AMERICAN BUSINESS BANK (Bank) (OTCBB:AMBZ) today reported net

income of $3,630,000 for the second quarter of 2013, a 36% increase

over the $2,663,000 earned in the second quarter of 2012. Earnings

per share (basic) in the second quarter of 2013 increased to $0.74

versus $0.55 in the second quarter of 2012 primarily due to a net

$0.39 per share increase in realized securities gains for the

quarter ending June 30, 2013.

“The increase in the Bank’s loan portfolio continued in the

second quarter as it had in the first quarter of 2013. Also,

deposits continued to grow in the second quarter and were up nearly

7% over the second quarter 2012, with demand deposits up over 12%,”

said Wes Schaefer, Vice Chairman and CFO. “The Bank was successful

in harvesting some of its gains in the securities from its bond

portfolio. The proceeds from the sales helped fund the loan

growth.”

“Our growth in the second quarter follows our continued success

in developing new relationship clients in the middle market

business community in Southern California,” said Leon Blankstein,

President and CEO. “Our demand deposits increased over $60 million

compared to the second quarter last year and our loans increased

over $130 million during the same period, due to the hard work of

the American Business Bank’s staff.”

Total assets increased 5% or $62 million to $1.298 billion at

June 30, 2013 as compared to $1.236 billion at June 30, 2012. The

loan portfolio (net) increased 30% or $130 million to $556 million

at June 30, 2013 as compared to $426 million at June 30, 2012.

Deposits increased 7% or $72 million to $1.142 billion at June 30,

2013 as compared to $1.070 billion at June 30, 2012.

During the second quarter of 2013, Net Interest Income increased

$866,000 or 9% to $9,865,000 from $8,999,000 during the second

quarter of 2012.

Non-Interest income during the second quarter of 2013 increased

$2,162,000 to $3,245,000 from $1,083,000 during the second quarter

of 2012.

Non-Interest expense during the second quarter of 2013 increased

$909,000 or 16% to $6,623,000 from $5,714,000 during the second

quarter of 2012, which included additions to our Relationship

Manager staff. Additionally, expenses were further affected by

$0.07 per share due to additions to our reserves which further

strengthened our capital.

Asset quality at quarter-end remains excellent, with $705,000

non-performing loans or 0.1% of total loans; and, no OREO. At the

end of June 2013, the allowance for loan losses stood at

$10,743,000 or 1.90% of loans.

AMERICAN BUSINESS BANK headquartered in downtown Los Angeles

with $1.298 billion in total assets offers a wide range of

financial services to the business marketplace. Clients include

wholesalers, manufacturers, service businesses, professionals and

non-profits. The Bank has opened four Loan Production Offices in

strategic areas including our Orange County Office in Irvine, our

South Bay Office in Torrance, our San Fernando Valley Office in the

Warner Center and our Inland Empire Office in Ontario.

American Business Bank Figures in $000, except

per share amounts

CONSOLIDATED BALANCE SHEET

(unaudited) For

the period ended:

June June Change

2013 2012 %

Assets:

Cash & Equivalents $ 48,360 $ 47,328 2.2 % Fed Funds Sold 5,000

4,000 25.0 % Interest Bearing Balances 28 28 0.0 %

Investment

Securities:

US Agencies 355,326 397,294 -10.6 % Mortgage Backed Securities

131,219 188,366 -30.3 % State & Municipals 161,114 134,094 20.2

% Other 3,100

135 2196.3 % Total Investment

Securities 650,759 719,889 -9.6 %

Gross

Loans:

Commercial Real Estate 323,826 238,214 35.9 % Commercial &

Industrial 202,378 159,139 27.2 % Other Real Estate 35,411 32,449

9.1 % Other 4,787

5,434 -11.9 % Total Gross Loans

566,402 435,236 30.1 % Allowance for Loan & Lease Losses

(10,743 )

(9,542 ) 12.6 % Net Loans 555,659 425,694 30.5 % Premises

& Equipment 640 1,019 -37.2 % Other Assets

37,897

38,651 -2.0 %

Total Assets

$ 1,298,343

$ 1,236,609 5.0 %

Liabilities:

