American Bus. Bank Announces Its Results for the Third Quarter Ended September 30, 2009, Including 10% Loan Growth, 24% Depos...

October 09 2009 - 12:00PM

Business Wire

AMERICAN BUSINESS BANK (Bank) (OTCBB: AMBZ) today reported net

income of $1,850,000 for the third quarter 2009, a 27% increase

over the $1,447,000 earned in the third quarter of 2008. Earnings

per share (EPS) in the third quarter 2009 increased to $0.51 versus

$0.41 in the third quarter 2008. Shares outstanding at the end of

the quarter totaled 3,609,937.

“The Bank is proud to report excellent earnings and growth for

the third quarter of 2009 despite some of the challenges that are

being faced by the banking industry today. Not least among them was

the significant increase in expense associated with the special

assessment levied on banks by the FDIC. Even with these issues, the

Bank had a record quarter in its earnings along with solid growth

in its assets,” said Wes Schaefer, Vice Chairman of the Bank.

Don Johnson, the Bank’s President, added, “The 24% growth in our

deposits over the third quarter in 2008 was especially satisfying.

This growth is a result of the Bank’s reputation as a premier

service provider whom our clients and prospects view as a resource

and a solid, middle market bank. New customers that have moved

their banking relationships to American Business Bank are well run

business entities that have proven to be managed successfully in

both up and down business cycles.”

“Given the uncertainty and softness in the economy, American

Business Bank will not waiver in finding the best operating

business customers in our area, serve them with the best bankers

and support them with a solid balance sheet. We committed to do

this at our founding and it continues to be our commitment today,”

Robert Schack, Chairman, said.

As further recognition of the Bank’s continued success, it was

announced today that the Board of Directors has authorized a ten

percent stock dividend to holders of record as of October 19, 2009,

payable on November 2, 2009. This dividend reflects the continued

confidence that the Bank has in its customers, its marketing

capability and its strong balance sheet. The dividend recognizes

the importance that the Bank’s shareholders have had in its

success, including positive feedback and continued business

referrals.

Assets and Liabilities

Total assets increased 21% or $154 million to $856 million at

September 30, 2009 as compared to $702 million at September 30,

2008. Loans increased 10% or by $34 million from $312 million to

$346 million while investments and federal funds sold increased

$119 million. Funding the asset growth was a 24% or $149 million

increase in deposits.

Interest Income

During the third quarter, Net Interest Income rose by $1,183,000

or 19% over the same quarter in 2008.

Non-interest Income

Non-interest Income in the third quarter of 2009 increased 41%

to $810,000 from $571,000 in the third quarter of 2008.

Credit Quality

Asset quality at quarter-end remains excellent, with zero

non-performing loans, no OREO and no charge offs. At quarter-end,

the allowance for loan losses stood at $5,137,000 or 1.46% of

loans.

AMERICAN BUSINESS BANK, headquartered in downtown Los Angeles,

offers a wide range of financial services to the business

marketplace. Clients include wholesalers, manufacturers, service

businesses, professionals and non-profits. The Bank has opened four

Loan Production Offices in strategic areas including our Orange

County Office in Irvine, our South Bay Office in Torrance, our San

Fernando Valley Office in the Warner Center and our Inland Empire

Office in Ontario.

AMERICAN BUSINESS BANK

BALANCE SHEET

(Unaudited-000’s

omitted)

September

2009

2008

Assets

Investment

Securities $ 427,212 $ 268,324 Trading Securities 202 59,057

Federal Funds Sold 20,000 600 Loans and Leases (net) 346,014

311,959 Cash, Checks in process of collection Due From Banks 35,049

39,427 Premises, Equipment and Other Assets

27,971

23,067

Total Assets

$

856,448

$

702,434

Liabilities and Shareholders’

Equity

Demand Deposits 292,708 200,377 Money Market and Now Deposits

373,277 293,050 Savings and Time Deposits

100,921

123,900 Total Deposits 766,906 617,327 FHLB Advances 25,335

40,585 Other Liabilities 6,532 612 Shareholders’ Equity

57,675

43,910

Total Liabilities and

Shareholders’ Equity

$

856,448

$

702,434

AMERICAN BUSINESS BANK

INCOME STATEMENT

(Unaudited-000’s

omitted)

Three months ended

September

2009

2008

Interest Income

Loans and Leases $ 4,991 $ 4,671 Investment

Securities 3,549 3,133 Fed Funds Sold 11

79 Total Interest Income 8,551 7,883

Interest Expense

Money Market and NOW Accounts 863 982 Savings and Time Deposits 281

612 Repurchase Agreements/ Other Borrowings 228

293 Total Interest Expense 1,372 1,887

Net Interest Income 7,179 5,996 Provision for Loan Losses

(305 ) (150 ) Net Interest Income after

Provision For Loan Losses 6,874 5,846

Other Income

810 571

Other Expense

5,461 4,510

Operating Income

2,223 1,907

Income Taxes

(373 ) (460 )

Net Earnings

$

1,850

$

1,447

Selected Ratios:

Earnings per share $ 0.51 $ 0.41 Capital to assets 6.787 % 6.20 %

Net Interest Margin 3.600 % 3.80 % Return on Beginning Equity

13.829 % 11.52 % Return on Average Assets 0.806 % 0.80 % Efficiency

Ratio 65.1 % 73.0 %

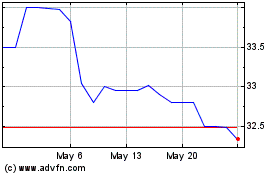

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Jan 2024 to Jan 2025