Critical Elements Corporation Sends Samples of Lithium Concentrate to Users

May 14 2014 - 10:00AM

Marketwired

Critical Elements Corporation Sends Samples of Lithium Concentrate

to Users

MONTREAL, QUEBEC--(Marketwired - May 14, 2014) - Critical

Elements Corporation (TSX-VENTURE:CRE)(OTCQX:CRECF) (FRANKFURT:F12)

is pleased to announce that it has started shipping samples of

lithium concentrate to a number of users for analysis and

validation of the product specifications. The concentrate samples

have a low iron content, which is specifically required by certain

users. Validation of the Rose project material by some of the

largest consumers of lithium concentrate with low iron content is

part of the process of setting up long-term off-take contracts.

Concurrently, the Critical Elements Corporation team will launch

a program over the coming months to produce a number of lithium

carbonate samples. These samples will be shipped to battery

manufacturers that the Company met with in the past year, for

specification analysis and validation.

The Critical Elements Corporation team is also pursuing

discussions with a number of potential users of lithium carbonate

and tantalum with the goal of entering into long-term sales

contracts.

Critical Elements is also pleased to announce that its President

& CEO, Jean-Sébastien Lavallée, has been invited to speak at

the 6th Lithium Supply & Markets Conference in Montréal on May

20-22, 2014, hosted by Industrial Minerals.

About Critical Elements Corporation

Critical Elements is actively developing its 100%-owned Rose

lithium-tantalum flagship project located in Quebec.

A recent financial analysis of the Rose project based on price

forecasts of US$260/kg ($118/lb) for Ta2O5 contained in a tantalite

concentrate and US$6,000/t for lithium carbonate (Li2CO3) showed an

estimated after-tax Internal Rate of Return (IRR) of 25% for the

Rose project, with an estimated Net Present Value (NPV) of CA$279

million at an 8% discount rate. The payback period is estimated at

4.1 years. The pre-tax IRR is estimated at 33% and the NPV at $488

million at a discount rate of 8%. (Mineral resources that are not

mineral reserves and do not have demonstrated economic viability).

(See press release dated November 21, 2011.)

The operation is scheduled to produce 26,606 tons of high purity

(99.9% battery grade) Li2CO3 and 206,670 pounds of Ta2O5 per year

over a 17-year mine life.

The project hosts a current NI 43-101-compliant Indicated

resource of 26.5 million tonnes of 1.30% Li2O Eq. or 0.98% Li2O and

163 ppm Ta2O5 and an Inferred resource of 10.7 million tonnes of

1.14% Li2O Eq. or 0.86% Li2O and 145 ppm Ta2O5.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains "forward-looking information"

including without limitation statements relating to realization of

resource estimates, reduction of capital and operating costs,

success of mining operations and the ranking of the project in

terms of production. Readers should not place undue reliance on

forward-looking statements.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Until a

positive feasibility study has been completed, and even with the

completion of a positive feasibility study, there are no assurances

that the Rose project will be placed into production. Factors that

could affect the outcome include, among others: the actual results

of development activities; project delays; inability to raise the

funds necessary to complete development; general business,

economic, competitive, political and social uncertainties; future

prices of metals; availability of alternative lithium or tantalum

sources; actual rates of recovery; conclusions of economic

evaluations; changes in project parameters as plans continue to be

refined; accidents, labour disputes and other risks of the mining

industry; political instability, terrorism, insurrection or war;

delays in obtaining governmental approvals, necessary permitting or

in the completion of development or construction activities. For a

more detailed discussion of such risks and other factors that could

cause actual results to differ materially from those expressed or

implied by such forward-looking statements, refer to the Company's

filings with Canadian securities regulators available on SEDAR at

www.sedar.com.

Although the Company has attempted to identify important factors

that could cause actual actions, events or results to differ

materially from those described in forward-looking statements,

there may be other factors that cause actions, events or results to

differ from those anticipated, estimated or intended.

Forward-looking statements contained herein are made as of the date

of this news release and the Company disclaims any obligation to

update any forward-looking statements, whether as a result of new

information, future events or results or otherwise, except as

required by applicable securities laws.

Neither the

TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange)

accepts responsibility for the adequacy or accuracy of this

release.

Jean-Sebastien Lavallee, P.Geo.President and Chief Executive

Officer819-354-5146president@cecorp.cawww.cecorp.caInvestor

Relations:Paradox Public Relations514-341-0408The Howard Group

Inc.Jeff WalkerSenior

Associate1-888-221-0915jeff@howardgroupinc.comwww.howardgroupinc.com

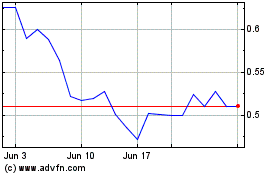

Critical Elements Lithium (QX) (USOTC:CRECF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Critical Elements Lithium (QX) (USOTC:CRECF)

Historical Stock Chart

From Jan 2024 to Jan 2025