SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

SCHEDULE 13D/A

(Amendment No.

4)

(Rule

13d-101)

information

to be included in statements filed pursuant

to rules 13d-1(a) and

amendments thereto filed

pursuant to rule 13d-2(a)1

| CLS

Holdings USA, Inc. |

(Name

of Issuer)

Common

Stock, $0.0001 par value per share |

(Title

of Class of Securities)

12565J308 |

(CUSIP

Number)

Navy

Capital Green Management, LLC

28

Reichert Circle

Westport,

CT 06880 |

(Name,

Address and Telephone Number of Person Authorized to Receive Notice and Communications)

December 29, 2023 |

(Date

of Event Which Requires Filing of this Statement) |

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this

Schedule 13D/A, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. o

Note: Schedules

filed in paper format shall include a signed original and five copies of the Schedule, including all exhibits. See Rule

13d-7(b) for other parties to whom copies are to be sent.

1 The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior

cover page.

The

information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

| CUSIP

No. 12565J308 |

13D/A |

Page

2 of 15 Pages |

|

|

|

|

|

| 1. |

names

of reporting person

i.r.s.

identification no. of above persons (entities only)

Navy

Capital Green Management, LLC

|

| 2. |

check

the appropriate box if a group* |

(a)

x

(b) o |

| 3. |

sec

use only

|

| 4. |

sources

of funds

AF |

| 5. |

check

box if disclosure of legal proceedings is required pursuant to item 2(d)

or 2(e) |

o |

| 6. |

citizenship

or place of organization

New

York, United States of America |

number

of

shares |

7. |

sole

voting power 0 |

beneficially

owned by |

8. |

shared

voting power 75,719,840 |

each

reporting |

9. |

sole

dispositive power 0 |

| person

with |

10. |

shared

dispositive power 75,719,840 |

| 11. |

aggregate

amount beneficially owned by each reporting person 75,719,840 |

| 12. |

check

box if the aggregate amount in row (11) excludes certain shares * |

o |

| 13. |

percent

of class represented by amount in row 11 57.03% |

| 14. |

type

of reporting person*

IA |

| CUSIP

No. 12565J308 |

13D/A |

Page

3 of 15 Pages |

|

|

|

|

|

| 1. |

names

of reporting persons

i.r.s.

identification no. of above persons (entities only)

Navy

Capital Green Management Partners, LLC

|

| 2. |

check

the appropriate box if a group* |

(a)

x

(b) o |

| 3. |

sec

use only

|

| 4. |

sources

of funds

AF |

| 5. |

check

box if disclosure of legal proceedings is required pursuant to item 2(d)

or 2(e) |

o |

| 6. |

citizenship

or place of organization

New

York, United States of America |

number

of

shares |

7. |

sole

voting power 0 |

beneficially

owned by |

8. |

shared

voting power 16,452,650 |

each

reporting |

9. |

sole

dispositive power 0 |

| person

with |

10. |

shared

dispositive power 16,452,650 |

| 11. |

aggregate

amount beneficially owned by each reporting person 16,452,650 |

| 12. |

check

box if the aggregate amount in row (11) excludes certain shares * |

o |

| 13. |

percent

of class represented by amount in row 11 12.39% |

| 14. |

type

of reporting person*

OO |

| CUSIP

No. 12565J308 |

13D/A |

Page

4 of 15 Pages |

|

|

|

|

|

| 1. |

names

of reporting persons

i.r.s.

identification no. of above persons (entities only)

Navy

Capital Green Fund, LP

|

| 2. |

check

the appropriate box if a group* |

(a)

x

(b) o |

| 3. |

sec

use only

|

| 4. |

sources

of funds

WC |

| 5. |

check

box if disclosure of legal proceedings is required pursuant to item 2(d)

or 2(e) |

o |

| 6. |

citizenship

or place of organization

Delaware,

United States of America |

number

of

shares |

7. |

sole

voting power 0 |

beneficially

owned by |

8. |

shared

voting power 16,452,650 |

each

reporting |

9. |

sole

dispositive power 0 |

| person

with |

10. |

shared

dispositive power 16,452,650 |

| 11. |

aggregate

amount beneficially owned by each reporting person 16,452,650 |

| 12. |

check

box if the aggregate amount in row (11) excludes certain shares * |

o |

| 13. |

percent

of class represented by amount in row 11 12.39% |

| 14. |

type

of reporting person*

PN |

| CUSIP

No. 12565J308 |

13D/A |

Page

5 of 15 Pages |

|

|

|

|

|

| 1. |

names

of reporting persons

i.r.s.

identification no. of above persons (entities only)

Navy

Capital Green Co-Invest Fund, LLC

|

| 2. |

check

the appropriate box if a group* |

(a)

x

(b) o |

| 3. |

sec

use only

|

| 4. |

sources

of funds

WC |

| 5. |

check

box if disclosure of legal proceedings is required pursuant to item 2(d)

or 2(e) |

o |

| 6. |

citizenship

or place of organization

Delaware,

United States of America |

number

of

shares |

7. |

sole

voting power 0 |

beneficially

owned by |

8. |

shared

voting power 59,267,190 |

each

reporting |

9. |

sole

dispositive power 0 |

| person

with |

10. |

shared

dispositive power 59,267,190 |

| 11. |

aggregate

amount beneficially owned by each reporting person 59,267,190 |

| 12. |

check

box if the aggregate amount in row (11) excludes certain shares * |

o |

| 13. |

percent

of class represented by amount in row 11 44.64% |

| 14. |

type

of reporting person*

OO |

| CUSIP

No. 12565J308 |

13D/A |

Page

6 of 15 Pages |

|

|

|

|

|

| 1. |

names

of reporting persons

i.r.s.

identification no. of above persons (entities only)

Navy

Capital Green Co-Invest Partners, LLC

|

| 2. |

check

the appropriate box if a group* |

(a)

x

(b) o |

| 3. |

sec

use only

|

| 4. |

sources

of funds

AF |

| 5. |

check

box if disclosure of legal proceedings is required pursuant to item 2(d)

or 2(e) |

o |

| 6. |

citizenship

or place of organization

Delaware,

United States of America |

number

of

shares |

7. |

sole

voting power 0 |

beneficially

owned by |

8. |

shared

voting power 59,267,190 |

each

reporting |

9. |

sole

dispositive power 0 |

| person

with |

10. |

shared

dispositive power 59,267,190 |

| 11. |

aggregate

amount beneficially owned by each reporting person 59,267,190 |

| 12. |

check

box if the aggregate amount in row (11) excludes certain shares * |

o |

| 13. |

percent

of class represented by amount in row 11 44.64% |

| 14. |

type

of reporting person*

OO |

| CUSIP

No. 12565J308 |

13D/A |

Page

7 of 15 Pages |

|

|

|

|

|

| 1. |

names

of reporting persons

i.r.s.

identification no. of above persons (entities only)

John

Kaden

|

| 2. |

check

the appropriate box if a group* |

(a)

x

(b) o |

| 3. |

sec

use only

|

| 4. |

sources

of funds

OO |

| 5. |

check

box if disclosure of legal proceedings is required pursuant to item 2(d)

or 2(e) |

o |

| 6. |

citizenship

or place of organization

United

States of America |

number

of

shares |

7. |

sole

voting power 0 |

beneficially

owned by |

8. |

shared

voting power 75,719,840 |

each

reporting |

9. |

sole

dispositive power 0 |

| person

with |

10. |

shared

dispositive power 75,719,840 |

| 11. |

aggregate

amount beneficially owned by each reporting person 75,719,840 |

| 12. |

check

box if the aggregate amount in row (11) excludes certain shares * |

o |

| 13. |

percent

of class represented by amount in row 11 57.03% |

| 14. |

type

of reporting person*

IN |

| CUSIP

No. 12565J308 |

13D/A |

Page

8 of 15 Pages |

|

|

|

|

|

| 1. |

names

of reporting persons

i.r.s.

identification no. of above persons (entities only)

