UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ Quarterly Report pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended June 30, 2024

☐ Transition Report pursuant to 13 or 15(d)

of the Securities Exchange Act of 1934

For the transition period from __________ to__________

Commission File Number: 000-56239

Ilustrato Pictures International, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | | 27-2450645 |

(State or other jurisdiction of

incorporation or organization) | | (IRS Employer

Identification No.) |

26 Broadway, Suite 934

New York, NY 10004

(Address of principal executive offices)

917-522-3202

(Registrant’s telephone number)

(Former name, former address and former

fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter

period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically

every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter)

during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes

☐ No

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

Securities registered pursuant to Section

12(b) of the Act: None

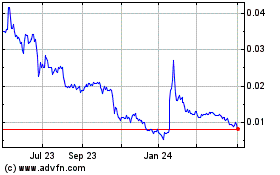

State the number of shares outstanding of each of the issuer’s

classes of common stock, as of the latest practicable date: 2,291,192,403 common shares as of August 26, 2024

EXPLANATORY NOTE

This Quarterly Report on Form 10-Q for the period

ended June 30, 2024 (the “Report”) including, but not limited to, the financial statements, related notes, and other information

included herein has not been reviewed by the Company’s independent public accounting firm prior to the filing of this Report. On

August 19, 2024, the Company engaged a new independent registered public accounting firm. The new independent registered

public accounting firm will review this Form 10-Q and upon the completion of its review, the Company will file the requisite amendment

to this Report.

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

Our financial statements included in this Form 10-Q are as follows:

These financial statements have been prepared in accordance with accounting

principles generally accepted in the United States of America for interim financial information and the SEC instructions to Form 10-Q.

In the opinion of management, all adjustments considered necessary for a fair presentation have been included. Operating results for the

interim period ended June 30, 2024, are not necessarily indicative of the results that can be expected for the full year.

ILUSTRATO PICTURES INTERNATIONAL INC.

CONSOLIDATED BALANCE SHEETS

(UNAUDITED/NOT REVIEWED)

| | |

June

30,

2024

Not Reviewed | | |

December 31,

2023

Audited | |

| ASSETS | |

| | |

| |

| Current Assets | |

| | |

| |

| Cash and Cash Equivalents | |

$ | 302,254 | | |

$ | 213,073 | |

| Inventory | |

| 2,025,381 | | |

| 1,612,800 | |

| Accounts Receivable | |

| 7,531,969 | | |

| 22,825,113 | |

| Deposits, Prepayments, & Advances | |

| 785,311 | | |

| 0 | |

| Other Current Assets | |

| 10,116,487 | | |

| 5,451,159 | |

| Total Current Assets | |

| 20,761,402 | | |

| 30,102,145 | |

| | |

| | | |

| | |

| Non-Current Assets | |

| | | |

| | |

| Long Term Investments | |

| 25,264,697 | | |

| 23,639,209 | |

| Property and Equipment | |

| 186,207 | | |

| 139,523 | |

| Right-of-Use assets | |

| 259,304 | | |

| 0 | |

| Capital work in progress | |

| 654,666 | | |

| 0 | |

| Receivable Non-Current Portion | |

| 7,157,417 | | |

| 0 | |

| Goodwill | |

| 11,115,562 | | |

| 8,606,289 | |

| Total Non-current Assets | |

| 44,637,853 | | |

| 32,385,021 | |

| Total Assets | |

$ | 65,399,255 | | |

$ | 62,487,166 | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts Payable | |

$ | 4,136,227 | | |

$ | 9,891,505 | |

| Lease Operating Liabilities | |

| 90,875 | | |

| 0 | |

| Related Party Payables | |

| 406,235 | | |

| 0 | |

| Other Current Liabilities | |

| 13,780,865 | | |

| 8,825,966 | |

| Total Current Liabilities | |

| 18,414,202 | | |

| 18,717,471 | |

| | |

| | | |

| | |

| Non-Current Liabilities | |

| | | |

| | |

| Lease Operating Non-Current Portion | |

| 180,062 | | |

| 0 | |

| Notes payable – long-term | |

| 14,355,776 | | |

| 11,740,619 | |

| Other Non-Current Liabilities | |

| 1,844,602 | | |

| 2,121,455 | |

| Total Long-Term Liabilities | |

| 16,380,440 | | |

| 13,862,074 | |

| Total Liabilities | |

| 34,794,642 | | |

| 32,579,545 | |

| Stockholders’ Equity | |

| | | |

| | |

| Class A - 10,000,000 authorized; 10,000,000 issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | |

| 10,000 | | |

| 10,000 | |

| Class B - 100,000,000 authorized; 3,560,000 and 4,064,000 issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | |

| 3,560 | | |

| 4,064 | |

| Class C - 10,000,000 authorized; 0 issued and outstanding as of June 30, 2024 and December 31, 2023 | |

| 0 | | |

| 0 | |

| Class D - 60,741,000 authorized; 60,741,000 issued and outstanding as of December 31, 2023, and 2022, respectively | |

| 60,741 | | |

| 60,741 | |

| Class E - 5,000,000 authorized; 3,172,175 issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | |

| 3,172 | | |

| 3,172 | |

| Class F - 50,000,000 authorized, 1,455,750 and 1,618,250 issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | |

| 1,456 | | |

| 1,618 | |

Common stock; $0.001 par value; 200,000,000 shares authorized; 133,006,691and 127,129,694 shares issued and outstanding as of June 30, 2024, and December 31, 2023, respectively | |

| 2,107,853 | | |

| 1,720,183 | |

| Additional paid-in capital | |

| 26,019,639 | | |

| 24,521,777 | |

| Retained Earnings/ accumulated Deficit | |

| -5,754,719 | | |

| -100,292 | |

| Capital Reserve | |

| 5,455,393 | | |

| - | |

| Noncontrolling interest | |

| 2,697,518 | | |

| 3,686,358 | |

| Total stockholders’ Equity | |

| 30,604,613 | | |

| 29,907,621 | |

| Total liabilities and stockholders’ Equity | |

$ | 65,399,255 | | |

$ | 62,487,166 | |

The accompanying notes are an integral part of

these unaudited/not reviewed consolidated financial statements.

ILUSTRATO PICTURES INTERNATIONAL INC.

CONSOLIDATED STATEMENT OF OPERATIONS

(UNAUDITED/NOT REVIEWED)

| | |

For the Three Months Ended | | |

For the Six Months Ended | |

| | |

30-Jun-24

Not Reviewed | | |

30-Jun-23

Not Reviewed | | |

30-Jun-24

Not Reviewed | | |

30-Jun-23

Not Reviewed | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

| 4,245,791 | | |

| 1,943,690 | | |

| 5,345,259 | | |

| 3,595,851 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| 2,688,540 | | |

| 1,375,004.00 | | |

| 3,467,733 | | |

| 2,553,284.00 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 1,557,251 | | |

| 568,686.00 | | |

| 1,877,526 | | |

| 1,042,567.00 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Professional fees | |

| 142,101 | | |

| 0 | | |

| 436,020 | | |

| 0 | |

| General and administrative | |

| 1,814,552 | | |

| 2,907,943 | | |

| 4,215,707 | | |

| 4,159,976 | |

| Total operating expenses | |

| 1,956,653 | | |

| 2,907,943 | | |

| 4,651,727 | | |

| 4,159,976 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from operations | |

| (399,402 | ) | |

| (2,339,257 | ) | |

| (2,774,201 | ) | |

| (3,117,409 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other (income) expenses | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| 255,669 | | |

| 1,116,537 | | |

| 438,694 | | |

| 1,542,509 | |

| Other Income | |

| (107,050 | ) | |

| (1,164 | ) | |

| (506,604 | ) | |

| (4,703 | ) |

| Total other (income) expense, net | |

| 148,619 | | |

| 1,115,373 | | |

| (67,910 | ) | |

| 1,537,806 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Income (Loss) | |

| (548,021 | ) | |

| (3,454,630 | ) | |

| (2,706,291 | ) | |

| (4,655,215 | ) |

| Less: net income attributable to noncontrolling interest | |

| 152,547 | | |

| - | | |

| 19,111 | | |

| - | |

| Net income (loss) attributable to ILUS stockholders | |

| (700,568 | ) | |

| (3,454,630 | ) | |

| (2,725,402 | ) | |

| (4,655,215 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding | |

| 1,959,529,013 | | |

| 1,444,380,699 | | |

| 1,959,529,013 | | |

| 1,444,380,699 | |

| | |

| | | |

| | | |

| | | |

| | |

Net income (loss) per common share - basic and diluted | |

| (0.00 | ) | |

| (0.00 | ) | |

| (0.00 | ) | |

| (0.00 | ) |

The accompanying notes are an integral part of

these unaudited/not reviewed consolidated financial statements.

