SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________

FORM 10-K

YEARLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal year ended July 31, 2010

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______

Commission File Number 0-02555

Exobox Technologies Corp.

(Name of Small Business Issuer in its charter)

|

Nevada

|

88-0456274

|

|

(State or other jurisdiction of incorporation)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

5780 Avenida Robledal, Pensacola, Florida

|

32504

|

|

(Address of principal executive offices)

|

(Zip code)

|

(Former name or former address, if changed since last report.)

|

206½ South Broadway

|

|

Pittsburg, Kansas 66762

|

(850) 384-3009

(Telephone number, including area code)

Securities registered under Section 12(g) of the Exchange Act:

Common Stock

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o

Yes

x

No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

o

Yes

x

No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x

Yes

o

No

Indicate by check mark if disclosure if delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

o

|

Accelerated filer

o

|

|

Non-accelerated filer

o

|

Smaller reporting company

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

o

No

x

State issuer’s revenues for its most recent fiscal year. $14,420 The issuer elects to file under 3-11 of Reg SX

State the aggregate market value of the voting stock held by non-affiliates computed by reference to the price at which the stock was sold, or the average bid and asked prices of such stock, as of a specified date within the past 60 days. The aggregate market value of the common stock held by non-affiliates of the registrant was approximately $593,700, based on the closing price on the OTCBB market on November 13, 2010.

As of November 30, 2010, approximately 415,771,591 shares of the registrant's common stock were outstanding.

EXOBOX TECHNOLOGIES CORP.

FORM 10-K FOR THE YEAR ENDED JULY 31, 2010

INDEX

|

PART I. FINANCIAL INFORMATION

|

Page

|

|

|

No.

|

|

Item 1. Financial Statements

|

|

|

|

|

|

Balance Sheet as of July 31, 2010 and July 31, 2009

|

3

|

|

|

|

|

Statements of Operations for the year ended July 31, 2010 and 2009

|

4

|

|

|

|

|

Statements of Cash Flows for the year ended July 31, 2010 and 2009

|

5

|

|

|

|

|

Notes to the Financial Statements

|

7

|

|

|

|

|

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

|

10

|

|

|

|

|

Item 3. Quantitative and Qualitative Disclosures about Market Risk

|

12

|

|

|

|

|

Item 4. Controls and Procedures

|

12

|

|

|

|

|

PART II. OTHER INFORMATION

|

|

|

|

|

|

Item 1. Legal Proceedings

|

12

|

|

|

|

|

Item 2. Recent Sales of Unregistered Securities

|

13

|

|

|

|

|

Item 3. Defaults Upon Senior Securities

|

14

|

|

|

|

|

Item 4. Submission of Matters to a Vote of Security Holders

|

14

|

|

|

|

|

Item 5. Other Information

|

14

|

|

|

|

|

Item 6. Exhibits

|

14

|

|

|

|

|

Signatures

|

15

|

EXOBOX TECHNOLOGIES CORP.

(A DEVELOPMENT STAGE COMPANY)

BALANCE SHEETS

(Unaudited)

|

|

|

|

July 31, 2010

|

|

|

|

July 31, 2009

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current Assets:

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

-

|

|

|

$

|

3

|

|

|

Accounts Receivable ($2,633 less reserve for uncollectable $2,633)

|

|

|

-

|

|

|

|

-

|

|

|

Other Current Assets

|

|

|

2,633

|

|

|

|

8,561

|

|

|

Total Current Assets

|

|

|

2,633

|

|

|

|

8,564

|

|

|

|

|

|

|

|

|

|

|

|

|

Furniture, fixtures and equipment, net (Notes to Financial Statements)

|

|

|

|

|

|

|

395,338

|

|

|

Other Assets:

|

|

|

|

|

|

|

|

|

|

Patents, net

|

|

|

-

|

|

|

|

1

|

|

|

Intangibles, net

|

|

|

-

|

|

|

|

6,568

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

$

|

2,633

|

|

|

$

|

410,471

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

|

|

|

|

|

|

|

|

|

Current Liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts Payable

|

|

$

|

433,550

|

|

|

$

|

432,621

|

|

|

Accounts Payable-Stockholders

|

|

|

-

|

|

|

|

2,594

|

|

|

Accrued Liabilities

|

|

|

1,753,754

|

|

|

|

314,964

|

|

|

Advances from Stockholders

|

|

|

930,081

|

|

|

|

875,081

|

|

|

Notes Payable

|

|

|

55,000

|

|

|

|

30,000

|

|

|

Notes Payable (See notes to Financial Statements)

|

|

|

340,000

|

|

|

|

-

|

|

|

Deferred Income

|

|

|

-

|

|

|

|

1,400

|

|

|

Total Current Liabilities

|

|

|

3,512,385

|

|

|

|

1,656,660

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES

|

|

|

3,512,385

|

|

|

|

1,656,660

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' DEFICIT

|

|

|

|

|

|

|

|

|

|

Preferred stock:

|

|

|

|

|

|

|

|

|

|

Series A convertible preferred stock, $0.001 par, 2,500,000 shares authorized, 1,378 and 1,378 shares issued and outstanding as of July 31, 2010 and July 31, 2009, respectively

|

|

|

1

|

|

|

|

1

|

|

|

Common stock, $0.001 par value, 500,000,000 shares authorized, 415,771

and 460,664,395 shares issued and outstanding at July 31, 2010 and July 31 2009, respectively

|

|

|

415,771

|

|

|

|

460,664

|

|

|

Additional paid-in capital

|

|

|

16,801,217

|

|

|

|

14,481,168

|

|

|

Deficit accumulated during development stage

|

|

|

(20,726,740

|

)

|

|

|

(16,188,022

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders' deficit

|

|

|

(3,509,752

|

)

|

|

|

(1,246,189

|

)

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT

|

|

$

|

2,633

|

|

|

$

|

410,471

|

|

See accompanying notes to the financial statements

EXOBOX TECHNOLOGIES CORP.