Sean

Stiefel

|

| 2. |

check

the appropriate box if a group* |

(a)

x

(b) o |

| 3. |

sec

use only

|

| 4. |

sources

of funds

OO |

| 5. |

check

box if disclosure of legal proceedings is required pursuant to item 2(d)

or 2(e) |

o |

| 6. |

citizenship

or place of organization

United

States of America |

number

of

shares |

7. |

sole

voting power 0 |

beneficially

owned by |

8. |

shared

voting power 75,719,840 |

each

reporting |

9. |

sole

dispositive power 0 |

| person

with |

10. |

shared

dispositive power 75,719,840 |

| 11. |

aggregate

amount beneficially owned by each reporting person 75,719,840 |

| 12. |

check

box if the aggregate amount in row (11) excludes certain shares * |

o |

| 13. |

percent

of class represented by amount in row 11 57.03% |

| 14. |

type

of reporting person*

IN |

| CUSIP

No. 12565J308 |

13D/A |

Page

9 of 15 Pages |

|

|

|

|

|

| 1. |

names

of reporting persons

i.r.s.

identification no. of above persons (entities only)

Chetan

Gulati

|

| 2. |

check

the appropriate box if a group* |

(a)

x

(b) o |

| 3. |

sec

use only

|

| 4. |

sources

of funds

OO |

| 5. |

check

box if disclosure of legal proceedings is required pursuant to item 2(d)

or 2(e) |

o |

| 6. |

citizenship

or place of organization

United

States of America |

number

of

shares |

7. |

sole

voting power 0 |

beneficially

owned by |

8. |

shared

voting power 75,719,840 |

each

reporting |

9. |

sole

dispositive power 0 |

| person

with |

10. |

shared

dispositive power 75,719,840 |

| 11. |

aggregate

amount beneficially owned by each reporting person 75,719,840 |

| 12. |

check

box if the aggregate amount in row (11) excludes certain shares * |

o |

| 13. |

percent

of class represented by amount in row 11 57.03% |

| 14. |

type

of reporting person*

IN |

| CUSIP

No. 12565J308 |

13D/A |

Page

10 of 15 Pages |

ITEM 1 Security and Issuer

This

Schedule 13D/A relates to the common stock, par value $0.0001 (the “Common Stock”), of CLS Holdings USA, Inc. (the

“Issuer”) and amends and supplements the Schedule 13D dated February 8, 2019, as amended by Amendment No. 1 to Schedule

13D filed May 28, 2021, Amendment No. 2 to Schedule 13D filed August 9, 2021 and Amendment No. 3 to Schedule 13D filed October

3, 2022, as specifically set forth herein. The address of the principal executive offices of the Issuer is 11767 South Dixie Highway,

Suite 115, Miami, FL 33156. Defined terms not herein defined shall have the meaning set forth in the Schedule 13D, Amendment No.

1, Amendment No. 2 or Amendment No. 3.

ITEM

3 Source and Amount of Funds or Other Consideration

Item

3 is hereby amended to add the following:

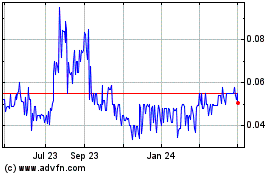

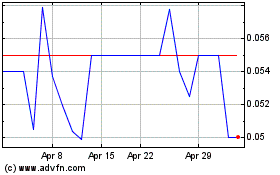

On

December 29, 2023, the Issuer entered into an amendment to subscription agreement (each, a “Third Amendment”) with and

executed a Third Amended and Restated Debenture (each, a “Third Amended and Restated Debenture”) to each of the Fund

and the Co-Investment Fund regarding a convertible debenture issued by the Issuer to the Fund on October 22, 2018 in the principal amount

of $1,000,000 (the outstanding amount of which was $504,500.05 as of December 29, 2023 after factoring in accrued and unpaid interest

as of December 31, 2023) and a convertible debenture issued by the Issuer to the Co-Investment Fund on October 22, 2018 in the principal

amount of $4,000,000 (the outstanding amount of which was $2,018,007.24 as of December 29, 2023 after factoring in accrued and unpaid

interest as of December 31, 2023), in order to, among other things, (i) reduce the conversion price of each remaining debenture to $0.07

per unit; (ii) extend the maturity date of each debenture to January 31, 2028; (iii) provide for interest accruing as of December 31,

2023 to be added to the principal balance of each debenture; and (iv) amend the definition of “unit” to mean one share

of the Issuer’s common stock, par value $0.001 and one-half of one warrant, with each warrant exercisable for three years

to purchase a share at a price of $0.10.

The

foregoing descriptions of the Third Amendments, the Third Amended and Restated Debentures, and the Warrants are summary descriptions

of the material terms thereof and are qualified in their entirety by reference to the full text of the Third Amendments, the Third Amended

and Restated Debentures, and the Warrants, which are incorporated by reference hereto and filed as Exhibits.1, 2, 3, 4, and 5

to this Schedule 13D/A.

ITEM

5 Interest in Securities of the Issuer

Item

5 is hereby amended and restated to read as follows:

(a)-(b) The

Investment Manager, John Kaden, Sean Stiefel and Chetan Gulati may be deemed, for purposes of Rule 13d-3 under the Securities

Exchange Act of 1934, as amended, to be the beneficial owner of an aggregate of 75,719,840 shares of Common Stock as of January

3, 2024, which represent 57.03% of the Issuer’s outstanding shares of Common Stock.

(i)

Sole power to vote or direct vote: 0

(ii)

Shared power to vote or direct vote: 75,719,840

(iii)

Sole power to dispose of or direct the disposition: 0

(iv)

Shared power to dispose of or direct the disposition: 75,719,840

The

Fund may be deemed, for purposes of Rule 13d-3 under the Securities Exchange Act of 1934, as amended, to be the beneficial owner

of an aggregate of 16,452,650 shares of Common Stock as of January 3, 2024, which represent 12.39% of the Issuer’s outstanding

shares of Common Stock.

(i)

Sole power to vote or direct vote: 0

(ii)

Shared power to vote or direct vote: 16,452,650

(iii)

Sole power to dispose of or direct the disposition: 0

(iv)

Shared power to dispose of or direct the disposition: 16,452,650

| CUSIP

No. 12565J308 |

13D/A |

Page

11 of 15 Pages |

NCG

may be deemed, for purposes of Rule 13d-3 under the Securities Exchange Act of 1934, as amended, to be the beneficial owner of

an aggregate of 16,452,650 shares of Common Stock as of January 3, 2024, which represent 12.39% of the Issuer’s outstanding

shares of Common Stock.

(i)

Sole power to vote or direct vote: 0

(ii)

Shared power to vote or direct vote: 16,452,650

(iii)

Sole power to dispose of or direct the disposition: 0

(iv)

Shared power to dispose of or direct the disposition: 16,452,650

The

Co-Investment Fund may be deemed, for purposes of Rule 13d-3 under the Securities Exchange Act of 1934, as amended, to be the

beneficial owner of an aggregate of 59,267,190 shares of Common Stock as of January 3, 2024, which represent 44.64% of the Issuer’s

outstanding shares of Common Stock.

(i)

Sole power to vote or direct vote: 0

(ii)

Shared power to vote or direct vote: 59,267,190

(iii)

Sole power to dispose of or direct the disposition: 0

(iv)

Shared power to dispose of or direct the disposition: 59,267,190

NCGP

may be deemed, for purposes of Rule 13d-3 under the Securities Exchange Act of 1934, as amended, to be the beneficial owner of

an aggregate of 59,267,190 shares of Common Stock as of January 3, 2024, which represent 44.64% of the Issuer’s outstanding

shares of Common Stock.

(i)

Sole power to vote or direct vote: 0

(ii)

Shared power to vote or direct vote: 59,267,190

(iii)

Sole power to dispose of or direct the disposition: 0

(iv)

Shared power to dispose of or direct the disposition: 59,267,190

For

purposes of calculating the percentages set forth in this Item 5, the number of shares of Common Stock outstanding is assumed

to be the aggregate of (i) 72,543,141 shares of Common Stock outstanding (as disclosed on the Issuer’s Form 10-Q filed with

the SEC on October 12, 2023) and (ii) the number of shares of Common Stock that would be obtained by the Reporting Persons upon

the exercise of any convertible securities held by the Reporting Persons.

Each

Reporting Person, as a member of a “group” with the other Reporting Persons for the purposes of Section 13(d)(3) of

the Securities Exchange Act of 1934, as amended, may be deemed the beneficial owner of the shares of Common Stock directly owned

by the other Reporting Persons. Each Reporting Person disclaims beneficial ownership of such shares except to the extent of his

or its pecuniary interest therein.