ILUSTRATO PICTURES INTERNATIONAL INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’

EQUITY

(UNAUDITED/NOT REVIEWED)

FOR THE PERIOD ENDED JUNE 30, 2024

| | |

| Preferred Stock A | | |

| Preferred Stock B | | |

| Preferred Stock D | | |

| Preferred Stock E | | |

| Preferred Stock F | | |

| Common Stock | | |

| Minority

Interest | | |

| Capital Reserve | | |

| Additional Paid-in Capital | | |

| Retain Loss | | |

| Total Equity | |

| | |

| Shares | | |

| Amount | | |

| Shares | | |

| Amount | | |

| Shares | | |

| Amount | | |

| Shares | | |

| Amount | | |

| Shares | | |

| Amount | | |

| Shares | | |

| Amount | | |

| Amount | | |

| Amount | | |

| Amount | | |

| Amount | | |

| Amount | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, December 31, 2023 | |

| 10,000,000 | | |

| 10,000 | | |

| 4,064,000 | | |

| 4,064 | | |

| 60,741,000 | | |

| 60,741 | | |

| 3,172,175 | | |

| 3,172 | | |

| 1,618,250 | | |

| 1,618 | | |

| 1,720,182,651 | | |

| 1,720,183 | | |

| 3,686,358 | | |

| 0 | | |

| 24,521,777 | | |

| (100,292 | ) | |

| 29,907,621 | |

| Shared Issued | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 0 | |

| Convertible

notes converted to common stock | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 11,986,538 | | |

| 11,987 | | |

| | | |

| | | |

| 40,807 | | |

| | | |

| 52,794 | |

| Common stock issued against Warrant | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 26,566,901 | | |

| 26,567 | | |

| | | |

| | | |

| 70,933 | | |

| | | |

| 97,500 | |

| Common stock issued for Cash | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 22,349,206 | | |

| 22,349 | | |

| | | |

| | | |

| 97,651 | | |

| | | |

| 120,000 | |

| Common stock issued as commitment shares | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 4,750,000 | | |

| 4,750 | | |

| | | |

| | | |

| 50,200 | | |

| | | |

| 54,950 | |

| Common stock as compensation to AJB Capital Investments LLC | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 75,000,000 | | |

| 75,000 | | |

| | | |

| | | |

| 558,000 | | |

| | | |

| 633,000 | |

| common stock as compensation to RB Capital Partners LLC | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 50,000,000 | | |

| 50,000 | | |

| | | |

| | | |

| 150,000 | | |

| | | |

| 200,000 | |

| Preferred Stock class F issued | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 162,500 | | |

| 163 | | |

| | | |

| | | |

| | | |

| | | |

| 199,838 | | |

| | | |

| 200,000 | |

| Preferred stock converted into common stock | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (50,000 | ) | |

| (50 | ) | |

| 5,000,000 | | |

| 5,000 | | |

| | | |

| | | |

| (4,950 | ) | |

| | | |

| 0 | |

| Minority Interest - Hyperion - Removed | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (131,319 | ) | |

| | | |

| | | |

| | | |

| (131,319 | ) |

| Minority Interest - QI - Removed | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (1,922,351 | ) | |

| | | |

| | | |

| | | |

| (1,922,351 | ) |

| Changes in Retained earnings | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 4,195,517 | | |

| 4,195,517 | |

| Capital Reserve | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 5,520,734 | | |

| | | |

| | | |

| 5,520,734 | |

| Net Income | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (206,332 | ) | |

| | | |

| | | |

| (1,951,939 | ) | |

| (2,158,270 | ) |

| Minority Interest | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 0 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Shareholders’ Equity as of March 31, 2024 | |

| 10,000,000 | | |

| 10,000 | | |

| 4,064,000 | | |

| 4,064 | | |

| 60,741,000 | | |

| 60,741 | | |

| 3,172,175 | | |

| 3,172 | | |

| 1,730,750 | | |

| 1,731 | | |

| 1,915,835,296 | | |

| 1,915,836 | | |

| 1,426,357 | | |

| 5,520,734 | | |

| 25,684,256 | | |

| 2,143,286 | | |

| 36,770,175 | |

| Shared Issued | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 0 | |

| Common Stock Share through Convertible | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 12,731,764 | | |

| 12,732 | | |

| | | |

| | | |

| 93,444 | | |

| | | |

| 106,176 | |

| Converted F Stock to Common | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (275,000 | ) | |

| (275 | ) | |

| 27,500,000 | | |

| 27,500 | | |

| | | |

| | | |

| (27,225 | ) | |

| | | |

| 0 | |

| Compensation Common Stock | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 101,385,800 | | |

| 101,386 | | |

| | | |

| | | |

| 319,060 | | |

| | | |

| 420,446 | |

| Converted B Stock to Common | |

| | | |

| | | |

| (504,000 | ) | |

| (504 | ) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 50,400,000 | | |

| 50,400 | | |

| | | |

| | | |

| (49,896 | ) | |

| | | |

| 0 | |

| Change in Capital Reserve | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (65,341 | ) | |

| | | |

| | | |

| (65,341 | ) |

| Adjustment | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (7,197,437 | ) | |

| (7,197,437 | ) |

| Change in shareholder’s account | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 1,118,615 | | |

| | | |

| | | |

| | | |

| 1,118,615 | |

| Net Income | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 152,547 | | |

| | | |

| | | |

| (700,568 | ) | |

| (548,021 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Shareholders’ Equity as of June 30, 2024 | |

| 10,000,000 | | |

| 10,000 | | |

| 3,560,000 | | |

| 3,560 | | |

| 60,741,000 | | |

| 60,741 | | |

| 3,172,175 | | |

| 3,172 | | |

| 1,455,750 | | |

| 1,456 | | |

| 2,107,852,860 | | |

| 2,107,853 | | |

| 2,697,518 | | |

| 5,455,393 | | |

| 26,019,639 | | |

| (5,754,719 | ) | |

| 30,604,613 | |

FOR THE PERIOD ENDED JUNE 30, 2023

| | |

| Preferred Stock A | | |

| Preferred Stock B | | |

| Preferred Stock D | | |

| Preferred Stock E | | |

| Preferred Stock F | | |

| Common Stock | | |

| Minority

Interest | | |

| Capital Reserve | | |

| Additional Paid-in Capital | | |

| Retain Loss | | |

| Total Equity | |

| | |

| Shares | | |

| Amount | | |

| Shares | | |

| Amount | | |

| Shares | | |

| Amount | | |

| Shares | | |

| Amount | | |

| Shares | | |

| Amount | | |

| Shares | | |

| Amount | | |

| Amount | | |

| Amount | | |

| Amount | | |

| Amount | | |

| Amount | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance December 31,2022 | |

| 10,000,000 | | |

| 10,000 | | |

| 3,400,000 | | |

| 3,400 | | |

| 60,741,000 | | |

| 60,741 | | |

| 3,172,175 | | |

| 3,172 | | |

| 1,633,250 | | |

| 1,634 | | |

| 1,355,230,699 | | |

| 1,355,230 | | |

| 24,386,712 | | |

| | | |

| 20,631,261 | | |

| 9,664,983 | | |

| 56,117,132 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock issued | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 63,850,000 | | |

| 63,850 | | |

| | | |

| | | |

| 484,650 | | |

| | | |

| 548,500 | |

| Common stock cancelled | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (40,000,000 | ) | |

| (40,000 | ) | |

| | | |

| | | |

| | | |

| 40,000 | | |

| 0 | |

| Preferred stock issued | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 35,000 | | |

| 35 | | |

| | | |

| | | |

| | | |

| | | |

| 2,205 | | |

| | | |

| 2,240 | |

| Adjustment | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 1,306,458 | | |

| | | |

| | | |

| 100 | | |

| 1,306,558 | |

| Changes in Retained earnings | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (1,640,192 | ) | |

| (1,640,192 | ) |

| Current Quarter Income | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 914,662 | | |

| 914,662 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Shareholders’ Equity as of March 31, 2023 | |

| 10,000,000 | | |

| 10,000 | | |

| 3,400,000 | | |

| 3,400 | | |

| 60,741,000 | | |

| 60,741 | | |

| 3,172,175 | | |

| 3,172 | | |

| 1,668,250 | | |

| 1,668 | | |

| 1,379,080,699 | | |

| 1,379,081 | | |

| 25,693,170 | | |

| | | |

| 21,118,116 | | |

| 8,979,553 | | |

| 57,248,900 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock issued | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 55,300,000 | | |

| 55,300 | | |

| | | |

| | | |

| 547,800.00 | | |

| | | |

| 603,100 | |

| Preferred converted into Common stock | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 10,000,000 | | |

| 10,000 | | |

| | | |

| | | |

| | | |

| | | |

| 10,000 | |

| Preferred stock converted | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (100,000 | ) | |

| (100 | ) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (100 | ) |

| Preferred stock issued | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 100,000 | | |

| 100 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 100 | |

| Adjustment | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (198 | ) | |

| (198 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 0 | |

| Changes in Retainer Earnings | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (216,214 | ) | |

| (216,214 | ) |

| Current Quarter Income | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 980,224 | | |

| 980,224 | |

| Share of profit transferred to Non-Controlling Interest | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 3,980,873 | | |

| | | |

| | | |

| (2,386,489 | ) | |

| 1,594,384 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Shareholders’ Equity as of June 30, 2023 | |

| 10,000,000 | | |

| 10,000 | | |

| 3,400,000 | | |

| 3,400 | | |

| 60,741,000 | | |

| 60,741 | | |

| 3,172,175 | | |

| 3,172 | | |

| 1,668,250 | | |

| 1,668 | | |

| 1,444,380,699 | | |

| 1,444,381 | | |

| 29,674,043 | | |

| 0 | | |

| 21,665,916 | | |

| 7,356,876 | | |

| 60,220,196 | |

The

accompanying notes are an integral part of these unaudited/not reviewed consolidated financial statements.

