SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange act 1934

April 24, 2015

(Date of report/date of earliest event reported)

CONSUMERS BANCORP, INC.

(Exact name of registrant as specified in

its charter)

| OHIO |

033-79130 |

34-1771400 |

| (State or other jurisdiction |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| of incorporation or organization) |

|

|

614 East Lincoln Way

P.O. Box 256

Minerva, Ohio 44657

(Address of principal executive offices)

(330) 868-7701

(Issuer’s telephone number)

N/A

(Former name of former address, if changes

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

On April 24, 2015, Consumers Bancorp, Inc.

issued a press release reporting its results for the third fiscal quarter ended March 31, 2015. A copy of the press release is

furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits

d. Exhibits

| Exhibit No. |

Description |

| 99.1 |

Press Release of Consumers Bancorp, Inc. dated April 24, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Consumers Bancorp, Inc. |

| |

|

| |

|

| |

|

| Date: April 24, 2015 |

/s/ Ralph J. Lober, II |

| |

Ralph J. Lober, II President and Chief |

| |

Executive Officer |

Exhibit 99.1

Consumers Bancorp, Inc. Reports:

| · | Net income increased by $142, or 6.9%, to $2.2 million for the first nine months of the 2015 fiscal year from the same period

last year |

| · | Total loans increased by an annualized 3.7% and assets increased by an annualized 6.7% during the nine months ended March 31,

2015 |

| · | Non-performing loans declined to 0.28% of total loans at March 31, 2015 from 0.87% at June 30, 2014 |

Minerva, Ohio— April 24, 2015 (OTCBB:

CBKM) Consumers Bancorp, Inc. (Consumers) today reported net income of $632 thousand for the third fiscal quarter of 2015, a decrease

of $46 thousand, or 6.8%, from the same period last year and a decrease of $176 thousand from the previous quarter of December

31, 2014. Earnings per share for the third fiscal quarter of 2015 were $0.23 compared to $0.25 for the same period last year.

For the nine months ended March 31, 2015,

net income was $2.2 million compared to $2.1 million for the same period last year. Fiscal year-to-date net income per share was

$0.80 compared to $0.76 for the same period last year. Return on average assets and return on average equity for the nine months

ended March 31, 2015 were 0.75% and 7.11% compared to 0.75% and 7.27%, respectively, for the same period last year.

Assets at March 31, 2015 totaled $401.6

million, an increase of $19.2 million, or an annualized 6.7%, from June 30, 2014. Loans increased by $6.2 million, available-for-sale

and held-to-maturity securities increased by $2.5 million and deposits increased by $16.9 million. The increase in deposits is

primarily from new business and public fund customer relationships stemming from increased successful calling efforts.

Ralph J. Lober, President and Chief Executive

Officer, stated, “Increases in noninterest income and balance sheet growth have offset the margin compression which we continue

to experience. We expect the new business lending center in Stow, Ohio and expanded calling efforts throughout our markets to provide

consistent commercial loan and deposit growth as well as noninterest income opportunities. Our business development efforts encompass

Stark, Carroll, Columbiana, Summit, Portage, and Cuyahoga counties. We are making strategic investments in experienced sales professionals

that we expect will positively affect future performance. In addition, improved sales processes are resulting in increased cross-departmental

referral activity.”

Net interest income for the third fiscal

quarter of 2015 increased by $123 thousand compared to the same period last year, with interest income increasing by $112 thousand

and interest expense decreasing by $11 thousand. The net interest margin was 3.79% for the current quarter ended March 31, 2015

and for the previous quarter ended December 31, 2014 and was 3.89% for the same period last year. The Corporation’s yield

on average interest-earning assets was 4.05% for the three months ended March 31, 2015, a decline from 4.17% for the same period

last year. The Corporation’s cost of funds decreased to 0.35% for the three months ended March 31, 2015 from 0.38% for the

same period last year.

Other income increased by $9 thousand,

or 1.4%, to $648 thousand for the third quarter of fiscal year 2015 compared with $639 thousand for the same period last year.

