Health, Motor Insurers Benefit From Pandemic -- Earnings at a Glance

August 05 2020 - 1:22PM

Dow Jones News

The Covid-19 pandemic has helped and hurt insurers, depending on

what the companies are insuring.

CVS Health Corp., which owns insurance giant Aetna, joined other

health insurers realizing savings from skipped elective procedures

and reduced visits to clinics and emergency rooms. Those savings

have well eclipsed insurers' payouts for coronavirus care.

Hastings Group Holdings PLC also had higher earnings in the

first half of the year. The U.K. motor insurer had fewer claims

amid the pandemic lockdowns. While claims frequencies have

increased during the second quarter as the restrictions have eased,

they remain lower than the same time a year ago, Hastings said.

Hannover Re SE's net profit for the first six months of the year

fell 39% as the German reinsurance giant set aside more money to

cover potential losses caused by the pandemic.

Allianz SE saw its second-quarter net profit and revenue decline

partly due to its property-casualty business, which had losses

related to the pandemic.

Legal & General Group PLC reported a fall in operating

pretax profit for the first half of 2020 and said its operating

profits were resilient. The FTSE 100-listed insurance company said

the effects of the coronavirus pandemic totaled 129 million pounds

($168.6 million).

Other earnings reported Wednesday:

BMW AG: The German luxury-car maker turned a loss in the second

quarter as revenue fell 22% during the coronavirus pandemic. BMW

Chief Executive Oliver Zipse said the company was cautiously

optimistic for the second half of the year.

BorgWarner Inc.: The U.S. company, which focuses on combustion,

hybrid and electric vehicles technology solutions, turned a loss in

the second quarter as net sales took a hit due to disruptions

arising from the pandemic.

Commerzbank AG: The German bank expects to be loss-making this

year as it posted a decline in second-quarter profits that were hit

by higher provisioning related to the pandemic.

Continental AG: The German car-parts supplier reported a loss in

the second quarter as the effects of the pandemic hit its business.

"There hasn't been a market collapse in the automotive industry

like we currently witnessing since the end of the Second World

War," Continental's Chief Executive Elmar Degenhart said.

Ferrexpo PLC: The FTSE 250 Switzerland-based miner said the

pandemic affected demand in most markets but its operations

continued with minimal disruption. Ferrexpo reported a lower profit

for the first half and expects to see a recovery in steel demand

outside of China in the second half.

Grandvision NV: The Dutch optical retailer swung to a net loss

for the first half of 2020. Revenue fell 28% as a result of store

closures related to the pandemic.

Honda Motor Co.: The Japanese auto maker posted a net loss in

its first quarter, as pandemic restrictions reduced production and

forced retail stores to close or shorten their operating hours.

Honda said the pandemic likely cut its first-quarter pretax profit

by 440 billion yen ($4.16 billion) and it expects the pandemic to

reduce its fiscal-year pretax profit by Y665 billion.

Jollibee Foods Corp.: The Philippine food-services company

posted another quarterly loss as Covid-19 restrictions weighed on

sales. Jollibee Foods, which also owns Los Angeles-based The Coffee

Bean & Tea Leaf, expects its financial performance to improve

progressively in the next two quarters as its more than 5,000

stores reopen with the easing of the Covid-19 restrictions.

Koninklijke Ahold Delhaize NV: The Netherlands-based owner of

grocery chains such as Stop & Shop and Giant Food raised its

guidance for the year as it reported market-beating net profit for

the second quarter due to "unprecedented" demand in both the U.S.

and Europe.

Moderna Inc.: The U.S. pharmaceutical company reported higher

second-quarter revenue as income from grants to find a Covid-19

vaccine increased. Chief Executive Stephane Bancel said Moderna has

signed small-volume supply contracts for its experimental Covid-19

vaccine that price the shots at $32 to $37 per dose.

New York Times Co.: The newspaper company reported a 44% decline

in advertising revenue in its second quarter as the punishing

impact of the coronavirus outbreak came to bear, more than

offsetting a record increase in digital subscriptions.

Regeneron Pharmaceuticals Inc.: The U.S. drugmaker's profit

surged above Wall Street's expectations in the latest quarter on

the back of collaborations with other pharmaceutical giants.

Regeneron said sales from its collaborations with drugmakers Bayer

AG and Sanofi rose 45%, but sales of its age-related macular

degeneration eye drug Eylea were negatively affected by the

pandemic, falling 3.9%.

Voestalpine AG: The Austrian steelmaker turned an after-tax loss

in the first quarter of its fiscal year. Voestalpine cited a

"massive meltdown in demand" for almost all of its customer

segments due to the pandemic.

Wayfair Inc.: The U.S. online furniture seller turned a profit

for the first time since going public in 2014, as more house-bound

online shoppers bought home goods during the pandemic, a trend so

new and volatile that Chief Executive Niraj Shah said it's hard to

predict whether it would last.

William Hill PLC: The U.K. betting company said its adjusted

profit and revenue fell sharply in the first half of 2020 and it

will close 119 shops in the wake of the pandemic.

Write to Mary de Wet at mary.dewet@wsj.com

(END) Dow Jones Newswires

August 05, 2020 13:07 ET (17:07 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

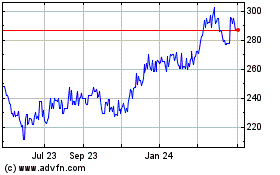

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Dec 2024 to Jan 2025

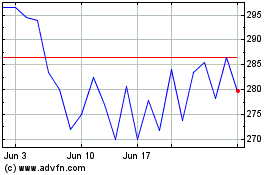

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Jan 2024 to Jan 2025