- Current report filing (8-K)

June 23 2009 - 10:08AM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): June 17, 2009

BEYOND

COMMERCE, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-52490

|

|

98-0512515

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer Identification No.)

|

|

|

|

9029

South Pecos

Suite

2800

Henderson,

Nevada 89074

(Address

of principal executive offices, including zip code)

(702)

463-7000

(Registrant’s

telephone number, including area code)

Copies

to:

Darrin M.

Ocasio, Esq.

Sichenzia

Ross Friedman Ference LLP

61

Broadway, 32

nd

Floor

New York,

New York 10006

Phone:

(212) 930-9700

Fax:

(212) 930-9725

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

o

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

o

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

o

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

o

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item

1.01 Entry

into a Material Definitive Agreement

On April

9, 2009, Beyond Commerce, Inc. (“the Company” or “BYOC”) entered into the first

tranche of a $1,000,000 financing (the “Financing”), with OmniReliant Holdings,

Inc. (“Omni” or the “Holder”) pursuant to a purchase agreement whereby it sold

to Omni a convertible original issue discount promissory note in the principal

amount of $550,000 (the “First Note”), with the Company receiving proceeds of

$500,000. The First Note was convertible at any time at the option of

the Holder at a conversion price of $1.00 and was due on May 9,

2009. Omni also received warrants to purchase up to 500,000 shares of

the Company’s Common Stock with an exercise price of

$1.00. Subsequently, on June 17, 2009, the Company entered into a

second tranche of the Financing with Omni pursuant to a second purchase

agreement whereby it executed a convertible original issue discount promissory

note (the “Second Note”) in the principal amount of $575,000 payable to Omni,

with the Company receiving proceeds of $500,000, with aggregate Financing

proceeds totaling $1,000,000. Pursuant to the terms of the Second

Note, the Company promises to pay to the Holder $575,000 in cash on August 1,

2009. The Second Note is convertible at any time at a conversion price of $0.70

per share.

Payment

of the Second Note is secured pursuant to a security interest and pledge

agreement whereby Linlithgow Holdings LLC pledged 2,500,000 shares of BYOC

common stock. Further, as part of the consideration provided to the

Holder for the Second Note, the Holder also received a warrant for the purchase

of up to 700,000 shares of the Company’s common stock at an exercise price of

$0.70 per share, with Omni receiving an aggregate of 1,200,000 warrants to

purchase BYOC common stock. The warrants are exercisable, in whole or in part,

any time from and after the date of issuance of the warrant to the five year

anniversary of the date of issuance.

|

|

Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance

Sheet Arrangement of a Registrant

|

On June

17, 2009, the Company became obligated on the Second

Note. Please refer to Item 1.01 above for further

information.

|

Item

9.01

|

Financial

Statements and Exhibits

|

Not

applicable.

|

(b)

|

Pro

forma financial information.

|

Not

applicable.

|

Exhibit

Number

|

|

Description

|

|

10.1

|

|

Purchase

Agreement dated June 17, 2009 by and between the Company and OmniReliant

Holdings, Inc.

|

|

10.2

|

|

Note

dated June 17, 2009 by and between the Company and OmniReliant Holdings,

Inc.

|

|

10.3

|

|

Warrant

dated June 17, 2009, by and between the Company and OmniReliant Holdings,

Inc.

|

|

10.4

|

|

Security

and Pledge Agreement dated June 17, 2009 by and between the Company and

OmniReliant Holdings, Inc.

|

|

|

|

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

Beyond

Commerce, Inc.

|

|

|

|

|

|

|

By:

|

/s/

Mark Noffke

|

|

|

|

Mark

Noffke

|

|

|

|

Chief

Financial Officer

|

Date:

June 23, 2009

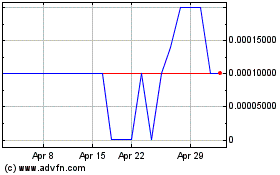

Beyond Commerce (PK) (USOTC:BYOC)

Historical Stock Chart

From Jun 2024 to Jul 2024

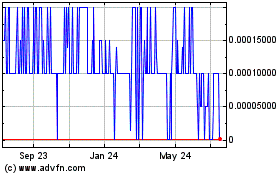

Beyond Commerce (PK) (USOTC:BYOC)

Historical Stock Chart

From Jul 2023 to Jul 2024