Gains from the sale of mortgage loans increased to $43 thousand, or by $9 thousand, from the same period last year.

Other expenses increased $106 thousand,

or 3.5%, for the third fiscal quarter of 2015 from the same period last year. The increase in other expenses is primarily the result

of higher salary and benefit expenses and occupancy expenses.

Non-performing loans were $0.7 million

at March 31, 2015, compared with $2.0 million at June 30, 2014 and $1.1 million at December 31, 2014. Non-performing loans decreased

from June 30, 2014 as a result of receiving proceeds from the sale of a portion of the collateral securing a commercial real estate

credit. As a result of the decrease in non-performing loans, the allowance for loan losses as a percentage of non-performing loans

increased to 370.8% at March 31, 2015 compared with 122.7% at March 31, 2014. The allowance for loan losses as a percent of total

loans at March 31, 2015 was 1.05% and annualized net charge-offs to total loans were 0.11% for the nine month period ended March

31, 2015 compared with a net charge-off ratio of 0.20% for the same period last year.

Consumers provides a complete range of

banking and other investment services to businesses and clients through its twelve full service locations and a loan production

office in Carroll, Columbiana, Stark and Summit counties in Ohio. Information about Consumers National Bank can be accessed on

the internet at http://www.consumersbank.com.

The information contained in this press

release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements may involve risks and uncertainties that are difficult to predict, may be beyond Consumers’

control and could cause actual results to differ materially from those described in such statements. Although Consumers believes

that the expectations reflected in such forward-looking statements are reasonable, Consumers can give no assurance that such expectations

will prove to be correct. The forward-looking statements included in this discussion speak only as of the date they are made, and,

except as required by law, Consumers undertakes no obligation to update these forward-looking statements to reflect subsequent

events or circumstances. Important factors that could cause actual results to differ materially from those suggested by these forward-looking

statements and that could adversely affect Consumers’ performance include, but are not limited to: regional and national

economic conditions becoming less favorable than expected, resulting in, among other things, a deterioration in credit quality

of assets and the underlying value of collateral could prove to be less valuable than otherwise assumed; the economic impact from

the oil and gas activity in the region could be less than expected or the timeline for development could be longer than anticipated;

an extended period in which market levels of interest rates remain at historical low levels which could reduce, or put pressure

on our ability to maintain, anticipated or actual margins; the nature, extent, and timing of government and regulatory actions;

credit risks of lending activities, competitive pressures on product pricing and services and changes in technology.

Contact: Ralph J. Lober, President and Chief Executive Officer

1-330-868-7701 extension 1135.

|

Consumers Bancorp, Inc.