(c) Except

as disclosed in Item 3 and Item 4, there have been no transactions in the shares of Common Stock by the Reporting Persons during

the past sixty days.

(d) The

Fund and the Co-Investment Fund have the right to receive or the power to direct the receipt of dividends from, or the proceeds

from the sale of, securities held in their accounts.

(e) Not

applicable.

| CUSIP

No. 12565J308 |

13D/A |

Page

12 of 15 Pages |

ITEM

7 Material to the Filed at Exhibits

| Exhibit 1: |

Third

Amendment to Subscription Agreement, dated December 29, 2023, by CLS Holdings USA, Inc., in favor of Navy Capital Green Fund,

LP |

| |

|

| Exhibit 2: |

Third Amendment

to Subscription Agreement, dated December 29, 2023, by CLS Holdings USA, Inc., in favor of Navy Capital Green Co-Invest Fund,

LLC |

| |

|

| Exhibit 3: |

Third Amended

and Restated Convertible Debenture, dated December 29, 2023, issued to Navy Capital Green Fund, LP |

| |

|

| Exhibit 4: |

Third Amended

and Restated Convertible Debenture, dated December 29, 2023, issued to Navy Capital Green Co-Invest Fund, LLC |

| |

|

| Exhibit 5: |

Form

of Warrant |

| |

|

| Exhibit 99.1: |

Joint Filing Agreement |

| CUSIP

No. 12565J308 |

13D/A |

Page

13 of 15 Pages |

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

| |

January 3, 2024 |

| |

Date |

| |

|

| |

NAVY CAPITAL GREEN MANAGEMENT LLC |

| |

|

| |

/s/ John

Kaden |

| |

Signature |

| |

|

| |

John Kaden/Manager |

| |

Name/Title |

| |

|

| |

/s/ Sean

Stiefel |

| |

Signature |

| |

|

| |

Sean Stiefel/Manager |

| |

Name/Title |

| |

|

| |

/s/ Chetan Gulati

|

| |

Signature

|

| |

|

| |

Chetan Gulati/Manager

|

| |

Name/Title

|

| |

|

| |

NAVY CAPITAL GREEN MANAGEMENT PARTNERS,

LLC |

| |

|

| |

/s/ John

Kaden |

| |

Signature |

| |

|

| |

John Kaden/Manager |

| |

Name/Title |

| |

|

| |

/s/ Sean

Stiefel |

| |

Signature |

| |

|

| |

Sean Stiefel/Manager |

| |

Name/Title |

| |

|

| |

/s/ Chetan Gulati

|

| |

Signature

|

| |

|

| |

Chetan Gulati/Manager

|

| |

Name/Title

|

| CUSIP

No. 12565J308 |

13D/A |

Page

14 of 15 Pages |

| |

NAVY CAPITAL GREEN FUND, LP |

| |

|

| |

/s/ John

Kaden |

| |

Signature |

| |

|

| |

John Kaden/Manager

of its General Partner |

| |

Name/Title |

| |

|

| |

/s/ Sean

Stiefel |

| |

Signature |

| |

|

| |

Sean Stiefel/Manager

of its General Partner |

| |

Name/Title |

| |

|

| |

/s/

Chetan Gulati

|

| |

Signature

|

| |

|

| |

Chetan

Gulati/Manager of its General Partner

|

| |

Name/Title

|

| |

|

| |

NAVY CAPITAL GREEN CO-INVEST FUND LLC |

| |

|

| |

/s/ John

Kaden |

| |

Signature |

| |

|

| |

John Kaden/Manager

of its Manager |

| |

Name/Title |

| |

|

| |

/s/ Sean

Stiefel |

| |

Signature |

| |

|

| |

Sean Stiefel/Manager

of its Manager |

| |

Name/Title |

| |

|

| |

/s/

Chetan Gulati

|

| |

Signature

|

| |

|

| |

Chetan

Gulati/Manager of its Manager

|

| |

Name/Title |

| CUSIP

No. 12565J308 |

13D/A |

Page

15 of 15 Pages |

| |

NAVY CAPITAL GREEN

CO-INVEST PARTNERS, LLC

|

| |

|

| |

/s/ John

Kaden |

| |

Signature |

| |

|

| |

John

Kaden/Manager of its Manager

|

| |

Name/Title

|

| |

|

| |

/s/

Sean Stiefel

|

| |

Signature

|

| |

|

| |

Sean

Stiefel/Manager of its Manager

|

| |

Name/Title

|

| |

|

| |

/s/

Chetan Gulati

|

| |

Signature

|

| |

|

| |

Chetan

Gulati/Manager of its Manager

|

| |

Name/Title

|

| |

|

| |

/s/

John Kaden

|

| |

Signature

|

| |

|

| |

John

Kaden

|

| |

Name

|

| |

|

| |

/s/

Sean Stiefel

|

| |

Signature

|

| |

|

| |

Sean

Stiefel

|

| |

Name

|

| |

|

| |

/s/

Chetan Gulati

|

| |

Signature

|

| |

|

| |

Chetan

Gulati

|

| |

Name

|

The

original statement shall be signed by each person on whose behalf the statement is filed or his authorized representative. If

the statement is signed on behalf of a person by his authorized representative other than an executive officer or general partner

of the filing person, evidence of the representative’s authority to sign on behalf of such person shall be filed with the statement,

provided, however, that a power of attorney for this purpose which is already on file with the Commission may be incorporated

by reference. The name and any title of each person who signs the statement shall be typed or printed beneath his signature.

NOTE:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§240.13d-7 for other parties for whom copies are to be sent.

Exhibit 1

THIRD

AMENDMENT TO SUBSCRIPTION AGREEMENT

THIS

THIRD AMENDMENT TO SUBSCRIPTION AGREEMENT (the “Amendment”) is made effective this 29th day of December, 2023 by CLS

HOLDINGS USA, INC., a Nevada corporation (“Maker”) in favor of NAVY CAPITAL GREEN FUND, LP

(“Purchaser”).

WHEREAS,

on October 22, 2018, Maker and Purchaser executed a Subscription Agreement (the “Subscription Agreement”) whereby

Purchaser agreed to purchase a Convertible Debenture (the “Debenture”) in the principal amount of $1,000,000 from

Maker;

WHEREAS,

the Subscription Agreement and Debenture provided that upon conversion of the Debenture the Purchaser would receive Units, where

each Unit comprised one share of Common Stock and a warrant to purchase one-half of a share of Common Stock;

WHEREAS,

the form of warrant was attached to the Subscription Agreement;

WHEREAS,

on October 31, 2018, Maker executed the Debenture in favor of the Purchaser;

WHEREAS,

on July 26, 2019, Maker and Purchaser executed a First Amendment to Debenture and form of warrant;

WHEREAS,

on April 15, 2021, Maker and Purchaser executed an Amended and Restated Debenture with a revised form of warrant and a First Amendment

to Subscription Agreement (the “First Amendment to the Subscription Agreement”) to memorialize certain changes they

had agreed upon to the Debenture, including a reduction in the conversion price and an extension in the Maturity Date;

WHEREAS,

on September 15, 2022, Maker and Purchaser executed an Amended and Restated Debenture with a revised form of Warrant and a Second

Amendment to Subscription Agreement to memorialize certain changes agreed upon to the Debenture, including a reduction in the

conversion price and changes to the Maturity Date and payment dates (the “Second Amendment to the Subscription Agreement”

and together with the First Amendment to the Subscription Agreement and the Subscription Agreement, the “Amended Subscription

Agreement”); and

WHEREAS,

the Maker and the Purchaser wish to further amend the Amended and Restated Debenture and form of warrant, and to amend the Amended

Subscription Agreement, as provided for in this Amendment;

NOW

THEREFORE, it is hereby agreed as follows:

| 1. | Defined Terms. Capitalized

terms used but not defined herein shall have the meanings ascribed to them in the Subscription Agreement. |

| 2. | Reduction in Conversion

Price; Extension of Maturity Date. The conversion price of the Debentures shall be reduced from $0.10 per Unit to $0.07 per

Unit. The “Maturity Date” of the Debenture, as defined in the Third Amended and Restated Debenture attached as Exhibit

