AMERICAN BUSINESS BANK Announces Its Results for the Second Quarter Ended June 30th 2010, Including 12% Loan Growth, 14% Depo...

July 15 2010 - 2:20PM

Business Wire

AMERICAN BUSINESS BANK (Bank) (OTCBB: AMBZ) today reported net

income of $2,225,000 for the second quarter 2010, a 32% increase

over the $1,676,000 earned in the second quarter of 2009. Earnings

per share (EPS) in the second quarter 2010 increased to $0.56

versus $0.42 in the second quarter 2009. Shares outstanding at the

end of the quarter totaled 3,974,840.

“We are very pleased with the direction of the bank and our

results here in the second quarter,” stated Robin Paterson, the

Bank’s Executive Vice President and Chief Credit Officer. “As the

economy continues to struggle, the bank remains focused on its

mission to assist our clients in achieving their financial

goals.”

“The second quarter was one with continued growth in all areas

of the bank. We had excellent growth in our earnings over the

already strong earnings that we had in 2009,” said Wes Schaefer,

Vice Chairman of the Bank.

“Recognizing that the economic recovery is weak but progressing,

we are pleased with these very positive results,” Robert Schack,

Chairman, said. “Our bank is merely a reflection of the high

quality of our client base, which includes some of the finest

companies in our market place.”

Assets and Liabilities

Total assets increased 13% or $109 million to $948 million at

June 30, 2010 as compared to $839 million at June 30, 2009. Loans

increased 12% or $41 million to $370 million at June 30, 2010 as

compared to $329 million at June 30, 2009 while investments and

federal funds sold increased $63 million. Funding the asset growth

was a 14% or $106 million increase in deposits.

Interest Income

During the second quarter, Net Interest Income rose by

$1,111,000 or 16% over the same quarter in 2009.

Non-interest Income

Non-interest Income in the second quarter of 2010 increased 29%

to $945,000 from $728,000 in the second quarter of 2009.

Credit Quality

Asset quality at quarter-end remains excellent, with zero

non-performing loans, no OREO and no charge offs. At quarter-end,

the allowance for loan losses stood at $6,064,000 or 1.61% of

loans.

AMERICAN BUSINESS BANK headquartered in downtown Los Angeles

offers a wide range of financial services to the business

marketplace. Clients include wholesalers, manufacturers, service

businesses, professionals and non-profits. The Bank has opened four

Loan Production Offices in strategic areas including our Orange

County Office in Irvine, our South Bay Office in Torrance, our San

Fernando Valley Office in the Warner Center and our Inland Empire

Office in Ontario.

AMERICAN

BUSINESS BANK BALANCE SHEET ( Unaudited - 000's

omitted) June 2010

2009

Assets Investment Securities $ 497,648 $

388,973 Trading Securities 176 29,825 Federal Funds Sold 14,000

30,000 Loans and Leases (net) 370,610 329,767

Cash, Checks in process of

collection Due from Banks

32,682 33,168 Premises, Equipment and Other Assets 33,206

27,655

Total Assets $ 948,322

$ 839,388 Liabilities and

Shareholders' Equity Demand Deposits 328,239

283,070 Money Market and Now Deposits 425,126 375,811 Savings and

Time Deposits 107,836 96,277 Total Deposits

861,201 755,158 FHLB Advances 15,335 30,334 Other

Liabilities 8,051 3,136 Shareholders' Equity 63,735

50,760

Total Liabilities and

Shareholders' Equity

$ 948,322 $ 839,388

AMERICAN BUSINESS BANK

INCOME STATEMENT ( Unaudited - 000's omitted)

Three months ended June

2010

2009 Interest Income Loans and Leases $ 5,296

$ 4,886 Investment Securities 3,702 3,272 Federal Funds Sold

4 11 Total Interest Income 9,002 8,169

Interest Expense Money Market and Now Accounts 803 875

Savings and Time Deposits 279 340 Repurchase Agreements/ Other

Borrowings 128 273 Total Interest

Expense 1,210 1,488 Net Interest Income 7,792 6,681

Provision for Loan Losses (288 ) (295 ) Net Interest

Income After Provision for Loan Losses 7,504 6,386

Other

Income 945 728

Other Expense 5,471

5,082

Operating Income 2,978 2,032

Income Taxes (753 ) (356 )

Net Earnings $ 2,225 $

1,676 Selected Ratios: Earnings per

Share $ 0.56 $ 0.42 Tier 1 Capital Ratio 6.85 % 6.70 % Net Interest

Margin 3.64 % 3.58 % Return on Beginning Equity 15.00 % 12.43 %

Return on Average Assets 0.89 % 0.76 % Efficiency Ratio 62.3 % 74.2

%

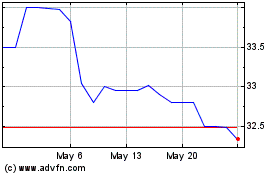

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Jan 2024 to Jan 2025