false

0001527702

0001527702

2024-09-12

2024-09-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): September

12, 2024

iQSTEL Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

000-55984 |

45-2808620 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| |

|

|

300 Aragon Avenue, Suite 375

Coral Gables, FL 33134 |

33134 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (954) 951-8191

|

________________________________________________

(Former name or former address, if changed since last

report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| |

[ ] |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

|

| |

[ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

SECTION 2 – Financial

Information

|

Item 2.02 | Results of Operations and Financial Condition.

|

|

We have issued a shareholder letter concerning our discussions with investment

banks for an uplist to a national exchange, our anticipated revenue results for 2024, our strategic plans and other matters.

The shareholder letter is furnished with this Current Report on Form 8-K

as Exhibits 99.1. The information furnished under this Item 2.02 and Item 9.01 of this Current Report on Form 8-K, including Exhibit 99.1,

shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise

subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any registration statement or other filing

under the Securities Act of 1933, as amended, regardless of any general incorporation by reference language in such filing, except as

shall be expressly set forth by specific reference in any such filing.

SECTION 9 – Financial Statements and Exhibits

| |

Item 9.01 | Financial Statements and Exhibits. |

| |

Exhibit No. |

Description |

| |

99.1 |

Corporate Presentation |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

iQSTEL Inc.

/s/ Leandro Iglesias

Leandro Iglesias

Chief Executive Officer

Date September 12, 2024

IQST - iQSTEL Meets Top Investment Banks in New York in

Conjunction with Nasdaq Uplisting Objective

NEW YORK, Sept. 12th, 2024 --

iQSTEL Inc. (OTC-QX: IQST) (www.iQSTEL.com), a US-based, multinational, fully reporting, and audited publicly listed telecommunications

and technology company, preparing for a Nasdaq uplisting, today released details regarding the company’s leadership team visit to

New York last week. The company engaged in productive discussions with five investment banks specializing in supporting small-cap companies

with market capitalizations below $500 million. Each of these banks expressed a strong interest in partnering with us, recognizing the

significant potential in iQSTEL's growth trajectory and our journey towards uplisting to Nasdaq.

During these meetings, management shared

the company’s strategic vision, plans for future growth, and recent substantial developments. We also discussed strategies to enhance

and expand shareholder value, focusing on consolidating divisions, rebranding, and leveraging the Nasdaq uplisting to position iQSTEL

on a much more substantial exchange, adding credibility and recognition our company now deserves.

To provide our valued shareholders a

clearer picture of our path forward, we’ve summarized the core message of our presentation in the following letter:

Dear Valued Shareholders,

As we reflect on our remarkable journey

and look ahead to an exciting future, I invite you to join us as we continue building on the success of iQSTEL. Our company, rooted in

decades of experience in the telecommunications industry, has achieved exponential growth since its inception. With your continued support,

we are poised to reach new heights.

Our Story: From Inception to Innovation

iQSTEL’s journey began with deep

roots in the global telecommunications sector. My CFO, Alvaro Quintana, and I spent years managing international business at major telecom

subsidiaries, Alvaro at Telecom Italia’s DIGITEL, and myself at Verizon’s Cantv. Together, we bring over 50 years of combined

experience in international voice, SMS, fiber-optic, and satellite connectivity. Throughout our careers, we built strong business

and personal relationships with the largest players in the telecom arena, further cementing the foundation for iQSTEL’s success.

This wealth of knowledge and personal relations became the foundation for what would later become iQSTEL.

In 2008, we co-founded Etelix

with a focus on international voice services, leveraging our expertise and network to establish a strong foothold in the industry. By

2018, we transitioned into a publicly traded company, recognizing that this path would provide us access to capital markets, fueling the

exponential growth we had envisioned. Today, iQSTEL stands as a leader in international telecommunications, constantly evolving and expanding

into new, innovative areas.

Enhancing Shareholder Value

During our recent meetings with five

investment banks in New York, we discussed our strategic initiatives for increasing shareholder value, including the consolidation of

divisions, a comprehensive rebranding strategy, and the anticipated Nasdaq uplisting. The move to Nasdaq will place iQSTEL on a substantial

exchange that brings added credibility, enhanced exposure, and broader access to investors, further driving shareholder value as we continue

to scale our operations.

Explosive Growth and Strong Momentum

In 2018, iQSTEL generated $13.8 million

in revenue. By 2023, we had reached $144.5 million, a tenfold increase in just five years. Our forecast for 2024 is set at $290 million,

with $134 million already reported in the first half of the year. Historically, the second half of the year shows stronger results, reinforcing

our confidence in achieving our forecast.

