UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K/A

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or

15d-16

of the Securities Exchange Act of 1934

For

the month of October 2024

Commission

File Number: 333-155412

JBS

S.A.

(Exact

Name as Specified in its Charter)

N/A

(Translation

of registrant’s name into English)

Av.

Marginal Direita do Tietê

500,

Bloco I, 3rd Floor

São

Paulo, SP, Brazil

(Address

of principal executive offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F:

☒ Form 40-F: ☐

EXPLANATORY

NOTE

JBS

S.A. is filing this Amendment No. 1 (this “Amendment”) to its report on Form 6-K, which was originally furnished to the U.S.

Securities and Exchange Commission on September 30, 2024 (Film No.: 241336910) (the “Original Form 6-K”).

This

Amendment is being furnished solely to amend Exhibit 99.1 to the Original Form 6-K to correct the deadline to settle authorized transactions

under the new share buyback program, from November 11, 2023 to March 23, 2026.

Accordingly,

an updated version of Exhibit 99.1 has been attached to this Amendment and supersedes the earlier version attached to the Original Form

6-K.

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Date:

October 11, 2024

| |

JBS S.A. |

| |

|

|

| |

By: |

/s/ Guilherme Perboyre Cavalcanti |

| |

Name: |

Guilherme Perboyre Cavalcanti |

| |

Title: |

Chief Financial and Investment Relations Officer |

Exhibit 99.1

JBS S.A.

Corporate Taxpayer’s ID (CNPJ/ME): 02.916.265/0001-60

Company Registry (NIRE): 35.300.330.587

Authorized Publicly-Held Company

MINUTES OF THE BOARD OF DIRECTORS’ MEETING

HELD ON SEPTEMBER 23, 2024, AT 2:00 P.M.

Date, Time and Place: September 23, 2024,

at 2:00 p.m., at the headquarters of JBS S.A. (“Company”), located at Avenida Marginal Direita do Tietê, 500,

Bloco I, 3º Andar, Vila Jaguara, CEP 05118-100, in the city and state of São Paulo.

Call notice: The call notice was emailed

to the Board of Directors members, according to Article 18 of the Company’s Bylaws.

Attendance: The necessary quorum for the

Board of Directors’ Meeting was verified, given the presence of all board members, pursuant to Articles 15 and 18 of its Bylaws,

namely Jeremiah O’Callaghan (Chair), José Batista Sobrinho (Vice Chair),

Wesley Mendonça Batista, Joesley Mendonça Batista, Alba Pettengill, Gelson Luiz Merisio, Francisco

Turra, Carlos Hamilton Vasconcelos Araujo, Kátia Regina de Abreu Gomes, Paulo Bernardo Silva, and Cledorvino

Belini.

Presiding Board: Jeremiah O’Callaghan,

Chair; and Daniel Schmidt Pitta, Secretary.

Agenda: discussion and approval of the

Company’s new share buyback plan.

Discussions and Resolutions:

The Board of

Directors members unanimously resolved to approve the Company’s new share buyback plan, pursuant to CVM Resolution 77/22

(“Resolution 77”) (“Buyback Plan”), aimed at authorizing the Company to acquire up to 10% (ten

percent) of the outstanding registered, book-entry common shares with no par value issued by the Company, to be held in treasury and

subsequently cancelled or disposed of, without reducing the share capital, and the Executive Board is responsible for defining the

opportunity and number of shares to be effectively acquired and/or disposed of, according to the limits and validity of this

authorization. Pursuant to Article 6 of Resolution 77, it was decided that: (a) by carrying out the transaction, the Company

aims at maximizing value creation for shareholders through an efficient capital structure management; (b) the number of

shares outstanding on the market today is 1,133,963,579 (one billion, one hundred and thirty-three million, nine hundred and

sixty-three thousand, five hundred and seventy-nine) registered, book-entry common shares with no par value. The Company does not

hold treasury shares on this date; (c) up to 113,396,357 (one hundred and thirteen million, three hundred and ninety-six

thousand, three hundred and fifty-seven) shares can be acquired, corresponding to up to 10% (ten percent) of the outstanding

registered, book-entry common shares with no par value on this date; (d) the maximum term to settle the transactions

conducted under the Buyback Plan authorized herein is 18 (eighteen) months as of this date, i.e. until March 23, 2026; (e)

the disposal of the shares acquired under the approved Buyback Plan is hereby authorized; (f) transactions for the

acquisition of shares shall be conducted at market prices on B3 by the following securities brokers: 1. ATIVA INVESTIMENTOS S.A.