Consolidated Financial Highlights |

| (Dollars in thousands, except per share data) | |

Three Month Period Ended | | |

Nine Month Period Ended | |

| Consolidated Statements of Income | |

March 31, 2015 | | |

March 31, 2014 | | |

March 31,

2015 | | |

March 31,

2014 | |

| Total interest income | |

$ | 3,534 | | |

$ | 3,422 | | |

$ | 10,652 | | |

$ | 10,121 | |

| Total interest expense | |

| 233 | | |

| 244 | | |

| 715 | | |

| 745 | |

| Net interest income | |

| 3,301 | | |

| 3,178 | | |

| 9,937 | | |

| 9,376 | |

| Provision for loan losses | |

| 90 | | |

| — | | |

| 214 | | |

| 168 | |

| Other income | |

| 648 | | |

| 639 | | |

| 2,232 | | |

| 2,071 | |

| Other expenses | |

| 3,100 | | |

| 2,994 | | |

| 9,233 | | |

| 8,767 | |

| Income before income taxes | |

| 759 | | |

| 823 | | |

| 2,722 | | |

| 2,512 | |

| Income tax expense | |

| 127 | | |

| 145 | | |

| 526 | | |

| 458 | |

| Net income | |

$ | 632 | | |

$ | 678 | | |

$ | 2,196 | | |

$ | 2,054 | |

| Basic and diluted earnings per share | |

$ | 0.23 | | |

$ | 0.25 | | |

$ | 0.80 | | |

$ | 0.76 | |

| Consolidated Statements of Financial Condition | |

March 31, 2015 | | |

June 30, 2014 | | |

March 31, 2014 | |

| Assets | |

| | |

| | |

| |

| Cash and cash equivalents | |

$ | 15,911 | | |

$ | 11,125 | | |

$ | 12,988 | |

| Certificates of deposit in other financial institutions | |

| 4,217 | | |

| 2,703 | | |

| 2,948 | |

| Securities, available-for-sale | |

| 128,220 | | |

| 126,393 | | |

| 124,476 | |

| Securities, held-to-maturity | |

| 3,690 | | |

| 3,000 | | |

| 3,000 | |

| Federal bank and other restricted stocks, at cost | |

| 1,396 | | |

| 1,396 | | |

| 1,186 | |

| Loans held for sale | |

| 583 | | |

| 559 | | |

| 511 | |

| Total loans | |

| 231,207 | | |

| 224,966 | | |

| 217,933 | |

| Less: allowance for loan losses | |

| 2,425 | | |

| 2,405 | | |

| 2,337 | |

| Net loans | |

| 228,782 | | |

| 222,561 | | |

| 215,596 | |

| Other assets | |

| 18,842 | | |

| 14,740 | | |

| 15,048 | |

| Total assets | |

$ | 401,641 | | |

$ | 382,477 | | |

$ | 375,753 | |

| Liabilities and Shareholders’ Equity | |

| | | |

| | | |

| | |

| Deposits | |

$ | 330,819 | | |

$ | 313,897 | | |

$ | 309,656 | |

| Other interest-bearing liabilities | |

| 25,443 | | |

| 25,785 | | |

| 24,752 | |

| Other liabilities | |

| 3,405 | | |

| 2,592 | | |

| 2,452 | |

| Total liabilities | |

| 359,667 | | |

| 342,274 | | |

| 336,860 | |

| Shareholders’ equity | |

| 41,974 | | |

| 40,203 | | |

| 38,893 | |

| Total liabilities and shareholders’ equity | |

$ | 401,641 | | |

$ | 382,477 | | |

$ | 375,753 | |

| | |

At or For the Nine Month Period Ended | |

| Performance Ratios: | |

March 31, 2015 | | |

March 31, 2014 | |

| Return on Average Assets (Annualized) | |

| 0.75 | % | |

| 0.75 | % |

| Return on Average Equity (Annualized) | |

| 7.11 | | |

| 7.27 | |

| Average Equity to Average Assets | |

| 10.51 | | |

| 10.36 | |

| Net Interest Margin (Fully Tax Equivalent) | |

| 3.79 | | |

| 3.85 | |

| | |

| | | |

| | |

| Market Data: | |

| | | |

| | |

| Book Value to Common Share | |

$ | 15.37 | | |

$ | 14.28 | |

| Dividends Paid per Common Share (YTD) | |

| 0.36 | | |

| 0.36 | |

| Period End Common Shares | |

| 2,731,612 | | |

| 2,724,278 | |

| | |

| | | |

| | |

| Asset Quality: | |

| | | |

| | |

| Net Charge-offs to Total Loans (Annualized) | |

| 0.11 | % | |

| 0.20 | % |

| Non-performing Assets to Total Assets | |

| 0.18 | | |

| 0.51 | |

| ALLL to Total Loans | |

| 1.05 | | |

| 1.07 | |

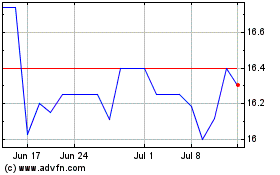

Consumers Bancorp (QX) (USOTC:CBKM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Consumers Bancorp (QX) (USOTC:CBKM)

Historical Stock Chart

From Nov 2023 to Nov 2024