(A DEVELOPMENT STAGE COMPANY)

STATEMENTS OF OPERATIONS

For the Years Ended July 31, 2010 and 2009

|

|

|

Year Ended

July 31, 2010

|

|

|

Year Ended

July 31, 2009

|

|

|

Revenues

|

|

|

14,420

|

|

|

|

|

|

Cost Of Revenues

|

|

|

29,883

|

|

|

|

14,657

|

|

|

Net Revenue/Gross Loss

|

|

|

( 15,463

|

)

|

|

|

( 14,657

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses:

|

|

|

|

|

|

|

|

|

|

General & Administrative

|

|

|

2,090,990

|

|

|

|

3,794,389

|

|

|

Depreciation and amortization

|

|

|

90,131

|

|

|

|

90,013

|

|

|

Professional Fees

|

|

|

339,815

|

|

|

|

796,115

|

|

|

Payroll Expenses

|

|

|

182,600

|

|

|

|

1,336,156

|

|

|

Loss on Disposal of Assets

|

|

|

315,688

|

|

|

|

9,855

|

|

|

Loss on Abandonment of Assets

|

|

|

1,405,433

|

|

|

|

50,591

|

|

|

Loss on Uncollectable Accounts Receivable

|

|

|

2,791

|

|

|

|

|

|

|

Research and Development

|

|

|

108,367

|

|

|

|

384,431

|

|

|

Total Operating Expenses

|

|

|

4,535,814

|

|

|

|

6,458,550

|

|

|

Loss from Operations

|

|

|

4,551,276

|

|

|

|

6,473,207

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expense):

|

|

|

|

|

|

|

|

|

|

Loss on Unrecovered Assets

|

|

|

( 5,177

|

)

|

|

|

|

|

|

Gain on sale of patent and impairment of patent

|

|

|

38,750

|

|

|

|

|

|

|

Gain on Extinguishment of AP

|

|

|

15,423

|

|

|

|

84,065

|

|

|

Gain on Extinguishment of Note

|

|

|

3,000

|

|

|

|

|

|

|

Interest Expense

|

|

|

( 39,440

|

)

|

|

|

93,021

|

|

|

Interest Income

|

|

|

|

|

|

|

1,489

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Other Income (Expenses)

|

|

|

12,556

|

|

|

|

( 7,469

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Loss Before Income Tax

|

|

|

( 4,538,720

|

)

|

|

|

( 7,469

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Provision for Income Tax

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

|

|

( 4,538,720

|

)

|

|

|

( 6,480,676

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted

|

|

|

|

|

|

|

|

|

|

Net Loss per common-share and diluted

|

|

|

( .01

|

)

|

|

|

( .02

|

)

|

|

Weighted average shares outstanding-basic & diluted

|

|

|

410,500,126

|

|

|

|

414,532,158

|

|

See accompanying notes to the financial statements

EXOBOX TECHNOLOGIES CORP.

(A DEVELOPMENT STAGE COMPANY)

STATEMENTS OF CASH FLOWS

For the year Ended July 31, 2010 and 2009,

(Unaudited)

|

|

|

Year

Ended

July 31,

|

|

|

Year

Ended

July 31,

|

|

|

|

|

2010

|

|

|

2009

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

Net Loss

|

|

$

|

(4,538,720

|

)

|

|

$

|

(6,480,676

|

)

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Shares issued for services

|

|

|

2,100,418

|

|

|

|

2,335,486

|

|

|

Warrant issued for consulting services

|

|

|

-

|

|

|

|

9,855

|

|

|

Loss on impairment of assets

|

|

|

-

|

|

|

|

50,591

|

|

|

Depreciation and amortization

|

|

|

94,032

|

|

|

|

90,013

|

|

|

Share-based compensation

|

|

|

|

|

|

|

593,977

|

|

|

(Gain) Loss on derivative

|

|

|

-

|

|

|

|

-

|

|

|

Gain on debt conversion

|

|

|

(3,000

|

)

|

|

|

-

|

|

|

(Gain)Loss on accounts payable

|

|

|

-

|

|

|

|

(84.065

|

)

|

|

Loss on Unrecovered Assets

|

|

|

5,155

|

|

|

|

-

|

|

|

Contributed capital

|

|

|

-

|

|

|

|

62,522

|

|

|

Amortization of debt discount

|

|

|

-

|

|

|

|

80,000

|

|

|

Loss on disposal of furniture, fixtures and equipment

|

|

|

314,219

|

|

|

|

|

|

|

Changes in operating assets and liabilities

|

|

|

|

|

|

|

|

|

|

Prepaid and other current assets

|

|

|

(5,931

|

)

|

|

|

76.039

|

|

|

Accounts payable

|

|

|

3,290

|

|

|

|

499,093

|

|

|

Accrued expenses

|

|

|

1,438,790

|

|

|

|

206,397

|

|

|

Deferred income

|

|

|

(1,400

|

)

|

|

|

1,400

|

|

|

Accounts payables to stockholders

|

|

|

(2,594

|

)

|

|

|

2.594

|

|

|

NET CASH USED IN OPERATING ACTIVITIES

|

|

|

(594,741

|

)

|

|

|

(2,556,774

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOW FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Proceeds from sale of patents

|

|

|

-

|

|

|

|

-

|

|

|

Investment in intangible assets

|

|

|

|

|

|

|

-

|

|

|

Investment in property and equipment

|

|

|

-

|

|

|

|

(228,642

|

)

|

|

NET CASH USED IN INVESTING ACTIVITIES

|

|

|

-0-

|

|

|

|

(228,642

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Proceeds from sale of stock and contributed capital

|

|

|

165,739

|

|

|

|

509,200

|

|

|

Advances from stockholders

|

|

|

166,000

|

|

|

|

1,397,081

|

|

|

Proceeds from warrants exercised

|

|

|

8,999

|

|

|

|

136,800

|

|

|

Repayment of advances from stockholders

|

|

|

(111,000

|

)

|

|

|

(100,000

|

)

|

|

Convertible Promissory Notes proceeds

|

|

|

25,000

|

|

|

|

80,000

|

|

|

Proceeds from third party debt, net

|

|

|

340,000

|

|

|

|

(5,000

|

)

|

|

NET CASH PROVIDED BY FINANCING ACTIVITIES

|

|

|

594,738

|

|

|

|

2,018,081

|

|

|

|

|

|

|

|

|

|

|

|

|

NET CHANGE IN CASH AND CASH EQUIVALENTS

|

|

|

(3

|

)

|

|

|

(767,335

|

)

|

|

Cash and cash equivalents at beginning of period

|

|

|

3

|

|

|

|

767,338

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to the financial statement

s

EXOBOX TECHNOLOGIES CORP.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

(Unaudited)

