the Borrower

does not maintain or replenish the Reserved Amount within three (3) business days of the request of the Holder, the principal amount of

the Note shall increase by Five Thousand and No/100 United States Dollars ($5,000) (under Holder’s and Borrower’s expectation

that any principal amount increase will tack back to the Issue Date) per occurrence.

1.4.

Method of Conversion.

(a)

Mechanics of Conversion. Subject to Section 1.1, this Note may be converted by the Holder in whole or in part at

any time from time to time after an Event of Default, by (A) submitting to the Borrower or Borrower’s transfer agent a Notice of

Conversion (by facsimile, e-mail or other reasonable means of communication dispatched on the Conversion Date prior to 11:59 p.m., New

York, New York time) and (B) subject to Section 1.4(b), surrendering this Note at the principal office of the Borrower.

(b)

Surrender of Note Upon Conversion. Notwithstanding anything to the contrary set forth herein, upon conversion of this Note

in accordance with the terms hereof, the Holder shall not be required to physically surrender this Note to the Borrower unless the entire

unpaid principal amount of this Note is so converted. The Holder and the Borrower shall maintain records showing the principal amount

so converted and the dates of such conversions or shall use such other method, reasonably satisfactory to the Holder and the Borrower,

so as not to require physical surrender of this Note upon each such conversion. In the event of any dispute or discrepancy, such records

of the Borrower shall, prima facie, be controlling and determinative in the absence of manifest error. Notwithstanding the foregoing,

if any portion of this Note is converted as aforesaid, the Holder may not transfer this Note unless the Holder first physically surrenders

this Note to the Borrower, whereupon the Borrower will forthwith issue and deliver upon the order of the Holder a new Note of like tenor,

registered as the Holder (upon payment by the Holder of any applicable transfer taxes) may request, representing in the aggregate the

remaining unpaid principal amount of this Note. The Holder and any assignee, by acceptance of this Note, acknowledge and agree that, by

reason of the provisions of this paragraph, following conversion of a portion of this Note, the unpaid and unconverted principal amount

of this Note represented by this Note may be less than the amount stated on the face hereof.

(c)

Payment of Taxes. The Borrower shall not be required to pay any tax which may be payable in respect of any transfer involved

in the issue and delivery of shares of Common Stock or other securities or property on conversion of this Note in a name other than that

of the Holder (or in street name), and the Borrower shall not be required to issue or deliver any such shares or other securities or property

unless and until the person or persons (other than the Holder or the custodian in whose street name such shares are to be held for the

Holder’s account) requesting the issuance thereof shall have paid to the Borrower the amount of any such tax or shall have established

to the satisfaction of the Borrower that such tax has been paid.

(d)

Delivery of Common Stock Upon Conversion. Upon receipt by the Borrower from the Holder of a facsimile transmission or e-mail

(or other reasonable means of communication) of a Notice of Conversion meeting the requirements for conversion as provided in this Section

1.4, the Borrower shall issue and deliver or cause to be issued and delivered to or upon the order of the Holder certificates for

the Common Stock issuable upon such conversion within three (3) business days after such receipt (the “Deadline”) (and, solely

in the case of conversion of the entire unpaid principal amount hereof, surrender of this Note) in accordance with the terms hereof and

the Purchase Agreement.

(e)

Obligation of Borrower to Deliver Common Stock. Upon receipt by the Borrower of a Notice of Conversion, the Holder shall

be deemed to be the holder of record of the Common Stock issuable upon such conversion, the outstanding principal amount and the amount

of accrued and unpaid interest on this Note shall be reduced to reflect such conversion, and, unless the Borrower defaults on its obligations

under this Article I, all rights with respect to the portion of this Note being so converted shall forthwith terminate except the

right to receive the Common Stock or other securities, cash or other assets, as herein provided, on such conversion. If the Holder shall

have given a Notice of Conversion as provided herein, the Borrower’s obligation to issue and deliver the certificates for Common

Stock shall be absolute and unconditional, irrespective of the absence of any action by the Holder to enforce the same, any waiver or

consent with respect to any provision thereof, the recovery of any judgment against any person or any action to enforce the same, any

failure or delay in the enforcement of any other obligation of the Borrower to the holder of record, or any setoff, counterclaim, recoupment,

limitation or termination, or any breach or alleged breach by the Holder of any obligation to the Borrower, and irrespective of any other

circumstance which might otherwise limit such obligation of the Borrower to the Holder in connection with such conversion. The Conversion

Date specified in the Notice of Conversion shall be the Conversion Date so long as the Notice of Conversion is received by the Borrower

before 11:59 p.m., New York, New York time, on such date.

(f)

Delivery of Common Stock by Electronic Transfer. In lieu of delivering physical certificates representing the Common Stock

issuable upon conversion, provided the Borrower is participating in the Depository Trust Company (“DTC”) Fast Automated Securities

Transfer (“FAST”) program, upon request of the Holder and its compliance with the provisions contained in Section 1.1

and in this Section 1.4, the Borrower shall use its commercially reasonable best efforts to cause its transfer agent to electronically

transmit the Common Stock issuable upon conversion to the Holder by crediting the account of Holder’s Prime Broker with DTC through

its Deposit Withdrawal At Custodian (“DWAC”) system.

(g)

DTC Eligibility & Market Loss. If the Borrower fails to maintain its status as “DTC Eligible” for any reason,

or, if the Conversion Price is less than $0.05 at any time after the Issue Date, the principal amount of the Note shall increase by Fifteen

Thousand and No/100 United States Dollars ($15,000) (under Holder’s and Borrower’s expectation that any principal amount

increase will tack back to the Issue Date) and the Variable Conversion Price shall be redefined to mean thirty percent (30%) multiplied

by the Market Price, subject to adjustment as provided in this Note.

