UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): November 14, 2014

General Steel Holdings, Inc.

(Exact name of registrant as specified

in its charter)

| Nevada |

|

001-33717 |

|

41-2079252 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification Number) |

Level 21, Tower B, Jia Ming Center

No. 27 Dong San Huan North Road

Chaoyang District, Beijing, China 100020

(Address of

principal executive offices)

Registrant’s telephone number,

including area code:

+ 86 (10) 57757691

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On November 14, 2014, General Steel Holdings, Inc. (the “Company”)

issued a press release relating to its financial results for its third quarter ended September 30, 2014. The press release contains

statements intended as “forward-looking statements,” all of which are subject to the cautionary statement about forward-looking

statements set forth therein. A copy of that press release is furnished as Exhibit 99.1 hereto and incorporated into this Item

2.02 by reference.

In accordance with General Instruction B.2 of Form 8-K, the

information included or incorporated in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes

of Section 18 of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall such

information and exhibit be deemed incorporated by reference in any filing under the United States Securities Act of 1933, as amended

(the “Securities Act”), except as shall be expressly set forth by specific reference in such a filing.

ITEM 7.01 REGULATION FD DISCLOSURE.

On November 14, 2014, in connection with its conference call

pertaining to its financial results for its third quarter ended September 30, 2014, the Company posted a slide show presentation

on its website at http://www.gshi-steel.com, which is also furnished as Exhibit 99.2 hereto and incorporated into this Item 7.01

by reference.

In accordance with General Instruction B.2 of Form 8-K, the

information included or incorporated in this Item 7.01, including Exhibit 99.2, shall not be deemed “filed” for purposes

of Section 18 of the Exchange Act, nor shall such information and exhibit be deemed incorporated by reference in any filing under

the Securities Act, except as shall be expressly set forth by specific reference in such a filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

|

Exhibit No. |

|

Description |

| |

|

| 99.1 |

|

Press Release issued on November 14, 2014. |

| 99.2 |

|

Presentation of General Steel Holdings, Inc. |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

General Steel Holdings, Inc. |

| |

|

|

| |

By: |

/s/ John Chen |

| |

Name: |

John Chen |

| |

Title: |

Chief Financial Officer |

Dated: November 14, 2014

Exhibit 99.1

General

Steel Reports Third Quarter 2014 Financial Results

Company Ships Record Quarterly Sales

Volume;

Closes its Previously Announced $7.5

Million Private Placement

BEIJING – November 14, 2014 –

General Steel Holdings, Inc. (“General Steel” or the “Company”) (NYSE: GSI), a leading non-state-controlled

steel producer in China, today announced its financial results for the third quarter ended September 30, 2014. The Company will

file its Quarterly Report on Form 10-Q for the quarter ended September 30, 2014 with the United States Securities and Exchange

Commission following market close on Friday, November 14, 2014.

Henry Yu, Chairman and Chief Executive

Officer of General Steel commented, “We continued to witness improving demand for our products in Western China, as our sale

volume grew more than 15% year-over-year to 1.45 million metric tons, the highest ever quarterly volume for General Steel. This

quarter, a number of smaller and unqualified steel mills were forced to exit the market, in light of which, we strategically offered

attractive discounts in neighboring markets to expand our geographic footprint.”

Mr. Yu continued, “We anticipate

the price of iron ore will continue on its downward trend, and with our better market position, improved industry fundamentals,

and higher production efficiency, we are solidly positioned to earn greater profits in 2015. We expect to harvest the fruits of

our continuous cost cutting measures and equipment upgrades and optimization over the past couple of years, and we look forward

to a broadening geographic footprint, improving efficiency, expanding operating leverage, and ultimately rising profitability.”

Mr. Yu concluded.

John Chen, Chief Financial Officer of General

Steel, commented, “As we strategically discounted our products in order to establish a foothold into neighboring markets,

our average selling price declined by 20.7% year-over-year in the third quarter. However, as the cost of iron ore decreased by

25.3% year-over-year, we were able to achieve leverage from the increased sales volume and expanded our quarterly gross margin

by 40 basis points and gross profits by 16.8% year-over-year.”

Mr. Chen then stated, “This December,

we will complete an upgrade to an existing 450 cubic-meter blast furnace with a much larger and more efficient 1,800 cubic-meter

blast furnace. This new equipment and expanded volume will enable a higher utilization of raw materials, better conversion rate,

and lower energy consumption during iron smelting, and ultimately generating further savings in our unit production cost. As we

complete our investment and upgrade plans in 2014, we enter 2015 with genuine optimism.”

Third Quarter 2014 Financial Information

| · | Sales volume increased by 15.1% year-over-year to approximately 1.45 million metric tons, compared

with 1.26 million metric tons in the third quarter of 2013. |

General Steel Holdings, Inc.

