Greece's Eurobank to Acquire Grivalia Properties -- 2nd Update

November 26 2018 - 2:50PM

Dow Jones News

By Nektaria Stamouli and Vipal Monga

ATHENS -- Greece's Eurobank Ergasias SA said it will acquire

real-estate company Grivalia Properties REIC, boosting its capital

and paving the way for the creation of a "bad bank" to help deplete

its pile of nonperforming loans.

The deal gives Fairfax Financial Holdings Ltd., under Chairman

Prem Watsa, a 32.9% stake in the merged entity. The Canada-based

insurer currently holds an 18.2% stake in Eurobank, Greece's

third-largest lender by assets, and a 51.4% stake in Grivalia .

Eurobank on Monday said it plans to buy Grivalia in an all-share

acquisition that values the real-estate firm at EUR780 million

($884.4 million). That will strengthen its capital base by around

EUR900 million, and the merger will be completed by April, the bank

said.

Greece's state bailout fund for banks' share in Eurobank will

decrease after the deal to 1.4% from 2.4%. The fund was set up in

2010 to oversee three recapitalizations to the sector completed

with the help of state aid and still holds stakes in Greek

banks.

Mr. Watsa, one of Canada's best-known investors, has made

bullish statements on Greece's recovery. Fairfax has been investing

money in Greece since 2010, but Mr. Watsa's bets haven't turned out

well so far. Fairfax put roughly $1.42 billion into the country and

lost almost 30% on the investments by the end of last year,

according to the company's annual report.

Greek banks have been under heavy pressure for the past several

months amid fears that they can't digest their mountain of bad

loans and might need fresh capital. Nonperforming loans and other

assets at Greek banks, which have been recapitalized three times

during the country's debt crisis, total around half of their entire

portfolio.

Still, Mr. Watsa said he expects Greece's economy to grow

between 2% and 3% starting next year, and growth could surpass that

expectation. "They've been in a depression," he said, of Greece's

economy. "On the way up and out, economic growth can be

significant."

Fokion Karavias, Eurobank's chief executive, and George

Chryssikos, Grivalia's CEO, came up with the acquisition plan and

presented it to Fairfax in September, said Mr. Watsa, in an

interview. "The opportunity is very significant," he said. "We

liked it."

Mr. Karavias will be the combined bank's CEO, while Mr.

Chryssikos will become nonexecutive vice chairman of the board. Mr.

Watsa said the two will work together on the merged bank's plans,

including any expansion.

Eurobank said the acquisition would allow it to cut its ratio of

nonperforming loans to 15% of its total loan portfolio by the end

of 2019 and reduce it to single digits by 2021, from the current

39%.

After the merger, Eurobank will proceed with plans to create the

bad bank, where it would transfer some EUR7 billion of its bad

loans. Those loans are considered the "worst of the total sour

loans," an official from the bank said.

It is estimated that unloading these sore loans will reduce the

bank's capital by EUR1.1 billion to EUR1.4 billion, which will be

covered by the capital boost from the merger as well as a strategic

investor Eurobank intends to seek for its loan servicer, Eurobank

Financial Planning Services SA.

Eurobank said its plans for reducing its pile on nonperforming

loans been approved by the banking-supervision unit of the European

Central Bank. An ECB official declined to comment.

Greece's central bank and the government's bailout fund for

banks are currently working on two separate plans to finance a bad

bank. The biggest question is whether the European Commission will

deem the plans legal under the bloc's rules limiting state aid for

companies.

Eurobank said both plans, if eventually approved, could be

combined with its nonperforming-loan reduction plan.

Eurobank stock, which jumped as much 25% during the session,

ended the session 4.3% higher, while Grivalia gained 6.3%. Despite

the initial jump in the banking sector after the deal was

announced, the banking-stocks index dropped 0.1%. Greek bank stocks

have lost some 40% in the past three months.

Write to Vipal Monga at vipal.monga@wsj.com and Nektaria

Stamouli at nektaria.stamouli@wsj.com

(END) Dow Jones Newswires

November 26, 2018 14:35 ET (19:35 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

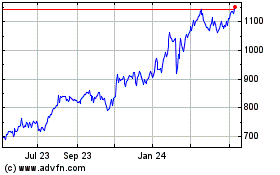

Fairfax Financial (PK) (USOTC:FRFHF)

Historical Stock Chart

From Feb 2025 to Mar 2025

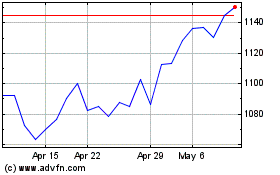

Fairfax Financial (PK) (USOTC:FRFHF)

Historical Stock Chart

From Mar 2024 to Mar 2025