CTCV, Address: AV. DAS AMERICAS, 3500, SALAS 314 A 318. RIO DE JANEIRO / RJ - CEP: 22.640-102; 2. BGC

LIQUIDEZ DTVM, Address: AV ALM BARROSO, 52 - 23 ANDAR, SALA 2301. RIO DE JANEIRO / RJ – CEP: 20.031-000; 3. BRADESCO

S/A CTVM, Address: PRES. JUSCELINO KUBITSCHEK, 1309, 11º ANDAR. SÃO PAULO / SP - CEP:

04.543-011; 4. BTG PACTUAL CTVM S.A., Address: AV FARIA LIMA, 3477 14º ANDAR, SÃO PAULO / SP - CEP: 04.538-133; 5.

CREDIT SUISSE S.A. CTVM, Address: R LEOPOLDO COUTO DE MAGALHÃES JR, 700, SÃO PAULO / SP – CEP: 04.542-000; 6.

C6 CTVM LTDA., Address: AV NOVE DE JULHO, 3186, SÃO PAULO / SP – CEP: 01.406-000; 7. GENIAL INSTITUCIONAL CCTVM

S.A., Address: AV FARIA LIMA, 3400 - CONJ 92. SÃO PAULO / SP – CEP: 04.538-132; 8. J.P. MORGAN CCMV S.A.,

Address: AV BRIGADEIRO FARIA LIMA, 3729 – 13º ANDAR, SÃO PAULO / SP – CEP: 04.538-905; 9. LECCA

DTVM LTDA., Address: R SÃO JOSÉ, 20 – SALA 201, RIO DE JANEIRO / RJ – CEP: 20.010-020; 10. MORGAN

STANLEY CTVM S.A., Address: AV BRIGADEIRO FARIA LIMA, 3600 – 6º ANDAR, SÃO PAULO / SP – CEP: 04.538-132; 11.

MERRILL LYNCH S.A. CTCM, Address: AV BRIGADEIRO FARIA LIMA, 3400 – 11º e 12º ANDAR, SÃO PAULO / SP

– CEP: 04.538-132; 12. SANTANDER CCVM S.A., Address: AV PRES JUSCELINO KUBITSCHEK, 2041, CONJ 241 BL A, SÃO

PAULO / SP – CEP: 04.543-011; 13. TULLETT PREBON BRASIL CVC LTDA., Address: R. SÃO TOME, 86 – CONJ 211 E

212, SÃO PAULO / SP – CEP: 04.551-080; 14. UBS BRASIL CCTVM S.A., Address: AV. FARIA LIMA, 4.440 - 7° ANDAR,

SÃO PAULO / SP – CEP: 04.538-132; 15. XP INVESTIMENTOS CCTVM S/A 3, Address: AV ATAULFO DE PAIVA, 153 - SALA

201, RIO DE JANEIRO / RJ – CEP: 22.440-032; 16. CITIGROUP GLOBAL MARKETS BRASIL CORRETORA DE CAMBIO TITULOS E VALORES

MOBILIARIOS SA, Address: Avenida Paulista, 1111, Andar 14 - Bela Vista, São Paulo – SP – CEP 01418-100; 17.

SAFRA DISTRIBUIDORA DE TITULOS E VALORES MOBILIARIOS LTDA., Address: Avenida Paulista, 2150, 8º andar, São Paulo

– SP - CEP 01310-300; 18. ITAU CORRETORA DE VALORES S/A, Address: Avenida Brigadeiro Faria Lima, 3500, 3º andar,

São Paulo – SP – CEP 04538-132; (g) the conclusion of the trades authorized herein shall not affect the

Company’s shareholding control or management structure; (h) the proceeds to be utilized for the conclusion of the

trades authorized herein shall be the Company’s cash or cash equivalents, observing the limits established in the applicable

regulation; and (i) The Company’s Board of Directors believes that the conclusion of the trades authorized herein shall

not cause any loss to the fulfillment of the obligations assumed by the Company, nor will they compromise the payment of mandatory

dividends, in view of the Company’s liquidity situation, indebtedness and cash generation.

Other information on the Buyback Plan approved today is detailed in the Material Fact disclosed by the Company pursuant to

Resolution 77 and Exhibit G of CVM Resolution 480, which is part of these Minutes as Exhibit I. The decision about the

cancellation or disposal of these shares will be taken and communicated to the market in due course. The Company’s Executive

Officers are authorized to take all measures necessary to formalize the resolution above at the opportunity they deem

appropriate.