NOTE 1 – NATURE OF BUSINESS AND SUMMARY OF ACCOUNTING POLICIES

The accompanying unaudited interim financial statements of Exobox Technologies Corp., a Nevada corporation, have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules of the Securities and Exchange Commission and should be read in conjunction with the financial statements and notes thereto contained in previous Quarterly and Annual Reports filed with the SEC on Form 10-Q’s and K’s. In the opinion of management, all material adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of financial position and the results of operations for the interim periods presented have been reflected herein.

Exobox was an enterprise and home user network and data security development company formed to capitalize upon the growing need for a modern, reliable, efficient, effective and proactive network and data security solutions. Exobox is the parent company to its wholly-owned subsidiary, Exbx Energy, Inc., a Texas corporation (“Exbx Energy”) since its formation in October, 2009. Exbx Energy, Inc never commenced business nor obtained a federal tax id number and has no effect on these financial statements.

NOTE 2 - GOING CONCERN

From Inception to July 31, 2010, Exobox has accumulated losses of $20,726,740. The ability of Exobox to emerge from the development stage with respect to any planned principal business activity is dependent upon its success in raising additional equity, debt financing, licensure of its patented technology, development of non-patented technology and software and/or attaining profitable operations. Management is attempting to seek additional capital. There is no guarantee that Exobox will be able to complete any of the above objectives. These factors raise substantial doubt regarding Exobox's ability to continue as a going concern.

NOTE 3 – PATENTS

Patents are mainly comprised of legal services paid to a shareholder and patent application fees. Exobox began amortizing these costs since the patents have been granted. Patents were impaired as of July 31, 2009 for $50,591.

On September 15, 2009, Exobox sold its SOS Patents to Scott Copeland for $95,000. On November 1, 2009, Copeland sold these SOS patents back to Exobox for 1,250,000 common shares valued at $56,250 and also a royalty of 3% of any net proceeds derived from the SOS technology.

NOTE 4 – FURNITURES, FIXTURES and EQUIPMENT

Due to the severe financial problems encountered as the result of not generating revenue, the company was not able to keep up with lease payments for its office at 2121 Sage Road Ste. 200 Houston, Texas 77056. Exobox abandoned the lease in April 2010, some furniture, fixtures and equipment that were in this office were handed over to the lessor and others to settle, in part, $67,376 of rent payable. Net book value of the furniture, fixtures and equipment at the time of the closed office was $298,165 For the year ended July 31, 2010, the company recorded a loss on settled rent payable of $230,789 and a loss of $ 5,155 for unrecovered assets which consisted primarily of computers costing $69,924 with $64,352 accumulated depreciation. The company moved its offices to 3315 Marquart Street until September 2010 when all records were moved to a self-storage location. On October 7 the records when they were transferred to current management. The disposition and proper booking of the companies computers, and other related assets, are continuing.

As of July 31, 2010 the company maintains computers costing $69,924 on its books. There is a Reserve for Deprecation of $64,747 and a Reserve for Unrecovered Assets of $ 5,155. The company continues to attempt to properly account for its computers and other assets.

NOTE 5 – DEBT

In June 2009, Exobox issued an unsecured promissory note to RSA Corp by converting the $35,000 previously outstanding account payable balance. The note bears interest of 0% per year and matured December 1, 2009. After payment on account, the loans totaled to $31,400 which includes $1,400 in interest as of April 30, 2010. On November 3, 2009, the Company received a demand for payment. To date, no suit has been filed.

$340,000: On December 21, 2009 the company was loaned $25,000 by Dr. Feldman with 10% due 9/21/10; the note was convertible to stock @ $.06/sh. On January 7, 2010 the company was loaned $30,000 by Kampa and $30,000 by Wittenburg. On January 11, 2010 the company entered into an Agreement to purchase up to $300,000 principal of Secured Convertible Promissory notes. An agreement , “Security Agreement” was signed by Feldman, Kampa, Wittenburg, Wirtz, Van Ryder, Hughes and White. On January 15, 2010 the company borrowed $5,000 from Wirtz. On March 19, 2010 the company borrowed $25,000 from Dr Feldman. On March 31, 2010 the company borrowed $50,000 from Hughes and $100,000 from White. On March 29, 2010 the company executed a note payable to Kampa for $44,000 for accrued payroll of $40,000 and $4,000 paid for legal fees. On March 29, 2010 the company executed notes payable to Van Ryder in the amount of $15,000 and Wirtz $15,000. All the notes were at 10% with approximately a n

ine month maturity. On March 29, 2010 all the individuals who purchased the convertible notes for collateral agreed to have equal lien on them and no one shall exercise remedy until majority approval. The notes purport to be secured by the Company’s technology. The total of these notes were $340,000 as of July 31, 2010. On October 14, 2010 the group filed UCC1’s against the corporate technology. The group did not complete its Letter of Intent with the company on October 15, 2010. The company is currently evaluating its position as it relates to the notes.

During March and April 2009, the company received loans from Mark Copeland in the amount of $85,581.

On December 8, 2009, the company received a demand to repay Reginald Goodman $227,301 ($210,400 principal and $16,970 in accrued interest). To date, no suit has been filed.

On December 8, 2009, Mr. Kampa loaned the company $3,000 through a non-interest bearing promissory note which was due on April 30, 2010. On April 1, 2010, the note was paid in full.

In April, 2010, Mr. Wirtz agreed to release, in his notes totaling $20,000, the security interest in the technology in exchange for an unsecured, interest free note or company stock at some conversion price acceptable to the Company.