Page 2 of 9 |

| · | Sales totaled $562.8 million, compared with $610.1 million in the third quarter of 2013. |

| · | Gross profit was $9.6 million on gross margin of 1.7%, compared with $8.2 million in the third

quarter of 2013. |

| · | Income from operations totaled $7.9 million, compared with $27.7 million in the third quarter of

2013. |

| · | Net loss attributable to the Company was $(3.5) million, or $(0.06) per diluted share, compared

with a net income of $3.8 million, or $0.07 per diluted share in the third quarter of 2013. |

| · | As of September 30, 2014, the Company had cash and restricted cash of $405.4 million. |

First Nine Months 2014 Financial Information

| · | Sales volume increased by 3.2% year-over-year to approximately 4.07 million metric tons, compared

with 3.95 million metric tons in the first nine months of 2013. |

| · | Sales were $1.7 billion, compared with $1.9 billion in the first nine months of 2013. |

| · | Gross profit was $15.1 million on gross margin of 0.9%, compared with a gross loss of $(23.2) million

in the first nine months of 2013. |

| · | Loss from operations was $(29.4) million, compared with income from operations of $12.7 million

in the first nine months of 2013. |

| · | Net loss attributable to the Company was $(58.1) million, or $(1.04) per diluted share, compared

with a net loss of $(32.9) million, or $(0.60) per diluted share in the first nine months of 2013. |

Third Quarter 2014 Financial and Operating

Results

Total Sales

Total sales for the third quarter of 2014

decreased by 7.7% year-over-year to $562.8 million, compared with $610.1 million in the third quarter of 2013. The year-over-year

sales decrease was primarily due to a decrease in average selling price of rebar.

| · | Total sales volume in the third quarter of 2014 was 1.45 million metric tons, an increase of 15.1%

compared with 1.26 million metric tons in the third quarter of 2013. |

| · | The average selling price of rebar at Longmen Joint Venture in the third quarter of 2014 decreased

to approximately $388.1 per metric ton, down by 20.7% from $489.6 per metric ton in the third quarter of 2013. |

Gross Profit

Gross profit for the third quarter of 2014

was $9.6 million, or 1.7% of total sales, as compared with $8.2 million, or 1.3% of total sales in the third quarter of 2013. The

improvement in gross margin during the quarter was mainly attributable to the decreased unit cost of manufactured rebar.

General Steel Holdings, Inc.

Page 3 of 9 |

Operating Expenses and Income from Operations

Selling, general and administrative expenses

for the third quarter of 2014 were $16.4 million, a decrease of 16.4% from $19.7 million in the third quarter of 2013. Driven by

effective headcount expense control, general and administrative expenses decreased to $9.7 million in the third quarter of 2014,

compared with $12.4 million in the third quarter of 2013. Selling expenses were $6.7 million in the third quarter of 2014, compared

with from $7.3 million in the same period of 2013.

Other operating income from a change in

the fair value of profit sharing liability during the third quarter of 2014 was $14.7 million, compared with $39.2 million recognized

in the same period of last year.

Correspondingly, income from operations

for the third quarter of 2014 was $7.9 million, compared with $27.7 million for the third quarter of 2013.

Finance Expense

Finance and interest expense in the third

quarter of 2014 was $19.4 million, of which, $5.2 million was the non-cash interest expense on capital lease, as compared with

$5.1 million in the same period of 2013, and $14.2 million was the interest expense on bank loans and discounted note receivables,

as compared with $17.7 million in the same period of 2013. The decrease in finance and interest expenses was mainly a result of

reduced finance charges from banks and fewer early redemptions on note receivables.

Net Loss/Income and Net Loss/Income

per Share

Net loss attributable to General Steel

for the third quarter of 2014 was $(3.5) million, or $(0.06) per diluted share, based on 55.9 million weighted average shares outstanding.

This compares to a net income attributable to General Steel of $3.8 million, or $0.07 per diluted share, based on 55.1 million

weighted average shares outstanding in the third quarter of 2013.

First Nine Months 2014 Financial and

Operating Results

Total Sales

Total sales for the first nine months of

2014 decreased by 8.9% year-over-year to $1.7 billion, compared with $1.9 billion in the first nine months of 2013. The year-over-year

sales decreases were due to decreases in average selling price of rebar.

| · | Total sales volume in the first nine months of 2014 was 4.07 million metric tons, an increase of

3.2% compared with 3.95 million metric tons in the first nine months of 2013. |

| · | The average selling price of rebar at Longmen Joint Venture in the first nine months of 2014 decreased

to approximately $428.3 per metric ton, down by 13.6% from $495.6 per metric ton in the first nine months of 2013. |

Gross Profit/Loss

Gross profit for the first nine months

of 2014 was $15.1 million, or 0.9% of total sales, as compared with a gross loss of $(23.2) million, or (1.2%) of total sales in

the first nine months of 2013. The improvement in gross margin was mainly attributable to decreased unit costs of rebar manufactured.

General Steel Holdings, Inc.

Page 4 of 9 |

Operating Expenses and Loss/Income from

Operations

Selling, general and administrative expenses

for the first nine months of 2014 were $56.3 million, slightly increased from $59.5 million in the first nine months of 2013. General

and administrative expenses were $31.6 million, compared with $34.9 million in the same period of 2013. Selling expenses increased

slightly to $24.7 million, compared to $24.6 million in the same period of 2013.

Other operating income from a change in

the fair value of profit sharing liability during the first nine months of 2014 was $11.8 million, compared with $95.4 million

in the same period of last year.

