0001618835

false

0001618835

2023-09-08

2023-09-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): September

8, 2023

EVOFEM

BIOSCIENCES, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-36754 |

|

20-8527075 |

| (State

or other jurisdiction |

|

(Commission |

|

(I.R.S.

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

7770

Regents Road, Suite

113-618

San

Diego, California

92122

(Address

of principal executive offices)

(858)

550-1900

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

EVFM |

|

OTCQB |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

Growth Company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

1.01 |

Entry into a Material

Definitive Agreement |

Amendment

to Securities Purchase Agreement

On

September 8, 2023 (“Effective Date”), Evofem Biosciences, Inc. (the “Company”), certain institutional investors

(the “Purchasers”) and Baker Bros. Advisors LP as their designated agent (the “Designated Agent”) entered into

a fourth amendment (the “Fourth Amendment”) to the Securities Purchase and Security Agreement by and among the Company, the

Purchasers and the Designated Agent, dated as of April 23, 2020 (the “Agreement”), as amended, pursuant to which the Purchasers

purchased certain convertible promissory notes (the “Notes”).

The

Fourth Amendment amends certain provisions within the Agreement including, (i) the rescission of the Notice of Default delivered to the

Company on March 7, 2023 and waiving the Events of Default named therein, (ii) the waiver of any and all other Events of Default existing

as of the Effective Date, (iii) the Notes shall no longer be convertible into shares of Company common stock, including the removal of

any requirement to reserve shares of common stock for conversion of the Notes as well as any registration rights related thereto, (iv)

the clarification that for the sole purpose of enabling ex-U.S. license agreement for such assets, any Patents, Trademarks or Copyrights

acquired after the Effective Date shall be excluded from the definition of Collateral, and (v) removal of the requirement for the Company

to obtain $100 million in cumulative net sales in the specified timeframe.

Additionally,

the Purchasers and the Designated Agent have granted to the Company the ability to repurchase the principal amount and accrued and unpaid

interest of the Notes for up to a five-year period for the “Repurchase Price” designated below:

| Date |

|

Repurchase

Price |

| On

or prior to September 8, 2024 |

|

$14,000,000

(less Applicable Reductions) |

| September

9, 2024-September 8, 2025 |

|

$16,750,000

(less Applicable Reductions) |

| September

9, 2025-September 8, 2026 |

|

$19,500,000

(less Applicable Reductions) |

| September

9, 2026-September 8, 2027 |

|

$22,250,000

(less Applicable Reductions) |

| September

9, 2027-September 8, 2028 |

|

$25,000,000

(less Applicable Reductions) |

The

current outstanding balance of $97.5 million will continue to accrue interest at 10% per annum. In the event of a default in the agreement

or a failure to pay the Repurchase Price on or before September 8, 2028 (the “Maturity Date”), the Purchasers and Designated

Agent may collect on the full principal amount then outstanding.

The

Company is required to make a $1 million Upfront Payment (as defined in the amendment) by October 1, 2023 and has agreed to make quarterly

cash payments of no more than 5% of the Company’s global net product revenues, depending on revenue thresholds. These upfront and

cash payments are Applicable Reductions from the Repurchase Price outlined above.

The

foregoing description of the Amendment is qualified in its entirety by reference to the Fourth Amendment attached as Exhibit 10.1 to

this Current Report on Form 8-K and is incorporated herein by reference.

| Item

2.03. |

Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet

Arrangement of a Registrant. |

The

information set forth under Items 1.01 of this Current Report on Form 8-K regarding the issuance of the Notes is incorporated into this

Item 2.03 by reference.

| Item

9.01 |

Financial

Statements and Exhibits. |

^

Pursuant to Item 601(b)(10) of Regulation S-K, certain portions of this exhibit have been omitted by means of marking such portions with

asterisks because the information is both not material and is the type that the Company treats as private or confidential.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

EVOFEM

BIOSCIENCES, INC. |

| |

|

|

| Dated:

September 11, 2023 |

By: |

/s/Saundra

Pelletier |

| |

|

Saundra

Pelletier |

| |

|

Chief

Executive Officer |

Exhibit

10.1

CERTAIN INFORMATION CONTAINED IN THIS EXHIBIT,

MARKED BY [***], HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE THE REGISTRANT HAS DETERMINED THAT IT IS BOTH NOT MATERIAL AND IS THE TYPE

THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL.