In May, 2010, one of the holders of a $30,000 note, agreed to release the security interest in the technology in exchange for an unsecured, interest free note or company stock at some conversion price acceptable to the Company.

On May 17, 2010 the company borrowed $25,000 from David Crawford in exchange for a unsecured note payable. In November 2010 the company received demand for payment.

The company intends to negotiate with the other holders of the secured notes totaling $290,000 releases of the security interest in the technology in exchange for an unsecured, interest free notes or company stock at some conversion price acceptable to the Company.

NOTE 6 – STOCKHOLDERS’ EQUITY

Stock Issued for Services

During the year ended July 31, 2010, we issued 60,325,003 common shares to consultants and employees pursuant to consulting and employment agreements with a value of $2,100,418.

Stock Issued for Cash

During the year ended July 31, 2010, we issued 10,450,000 common shares for $142,000 in cash.

Stock Issued for Warrants Exercised

During the year ended July 31, 2010, we issued 150,000 common shares in relation to warrants exercised for $9,000.

Stock Issued for Debt

During the year ended July 31, 2010, we issued 1,000,000 common shares in relation to convertible note.

Stock Issued for Patents

During the year ended July 31, 2010, we issued 1,250,000 common shares valued at $56,250. (see Note 3 above)

Stock Option, Stock Warrant and Stock Award Plan

OPTIONS

In the year ended July 31, 2010, Exobox granted an employee an option to purchase 25,000 shares with exercise price of $0.25 a share. The shares were vested immediately. During the twelve months ended July 31, 2010, 12,650,000 shares expired due to 90 days passing of the termination of employment of several option holders as called for in the 2007 Stock Option Plan.

The following assumptions were applied to value the options:

|

Expected volatility

|

|

|

174%- 243%

|

|

|

Term (years)

|

|

|

1.5 – 3

|

|

|

Risk-free interest rate

|

|

|

1.16% - 3.01%

|

|

|

Expected dividend yield

|

|

|

0%

|

|

Black-Scholes was applied to value the options and Exobox recognized $13,420 of stock based compensation expense for the year ended July 31, 2010. The remaining 24,479 unvested shares have an unrecognized value of $3,975 The options intrinsic value is $0 as of July 31, 2010.

The status of the options as of July 31, 2010, is as follows:

|

|

|

Options

|

|

|

Weighted Average Exercise Price

|

|

|

Outstanding July 31, 2009

|

|

|

20,225,000

|

|

|

|

0.28

|

|

|

Granted

|

|

|

25,000

|

|

|

|

-

|

|

|

Expired

|

|

|

12,650,000

|

|

|

|

0.25

|

|

|

Exercised

|

|

|

-

|

|

|

|

-

|

|

|

Outstanding, July 31, 2010

|

|

|

7,600,000

|

|

|

$

|

0.35

|

|

Following is the details of options outstanding as of July 31, 2010:

|

Number of Common

Stock Equivalents

|

|

Expiration Date

|

|

Remaining Contracted Life (Years)

|

|

|

Exercise Price

|

|

|

|

25,000

|

|

4/1/2012

|

|

|

2.17

|

|

|

|

0.25

|

|

|

|

25,000

|

|

4/1/2013

|

|

|

3.17

|

|

|

|

0.25

|

|

|

|

25,000

|

|

4/1/2014

|

|

|

4.17

|

|

|

|

0.25

|

|

|

|

25,000

|

|

4/1/2015

|

|

|

5.17

|

|

|

|

0.25

|

|

|

|

2,500,000

|

|

12/1/2013

|

|

|

3.84

|

|

|

|

0.15

|

|

|

|

1,500,000

|

|

12/1/2013

|

|

|

3.84

|

|

|

|

0.25

|

|

|

|

1,500,000

|

|

12/1/2013

|

|

|

3.84

|

|

|

|

0.40

|

|

|

|

1,000,000

|

|

12/1/2013

|

|

|

3.84

|

|

|

|

0.50

|

|

|

|

1,000,000

|

|

12/1/2013

|

|

|

3.84

|

|

|

|

0.75

|

|

|

|

7,600,000

|

|

|

|

|

3.83

|

|

|

|

0.35

|

|

The following is a summary of non-vested shares:

|

|

OPTIONS

|

|

Non-vested shares at July 31, 2009

|

386,198

|

|

Granted

|

0

|

|

Vested

|

(170,313)

|

|

Forfeited

|

(191,406)

|

|

Expired

|

-

|

|

Exercised

|

-

|

|

Non-vested shares at July 31, 2010

|

24,479

|

WARRANTS

At July 31, 2010, we had outstanding and exercisable warrants to purchase an aggregate of 15,844,284 shares of common stock with an intrinsic value of $0. The weighted average remaining life is 1.35 years and the weighted average price per share is $0.42 per share.

The status of the warrants as of July 31, 2010, is as follows:

|

Warrants Outstanding and Exercisable

|

|

Warrants

|

|

|

Weighted Average Exercise Price

|

|

|

Outstanding, July 31, 2009

|

|

|

15,994,284

|

|

|

$

|

0.47

|

|

|

Granted

|

|

|

-

|

|

|

|

-

|

|

|

Expired

|

|

|

-

|

|

|

|

-

|

|

|

Exercised

|

|

|

(150,000

|

)

|

|

|

(0.06

|

)

|

|

Outstanding, July 31, 2010

|

|

|

15,844,284

|

|

|

$

|

0.41

|

|

Following is the details of warrants outstanding as of July 31, 2010:

|

Number of Common

Stock Equivalents

|

|

|

Expiration Date

|

|

|

Remaining Contracted

Life (Years)