A to this Amendment (the “Third Amended and Restated Debenture”), shall be January 31, 2028. |

| 3. | Replacement of Exhibits

C and D (Form of Debenture and Form of Warrant). Exhibit C to the Subscription Agreement, the form of Amended and Restated

Debenture, shall be replaced with Exhibit A attached hereto, which is the Third Amended and Restated Debenture. Exhibit

D to the Subscription Agreement, which is the form of warrant, shall be replaced with Exhibit B hereto. |

| 4. | Ratification. Except

as set forth herein, the terms of the Amended Subscription Agreement, as amended by this Amendment (which together shall be referred

to as the “Third Amended Subscription Agreement”), shall remain in full force and effect after the date hereof, the

term “Unit” shall refer to the Units received upon conversion of the Third Amended and Restated Debentures at the

revised conversion prices set forth herein, and shall consist of one Share of Maker’s Common Stock and one-half of one Warrant,

with each warrant exercisable for the period provided in such warrant to purchase one Share of Common Stock for $0.10 per Share. |

[Signature

Page Follows]

IN

WITNESS WHEREOF, Maker has caused this Amendment to be signed in its name by its duly authorized officer on December 29, 2023.

| CLS HOLDINGS USA, INC. |

|

| |

|

|

| By: |

|

|

| Name: |

Andrew Glashow |

|

| Title: |

CEO and Chairman of the Board |

|

| |

|

|

| ACCEPTED AND AGREED: |

|

| |

|

|

| NAVY CAPITAL GREEN FUND, LP |

|

| |

|

|

| By: |

/s/ Kevin McLaughlin |

|

| Name: |

Kevin McLaughlin |

|

| Title: |

CFO, Navy Capital

Green Management, LLC |

|

| |

its Investment Manager |

|

EXHIBIT

A

FORM OF THIRD

AMENDED AND RESTATED DEBENTURE

THIRD

AMENDED AND RESTATED

CONVERTIBLE DEBENTURE

THIS

CONVERTIBLE DEBENTURE IS SUBJECT TO A CONVERTIBLE DEBENTURE SUBSCRIPTION AGREEMENT DATED OCTOBER 25, 2018, AS AMENDED APRIL 15,

2021, AS AMENDED SEPTEMBER 15, 2022, AS AMENDED DECEMBER 29, 2023 (THE “THIRD AMENDED SUBSCRIPTION AGREEMENT”).

AS

DESCRIBED IN THE THIRD AMENDED SUBSCRIPTION AGREEMENT, THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES

ACT OF 1933, AS AMENDED (“ACT”), OR ANY APPLICABLE STATE SECURITIES LAWS (“BLUE SKY LAWS”). ANY TRANSFER

OF SUCH SECURITIES WILL BE INVALID UNLESS A REGISTRATION STATEMENT UNDER THE ACT AND AS REQUIRED BY BLUE SKY LAWS IS IN EFFECT

AS TO SUCH TRANSFER OR IN THE OPINION OF COUNSEL SATISFACTORY TO THE BORROWER SUCH REGISTRATION IS UNNECESSARY IN ORDER FOR SUCH

TRANSFER TO COMPLY WITH THE ACT AND BLUE SKY LAWS.

| $504,500.05 |

December 29, 2023 |

WHEREAS,

on October 22, 2018, CLS Holdings USA, Inc., a Nevada corporation (the “Maker” or the “Company”) and Navy

Capital Green Fund, LP (the “Purchaser”) executed a Subscription Agreement (the “Subscription Agreement”)

whereby Purchaser agreed to purchase a Convertible Debenture in the principal amount of $1,000,000 (One Million Dollars) from

Maker (the “Original Debenture”);

WHEREAS,

on April 15, 2021, the Maker and the Purchaser executed the First Amendment to Subscription Agreement (together with the Subscription

Agreement the “Amended Subscription Agreement”);

WHEREAS,

pursuant to the Amended Subscription Agreement, the Maker executed an Amended and Restated Debenture on April 15, 2021 (the “Amended

and Restated Debenture”), which replaced the Original Debenture;

WHEREAS,

effective on September 15, 2022, the Maker and the Purchaser executed the Second Amendment to Subscription Agreement (together

with the Amended Subscription Agreement and the Subscription Agreement, the “Second Amended Subscription Agreement”)

and a portion of the amounts due under the Amended and Restated Debenture were converted into the Maker’s Units;

WHEREAS,

pursuant to the Second Amendment to Subscription Agreement, the Maker executed a Second Amended and Restated Debenture on September

15, 2022 (the “Second Amended and Restated Debenture”), which replaced the Amended and Restated Debenture;

WHEREAS, effective on December 29, 2023, the Maker and the Purchaser executed the Third

Amendment to Subscription Agreement (together with the Second Amended Subscription Agreement, the Amended Subscription Agreement

and the Subscription Agreement, the “Third Amended Subscription Agreement”);

WHEREAS,

pursuant to the Third Amended Subscription Agreement, the Maker and the Purchaser now wish to amend and restate the Second Amended

and Restated Debenture, which Third Amended and Restated Debenture shall replace the Second Amended and Restated Debenture in

all respects, as follows:

For

Value Received, CLS Holdings USA, Inc, a Nevada corporation (“Maker”), under the terms of this Convertible Debenture

(“Debenture”) promises to pay to the order of Navy Capital Green Fund, LP (“Purchaser”), by check, in

lawful money of the United States of America and in immediately available funds, the principal amount of Five Hundred Four Thousand

Five Hundred and 05/100 Dollars ($504,500.05) (the “Original Principal Amount”), together with such interest on the

Original Principal Amount as provided for below on January 31, 2028 (the “Maturity Date”) if not sooner indefeasibly

paid in full.

Interest

payable on the Original Principal Amount (including the PIK Amount (as defined below) added thereto, the “Principal Amount”)

shall accrue at a rate per annum equal to eight percent (8%) (the “Contract Rate”). Interest shall be (i) calculated

on the basis of a 360-day year. Maker shall pay Purchaser a monthly payment on the last business day of each month commencing

January 31, 2024 in accordance with Appendix I attached hereto. Payments shall be allocated first to accrued but unpaid interest

and then principal.

Interest

on the Principal Amount of this Debenture at the Contract Rate that shall have accrued and shall remain unpaid as of December

31, 2023 (the “PIK Amount”) shall be added to the then outstanding Principal Amount.

Maker

may, in its sole discretion, pay any amounts due under this Debenture at any time without any premium or penalty.

If

at any Measurement Date commencing May 31, 2024 for which financial statements are available, the Company determines that CAFDS

exceeds Seven Hundred Fifty Thousand Dollars ($750,000.00), Maker shall provide written notice to Purchaser, no later than ten

(10) Business Days following the date of such determination, and Purchaser shall have ten (10) business days from the receipt

of such notice to elect to cause Maker to pay to Purchaser Purchaser’s pro rata share, based on the Principal Amount of

this Debenture, the debenture held by Navy Capital Green Co-Invest Fund, LLC, and the Canaccord Debentures, of the amount of CAFDS

exceeding Seven Hundred Fifty Thousand Dollars ($750,000.00) (the “CAFDS Payment”). Maker shall pay Purchaser the

CAFDS Payment within five (5) business days of receipt of Purchaser’s election.

For

purposes of this Convertible Debenture, “Canaccord Debentures” means those debentures Maker issued pursuant to that

certain Indenture dated as of December 18, 2018, by and between Maker and Odyssey Trust Company, as amended.

For purposes of this Convertible Debenture, “CAFDS” for any period ending on a Measurement

Date and for which financial statements are available, means Maker’s unrestricted (as determined in accordance with generally

accepted accounting practices, consistently applied) cash on hand, whether from operations or treasury activities.

For

purposes of this Convertible Debenture, “Measurement Date” means the last day of each fiscal quarter of Maker.