FOURTH

AMENDMENT TO

SECURITIES

PURCHASE AND SECURITY AGREEMENT

This

Fourth Amendment to Securities Purchase and Security Agreement (this “Amendment”) is entered into as of September

8, 2023 (the “Amendment Effective Date”) by and among Evofem Biosciences, Inc., a Delaware corporation (the “Company”),

667, L.P., Baker Bros. Life Sciences, L.P. (each, a “Purchaser”, and collectively, the “Purchasers”),

and Baker Bros. Advisors LP, as agent and collateral agent for the Purchasers (in such capacity, the “Designated Agent”).

RECITALS

WHEREAS,

the Company, the Purchasers and the Designated Agent are party to that certain Securities Purchase Agreement, dated as of April 23, 2020,

as amended by that First Amendment to the Agreement, dated as of November 20, 2021, that Second Amendment to the Agreement, dated as

of March 21, 2022, and that Third Amendment dated as of September 15, 2022, by and among the Company, the Purchasers and the Designated

Agent (as amended, the “Purchase Agreement”), pursuant to which the Purchasers purchased certain convertible promissory

notes (the “Notes”) and common stock warrants (the “Warrants”, and together with the Purchase Agreement

and the Notes, the “Transaction Documents”) of the Company;

WHEREAS,

pursuant to Section 12.8 of the Purchase Agreement, any term of the Purchase Agreement, the Notes or the Warrants may be amended only

with the written consent of the Company, the Designated Agent and the Purchasers holding a majority of the outstanding balance, in the

aggregate, of all Notes issued pursuant to the Purchase Agreement (the “Requisite Purchasers”);

WHEREAS,

the undersigned Purchasers constitute the Requisite Purchasers; and

WHEREAS,

the Company, the Purchasers and the Designated Agent wish to amend the Purchase Agreement to address the provisions set forth herein

effective as of the Amendment Effective Date.

NOW,

THEREFORE, for valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree

as follows:

AGREEMENT

1.

Definitions; References; Continuation of Purchase Agreement. Unless otherwise specified herein, each capitalized term used herein

that is defined in the Purchase Agreement shall have the meaning assigned to such term in the Purchase Agreement and each capitalized

term used herein that is defined in the Warrants shall have the meaning assigned to such term in the Warrants. Each reference to “hereof,”

“hereto,” “hereunder,” “herein” and “hereby” and each other similar reference, and each

reference to “this Agreement”, the “Securities Purchase Agreement” and each other similar reference, contained

in the Purchase Agreement and any other Transaction Document shall from and after the date hereof refer to the Purchase Agreement as

amended hereby. Except as amended or waived hereby, all terms and provisions of the Purchase Agreement, the Notes and the Warrants shall

continue unmodified and remain in full force and effect.

2.

Amendment to the Purchase Agreement.

2.1

Amendment to Section 1.1 of the Purchase Agreement. Effective as of the Amendment Effective Date, Section 1.1 of the Purchase

Agreement is hereby amended to add new defined terms for “Amendment Effective Date,” “Applicable Reductions,”

“Cash Rate,” “Interest Payment Date” and “Repurchase Date” as set forth below:

“Amendment

Effective Date” shall mean September 8, 2023.

“Applicable

Reductions” has the meaning set forth in the definition of “Repurchase Price”.

