0001448597

false

0001448597

2023-09-06

2023-09-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (date of earliest event reported): September 6, 2023

AUGUSTA GOLD CORP.

(Exact name of registrant as specified in its charter)

| Delaware | |

000-54653 | |

41-2252162 |

(State or other jurisdiction

of incorporation) | |

(Commission

File Number) | |

(IRS Employer

Identification No.) |

Suite 555 - 999 Canada Place, Vancouver, BC,

Canada | |

V6C 3E1 |

| (Address of principal executive offices) | |

(Zip Code) |

Registrant’s telephone number, including area

code: (604) 687-1717

_____________________________________________

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act: None

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement |

On September 6, 2023,

Augusta Gold Corp. a Delaware corporation (the “Company”), entered into an Agreement and Plan of Merger (the “Plan

of Merger”), by and between the Company and Augusta Gold Corp., a Nevada corporation and a wholly owned subsidiary of the Company

(“Augusta Nevada”), pursuant to which the Company will be reincorporated from Delaware to Nevada (the “Reincorporation”).

The Plan of Merger was adopted and approved by the board of directors of the Company (the “Board”) by unanimous written

consent on July 25, 2023.

Consummation of the Reincorporation

was subject to the adoption and approval of the Plan of Merger by the holders of a majority of the outstanding common stock of the Company,

which was obtained at the Company’s stockholder meeting on September 7, 2023. The Company intends to consummate the Reincorporation

as soon as practicable following receipt of any necessary regulatory approvals; provided, however, that the Plan of Merger may be terminated

by action of the Board, at any time prior to the effective time of the Reincorporation if the Board determines for any reason that such

termination would be in the best interests of the Company and its stockholders.

Following consummation

of the Reincorporation, the Company’s corporate existence will be governed by the laws of the State of Nevada. Other than the change

in the state of incorporation, the Reincorporation will not result in any change in the business, physical location, management, assets,

liabilities or net worth of the Company, nor will it result in any change in location of the Company’s employees, including the

Company’s management.

The Reincorporation will

not alter any stockholder’s percentage ownership interest or number of shares owned in the Company. The stockholders need not exchange

existing stock certificates for stock certificates of the Nevada corporation.

The foregoing summary

of the Plan of Merger does not purport to be complete and is qualified in its entirety by reference to the actual Plan of Merger, which

is filed as Exhibit 2.1 hereto, and which is incorporated by reference herein.

| Item 5.07 | Submission of Matters to a Vote of Security Holders. |

Results of Annual General Meeting of Shareholders

On September 7, 2023,

Augusta Gold Corp. (the “Company’) held its annual general meeting of shareholders (the “Meeting”). A total of

49,365,972 common shares in the capital of the Company (“Common Shares”) were represented at the Meeting, being 57.45% of

the Company’s issued and outstanding voting stock on the record date for the Meeting.

All matters presented

for approval at Meeting were approved and all nominees as directors to the Board of Directors of the Company were elected.

Detailed results for

the ballot votes are as follows:

| Election of Directors |

Votes For |

Votes Withheld |

Broker Non-Votes |

| Richard Warke |

45,359,936 |

28,386 |

3,977,650 |

| Donald Taylor |

45,362,678 |

25,644 |

3,977,650 |

| Lenard Boggio |

45,342,308 |

46,014 |

3,977,650 |

| John Boehner |

45,290,762 |

97,560 |

3,977,650 |

| Daniel Earle |

45,348,272 |

40,050 |

3,977,650 |

| Poonam Puri |

45,333,296 |

55,026 |

3,977,650 |

| Proposal |

Votes For |

Against |

Abstain |

Broker Non-Votes |

| Ordinary resolution to appoint Davidson & Company LLP as Auditors of the Company for the ensuing year and authorizing the directors to fix their remuneration. |