This rapid growth is a direct result

of a strategic blend of acquisitions, ventures, and organic development. Since 2018, we have completed 11 acquisitions and ventures,

primarily in telecommunications, carefully selecting companies that complement our existing portfolio and bringing in top industry executives

to drive further expansion. In 2023, we reported $144.5 million in revenue, with $50 million—one-third of the total—coming

from organic growth. For 2024, we expect to achieve $290 million in revenue, with $90 million in organic growth, again accounting for

one-third of the total forecast.

Our Executive Strength: A Deep Bench

of Global Expertise

At iQSTEL, our success lies in our ability

to integrate acquisitions and the top executive team as partners into our broader strategy, allowing synergies to propel organic growth.

Today, we have 100 employees spread across 20 countries, operating in 17 time zones, and our business serves major telecom players like

Verizon, T-Mobile, Telefonica, Telecom Italia, British Telecom, Deutsche Telecom, Vodafone, Millicom, Orange, Etisalat, China Telecom,

among others.

Our executive team not only brings over

250 years of combined experience in telecommunications and international business, but also boasts deep connections with major companies

worldwide. This structure allows us to take on significant new business without adding additional management, ensuring scalable and efficient

growth as we continue to expand globally.

Our presence is global, with offices

in Miami, Venezuela, Argentina, UK, Switzerland, Turkey, and Dubai. We maintain more than 400 high value network interconnections around

the world, delivering international voice, SMS, and connectivity services that form the core of our business.

Strategic Focus on High-Margin SMS

Services

Our current telecom voice services generate

an 8% gross profit, while part of our SMS portfolio offers over 20% in gross margin. Over the past two years, we have rapidly developed

this high-margin SMS portfolio, making it a key focus of our growth strategy. By increasing sales in this segment by just 10%, we can

achieve the equivalent of a 25% increase in our voice services. A key justification for acquiring QXTEL was the SMS portfolio it brings,

which aligns perfectly with our strategy to prioritize higher-margin products. This shift positions us to steadily grow our operating

income while maintaining our current business trajectory.

Selective and Strategic Acquisitions

and Ventures

In acquiring our 11 subsidiaries and

ventures, we carefully selected targets that added, focusing on adding top executives in the international telecom arena while gaining

high-value in terms of products, strategic customer relationships, and expanding our international footprint. This approach has allowed

us to establish a strong business position and maintain a high quality of service across the U.S., Latin America, Europe, Africa, and

the Middle East.

Preparing for Nasdaq: A Strategic

Approach

We have been diligently

preparing for our uplisting to Nasdaq for two years, a pivotal moment for iQSTEL. We have already met almost all the requirements, including

the establishment of an Independent Board of Directors, Audit Committee, Compensation Committee, Ethics Code Committee, and fulfilling

the shareholders’ equity requirement, among others. The only remaining requirement is achieving the minimum price per share, a matter

we have communicated in detail to our 22,000 shareholders.

In conjunction with the Nasdaq uplisting,

we are implementing several strategic initiatives, including:

- A complete branding

strategy led by a professional marketing agency.

- Consolidating the ownership

of our subsidiaries to create a streamlined business structure.

- Implementing a unified

technological platform to enable synergies, cross-selling, and up-selling across our product and service lines.

These measures are designed to accelerate

our growth and profitability. By reducing costs through platform consolidation and refining our business operations, we anticipate adding

$2 million to our operating income. Simultaneously, our growing revenue base enables us to expand without significant new cost contributions,

leading to an even more rapid increase in our bottom line.

A Bright Future: High-Margin Products

and Strategic Growth

We believe iQSTEL has a brilliant future,

and we are laying the groundwork for sustained success. Over the past few years, we have built a strong business platform, positioning

ourselves to offer additional high-margin products and services to our existing telecom customers. This is the cornerstone of our long-term

strategy to develop high-tech, high-margin products in emerging sectors.

Our efforts are already underway in

key areas like Fintech, Electric Vehicles (EV), and AI-driven services. These products will not only diversify our revenue streams but

also leverage our existing relationships with major telecom clients, creating significant cross-selling opportunities.

Path to $1 Billion in Revenue

Our ambitious business plan projects

iQSTEL achieving $500 million in organic revenue by 2027, with $20 million in operating income. Beyond that, we are actively exploring

a strategic acquisition that could double our business size, positioning us to reach $1 billion in revenue by 2027, with $40 million in

operating income. This strategic acquisition, and being a $1 billion revenue corporation, will serve as catalysts for growth while also

preparing the company for investments in fiber-optic networks, cell towers, data centers, and satellite systems. Our current plan to continue

building and expanding iQSTEL spans the next 20-30 years.

