Eurotin Reports A Significant Increase in Indicated Resources at

the Oropesa Tin Project Including Increase to 7.44 Mt at 0.52% Sn

at A 0.3% Cut Off

TORONTO, ONTARIO--(Marketwired - Jun 10, 2014) - Eurotin Inc.

("Eurotin" or the "Company") (TSX-VENTURE:TIN), is pleased to

provide the following resource update on its Oropesa tin ("Sn")

project, located in SW Spain.

Highlights

- At a 0.3% cut-off, the updated Mineral Resource contains 7.44

million tonnes at 0.52% Sn (38,430 tonnes of contained tin) and

2.14 million tonnes at 0.53% Sn (22,261 tonnes of contained tin) in

the Indicated and Inferred classification categories,

respectively.

- At a 0.1% Sn cut off, the updated Mineral Resource contains

54,690 and 16,078 tonnes of contained tin in the Indicated and

Inferred classification categories, respectively, compared to

28,764 and 22,871 tonnes of contained tin in the Indicated and

Inferred classification categories, respectively, in the October

2012 Mineral Resource. This represents an aggregate increase of 37%

in contained tin.

- At a 0.1% cut-off, the average grade has increased to 0.37% Sn

from 0.32% Sn and 0.26% Sn in each of the Indicated and Inferred

classification categories, respectively.

- Resource confirms the positive open pit potential of the

Oropesa tin deposit.

The updated Oropesa Mineral Resource Estimate was completed by

SRK Consulting (UK) Ltd ("SRK") and has been restricted to all

classified material within 200 metres from the topographic surface

and above a marginal cut-off grade of 0.1% Sn. This represents the

material which has a reasonable prospect for eventual economic

extraction by open pit mining methods. The Mineral Resource

statement has been prepared by SRK in accordance with Canadian

Securities Administrators' National Instrument 43-101 "Standards of

Disclosure for Mineral Projects" ("NI 43-101").

The table below shows the resulting Mineral Resource Statement

for Oropesa at a marginal cut-off grade of 0.1% Sn. The statement

is based on calculations to derive sub-totals, totals and weighted

averages. Such calculations inherently involve a degree of rounding

and consequently introduce a margin of error. Where these occur,

SRK does not consider them to be material. The Mineral Resource

Estimation methodology and accompanying Mineral Resource Statement

is included in Appendix 1.

|

MATERIAL TYPE |

CATEGORY |

TONNES (Mt) |

Sn% |

CONTAINED TIN (t) |

| OXIDE |

INDICATED |

3.3 |

0.35 |

11,447 |

|

INFERRED |

1.1 |

0.35 |

3,948 |

| FRESH |

INDICATED |

11.6 |

0.37 |

43,243 |

|

INFERRED |

3.2 |

0.38 |

12,130 |

|

Notes: |

|

(1) Mineral Resources which are not Mineral Reserves have no

demonstrated economic viability. |

|

(2) The effective date of the Mineral Resource is June 5,

2014. |

|

(3) The Mineral Resource Estimate for the Oropesa project was

constrained within grade based solids and above an

elevation of 200m below the topographic surface. |

|

(4) The incremental cut-off grade is based on a Sn price of

US$23,000/t and a process recovery of 76%. For incremental

material, mining costs were ignored and a combined processing and

G&A cost of US$12/t were assumed. |

The geological model, statistical and geostatistical analysis,

selection of resource estimation parameters, construction of the

block model and estimation of grade was undertaken by Mr. Oliver

Jones, FGS, under the guidance of Mr. Howard Baker, FAusIMM(CP),

both employees of SRK. By virtue of his education, work experience

that is relevant to the style of mineralization and deposit type

under consideration and to the activity undertaken, and membership

to a recognized professional organization, Mr. Baker is considered

a Qualified Person pursuant to National Instrument 43-101 and is

wholly independent from Eurotin. Mr. Baker has verified the

technical data contained in this news release and has reviewed and

approved the contents of this news release with respect to the

Mineral Resource Estimation.