49,341,583 |

17,874 |

6,515 |

0 |

| Proposal |

Votes For |

Against |

Abstain |

Broker Non-Votes |

| Ordinary resolution to approve, on an advisory, non-binding basis, the resolutions regarding the compensation of the Company’s named executive officers as described in the management information circular and proxy statement for the Meeting (the “Proxy Statement”). |

45,202,366 |

73,227 |

112,729 |

3,977,650 |

| Proposal |

Votes For |

Against |

Abstain |

Broker Non-Votes |

| Ordinary resolution to approve the Agreement and Plan of Merger (the “Merger Agreement”) set forth as Appendix B to the Proxy Statement and the reincorporation of the Company in the State of Nevada pursuant to a merger with and into a wholly-owned subsidiary of the Company as set forth in the Merger Agreement and as more particularly set out in the Proxy Statement |

45,356,010 |

26,181 |

6,131 |

3,977,650 |

Forward-Looking Statements

This Current Report on

Form 8-K and the documents incorporated by reference herein contain forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”). Forward-looking statements can be identified by words such as: “believe,”

“expect,” “will,” “shall,” “may,” “anticipate,” “estimate,” “would,”

“positioned,” “future,” “forecast,” “intend,” “plan,” “project,”

“outlook” and other similar expressions that predict or indicate future events or trends or that are not statements of historical

matters. Forward-looking statements include, among others, statements made in this Current Report regarding the proposed Plan of Merger

including the expected timing of the Reincorporation. We caution that we cannot assume that

such statements will be realized or the forward-looking events and circumstances will occur. Factors that might cause such a difference

include, without limitation: risks related to our Board determining that the Reincorporation is no longer in the best interests of our

stockholders. You are cautioned not to place undue reliance on forward-looking statements. The forward-looking statements are made

only as of the date hereof. We do not undertake any obligation to update any such statements except as required by law.

Item 9.01 Financial

Statements and Exhibits.

(d)

Exhibits.

The

exhibits listed in the following Exhibit Index are filed as part of this Current Report on Form 8-K.

SIGNATURE

Pursuant to the requirement of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

AUGUSTA GOLD CORP. |

| |

|

|

| Date: September 8, 2023 |

By: |

/s/ Tom Ladner |

| |

Name: |

Tom Ladner |

| |

Title: |

VP Legal |

Exhibit 2.1

Agreement

and plan of Merger

This Agreement and Plan of

Merger (“Agreement”), is effective as of September 6, 2023, by and between Augusta Gold Corp., a Delaware corporation

(“Merging Corporation”), and Augusta Gold Corp., a Nevada corporation and wholly-owned subsidiary of Merging Corporation

(the “Surviving Corporation”), pursuant to Section 253 of the General Corporation Law of the State of Delaware (the

“DGCL”) and Chapter 92A.190 of the Nevada Revised Statutes (the “NRS”). Surviving Corporation and

Merging Corporation are sometimes referred to herein collectively as the “Constituent Entities”.

RECITALS

WHEREAS, Merging Corporation,

duly incorporated and existing under the laws of the State of Delaware, desires to reincorporate as a Nevada corporation and has formed

Surviving Corporation in order to effectuate such reincorporation;

WHEREAS, the board of directors

of each of Merging Corporation and Surviving Corporation deems it advisable, fair to and in the best interests of such corporations and

their respective stockholders that Merging Corporation be merged with and into Surviving Corporation, upon the terms and subject to the

conditions herein stated, and that Surviving Corporation be the surviving corporation after such merger (the “Merger”);

WHEREAS, the board of directors

and stockholders of each of Merging Corporation and Surviving Corporation have approved this Agreement and the Merger pursuant to the

DGCL and the NRS, as applicable, and all other applicable laws and regulations; and

WHEREAS, the Merger is intended

to qualify as a “reorganization” under, and within the meaning of, Section 368(a) of the Internal Revenue Code of 1986, as

amended (including the Treasury Regulations in effect thereunder, the “Code”).