|

|

|

Exercise Price

|

|

|

2,902,500

|

|

|

10/31/2010

|

|

|

|

0.50

|

|

|

$

|

0.20

|

|

|

50,000

|

|

|

7/31/2011

|

|

|

|

1.25

|

|

|

$

|

0.25

|

|

|

5,400,000

|

|

|

12/31/2011

|

|

|

|

1.42

|

|

|

$

|

1.00

|

|

|

1,600,000

|

|

|

4/30/2012

|

|

|

|

1.75

|

|

|

$

|

0.03

|

|

|

825,000

|

|

|

6/1/2012

|

|

|

|

1.83

|

|

|

$

|

0.03

|

|

|

2,075,000

|

|

|

6/4/2012

|

|

|

|

1.83

|

|

|

$

|

0.03

|

|

|

83,333

|

|

|

6/12/2012

|

|

|

|

1.83

|

|

|

$

|

0.03

|

|

|

1,408,451

|

|

|

6/29/2012

|

|

|

|

1.92

|

|

|

$

|

0.03

|

|

|

1,500,000

|

|

|

9/24/2012

|

|

|

|

1.17

|

|

|

$

|

0.30

|

|

NOTE 7 – COMMITMENTS AND CONTINGENCIES

On November 25, 2009, former employee Theodore Ernst filed suit in the 434

th

District Court of Fort Bend County, Texas claiming unspecified damages. On January 11, 2010, Exobox through its attorneys filed a motion to transfer venue, an application to compel arbitration and answered the Plaintiff’s petition. The motion was granted on April 30, 2010. The Company has begun discussions to obtain an agreement with Mr. Ernst. As of April 30, 2010, the company accrued approximately $440,831 of damages related to this litigation as part of accrued expenses.

On December 12, 2009 the company borrowed $20,000 from Gemstone Leasing, LLC at 12%. The note was due May 31, 2010. No demand for payment has been received.

On December 8, 2009, the company received a demand to repay Reginald Goodman $227,301 ($210,400 principal and $16,970 in accrued interest). To date, no suit has been filed and no interest was accrued.

On January 22, 2010, an attorney representing former employee Gary Leibowitz sent the Company a demand letter asking the company pay him $640,000 in termination damages as called for in his employment agreement, $56,532 in compensation not paid and $1,079 in reimbursable expenses. In addition, a Notice of Default and demand letter was received demanding payment of a total of $16,551 ($15,988 promissory note and $563 of accrued interest) be made or Mr. Leibowitz would file suit. The company has had discussions and came to an agreement with Mr. Leibowitz. As of July 31, 2010, the past due loan and accrued interest were included part of the advances from stockholder.

On March 8, 2010 the Company received several Preliminary Wage Determination Order from the Texas Workforce Commission to pay unpaid wages to several employees totaling $63,907.41. The determinations were for wages due to Don Baird $16,200, Jan Beaty $13,125 and Ted Ernst $34,582.41. The company is pursuing settlement of the outstanding determination.

On May 5, 2010, an attorney representing Behr Construction, Inc. sent the Company a demand letter asking the company pay $6,634 owed to Behr Construction and later Behr Construction filed suit. The company is discussing an agreement to settle this law suit with Behr Construction. As of July 31, 2010, the construction expenses were included in the accounts payable.

On May 7, 2010, an attorney representing former employee Donald Baird sent the Company a demand letter asking the company pay him $16,200 in compensation not paid. In addition, a Notice of Default and demand letter was received demanding payment of a total of $25,988 ($25,000 promissory note, $2,188 of accrued interest and $800 in legal fees) be made or Mr. Baird would file suit. The company intends to open discussions with Mr. Baird. The note payable and accrued interest were included as part of notes payable as of July 31, 2010.

On May 18, 2010, an attorney representing Sam Skipper, Consultant to the Company, sent the Company a demand letter to register him the shares due to him under his consulting agreement and additional shares as penalty for delay in registering the original shares. The company came to an agreement and issued additional shares as called for in the demand letter. As of July 31, 2010, both the original and additional shares that related to the consulting agreement and the demand letter were accounted for in the stockholders’ deficit.

On November 5, 2009, the company received a demand to repay Mr. Goodman ($210,400 principal and $16,970 in accrued interest). To date, no suit has been filed.

The company is aware of a Class Action Lawsuit instituted against Exobox Technologies Corporation for securities fraud. The company is pursing defense against this action. The company has not booked any liability for this action.

On November 4, the company received notice from an attorney representing former director Dr. Evans that he had been served in a Class Action Lawsuit and demanded that the company provide for his legal defense. The company has not booked any liability for this action.

On December 8, 2009, the company received a demand to repay RJS $30,000 To date, no suit has been filed The note was executed for professional fees related to programmer.

During of 2010, the companies Board of Directors voted to reimburse its board members for legal fees and representation costs for any legal matters brought against its members. This resolution was cancelled at a October Board meeting to limited financial condition of the company.

Subsequent to the year end, settlements with the various individuals had been negotiated and agreed upon and are due and or settled in the amount of $167,000.00. The settlements when paid and or other actions completed would of reduce the indebtedness of the company by approximately $1,231,000.00.

Except for the above mentioned liabilities, the company has not yet accrued for any additional loss associated with these contingencies as it is too early to assess the outcome.

NOTE 8-OIL AND GAS PROPERTIES

On October 22, 2009, Exobox Technologies Corp. purchased 17 oil & gas wells located in Ohio from a private company for $5.9 million, which includes:

|

|

·

|

$3.0 million in total existing debt.

|

|

|

·

|

$1.5 million 5-year, 7.5% convertible note.

|

|

|

·

|

1,163,000 shares of Series E Convertible Preferred Stock, valued at $974,286

.

|

|

|

·

|

3,000,000 common shares valued at $120,000.

|

|

|

·

|

$273,075 assumed asset retirement obligation

|

On January 13, 2010, Exobox and the seller mutually agreed to rescind the transaction, with cancelation of all obligations and securities issued.

A summary of the well income and expenses during the ownership period is as follows:

|

10/23/2009 to 1/13/2010

|

|

|

|

|

Revenue – sales of oil & gas

|

|

$

|

81,031

|

|

|

EXPENSES

|

|

|

|

|

|

Depletion Expense

|

|

|

21,282

|

|

|

Expenses of Wells

|

|

|

53,633

|

|

|

Interest on $1.5m Note

|

|

|

28,125

|

|

|

Total Expenses

|

|

|

103,040

|

|

|

|

|

|

|

|

|

Net Income on Wells

|

|

$

|

(22,009

|

)

|

During the time of the ownership of the oil and gas properties, there was no cash inflows or outflows. Thus, there was no impact on the cash flows statement.