A comparison between the updated Mineral Resource Estimate and

the previous Mineral Resource Estimate, reported in October 2012,

at incremental cut off grades is illustrated in the tables

below.

| Indicated Resource - 2014 |

|

Indicated Resource - 2012 |

|

Sn Cut Off Grade |

Tonnes (Mt) |

Tin Grade (%) |

Contained Sn (t) |

|

Tonnes (Mt) |

Tin Grade (%) |

Contained Tin (t) |

|

0.00% |

14.96 |

0.37 |

54,733 |

|

9.62 |

0.30 |

28,856 |

|

0.10% |

14.87 |

0.37 |

54,690 |

|

9.00 |

0.32 |

28,764 |

|

0.20% |

12.30 |

0.41 |

50,436 |

|

6.39 |

0.38 |

24,288 |

|

0.30% |

7.44 |

0.52 |

38,430 |

|

3.25 |

0.51 |

16,559 |

|

0.40% |

4.90 |

0.61 |

29,683 |

|

1.84 |

0.64 |

11,763 |

|

|

|

|

|

|

|

|

| Inferred Resource - 2014 |

|

Inferred Resource - 2012 |

|

Sn Cut Off Grade |

Tonnes (Mt) |

Tin Grade (%) |

Contained Sn (t) |

|

Tonnes (Mt) |

Tin Grade (%) |

Contained Tin (t) |

|

0.00% |

4.36 |

0.37 |

16,089 |

|

9.40 |

0.25 |

23,512 |

|

0.10% |

4.34 |

0.37 |

16,078 |

|

8.80 |

0.26 |

22,871 |

|

0.20% |

3.59 |

0.41 |

14,839 |

|

5.35 |

0.34 |

18,185 |

|

0.30% |

2.14 |

0.53 |

11,261 |

|

2.54 |

0.43 |

10,921 |

|

0.40% |

1.30 |

0.64 |

8,374 |

|

1.13 |

0.54 |

6,126 |

At a 0.1% Sn cut off, the updated Mineral Resource contains

70,768 tonnes of contained tin in the combined Indicated and

Inferred classification categories, compared to 51,635 tonnes of

contained tin in the combined Indicated and Inferred classification

categories in the October 2012 Mineral Resource. This represents an

increase of 37% in contained tin. The principal reasons for the

significant increase of contained tin, plus the increase in the

amount of material in the Indicated Resource category in the new

resource, are:

- The inclusion of results from an additional 36 holes drilled in

2012 and 2013; and

- A re-interpretation of the lithological and structural controls

on the tin mineralisation that has resulted in a more selective and

tighter control on the mineralisation domains created. This has

resulted in a reduction in the amount of diluting material from

within the mineralisation domains and has improved the overall

continuity of the interpretation.

Comments

- The updated Mineral Resource Estimate is currently being used

in the production of a Preliminary Economic Assessment ("PEA") for

the Oropesa project.

- The resource figures are reported only for a potential open pit

with a maximum depth of 200 metres and exclude all drill intercepts

of mineralisation below that depth.

- The Oropesa resource has been estimated from within a zone of

tin mineralisation with the following approximate parameters: i) a

length of 1,500 metres, ii) a width of 250 metres, and iii) a

vertical depth of 270 metres. Mineralisation remains open to the

west, east and at depth.

- The combined resource figures demonstrate some 30,000 tonnes of

contained tin within the first 100 metres from surface and 40,000

tonnes of contained tin between 100 metres and 200 metres from

surface.

- SRK has modelled a high grade, vertically dipping domain

averaging 0.6% Sn in the western part of the project. Due to the

low waste : ore stripping ratio and the presence of near surface

mineralisation within this domain, the opportunity for a starter

pit operation will be tested as part of the on-going PEA.

- Further information on the updated resource figures is given in

Appendix 1 at the end of this release.

Conclusion

David Danziger, interim President & CEO, comments: "This new

resource is a major step forward in our goal of developing Oropesa

into a significant tin producer. We anticipate finding additional

surface resources for a potential open pit operation, however due

to the type of tin mineralisation at Oropesa, we also recognise

that the project's greatest potential probably lies at depths

greater than 200 metres."

SRK's Oropesa Mineral Resource Technical Report will be filed on

SEDAR (www.sedar.com) within 45 days.

Forward-Looking Statements

Results presented in this press release are exploratory in

nature. Historical data, if mentioned, should not be relied upon,

as they are not admissible under NI 43-101 rules and the Company

has not conducted sufficient testing to verify this type of

information. In addition, this press release includes certain

forward-looking statements within the meaning of Canadian

securities laws that are based on expectations, estimates and

projections as of the date of this press release. There can be no

assurance that such statements will prove accurate, and actual

results and developments are likely to differ, in some case

materially, from those expressed or implied by the forward-looking

statements contained in this press release. Readers of this press

release are cautioned not to place undue reliance on any such

forward-looking statements.