NOW, THEREFORE, in consideration

of the premises and the agreements of the parties hereto contained herein, intending to be legally bound, the parties hereto agree as

follows:

ARTICLE I

MERGER AND RELATED MATTERS

1.1 Upon the terms and

subject to the conditions of this Agreement, Merging Corporation and Surviving Corporation shall cause the Merger to be consummated by

causing the articles of merger (or equivalent documents) (the “Nevada Articles of Merger”) to be duly prepared and

executed in accordance with the NRS and filed with the Secretary of State of the State of Nevada and shall cause the certificate of merger

(or equivalent documents) to be duly prepared and executed in accordance with the DGCL and filed with the Secretary of State of the State

of Delaware (the “Delaware Certificate of Merger”, and together with the Nevada Articles of Merger, the “Merger

Certificates”) as soon as practicable on or after the Closing Date (as defined in Section 2 hereof). The Merger shall become

effective upon the date and time specified in the Merger Certificates (the “Effective Time”).

1.2 At the Effective Time,

Merging Corporation shall merge with and into Surviving Corporation, whereupon the separate existence of Merging Corporation shall cease

to exist. Surviving Corporation shall succeed to, and shall possess and be vested with, as applicable, without further act, deed or other

transfer, all of the assets and property (whether real, personal or mixed), rights, privileges, franchises, immunities, authority and

powers of Merging Corporation, and shall assume and be subject to all of the liabilities, obligations and restrictions of every kind and

description of Merging Corporation, including, without limitation, all outstanding indebtedness of Merging Corporation. All property of

every description and every interest therein of Merging Corporation on whatever account shall thereafter be deemed to be held by or transferred

to, as the case may be, and vested in, Surviving Corporation. Surviving Corporation shall thenceforth be responsible and liable for all

the liabilities and obligations of Merging Corporation, including, but not limited to, all federal, state and local laws, rules and regulations

that were applicable to Merging Corporation immediately prior to the Effective Time (only to the extent such laws, rules and regulations

continue to be applicable to the business, operations and securities of Surviving Corporation); and any claim existing or action or proceeding

pending by or against any of Merging Corporation may be prosecuted to judgment as if the Merger had not taken place, or the Surviving

Corporation may be substituted in its place. Neither the rights of creditors nor any liens upon the property of any of Merging Corporation

shall be impaired by the Merger. From time to time prior to the Effective Time, as and when required by the Surviving Corporation or by

its successors and assigns, Merging Corporation shall execute and deliver, or cause to be executed and delivered, all such deeds and other

instruments and will take or cause to be taken such further or other action as the Surviving Corporation may deem necessary in order to

carry out the intent and purposes of this Agreement.

1.3 Surviving Corporation shall

maintain a copy of this Agreement at its principal executive office and shall provide a copy of this Agreement to the shareholders of

any of the Constituent Entities upon written request by such shareholders and without charge.

ARTICLE II

CLOSING; REPRESENTATIONS AND WARRANTIES

2.1 The Closing. The

closing of the Merger (the “Closing”) shall, unless otherwise agreed, take place at the offices of Dorsey & Whitney

LLP, 1400 Wewatta St #400, Denver, Colorado 80202 at 10:00 A.M., local time, on the day which the last of the conditions set forth in

Article 4 hereof is fulfilled or waived (subject to applicable law), or at such other time and place and on such other date as the parties

hereto shall mutually agree (the “Closing Date”).

2.2 Representations and

Warranties of Merging Corporation. Merging Corporation represents and warrants to Surviving Corporation as follows:

(a) Merging Corporation is

a corporation duly incorporated, validly existing, and in good standing under the laws of the state of its organization, has all requisite

power and authority to own, lease, and operate its properties and to carry on its business as now being conducted, and is duly qualified

and in good standing to conduct business in each jurisdiction in which the business it is conducting, or the operation, ownership, or

leasing of its properties, makes such qualifications necessary, other than in such jurisdictions where the failure so to qualify could

not reasonably be expected to have a material adverse effect with respect to Merging Corporation.

