Exxe Group’s Reports Over 600% Increase in

Annual Revenue and 111% in Net Income

-

Revenue of $15.3 million

for year ended March 31, 2020 versus $2.1 million a year

ago

-

Net income for the year was

$3.6 million as compared with $1.7 million last

year

-

Shareholder’s equity leaped

to $116. 2 million, up from $37.8 million

New York, NY -- August 27,

2020 -- InvestorsHub NewsWire -- Exxe Group, Inc. (OTC

PINK: AXXA), a diversified company focused on synergistic

acquisitions in financial services, real estate, sustainable

technology, and agribusiness, is pleased to announce that its

financial results for the year ended March 31, 2020 were

substantially higher than results from the previous year. Revenue

of $15,341,001 was over 620% higher than the $2,102,415 reported

for the year ended March 31, 2019. Net income gains were also very

strong, rising over 111% to $3,556,558 from

$1,686,106.

Shareholder’s equity jumped

by over 207% to $116.2 million, up from $37.8 million, aided by a

large increase in assets from $65.3 million in the previous year to

$192.8 million in assets as of March 2020. Based on the shares

outstanding at the end of the period, book value per AXXA share was

$0.29, a level many times greater than the stock’s recent share

price.

Fiscal Year

Highlights

While growth in revenue was

diverse and across multiple holdings, the primary drivers of the

sales growth included new holdings closed during the fiscal year,

including the Company’s agribusinesses holdings and our Myle-One

Beteiligungen AG automotive sector including engine repair and car

parts ecommerce business among others. Despite the current COVID-19

pandemic, sales momentum is growing in our key holdings and we

expect to continue to generate strong gains in revenue, going

forward.

In addition to closing

several transactions in the agribusiness, automotive, real estate,

venture capital and fintech segments, management made steps to

improve shareholder value. Exxe Group entered into a share

agreement with its largest shareholder which had a very positive

impact on our total share count. A shareholder agreed to convert 50

million common AXXA shares into Series B preferred on a dollar for

dollar basis, thereby reducing shares outstanding by over

10%.

Our

Future

While we will always have

an eye to growing shareholder’s equity, management is more focused

than ever on producing consistently strong operating results. We

believe that above-average operating performance should generate

shareholder value reflective of our $15 million revenue base and

$3+ million net income mark. Thus, as the integration of recently

closed transactions continues, we plan to produce high top-line

growth rates, with measurable cross-sales in various industries.

Moreover, our plan to layer unique innovation on top of our

promising financial services and real estate businesses should

begin to bear significant fruit in the coming months and add high

value to AXXA.

In conjunction with the

operating performance, management will continue to explore

alternative financing sources to reduce our financing costs, and

thus raise the value of our income statement and balance sheet. In

addition, we continue to monitor potential public spin-off

opportunities for our group of companies and early-stage firms in

the AXXA Venture Fund.

Eduard Nazmiev, CEO and

President of Exxe Group commented on the quarter and the future for

AXXA. “We are very proud of the incredible financial performance

for the year ended March 2020. Very few companies can produce the

type of revenue and net income growth that we generated and it is a

testament to the entire Exxe Group of companies and employees.

Still, we are not resting on our laurels. Instead, we are

hyper-focused on achieving shareholder value that corresponds with

and reflects our operating results and growth. As we continue to

outperform financially and strategically by layering innovation on

top of our core businesses, it should have a uniquely positive

impact on AXXA, and raise our

profile.”

About Exxe Group, Inc.

Exxe Group is a diversified corporation focusing on acquisitions in

the following sectors: real estate, sustainable technology, media,

agribusiness, and financial services. Exxe Group is an

acquisition-driven company. The Company strategy is to acquire

controlling equity interests in undervalued companies and undertake

an active role in improving their performance - accelerating their

growth by providing both access to capital and management

expertise. For additional information go to www.exxegroup.com

CONTACT: Exxe Group

IR: info@exxegroup.com

Forward-Looking

Statements

This press release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

In some cases, you can identify forward-looking statements by the

following words: "anticipate," "believe," "continue," "could,"

"estimate," "expect," "intend," "may," "ongoing," "plan,"

"potential," "predict," "project," "should," "will," "would," or

the negative of these terms or other comparable terminology,

although not all forward-looking statements contain these words.

Forward-looking statements are not a guarantee of future

performance or results and will not necessarily be accurate

indications of the times at, or by, which such performance or

results will be achieved. Forward-looking statements are based on

information available at the time the statements are made and

involve known and unknown risks, uncertainties and other factors

that may cause our results, levels of activity, performance or

achievements to be materially different from the information

expressed or implied by the forward-looking statements in this

press release.

About Exxe Group, Inc.

Exxe Group is a diversified corporation focusing on acquisitions in

the following sectors: real estate, sustainable technology, media,

agribusiness, and financial services. Exxe Group is an

acquisition-driven company. The Company strategy is to acquire

controlling equity interests in undervalued companies and undertake

an active role in improving their performance - accelerating their

growth by providing both access to capital and management

expertise. For additional information go to www.exxegroup.com

CONTACT: Exxe Group

IR: info@exxegroup.com

Forward-Looking

Statements

This press release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

In some cases, you can identify forward-looking statements by the

following words: "anticipate," "believe," "continue," "could,"

"estimate," "expect," "intend," "may," "ongoing," "plan,"

"potential," "predict," "project," "should," "will," "would," or

the negative of these terms or other comparable terminology,

although not all forward-looking statements contain these words.

Forward-looking statements are not a guarantee of future

performance or results and will not necessarily be accurate

indications of the times at, or by, which such performance or

results will be achieved. Forward-looking statements are based on

information available at the time the statements are made and

involve known and unknown risks, uncertainties and other factors

that may cause our results, levels of activity, performance or

achievements to be materially different from the information

expressed or implied by the forward-looking statements in this

press release.

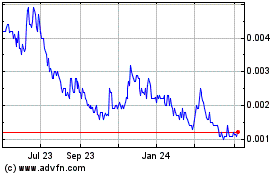

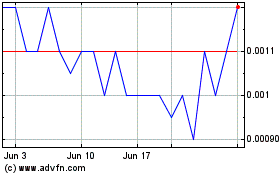

Exxe (PK) (USOTC:AXXA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Exxe (PK) (USOTC:AXXA)

Historical Stock Chart

From Dec 2023 to Dec 2024