Minutes in Summary Form: The Board of Directors

authorized the drawing up of these minutes in summary form and their publication by omitting the signatures, pursuant to paragraphs 1

and 2 of Article 130 of Brazilian Corporate Law.

Closure: There being no further business

to address, the Chair offered the floor to anyone who intended to speak and, as no one did, the meeting was adjourned for the time necessary

to draw up these minutes, which were then read, approved, and signed by all attendees. Presiding Board: Jeremiah O’Callaghan

(Chair), José Batista Sobrinho (Vice Chair),

Wesley Mendonça Batista, Joesley Mendonça Batista, Alba Pettengill, Gelson Luiz Merisio, Francisco

Turra, Carlos Hamilton Vasconcelos Araujo, Kátia Regina de Abreu Gomes, Paulo Bernardo Silva, and Cledorvino

Belini.

São Paulo,

September 23, 2024.

Daniel Schmidt Pitta

Secretary

Exhibit I to the Minutes of the Board of Directors’

Meeting of JBS S.A.

held on September 23, 2024, at 2:00 p.m.

JBS S.A.

Corporate Taxpayer’s ID (CNPJ/ME): 02.916.265/0001-60

Company Registry (NIRE): 35.300.330.587

Authorized Publicly-Held Company

Exhibit G of CVM Resolution 80

Trading of Company Shares

1. Justify

in detail the purpose and expected economic effects of the transaction:

The main objective of the Company’s Share

Buyback Program, approved at the Board of Directors’ Meeting held on September 23, 2024, is to maximize value creation for shareholders

through an efficient capital structure management.

2. State

the number of (i) outstanding shares and (ii) treasury shares:

The Company currently has 1,133,963,579 (one billion,

one hundred and thirty-three million, nine hundred and sixty-three thousand, five hundred and seventy-nine) outstanding registered, book-entry

common shares with no par value issued. The Company does not have treasury shares on this date.

3. State

the number of shares that may be acquired or disposed of:

The Company may acquire up to 113,396,357 (one

hundred and thirteen million, three hundred and ninety-six thousand, three hundred and fifty-seven) registered, book-entry common shares

with no par value.

4. Describe

the main characteristics of the derivative instruments that the Company may use, if applicable:

The purchase or sale of options and structured

operations with derivative contracts, such as swaps, options and stock futures, is authorized under the Buyback Plan.

5. Describe,

if applicable, existing voting instructions or agreements between the Company and the other party of the transactions:

Not applicable, since the Company will carry out

transactions on B3 – Brasil, Bolsa, Balcão.

6. In

case of transactions carried out outside organized securities markets, state: (a) the maximum (minimum) price at which the shares will

be acquired (disposed of); and (b) if applicable, the reasons that justify the execution of the transaction at prices more than 10% (ten

percent) higher, in the case of acquisition, or more than 10% (ten percent) lower, in the case of disposal, than the average price, weighted

by volume, in the 10 (ten) previous trading sessions:

Not applicable, since the Company will carry out

transactions on B3 – Brasil, Bolsa, Balcão.

7. State,

if applicable, the impacts created by the trades on the Company’s shareholding control or management structure:

Not applicable, since the conclusion of the trades

authorized herein shall not affect the Company’s shareholding control or management structure.

8. Identify

the other parties, if applicable, and, in the case of a party related to the Company, as defined by the accounting rules governing this

matter, and provide the information required by Article 9 of CVM Resolution 81, March 29, 2022;

Not applicable, since the Company will carry out

transactions on B3 – Brasil, Bolsa, Balcão.

9. Indicate

the allocation of the proceeds, if applicable:

The proceeds to be utilized for the conclusion

of the trades authorized herein shall be the Company’s cash or cash equivalents, observing the limits established in the applicable

regulation.

10. Indicate

the maximum term to settle the authorized transactions:

The maximum term to settle the transactions authorized

herein is 18 (eighteen) months as of today, i.e. until March 23, 2026.