“Cash

Rate” shall mean:

(a)

an amount equal to the sum of: (A) the product obtained by multiplying 3% by global net revenues of Phexxi during such applicable calendar

quarter that is equal to or less than $5,000,000, plus (B) the product obtained by multiplying 4% by global net revenues of Phexxi during

such applicable calendar quarter that exceeds $5,000,000 and is equal to or less than $7,000,000, plus (C) the product obtained by multiplying

5% by global net revenues of Phexxi during such applicable calendar quarter that exceeds $7,000,000; plus

(b)

[***]1

“Interest

Payment Date” shall mean, for each calendar quarter, a date within 30 days of filing of the audited or reviewed financial statements

in the Form 10-Q and/or 10-K as applicable (if timely filed, and if not timely filed, within 45 days of the last day of each applicable

quarter).

“Repurchase

Price” means the applicable amount set forth below, reduced in each case by the aggregate amount of (i) the Upfront Payment

and (ii) all payments of interest made at the Cash Rate, in each case, to the extent made prior to the applicable repurchase date (collectively,

the “Applicable Reductions”):

| Applicable

Repurchase Date |

|

Repurchase

Price |

| On

or prior to the twelve-month anniversary of the Amendment Effective Date |

|

$14,000,000

(less Applicable Reductions) |

| |

|

|

| After

the twelve-month anniversary of the Amendment Effective Date, but on or prior to the twenty-four-month anniversary of the Amendment

Effective Date |

|

$16,750,000

(less Applicable Reductions) |

1Certain

confidential information omitted.

| After

the twenty-four-month anniversary of the Amendment Effective Date, but on or prior to the thirty-six-month anniversary of the Amendment

Effective Date |

|

$19,500,000

(less Applicable Reductions)

|

| |

|

|

| After

the thirty-six-month anniversary of the Amendment Effective Date, but on or prior to the forty-eight-month anniversary of the Amendment

Effective Date |

|

$22,250,000

(less Applicable Reductions) |

| |

|

|

| After

the forty-eight-month anniversary of the Amendment Effective Date, but on or prior to the sixty-month anniversary of the Amendment

Effective Date |

|

$25,000,000

(less Applicable Reductions) |

2.2

Amendment to Section 3.1 of the Purchase Agreement. Effective as of the Amendment Effective Date, Section 3.1 of the Purchase

Agreement is hereby amended to replace clause (a) thereof with the following: “(a) the fifth anniversary of the Amendment Effective

Date,”

2.3

Amendment to Section 3.2 of the Purchase Agreement. Effective as of the Amendment Effective Date, Section 3.2 of the Purchase

Agreement is hereby deleted in its entirety and replaced with the following:

“3.2

Interest; Repayment. Interest on the unpaid principal balance of the Notes (such balance as increased as provided in this Section

3.2, the “Outstanding Balance”) will accrue from the applicable Closing Date at the rate of 10.0% per annum, calculated

on the basis of a 360 day year and actual days elapsed. Accrued interest shall accrue daily and shall be paid on each Interest Payment

Date, by paying the accrued and unpaid interest due on such Interest Payment Date (a) in cash in an amount equal to the Cash Rate, and

(b) the remainder in kind by automatically capitalizing the remaining amount of accrued and unpaid interest as additional principal to

the Outstanding Balance of the Notes. To the extent not previously repurchased pursuant to Section 5 hereof, the Company will repay the

Outstanding Balance plus all accrued and unpaid interest thereon on the Maturity Date, but not to exceed the Repurchase Price maximum

of $25,000,000 (less applicable reductions), provided further that such Repurchase Price maximum shall apply (1) only if the Company

is not then in default of the Notes, and (2) only if the Company pays the Repurchase Price (less applicable reductions) in full on or

before the Maturity Date and not, for the sake of clarity, after the Maturity Date”

2.4

Amendment to Article of the Purchase Agreement. Effective as of the Amendment Effective Date, Article 5 of the Purchase Agreement

is hereby deleted in its entirety and replaced with the following:

“5.

REPURCHASE BY THE COMPANY.

