What is the goal of the Fund?

The Fund seeks to maximize inflation protected total return.

Fees and Expenses of the Fund

The following tables describe the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts on purchases of Class A Shares if you and

your family invest, or agree to invest in the future, at least $100,000 in the J.P. Morgan Funds.

More information about these and other discounts is available from your financial intermediary and in “How to Do Business with the Fund —

SALES CHARGES” on page 105 of the prospectus and in “PURCHASES, REDEMPTIONS AND EXCHANGES” in Appendix A to Part II of the Statement of Additional Information.

|

|

|

|

|

|

|

|

|

SHAREHOLDER FEES

(Fees paid directly from your investment)

|

|

|

|

Class A

|

|

Class C

|

|

Select

Class

|

|

Maximum Deferred Sales Charge (Load) Imposed on Purchases as a % of Offering Price

|

|

3.75%

|

|

NONE

|

|

NONE

|

|

Maximum Deferred Sales Charge (Load) as a % of Original Cost of the Shares

|

|

NONE

|

|

1.00%

|

|

NONE

|

|

|

|

(under

$1 million)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANNUAL FUND OPERATING EXPENSES

(Expenses that you pay each year as a percentage of the value

of your investment)

|

|

|

|

|

Class A

|

|

|

Class C

|

|

|

Select

Class

|

|

|

Management Fees

|

|

|

0.35

|

%

|

|

|

0.35

|

%

|

|

|

0.35

|

%

|

|

Distribution (Rule

12b-1)

Fees

|

|

|

0.25

|

|

|

|

0.75

|

|

|

|

NONE

|

|

|

Other Expenses

|

|

|

0.41

|

|

|

|

0.41

|

|

|

|

0.41

|

|

|

Shareholder Service Fees

|

|

|

0.25

|

|

|

|

0.25

|

|

|

|

0.25

|

|

|

Remainder of Other Expenses

|

|

|

0.16

|

|

|

|

0.16

|

|

|

|

0.16

|

|

|

Acquired Fund Fees and Expenses

|

|

|

0.01

|

|

|

|

0.01

|

|

|

|

0.01

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

|

|

1.02

|

|

|

|

1.52

|

|

|

|

0.77

|

|

|

Fee Waivers and/or Expense Reimbursements

1

|

|

|

(0.26

|

)

|

|

|

(0.11

|

)

|

|

|

(0.16

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Annual Fund Operating Expenses After Fee Waivers and Expense Reimbursements

1

|

|

|

0.76

|

|

|

|

1.41

|

|

|

|

0.61

|

|

|

1

|

The Fund’s adviser, administrator and distributor (the Service Providers) have contractually agreed to waive fees and/or reimburse expenses to the extent Total Annual

Fund Operating Expenses (excluding Acquired Fund Fees and Expenses, dividend expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, extraordinary expenses and expenses related to the Board of

Trustees’ deferred compensation plan) exceed 0.75%, 1.40%, and 0.60% of the average daily net assets of Class A, Class C and Select Class Shares, respectively. This contract cannot be terminated prior to 7/1/14, at which time the Service

Providers will determine whether or not to renew or revise it.

|

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you

invest $10,000 in the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses are equal to the total annual fund operating expenses after fee waivers

and expense reimbursements shown in the fee table through 6/30/14 and total annual fund operating expenses thereafter. Your actual costs may be higher or lower.

1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IF YOU SELL YOUR SHARES, YOUR COST WOULD BE:

|

|

|

|

|

1 Year

|

|

|

3 Years

|

|

|

5 Years

|

|

|

10 Years

|

|

|

CLASS A SHARES ($)

|

|

|

450

|

|

|

|

663

|

|

|

|

893

|

|

|

|

1,553

|

|

|

CLASS C SHARES ($)

|

|

|

244

|

|

|

|

469

|

|

|

|

819

|

|

|

|

1,803

|

|

|

SELECT CLASS SHARES ($)

|

|

|

62

|

|

|

|

230

|

|

|

|

412

|

|

|

|

939

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IF YOU DO NOT SELL YOUR SHARES, YOUR COST

WOULD BE:

|

|

|

|

|

1 Year

|

|

|

3 Years

|

|

|

5 Years

|

|

|

10 Years

|

|

|

CLASS A SHARES ($)

|

|

|

450

|

|

|

|

663

|

|

|

|

893

|

|

|

|

1,553

|

|

|

CLASS C SHARES ($)

|

|

|

144

|

|

|

|

469

|

|

|

|

819

|

|

|

|

1,803

|

|

|

SELECT CLASS SHARES ($)

|

|

|

62

|

|

|

|

230

|

|

|

|

412

|

|

|

|

939

|

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and

may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent fiscal year,

the Fund’s portfolio turnover rate was 16% of the average value of its portfolio.

What are the Fund’s main investment strategies?