Capitalized

terms used herein but not otherwise defined shall have the meanings given to them in the Subscription Agreement.

| 1. | Conversion. At Purchaser’s

option, at any time prior to the close of business on the earlier of (i) the last business day immediately prior to the Maturity

Date; or (ii) the Redemption Date (as defined in Section 3 below), the Purchaser may choose to have all or part of the outstanding

principal and accrued interest owing to Purchaser repaid in Units at a conversion rate equal to seven cents ($0.07) per Unit,

as adjusted pursuant to Section 2 (the “Conversion Price”). In the event Purchaser chooses to convert all or part

of the outstanding principal and accrued interest into Units, Purchaser shall give written notice to Maker of such conversion

no less than fifteen (15) business days prior to such conversion, and shall surrender the original of this Debenture to Maker,

after which Purchaser will have no further rights under this Debenture as to the converted principal and interest, except the

right to receive certificates representing the components of the Units. Notwithstanding anything to the contrary in either the

Subscription Agreement or this Debenture, if at any time after six (6) months and one (1) day after the date of issuance of the

Debenture (the “Closing Date”) the price of a Share on the exchange or trading platform on which the Shares are traded

exceeds $0.80 (U.S.) for ten consecutive trading days, the Maker, on not less than thirty (30) days-notice (the end of such notice

period, the “Forced Conversion Date”) to the Purchaser, may require conversion of this Debenture, in which case, following

the Forced Conversion Date, interest shall cease to accrue on this Debenture and the Purchaser will have no further rights under

this Debenture as to the converted principal and interest, except the right to receive certificates representing the components

of the Units. |

| 2. | Amendment to the Definition

of Unit. Unit, as defined in the Subscription Agreement, shall mean (i) one (1) share of Maker’s Common Stock, par value

$0.001, (the “Shares”) and (ii) one-half of one (1) warrant, with each warrant exercisable for three years to purchase

a Share at a price of $0.10 (U.S.) (each, a “Warrant”). The description of a Warrant in this Section 2 is intended

to modify the description of a Warrant in this Third Amended and Restated Debenture, the Third Amended Subscription Agreement

and any other document related to this Third Amended and Restated Debenture, and in the case of any conflict between the description

of a Warrant in this Third Amended and Restated Debenture, the Third Amended Subscription Agreement or any other document related

to this Third Amended and Restated Debenture, the description in this Third Amended and Restated Debenture shall control. |

Without

limiting the foregoing, Maker and Purchaser also intend that each warrant heretofore delivered to Purchaser (including, but not

limited to, the warrants issued concurrently with the Second Amended and Restated Subscription Agreement) be amended to conform

with the foregoing. As such, each warrant issued concurrently with the Second Amended and Restated Subscription Agreement shall

be deemed to be exercisable until the date which is three (3) years hereafter

at a price of $0.10 per Share, with the same force and effect as though each such warrant were expressly amended on the date hereof

to be a Warrant. The foregoing provision is intended to be self-operative and binding on the Maker in all respects, but the Maker

shall promptly deliver any documents, instruments and certificates which the Purchaser may request to evidence the same (including,

but not limited to, amended and restated warrants).

| 3. | Adjustment of

Conversion Price. The Conversion Price shall be subject to adjustment from time to time as follows: |

| (a) | If at any time after the

date of this Debenture, Maker shall subdivide its outstanding Shares, the Conversion Price and Mandatory Conversion Threshold

in effect immediately prior to such issuance or subdivision shall be proportionately reduced. If the outstanding Shares shall

be combined into a smaller number of shares, the Conversion Price and Mandatory Conversion Threshold in effect immediately prior

to such combination shall be proportionately increased. The Conversion Price and Mandatory Conversion Threshold also shall be

appropriately adjusted in the event of the subsequent issuance of Shares or securities convertible into Shares, by way of security

dividend or distribution, the issuance of rights, options or warrants to all or substantially all the holders of Shares or the

distribution of shares of any other class of shares, rights, options, warrants, evidences of indebtedness or assets. |

| (b) | Except as set forth herein,

if at any time after the date of this Third Amended and Restated Debenture, the Maker shall issue or sell Common Stock, or warrants

or options exercisable for Common Stock, preferred stock convertible into Common Stock, or any other securities convertible into

Common Stock, in a capital raising transaction, at a consideration per share, or exercise or conversion price per share, as applicable,

less than the Conversion Price in effect immediately prior to such issuance, the Conversion Price shall be reduced to such issuance

price. For purposes of determining the issuance price, the amount of consideration paid upon issuance of the security and any

additional consideration to be paid upon conversion or exercise of the same security shall be combined to determine the total

issuance price. The following securities shall be excluded from the foregoing and shall not result in any change to the Conversion

Price: (i) capital stock, options or convertible securities issued to directors, officers, employees or consultants of the Maker

in connection with their service as directors of the Maker, their employment by the Maker or their retention as consultants by

the Maker, (ii) shares of Common Stock issued upon the conversion or exercise of options or convertible securities that were issued

and outstanding on the date immediately preceding the date of this Third Amended and Restated Debenture, provided such securities

are not amended after the date of this Third Amended and Restated Debenture to increase the number of shares of Common Stock issuable

thereunder or to lower the exercise or conversion price thereof (iii) securities issued pursuant to the Third Amended and Restated

Debenture and securities issued upon the exercise or conversion of those securities, (iv) shares of Common Stock issued

or issuable by reason of a dividend, stock split or other distribution on shares of Common Stock (but only to the extent that

such a dividend, split or distribution results in an adjustment in the Conversion Price pursuant to the other provisions of this

Third Amended and Restated Debenture), and (v) capital stock, options or convertible securities issued as consideration for an

acquisition or strategic transaction approved by a majority of the disinterested directors of the Maker, provided that any such

issuance shall only be a person or entity (or to the equityholders of an entity) which is, itself or through its subsidiaries,

an operating company or an owner of an asset in a business synergistic with the business of the Maker and shall provide to the

Maker additional benefits in addition to the investment of funds, but shall not, for the purposes of this clause (v), include

a transaction in which the Maker is issuing securities primarily for the purpose of raising capital or to an entity whose primary

business is investing in securities. Notwithstanding the foregoing, no adjustment to the Conversion Price shall be made as a result

of the Maker’s sale of securities through February 1, 2024. |

| (c) | No adjustment in the Conversion

Price and/or the number of shares of Common Stock subject to the Debenture need be made if such adjustment would result in a change

in the Conversion Price of less than one cent ($0.01) or a change in the number of subject shares of less than one-tenth (1/10th)

of a share. |

| (d) | Upon any adjustment of

the Conversion Price hereunder, Maker will compute the adjustment and prepare and furnish to Purchaser a certificate setting forth

such adjustment and showing in detail the facts upon which the adjustment is based. |

| 4. | Redemption/Change

in Control. |

| (a) | The Purchaser may, upon

not less than thirty (30) days-notice (the end of such notice period, the “Redemption Date”) to Maker following a

“Change in Control” (as defined below), require Maker to repurchase the Debenture, in whole or in part, at a price

(the “Redemption Price”) equal to 105% of the principal amount of the Debenture outstanding (including any accrued

and unpaid interest) on the Redemption Date. |

| (b) | If holders of ninety percent

(90%) or more of the series of debentures of which this Debenture is a part have demanded to require Maker to repurchase their

debentures following a Change in Control, the Purchaser agrees to allow Maker to repurchase this Debenture for the Redemption

Price on the Redemption Date notwithstanding the fact that the Purchaser has not provided the notice described in section 3(a). |

| (c) | Following the Redemption

Date, interest shall cease to accrue on this Debenture and the Purchaser will have no further rights under this Debenture as to

the converted principal and interest, except the right to receive the Redemption Price. |

| (d) | A “Change in Control,”

for purposes of this Debenture, means (i) any event as a result of or following which any person, or group of persons acting jointly

or in concert within the meaning of applicable United States securities laws, beneficially owns or exercises control or direction

over an aggregate of more than 50% of the then outstanding Shares; or (ii) the sale or other transfer of all or substantially

all of the consolidated assets of Maker. A “Change in Control” does not include a sale, merger, reorganization or

other similar transaction if the previous holders of the Shares hold at least 50% of the voting shares of such merged, reorganized

or other continuing entity. |

| 5. | Authorized Shares.