Correspondingly, loss from operations for

the first nine months of 2014 was $(29.4) million, compared with income from operations of $12.7 million for the first nine months

of 2013.

Finance Expense

Finance and interest expense in the first

nine months of 2014 was $74.7 million, of which, $16.0 million was the non-cash interest expense on capital lease, as compared

with $15.3 million in the same period of 2013, and $58.7 million was the interest expense on bank loans and discounted note receivables,

as compared with $53.6 million in the first nine months of 2013.

Net Loss and Net Loss per Share

Net loss attributable to General Steel

for the first nine months of 2014 was $(58.1) million, or $(1.04) per diluted share, based on 55.8 million weighted average shares

outstanding. This compares to a net loss of $(32.9) million, or $(0.60) per diluted share, based on 54.9 million weighted average

shares outstanding in the first nine months of 2013.

Balance Sheet

As of September 30, 2014, the Company had

cash and restricted cash of approximately $405.4 million, compared to $431.3 million as of December 31, 2013. The Company had an

inventory balance of $250.0 million as of September 30, 2014, compared to $212.9 million as of December 31, 2013.

Closing of Private Placement Offering

of $7.5 Million

The Company closed its previously announced

private placement (the “Private Placement”) with Mr. Yu in October 2014, following the satisfaction of certain closing

conditions. In the Private Placement, Mr. Yu purchased 5 million shares of the Company’s common stock at a purchase price

of $1.50 per share, for total proceeds of $7.5 million. The shares of the Company’s common stock purchased and issued in

the Private Placement are subject to the six-month holding period provisions of Rule 144 of the Securities Act of 1933, as amended,

beginning as of October 24, 2014.

General Steel Holdings, Inc.

Page 5 of 9 |

The Company intends to use such proceeds

from the Private Placement mainly to fund its expansion into high-growth bulk commodity e-commerce.

Conference Call and Webcast:

General Steel will hold a corresponding

conference call and live webcast at 8:00 a.m. EST on Friday, November 14, 2014 (which corresponds to 9:00 p.m. Beijing/Hong Kong

Time on Friday, November 14, 2014) to discuss the results and answer questions from investors. Listeners may access the call by

dialing:

| US Toll Free: |

1-888-346-8982 |

| International Toll: |

1-412-902-4272 |

| China Toll Free: |

400-120-1203 |

| Hong Kong Toll Free: |

800-905-945 |

| Conference ID: |

General Steel Holdings |

The call will also be available as a live,

listen-only Webcast under the "Events and Presentations" page on the "Investor Relations" section of the Company's

Website at http://www.corpasia.net/us/GSI/irwebsite/index.php?mod=event. Following the live Webcast, an online archive

of the Webcast will be available for 90 days.

A replay of the conference call may be

accessed through November 21, 2014 by dialing:

| US Toll Free: |

1-877-344-7529 |

| International Toll: |

1-412-317-0088 |

| Access Code: |

10055765 |

About General Steel Holdings, Inc.

General Steel Holdings, Inc., headquartered

in Beijing, China, produces a variety of steel products including rebar, high-speed wire and spiral-weld pipe. The Company has

operations in China’s Shaanxi and Guangdong provinces, Inner Mongolia Autonomous Region and Tianjin municipality, with seven

million metric tons of crude steel production capacity under management. For more information, please visit www.gshi-steel.com.

To be added to the General Steel email

list to receive Company news, or to request a hard copy of the Company’s Annual Report on Form 10-K, please send your request

to generalsteel@asiabridgegroup.com.

General Steel Holdings, Inc.

Page 6 of 9 |

Forward-Looking Statements

This press release may contain certain

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based

on management's current expectations or beliefs about future events and financial, political and social trends and assumptions

it has made based on information currently available to it. The Company cannot assure that any expectations, forecasts or assumptions

made by management in preparing these forward-looking statements will prove accurate, or that any projections will be realized.

Actual results could differ materially from those projected in the forward-looking statements as a result of inaccurate assumptions

or a number of risks and uncertainties. These risks and uncertainties are set forth in the Company's filings under the Securities

Act of 1933 and the Securities Exchange Act of 1934 under “Risk Factors” and elsewhere, and include: (a) those risks

and uncertainties related to general economic conditions in China, including regulatory factors that may affect such economic conditions;

(b) whether the Company is able to manage its planned growth efficiently and operate profitable operations, including whether its

management will be able to identify, hire, train, retain, motivate and manage required personnel or that management will be able

to successfully manage and exploit existing and potential market opportunities; (c) whether the Company is able to generate sufficient

revenues or obtain financing to sustain and grow its operations; (d) whether the Company is able to successfully fulfill our primary

requirements for cash; and (e) other risks, including those disclosed in the Company’s Annual Report on Form 10-K, filed

with the United States Securities and Exchange Commission. Forward-looking statements contained herein speak only as of the

date of this release. The Company does not undertake any obligation to update or revise publicly any forward-looking statements,

whether to reflect new information, future events or otherwise.

Contact Us

General Steel Holdings, Inc.

Joyce Sung

Tel: +1-347-534-1435

Email: joyce.sung@gshi-steel.com

Asia Bridge Capital Limited

Carene Toh

Tel: +1-888-957-3362

Email: generalsteel@asiabridgegroup.com

General Steel Holdings, Inc.