ILUSTRATO PICTURES INTERNATIONAL INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED/NOT REVIEWED)

| | |

June 30,

2024 | | |

June 30,

2023 | |

| Cash flows from operating activities | |

| | |

| |

| Loss for the period | |

| (2,706,291 | ) | |

| (4,655,215 | ) |

| | |

| | | |

| | |

| Adjustment to reconcile net gain (loss) to net cash | |

| | | |

| | |

| Finance cost | |

| 438,694 | | |

| 0 | |

| Non-Cash Stock Compensation Expense | |

| 679,113 | | |

| 0 | |

| Stock issued for Services | |

| | | |

| | |

| Amortization | |

| 58,393 | | |

| | |

| Commitment fees | |

| 248,350 | | |

| 0 | |

| Depreciation - PPE | |

| 38,680 | | |

| 31,868 | |

| Other income | |

| (506,604 | ) | |

| 0 | |

| Discount on convertible Notes | |

| 77,522 | | |

| 0 | |

| Changes in Assets and Liabilities, net | |

| | | |

| | |

| Current Assets | |

| 9,429,924 | | |

| (1,937,566 | ) |

| Other Current Liabilities | |

| (303,269 | ) | |

| (68,940,644 | ) |

| Net cash (used In) provided by operating activities | |

| 7,454,512 | | |

| (75,501,557 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Addition of Fixed Assets | |

| (740,030 | ) | |

| (948,437 | ) |

| Right of use Assets | |

| (259,304 | ) | |

| 0 | |

| Changes in Non-current assets | |

| (11,292,178 | ) | |

| 43,170,769 | |

| Changes in Non- Current Liabilities | |

| 2,338,304 | | |

| 2,567,583 | |

| Net cash used in investing activities | |

| (9,953,208 | ) | |

| 44,789,915 | |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| | |

| | | |

| | |

| Common Stock issued | |

| 387,670 | | |

| 52,034,434 | |

| Lease Finance | |

| 180,062 | | |

| 0 | |

| Preferred Stock Issued | |

| (666 | ) | |

| 5,455,341 | |

| Finance cost | |

| (438,694 | ) | |

| 0 | |

| Discount on convertible Notes | |

| (77,522 | ) | |

| 0 | |

| Additional Paid-up Capital | |

| 1,497,862 | | |

| 4,262,103 | |

| Changes in Retained Earnings & MI | |

| 1,039,165 | | |

| (30,990,287 | ) |

| | |

| | | |

| 0 | |

| Net cash generated from financing activities | |

| 2,587,877 | | |

| 30,761,591 | |

| | |

| | | |

| | |

| Net increase/(decrease) in cash and cash equivalents | |

| 89,181 | | |

| 49,949 | |

| Cash and cash equivalents at the beginning of the year | |

| 213,073 | | |

| 163,124 | |

| Cash and cash equivalents at end of the year | |

| 302,254 | | |

| 213,073 | |

The accompanying notes are an integral part of

these unaudited/not reviewed consolidated financial statements.

ILUSTRATO PICTURES INTERNATIONAL INC.

NOTES TO AUDITED FINANCIAL STATEMENTS

NOTE 1: ORGANIZATION, HISTORY AND BUSINESS

(A) We were incorporated as a Superior Venture

Corp. on April 27, 2010, in the State of Nevada to sell wine varietals. On November 9, 2012, we entered into an Exchange Agreement with

Ilustrato Pictures Ltd., a British Columbia corporation (Ilustrato BC”), whereby we acquired all the issued and outstanding common

stock of Ilustrato BC. On November 30, 2012, Ilustrato BC transferred all of its assets and liabilities to Ilustrato Pictures Limited,

our wholly-owned subsidiary in Hong Kong (“Ilustrato HK”). On February 11, 2013, we changed the name to Ilustrato Pictures

International, Inc.

(B) On April 1, 2016, Barton Hollow and the newly

elected director of the issuer caused the Issuer to enter into a letter of Intent to merge with Cache Cabinetry, LLC, and Arizona limited

liability company. Pursuant to the Letter of Intent, the parties thereto would endeavor to arrive at, and enter into, a definitive merger

agreement providing for the Merger. As an inducement to the members of Cache Cabinetry, LLC to enter into the Letter of Intent and thereafter

transact, the Issuer caused to be issued 360,000,000 shares of its common stock to the members.

(C) Subsequently, on April 6, 2016, the Issuer

and Cache Cabinetry, LLC entered into a definitive agreement and Plan of Merger (the “Merger Agreement”). Concomitant therewith,

the stockholders of the Issuer elected Derrick McWilliams, the President of Cache Cabinetry, LLC Chief Executive Officer of the Issuer,

who along with Barton Hollow, ratified and approved the Merger Agreement and Merger.

(D) The Merger closed on June 3, 2016. The merger

is designed as a reverse subsidiary merger pursuant to Section 368(a)(2)(E) of the Internal Revenue Code. That is, upon closing, Cache

Cabinetry LLC will merge into a newly created subsidiary of the Issuer with the members of Cache Cabinetry, LLC receiving shares of the

common stock of the Issuer as consideration therefor. Upon closing of the Merger, Cache Cabinetry, LLC will be the surviving corporation

in its merger with the wholly-owned subsidiary of the Issuer and, therefore has become the wholly-owned operating subsidiary of the Issuer.

(E) On November 9th, 2018, the Company entered

into a Term Sheet for a Plan of Merger and Control with Larson Elmore.

(F) As a part of the share purchase arrangement

between Lee Larson Elmore and FB Technologies Global Inc., Nick Link, the owner of FB Technologies Global Inc. replaced Lee Larson Elmore

as CEO of Ilustrato Pictures International Inc. on January 14, 2021, where we eventually got control over activities and books of accounts

of Ilustrato Pictures International Inc. So, we are not aware about facts mentioned above vide note no. 1(A), 1(B), 1(C), 1(D), 1(E),

1(F) and 1(G) ‘organization, history, and business’ as they are related to prior to the date on which control over activities

and books of accounts of Ilustrato Pictures International Inc. were handed over to us. Thus, those events have been reiterated as disclosed

in previous fillings made by the preceding management of the company with the SEC.

(G) On May 18, 2020, the Company entered into

a definitive agreement and Plan of Merger with FB Technologies Global, Inc, the shareholders of FB Technologies Global, Inc. were issued

3,172,175 shares of Series E Preferred Stock for their shares 360,000,000 common shares, 60,741,000 Preference D and 10,000,000 Preference

A Shares. A final tranche of preference shares subject to performance to be issued in Quarter 1 of 2022. The merger was consummated on

January 14, 2021.

(H) Firebug Mechanical Equipment LLC was incorporated

on May 8, 2017. ILUS acquired 100% of this company on January 26, 2021, under a signed Share Purchase Agreement. This company is engaged

in the research and development of firefighting technologies and the manufacturing of firefighting equipment and vehicles for its customers

in the Middle East, Asia, and Africa.

(I) Georgia Fire & Rescue Supply LLC (Georgia

Fire) was incorporated on January 21, 2003. ILUS acquired 100% of this company on March 31, 2022, under a signed Share Purchase Agreement.