(h)

Failure to Deliver Common Stock Prior to Delivery Deadline. Without in any way limiting the Holder’s right to pursue

other remedies, including actual damages and/or equitable relief, the parties agree that if delivery of the Common Stock issuable upon

conversion of this Note is not delivered by the Deadline (other than a failure due to the circumstances described in Section 1.3

above, which failure shall be governed by such Section) the Borrower shall pay to the Holder $2,000 per day in cash, for each day beyond

the Deadline that the Borrower fails to deliver such Common Stock until the Borrower issues and delivers a certificate to the Holder or

credit the Holder’s balance account with OTC for the number of shares of Common Stock to which the Holder is entitled upon such

Holder’s conversion of any Conversion Amount (under Holder’s and Borrower’s expectation that any damages will tack back

to the Issue Date).. Such cash amount shall be paid to Holder by the fifth day of the month following the month in which it has accrued

or, at the option of the Holder (by written notice to the Borrower by the first day of the month following the month in which it has accrued),

shall be added to the principal amount of this Note, in which event interest shall accrue thereon in accordance with the terms of this

Note and such additional principal amount shall be convertible into Common Stock in accordance with the terms of this Note. The Borrower

agrees that the right to convert is a valuable right to the Holder. The damages resulting from a failure, attempt to frustrate, interference

with such conversion right are difficult if not impossible to qualify. Accordingly the parties acknowledge that the liquidated damages

provision contained in this Section 1.4(h) are justified.

(i)

Rescindment of a Notice of Conversion. If (i) the Borrower fails to respond to Holder within one (1) business day from the

Conversion Date confirming the details of Notice of Conversion, (ii) the Borrower fails to provide any of the shares of the Borrower’s

Common Stock requested in the Notice of Conversion within three (3) business days from the date of receipt of the Note of Conversion,

(iii) the Holder is unable to procure a legal opinion required to have the shares of the Borrower’s Common Stock issued unrestricted

and/or deposited to sell for any reason related to the Borrower’s standing, (iv) the Holder is unable to deposit the shares of the

Borrower’s Common Stock requested in the Notice of Conversion for any reason related to the Borrower’s standing, (v) at any

time after a missed Deadline, at the Holder’s sole discretion, or (vi) if OTC Markets changes the Borrower’s designation to

`Limited Information’ (Yield), `No Information’ (Stop Sign), `Caveat Emptor’ (Skull & Crossbones), `OTC’,

`Other OTC’ or `Grey Market’ (Exclamation Mark Sign) or other trading restriction on the day of or any day after the Conversion

Date, the Holder maintains the option and sole discretion to rescind the Notice of Conversion (“Rescindment”) with a “Notice

of Rescindment.”

1.5.

Concerning the Shares. The shares of Common Stock issuable upon conversion of this Note may not be sold or transferred unless

(i) such shares are sold pursuant to an effective registration statement under the Act or (ii) the Borrower or its transfer agent shall

have been furnished with an opinion of counsel (which opinion shall be in form, substance and scope customary for opinions of counsel

in comparable transactions) to the effect that the shares to be sold or transferred may be sold or transferred pursuant to an exemption

from such registration or (iii) such shares are sold or transferred pursuant to Rule 144 under the Act (or a successor rule) (“Rule

144”) or other applicable exemption or (iv) such shares are transferred to an “affiliate” (as defined in Rule 144) of

the Borrower who agrees to sell or otherwise transfer the shares only in accordance with this Section 1.5 and who is an Accredited

Investor (as defined in the Purchase Agreement). Except as otherwise provided in the Purchase Agreement (and subject to the removal provisions

set forth below), until such time as the shares of Common Stock issuable upon conversion of this Note have been registered under the Act

or otherwise may be sold pursuant to Rule 144 or other applicable exemption without any restriction as to the number of securities as

of a particular date that can then be immediately sold, each certificate for shares of Common Stock issuable upon conversion of this Note

that has not been so included in an effective registration statement or that has not been sold pursuant to an effective registration statement

or an exemption that permits removal of the legend, shall bear a legend substantially in the following form, as appropriate:

“NEITHER THE ISSUANCE AND SALE OF

THE SECURITIES REPRESENTED BY THIS CERTIFICATE NOR THE SECURITIES INTO WHICH THESE SECURITIES ARE EXERCISABLE HAVE BEEN REGISTERED UNDER

THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED

OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED,

OR (B) AN OPINION OF COUNSEL (WHICH COUNSEL SHALL BE SELECTED BY THE HOLDER), IN A GENERALLY ACCEPTABLE FORM, THAT REGISTRATION IS NOT

REQUIRED UNDER SAID ACT OR (II) UNLESS SOLD PURSUANT TO RULE 144 OR RULE 144A UNDER SAID ACT OR OTHER APPLICABLE EXEMPTION. NOTWITHSTANDING

THE FOREGOING, THE SECURITIES MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT OR OTHER LOAN OR FINANCING ARRANGEMENT SECURED

BY THE SECURITIES.”

The legend set forth above

shall be removed and the Borrower shall issue to the Holder a new certificate therefore free of any transfer legend if (i) the Borrower

or its transfer agent shall have received an opinion of counsel, in form, substance and scope customary for opinions of counsel in comparable

transactions, to the effect that a public sale or transfer of such Common Stock may be made without registration under the Act, which

opinion shall be reasonably accepted by the Borrower so that the sale or transfer is effected or (ii) in the case of the Common Stock

issuable upon conversion of this Note, such security is registered for sale by the Holder under an effective registration statement filed