BitFrontier Capital Holdings, Inc. Wins Court Case to Cancel 99% of Outstanding Common Stock Totaling 12,260,000,000 Shares

May 31 2019 - 10:15AM

InvestorsHub NewsWire

BitFrontier Capital Holdings, Inc. Wins Court Case to Cancel 99% of

Outstanding Common Stock Totaling 12,260,000,000 Shares

Fredericksburg, VA -- May 31, 2019 -- InvestorsHub NewsWire --

BitFrontier Capital Holdings, Inc. (OTC: BFCH) announced today that

it won its court case to cancel approximately 99% of its issued and

outstanding shares of Common Stock.

On May 30, 2019 in the district court of Laramie, Wyoming, the

following shares were deemed to have been improperly and illegally

issued and the court has ordered them to be cancelled:

- Claremont Group Corp. - 2,000,000,000 (2 Billion) shares

of Common Stock;

- Claremont Group Corp. - 10,000,000 (10 Million) shares of

Series B Preferred Stock;

- Fordee CA Trust - 120,000,000 (120 Million) shares of

Common Stock;

- Fordee CA Trust - 2,000,000 (2 Million) shares of Series

B Preferred Stock;

- Market Awareness Corp. - 140,000,000 (140 Million) shares

of Common Stock;

- Market Awareness Corp. - 2,000,000 (2 Million) shares of

Series B Preferred Stock;

- Daryl English - 5,000,000,000 (5 Billion) shares of

Common Stock;

- Daryl English - 1 share of Series A Preferred Stock;

- JA Maurice Swanson - 5,000,000,000 (5 Billion) shares of

Common Stock;

- JA Maurice Swanson - 1 share of Series A Preferred Stock;

and

- Any shares that have been converted from any of the above

listed shares into any other type of shares in BitFrontier Capital

Holdings, Inc.

The shares above total 12,260,000,000 (12.26 Billion) shares of

Common Stock, 2 shares of Series A Preferred Stock, and 14,000,000

(14 Million) shares of Preferred B Stock, making up almost 99% of

BitFrontier's issued and outstanding shares of Common Stock, and

100% of the issued and outstanding Series A Preferred Stock and

Series B Preferred Stock classes.

The Company sent the signed court order to Pacific Stock

Transfer to formally cancel these shares. The Company profile on

OTC Markets will be updated with the new share structure in the

coming days. Once the transfer agent has processed the cancellation

of these shares, the Company will be able to further enhance its

share structure with a substantial authorized share

reduction.

Shareholders interested in viewing the signed court order

authorizing the cancellation of these shares can do so on the

Company’s OTC Markets page.

BitFrontier CEO, Spencer Payne, commented, “On behalf of the

entire dedicated team here at BitFrontier, I wish to thank our

tremendously committed shareholder base for staying with us

throughout this complex process. I would also like to thank our

talented team of attorneys at Hathaway & Kunz LLP for all the

work they have contributed to this process. It’s been quite an

adventure, but the payoff is finally here.”

About BitFrontier Capital Holdings, Inc.

BitFrontier Capital Holdings business plan is to concentrate on

cryptocurrency related investments and development opportunities

through cryptocurrency mining, investments in private and/or public

entities, joint ventures and acquisitions of blockchain related

companies. BitFrontier Capital Holdings has two wholly owned

operating subsidiaries, BitFrontier Capital Investments, Inc. and

BitFrontier Technologies, Inc. Through the Company's wholly owned

subsidiary, BitFrontier Technologies, Inc., the Company plans to

build a warehouse specifically designed for hosting cryptocurrency

mining equipment. Cryptocurrency mining (e.g. bitcoin mining)

entails running ASIC (application-specific integrated circuit)

servers or other specialized servers which solve a set of

prescribed complex mathematical calculations in order to add a

block to a blockchain and thereby confirm digital asset

transactions. A party which is successful in adding a block to the

blockchain is awarded a fixed number of digital assets in

return.

NOTES ABOUT FORWARD-LOOKING STATEMENTS

Except for any historical information contained herein, the

matters discussed in this press release contain forward-looking

statements that involve risks and uncertainties, including those

described in the Company's reports and filings

at https://www.otcmarkets.com/

Certain statements contained in this release that are not

historical facts constitute forward-looking statements, within the

meaning of the Private Securities Litigation Reform Act of 1995,

and are intended to be covered by the safe harbors created by that

Act. Reliance should not be placed on forward-looking statements

because they involve unknown risks, uncertainties and other

factors, which may cause actual results, performance or

achievements to differ materially from those expressed or implied.

Forward-looking statements may be identified by words such as

estimates, anticipates, projects, plans, expects, intends,

believes, should and similar expressions and by the context in

which they are used. Such statements are based upon current

expectations of the Company and speak only as of the date made.

BitFrontier Capital Holdings Investor Relations

540-736-3069

IR@bitfrontiercapitalholdings.com

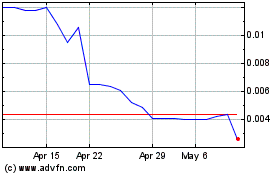

BitFrontier Capital (PK) (USOTC:BFCH)

Historical Stock Chart

From Jan 2025 to Feb 2025

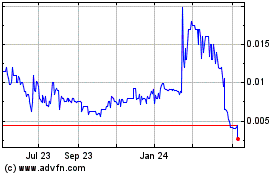

BitFrontier Capital (PK) (USOTC:BFCH)

Historical Stock Chart

From Feb 2024 to Feb 2025