This company is engaged in the business of sales, distribution and servicing/maintenance of Firefighting, Rescue and Emergency Medical

Services equipment. Purchase consideration includes an aggregate cash purchase price of $900,000 (Nine Hundred Thousand Dollars), wherein

a fixed sum of $680,000 (Six Hundred Eighty Thousand) payable upon closing and the remaining $220,000 (Two Hundred Twenty Thousand Dollars)

payable over a one-year period after closing to the extent the business operations of Georgia Fire & Rescue Supply, LLC meet mutually

agreeable performance thresholds along with 1,500 (One Thousand Five Hundred) restricted Class F Preferred Shares in the public company

llustrato Pictures International Inc. (Symbol: ILUS)

(J) Bright Concept Detection and Protection System

LLC (BCD Fire) was incorporated on March 18, 2014. ILUS acquired 100% of this company on April 13, 2021, in connection with a signed Share

Purchase Agreement. This company is engaged in the business of sales, distribution, installation and maintenance of Fire Protection and

Security systems. Purchase consideration includes 250,000 AED (Two hundred and fifty thousand) payable on signing of the Sales Purchase

agreement, 10,000 AED (Ten thousand) monthly for 24 months starting from May 2021 and 1,000,000 (1 million) restricted shares in the public

company llustrato Pictures International Inc. (Symbol: ILUS)

(K) Bull Head Products Inc. was incorporated on

June 8, 2007. ILUS acquired 100% of this company on January 1, 2022, under a signed Share Purchase Agreement. This company is engaged

in manufacturing aluminum truck beds and brush truck skid units for firefighting purposes including wildland firefighting. Purchase consideration

includes an aggregate cash purchase price of $500,000 (Five Hundred Thousand) wherein a fixed sum of $300,000 (Three Hundred Thousand)

payable upon closing and remaining $200,000 (Two Hundred Thousand) payable over a one-year period after closing to the extent the business

operations of Bull Head Products Inc. meet mutually agreeable performance thresholds referenced in Exhibit B in the SPA along with 6,750

(Six Thousand Seven Hundred and Fifty) restricted Class F Preferred Shares in the public company llustrato Pictures International Inc.

(Symbol: ILUS)

(L) Emergency Response Technologies, Inc. This

company was incorporated by ILUS on February 22, 2022, as the company’s Emergency Response Subsidiary. This company is engaged in

the business of public safety and emergency response-focused mergers and acquisitions.

(M) E-Raptor. This company was incorporated by

ILUS as the company’s Commercial Electric Utility Vehicle manufacturer on February 22, 2022. This company is engaged in the business

of manufacturing electric utility vehicles for the emergency response, agricultural, industrial, hospitality and transport sectors.

(N) Replay Solutions was incorporated by ILUS

on March 1, 2022. The company is engaged in the business of recovering precious metals from electronic waste, known as urban mining.

(O) Quality Industrial Corp. was originally incorporated

on May 4, 1998. ILUS acquired 77% of this company on May 28, 2022, under a signed Share Purchase Agreement for an aggregate amount of

$500,000. This company is engaged in the industrial, oil & gas, and manufacturing sectors. Quality Industrial Corp. is a public company

that trades on the OTC Market under the ticker QIND and is designed as a Special Purpose Vehicle for our industrial and manufacturing

division as well as for our operating company Quality International Co Ltd FCZ and other future acquisitions.

(P) AL Shola Al Modea Safety and Security LLC

is a fire safety company registered in the United Arab Emirates. The company has signed a Share Purchase Agreement to acquire 51% control

of AL Shola Al Modea Safety and Security LLC (ASSS) on December 13, 2022. The purchase consideration for 51% of the shares shall be up

to $714,000 subject to certain agreed Targets and Key Performance indices being met as referenced in the SPA.

(Q) On January 3, 2024, Ilustrato Pictures International

Inc. acquired a convertible note from YAII PN, LTD with outstanding principal and accrued interest of $600,685 in Samsara Luggage Inc.

(SAML). On January 5, 2024, SAML reissued a convertible note to ILUS who on the same day converted the note into 150,753,425 shares of

common stock in the Company pursuant to the terms of said exchange note. As a result of such conversion, Ilustrato acquired control of

91.5% of the outstanding shares in SAML as of January 5, 2024.

(R) On February 23, 2024, Ilustrato Pictures International,

Inc., entered into a Stock Purchase Agreement with Samsara Luggage Inc., and sold all its equity interests in seven companies owned by

the Company:

| ● | Firebug

Mechanical Equipment LLC |

| ● | Georgia

Fire & Rescue Supply LLC |

| ● | Bright

Concept Detection and Protection System LLC |

| ● | AL

Shola Al Modea Safety and Security LLC, the only entity in which the Company does not own 100% but only 51% of the membership interests. |

The consideration for the sale of the equity interests

in the foregoing companies was paid by SAML by the issuance of 350,000 restricted shares of Series B stock of SAML convertible into 350,000,000

common stock and further milestone payment/s should applicable performance targets be referenced.

(S) On March 27, 2024, our subsidiary QIND entered

into a definitive Stock Purchase Agreement (the “Stock Purchase Agreement”) with the shareholders of Al Shola Al Modea Gas

Distribution LLC (“ASG” or “Al Shola Gas”) to acquire a 51% interest in ASG. The Closing of the transaction took

place when both parties signed the definitive Stock Purchase Agreement. Al Shola Gas is an Engineering and Distribution Company in the

liquefied petroleum gas (“LPG”) Industry in the United Arab Emirates and was established in 1980. The company is one of the

region’s leading suppliers and contractors of LPG centralized pipeline systems and is approved by The General Directorate of Civil

Defense, Government of Dubai, as a Central Gas Contractor and LPG Supplier.

NOTE 2: SUMMARY OF ACCOUNTING POLICIES

Revenue Recognition

The Company recognizes revenue in accordance with

Accounting Standards Codification 606, Revenue from Contracts with Customers.

Accordingly, revenue is recognized when control

of the goods or services promised under a contract is transferred to the customer either at a point in time (e.g., upon delivery) or over

time (e.g., as the Company performs under the contract) in an amount that reflects the consideration to which the Company expects to be

entitled in exchange for the goods or services. The Company accounts for a contract when it has approval and commitment from both parties,

the rights and payment terms of the parties are identified, the contract has commercial substance and collectability of consideration

is probable. If collectability is not probable, the sale is deferred until collection becomes probable or payment is received.

Contract Assets and Contract Liabilities acquired under Business

Combinations

The company follows new guidance under ASC 606

regarding the recognition and measurement of contract assets and contract liabilities acquired in a business combination. The company

applies the definition of a performance obligation in ASC 606 when recognizing contract liabilities assumed in a business combination.

The company eventually recognizes contract assets and contract liabilities at amounts consistent with those recorded by the acquiree immediately

before the acquisition date. Earlier, contract assets and contract liabilities acquired in a business combination were recorded by the

acquirer at fair value.

Work-in-progress

Work-in-progress is stated at cost plus attributable

profit, less provision for any anticipated losses and progress billings. Cost comprises direct materials, labor, depreciation, and overheads.

If any progress billings for any contract exceed the cost-plus attributable profit or less anticipated losses, the excess to be shown

as excess progress billings. Claims are only recognized as income when the outcome and recoverability can be determined with reasonable

certainty. Contract revenue and costs are recognized as revenue and expenses, respectively, in the statement of comprehensive income when

the outcome of a construction contract can be estimated reliably.

In accordance with ASC-606 revenue recognition,

amounts are billed in accordance with contractual terms or as work progresses. Unbilled amounts arise when the timing of billing differs

from the timing of revenue recognized, such as when contract provisions require specific milestones to be met before a customer can be

billed. Unbilled amounts primarily relate to performance obligations satisfied over time when the cost-to-cost method is utilized, and

the revenue recognized exceeds the amount billed to the customer as there’s not yet a right to invoice in accordance with contractual

terms. Unbilled amounts are recorded as a contract asset when the revenue associated with the contract is recognized prior to billing

and derecognized when billed in accordance with the terms of the contract.

Variations

Variations are recognized in contract revenue

when the outcome can be determined with reasonable certainty and are capable of being reliably measured.

Variable consideration

If the consideration in a contract includes a

variable amount, the Company estimates the amount of consideration to which it will be entitled in exchange for transferring the goods

to the customer. The variable consideration is estimated at contract inception and constrained until it is highly probable that a significant

revenue reversal in the amount of cumulative revenue recognized will not occur when the associated uncertainty with the variable consideration

is subsequently resolved. The construction contracts provide customers with a right to claim damages for delay in delivery of goods. The

rights to claim damages for delay in delivery of goods give rise to variable consideration.

Accounts Receivable

Accounts receivable are reported at the customers’

outstanding balances, less any allowance for doubtful accounts. Interest is not accrued on overdue accounts receivable.

The duration of such receivables extends from

30 days to beyond 12 months. Full payment is received only when a job/project is completed, and approvals are obtained. Provisions are

created based on estimated irrecoverable amounts determined by reference to past default experience.

Allowance for Doubtful Accounts

An allowance for doubtful accounts on accounts

receivable is charged to operations in amounts sufficient to maintain the allowance for uncollectible accounts at a level management believes

is adequate to cover any probable losses. Management determines the adequacy of the allowance based on historical write-off percentages

and information collected from individual customers. Accounts receivables are charged off against the allowances when collectability is

determined to be permanently impaired.

