Investors Wonder What's Next for L'Oréal and Nestlé After Bettencourt Death

September 22 2017 - 3:02PM

Dow Jones News

By Matthew Dalton and Brian Blackstone

PARIS -- The death of Liliane Bettencourt has placed a question

mark over the decadeslong ties between L'Oréal SA and Nestlé SA,

two of the world's largest consumer-goods companies.

Shares in L'Oréal jumped Friday as investors began speculating

on the possibility either side might reconsider Nestlé's large

stake in L'Oréal. Analysts and a person close to the Bettencourt

family, however, are tamping down expectations of a shake-up,

citing a thicket of financial hurdles as well as the companies'

comfort with the status quo.

Nestlé, the Swiss consumer-goods giant, and L'Oréal, the world's

biggest cosmetics company, have been intertwined since 1974, when

Ms. Bettencourt, heiress to the L'Oréal cosmetics fortune, swapped

a large stake in L'Oréal for shares in Nestlé to fend off a feared

nationalization by the French state.

That agreement between Nestlé and Ms. Bettencourt, who died

Thursday in Paris at the age of 94, allows either party to increase

its stake in L'Oréal six months after her death.

Nestlé and L'Oréal have been moving to unwind their relationship

in recent years. In 2014, Nestlé agreed to sell 48.5 million

L'Oréal shares back to L'Oréal for assets and cash, cutting its

stake from 29.4% to 23.29%. Ms. Bettencourt's stake in L'Oréal rose

from 30.6% to 33.31%, while Nestlé's presence on L'Oréal's board

shrank from three seats to two.

Following Ms. Bettencourt's death, Nestlé said now is "not the

right time" to comment on the future of its L'Oréal holdings. But

executives have previously said they are in no rush to trim the

L'Oréal stake further.

"This asset has been delivering stellar financial returns to us

in recent years, and we also consider it a strategic asset. Hence

anything we would ever want to do on that would need to be pondered

very carefully," Nestlé Chief Executive Mark Schneider told a news

conference in February

Some analysts have also questioned whether Ms. Bettencourt's

death could prompt her heirs either to get rid of their shares in

L'Oréal or to increase their stake in the company. But a person

close to the family and analysts say neither outcome is likely.

Françoise Bettencourt Meyers, Ms. Bettencourt's only child,

orchestrated the 2014 deal to cement her family's control over

L'Oréal. Neither she nor her sons want to separate from the

company, a person close to the family said Friday.

"It's the story of their life, their family," the person said.

"They are very attached to the company."

The family faces a significant obstacle to increasing its stake:

Under French law, any shareholder that wants to own more than a

third of a company must make an offer to buy all of the company.

That would stretch the pockets of even one of the world's richest

families.

"Launching a mandatory offer on L'Oréal would require close to

EUR60 billion, which is a significant amount," said Marion

Boucheron, an analyst at Raymond James in Paris.

The relationship between the two companies extends beyond

shareholding. Nestlé's stake in L'Oréal gives it a valuable asset

in neighboring France while providing L'Oréal with a stable

long-term investor.

Nestlé has two representatives on L'Oréal's board of directors:

Nestlé Chairman Paul Bulcke and General Manager for Germany

Béatrice Guillaume-Grabisch.

But Nestlé has come under investor pressure to sell off its

stake in L'Oréal to strengthen its core businesses that includes

coffee, water pet care, infant formula and health science. The

pressure comes as Nestlé has struggled to meet a long-term revenue

growth target of 5% to 6% that it has missed four straight years

and ended up ditching altogether early this year.

In June, billionaire activist investor Daniel Loeb's Third Point

LLC said it had taken a $3.5 billion 1.25% stake in Nestlé and

pressed for changes, including the sale of noncore assets such as

Nestlé's stake in L'Oréal.

Days later, Nestlé announced a 20 billion Swiss franc ($20.6

billion) share buyback program and said it would orient its capital

spending toward high-growth parts of its business, including pet

care, infant nutrition, coffee and bottled water.

Selling some of its L'Oréal stake to the Bettencourt family

would give Nestlé the financial means to increase the amount of the

buyback, analysts say.

"While [Nestlé's] passive investment in [L'Oréal] looks like an

anachronism to us, they might perceive it as a store of value,

capable of being liquidated years hence when the right opportunity

presents itself," said Martin Deboo, an analyst at Jefferies, in a

research note. "For [L'Oréal 's] part, they will value the

stability and security afforded by tightly held ownership."

Write to Matthew Dalton at Matthew.Dalton@wsj.com and Brian

Blackstone at brian.blackstone@wsj.com

(END) Dow Jones Newswires

September 22, 2017 14:47 ET (18:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

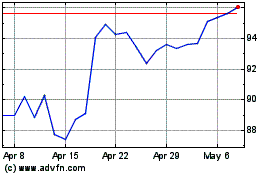

Loreal (PK) (USOTC:LRLCY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Loreal (PK) (USOTC:LRLCY)

Historical Stock Chart

From Nov 2023 to Nov 2024