Funding and the Road Ahead

In order to support our vision and strengthen

our balance sheet, we are seeking to raise up to $10 million within the 6 months. These funds will be used in part to restructure existing

debt and reinforce our balance sheet as we prepare for our Nasdaq uplisting. iQSTEL management firmly believes the company is currently

undervalued. Our revenue per share was $0.83 in December 2023, and we expect to reach $1.50 by the end of 2024. With a current trading

price of $0.17 per share, we believe there is a significant opportunity

We are actively selecting an investment

bank to guide us through the final stage of our Nasdaq uplisting and drive our continued growth, positioning us to seize every opportunity

and maximize our potential in the short, mid, and long term.

A Call to iQSTEL’s Future

iQSTEL is at an inflection point, and

the next few years will define our success for decades to come. We are building a company that will not only thrive today but will also

stand the test of time, with a vision to lead in the telecommunications, fintech, EV, and AI spaces.

We genuinely believe that now is the

time to be part of this journey in iQSTEL, as we continue to deliver on our promises and create lasting value for our shareholders. Thank

you for your trust and support.

Sincerely,

Leandro Jose Iglesias

CEO, and Chairman, iQSTEL Inc.

About IQSTEL (updated):

iQSTEL

Inc. (OTC-QX: IQST) (www.iQSTEL.com)

is a US-based, multinational publicly listed company preparing for a Nasdaq up-listing with an FY2023 $144 million revenue,

and with a $290 Million Dollar Revenue forecast and a Positive Operating Income of 7 digits forecast for FY-2024. iQSTEL's mission is

to serve basic human needs in today's modern world by making the necessary tools accessible regardless of race, ethnicity, religion, socioeconomic

status, or identity. iQSTEL recognizes that in today's modern world, the pursuit of the human hierarchy of needs (physiological,

safety, relationship, esteem and self-actualization) is marginalized without access to ubiquitous communications, the freedom of virtual

banking, clean affordable mobility and information and content. iQSTEL has 4 Business Divisions delivering accessibly to the necessary

tools in today's pursuit of basic human needs: Telecommunications, Fintech, Electric Vehicles and Metaverse.

| · | The Enhanced Telecommunications

Services Division (Communications) includes VoIP, SMS, International Fiber-Optic, Proprietary Internet of Things (IoT), and a Proprietary

Mobile Portability Blockchain Platform. |

| · | The Fintech Division (Financial

Freedom) includes remittances services, top up services, Master Card Debit Card, a US Bank Account (No SSN required), and a Mobile App. |

| · | The Electric Vehicles (EV) Division

(Mobility) offers Electric Motorcycles and plans to launch a Mid Speed Car. |

| · | The Artificial Intelligence (AI)-Enhanced

Metaverse Division (information and content) includes an enriched and immersive white label proprietary AI-Enhanced Metaverse platform

to access products, services, content, entertainment, information, customer support, and more in a virtual 3D interface. |

The

company continues to grow and expand its suite of products and services both organically and through mergers and acquisitions.

iQSTEL has completed 11 acquisitions since June 2018 and continues to develop an active pipeline of potential future acquisitions.

Safe

Harbor Statement: Statements in this news release may be "forward-looking statements". Forward-looking statements include, but

are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions, or any other information relating

to our future activities or other future events or conditions. These statements are based on current expectations, estimates, and projections

about our business based partly on assumptions made by management. These statements are not guarantees of future performance and involve

risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual outcomes and results may and are likely to differ

materially from what is expressed or forecasted in forward-looking statements due to numerous factors. Any forward-looking statements

speak only as of the date of this news release, and iQSTEL Inc. undertakes no obligation to update any forward-looking statement to reflect

events or circumstances after the date of this news release. This press release does not constitute a public offer of any securities for

sale. Any securities offered privately will not be or have not been registered under the Act and may not be offered or sold in the

United States absent registration or an applicable exemption from registration requirements.

iQSTEL

Inc.

IR US Phone: 646-740-0907

IR Email: investors@iqstel.com

Contact

Details

iQSTEL Inc.

+1 646-740-0907

investors@iqstel.com

Company

Website

www.iqstel.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

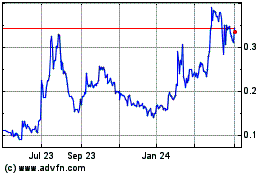

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Feb 2025 to Mar 2025

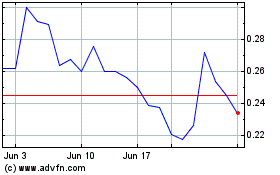

iQSTEL (QX) (USOTC:IQST)

Historical Stock Chart

From Mar 2024 to Mar 2025