Page 7 of 9 |

GENERAL STEEL HOLDINGS, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(UNAUDITED)

(In thousands)

| | |

September 30, | | |

December 31, | |

| | |

2014 | | |

2013 | |

| ASSETS | |

| | |

| |

| CURRENT ASSETS: | |

| | | |

| | |

| | |

| | | |

| | |

| Cash | |

$ | 22,108 | | |

$ | 31,967 | |

| Restricted cash | |

| 383,250 | | |

| 399,333 | |

| Notes receivable | |

| 66,984 | | |

| 60,054 | |

| Restricted notes receivable | |

| 109,510 | | |

| 395,589 | |

| Loans receivable | |

| 14,625 | | |

| - | |

| Loans receivable - related parties | |

| - | | |

| 4,540 | |

| Accounts receivable, net | |

| 8,481 | | |

| 4,078 | |

| Accounts receivable - related parties | |

| 2,153 | | |

| 2,942 | |

| Other receivables, net | |

| 77,232 | | |

| 54,716 | |

| Other receivables - related parties | |

| 71,980 | | |

| 54,106 | |

| Inventories | |

| 250,017 | | |

| 212,921 | |

| Advances on inventory purchase | |

| 43,374 | | |

| 44,897 | |

| Advances on inventory purchase - related parties | |

| 127,899 | | |

| 83,003 | |

| Prepaid expense and other | |

| 3,943 | | |

| 1,388 | |

| Prepaid taxes | |

| 11,935 | | |

| 28,407 | |

| Short-term investment | |

| 2,763 | | |

| 2,783 | |

| TOTAL CURRENT ASSETS | |

| 1,196,254 | | |

| 1,380,724 | |

| | |

| | | |

| | |

| PLANT AND EQUIPMENT, net | |

| 1,516,009 | | |

| 1,271,907 | |

| | |

| | | |

| | |

| OTHER ASSETS: | |

| | | |

| | |

| Advances on equipment purchase | |

| 15,655 | | |

| 6,409 | |

| Investment in unconsolidated entities | |

| 16,742 | | |

| 16,943 | |

| Long-term deferred expense | |

| 496 | | |

| 668 | |

| Intangible assets, net of accumulated amortization | |

| 23,121 | | |

| 23,707 | |

| TOTAL OTHER ASSETS | |

| 56,014 | | |

| 47,727 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 2,768,277 | | |

$ | 2,700,358 | |

| | |

| | | |

| | |

| LIABILITIES AND DEFICIENCY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Short term notes payable | |

$ | 784,323 | | |

$ | 1,017,830 | |

| Accounts payable | |

| 589,283 | | |

| 434,979 | |

| Accounts payable - related parties | |

| 265,744 | | |

| 235,692 | |

| Short term loans - bank | |

| 248,289 | | |

| 301,917 | |

| Short term loans - others | |

| 60,340 | | |

| 62,067 | |

| Short term loans - related parties | |

| 223,460 | | |

| 126,693 | |

| Current maturities of long-term loans - related party | |

| 67,249 | | |

| 53,013 | |

| Other payables and accrued liabilities | |

| 50,568 | | |

| 45,653 | |

| Other payable - related parties | |

| 101,475 | | |

| 94,079 | |

| Customer deposits | |

| 186,807 | | |

| 87,860 | |

| Customer deposits - related parties | |

| 113,674 | | |

| 64,881 | |

| Deposit due to sales representatives | |

| 29,917 | | |

| 24,343 | |

| Deposit due to sales representatives - related parties | |

| 2,308 | | |

| 1,997 | |

| Taxes payable | |

| 3,930 | | |

| 4,628 | |

| Deferred lease income, current | |

| 2,171 | | |

| 2,187 | |

| Capital lease obligations, current | |

| 6,825 | | |

| 4,321 | |

| TOTAL CURRENT LIABILITIES | |

| 2,736,363 | | |

| 2,562,140 | |

| | |

| | | |

| | |

| NON-CURRENT LIABILITIES: | |

| | | |

| | |

| Long-term loans - related party | |

| 4,875 | | |

| 19,644 | |

| Deferred lease income, noncurrent | |

| 73,077 | | |

| 75,257 | |

| Capital lease obligations, noncurrent | |

| 388,615 | | |

| 375,019 | |

| Profit sharing liability | |

| 149,363 | | |

| 162,295 | |

| TOTAL NON-CURRENT LIABILITIES | |

| 615,930 | | |

| 632,215 | |

| TOTAL LIABILITIES | |

| 3,352,293 | | |

| 3,194,355 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES | |

| | | |

| | |

| | |

| | | |

| | |

| DEFICIENCY: | |

| | | |

| | |

| Preferred stock, $0.001 par value, 50,000,000 shares authorized, 3,092,899 shares issued and outstanding as of September 30, 2014 and December 31, 2013 | |

| 3 | | |

| 3 | |

| Common stock, $0.001 par value, 200,000,000 shares authorized, 58,314,688 and 58,234,688 shares issued, 55,842,382 and 55,762,382 shares outstanding as of September 30, 2014 and December 31, 2013, respectively | |