5.1

Until the fifth anniversary of the Amendment Effective Date (the “Repurchase Date”), the Company may repurchase the

Notes from the Purchasers, in whole but not in part, at the Repurchase Price. If, as of the Repurchase Date, the Company has not earlier

repurchased the Notes, the Company shall then repurchase the Notes from the Purchasers for an aggregate cash payment of $25,000,000 (less

Applicable Reductions).”

2.5

Amendment to Article 8 of the Purchase Agreement. Effective as of the Amendment Effective Date, Article 8 of the Purchase Agreement

is hereby amended to replace each of Sections 8.1(c), 8.1(d), 8.1(e), 8.1(f), 8.1(h), 8.1(i), 8.1(j), 8.1(k) and 8.1(l) in its entirety

with “[Reserved].”

2.6

Amendment to Section 2.7 of the Third Amendment to Purchase Agreement. Effective as of the Amendment Effective Date, Section 2.7

of the Third Amendment to the Purchase Agreement, dated as of September 15, 2022, is hereby deleted in its entirety and replaced with

“[Reserved.]”.

2.7

Amendment to Exhibit C of the Purchase Agreement. The last paragraph of Exhibit C shall be amended to delete the word “and”

prior to clause (iv) thereto, and add the following immediately prior to end of such paragraph: “and (v) for the sole purpose of

enabling ex-U.S. license agreements for such assets, any Patents, Trademarks or Copyrights acquired after the Amendment Effective Date”.

3.

Certain Waivers.

3.1

Notice of Default. Effective as of the Amendment Effective Date, the Purchasers rescind the Notice of Default delivered to the

Company on March 7, 2023 and waive from the date hereof the Events of Default described therein.

3.2

Purchasers waive any and all other Events of Default under the Transaction Documents existing as of the Amendment Effective Date.

4.

Conditions Subsequent. No later than October 1, 2023 (the “Upfront Payment Deadline”), the Company shall pay

to the Purchasers, or the Designated Agent for the benefit of the Purchasers an amount of the Outstanding Balance of the Notes equal

to $1,000,000 (the “Upfront Payment”). Failure to pay the Upfront Payment by the Upfront Payment Deadline shall constitute

an immediate Event of Default under the Purchase Agreement pursuant to Section 9.1(a)(i) of the Purchase Agreement.

5.

Miscellaneous.

5.1

Governing Law. This Amendment shall be governed in all respects by and construed in accordance with the laws of the State of New

York without regard to provisions regarding choice of laws.

5.2

Entire Agreement. This Amendment, together with the Purchase Agreement, the Notes, the Warrants, the other Note Documents and

the Exhibits and Schedules to the Purchase Agreement and thereto (all of which are hereby expressly incorporated herein by this reference)

constitute the entire understanding and agreement between the parties with regard to the subjects hereof and thereof.

5.3

Titles and Subtitles. The titles of the sections and clauses of this Amendment are for convenience of reference only and are not

to be considered in construing this Amendment.

5.4

Counterparts. This Amendment may be executed in any number of counterparts, each of which shall be an original, but all of which

together shall constitute one instrument. Delivery by facsimile or e-mail of an executed counterpart of a signature page shall be effective

as delivery of an original executed counterpart.

5.5

Severability. Should any provision of this Amendment be determined to be illegal or unenforceable, such determination shall not

affect the remaining provisions of this Amendment.

5.6

Tax Matters. Each of the parties hereto agrees to treat (a) any interest or original issue discount arising under this Amendment

as interest described in section 871(h)(4)(C)(i) of the Internal Revenue Code of 1986, as amended (the “Code”) and (b) this

Amendment as a recapitalization within the meaning of Code section 368(a)(1)(E).

[Signature

page follows.]