Inventories

In accordance with ASC 330, the Company states

inventories at the lower of cost or net realizable value. Cost, which includes material, labor and overhead, is determined on a first-in,

first-out basis. The Company makes adjustments to reduce the cost of inventory to its net realizable value, if required, for estimated

excess, obsolete, zero usage or impaired balances. Factors influencing these adjustments include changes in market demand, product life

cycle and engineering changes.

Tangible Assets/ Property Plant & Equipment

Property, plant, and equipment are recorded at

cost, except when acquired in a business combination where property, plant and equipment are recorded at fair value. Depreciation of property,

plant and equipment is recognized over the estimated useful lives of the respective assets using the straight-line method.

The estimated useful lives are as follows:

| Buildings, related improvements & land improvements | |

5-25 |

| Machinery & equipment | |

3-15 |

| Computer hardware & software | |

3-10 |

| Office, furniture & others | |

3-15 |

Expenditures that extend the useful life of existing

property, plant and equipment are capitalized and depreciated over the remaining useful life of the related asset. Expenditures for repairs

and maintenance are expensed as incurred. When property, plant and equipment are retired or sold, the cost and related accumulated depreciation

is removed from the Company’s balance sheet, with any gain or loss reflected in operations.

Stock-Based Compensation

When applicable, the Company will account for

stock-based payments to employees in accordance with ASC 718, “Stock Compensation” (“ASC 718”). Stock-based payments

to employees include grants of stocks, grants of stock options and issuance of warrants that are recognized in the consolidated statement

of operations based on their fair values at the date of grant.

In accordance with ASC 718, the company will generally

apply the same guidance to both employee and nonemployee share-based awards. However, the company will also follow specific guidance for

share-based awards to nonemployees related to the attribution of compensation cost and the inputs to the option-pricing model for the

expected term. Nonemployee share-based payment equity awards are measured at the grant-date fair value of the equity instruments, similar

to employee share-based payment equity awards.

The Company calculates the fair value of option

grants and warrant issuances utilizing the Binomial pricing model. The amount of stock-based compensation recognized during a period is

based on the value of the portion of the awards that are ultimately expected to vest. ASC 718 requires forfeitures to be estimated at

the time stock options are granted and warrants are issued to employees and non-employees, and revised, if necessary, in subsequent periods

if actual forfeitures differ from those estimates. The term “forfeiture” is distinct from “cancellations” or “expirations”

and represents only the unvested portion of the surrendered stock option or warrant. The Company estimates forfeiture rates for all unvested

awards when calculating the expenses for the period. In estimating the forfeiture rate, the Company monitors both stock option and warrant

exercises as well as employee termination patterns. The resulting stock-based compensation expense for both employee and non-employee

awards is generally recognized on a straight-line basis over the period in which the Company expects to receive the benefit, which is

generally the vesting period.

Earnings (Loss) per Share

The Company reports earnings (loss) per share

in accordance with ASC Topic 260-10, “Earnings per Share.” Basic earnings (loss) per share is computed by dividing income

(loss) available to shareholders by the weighted average number of shares available. Diluted earnings (loss) per share available. Diluted

earnings (loss) per share is computed similarly to basic earnings (loss) per share except the denominator is increased to include the

number of additional shares that would have been outstanding if the potential shares had been issued and if the additional shares were

dilutive.

Organization and Offering Cost

The Company has a policy to expense organization

and offering cost as incurred.

Cash and Cash Equivalents

For the purpose of the statements of cash flows,

the Company considers cash and cash equivalents to include all stable, highly liquid investments with maturities of three months or less.

Fair Value of Financial Instruments

The company’s financial instruments consist

of cash and cash equivalents, accounts receivable, and notes payable. The carrying amount of these financial instruments approximates

fair value due either to length of maturity or interest rates that approximate prevailing market rates unless otherwise disclosed in these

financial statements.

Use of Estimates

The preparation of financial statements in conformity

with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that

affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Business segment

ASC 280, “Segment Reporting” requires

the use of the “management approach” model for segment reporting. The management approach model is based on the way a company’s

management organizes segments within the company for making operating decisions and assessing performance.

Below is the Statement of operations of reportable Segment:

Divisional Income Statement

The Company is organized into two divisions based

on the similarity of products, customers served, common use of facilities, and economic characteristics. The Company’s segments

are as follows:

| 2. | Industrial

& Manufacturing |

All intersegment transactions have been eliminated

in consolidation.

| | |

For the

Six Months Ended | |

| | |

June 30,

2024 | | |

2023

(Restated) | |

| Emergency & Response Division | |

| | |

| |

| Revenue | |

| 2,028,053 | | |

| 3,595,851 | |

| Cost Of Goods Sold | |

| 1,399,025 | | |

| 2,553,284 | |

| Gross Profit | |

| 629,028 | | |

| 1,042,567 | |

| Total Operating Expenses | |

| 1,886,734 | | |

| 3,259,649 | |

| Operating Loss | |

| (1,257,706 | ) | |

| (2,217,08 | ) |

| Net Loss | |

| (1,252,125 | ) | |

| (2,988,458 | ) |

Our revenue decreased to $2,028,053 for the six

months ended June 30, 2024, from $3,595,851 in 2023, a 44% decrease year to date. Gross profit percentage increased to 31% for the six

months ended June 3, 2024, from 29% in 2023.

Operating expenses decreased to $1,886,734 for

the six months ended June 30, 2024, compared with the same period of $ 3,259,649 in the year 2023.

For the coming period 2024, the Company will continue

to allocate financial, technical and sales resources for recently acquired subsidiaries to positively impact their financial results through

increased sales orders and efficiency. Allocated personnel will primarily focus on accelerating sales and marketing efforts, product development,

international market expansion, optimizing supply chain and production processes, and overall increased profitability while continuing

with the integration and optimization of currently operating companies. With the group expansion and growth, we also intend to hire executives

and personnel with specific industry experience and fields of expertise to streamline financial reporting, compliance, and Investor Relations

and to improve our corporate governance.

| | |

For the Six Months Ended | |

| | |

June 30, 2024 | | |

June 30,

2023

(Restated) | |

| Industrial & Manufacturing Division (QIND) | |

| | |

| |

| Revenue | |

| 3,317,206 | | |

| 0 | |

| | |

| | | |

| | |

| Cost of revenues | |

| 2,068,708 | | |

| 0 | |

| | |

| | | |

| | |

| Gross profit | |

| 1,248,498 | | |

| 0 | |

| | |

| | | |

| | |

| Total Operating Expenses | |

| 911,179 | | |

| 900,327 | |

| Profit/ loss from Operations | |

| 337,319 | | |

| (900,327 | ) |

| Non-Operating expenses | |

| 165,851 | | |

| 766,430 | |

| Non-Operating Income | |

| 427,554 | | |

| — | |

| Net loss/ profit | |

| 599,022 | | |

| (1,666,757 | ) |

For our Industrial and Manufacturing Division,

the Operating Revenue increased to $3,317,206 for the quarter ended June 30, 2024, compared to $0 for the year ended June 30, 2023. The

increase in revenue, was the result of the consolidation of Al Shola Gas For our Industrial and Manufacturing Division, the Operating

expenses increased to $10,852 for the year ended June 30, 2024, compared to $65,013 for the year ended June 30, 2023. Our increase in

operating expenses in 2024 was mainly the result of the consolidation of Al Shola Gas in our subsidiary QIND. Our Subsidiary QIND acquired

a 51% interest in Al Shola Gas on March 23, 2024, and is consolidating the profitable operating company into its financials from Q2 2024.

We earned a profit of $599,022 for the six months

ended June 30, 2024, compared to a net loss of $1,666,757 for the six months ended June 30, 2023. The change from loss to profit for the

period ended June 30, 2024, is a result of Net Income from our acquisition of Al Shola Gas and the reversal of interest payments

on the loan agreements with Mahavir and Artelliq.

Geographical presence

Presently our operations are spread across the

United States, United Arab Emirates, United Kingdom, and the Republic of Serbia, however, we plan to further expand our regional presence

and aim to expand our manufacturing operations in the United States during 2024. At present the revenue reported above is from the United

States and United Arab Emirates. We’ve classified the revenue based on the entities registered in their respective locations. All

the revenue generated as indicated has solely come from external customers, with no sales involving inter-company transactions.

Income Taxes

The Company accounts for income tax positions

in accordance with Accounting Standards Codification Topic 740, “Income Taxes” (“ASC Topic 740”). This standard

prescribes a recognition and measurement of tax positions taken or expected to be taken in a tax return. For those benefits to be recognized,

a tax position must be more likely than not to be sustained upon examination by taxing authorities. There was no material impact on the

Company’s financial position or results of operations as a result of the application of this standard. Deferred tax assets have

not been created for those subsidiaries which are in income tax-free jurisdiction, because the losses incurred cannot be utilized in the

future, rendering deferred tax assets irrelevant.