| 58 | | |

| 58 | |

| Treasury stock, at cost, 2,472,306 shares as of September 30, 2014 and December 31, 2013 | |

| (4,199 | ) | |

| (4,199 | ) |

| Paid-in-capital | |

| 107,249 | | |

| 106,878 | |

| Statutory reserves | |

| 6,485 | | |

| 6,243 | |

| Accumulated deficits | |

| (472,871 | ) | |

| (414,798 | ) |

| Accumulated other comprehensive income | |

| (189 | ) | |

| 729 | |

| TOTAL GENERAL STEEL HOLDINGS, INC. DEFICIENCY | |

| (363,464 | ) | |

| (305,086 | ) |

| | |

| | | |

| | |

| NONCONTROLLING INTERESTS | |

| (220,552 | ) | |

| (188,911 | ) |

| | |

| | | |

| | |

| TOTAL DEFICIENCY | |

| (584,016 | ) | |

| (493,997 | ) |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND DEFICIENCY | |

$ | 2,768,277 | | |

$ | 2,700,358 | |

General Steel Holdings, Inc.

Page 8 of 9 |

GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE LOSS

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER

30, 2014 AND 2013

(UNAUDITED)

(In thousands, except per share

data)

| | |

Three months ended September 30, | | |

Nine months ended September 30, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

| | |

| | |

| | |

| |

| SALES | |

$ | 456,142 | | |

$ | 514,549 | | |

$ | 1,476,784 | | |

$ | 1,534,330 | |

| | |

| | | |

| | | |

| | | |

| | |

| SALES - RELATED PARTIES | |

| 106,680 | | |

| 95,546 | | |

| 268,262 | | |

| 380,707 | |

| TOTAL SALES | |

| 562,822 | | |

| 610,095 | | |

| 1,745,046 | | |

| 1,915,037 | |

| | |

| | | |

| | | |

| | | |

| | |

| COST OF GOODS SOLD | |

| 447,263 | | |

| 511,932 | | |

| 1,460,018 | | |

| 1,550,829 | |

| | |

| | | |

| | | |

| | | |

| | |

| COST OF GOODS SOLD - RELATED PARTIES | |

| 105,949 | | |

| 89,932 | | |

| 269,885 | | |

| 387,446 | |

| TOTAL COST OF GOODS SOLD | |

| 553,212 | | |

| 601,864 | | |

| 1,729,903 | | |

| 1,938,275 | |

| | |

| | | |

| | | |

| | | |

| | |

| GROSS PROFIT (LOSS) | |

| 9,610 | | |

| 8,231 | | |

| 15,143 | | |

| (23,238 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| SELLING, GENERAL AND ADMINISTRATIVE EXPENSES | |

| (16,434 | ) | |

| (19,661 | ) | |

| (56,336 | ) | |

| (59,464 | ) |

| CHANGE IN FAIR VALUE OF PROFIT SHARING LIABILITY | |

| 14,727 | | |

| 39,164 | | |

| 11,758 | | |

| 95,437 | |

| | |

| | | |

| | | |

| | | |

| | |

| INCOME (LOSS) FROM OPERATIONS | |

| 7,903 | | |

| 27,734 | | |

| (29,435 | ) | |

| 12,735 | |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER INCOME (EXPENSE) | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 2,767 | | |

| 2,835 | | |

| 10,025 | | |

| 8,657 | |

| Finance/interest expense | |

| (19,422 | ) | |

| (22,842 | ) | |

| (74,736 | ) | |

| (68,915 | ) |

| Gain (loss) on disposal of equipment and intangible

assets | |

| (21 | ) | |

| 17 | | |

| (117 | ) | |

| 113 | |

| Income from equity investments | |

| 32 | | |

| 47 | | |

| 99 | | |

| 137 | |

| Foreign currency transaction gain (loss) | |

| 3,146 | | |

| 322 | | |

| 1,329 | | |

| 448 | |

| Lease income | |

| 542 | | |

| 542 | | |

| 1,630 | | |

| 1,613 | |

| Other non-operating income

(expense), net | |

| (18 | ) | |

| 770 | | |

| 108 | | |

| 1,560 | |

| Other expense, net | |

| (12,974 | ) | |

| (18,309 | ) | |

| (61,662 | ) | |

| (56,387 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| (LOSS) INCOME BEFORE PROVISION FOR INCOME TAXES

AND NONCONTROLLING INTEREST | |

| (5,071 | ) | |

| 9,425 | | |

| (91,097 | ) | |

| (43,652 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| PROVISION FOR INCOME TAXES | |

| | | |

| | | |

| | | |

| | |

| Current | |

| 93 | | |

| 25 | | |

| 205 | | |

| 201 | |

| Deferred | |

| - | | |

| - | | |

| - | | |

| - | |

| Provision for income

taxes | |

| 93 | | |

| 25 | | |

| 205 | | |

| 201 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET (LOSS) INCOME | |

| (5,164 | ) | |

| 9,400 | | |

| (91,302 | ) | |

| (43,853 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Less: Net (loss) income attributable to noncontrolling

interest | |

| (1,674 | ) | |

| 5,599 | | |

| (33,229 | ) | |

| (10,939 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| NET (LOSS) INCOME ATTRIBUTABLE TO GENERAL