(b)(i) Merging Corporation

has all requisite power and authority to enter into this Agreement and to consummate the transactions contemplated hereby. The execution

and delivery of this Agreement and the consummation of the transactions contemplated hereby have been duly authorized by all necessary

action on the part of Merging Corporation. This Agreement has been duly executed and delivered by Merging Corporation and assuming that

this Agreement constitutes the valid and binding agreement of Surviving Corporation, constitutes a valid and binding obligation of Merging

Corporation enforceable in accordance with its terms, except that the enforcement hereof may be limited to: (A) bankruptcy, insolvency,

reorganization, moratorium, or other similar laws now or hereafter in effect relating to creditors’ rights generally and (B) general

principles of equity (regardless of whether enforceability is considered in a proceeding at law or in equity).

(b)(ii) The execution and delivery

of this Agreement and the consummation of the transactions contemplated hereby by Merging Corporation will not conflict with, or result

in any violation of, or default (with or without notice or lapse of time, or both) under, or give rise to a right of termination, cancellation

or acceleration of any obligation (any such conflict, violation, default, right of termination, cancellation or acceleration, a “Violation”),

pursuant to any provision of the certificate of incorporation or by-laws of Merging Corporation, each as amended to date, result in any

Violation of any agreement to which Merging Corporation is a party, or any law applicable to Merging Corporation or its assets, in each

case which could reasonably be expected to have a material adverse effect with respect to Merging Corporation.

(b)(iii) No consent, approval,

or authorization from any governmental authority is required by or with respect to Merging Corporation in connection with the execution

and delivery of this Agreement by Merging Corporation or the consummation by Merging Corporation of the transactions contemplated hereby,

except for the filing of the Merger Certificates.

2.3 Representations and

Warranties of Surviving Corporation. Surviving Corporation represents and warrants to Merging Corporation as follows:

(a) Surviving Corporation is

a corporation duly incorporated, validly existing, and in good standing under the laws of the state of its organization, has all requisite

power and authority to own, lease, and operate its properties and to carry on its business as now being conducted, and is duly qualified

and in good standing to conduct business in each jurisdiction in which the business it is conducting, or the operation, ownership, or

leasing of its properties, makes such qualifications necessary, other than in such jurisdictions where the failure so to qualify could

not reasonably be expected to have a material adverse effect with respect to Surviving Corporation.

(b)(i) Surviving Corporation

has all requisite power and authority to enter into this Agreement and to consummate the transactions contemplated hereby. The execution

and delivery of this Agreement and the consummation of the transactions contemplated hereby have been duly authorized by all necessary

action on the part of Surviving Corporation. This Agreement has been duly executed and delivered by Surviving Corporation and assuming

that this Agreement constitutes the valid and binding agreement of Merging Corporation, constitutes a valid and binding obligation of

Surviving Corporation enforceable in accordance with its terms, except that the enforcement hereof may be limited to: (A) bankruptcy,

insolvency, reorganization, moratorium, or other similar laws now or hereafter in effect relating to creditors’ rights generally

and (B) general principles of equity (regardless of whether enforceability is considered in a proceeding at law or in equity).

(b)(ii) The execution and delivery

of this Agreement and the consummation of the transactions contemplated hereby by Surviving Corporation will not conflict with, or result

in any Violation pursuant to any provision of the articles of organization or bylaws of Surviving Corporation, each as amended to date,

result in any Violation of any agreement to which Surviving Corporation is a party, or any law applicable to Surviving Corporation or

its assets, which could reasonably be expected to have a material adverse effect with respect to Surviving Corporation.

(b)(iii) No consent, approval,

or authorization from any governmental authority is required by or with respect to Surviving Corporation in connection with the execution

and delivery of this Agreement by Surviving Corporation, or the consummation by Surviving Corporation of the transactions contemplated

hereby, except for the filing of the Merger Certificates.