The Fund is designed to protect the total return generated by its core fixed income holdings from inflation risk. As used in the Fund’s goal,

“total return” includes income and capital appreciation. The Fund seeks to hedge this risk by using swaps that are based on the Non-Seasonally Adjusted Consumer Price Index for all Urban Consumers (CPI-U) in combination with its core

portfolio of fixed income securities. This strategy is intended to create the equivalent of a portfolio of inflation-protected fixed income securities. Secondarily, the Fund may purchase other investments including actual inflation-protected

securities such as Treasury Inflation Protected Securities (TIPS).

“Inflation Managed” in the Fund’s name does not refer to a type

of security in which the Fund invests, but rather describes the Fund’s overall strategy of creating a portfolio of inflation-protected securities. Under normal circumstances, the Fund will invest at least 80% of its “Assets” in bonds.

“Assets” means net assets, plus the amount of borrowings for investment purposes.

As part of its main investment strategy, the Fund may

principally invest in corporate bonds, U.S. government and agency debt securities, asset-backed securities, and mortgage-related and mortgage-backed securities. Mortgage-related and

mortgage-backed securities may be structured as collateralized mortgage obligations (agency and

non-agency),

stripped mortgage-backed securities

(interest-only or principal-only), commercial mortgage-backed securities, and mortgage pass-through securities. Additional information about these types of investments may be found in “Investment Practices” in the Fund’s prospectus.

Securities purchased by the Fund will be rated investment grade (or the unrated equivalent) at the time of purchase. In addition, all securities will be U.S. dollar-denominated although they may be issued by a foreign corporation, government or its

agencies and instrumentalities. The Fund may invest a significant portion or all of its assets in mortgage-related and mortgage-backed securities at the adviser’s discretion. The Fund expects to invest no more than 10% of its assets in

“sub-prime” mortgage-related securities at the time of purchase.

The adviser buys and sells securities and investments for the Fund

based on its view of individual securities and market sectors. Taking a long-term approach, the adviser looks for individual fixed income investments that it believes will perform well over market cycles. The adviser is value oriented and makes

decisions to purchase and sell individual securities and instruments after performing a risk/reward analysis that includes an evaluation of interest rate risk, credit risk, duration, liquidity and the complex legal and technical structure of the

transaction.

The Fund’s Main Investment Risks

The Fund is subject to management risk and may not achieve its objective if the adviser’s expectations regarding particular securities or markets are not met.

An investment in this Fund or any other fund may not provide a complete investment program. The suitability

of an investment in the Fund should be considered based on the investment objective, strategies and risks described in this prospectus, considered in light of all of the other investments in your portfolio, as well as your risk tolerance, financial

goals and time horizons. You may want to consult with a financial advisor to determine if this Fund is suitable for you.

General Market

Risk.

Economies and financial markets throughout the world are becoming increasingly interconnected, which increases the likelihood that events or conditions in one country or region will adversely impact markets or issuers in other countries or

regions.

Interest Rate Risk.

The Fund’s investments in bonds and other debt securities will change in value based on changes in

interest rates. If rates rise, the value of these investments generally drops. The Fund may invest in variable and floating rate securities.

2

Although these instruments are generally less sensitive to interest rate changes than fixed rate instruments, the value of floating rate securities may decline if their interest rates do not rise

as quickly, or as much, as general interest rates. Given the historically low interest rate environment, risks associated with rising rates are heightened.

Credit Risk.

The Fund’s investments are subject to the risk that the issuer or the counterparty will fail to make payments when due or default completely. If an issuer’s financial condition

worsens, the credit quality of the issuer may deteriorate making it difficult for the Fund to sell such investments.

Strategy Risk.

The

Fund’s investment strategies may not work to generate inflation-protected return. There is no guarantee that the use of derivatives and debt securities will mimic a portfolio of inflation-protected bonds.

Derivatives Risk

. The Fund may have significant exposure to derivatives. Derivatives, including swaps, may be riskier than other types of investments

and may increase the volatility of the Fund. Derivatives may be sensitive to changes in economic and market conditions and may create leverage, which could result in losses that significantly exceed the Fund’s original investment. Certain

derivatives are synthetic instruments that attempt to replicate the performance of certain reference assets. With regard to such derivatives, the Fund does not have a claim on the reference assets and is subject to enhanced counterparty risk.

Derivatives expose the Fund to counterparty risk, which is the risk that the derivative counterparty will not fulfill its contractual obligations (and includes credit risk associated with the counterparty). Derivatives may not perform as

expected, so the Fund may not realize the intended benefits. When used for hedging, the change in value of a derivative may not correlate as expected with the security being hedged. In addition, given their complexity, derivatives expose the Fund to

risks of mispricing or improper valuation. Certain of the Fund’s transactions in derivatives could also affect the amount, timing and character of distributions to shareholders which may result in the Fund realizing more short-term capital gain

and ordinary income subject to tax at ordinary income tax rates than it would if it did not engage in such transactions, which may adversely impact the Fund’s after-tax returns.

