AMERICAN BUSINESS BANK (Bank) (OTCBB: AMBZ) today reported net

income of $1,676,000 for the second quarter 2009, a 27% increase

over the $1,317,000 earned in the second quarter of 2008. Earnings

per share (EPS) in the second quarter 2009 increased to $0.46

versus $0.37 in the second quarter 2008. Shares outstanding at the

end of the quarter totaled 3,605,779.

�The Bank had a significant increase in assets in the second

quarter 2009 compared to the second quarter 2008 and we were able

to maintain our margins. Growth occurred both due to new business

and increases in deposits of current account holders. The increase

in the Bank�s loan portfolio was similar to the first quarter 2009

and ahead of the increase we saw in the second quarter of 2008,�

said Wes Schaefer, Vice Chairman of the Bank.

Don Johnson, the Bank�s President, added, �We continue to

operate our business with the same game plan as when we started it.

We solicit well run, successful middle market companies that are

looking for a traditional partner in their banking relationship. We

know our customers well which has helped us avoid the loan problems

that a number of banks have had in this deep recession that will

hopefully have run its course and will soon come to an end.�

�We are quite pleased with our continued strong performance, but

it merely reflects our ongoing commitment to the fundamentals. They

don�t change,� Robert Schack, Chairman, said.

Assets and Liabilities

Total assets increased 29% or $188 million to $839 million at

June 30, 2009 as compared to $651 million at June 30, 2008. Loans

increased 16% or by $46 million from $283 million to $329 million

while investments and federal funds sold increased $143 million.

Funding the asset growth was a 31% or $182 million increase in

deposits.

Interest Income

During the second quarter, Net Interest Income rose by

$1,250,000 or 23% over the same quarter in 2008.

Non-interest Income

Non-interest Income in the second quarter of 2009 increased by

$367,000, or 101%, over the second quarter of 2008.

Credit Quality

Asset quality at quarter-end remains excellent, with zero

non-performing loans, no OREO and no charge offs. At quarter-end,

the allowance for loan losses stood at $4,837,000 or 1.44% of

loans, a level that is higher than our peer group average.

AMERICAN BUSINESS BANK, headquartered in downtown Los Angeles,

offers a wide range of financial services to the business

marketplace. Clients include wholesalers, manufacturers, service

businesses, professionals and non-profits. The Bank has opened four

Loan Production Offices in strategic areas including our Orange

County Office in Irvine, our South Bay Office in Torrance, our San

Fernando Valley Office in the Warner Center and our Inland Empire

Office in Ontario.

AMERICAN BUSINESS BANK

BALANCE SHEET

(Unaudited-000�s

omitted)

� � � �

June

�

2009

� � �

2008

Assets

Investment Securities $ 388,973 $ 220,656 Trading Securities 29,825

82,424 Federal Funds Sold 30,000 2,697 Loans and Leases (net)

329,767 282,932

Cash, checks being collected and

Due From Banks

33,168 39,677 Premises, Equipment and Other Assets 27,655 23,168 �

Total Assets

$

839,388

$

651,554

�

Liabilities and Shareholders�

Equity

Demand Deposits 283,070 187,290 Money Market and Now Deposits

375,811 281,450 Savings and Time Deposits 96,277 103,894 Total

Deposits 755,158 572,634 � FHLB Advances 30,334 30,586 Other

Liabilities 3,136 2,646 Shareholders� Equity 50,760 45,688 �

Total Liabilities and

Shareholders� Equity

$

839,388

$

651,554

�

AMERICAN BUSINESS BANK

INCOME STATEMENT

(Unaudited-000�s

omitted)

�

Three months ended June

� �

2009

� � �

2008

Interest Income

� � � � Loans and Leases $ 4,886 $ 4,498 Investment Securities

3,272 2,738 Fed Funds Sold 11 � � � � � 65 � Total Interest Income

8,169 7,301 �

Interest Expense

Money Market and NOW Accounts

875 988 Savings and Time Deposits 340 673

Repurchase Agreements/Other

Borrowings

273 � � � � � 209 �

Total Interest Expense

1,488 1,870 � Net Interest Income 6,681 5,431 Provision for Loan

Losses (295 ) � � � � (150 ) Net Interest Income after Provision

For Loan Losses 6,386 5,281 �

Other Income

728 361 �

Other Expense

5,082 � � � � � 3,930 � �

Operating Income

2,032 1,712 �

Income Taxes

(356 ) � � � � (395 ) �

Net Earnings

$

1,676

$

1,317

�

Selected Ratios:

Earnings per share $ 0.46 $ 0.37 Capital to assets 6.683 % 6.98 %

Net Interest Margin 3.82 % 3.76 % Return on Beginning Equity 12.937

% 10.74 % Return on Average Assets 0.78 % 0.77 % Efficiency Ratio

65.9 % 74.3 %

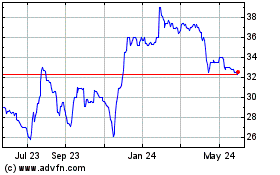

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

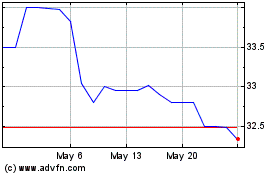

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Jan 2024 to Jan 2025