Current Report Filing (8-k)

January 20 2023 - 4:11PM

Edgar (US Regulatory)

0001630176

false

0001630176

2023-01-13

2023-01-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

|

| January 13, 2023

|

HEALTHY EXTRACTS INC.

(Exact name of registrant as specified in its charter)

Nevada

|

| 333-202542

|

| 47-2594704

|

(State or other

|

| (Commission

|

| (I.R.S. Employer

|

jurisdiction of incorporation)

|

| File Number)

|

| Identification No.)

|

|

|

|

|

|

|

|

|

|

|

7375 Commercial Way, Suite 125

Henderson, NV 89011

(Address of principal executive offices) (zip code)

|

|

|

|

|

|

|

|

|

|

|

(702) 463-1004

(Registrant’s telephone number, including area code)

|

|

|

|

|

|

|

|

|

|

|

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Section 1 – Registrant’s Business and Operations

Item 1.01 Entry into a Material Definitive Agreement.

On January 13, 2023, we entered into an Acquisition Agreement for the acquisition of Hyperion, L.L.C. and Online Publishing & Marketing, LLC, both Virginia limited liabilities companies, by merging them into our newly-formed wholly-owned subsidiaries, Green Valley Natural Solutions, LLC (“Green Valley”) and Online Publishing & Marketing, LLC (“OPM”), both Nevada limited liability companies. The closing of the acquisition will take place following the satisfaction of certain closing conditions, including a capital raise of at least $4,000,000 and the commencement of trading, or approval for the commencement of trading, of our common stock on the Nasdaq Capital Market. The total purchase price for the acquisitions will be $1,750,000 in cash, $1,300,000 in the form of secured promissory notes, and $1,250,000 worth of our common stock (based on a 30% premium to the price paid per share of common stock in the above-referenced capital raise, but in no event more than ninety percent (90%) of the volume weighted average price for our common stock for the ninety (90) trading days up to and including the trading day immediately before the day the price is finally determined for securities sold in the capital raise).

Section 9 – Financial Statements and Exhibits.

Item 9.01Financial Statements and Exhibits.

(d)Exhibits

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Healthy Extracts Inc.

|

|

|

|

|

Dated: January 20, 2023

| /s/ Kevin “Duke” Pitts

|

| By:Kevin “Duke” Pitts

|

| Its:President

|

3

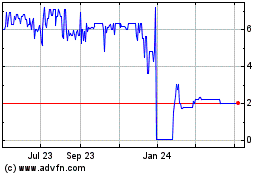

Healthy Extracts (QB) (USOTC:HYEX)

Historical Stock Chart

From Dec 2024 to Jan 2025

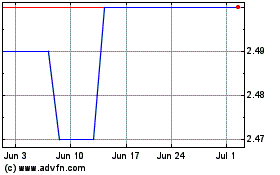

Healthy Extracts (QB) (USOTC:HYEX)

Historical Stock Chart

From Jan 2024 to Jan 2025