STEEL HOLDINGS, INC. | |

$ | (3,490 | ) | |

$ | 3,801 | | |

$ | (58,073 | ) | |

$ | (32,914 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| NET (LOSS) INCOME | |

$ | (5,164 | ) | |

$ | 9,400 | | |

$ | (91,302 | ) | |

$ | (43,853 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER COMPREHENSIVE (LOSS) INCOME | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation

adjustments | |

| (3,232 | ) | |

| (2,547 | ) | |

| 509 | | |

| (12,283 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| COMPREHENSIVE (LOSS) INCOME | |

| (8,396 | ) | |

| 6,853 | | |

| (90,793 | ) | |

| (56,136 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Less: Comprehensive loss attributable to noncontrolling

interest | |

| (1,701 | ) | |

| 4,782 | | |

| (31,802 | ) | |

| (15,508 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| COMPREHENSIVE LOSS ATTRIBUTABLE TO GENERAL

STEEL HOLDINGS, INC. | |

$ | (6,695 | ) | |

$ | 2,071 | | |

$ | (58,991 | ) | |

$ | (40,628 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| WEIGHTED AVERAGE NUMBER OF SHARES | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

| 55,878 | | |

| 55,141 | | |

| 55,845 | | |

| 54,976 | |

| | |

| | | |

| | | |

| | | |

| | |

| LOSS PER SHARE | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted | |

$ | (0.06 | ) | |

$ | 0.07 | | |

$ | (1.04 | ) | |

$ | (0.60 | ) |

General Steel Holdings, Inc.

Page 9 of 9 |

| GENERAL STEEL HOLDINGS, INC. AND SUBSIDIARIES |

|

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

|

(UNAUDITED)

(In thousands) |

|

| | |

For the

Nine months ended September 30, | |

| | |

2014 | | |

2013 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net (loss) income | |

$ | (91,302 | ) | |

$ | (43,853 | ) |

| Adjustments to reconcile net loss to cash provided by (used in) operating activities: | |

| | | |

| | |

| Depreciation, amortization and depletion | |

| 71,696 | | |

| 64,955 | |

| Change in fair value of derivative liabilities | |

| - | | |

| (1 | ) |

| Change in fair value of profit sharing liability | |

| (11,758 | ) | |

| (95,437 | ) |

| (Gain) loss on disposal of equipment and intangible assets | |

| 117 | | |

| (113 | ) |

| Provision for doubtful accounts | |

| (324 | ) | |

| (251 | ) |

| Reservation of mine maintenance fee | |

| 403 | | |

| 315 | |

| Stock issued for services and compensation | |

| 371 | | |

| 692 | |

| Amortization of deferred financing cost on capital lease | |

| 14,585 | | |

| 15,338 | |

| Income from equity investments | |

| (99 | ) | |

| (137 | ) |

| Foreign currency transaction (gain) loss | |

| (1,329 | ) | |

| (448 | ) |

| Deferred lease income | |

| (1,630 | ) | |

| (1,613 | ) |

| Changes in operating assets and liabilities | |

| | | |

| | |

| Notes receivable | |

| 49,973 | | |

| 32,138 | |

| Accounts receivable | |

| (4,142 | ) | |

| (483 | ) |

| Accounts receivable - related parties | |

| 768 | | |

| 11,968 | |

| Other receivables | |

| (22,765 | ) | |

| (3,466 | ) |

| Other receivables - related parties | |

| (18,291 | ) | |

| (55,744 | ) |

| Inventories | |

| (41,206 | ) | |

| 4,191 | |

| Advances on inventory purchases | |

| 1,195 | | |

| 1,996 | |

| Advances on inventory purchases - related parties | |

| (45,566 | ) | |

| (27,882 | ) |

| Prepaid expense and other | |

| (2,567 | ) | |

| (1,016 | ) |

| Long-term deferred expense | |

| 167 | | |

| 373 | |

| Prepaid taxes | |

| 16,286 | | |

| 8,250 | |

| Accounts payable | |

| (50,586 | ) | |

| 113,592 | |

| Accounts payable - related parties | |

| 17,178 | | |

| 54,364 | |

| Other payables and accrued liabilities | |

| 4,979 | | |

| (3,742 | ) |

| Other payables - related parties | |

| 8,089 | | |

| (12,844 | ) |

| Customer deposits | |

| 99,726 | | |

| (33,185 | ) |

| Customer deposits - related parties | |

| 49,335 | | |

| (7,981 | ) |

| Taxes payable | |

| (665 | ) | |

| (7,317 | ) |

| Other noncurrent liabilities | |

| - | | |

| 1,384 | |

| Net cash provided by operating activities | |

| 42,638 | | |

| 14,043 | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Restricted cash | |