Demand Deposits $ 557,005 $ 494,870 12.6 % Money Market 503,118

488,136 3.1 % Time Deposits and Savings

82,115 87,259

-5.9 % Total Deposits 1,142,238 1,070,265 6.7 % FHLB

Advances / Other Borrowings 46,000 52,000 -11.5 % Other Liabilities

10,620

18,333 -42.1 %

Total Liabilities

$ 1,198,858

$ 1,140,598 5.1 %

Shareholders'

Equity:

Common Stock & Retained Earnings $ 100,340 $ 84,347 19.0 %

Accumulated Other Comprehensive Income

(855 ) 11,664

-107.3 %

Total Shareholders' Equity

$ 99,485

$ 96,011 3.6 %

Total Liabilities &

Shareholders' Equity $

1,298,343 $

1,236,609 5.0 %

Capital

Adequacy:

Tangible Common Equity / Tangible Assets 7.66 % 7.76 % -- Tier 1

Leverage Ratio 7.79 % 7.11 % -- Tier 1 Capital Ratio / Risk

Weighted Assets 15.62 % 17.16 % -- Total Risk-Based Ratio 16.87 %

18.42 % --

Per Share

Information:

Common Shares Outstanding 4,878,716 4,873,332 -- Book Value Per

Share $ 20.39 $ 19.70 3.5 % Tangible Book Value Per Share $ 20.39 $

19.70 3.5 %

American

Business Bank Figures in $000, except per share amounts

CONSOLIDATED INCOME STATEMENT (unaudited)

For the 3-month period: June June

Change 2013 2012

%

Interest

Income:

Loans & Leases $ 6,294 $ 5,474 15.0 % Investment Securities

4,033

4,251 -5.1 % Total Interest Income

10,327 9,725 6.2 %

Interest

Expense:

Money Market, NOW Accounts & Savings 329 510 -35.5 % Time

Deposits 90 141 -36.2 % Repurchase Agreements / Other Borrowings

43

75 -42.7 % Total Interest Expense 462 726

-36.4 % Net Interest Income 9,865 8,999 9.6 %

Provision for Loan Losses (850 )

(300 ) 183.3 % Net Interest

Income After Provision 9,015 8,699 3.6 %

Non-Interest

Income:

Deposit Fees 277 272 1.8 % Realized Securities Gains / (Losses)

2,960 766 286.4 % Other 8

45 -82.2 % Total

Non-Interest Income 3,245 1,083 199.6 %

Non-Interest

Expense:

Compensation & Benefits 3,956 3,452 14.6 % Occupancy &

Equipment 492 558 -11.8 % Other

2,175 1,704 27.6 %

Total Non-Interest Expense 6,623 5,714 15.9 % Pre-Tax

Income 5,637 4,068 38.6 % Provision for Income Tax

(2,007 )

(1,405 ) 42.8 %

Net Income

$ 3,630 $ 2,663

36.3 %

Per Share

Information:

Average Shares Outstanding (for the quarter) 4,878,032 4,872,438 --

Earnings Per Share - Basic $ 0.74 $ 0.55 36.2 %

American Business Bank

Figures in $000, except per share amounts

June

June Change 2013

2012 %

Performance

Ratios

Return on Average Assets (ROAA) 1.17 % 0.85 % -- Return on Average

Equity (ROAE) 14.36 % 11.17 % --

Asset Quality

Overview

Non-Performing Loans $ - $ 2,209 -100.0 % Loans 90+Days Past Due

705

220 NA Total

Non-Performing Loans $ 705 $ 2,429 -71.0 % Restructured

Loans (TDR's) $ 6,335 $ 213 2874.2 % Other Real Estate Owned

0 0 -- ALLL / Gross Loans 1.90 % 2.19 % -- ALLL /

Non-Performing Loans * 1523.83 % 392.84 % -- Non-Performing Loans /

Total Loans * 0.12 % 0.56 % -- Non-Performing Assets / Total Assets

* 0.05 % 0.20 % -- Net Charge-Offs $ 944 $ - -- Net Charge-Offs /

Average Gross Loans 0.17 % 0.00 % --

* Excludes Restructured Loans

American Business BankWes E. SchaeferVice Chairman and Chief

Financial Officer213-430-4000

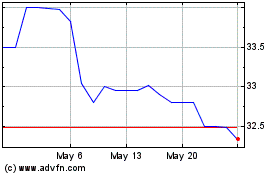

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Jan 2024 to Jan 2025