Recent Accounting Pronouncements

In January 2017, the FASB issued ASU 2017-04,

Simplifying the Test for Goodwill Impairment, which simplifies the accounting for goodwill impairments by eliminating step two from the

goodwill impairment test. Instead, if the carrying amount of a reporting unit exceeds its fair value, an impairment loss shall be recognized

in an amount equal to that excess, limited to the total amount of goodwill allocated to that reporting unit. ASU 2017-04 also clarifies

that an entity should consider income tax effects from any tax-deductible goodwill on the carrying amount of the reporting unit when measuring

the goodwill impairment loss, if applicable. The new standard is effective for fiscal years beginning after December 15, 2019, for both

interim and annual reporting periods.

Rounding Off

Figures are rounded off to the nearest $, except the value of EPS and

number of shares.

NOTE 3: CURRENT ASSETS

| | |

June 30, | | |

December 31, | |

| Particulars | |

2024 | | |

2023 | |

| | |

| | |

| |

| Loans advanced | |

| (2,327 | ) | |

| 1,855,892 | |

| Advance given to suppliers and sub-contractors | |

| 0 | | |

| 65,089 | |

| Director’s current accounts | |

| 2,519,267 | | |

| 679,245 | |

| Statutory dues receivable | |

| 0 | | |

| 50,404 | |

| Deposits | |

| 0 | | |

| 46,918 | |

| Accrual of discount on notes | |

| 85,354 | | |

| 217,440 | |

| Deferred expenses - consultancy | |

| 1,785,938 | | |

| 0 | |

| Buy Back Commitment | |

| 2,000,000 | | |

| 2,000,000 | |

| Toto Loan Current Portion | |

| 3578709 | | |

| 0 | |

| Misc. current assets | |

| 149,546 | | |

| 536,171 | |

| Total | |

| 10,116,487 | | |

| 5,451,159 | |

| ● | Advances

to Subcontractors and Suppliers: Advances have been paid to the suppliers/ sub-contractors in the ordinary course of business for procurement

of specialized material and equipment. |

| ● | Directors

Current Account includes amount incurred for Company’s Annual shareholders meeting, events for investor relationship, advances

for our investment projects and other expenses incurred for future potential acquisitions. |

| ● | Loan

advanced refers to the amount advanced by a company in the ordinary course of business and includes the amount paid for set up of new

businesses. |

Accounts Receivable

Accounts receivables are reported at the customers’

outstanding balances, less any allowance for doubtful accounts. Interest is not accrued on overdue accounts receivable.

The duration of such receivables extends from

30 days to beyond 12 months. Full payment is received only when a job/project is completed, and approvals are obtained. Provisions are

created based on estimated irrecoverable amounts determined by reference to past default experience.

| | |

June 30, | |

| | |

2024 | |

| Accounts Receivables Ageing | |

(unaudited) | |

| 1-30 days | |

| 329,345 | |

| 31-60 days | |

| 175,352 | |

| 61-90 days | |

| 146,028 | |

| +90 days | |

| 6,881,243 | |

| Total | |

| 7,531,969 | |

NOTE 4: NON-CURRENT ASSETS

Goodwill

As a part of the share purchase arrangement between

Lee Larson Elmore and FB Technologies Global Inc., Nick Link, the owner of FB Technologies Global Inc. replaced Lee Larson Elmore as CEO

of Ilustrato Pictures International Inc. on January 14, 2021, and we eventually got control over activities and books of accounts of Ilustrato

Pictures International Inc. from the date January 14, 2021.

As of June 30, 2024, the additional Goodwill has

been generated through the acquisition by our subsidiary Quality Industrial Corp, through the operating business of Al Shola Gas as consolidated

from April 1, 2024. Goodwill accounted for in the books is primarily a result of the acquisition, representing the excess of the purchase

price over the fair value of the tangible net assets acquired.

The Company accounts for business combinations

by estimating the fair value of the consideration paid for acquired businesses and assigning that amount to the fair values of assets

acquired and liabilities assumed, with the remainder assigned to goodwill. If the fair value of assets acquired and liabilities assumed

exceeds the fair value of consideration paid, a gain on bargain purchase is recognized. The estimates of fair values are determined utilizing

customary valuation procedures and techniques, which require us, among other things, to estimate future cash flows and discount rates.

Such analyses involve significant judgments and estimations.

The Company follows the guidance prescribed in

Accounting Standards Codification (“ASC”) 350, Goodwill and Other Intangible Assets, to test goodwill and intangible

assets for impairment annually if an event occurs or circumstances change which indicates that its carrying amount may not exceed its

fair value.

The annual impairment review is performed in the

fourth quarter of each fiscal year based upon information and estimates available at that time. To perform the impairment testing, the

Company first assesses qualitative factors to determine whether it is more likely than not that the fair values of the Company’s

reporting units or indefinite-lived intangible assets are less than their carrying amounts as a basis for determining whether or not to

perform the quantitative impairment test. Qualitative testing includes the evaluation of economic conditions, financial performance, and

other factors such as key events when they occur. The Company then estimates the fair value of each reporting unit and each indefinite-lived

intangible asset not meeting the qualitative criteria and compares their fair values to their carrying values.

The company will assess impairment from the 2024

year-end in accordance with the guidance prescribed in ASC 350. The Company would assess at year-end whether there has been an impairment

in the value of goodwill and identifiable intangible assets.

If future operating performance at one or more

of the Company’s reporting units were to fall significantly below forecasted levels, the Company could be required to reflect, under

current applicable accounting rules, a non-cash charge to operating income for an impairment. Any determination requiring the write-off

of a significant portion of goodwill, or identifiable intangible assets would adversely impact the Company’s results of operations

and net worth.

On April 1, 2024, the Agreement with Quality International

was canceled by the Board of Directors of Quality Industrial Corp. QIND restated its financial statements as of December 31, 2022, which

were previously reported on the Original Filing and subsequent amendments. Quality International is no longer considered as Goodwill.

The following items reflect the restatements:

As of June 30, 2024, Goodwill, and intangible

assets amount to $11,115,562 as compared to total assets amounting to $8,606,289 as of December 31, 2023. Below is a table displaying

the Goodwill arising from the Company’s acquisitions:

| Year | |

June 30,

2024 | | |

December 31,

2023 | |

| QIND | |

| 6,704,318 | | |

| 6,704,318 | |

| Firebug | |

| 0 | | |

| (81,676 | ) |

| Bullhead | |

| 0 | | |

| 597,226 | |

| Georgia Fire | |

| 0 | | |

| 136,175 | |

| ILUS UK | |

| 335,741 | | |

| 335,741 | |

| BCD | |

| 0 | | |

| 306,597 | |

| ASSS | |

| 0 | | |

| 607,908 | |

| SAML | |

| 4,075,503 | | |

| 0 | |

| Goodwill Total | |

| 11,115,562 | | |

| 8,606,289 | |

Long term investments

| Particulars | |

June 30,

2024 | | |

December 31,

2023 | |

| Investment in BCD | |

| 0 | | |

| 20,500 | |

| Investment in FB Fire Technologies Ltd | |

| 2,036,767 | | |

| 3,172,175 | |

| Investment in Quality International | |

| 0 | | |

| 6,500,000 | |

| Investment in Wikisoft | |

| 6,555,755 | | |

| 0 | |

| Investment in Dear Cashmere Holding Co. | |

| 12,000,000 | | |

| 12,000,000 | |

| Long term investment | |

| 4,672,175 | | |

| 0 | |

| Loan to Fb Fire Technologies Ltd | |

| 0 | | |

| 1,946,534 | |

| Total | |

| 25,264,697 | | |

| 23,639,209 | |

The company holds long-term investments of $6,500,000

and $0 as of December 31, 2023, and June 30, 2024, respectively. These investments were made for the acquisition of Quality

International, a transaction that was terminated on April 1, 2024

Investment in Dear Cashmere Holding Co.: The company

received 10,000,000 shares of Common stock in Dear Cashmere Holding Co on May 21, 2021, as compensation for services to provided DRCR

such as but not limited to, free rent in Al Marsa Street 66, 11th Floor, Office 1105, Dubai, free use of inhouse accounting, IT, and legal

team from 2021 until December 31, 2023. The shares were discretionary awarded and recorded at a fair market value of $1.20 with a grant

date as of May 21, 2021, in accordance with ASC 718 and issued by, the Chairman, Nicolas Link and CEO, James Gibbons, of DRCR.

Investment in FB Fire Technologies:

Represents 3,172,175 number of Class E Preferred Stock issued, in advance, at $1 per share amounting $3,172,175 to the shareholders of FB Fire Technologies Ltd.