Forward-looking statements contained in this press release are

based on a number of assumptions that may prove to be incorrect,

including, but not limited to: timely implementation of anticipated

drilling and exploration programs; the successful completion of new

development projects, planned expansions or other projects within

the timelines anticipated and at anticipated production levels; the

accuracy of reserve and resource estimates, grades, mine life and

cash cost estimates; whether mineral resources can be developed;

title to mineral properties; financing requirements, general market

conditions, and the uncertainty of access to additional capital;

changes in the world-wide price of mineral commodities; general

economic conditions; and changes in laws, rules and regulations

applicable to the Company. In addition to being subject to a number

of assumptions, forward-looking statements in this press release

involve known and unknown risks, uncertainties and other factors

that may cause actual results and developments to be materially

different from those expressed or implied by such forward-looking

statements. The Company has no intention or obligation to update

the forward-looking statements contained in this press release.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Appendix 1

Geology and Mineralisation

The Oropesa property lies within the "West European Tin Belt",

which is approximately 200 km wide and trends in a northerly

direction cutting across western Spain, northeastern Portugal,

western France and terminating in Cornwall and Devon in the

southwest of the United Kingdom.

The Oropesa property is situated at the west-northwestern end of

the Penarroya-Belmez-Espiel basin. The basin is a 50 km long and 1

km wide graben which formed during the Mid to Late Carboniferous,

it is bounded by a normal fault to the north and a thrust fault to

the south.

The dominant lithologies that comprise the Oropesa property are

a series of NE dipping greywackes, conglomerates and shales that

terminate against the NW-SE trending Escondida Fault. To the north

of the fault lies an unmineralised coarse conglomerate unit.

Mineralisation at Oropesa has been interpreted to occur as a

multistage system, with the main vein structures following major

lithological contacts and structures. Some six to seven

mineralising events have been recognised, starting with an early

cassiterite bearing phase followed by a lower temperature mixed

base metal sulphide phase.

Along the southern boundary of the project area a granitic

intrusion of unknown age has been identified. It is currently not

known whether this granite is related to or the source of the Sn

mineralisation.

Geological Model

Geological modelling was conducted using Leapfrog Mining

Software. Lithological logging files were received from the client

and used to create a lithological model of the main greywacke,

conglomerate and shale units as well as a number of faults and a

shallow layer of overburden. A base of oxidation surface was also

generated.

Given the strong lithological control on mineralisation, the

geological model was then used to inform the creation of

mineralised wireframe domains. Based on preliminary mining and

metallurgical input, SRK has used an approximate Sn cut off of 0.1%

to define the limits of potentially economic mineralisation using

manually digitised wireframe solids.

During the course of constructing the mineralisation wireframes,

two broad mineralisation styles were identified at Oropesa. The

first style is characterised by steeply dipping zones of relatively

high grade Sn mineralisation. The zones are considered to be

litho-structurally controlled and likely related to E-W sinistral

faulting. The second mineralisation type relates to a broad group

of shallow NE dipping zones which follow the lithological contacts

between greywacke, shale and conglomerate units.

A total of 23 mineralisation domains were created, these were

then subdivided into two mineralisation styles and further split by

oxidation state.

Mineral Resource Estimate

A 2 m composite file was used in a geostatistical study

(variography and Quantitative Kriging Neighbourhood Analysis -

"QKNA") that enabled Ordinary Kriging ("OK") to be used as the main

interpolation method. The interpolation used an elliptical search

following the predominant dip and dip direction of the mineralized

domains and utilising the dynamic anisotropy function in CAE

Datamine Studio 3 to guide the ellipse in areas of gentle

undulations to the mineralized domains. The results of the

variography and the QKNA were utilised to determine the most

appropriate search parameters.

The interpolated block model was validated through visual checks

and a comparison of the mean input composite and output model

grades. SRK is confident that the interpolated block grades are a

reasonable reflection of the available sample data.

The Oropesa grade estimate was classified as a combination of

Indicated and Inferred. This classification was completed based on

the quality of the input data, the geological understanding and the

robustness of the grade interpolation.

To determine the final Mineral Resource Statement, and so as to

comply with the NI 43-101 guidelines, the resulting blocks have

been subjected to a Whittle pit optimization exercise to determine

the proportion of the material defined that has a reasonable

prospect of economic extraction. This exercise is not intended to

generate a Mineral Reserve and is purely used to assist in

determining the possible down dip extent of the Mineral Resource.