ARTICLE III

MANAGEMENT AND BUSINESS OF SURVIVING CORPORATION

3.1 Charter and Bylaws.

The articles of incorporation (the “Nevada Articles of Incorporation”) and bylaws (“Nevada Bylaws”)

of Surviving Corporation as in effect prior to the Effective Time shall be and remain the articles of incorporation and bylaws, respectively,

of Surviving Corporation.

3.2 Officers and Directors.

The officers and directors of Merging Corporation immediately prior to the Effective Time shall be the officers and directors of the Surviving

Corporation immediately after the Effective Time, each to hold office in accordance with the provisions of the NRS, all other applicable

laws and regulations, the Nevada Articles of Incorporation and the Nevada Bylaws.

3.3 Committees. Each

committee of the board of directors of Merging Corporation existing immediately prior to the Effective Time shall, effective as of, and

immediately following, the Effective Time, become a committee of the board of directors of Surviving Corporation, consisting of the members

of such committee of Merging Corporation immediately prior to the Effective Time and governed by the charter of such committee of Merging

Corporation in existence immediately prior to the Effective Time, which charter shall, at the Effective Time, become the charter of such

committee of Surviving Corporation.

3.4 Other Operations.

The corporate policies, employees, business, operations and material agreements and other relationships of Merging Corporation, effective

immediately prior to the Effective Time shall continue in all material respects as those of the Surviving Corporation immediately following

the Effective Time.

ARTICLE IV

CONDITIONS PRECEDENT TO MERGER

4.1 Conditions Precedent

to Obligations of each of the Constituent Entities. The respective obligations of the Constituent Entities to effect the Merger are

subject to the satisfaction or waiver at or prior to the Closing Date of each of the following conditions:

(a) This Agreement and the

Merger shall have been approved and adopted by the affirmative vote of the stockholders of each of the Constituent Entities pursuant to

the DGCL and the NRS, as applicable, the articles of incorporation, certificate of incorporation and bylaws, as applicable, of each of

the Constituent Entities, and all other applicable laws and regulations.

(b) No claim, action, suit,

proceeding, arbitration, or litigation has been threatened to be filed, has been filed or is proceeding which has arisen in whole or in

part out of, or pertaining to the performance of obligations hereunder or the consummation of the transactions contemplated hereby.

(c) No statute, rule, regulation,

or order of any kind shall have been enacted, issued, entered, promulgated or enforced by any governmental entity which prohibits the

consummation of the Merger and which is in effect at the Effective Time.

(d) Receipt of approval by

the Financial Industry Regulatory Authority, Inc. and the Toronto Stock Exchange of the provisions of this Agreement and the transactions

contemplated hereby.

4.2 Conditions to obligations

of Surviving Corporation. The obligations of Surviving Corporation to effect the Merger are subject to the satisfaction or waiver

at or prior to the Closing Date of each of the following conditions:

(a) The representations and

warranties of Merging Corporation set forth in this Agreement shall be true and correct, in all material respects, as of the date of this

Agreement and as of the Closing Date as though made on and as of the Closing Date, except as otherwise contemplated by this Agreement.

(b) Merging Corporation shall

have performed in all material respects all obligations required to be performed by it under this Agreement at or prior to the Closing

Date.

4.3 Conditions to Obligations

of Merging Corporation. The obligations of Merging Corporation to effect the Merger are subject to the satisfaction or waiver at or

prior to the Closing Date of each of the following conditions:

(a) The representations and

warranties of Surviving Corporation set forth in this Agreement shall be true and correct, in all material respects, as of the date of

this Agreement and as of the Closing Date as though made on and as of the Closing Date, except as otherwise contemplated by this Agreement.

(b) Surviving Corporation shall

have performed in all material respects all obligations required to be performed by it under this Agreement at or prior to the Closing

Date.