IN

WITNESS WHEREOF, the parties have executed this Fourth Amendment to Securities Purchase and Security Agreement to be effective as

of the date first above written.

| |

EVOFEM BIOSCIENCES, INC., as Company |

| |

|

|

| |

By: |

/s/

Saundra Pelletier |

| |

Name: |

Saundra Pelletier |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

Address: |

| |

12400

High Bluff Drive, Suite 600 |

| |

San

Diego, CA |

| |

|

|

| |

Email: |

Signature

Page to Fourth Amendment to Securities Purchase and Security Agreement

| |

BAKER

BROS. ADVISORS LP, |

| |

as

the Designated Agent |

| |

|

| |

By: |

/s/

Scott Lessing |

| |

|

Scott

Lessing |

| |

|

President |

| |

|

|

| |

Address: |

| |

|

860

Washington St., 10th Floor |

| |

|

New

York, NY 10014 |

| |

|

Attn:

Scott Lessing |

| |

|

|

| |

Email: |

|

Signature

Page to Fourth Amendment to Securities Purchase and Security Agreement

| |

667,

L.P., |

| |

as

a Purchaser |

| |

|

| |

By:

Baker Bros. Advisors LP, management company and investment adviser to 667, L.P., pursuant to authority granted

to it by Baker Biotech Capital, L.P., general partner to 667, L.P., and not as the general partner. |

| |

|

|

| |

By: |

/s/

Scott Lessing |

| |

|

Scott

Lessing |

| |

|

President |

| |

|

|

| |

Address: |

| |

|

c/o

Baker Bros. Advisors LP |

| |

|

860

Washington St., 10th Floor |

| |

|

New

York, NY 10014 |

| |

|

Attn:

Scott Lessing |

| |

|

|

| |

Email: |

|

Signature

Page to Fourth Amendment to Securities Purchase and Security Agreement

| |

BAKER

BROTHERS LIFE SCIENCES, L.P., |

| |

as

a Purchaser |

| |

|

|

| |

By: |

BAKER BROS. ADVISORS LP, |

| |

management company and investment adviser to Baker Brothers Life Sciences, L.P., pursuant to

authority granted to it by Baker Brothers Life Sciences Capital, L.P., general partner to Baker Brothers Life Sciences, L.P., and

not as the general partner. |

| |

|

|

| |

By: |

/s/

Scott Lessing |

| |

|

Scott

Lessing |

| |

|

President |

| |

|

|

| |

Address: |

| |

|

c/o

Baker Bros. Advisors LP |

| |

|

860

Washington St., 10th Floor |

| |

|

New

York, NY 10014 |

| |

|

Attn:

Scott Lessing |

| |

|

|

| |

Email: |

|

Signature

Page to Fourth Amendment to Securities Purchase and Security Agreement

Exhibit 99.1

Evofem

Biosciences Successfully Amends S.P.A.

with

Institutional Investor

—

Investor withdraws March 2023 Notice of Default —

—

Notes are no longer convertible to shares of common stock, removing potential dilution from the previously-reserved over 240 million

shares of common stock —

—

Evofem may repurchase Notes within five years for as little as $14 million

and

no more than $25 million, instead of the $97.5 million outstanding balance —

SAN

DIEGO, CA, September 11, 2023 —Evofem Biosciences, Inc. (OTCQB: EVFM) (Evofem or the “Company”) today announced it

has successfully negotiated and entered into a fourth amendment (the “Fourth Amendment”) to its Securities Purchase and Security

Agreement dated April 2020, as amended (the “2020 S.P.A.”), with a U.S.-based, healthcare-focused institutional investor

(the “Investor”), under which the Investor purchased $25 million of convertible senior secured promissory notes (the “Notes”)

from Evofem. Most notably, in the Fourth Amendment, the Investor withdraws and waives the March 2023 Event of Default and allows for

the Company to repurchase the Notes for no more than $25 million.

“We

deeply appreciate that the Investor has worked with us to amend the 2020 S.P.A. in a way that respects their initial investment while

dramatically strengthening our financial position, facilitating execution of our growth strategy, and positioning Evofem for future success,”

said Saundra Pelletier, CEO of Evofem Biosciences.

