YANGAROO Inc. (TSX-V: YOO, OTCBB: YOOIF), (“The

Company, or “Yangaroo”) the leading secure digital media management

and distribution company, today announced its results for the year

and fourth quarter ended December 31, 2018. The full text of the

Financial Statements and Management Discussion & Analysis is

available at www.yangaroo.com and at www.sedar.com. Please note

that all currency in this press release is denoted in Canadian

dollars.

“As anticipated, revenue in the final quarter of

2018 grew over the prior quarter, reflecting the seasonal trends in

both segments of our business,” said Gary Moss, President and CEO

of YANGAROO. “Notwithstanding the impact of seasonality and

general customer activity on a quarter to quarter basis, we remain

confident that our prior stated goal of a 15% exit annual run rate

growth for 2019 in our Advertising division is achievable. We

commenced our share buy-back program in January 2019 and are

pleased with the response to date. The program remains in place for

the balance of 2019, subject to normal trading blackout

restrictions. We expect to lift the current blackout period

in the third week of May 2019. To date the Company has

bought-back 104,500 shares at an average price of $0.155.”

Gary Moss further added, “the Company’s recent

quarterly sales growth, combined with its ability to keep costs

low, have contributed to a strengthened balance sheet.

Working capital and cash balances at year-end were significantly

improved from the prior-quarter and prior-year, which can be

expected to continue for the foreseeable future, as the Company

looks to deploy its improved balance sheet strength to grow the

business.”

Revenue for 2018 was $7.5M or 2% lower than 2017

primarily attributed to a loss of business from advertising clients

partially off-set by increased music and entertainment sales.

Fourth quarter revenue was $2.0M or 5% higher than the same period

in 2017 and primarily attributed to increased music and

entertainment sales. EBITDA for 2018 and the fourth quarter of 2018

increased by $0.4M or 159% and $0.3M or 195%, respectively, from

the same periods in 2017, and was primarily attributed to lower

salary and technical development expenses and higher foreign

exchange gains. Normalized EBITDA and Net Income for 2018

were $0.8M and $0.5M, respectively.

Additionally the Company’s Working Capital

position as at December 31, 2018 was $2.7M, an increase of $0.8M or

39% from the same period in the previous year, resulting primarily

from a higher cash position and lower trade and contractual

severance payables.

Summary of operating results for the years,

fourth quarters ended, and as at December 31:

| $ CDN |

Year |

Fourth Quarter |

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| Revenues |

|

7,487,784 |

|

7,655,166 |

|

2,005,479 |

|

1,909,974 |

|

EBITDA |

|

687,487 |

|

265,785 |

|

405,409 |

|

137,508 |

|

Normalized EBITDA |

|

771,494 |

|

952,271 |

|

339,262 |

|

150,879 |

|

Net Income |

|

513,055 |

|

77,228 |

|

362,066 |

|

88,493 |

|

Basic EPS |

$0.01 |

$0.00 |

$0.01 |

$0.00 |

|

Diluted EPS |

$0.01 |

$0.00 |

$0.01 |

$0.00 |

|

Working Capital |

|

2,724,443 |

|

1,960,841 |

|

2,724,443 |

|

1,960,841 |

As at April 23, 2019, the Company had a cash

balance of $1.8M.

About YANGAROO:YANGAROO is a

company dedicated to digital media management. YANGAROO’s patented

Digital Media Distribution System (DMDS) is a leading secure B2B

digital cloud-based solution focused on the music and advertising

industries. The DMDS solution provides more accountable, effective,

and far less costly digital management of broadcast quality media

via the Internet. It replaces the physical, satellite and closed

network distribution and management of audio and video content, for

music, music videos, and advertising to television, radio, media,

retailers, and other authorized recipients. The YANGAROO Awards

platform is now the industry standard and powers most of North

America’s major awards shows.

YANGAROO has offices in Toronto, New York, and

Los Angeles. YANGAROO trades on the TSX Venture Exchange (TSX-V)

under the symbol YOO and in the U.S. under OTCBB: YOOIF. For

further information, please contact Gary Moss at 416-534-0607

ext.111 or visit www.yangaroo.com.

THE TSX VENTURE EXCHANGE HAS NOT

REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THE CONTENT OF THIS NEWS RELEASE.

Cautionary Note Regarding

Forward-looking Statements

This news release contains certain

forward-looking statements and forward-looking information

(collectively referred to herein as "forward-looking statements")

within the meaning of applicable Canadian securities laws. All

statements other than statements of present or historical fact are

forward-looking statements. Forward-looking statements are often,

but not always, identified by the use of words such as

"anticipate", "achieve", "could", "believe", "plan", "intend",

"objective", "continuous", "ongoing", "estimate", "outlook",

"expect", "may", "will", "project", "should" or similar words,

including negatives thereof, suggesting future outcomes.

Forward looking statements are subject to both

known and unknown risks, uncertainties and other factors, many of

which are beyond the control of YANGAROO, that may cause the actual

results, level of activity, performance or achievements of YANGAROO

to be materially different from those expressed or implied by such

forward looking statements, including but not limited to: the use

of proceeds of the offering, receipt of all necessary approvals of

the offering, general business, economic, competitive, political

and social uncertainties; negotiation uncertainties and other risks

of the technology industry. Although YANGAROO has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended.

Forward-looking statements are not a guarantee

of future performance and involve a number of risks and

uncertainties, some of which are described herein. Such

forward-looking statements necessarily involve known and unknown

risks and uncertainties, which may cause YANGAROO’s actual

performance and results to differ materially from any projections

of future performance or results expressed or implied by such

forward-looking statements. Any forward-looking statements are made

as of the date hereof and, except as required by law, neither

YANGAROO assumes no obligation to publicly update or revise such

statements to reflect new information, subsequent or otherwise.

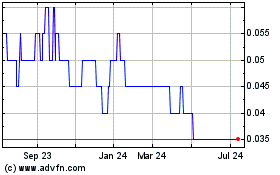

Yangaroo (TSXV:YOO)

Historical Stock Chart

From Dec 2024 to Jan 2025

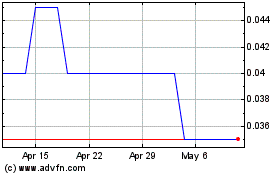

Yangaroo (TSXV:YOO)

Historical Stock Chart

From Jan 2024 to Jan 2025