| 13,174 | | |

| (72,676 | ) |

| Loans to related parties | |

| - | | |

| 1,460 | |

| Cash proceeds from short term investment | |

| - | | |

| (80 | ) |

| Cash proceeds from sales of equipment and intangible assets | |

| 43 | | |

| 16 | |

| Equipment purchase and intangible assets | |

| (117,826 | ) | |

| (75,326 | ) |

| Net cash used in investing activities | |

| (104,609 | ) | |

| (146,606 | ) |

| | |

| | | |

| | |

| CASH FLOWS FINANCING ACTIVITIES: | |

| | | |

| | |

| Capital contributed by noncontrolling interest | |

| - | | |

| 18,028 | |

| Restricted notes receivable | |

| 283,563 | | |

| 10,218 | |

| Borrowings on short term notes payable | |

| 1,264,884 | | |

| 1,348,631 | |

| Payments on short term notes payable | |

| (1,491,237 | ) | |

| (1,370,832 | ) |

| Borrowings on short term loans - bank | |

| 286,852 | | |

| 258,357 | |

| Payments on short term loans - bank | |

| (337,007 | ) | |

| (155,390 | ) |

| Borrowings on short term loan - others | |

| 47,755 | | |

| 148,678 | |

| Payments on short term loans - others | |

| (32,389 | ) | |

| (169,558 | ) |

| Borrowings on short term loan - related parties | |

| 47,189 | | |

| 362,202 | |

| Payments on short term loans - related parties | |

| (23,353 | ) | |

| (274,718 | ) |

| Deposits due to sales representatives | |

| 5,761 | | |

| (6,521 | ) |

| Deposit due to sales representatives - related parties | |

| 325 | | |

| 531 | |

| Payments on long-term loans - related party | |

| - | | |

| (22,856 | ) |

| Principal payment on capital lease obligation | |

| (1,285 | ) | |

| - | |

| Net cash provided by financing activities | |

| 51,058 | | |

| 146,770 | |

| EFFECTS OF EXCHANGE RATE CHANGE IN CASH | |

| 1,054 | | |

| 1,417 | |

| (DECREASE) INCREASE IN CASH | |

| (9,859 | ) | |

| 15,624 | |

| CASH, beginning of period | |

| 31,967 | | |

| 46,467 | |

| CASH, end of period | |

$ | 22,108 | | |

$ | 62,091 | |

Exhibit 99.2

1 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. Third Quarter 2014 Earnings Call Presentation November 14, 2014

2 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. Safe Harbor Statement This presentation (including the financial projections and any subsequent questions and answers) contains statements that are forward - looking within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934 . Such forward - looking statements are only predictions and are not guarantees of future performance . Any such forward - looking statements are and will be, as the case may be, subject to many risks, uncertainties, certain assumptions and factors relating to the operations and business environments of General Steel Holdings, Inc . and its subsidiaries that may cause the actual results of the companies to be materially different from any future results expressed or implied in such forward - looking statements . These risk factors, include, but are not limited to, any comments relating to our financial performance, the competitive nature of the marketplace, the condition of the worldwide economy and other factors that have been or will be detailed in the Company’s periodic filings (including Forms 8 - K, 10 - K and 10 - Q) or other documents filed with the Securities and Exchange Commission . For more detailed information on the Company, please refer to the Company filings with the Securities and Exchange Commission, which are readily available at http : //www . sec . gov, or through the Company’s Investor Relations website at http : //www . gshi - steel . com . The Company undertakes no obligation to publicly update any forward - looking statement, whether as a result of new information, future events or otherwise .

3 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. Review of Progress on Key Initiatives Agenda China Steel Industry Dynamics Third Quarter 2014 Highlights Equipment Upgrades to Further Improve I ron S melting Efficiency Review of Third Quarter 2014 Financials

4 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. Third Quarter 2014 Highlights 0.9% 3.6% - 1.9% 1.7% 0.6% - 5.4% 1.3% - 6.0% - 3.7% 4.8% 1.7% -10% -5% 0% 5% 10% 1Q 2012 2Q 2012 3Q 2012 4Q 2012 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 3Q 2014 Quarterly Gross Margin Improved 40 bps Gross Profit Up 16 .8% to $9.6 Million Record Sales Volume in 3Q 2014 1,175 1,339 1,397 1,425 1,304 1,385 1,257 1,154 1,318 1,306 1,447 0 500 1,000 1,500 1Q 2012 2Q 2012 3Q 2012 4Q 2012 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 3Q 2014 1,000 mt Lowered Unit Cost of Rebar* 583.2 575.0 530.7 481.2 511.8 509.5 483.0 483.1 467.7 428.4 381.9 300 400 500 600 1Q 2012 2Q 2012 3Q 2012 4Q 2012 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 3Q 2014 $ / mt *Unit cost of rebar at Longmen Joint Venture