Until the Maturity Date, Maker shall maintain sufficient numbers of authorized and unissued Shares to permit the full exercise

of the conversion of this Third Amended and Restated Debenture and the exercise of any Warrant. |

| |

6.1 | Events

of Default. With respect to the Third Amended and Restated Debenture, the following

events are “Events of Default”: |

| (a) | Default by Maker in the

payment of principal on or any interest payable under the Debenture after fifteen (15) business days’ written notice from

Purchaser following the date when the same is due and payable; or |

| (b) | Default in the due performance

or observance of any other material covenant, agreement or provision in the Subscription Agreement, or in this Third Amended and

Restated Debenture, to be performed or observed by Maker, and such default shall have continued for a period of thirty (30) business

days after written notice thereof to Maker from Purchaser; or |

| (c) | the

occurrence of any of the following: |

| (i) | the

Maker files a petition in bankruptcy or for reorganization or for the adoption of an

arrangement under the United States Bankruptcy Code (as now or in the future amended,

the “Bankruptcy Code”); |

| (ii) | the

Maker makes a general assignment for the benefit of its creditors; |

| (iii) | the

Maker consents to the appointment of a receiver or trustee for all or a substantial part

of the property of Maker or approves as filed in good faith a petition filed against

Maker under the Bankruptcy Code; or |

| (iv) | the

commencement of a proceeding or case, without the application or consent of Maker, in

any court of competent jurisdiction, seeking (i) its liquidation, reorganization, dissolution

or winding-up, or the composition or readjustment of its debts, (ii) the appointment

of a trustee, receiver, custodian, liquidator or the like of Maker or of all or any substantial

part of its assets, or (iii) similar relief in respect of Maker under any law relating

to bankruptcy, insolvency, reorganization, winding-up or composition or adjustment of

debts, and such proceeding or case set forth in (i), (ii), or (iii) above continues undismissed

or uncontroverted, or an order, judgement or decree approving or ordering any of the

foregoing is entered and continues unstayed and in effect, for a period of sixty (60)

business days. |

| 6.2 | Acceleration. If

any one or more Events of Default described in Section 5.1 shall occur and be continuing, then Purchaser may, at Purchaser’s

option and by written notice to Maker, declare the unpaid balance of the Debenture owing to Purchaser to be forthwith due and

payable. |

| 7. | Security. In order

to permit the Company to grant a security interest in any of the assets that form part of its Nevada operations, the Nevada Cannabis

Control Board (“CCB”) must receive notice in advance of the proposed grant of the security interest, and the CCB reserves

the right to vet the recipients thereof (including all debentureholders). Maker shall use commercially reasonable efforts to obtain

all necessary regulatory approvals to permit it to grant to debentureholders a security interest (“Security”) in certain

of its select assets, such as its licenses, inventory (including work in process), equipment (excluding equipment subject to leases

or purchase money financing) and contract rights (excluding investments in entities other than wholly-owned subsidiaries); however,

the grant of the Security will be subject to CBB approval, which has not yet been requested or received. It is not possible to

state with certainty when the effective date of the grant of the Security will occur, if at all. The grant of the Security is

subject to the risk that CCB approval for the grant may not be received at all, or may be received with burdensome conditions

for Maker and/or one or more of the debentureholders that are not commercially reasonable to comply with and/or may be outside

the control of Maker. In the event the Security is ultimately granted to debentureholders, the Maker will retain the ability to

subsequently grant a security interest in the same assets comprising the Security to other debtholders of Maker whether existing

on the date hereof or incurred by Maker in the future, and which debts are currently secured or may be secured in the future.

Anything contained herein to the contrary notwithstanding, whether or not the foregoing is successful, the Maker shall not grant

Security in any of its assets whatsoever to any other lender or any other rights to any other creditor, which would have the effect

causing the Purchaser’s claim in connection with any such assets to be subordinate to the rights of such third party, it

being intended that for all purposes no lien or indebtedness shall be senior to Purchaser’s lien and that the lien of any

other indebtedness will be subject and subordinate to this Debenture. Without limiting the foregoing, Maker represents and warrants

that (i) any lien of and indebtedness evidenced by any debenture accruing interest at a rate of 15% per annum will be subject

and subordinate to this Debenture and (ii) covenants not to issue any indebtedness other than as is subject and subordinate to

this Debenture. |

| 8. | Governing Law. This

Third Amended and Restated Debenture shall be governed by, and construed and enforced in accordance with, the laws of the state

of Nevada, excluding conflict of laws principles that would cause the application of laws of any other jurisdiction. |

| 9. | Successors. The

provisions of this Third Amended and Restated Debenture shall inure to the benefit of and be binding on any successor of Purchaser.

This Third Amended and Restated Debenture cannot be assigned by any party hereto except as described in the Third Amended Subscription

Agreement. |

CLS Holdings, USA,

Inc., a Nevada corporation

APPENDIX

I

PAYMENT

SCHEDULE

[To

be inserted]