Under

the Fourth Amendment, Evofem may repurchase the Notes for as little as $14 million and no more than $25 million, depending on timing

of the repurchase within the stated five-year time frame. Evofem will pay the Investor $1 million by October 1, 2023, which will be applied

towards the eventual Note repurchase price. Furthermore, for five years or until the date of repurchase, whichever is earlier, Evofem

will pay the Investor a low single-digit percentage of its global net product sales. These payments will also count towards and reduce

the ultimate Note repurchase price.

A

key benefit of the Fourth Amendment is the positive impact to Evofem’s capital structure. Because the Notes are no longer convertible

into shares of Evofem’s common stock, the Company will no longer need to reserve shares of common stock to provide for their potential

conversion. The current balance will accrue interest and remain in the footnotes to Evofem’s financial tables until the Company

has repurchased the debt. The repayment is expected to be no more than $25 million instead of the approximately $97.5 million principal

amount and accrued interest as of September 8, 2023.

The

Investor continues to hold warrants to purchase shares of Evofem’s common stock, and the Company will continue to reserve from

its authorized and unissued common stock enough shares to provide for the issuance of warrant shares upon the exercise of these warrants.

About

Evofem Biosciences

Evofem

Biosciences, Inc., is focused on commercializing innovative products to address unmet needs in women’s sexual and reproductive

health. The Company’s first FDA-approved product, Phexxi® (lactic acid, citric acid and potassium bitartrate), is a hormone-free,

on-demand prescription contraceptive vaginal gel. It comes in a box of 12 pre-filled applicators and is applied 0-60 minutes before each

act of sex. Learn more at phexxi.com and evofem.com.

Phexxi®

is a registered trademark of Evofem Biosciences, Inc.

Forward-Looking

Statements

This

press release includes “forward-looking statements” within the meaning of the safe harbor for forward-looking statements

provided by Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995

including, without limitation, statements related to: the expected benefits to the Company of the Fourth Amendment; the Company’s

ability to meet the terms of the Fourth Amendment; successful execution the Company’s growth strategy; the Company’s anticipated

future operating results including, but not limited to, net sales, operating expenses, income from operations and net income; the sufficiency

of the Company’s cash resources; and, the availability of additional financing if and as needed. You are cautioned not to place

undue reliance on these forward-looking statements, which are current only as of the date of this press release. Each of these forward-looking

statements involves risks and uncertainties. Important factors that could cause actual results to differ materially from those discussed

or implied in the forward-looking statements are disclosed in the Company’s SEC filings, under the heading “Risk Factors,”

including its Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on April 27, 2023, Quarterly Report

on Form 10-Q for the quarter ended June 30, 2023 filed with the SEC on August 14, 2023 and any subsequent filings. All forward-looking

statements are expressly qualified in their entirety by such factors. The Company does not undertake any duty to update any forward-looking

statement except as required by law.

Contact

Amy

Raskopf

Evofem

Biosciences, Inc.

araskopf@evofem.com

(917)

673-5775

v3.23.2

Cover

|

Sep. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 08, 2023

|

| Entity File Number |

001-36754

|

| Entity Registrant Name |

EVOFEM

BIOSCIENCES, INC.

|

| Entity Central Index Key |

0001618835

|

| Entity Tax Identification Number |

20-8527075

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

7770

Regents Road

|

| Entity Address, Address Line Two |

Suite

113-618

|

| Entity Address, City or Town |

San

Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92122

|

| City Area Code |

(858)

|

| Local Phone Number |

550-1900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.0001 per share

|

| Trading Symbol |

EVFM

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

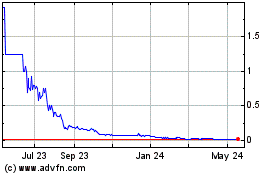

Evofem Biosciences (QB) (USOTC:EVFM)

Historical Stock Chart

From Feb 2025 to Mar 2025

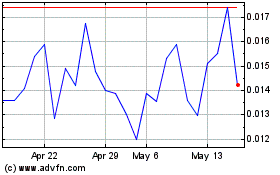

Evofem Biosciences (QB) (USOTC:EVFM)

Historical Stock Chart

From Mar 2024 to Mar 2025