Tangible Assets

| Particulars | |

June 30,

2024 | | |

December 31,

2023 | |

| Tangible Assets | |

| | |

| |

| Land and Buildings | |

| 0 | | |

| 0 | |

| Plant and Machineries | |

| 34,401 | | |

| 38,582 | |

| Furniture, Fixtures and Fittings | |

| 34,250 | | |

| 37,432 | |

| Vehicles | |

| 69,397 | | |

| 14,645 | |

| Computer and Computer Equipment | |

| 48,160 | | |

| 49,044 | |

| Total | |

| 186,207 | | |

| 139,523 | |

Depreciation on tangible assets in accordance with ASC 360.

| | |

Plant &

Machinery | | |

Furniture,

Fixtures &

Office

Equipment | | |

Vehicles | | |

Computers | | |

Total | |

| Carrying value as of January 1, 2024 | |

| 38,582 | | |

| 37,432.00 | | |

| 118,789 | | |

| 49,044 | | |

| 243,847 | |

| Addition during Q1 2024 | |

| 3,116 | | |

| 9,801 | | |

| - | | |

| - | | |

| 12,917 | |

| Charged Depreciation Q1 2024 | |

| 3,806 | | |

| 10,075 | | |

| 24,290 | | |

| - | | |

| 38,171 | |

| Carrying value March 31, 2024 | |

| 37,892 | | |

| 37,158 | | |

| 94,499 | | |

| 49,044 | | |

| 218,592 | |

| Addition during Q2 2024 | |

| 0 | | |

| 3,949 | | |

| 0 | | |

| 2,060 | | |

| 6,009 | |

| Charged Depreciation Q2 2024 | |

| 3,491 | | |

| 6,857 | | |

| 25,102 | | |

| 2,944 | | |

| 38,394 | |

| Carrying value June 30, 2024 | |

| 34,401 | | |

| 34,250 | | |

| 69,397 | | |

| 48,160 | | |

| 186,207 | |

NOTE 5: CURRENT LIABILITIES

Other Current Liabilities

| Particulars | |

June 30,

2024 | | |

December 31,

2023 | |

| Accrued payables | |

| 68,505 | | |

| 204,925 | |

| Credit cards | |

| 10,494 | | |

| 8,221 | |

| other advances | |

| 942,990 | | |

| 827,824 | |

| Loan Payable | |

| 537,115 | | |

| 6,021,338 | |

| Misc. current liabilities | |

| 432,607 | | |

| 165,344 | |

| Payroll Liabilities | |

| 792,605 | | |

| 534,068 | |

| Payable to Government Authorities | |

| 124,309 | | |

| 64,199 | |

| Provision for Audit Fees | |

| 39,500 | | |

| 24,500 | |

| Payable to subsidiaries | |

| 10,832,740 | | |

| 975,547 | |

| Total | |

| 13,780,865 | | |

| 8,825,966 | |

As per the applicable accounting standards, Borrowings

from financial institutions have been bifurcated into current and non-current liabilities.

NOTE 6: NON-CURRENT LIABILITIES

Notes Payable

The following is the list of Notes payable as of

June 30, 2024. Convertible Notes issued during the reported period are accounted in the books as a liability, accrued Interest and discount

on notes is also accounted accordingly as per general accounting principles.

On

February 04, 2022, the company entered into a convertible note with Discover Growth Fund LLC – John Burke for the amount of $2,000,000.

The note is convertible at 35% below the lowest past 15-day share price and bears 12% interest per annum. The note matured on February

4, 2023. The Company signed a Forbearance Agreement with Discover Growth Fund on May 3, 2023. The Company shall make monthly minimum loan

payments to Discover Growth Fund of $450,000.00 commencing on May 30, 2023, and on the 5th day of each month thereafter, until the Note

is paid in full. Four payments of 450,000 have

been made as of June 30, 2024.

On June 1, 2022, the company entered into a convertible

note with RB Capital Partners Inc., for the amount of $1,000,000. The note is convertible into common stock at the rate of $0.50 and bears

5% interest per annum. The note matures on May 31, 2024. This note has been partially converted.

On December 22, 2023, the company entered into

a convertible note with AJB Capital Investment LLC for the amount of $1,680,000. The note is convertible into common stock upon an event

of default at the rate equal to volume weighted average trading price of the specified period and bears 12% interest. The note matures

on May 1, 2024.

On January 15, 2024, the company entered into

a convertible note with Twn Brooks Inc., for the amount of $27,500. The note is convertible into common stock at the rate of 65% of the

lowest trading price 10 days prior to conversion and bears a 9% interest per annum. The note matures on July 15, 2024.

On January 23, 2024, the company entered into

a convertible note with Twn Brooks Inc., for the amount of $25,000. The note is convertible into common stock at the rate of 65% of the

lowest trading price 10 days prior to conversion and bears a 9% interest per annum. The note matures on July 23, 2024.