ARTICLE V

CONVERSION OF MERGING CORPORATION SECURITIES

5.1 Conversion of Securities.

At the Effective Time, by virtue of the Merger and without any further action on the part of the Constituent Entities or the stockholders

of the Constituent Entities:

(a) Each one (1) share of common

stock, par value $0.0001 per share, of Merging Corporation outstanding immediately prior to the Effective Time (“Merging Corporation

Common Stock”) shall, by virtue of the Merger and without any action on the part of the holder thereof, be converted into one

(1) fully paid and non-assessable share of common stock, par value $0.0001 per share, of Surviving Corporation (“Surviving Corporation

Common Stock”), and all outstanding shares of Merging Corporation Common Stock immediately prior to the Effective Time shall

be cancelled and retired and the certificates therefor, if any, shall be surrendered to Merging Corporation and cancelled, without the

issuance of any additional ownership interests thereof.

(b) At the Effective Time,

each option, warrant and other security or instrument of the Merging Corporation granting the holder thereof the right to acquire Merging

Corporation Common Stock (or other Merging Corporation securities) outstanding immediately prior to the Effective Time (collectively,

the “Merging Corporation Securities”) shall, by virtue of the Merger and without any action on the part of the holder

thereof, be converted into a corresponding option, warrant and other security or instrument of the Surviving Corporation granting the

holder thereof the right to acquire an equivalent number of shares of Surviving Corporation Common Stock (or other Surviving Corporation

securities) as the number of shares of Merging Corporation Common Stock underlying such Merging Corporation Securities (collectively,

the “Surviving Corporation Securities”). Notwithstanding any term of any agreement, instrument or other document to

which such Merging Corporation Securities was subject immediately prior to the Effective Time that provides otherwise, immediately following

the Effective Time, each of the Surviving Corporation Securities shall have the same terms and conditions as those of the applicable Merging

Corporation Securities, including any vesting and forfeiture conditions. Neither the execution of this Agreement, the consummation of

the Merger, nor any other transaction contemplated herein is intended, or shall be deemed, to constitute a “change in control”

(or term of similar import) under any agreement to which any Merging Corporation Securities is subject.

5.2 Cancellation of Merging

Corporation Securities. At the Effective Time, all rights with respect to the Merging Corporation Common Stock and the Merging Corporation

Securities shall cease and terminate, and the Merging Corporation Common Stock and the Merging Corporation Securities shall no longer

be deemed to be outstanding, whether or not the certificate(s), if any, representing such shares of capital stock have been surrendered

to Merging Corporation.

ARTICLE VI

TAX MATTERS

6.1 Plan of Reorganization.

This Agreement is intended to constitute a plan of reorganization for purposes of Treasury Regulations Section 1.368-2(g) and Sections

354, 361, and 368 of the Code, and the Merger is intended to constitute a reorganization under Section 368(a) of the Code. Each party

hereto shall perform, and shall cause its affiliates to perform, its United States federal income tax reporting and conforming state tax

reporting in accordance with such treatment unless otherwise required by a determination as defined in Section 1313(a) of the Code.

ARTICLE VII

MISCELLANEOUS

7.1 Governing Law. This

Agreement shall be governed by, enforced under and construed in accordance with the laws of the State of Nevada without giving effect

to any choice or conflict of law provision or rule thereof, and interpreted consistent with the intent that the Merger qualify as a “reorganization”

under, and within the meaning of, Section 368(a) of the Code.

7.2 Modification or Amendment.

Subject to the provisions of applicable law, at any time prior to the Effective Time, the parties hereto may modify or amend this Agreement; provided, however,

that an amendment made subsequent to the adoption of this Agreement by the stockholders of Merging Corporation shall not (a) alter or

change the amount or kind of shares and/or rights to be received in exchange for or on conversion of all or any of the shares of capital

stock or other securities of Merging Corporation, or (b) alter or change any provision of the Nevada Articles of Incorporation or Nevada

Bylaws that will become effective immediately following the Merger other than as provided herein. No amendment or waiver to this Agreement

shall be effective unless it is in writing, identified as an amendment or waiver to this Agreement and signed by an authorized representative

of each party hereto.