11. Identify

the financial institutions that will act as brokers, if applicable:

1. ATIVA INVESTIMENTOS S.A. CTCV, Address:

AV. DAS AMERICAS, 3500, SALAS 314 A 318. RIO DE JANEIRO / RJ - CEP: 22.640-102; 2. BGC LIQUIDEZ DTVM, Address:

AV ALM BARROSO, 52 - 23 ANDAR, SALA 2301. RIO DE JANEIRO / RJ – CEP: 20.031-000; 3. BRADESCO S/A CTVM, Address:

PRES. JUSCELINO KUBITSCHEK, 1309, 11º ANDAR. SÃO PAULO / SP - CEP: 04.543-011; 4. BTG PACTUAL CTVM

S.A., Address: AV FARIA LIMA, 3477 14º ANDAR, SÃO PAULO / SP - CEP: 04.538-133; 5. CREDIT SUISSE S.A. CTVM, Address:

R LEOPOLDO COUTO DE MAGALHÃES JR, 700, SÃO PAULO / SP – CEP: 04.542-000; 6. C6 CTVM LTDA., Address: AV

NOVE DE JULHO, 3186, SÃO PAULO / SP – CEP: 01.406-000; 7. GENIAL INSTITUCIONAL CCTVM S.A., Address: AV FARIA LIMA,

3400 - CONJ 92. SÃO PAULO / SP – CEP: 04.538-132; 8. J.P. MORGAN CCMV S.A., Address: AV BRIGADEIRO FARIA LIMA, 3729

– 13º ANDAR, SÃO PAULO / SP – CEP: 04.538-905; 9. LECCA DTVM LTDA., Address: R SÃO JOSÉ,

20 – SALA 201, RIO DE JANEIRO / RJ – CEP: 20.010-020; 10. MORGAN STANLEY CTVM S.A., Address: AV BRIGADEIRO FARIA LIMA,

3600 – 6º ANDAR, SÃO PAULO / SP – CEP: 04.538-132; 11. MERRILL LYNCH S.A. CTCM, Address: AV BRIGADEIRO

FARIA LIMA, 3400 – 11º e 12º ANDAR, SÃO PAULO / SP – CEP: 04.538-132; 12. SANTANDER CCVM S.A., Address:

AV PRES JUSCELINO KUBITSCHEK, 2041, CONJ 241 BL A, SÃO PAULO / SP – CEP: 04.543-011; 13. TULLETT PREBON BRASIL CVC LTDA.,

Address: R SÃO TOME, 86 – CONJ 211 E 212, SÃO PAULO / SP – CEP: 04.551-080; 14. UBS BRASIL CCTVM S.A.,

Address: AV. FARIA LIMA, 4.440 - 7° ANDAR, SÃO PAULO / SP – CEP: 04.538-132; 15. XP INVESTIMENTOS CCTVM S/A 3,

Address: AV ATAULFO DE PAIVA, 153 - SALA 201, RIO DE JANEIRO / RJ – CEP: 22.440-032; 16. CITIGROUP GLOBAL MARKETS BRASIL

CORRETORA DE CAMBIO TITULOS E VALORES MOBILIARIOS SA, Address: Avenida Paulista, 1111, Andar 14 - Bela Vista, São Paulo –

SP – CEP 01418-100; 17. SAFRA DISTRIBUIDORA DE TITULOS E VALORES MOBILIARIOS LTDA., Address: Avenida Paulista, 2150, 8º

andar, São Paulo – SP - CEP 01310-300; 18. ITAU CORRETORA DE VALORES S/A, Address: Avenida Brigadeiro Faria Lima,

3500, 3º andar, São Paulo – SP – CEP 04538-132.

12. Specify

the proceeds available to be utilized, according to Paragraph 1 of Article 8 of CVM Instruction 77, of March 29, 2022:

The proceeds to be utilized by the Company for

the conclusion of the trades authorized herein shall be the Company’s cash or cash equivalents, according to the limits established

in the applicable regulation.

13. Specify

why the Board of Directors members believe that the share buyback will not jeopardize compliance with the obligations assumed with creditors

or the payment of fixed or minimum mandatory dividends:

The Board of Directors believes that the conclusion

of the trades authorized herein shall not jeopardize the fulfillment of the obligations assumed by the Company, nor will they compromise

the payment of mandatory dividends, given the Company’s liquidity situation, indebtedness, and cash generation.

5

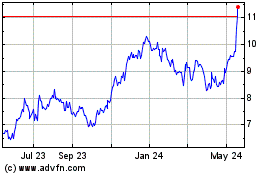

JBS (QX) (USOTC:JBSAY)

Historical Stock Chart

From Nov 2024 to Dec 2024

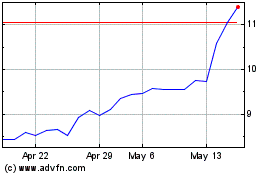

JBS (QX) (USOTC:JBSAY)

Historical Stock Chart

From Dec 2023 to Dec 2024