Exobox recorded no loss or gain on the discontinued operation of the oil and gas assets acquired on October 22, 2009.

On January 13, 2010, Exobox Technologies Corp. (“Exobox”) and SPQR Energy, Inc. (“SPQR”) entered into a Rescission Agreement (“Rescission Agreement”) to unwind, rescind and render null and void the Purchase and Sale Agreement dated October 22, 2009 by and between Exobox and SPQR (“Purchase and Sale Agreement”). In addition, Exobox and SPQR have agreed that both have no further rights, entitlements, liabilities or obligations with respect to the Purchase and Sale Agreement and each party further expressly, fully and completely releases the other with respect to all claims it has, had or may have against the other with respect thereto

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This report on Form 10-Q contains forward-looking statements that relate to the Company's expectations regarding future events or future financial performance. Any statements contained in this report that are not statements of historical fact may be deemed forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as "may," "will," "should," "expect," "plan," "anticipate," "intend", "believe," "estimate," "predict," "potential" or "continue," or the negative of such terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we, nor any other entity, assume responsibility for the accuracy and completeness of the forward-looking statements. We are under no obligation to update any of the forward-looking statements after the filing of this Form 10-Q to conform such statements to actual results or to changes in our expectations.

The following discussion should be read in conjunction with our condensed consolidated financial statements, related notes and the other financial information appearing elsewhere in this Form 10-Q. Readers are also urged to carefully review and consider the various disclosures made by us, which attempt to advise interested parties of the factors which affect our business, including without limitation, the disclosures made under Item 1A. Risk Factors. The risk factors below supplement and should be read in conjunction with “ Risk Factors” under Item I in our Annual Report on Form 10-K for the fiscal year ended July 31, 2009.

Overview

Exobox Technologies Corp. develops and delivers information risk management and security software solutions that help organizations protect and recover their most valuable information assets. We are committed to our vision of creating a more secure environment for the information-centric community through the development of new technologies and security services. This information-centric community is primarily comprised of companies that must abide by Governance, Risk and Compliance (GRC) policies - Fortune 500 public companies; the secondary target audience are those companies with valuable at-risk information, which includes financial services providers, healthcare providers and high-technology providers.

Information follows a typical path, or lifecycle: creation, distribution, storage, copying, transformation, and disposal. Throughout this data lifecycle, an organization’s information or intellectual property is at risk to exposure of being in the wrong hands or in the wrong place. Nearly every organization has been exploited through data leaks. Intellectual property, financial information, confidential client lists, customer, patient and employee data . . . it is all at risk of exposure from both internal and external threats. The biggest contributors to information security risks are the open exchange of information through the Internet, especially via web 2.0 applications such as social-networking sites, video-sharing sites and blogs, the rapid growth of a mobile workforce, the termination of employment, the lack of understanding that information is confidential – just to name a few. In fact, the market is so concerned about these issues that security software revenue is expected to exceed $13.1 billion by 2012 or a compound average growth rate (CAGR) of 10.5% by 2012 according to Gartner.

CURTAILED OPERATION

On September 4, 2009 the Board of Directors Special Committee that was appointed to analyze any and all financing and business combinations opportunities reported that there were no new developments. Each board member was empowered, directed and authorized to pursue financing. On or about September 30, 2009 Exobox fired or laid off all of its employees and consultants, no approval by the board of directors was received. On the even date, sales contracts which would of given the company reoccurring monthly revenue of approximately $1,500 to $2,500 were not picked up nor executed. In addition, another reoccurring revenue sales contracts equal to approximately 6-8 times greater in monthly revenue were also cancelled on the same date. One week later, the company announced it was entering into a transaction with SPQR Energy, Inc to purchase oil and gas assets for $5.9 million. On October 22, 2009, Exobox Technologies Corp. closed the purchase 17 oil & gas wells located in Ohio from a private company owned by Mr. Skipper for $5.9 million. On January 13, 2010, Exobox Technologies Corp. (“Exobox”) and SPQR Energy, Inc. (“SPQR”) entered into a Rescission Agreement (“Rescission Agreement”) to unwind, rescind and render null and void the Purchase and Sale Agreement dated October 22, 2009 by and between Exobox and SPQR (“Purchase and Sale Agreement”). In addition, Exobox and SPQR have agreed that both have no further rights, entitlements, liabilities or obligations with respect to the Purchase and Sale Agreement and each party further expressly, fully and completely releases the other with respect to all claims it has, had or may have against the other with respect thereto.

Exobox was founded in 2002 and, in conjunction with becoming a publicly-traded company in September 2005, merged with a successor Nevada

corporation which was originally incorporated in 1999.

Results of Operations

Year ended July 31, 2010 Compared to year ended July 31 2009

Net Sales

. Sales during for the year ended July 31, 2010, were $14,420 compared to $0 reported for the year ended July 31, 2009. Deferred Revenue of $1,400 as of July 31, 2009 was recognized as income for the year ended July 31, 2010. These are some of the first sales for the company as the company brought its first product, ExoDetect™ to market earlier this year.

Research

and Software Development Expenses

. Research and development expenses consist primarily of compensation and related costs for personnel responsible for the research and development of new products and services, and in the future will include those costs and expenses related to significant improvements to existing products and services. We have expensed research and development costs as they have been incurred. We had research and development expenses of $35,674 for the nine months ended April 30, 2010 as compared to $410,141 incurred in the same period of 2009. The decreased research and development expenses in 2010 relate to the limited operations of the company.

Sales and Marketing Expenses

. Sales and marketing expenses consist primarily of compensation and related costs for personnel engaged in customer service, sales, and sales support functions, as well as advertising and promotional expenditures. In preparation for the upcoming release of our first product, ExoDetect™, we had sales of $14,420 for the year ended July 31, 2010 as compared to $ 0 incurred in the same period of 2009. We incurred $29,882 in costs related to sales.