7.3 No Third-Party Beneficiaries.

This Agreement is not intended to confer upon any person other than the parties hereto any rights, benefits or remedies hereunder.

7.4 Expenses. If the

Merger becomes effective, Surviving Corporation shall assume and pay all expenses in connection therewith not theretofore paid by the

respective parties. If for any reason the Merger shall not become effective, Merging Corporation shall pay all expenses incurred in connection

with all the proceedings taken in respect of this Agreement or relating thereto.

7.5 Headings. The headings

herein are for convenience of reference only, do not constitute part of this Agreement and shall not be deemed to limit or otherwise affect

any of the provisions hereof.

7.6 Entire Agreement.

This Agreement constitutes the entire agreement and supersedes all other prior agreements, understandings, representations and warranties

both written and oral, among the parties hereto, with respect to the subject matter hereof.

7.7 Severability. If

any term or other provision of this Agreement is invalid, illegal or incapable of being enforced by any rule of law or public policy,

all other conditions and provisions of this Agreement shall nevertheless remain in full force and effect so long as the economic or legal

substance of the transactions contemplated hereby is not affected in any manner adverse to any party. Upon such determination that any

term or other provision is invalid, illegal or incapable of being enforced, the parties hereto shall negotiate in good faith to modify

this Agreement so as to effect the original intent of such parties as closely as possible in an acceptable manner to the end that transactions

contemplated hereby are fulfilled to the extent possible.

7.8 Termination. This

Agreement may be terminated and the Merger abandoned at any time prior to the Effective Time, whether before or after either party hereto

obtains stockholder approval of this Agreement, upon the consent of the board of directors of Merging Corporation and Surviving Corporation.

7.9 Further Assurances.

Each party hereto shall do and perform, or cause to be done and performed, all such further acts and things, and shall execute and deliver

all such other agreements, certificates, instruments and documents, as the other party may reasonably request in order to carry out the

intent and accomplish the purposes of this Agreement and the consummation of the transactions contemplated hereby.

7.10 Successors and Assigns.

This Agreement shall be binding upon, and inure to the benefit of and be enforceable by, each of the parties hereto and their respective

successors and assigns. Each party hereto may assign any or all of its rights under this Agreement to any transferee, provided such transferee

agrees in writing to be bound by the provisions hereof that apply to such transferee.

7.11 Counterparts. This

Agreement may be executed in any number of counterparts, each such counterpart being deemed to be an original instrument, and all such

counterparts shall together constitute the same agreement. Delivery of a signed counterpart of this Agreement by facsimile or email/pdf

transmission shall constitute valid and sufficient delivery thereof.

[Signature

page follows]

In witness

whereof, each of the parties hereto has executed this Agreement as of the date first set forth above.

| AUGUSTA GOLD CORP., a Delaware corporation |

|

AUGUSTA GOLD CORP., a Nevada corporation |

| |

|

|

| By: |

/s/ Donald R. Taylor |

|

By: |

/s/ Donald R. Taylor |

| |

Donald R. Taylor, President |

|

|

Donald R. Taylor, President |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

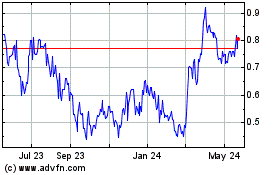

Augusta Gold (QB) (USOTC:AUGG)

Historical Stock Chart

From Dec 2024 to Jan 2025

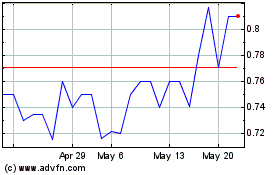

Augusta Gold (QB) (USOTC:AUGG)

Historical Stock Chart

From Jan 2024 to Jan 2025