The optimization was undertaken to assist in determining the

potential depth extent that an open pit operation could support and

in the determination of a suitable cut-off grade for resource

reporting. SRK notes that some of the assumptions used in the

optimization are high level estimates based on the data available

at the time, and in particular to the quantity of representative

metallurgical testwork results that have been undertaken on the

project to date.

The optimization study showed that an open pit operation could

be supported to a potential depth extent of the 200 m below the

current topographic surface and that a lower cut-off grade of 0.1%

Sn is appropriate.

The Mineral Resource Statement generated by SRK has been

restricted to all classified material within 200 m from the

topographic surface and above a marginal cut-off grade of 0.1% Sn.

This represents the material which SRK considers has reasonable

prospect for eventual economic extraction potential. Table shows

the resulting Mineral Resource Statement for Oropesa.

The statement has been classified by a Qualified Person, Howard

Baker (FAusIMM(CP)) in accordance with the Guidelines of NI 43-101

and accompanying documents 43-101.F1 and 43-101.CP. It has an

effective date of 5 June 2014. Mineral Resources that are not

Mineral Reserves have no demonstrated economic viability. SRK and

Eurotin are not aware of any factors (environmental, permitting,

legal, title, taxation, socio-economic, marketing, political, or

other relevant factors) that have materially affected the Mineral

Resource Estimate. The Oropesa project is a greenfield site and

therefore is not affected by any mining, metallurgical or

infrastructure factors.

The quantity and grade of reported Inferred Mineral Resources in

this estimation are uncertain in nature and there has been

insufficient exploration to define these Inferred Mineral Resources

as an Indicated or Measured Mineral Resource; and it is uncertain

if further exploration will result in upgrading them to an

Indicated or Measured Mineral Resource category.

Table 1: Mineral Resource Statement for the Oropesa Sn project -

reported to a depth of 200 m and above a 0.1% Sn cut-off grade

|

MATERIAL |

CLASSIFICATION CATEGORY |

TONNES (Mt) |

Sn% |

Contained Sn (Tonnes) |

| Oxide (0.1COG) |

MEASURED |

- |

- |

- |

|

INDICATED |

3.3 |

0.35 |

11,447 |

|

MEAS + IND |

3.3 |

0.35 |

11,447 |

|

INFERRED |

1.1 |

0.35 |

3,948 |

| Fresh (0.1 COG) |

MEASURED |

- |

- |

- |

|

INDICATED |

11.6 |

0.37 |

43,243 |

|

MEAS + IND |

11.6 |

0.37 |

43,243 |

|

INFERRED |

3.2 |

0.38 |

12,130 |

|

Notes: |

|

(1) Mineral Resources which are not Mineral Reserves have no

demonstrated economic viability. |

|

(2) The effective date of the Mineral Resource is 5 June

2014. |

|

(3) The Mineral Resource Estimate for the Oropesa project was

constrained within grade based solids and above an elevation of

200m below the topographic surface. |

|

(4) The incremental cut-off grade is based on a Sn price of

US$23,000/t and a process recovery of 76%. For incremental

material, mining costs were ignored and a combined processing and

G&A cost of US$12/t were assumed. |

In total, SRK has derived an Oxide Indicated Mineral Resource of

3.3 Mt grading 0.35% Sn and a Fresh Indicated Mineral Resource of

11.6 Mt grading 0.37% Sn. Additionally, SRK has derived an Oxide

Inferred Mineral Resource of 1.1 Mt grading 0.35% Sn and a Fresh

Inferred Mineral Resource of 3.2 Mt grading 0.38% Sn.

Eurotin Inc.David DanzigerCEO and President(416)

641-4940www.eurotin.ca

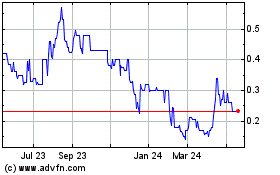

Tincorp Metals (TSXV:TIN)

Historical Stock Chart

From Dec 2024 to Jan 2025

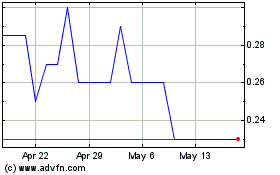

Tincorp Metals (TSXV:TIN)

Historical Stock Chart

From Jan 2024 to Jan 2025