General

and Administrative Expenses

(“G&A”)

. General and administrative expenses consist primarily of compensation and related costs for personnel and facilities related to our finance, human resources, facilities, information technology and legal organizations, and fees for professional services. Professional services are principally comprised of outside legal, audit, information technology consulting, general business consulting and outsourcing services. G&A expenses for the year ended July 31, 2010 as compared to 2009 decreased to $1,927,107 from $2,282,549. The decrease was primarily due to decreased number of employees.

Payroll expense

. Payroll expenses consist primarily of compensation and related costs for our current officers and ex-employees. Payroll expense for the year ended July 31, 2010 as compared to 2009 increased from $1,035,577 to $1,840,716. The decrease was primarily due to less employees employed during the last year which also offset by the termination payments due to the terminated employees under their employment agreements.

Net Loss

. Net loss for the year ended July 31, 2010 and 2009 was $4,538,720 and $6,480,676, respectively. The decreased loss

was primarily due to limited operations. The 2010 loss was increased by accruing termination payments due to the employees in the amount of $1,405,433.

As of July 31, 2010, we had a working capital deficit of $3,509,752. Our current liquidity position does not allow us to meet our nominal working capital need which has required us to leverage off our vendors and seek loans from certain shareholders. Historically, our working capital resulted from best efforts equity financing and shareholder loans. It is likely we will have to issue additional shares of our common stock in the future in an attempt to conserve cash. We will need to obtain working capital of at least $ 300,000 to fund our minimum operating expenses for the next twelve months. In order to fund our full product development of our patented technology, including marketing and testing, we will need to raise at least an additional $2,400,000 to $5,000,000. We estimate we need to raise $500,000-$750,000 in order to negotiate with our current creditors. We estimate we need to raise $100,000 in order to proceed with Exodetect and Exowatch product development and marketing. We have no external credit or debt facilities in place to provide financing. We will be reliant upon best efforts debt or equity financing to provide necessary working capital. Accordingly, there can be no assurance we will be able obtain necessary funding to meet working capital requirements, the failure of which will result in our curtailing operations and/or selling assets.

Off-Balance Sheet Arrangements

None.

Contractual Commitments

None.

|

ITEM 3.

|

QUALITATIVE AND QUANTITATIVE DISCLOSURES ABOUT MARKET RISK

|

Not applicable.

|

ITEM 4.

|

CONTROLS AND PROCEDURES

|

We have carried out an evaluation, under the supervision and with the participation of our management, including our Chief Executive Officer (the "CEO") and our Chief Financial Officer (the "CFO"), of the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rule 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the "Act")) as of the end of the fiscal year covered by this report. Based upon that evaluation, our CEO and CFO concluded that the company’s disclosure controls and procedures were not effective in providing reasonable assurance that (a) the information required to be disclosed by us in the reports that we file or submit under the Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms, and (b) such information was accumulated and communicated to our management, including our CEO and CFO, as appropriate to allow timely decisions regarding required disclosure. Specifically, weaknesses were identified in the companies disclosure controls related to valuing and accounting for share-based payments and accrued expenses. We plan to remediate this deficiency in disclosure controls by monitoring personnel and their activities more closely and increasing the supervision and training of accounting and management personnel.

No changes in the companies internal control over financial reporting or preservation of assets during the year ended July 31, 2010 as compared to prior years that have been covered by this report could be located. The companies internal controls have materially affected and is reasonably likely to materially affect its financial reporting

for the period covered by this report.

Internal Controls of the company were not effectively applied. For the year ended the company paid $136,547 in auditing and accounting fees. The company was not able to file its income tax returns or keep state filings current. It was determined that the corporation did not obtain or ask for written reports or record of activities accomplished by its consultants, obtain competing bids for the purchase of assets, produce or keep written records of the disposition of assets or “sales bull pen” transactions, provide written board or audit committee approved internal controls, provide adequate training for its employees, approval of disbursements are not recorded in the board minutes , maintain invoices for asset purchases, and email retention may have been compromised. This discussion does not include all internal control deficiencies.

The company is taking action to implement strict internal controls over its assets.

PART II – OTHER INFORMATION

|

ITEM 1.

|

LEGAL PROCEEDINGS

|

On November 25, 2009, former employee Theodore Ernst filed suit in the 434

th

District Court of Fort Bend County, Texas claiming unspecified damages. On January 11, 2010, Exobox through its attorneys filed a motion to transfer venue, an application to compel arbitration and answered the Plaintiff’s petition. . . The motion was granted on April 30, 2010. The Company has begun discussions to come to an agreement with Mr. Ernst.

On December 8, 2009, the company received a demand to repay Reginald Goodman $227, 301 ($210,400 principal and $16,970 in accrued interest). To date, no suit has been filed.

On January 22, 2010, an attorney representing former employee Gary Leibowitz sent the Company a demand letter asking the company pay him $640,000 in termination damages as called for in his employment agreement, $56,532.47 in compensation not paid and $1,079.37 in reimbursable expenses. In addition, a Notice of Default and demand letter was received demanding payment of a total of $16,551.13 ($15,987.63 promissory note and $563.50 of accrued interest) be made or Mr. Leibowitz would file suit. The company has begun discussions to come to an agreement with Mr. Leibowitz.

On March 8, 2010 the Company received several Preliminary Wage Determination Order from the Texas Workforce Commission to pay unpaid wages to several employees totaling $69,740.00. The company intends to make payment in the near future.

On May 5, 2010, an attorney representing Behr Construction, Inc. sent the Company a demand letter asking the company pay $6,633.85 owed to Behr Construction or Behr Construction would file suit The company intends to discuss a potential agreement with Behr Construction on these demands.

On May 7, 2010, an attorney representing former employee Donald Baird sent the Company a demand letter asking the company pay him $16,200 in compensation not paid. In addition, a Notice of Default and demand letter was received demanding payment of a total of $25,987.50 ($25,000.00 promissory note, $2,187.50 of accrued interest and $800 in legal fees) be made or Mr. Baird would file suit The company intends to open discussions with Mr. Baird.