| $500,500.05 8% Navy Capital Green |

|

| Period |

|

Payment Date |

|

Beginning

Balance |

|

Payment |

|

Interest |

|

Principal |

|

Ending

Balance |

|

| 1 |

|

|

1/31/24 |

|

$ |

504,500.05 |

|

$ |

8,000.00 |

|

$ |

3,363.33 |

|

$ |

4,636.67 |

|

$ |

499,863.38 |

|

| 2 |

|

|

2/28/24 |

|

$ |

499,863.38 |

|

$ |

8,000.00 |

|

$ |

3,332.42 |

|

$ |

4,667.58 |

|

$ |

495,195.80 |

|

| 3 |

|

|

3/31/24 |

|

$ |

495,195.80 |

|

$ |

8,000.00 |

|

$ |

3,301.31 |

|

$ |

4,698.70 |

|

$ |

490,497.10 |

|

| 4 |

|

|

4/30/24 |

|

$ |

490,497.10 |

|

$ |

8,000.00 |

|

$ |

3,269.98 |

|

$ |

4,730.02 |

|

$ |

485,767.08 |

|

| 5 |

|

|

5/31/24 |

|

$ |

485,767.08 |

|

$ |

8,000.00 |

|

$ |

3,238.45 |

|

$ |

4,761.56 |

|

$ |

481,005.52 |

|

| 6 |

|

|

6/30/24 |

|

$ |

481,005.52 |

|

$ |

8,000.00 |

|

$ |

3,206.70 |

|

$ |

4,793.30 |

|

$ |

476,212.22 |

|

| 7 |

|

|

7/31/24 |

|

$ |

476,212.22 |

|

$ |

8,000.00 |

|

$ |

3,174.75 |

|

$ |

4,825.26 |

|

$ |

471,386.97 |

|

| 8 |

|

|

8/31/24 |

|

$ |

471,386.97 |

|

$ |

8,000.00 |

|

$ |

3,142.58 |

|

$ |

4,857.42 |

|

$ |

466,529.54 |

|

| 9 |

|

|

9/30/24 |

|

$ |

466,529.54 |

|

$ |

8,000.00 |

|

$ |

3,110.20 |

|

$ |

4,889.81 |

|

$ |

461,639.74 |

|

| 10 |

|

|

10/31/24 |

|

$ |

461,639.74 |

|

$ |

8,000.00 |

|

$ |

3,077.60 |

|

$ |

4,922.41 |

|

$ |

456,717.33 |

|

| 11 |

|

|

11/30/24 |

|

$ |

456,717.33 |

|

$ |

8,000.00 |

|

$ |

3,044.78 |

|

$ |

4,955.22 |

|

$ |

451,762.11 |

|

| 12 |

|

|

12/31/24 |

|

$ |

451,762.11 |

|

$ |

8,000.00 |

|

$ |

3,011.75 |

|

$ |

4,988.26 |

|

$ |

446,773.85 |

|

| 13 |

|

|

1/31/25 |

|

$ |

446,773.85 |

|

$ |

8,000.00 |

|

$ |

2,978.49 |

|

$ |

5,021.51 |

|

$ |

441,752.34 |

|

| 14 |

|

|

2/28/25 |

|

$ |

441,752.34 |

|

$ |

8,000.00 |

|

$ |

2,945.02 |

|

$ |

5,054.99 |

|

$ |

436,697.35 |

|

| 15 |

|

|

3/31/25 |

|

$ |

436,697.35 |

|

$ |

8,240.06 |

|

$ |

2,911.32 |

|

$ |

5,328.74 |

|

$ |

431,368.61 |

|

| 16 |

|

|

4/30/25 |

|

$ |

431,368.61 |

|

$ |

8,240.06 |

|

$ |

2,875.79 |

|

$ |

5,364.27 |

|

$ |

426,004.35 |

|

| 17 |

|

|

5/31/25 |

|

$ |

426,004.35 |

|

$ |

8,240.06 |

|

$ |

2,840.03 |

|

$ |

5,400.03 |

|

$ |

420,604.32 |

|

| 18 |

|

|

6/30/25 |

|

$ |

420,604.32 |

|

$ |

8,240.06 |

|

$ |

2,804.03 |

|

$ |

5,436.03 |

|

$ |

415,168.29 |

|

| 19 |

|

|

7/31/25 |

|

$ |

415,168.29 |

|

$ |

8,240.06 |

|

$ |

2,767.79 |

|

$ |

5,472.27 |

|

$ |

409,696.02 |

|

| 20 |

|

|

8/31/25 |

|

$ |

409,696.02 |

|

$ |

8,240.06 |

|

$ |

2,731.31 |

|

$ |

5,508.75 |

|

$ |

404,187.27 |

|

| 21 |

|

|

9/30/25 |

|

$ |

404,187.27 |

|

$ |

8,240.06 |

|

$ |

2,694.58 |

|

$ |

5,545.48 |

|

$ |

398,641.80 |

|

| 22 |

|

|

10/31/25 |

|

$ |

398,641.80 |

|

$ |

8,240.06 |

|

$ |

2,657.61 |

|

$ |

5,582.45 |

|

$ |

393,059.35 |

|

| 23 |

|

|

11/30/25 |

|

$ |

393,059.35 |

|

$ |

8,240.06 |

|

$ |

2,620.40 |

|

$ |

5,619.66 |

|

$ |

387,439.69 |

|

| 24 |

|

|

12/31/25 |

|

$ |

387,439.69 |

|

$ |

8,240.06 |

|

$ |

2,582.93 |

|

$ |

5,657.13 |

|

$ |

381,782.56 |

|

| 25 |

|

|

1/31/26 |

|

$ |

381,782.56 |

|

$ |

8,240.06 |

|

$ |

2,545.22 |

|

$ |

5,694.84 |

|

$ |

376,087.72 |

|

| 26 |

|

|

2/28/26 |

|

$ |

376,087.72 |

|

$ |

8,240.06 |

|

$ |

2,507.25 |

|

$ |

5,732.81 |

|

$ |

370,354.92 |

|

| 27 |

|

|

3/31/26 |

|

$ |

370,354.92 |

|

$ |

8,240.06 |

|

$ |

2,469.03 |

|

$ |

5,771.02 |

|

$ |

364,583.89 |

|

| 28 |

|

|

4/30/26 |

|

$ |

364,583.89 |

|

$ |

8,240.06 |

|

$ |

2,430.56 |

|

$ |

5,809.50 |

|

$ |

358,774.40 |

|

| 29 |

|

|

5/31/26 |

|

$ |

358,774.40 |

|

$ |

8,240.06 |

|

$ |

2,391.83 |

|

$ |

5,848.23 |

|

$ |

352,926.17 |

|

| 30 |

|

|

6/30/26 |

|

$ |

352,926.17 |

|

$ |

8,240.06 |

|

$ |

2,352.84 |

|

$ |

5,887.22 |

|

$ |

347,038.95 |

|

| 31 |

|

|

7/31/26 |

|

$ |

347,038.95 |

|

$ |

8,240.06 |

|

$ |

2,313.59 |

|

$ |

5,926.46 |

|

$ |

341,112.49 |

|

| 32 |

|

|

8/31/26 |

|

$ |

341,112.49 |

|

$ |

8,240.06 |

|

$ |

2,274.08 |

|

$ |

5,965.97 |

|

$ |

335,146.51 |

|

| 33 |

|

|

9/30/26 |

|

$ |

335,146.51 |

|

$ |

8,240.06 |

|

$ |

2,234.31 |

|

$ |

6,005.75 |

|

$ |

329,140.77 |

|

| 34 |

|

|

10/31/26 |

|

$ |

329,140.77 |

|

$ |

8,240.06 |

|

$ |

2,194.27 |

|

$ |

6,045.79 |

|

$ |

323,094.98 |

|

| 35 |

|

|

11/30/26 |

|

$ |

323,094.98 |

|

$ |

8,240.06 |

|

$ |

2,153.97 |

|

$ |

6,086.09 |

|

$ |

317,008.89 |

|

| 36 |

|

|

12/31/26 |

|

$ |

317,008.89 |

|

$ |

8,240.06 |

|

$ |

2,113.39 |

|

$ |

6,126.66 |

|

$ |

310,882.23 |

|

| 37 |

|

|

1/31/27 |

|

$ |

310,882.23 |

|

$ |

8,240.06 |

|

$ |

2,072.55 |

|

$ |

6,167.51 |

|

$ |

304,714.72 |

|

| 38 |

|

|

2/28/27 |

|

$ |

304,714.72 |

|

$ |

8,240.06 |

|

$ |

2,031.43 |

|

$ |

6,208.63 |

|

$ |

298,506.09 |

|

| $500,500.05 8% Navy Capital Green |

|

| Period |

|

Payment Date |

|

Beginning

Balance |

|

Payment |

|

Interest |

|

Principal |

|

Ending

Balance |

|

| 39 |

|

|

3/31/27 |

|

$ |

298,506.09 |

|

$ |

8,240.06 |

|

$ |

1,990.04 |

|

$ |

6,250.02 |

|

$ |

292,256.08 |

|

| 40 |

|

|

4/30/27 |

|

$ |

292,256.08 |

|

$ |

8,240.06 |

|

$ |

1,948.37 |

|

$ |

6,291.68 |

|

$ |

285,964.39 |

|

| 41 |

|

|

5/31/27 |

|

$ |

285,964.39 |

|

$ |

8,240.06 |

|

$ |

1,906.43 |

|

$ |

6,333.63 |

|

$ |

279,630.77 |

|

| 42 |

|

|

6/30/27 |

|

$ |

279,630.77 |

|

$ |

8,240.06 |

|

$ |

1,864.21 |

|

$ |

6,375.85 |

|

$ |

273,254.91 |

|

| 43 |

|

|

7/31/27 |

|

$ |

273,254.91 |

|

$ |

8,240.06 |

|

$ |

1,821.70 |

|

$ |

6,418.36 |

|

$ |

266,836.56 |

|

| 44 |

|

|

8/31/27 |

|

$ |

266,836.56 |

|

$ |

8,240.06 |

|

$ |

1,778.91 |

|

$ |

6,461.15 |

|

$ |

260,375.41 |

|

| 45 |

|

|

9/30/27 |

|

$ |

260,375.41 |

|

$ |

8,240.06 |

|

$ |

1,735.84 |

|

$ |

6,504.22 |

|

$ |

253,871.19 |

|

| 46 |

|

|

10/31/27 |

|

$ |

253,871.19 |

|

$ |

8,240.06 |

|

$ |

1,692.47 |

|

$ |

6,547.58 |

|

$ |

247,323.61 |

|

| 47 |

|

|

11/30/27 |

|

$ |

247,323.61 |

|

$ |

8,240.06 |

|

$ |

1,648.82 |

|

$ |

6,591.23 |

|

$ |

240,732.37 |

|

| 48 |

|

|

12/31/27 |

|

$ |

240,732.37 |

|

$ |

8,240.06 |

|

$ |

1,604.88 |

|

$ |

6,635.17 |

|

$ |

234,097.20 |

|

| 49 |

|

|

1/31/28 |

|

$ |

234,097.20 |

|

$ |

235,657.85 |

|

$ |

1,560.65 |

|

$ |

234,097.20 |

|

$ |

— |

|

| |

|

|

|

|

|

|

|

$ |

627,819.84 |

|

$ |

123,319.79 |

|

$ |

504,500.05 |

|

|

|

|

EXHIBIT

B

FORM OF WARRANT

THESE

SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THESE SECURITIES

MAY NOT BE SOLD, OFFERED FOR SALE, TRANSFERRED, ASSIGNED, PLEDGED OR HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION

STATEMENT WITH RESPECT TO THE SECURITIES UNDER SUCH ACT, OR AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY IN ITS REASONABLE

JUDGMENT THAT SUCH REGISTRATION IS NOT REQUIRED UNDER SUCH ACT AND APPLICABLE STATE SECURITIES LAWS.