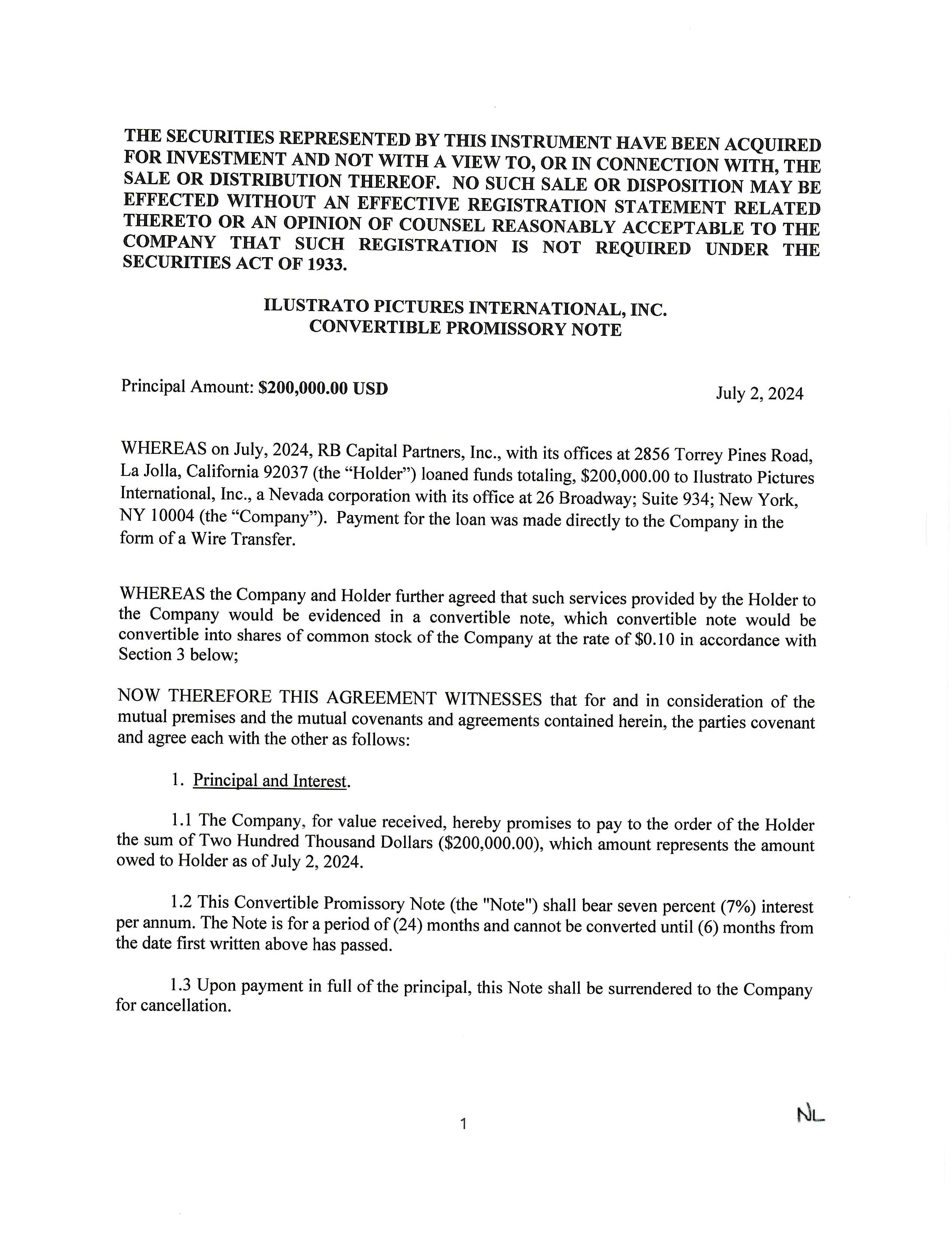

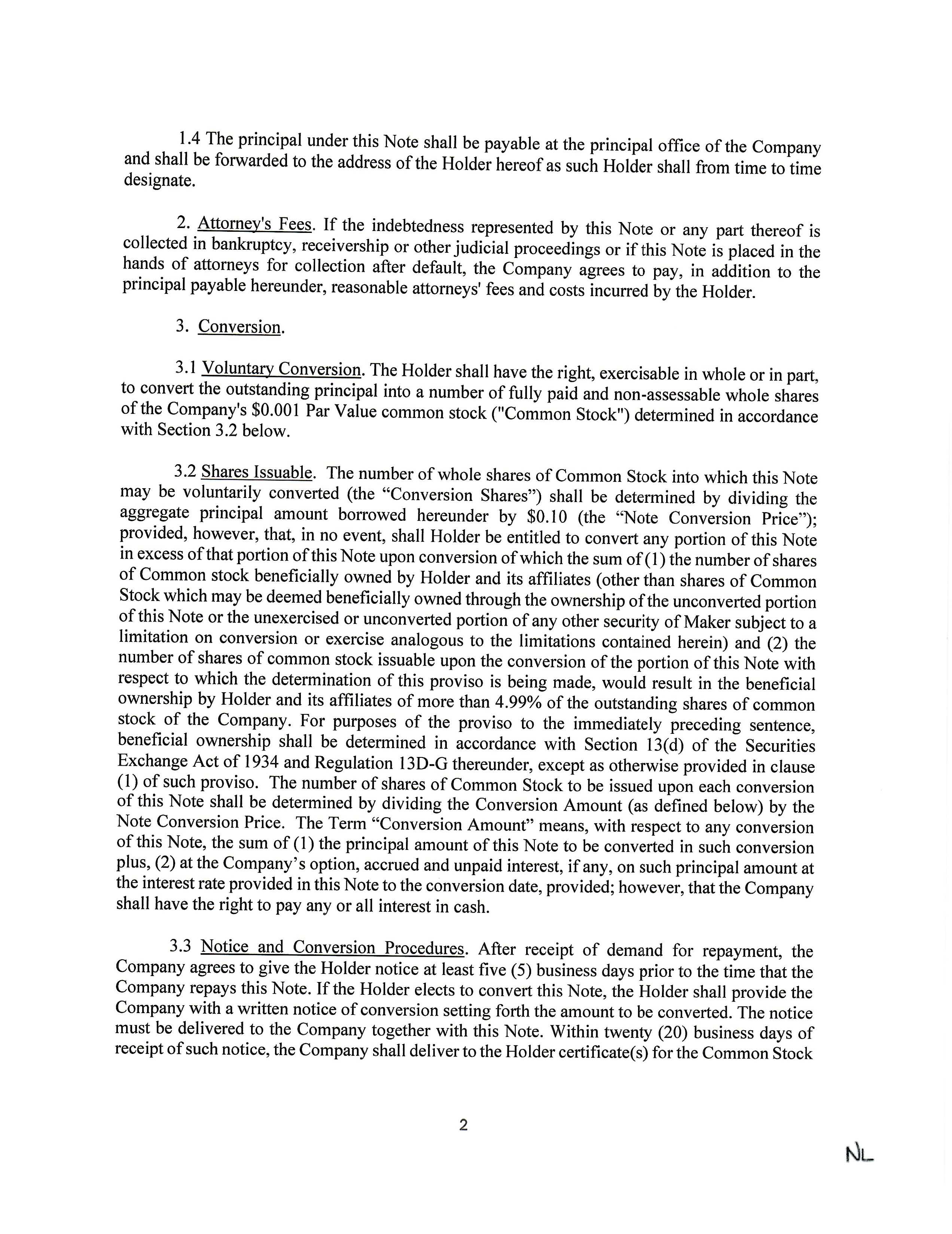

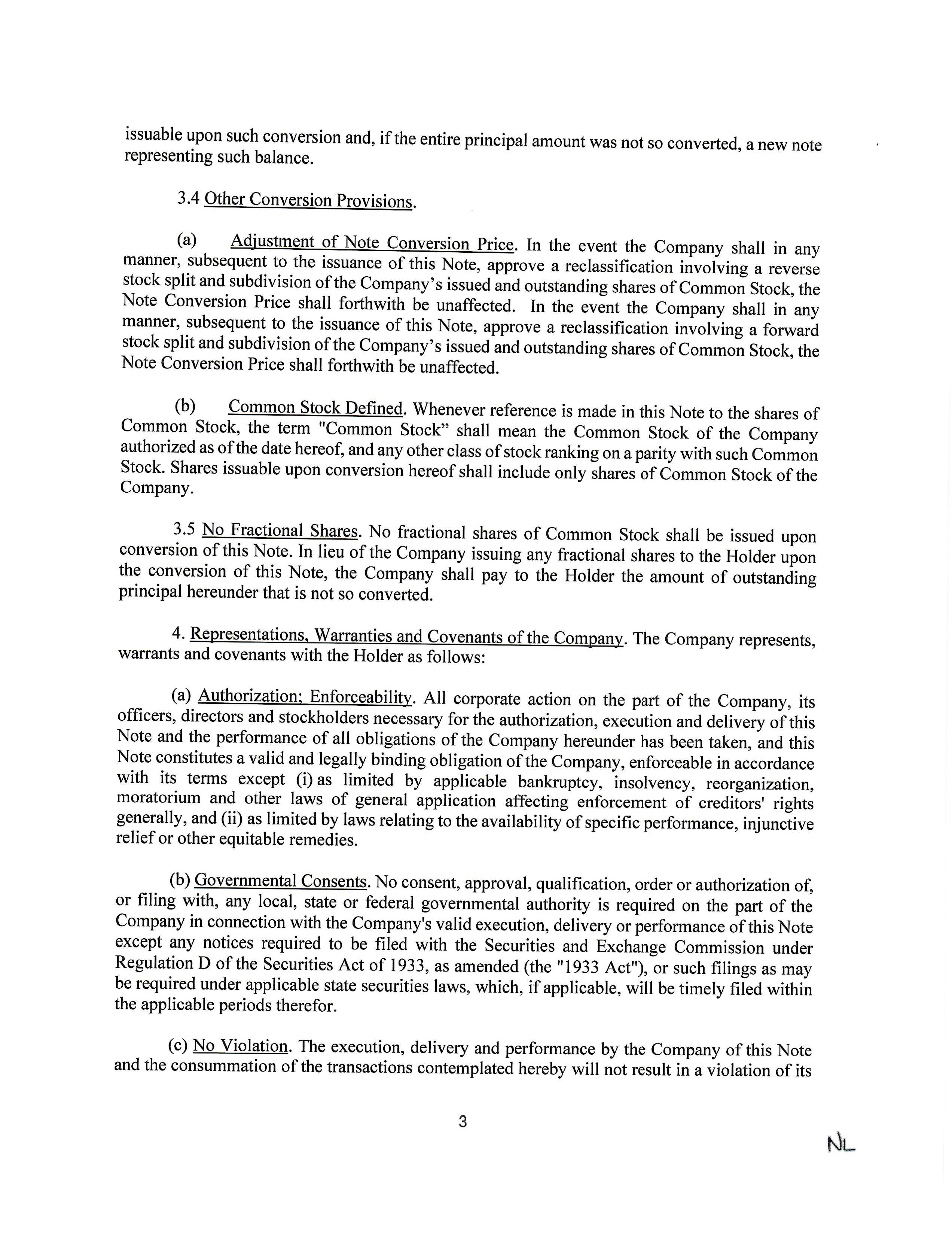

On January 31, 2024, the company entered into

a convertible note with RB Capital Partners Inc., for the amount of $600,000. The note is convertible into common stock at the rate of

$0.10 and bears 8% interest per annum. The note matures on January 31, 2026.

On April 1, 2024, ILUS entered into a consolidated

note payable with a principal amount of $6,405,750 with RB Capital Inc. which amount represents the amount owed to Holder as of April

1, 2024. Repayable at any time and bears 7% interest rate per annum. The Company may repay the Holder in cash at any time in full including

all interest and principal, without penalty. If the issuer pays the holder $650,000 in cash in a fiscal quarter the holder will not be

permitted to carry out a conversion in that fiscal quarter, unless by mutual agreement. The note is convertible into common stock at a

rate equal to the variable conversion price as of 70% of the lowest trading price during the previous ten trading days.

On April 15, 2024, the company entered into a

convertible note with Twn Brooks Inc., for the amount of $55,000. The note is convertible into common stock at the rate of 65% of the

lowest trading price 10 days prior to conversion and bears a 9% interest per annum. The note matures on October 15, 2024.

On May 6, 2024, the company entered into a convertible

note with RB Capital Partners Inc., for the amount of $100,000. The note is convertible into common stock at the rate of $0.10 and bears

a 7% interest per annum. The note matures on May 6, 2026.

On May 16, 2024, the company entered into a convertible

note with RB Capital Partners Inc., for the amount of $150,000. The note is convertible into common stock at the rate of $0.10 and bears

a 7% interest per annum. The note matures on May 16, 2026.

On May 20, 2024, the company entered into a convertible

note with Twn Brooks Inc., for the amount of $27,500. The note is convertible into common stock at the rate of 35% below the average past