On May 18, 2010, an attorney representing a Consultant to the Company, sent the Company a demand letter asking the Company issue him the shares due to him under his consulting agreement with the Company. The company intends to come to an agreement and issue the shares as called for in the consulting agreement.

The shares have already been expensed in the first and second quarters

.

We know of no other material, active or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest other than those referred to in this report.

We will vigorously defend ourselves in these lawsuits. We believe that any of these matters could, individually or in the aggregate, have a material adverse effect on our business or financial condition. We cannot give assurance, however, that one or more of these lawsuits will not have a material adverse effect on our results of operations for the period in which they are resolved.

Certain Factors that May Affect Future Performance

The risk factors below supplement and should be read in conjunction with “ Risk Factors” under Item I in our Annual Report on Form 10-K for the fiscal year ended July 31, 2009.

We have a limited operating history with significant losses and expect losses to continue for the foreseeable future.

We have incurred annual operating losses since our inception. As a result, at July 31, 2010, we had an accumulated deficit of $20,726,740 We had gross revenues of $14,420 for the year ended July 31, 2010, and a loss from operations of $4,538,720. As we pursue our business plan, we expect our operating expenses to increase significantly, especially in the areas of sales and marketing. As a result, we expect continued losses in fiscal 2011 and thereafter.

We may not be able to meet our current and future liabilities and remain in operation until we receive additional capital

.

As of July 31, 2010, we have current assets of $ 0 and current liabilities of $3,512,385. Our current liquidity position does not allow us to meet nominal working capital needs. We will need $3,812,000 to meet our working capital needs through fiscal 2011. Any failure to obtain such financing could force us to abandon or curtail our operations.

We have substantial doubts as to our ability to continue as a going concern.

Because we do not have sufficient capital, we may be required to suspend or cease the implementation of our business plans within 12 months. Because of our going concern issue, it may be more difficult for us to attract investors. Our future is dependent upon our ability to obtain financing, our ability to develop our products further and upon future profitable operations from the sale of our products.

|

ITEM 2

.

|

RECENT SALES OF UNREGISTERED SECURITIESRISK FACTORS

|

Set forth below is certain information concerning issuances of common stock that were not registered under the Securities Act of 1933 (“Securities Act”) that occurred in the second quarter of fiscal 2010.

On February 15, 2010, March 15, 2010 and April 15, 2010 we issued a total of 1,385,251 shares of common stock to Mr. Dillon (1,154,376 shares) and Mr. Wirtz (230,875, shares) in accordance with the terms of their separation agreements. As part of his previous employment agreement Mr. Wirtz agreed to forego the December 2009 through March 2010 payments called for in his May 6, 2009 Termination Agreement.

In March 2010, the Company granted 750,000 shares of common stock to consultants for services performed. The shares were valued at $7,500 on the date of issuance.

In April 2010, 1,000,000 common shares were issued to Mr. Studdard as part of his consulting agreement. The shares were valued at $6,500 on the date of issuance. Mr. Studdard resigned October 5, 2010.

Sam Skipper has been issued 30,000,000 common shares for consulting services and activities related to the recession of the Oil and Gas Purchase. 1,000,000 were restricted and 20,000,000 were unrestricted.

The issuances referenced above were consummated pursuant to Section 4(2) of the Securities Act and the rules and regulations promulgated thereunder on the basis that such transactions did not involve a public offering and the offerees were sophisticated, accredited investors with access to the kind of information that registration would provide. The recipients of these securities represented their intention to acquire the securities for investment only and not with a view to or for sale in connection with any distribution thereof and appropriate legends were affixed to the share certificates and other instruments issued in such transactions. No sales commissions were paid in connection with these issuances listed above.

The company Board of Directors created Series E Preferred Stock on October 22, 2009. Series E Preferred Stock was authorized to consist of up to 1,163,000 shares. Beginning, 3/31/10 holders of Series E Preferred stock were entitled to receive dividends at 7.5% annum of an amount equal to the original issue price on the payment date. Dividends were to be paid quarterly and accrue from the date of issuance of such shares and shall be deemed to accrue from day to day whether or not earned or declared. Dividends are to be cumulative, paid in preference of any other class of shares. All preferred dividends shall be paid in cash unless holder elects to convert accrued dividends. Holders have the option to convert to common stock at $0.477 cents a share subject to adjustments.

|

ITEM 3.

|

DEFAULTS UPON SENIOR SECURITIES

|

None.

|

ITEM 4.

|

SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

|

None.

|

ITEM

5.

|

OTHER INFORMATION

|

On March 30, 2010, Exobox was granted its first patent

relating

to its Secure Environmentalization software. The company has three fully issued patents in the United States. The company has 18 additional patent filings pending, domestic and foreign.

Carl Ulepich has been acting secretary for the corporation until November 14, 2010 when he was appointed to the Board of Directors. On November 15, 2010 Eric Cavanaugh was appointed to the Board of Directors of the company.

ITEM 6. EXHIBITS

|

EXHIBIT

NUMBER

|

|

DESCRIPTION OF EXHIBIT

|

|

31.1

|

|

Certification of Chief Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

31.2

|

|

Certification of Chief Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

32.1

|

|

Certification of Chief Executive Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

|

32.2

|

|

Certification of Chief Financial Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

EXOBOX TECHNOLOGIES CORP.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf of the undersigned thereunto duly authorized.

EXOBOX TECHNOLOGIES CORP.

|

Dated: November 14, 2010

|

By: /s/ Jacob P Cukjati

|

|

|

|

Jacob P Cukjati

|

|

|

|

Chief Executive Officer

|

|

|

|

(Principal Executive Officer)

|

|

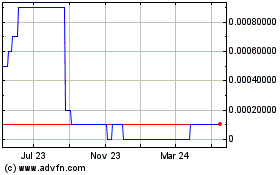

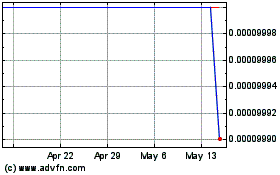

Exobox Technologies (CE) (USOTC:EXBX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Exobox Technologies (CE) (USOTC:EXBX)

Historical Stock Chart

From Apr 2023 to Apr 2024