Inflation-Protected Securities Risk.

Inflation-linked debt securities are subject to the effects of changes in market interest rates caused by factors other than inflation (real interest rates). In

general, the price of an inflation-linked security tends to decline when real interest rates increase. Unlike conventional bonds, the principal and interest payments of inflation-protected securities such as TIPS are adjusted periodically to a

specified rate of inflation (e.g.,

CPI-U).

There can be no assurance that the inflation index used will accurately measure the actual rate of

inflation. These securities may lose value in the event that the actual rate of inflation is different than the rate of the inflation index.

Government Securities Risk.

The Fund invests in securities issued or guaranteed by the U.S. government or its agencies and instrumentalities (such as

the Government National Mortgage Association (Ginnie Mae), the Federal National Mortgage Association (Fannie Mae), or the Federal Home Loan Mortgage Corporation (Freddie Mac)). U.S. government securities are subject to market risk, interest rate

risk and credit risk. Securities, such as those issued or guaranteed by Ginnie Mae or the U.S. Treasury, that are backed by the full faith and credit of the United States are guaranteed only as to the timely payment of interest and principal when

held to maturity and the market prices for such securities will fluctuate. Notwithstanding that these securities are backed by the full faith and credit of the United States, circumstances could arise that would prevent the payment of interest or

principal. This would result in losses to the Fund. Securities issued or guaranteed by U.S.

government-related

organizations, such as Fannie Mae and Freddie Mac, are not backed by the full faith and credit of

the U.S. government and no assurance can be given that the U.S. government would provide financial support. Therefore, U.S. government-related organizations may not have the funds to meet their payment obligations in the future.

Asset-Backed, Mortgage-Related and Mortgage-Backed Securities Risk.

The Fund may invest in asset-backed, mortgage-related and mortgage-backed

securities including

so-called

“sub-prime” mortgages that are subject to certain other risks including prepayment and call risks. When mortgages and other obligations are prepaid and when securities

are called, the Fund may have to reinvest in securities with a lower yield or fail to recover additional amounts (i.e., premiums) paid for securities with higher interest rates, resulting in an unexpected capital loss and/or a decrease in the amount

of dividends and yield. In periods of rising interest rates, the Fund may be subject to extension risk, and may receive principal later than expected. As a result, in periods of rising interest rates, the Fund may exhibit additional volatility.

During periods of difficult or frozen credit markets, significant changes in interest rates, or deteriorating economic conditions, such securities may decline in value, face valuation difficulties, become more volatile and/or become illiquid.

Collateralized mortgage obligations (CMOs) and stripped mortgage-backed securities, including those structured as interest-only (IOs) and

principal-only (POs) are more volatile and may be more sensitive to the rate of payments than other mortgage-related securities. The risk of default, as described under “

Credit Risk

”, for “sub-prime” mortgages is generally

3

higher than other types of mortgage-backed securities. The structure of some of these securities may be complex and there may be less available information than other types of debt securities.

Redemption Risk.

The Fund could experience a loss when selling securities to meet redemption requests by shareholders. The risk of loss

increases if the redemption requests are unusually large or frequent, occur in times of overall market turmoil or declining prices for the securities sold, or when the securities the Fund wishes to or is required to sell are illiquid.

Foreign Issuer Risks.

U.S. dollar-denominated securities of foreign issuers or U.S. affiliates of foreign issuers may be subject to additional risks

not faced by domestic issuers. These risks include political and economic risks, civil conflicts and war, greater volatility, expropriation and nationalization risks, and regulatory issues facing issuers in such foreign countries. Events and

evolving conditions in certain economies or markets may alter the risks associated with investments tied to countries or regions that historically were perceived as comparatively stable becoming riskier and more volatile.

Investments in the Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are

not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency.

You could lose money investing in the Fund.

The Fund’s Past Performance

This section

provides some indication of the risks of investing in the Fund. The bar chart shows the performance of the Fund’s Select Class Shares for the past two calendar years. The table shows the average annual total returns for the past one year and

life of the Fund. The table compares that performance to the Barclays 1-10 Year U.S. TIPS Index, Barclays U.S. Intermediate Aggregate Index, both broad-based securities market indexes, Inflation Managed Bond Composite Benchmark (a composite

benchmark determined by adding the Barclays Intermediate Government/Credit Index and 80% of the Barclays Inflation Swap 5 Year Zero Coupon Index) and the Lipper Inflation-Protected Bond Funds Index, an index based on the total returns of certain

mutual funds within the Fund’s designated category as determined by Lipper. Unlike the other indexes, the Lipper index includes the expenses of the mutual funds included in the index. Past performance (before and after taxes) is not necessarily

an indication of how the Fund will perform in the future.