5 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. China Steel Industry Dynamics ASP Support during APEC Summit » In July 2014, MIIT announced the first batch of capacity to be closed: • 44 iron - making companies with total capacity of 25.4 million tons • 30 steel - making companies with total capacity of 21.5 million tons • Deadline of closure by September 30, 2014 Steel Capacity Trimming Underway Improving China Steel Mills Profitability in 3Q 2014 0% 1% 2% 3% Feb-13 Mar-13 Apr-13 May-13 Jun-13 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Industry Average Net Margin 12.1% 9.8% 6.6% 6.8% 7.3% 4.6% 6.2% 12.8% 11.0% 9.2% 4.2% 6.5% 2.2% 2.1% 2.6% 4.5% 1.5% 1.0% 1.8% 0 2,000 4,000 6,000 8,000 Jan/13 Feb/13 Mar/13 Apr/13 May/13 Jun/13 Jul/13 Aug/13 Sep/13 Oct/13 Nov/13 Dec/13 Feb/14 Mar/14 Apr/14 May/14 Jun/14 Jul/14 Aug/14 Sep/14 3Q 2014 Crude Steel Output Growth Rate Contracted to 2.34% YoY Source: Changjiang Securities • Tier 1 control area - 100km radius around Beijing: 100 % production halt • Tier 2 control area - 100 - 200km radius around Beijing: P roduction halts for unqualified producers , and P roduction limit for qualified producers; • Normal control area: P roduction halts or production limit when heavy smog » S trict steel production controls » Covering 93 % of Hebei Province’s total steel capacity , or approximately 20% of China's total capacity

6 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. Ramped - Up Continuous Rolling Capacity Optimized Procurement Channel Continued Progress on Key Initiatives General Steel has continually made progress in optimizing sourcing mechanisms, upgrading production lines and implementing continuous technical improvements. x Partnered with local SOEs to secure high quality and steady supply of local raw materials x Signed direct supply agreement with Rio Tinto in April 2014 for 1,500,000 metric tons of imported iron ore x 3 Q 2014, unit cost of iron ore and coke decreased by 25.3 % and 1 5.8 % , respectively x Effective reduction of overall unit production cost x Fully ramped - up utilization Unit cost of rebar manufactured Down by 20 .9 % YoY □ Rolling yield 101.43% in 3Q 2014 VS 101.16% in 1H 2014 , □ Rebar rolling processing cost RMB 134.9 million in 3Q 2014 Saving of RMB 50/mt compared with outsourced - processing x Overall production cost saving of over RMB 52 million in 3Q 2014 by internal estimation

7 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. Equipment Upgrades Blast Furnaces at Longmen Joint Venture Sintering Machines at Longmen Joint Venture 4 x 1,280 m 3 450 m 3 1,800 m 3 4 50 m 2 4 00 m 2 The Company expects to launch the upgraded equipment in December 2014 , and cut unit production cost by RMB 50/mt once production normalizes. 265 m 2

8 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. Items 3Q 2014 3Q 2013 Y - o - Y% Total Sales Volume (Thousands MT) 1,447 1,257 +15.1% ASP of Rebar** (US$ /MT) 388.1 489.6 - 20.7% Revenue (US$ million) 562.8 610.1 - 7.7% Gross Profit (US$ million) 9.6 8.2 +16.8% Gross Margin 1.7% 1.3% Up by 40 bps Operating Income* (US$ million) 7.9 27.7 - 71.5% Finance Expense (US$ million) - 19.4 - 22.8 - 15.0% EPS* (US$) - 0.06 0.07 N.A. Third Quarter 2014 Financial Summary Sales Volume Breakdown • Includes $14.7 million change in fair value of profit sharing liability for the third quarter of 2014. • ** ASP of rebar at Longmen Joint Venture Thousands MT Operating Expense Breakdown 7.3 6.7 12.4 9.7 3Q 2013 3Q 2014 G&A Expense Selling Expense USD Million 1,239 1,441 18 6 3Q 2013 3Q 2014 Other Subsidiaries Longmen Joint Venture $19.7 $16.4

9 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. Balance Sheet Summary AS OF (USD 1,000) September 30, 2014 December 31, 2013 Assets: Cash and Restricted Cash $405,358 $431,300 Accounts Receivable $10,634 $7,020 Notes Receivable $66,984 $60,054 Inventories $ 250,017 $212,921 Advances on Inventory Purchases $171,273 $127,900 Total Current Assets $ 1,196,254 $1,380,724 Property Plant and Equipment $ 1,516,009 $1,271,907 Total Assets $ 2,768,277 $2,700,358 Liabilities: Short Term Notes Payable $784,323 $1,017,830 Accounts Payable $855,027 $670,671 Short Term Loan $532,089 $490,677 Customer Deposits $300,481 $152,741 Taxes Payable $3,930 $4,628 Total Current Liabilities $ 2,736,363 $ 2,562,140 Capital Lease Obligations, noncurrent $ 388,615 $ 375,019 Profit Sharing Liability $ 149,363 $ 162,295

10 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. 10 Q&A Joyce Sung General Steel Holdings, Inc. Tel: +1 - 347 - 534 - 1435 Email: joyce.sung@gshi - steel.com

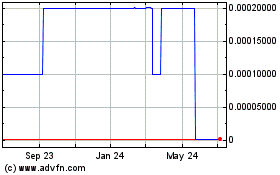

General Steel (CE) (USOTC:GSIH)

Historical Stock Chart

From Jun 2024 to Jul 2024

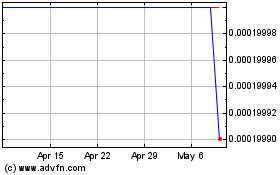

General Steel (CE) (USOTC:GSIH)

Historical Stock Chart

From Jul 2023 to Jul 2024