CLS

HOLDINGS USA, INC.

Warrant

for the Purchase of Common Stock, par value $0.001 per share

| No. _________ |

_________

Shares |

Date:

_______

THIS

CERTIFIES that, for good and valuable consideration, [·] (together with its successors and permitted assigns, the

“Holder”), with an address at [·] is entitled to subscribe for and purchase from CLS HOLDINGS USA, INC. (the

“Company”), upon the terms and conditions set forth herein, in whole or in part, at any time, or from time to

time, after the date hereof and before 5:00 p.m. on a date that is not later than thirty-six (36) months after the

earlier of: (i) the date this Warrant is issued according to the date set forth above; or (ii) the effectiveness of a

registration statement under the Securities Act of 1933, as amended, relating to the Warrant Shares (as defined below) (the

“Exercise Period”), that number of shares of the Company’s common stock set forth above, par value $0.001

per share (“Common Stock”), at a price of $0.10 per share (the “Exercise Price”), as same may be

adjusted as provided for herein (the “Warrant Shares”).

| 1. | To the extent otherwise

exercisable, this Warrant may be exercised during the Exercise Period as to the whole or any portion of the number of Warrant

Shares, by (i) delivery of a written notice, in the form of the exercise notice attached hereto as Exhibit A (the “Exercise

Notice”), of such Holder’s election to exercise this Warrant, which notice shall specify the number of Warrant Shares

to be purchased, (ii) delivery of this Warrant to the Company, and (iii) either (a) payment to the Company of an amount equal

to the Exercise Price multiplied by the number of Warrant Shares to be exercised (plus any applicable issue or transfer taxes)

(the “Aggregate Exercise Price”) in cash, or by means of bank check or wire transfer of immediately available funds,

or (b) if at the time the Company delivers a Mandatory Exercise Notice to the Holder, the Warrant Shares are not subject to an

effective registration statement, delivery of an election to receive upon such exercise the “Net Number” of shares

of Common Stock determined according to the following formula (the “Cashless Exercise”): |

Net

Number = (A x B) – (A x C)

B

For

purposes of the foregoing formula:

A = the total

number of Warrant Shares with respect to which this Warrant is then being exercised.

B = the closing bid

price of the Common Stock on the date of exercise of the Warrant.

C = the Warrant

Exercise Price then in effect for the applicable Warrant Shares at the time of such exercise.

In

the event that the exercise of this Warrant is for less than all of the Warrant Shares purchasable under this Warrant, the Company

shall cause to be issued in the name of and delivered to the Holder hereof or as the Holder may direct, as soon as practicable,

a new Warrant or Warrants of like tenor, for the balance of the Warrant Shares purchasable hereunder.

| 2. | Upon the exercise of the

Holder’s right to purchase Warrant Shares granted pursuant to this Warrant, the Holder shall be deemed to be the holder

of record of the number of Warrant Shares issuable upon such exercise, notwithstanding that the transfer books of the Company

shall then be closed or certificates representing such Warrant Shares shall not then have been actually delivered to the Holder.

As soon as practicable after the exercise of this Warrant, the Company shall issue and deliver to the Holder a certificate or

certificates for the applicable number of Warrant Shares, registered in the name of the Holder. No fractional shares of Common

Stock are to be issued upon exercise of this Warrant, but rather the number of shares of Common Stock issued upon exercise of

this Warrant shall be rounded up or down to the nearest whole number. |

| (a) | The Company shall maintain

at its principal executive offices (or such other office or agency of the Company as it may designate by notice to the Holder

hereof), a register for this Warrant, in which the Company shall record the name and address of the person in whose name this

Warrant has been issued, as well as the name and address of each transferee upon receipt of a duly executed warrant power in the

form of Exhibit B hereto. The Company may treat the person in whose name any Warrant is registered on the register as the owner

and holder thereof for all purposes, notwithstanding any notice to the contrary. |

| (b) | The Company shall at all

times reserve and keep available out of its authorized and unissued Common Stock, solely for the purpose of providing for the

exercise of the rights to purchase all Warrant Shares granted pursuant to this Warrant, such number of shares of Common Stock

as shall be sufficient therefor. The Company covenants that all shares of Common Stock issuable upon exercise of this Warrant,

upon receipt by the Company of the purchase price therefor, shall be validly issued, fully paid and nonassessable. |

| (c) | The Company, upon ten (10)

days prior notice to the Holder (a “Mandatory Exercise Notice”), at any time prior to expiration of the Exercise Period,

may demand that the Investor exercise this Warrant, in its entirety, if the closing bid price of the Shares equals or exceeds

$0.80 (subject to adjustments as set forth in Section 4 of this Warrant) for twenty (20) consecutive business days. Should the

Investor fail to exercise the Warrant in its entirety within thirty (30) days after receiving the Company’s demand, the

Warrant shall expire and be of no further force or effect. |

2.

| (a) | In the event that the outstanding

shares of Common Stock are changed into a different number of shares of Common Stock by reason of any recapitalization, reclassification,

stock split- up, combination of shares or dividend payable in shares of the Company or an otherwise similar event, appropriate

adjustment shall be made in the number and kind of securities as to which this Warrant shall be exercisable, to the end that the

proportionate interest of the Holder immediately after the occurrence of such event shall equal the proportionate interest of

the Holder immediately before the occurrence of such event. Such adjustment shall be made without change in the total Exercise

Price applicable to this Warrant but with corresponding adjustments in the number of shares of Common Stock underlying the Warrant

and Exercise Price per share evidenced by this Warrant. To illustrate: In the event of a reverse split in the ratio of 1:4, if

this Warrant was for 75,000 Shares, the Exercise Price would become $0.40 and the number of underlying shares of Common Stock

would be reduced to 18,750. |

| (b) | In case of any consolidation

with or merger of the Company with or into another corporation or entity (other than a merger or consolidation in which the Company

is the surviving or continuing corporation), or in case of any sale, conveyance or lease to another person or entity of the property

of the Company as an entirety or substantially as an entirety, such successor or purchasing person or entity, as the case may

be, shall (i) execute in favor of the Holder an agreement or instrument providing that the Holder shall have the right thereafter

to receive upon exercise of this Warrant solely the kind and amount of shares of stock or other securities, property, cash or

any combination thereof receivable upon such consolidation, merger, sale, lease or conveyance by a holder of the number of shares

of Common Stock for which this Warrant might have been exercised immediately prior to such event, (ii) make effective provision

in its certificate of incorporation or otherwise, if necessary, in order to effect such agreement and (iii) set aside or reserve, for the benefit of the Holder, the stock, securities, property and/or cash to which the Holder would be

entitled upon exercise of this Warrant; provided, that, nothing contained in this paragraph 4(b) shall be interpreted so as to

preclude the Holder from exercising this Warrant, in whole or in part, at any time prior to the consummation of any such consolidation,

merger, sale, lease or conveyance. |

| (c) | The above provisions of

this paragraph 4 shall similarly apply to successive consolidations, mergers, sales, leases, issuances or conveyances. |

3.

| (a) | In

case at any time the Company shall propose: |

| (i) | to pay any dividend or

make any distribution on shares of Common Stock in shares of common stock, or make any other distribution (other than regularly

scheduled cash dividends) to all holders of common stock; or |

| (ii) | to issue any rights, warrants

or other securities to all holders of the Company’s common stock entitling them to purchase any additional shares of common

stock or any other rights, warrants or other securities; or |

| (iii) | to effect any reclassification

or recapitalization of the Company’s common stock, or any consolidation or merger; or |

| (iv) | to effect any liquidation,

dissolution or winding-up of the Company; or |

| (v) | to issue any shares of

its Common Stock, or securities convertible or exercisable into its Common Stock, at a price per share lower than the Exercise

Price, if such price is also lower than the market price for its Common Stock on such date; then, and in any one or more of such

cases, the Company shall give written notice thereof, by registered mail, postage prepaid, to the Holder at the Holder’s

address as it shall appear in the Warrant Register, mailed at least ten (10) days prior to the date on which any such event is

expected to occur. |

| (b) | If and whenever on or after

the date of this Warrant, the Company issues or sells any shares of Common Stock (including the issuance or sale of shares of