Updated performance information is available by visiting www.jpmorganfunds.com or by calling

1-800-480-4111.

|

|

|

|

|

|

|

|

|

Best Quarter

|

|

1st quarter, 2012

|

|

|

2.57%

|

|

|

Worst Quarter

|

|

3rd quarter, 2011

|

|

|

0.16%

|

|

The Fund’s year-to-date return through 3/31/13 was 0.26%.

|

|

|

|

|

|

|

|

|

|

|

AVERAGE ANNUAL TOTAL RETURNS

(WITH MAXIMUM SALES CHARGES)

(For the period ended December 31, 2012)

|

|

|

|

|

Past

1 Year

|

|

|

Life of Fund

(since 3/31/10)

|

|

|

SELECT CLASS SHARES

|

|

|

|

|

|

|

|

|

|

Return Before Taxes

|

|

|

5.63

|

%

|

|

|

5.43

|

%

|

|

Return After Taxes on Distributions

|

|

|

4.79

|

|

|

|

4.54

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares

|

|

|

3.68

|

|

|

|

4.13

|

|

|

CLASS A SHARES

|

|

|

|

|

|

|

|

|

|

Return Before Taxes

|

|

|

1.43

|

|

|

|

3.83

|

|

|

CLASS C SHARES

|

|

|

|

|

|

|

|

|

|

Return Before Taxes

|

|

|

3.75

|

|

|

|

4.60

|

|

|

BARCLAYS 1-10 YEAR U.S. TIPS INDEX

|

|

|

|

|

|

|

|

|

|

(Reflects No Deduction for Fees, Expenses or Taxes)

|

|

|

3.07

|

|

|

|

6.25

|

|

|

BARCLAYS U.S. INTERMEDIATE AGGREGATE INDEX

|

|

|

|

|

|

|

|

|

|

(Reflects No Deduction for Fees, Expenses or Taxes)

|

|

|

2.70

|

|

|

|

4.73

|

|

|

INFLATION MANAGED BOND COMPOSITE BENCHMARK

|

|

|

|

|

|

|

|

|

|

(Reflects No Deduction for Fees, Expenses or Taxes)

|

|

|

2.57

|

|

|

|

4.69

|

|

|

LIPPER INFLATION-PROTECTED BOND FUNDS INDEX

|

|

|

|

|

|

|

|

|

|

(Reflects No Deduction for Taxes)

|

|

|

6.47

|

|

|

|

8.80

|

|

4

After-tax returns are shown for only the Select Class Shares and after-tax returns for the other classes will

vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may

differ from those shown, and the after-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

Management

J.P. Morgan Investment Management Inc.

|

|

|

|

|

|

|

Portfolio

Manager

|

|

Managed

Fund

Since

|

|

Primary Title with

Investment Adviser

|

|

Scott E. Grimshaw

|

|

2010

|

|

Executive Director

|

|

Deepa Majmudar

|

|

2010

|

|

Managing Director

|

|

Duane Huff

|

|

2010

|

|

Managing Director

|

|

Steven Lear

|

|

2013

|

|

Managing Director

|

Purchase and Sale of Fund Shares

Purchase minimums

|

|

|

|

|

|

|

For Class A and Class C Shares

|

|

|

|

|

|

To establish an account

|

|

|

$1,000

|

|

|

To add to an account

|

|

|

$25

|

|

|

For Select Class Shares

|

|

|

|

|

|

To establish an account

|

|

|

$1,000,000

|

|

|

To add to an account

|

|

|

No minimum levels

|

|

In general, you may purchase or redeem shares on any business day

|

Ÿ

|

|

Through your Financial Intermediary

|

|

Ÿ

|

|

By writing to J.P. Morgan Funds Services, P.O. Box 8528, Boston, MA 02266-8528

|

|

Ÿ

|

|

After you open an account by calling J.P. Morgan Funds Services at

1-800-480-4111

|

Tax Information

The Fund intends to make distributions that may be taxed as ordinary income or capital gains, except when your investment is in an IRA, 401(k) plan or other

tax-advantaged

investment plan, in which case you may be subject to federal income tax upon withdrawal from the tax-advantaged investment plan.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund

through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the financial intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by

influencing the broker-dealer or financial intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

5

This Page Intentionally

Left Blank.

SPRO-IMB-ACS-713-2

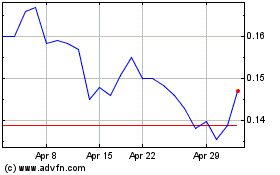

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From May 2024 to Jun 2024

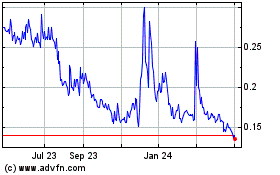

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Jun 2023 to Jun 2024