Imperial Brands Launches Buyback of Up to GBP1 Billion; Fiscal Year 2022 Performance in Line With Views

October 06 2022 - 2:53AM

Dow Jones News

By Anthony O. Goriainoff

Imperial Brands PLC said Thursday that it is launching a

share-buyback program of up to one billion pounds ($1.13 billion),

and that its performance for the year ended Sept. 30 was in line

with expectations.

The FTSE 100 tobacco group--which houses Davidoff, Gauloises and

JPS among its brands--said that including dividends and buybacks,

total capital returns in fiscal 2023 are expected to be above

GBP2.3 billion, and that this represented around 13% of its current

market capitalization.

Imperial said that the progress of its next-generation-product

launches supports further market rollouts, and that the company is

on track to deliver on its five-year plan.

"In line with previous guidance, we expect full-year net revenue

and group adjusted operating profit to both grow by around 1% at

constant currency," Imperial said.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

October 06, 2022 02:38 ET (06:38 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

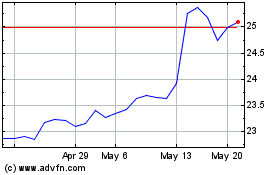

Imperial Brands (QX) (USOTC:IMBBY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Imperial Brands (QX) (USOTC:IMBBY)

Historical Stock Chart

From Jul 2023 to Jul 2024