Report of Foreign Issuer (6-k)

March 14 2017 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2017

Commission File Number: 001-53087

IAO KUN GROUP HOLDING COMPANY LIMITED

(Translation of registrant’s name

into English)

Alameda Dr. Carlos D’ Assumpcao No:

181-187

Centro Comercial do Grupo

Brilhantismo, 12 Andar T Macau

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

¨

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

¨

Indicate by check mark whether the registrant by furnishing

the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

Yes

¨

No

x

If “Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b): 82-_______.

Notice of Delisting or Failure to Satisfy a Continued Listing

Rule or Standard; Transfer of Listing.

As previously reported, on September 13, 2016, Iao Kun Group

Holding Company Limited (the “Company”) received a written notice (the “Notice”) from the Listing Qualifications

department of The Nasdaq Stock Market (“Nasdaq”) indicating that the Company is not in compliance with the minimum

bid price requirement of $1.00 per share set forth in Nasdaq Listing Rule 5450(a)(1). The Nasdaq Listing Rules require listed securities

to maintain a minimum bid price of $1.00 per share and, based upon the closing bid price for the 30 consecutive business days ended

September 12, 2016, the Company did not meet this requirement. The Company was provided a 180 day period in which to regain compliance,

which period expired on March 13, 2017. The Company did not regain compliance during this period.

However, effective March 14, 2017, the Company transferred the

listing of its ordinary shares from the Nasdaq Global Market to the Nasdaq Capital Market and, accordingly, Nasdaq provided the

Company an additional 180 days, or until September 11, 2017, to regain compliance, subject to the Company effecting a reverse stock

split during the this period if necessary to cure the deficiency. The Company’s stock symbol will remain “IKGH”.

If at any time during the additional 180 day period the closing bid price of the Company’s ordinary shares is at least $1.00

for a minimum of ten consecutive business days, the Company will receive a written confirmation of compliance from Nasdaq and the

matter will be closed.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

Dated: March 14, 2017

|

IAO KUN GROUP HOLDING COMPANY LIMITED

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Yip Cheuk Fai

|

|

|

|

|

Name: Yip Cheuk Fai

Title: Chief Financial Officer

|

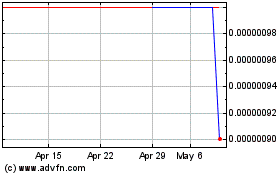

LiNiu Technology (CE) (USOTC:LINUF)

Historical Stock Chart

From Apr 2024 to May 2024

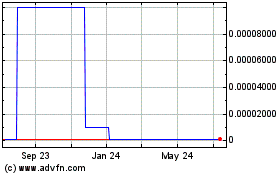

LiNiu Technology (CE) (USOTC:LINUF)

Historical Stock Chart

From May 2023 to May 2024