Rio Alto Completes Final Tranche of Private Placement for C$0.9 Million for Total Proceeds of $20.27 Million

December 02 2010 - 12:38PM

Marketwired

Rio Alto Mining Limited ("Rio Alto") (TSX VENTURE: RIO)(OTCQX:

RIOAF)(BVLAC: RIO)(DBFrankfurt: MS2) is pleased to announce that

has closed the final tranche of its previously announced private

placement of common shares for gross proceeds of C$895,944

(US$879,945). At this final closing, a total of 533,300 common

shares were sold at the issue price of C$1.68 (US$1.65) per share.

Rio Alto received total gross proceeds of C$20,271,312 pursuant to

this private placement.

Of the net proceeds of the private placement, $10 million will

be used by Rio Alto to develop La Arena Gold Oxide Project in Peru

and for related working capital requirements with the balance to be

used by Rio Alto to partially exercise its option under the Option

and Earn-in Purchase Agreement dated June 15, 2009 to acquire

shares of La Arena S.A., the owner of La Arena Project, and to

conduct exploration activities on other areas of La Arena

Project.

The common shares issued at this closing of the private

placement are subject to a statutory resale restriction period of

four months and a day expiring on March 3, 2011. The completion of

the private placement is subject to final approval from the TSX

Venture Exchange.

In connection with this tranche of the private placement, Rio

Alto will pay finder's fees of C$31,358.

To learn more about Rio Alto Mining Limited, please visit:

www.rioaltomining.com or Rio Alto's SEDAR profile at

www.sedar.com.

ON BEHALF OF THE BOARD OF RIO ALTO MINING LIMITED

Anthony Hawkshaw, Director and Chief Financial Officer

Forward Looking Statements

Certain statements contained herein constitute forward-looking

statements, including the expected amount of and use of proceeds

and timing of the closing of a private placement of the Shares and

for the development of the La Arena Gold Oxide Project. Rio Alto

believes the expectations reflected in these forward looking

statements are reasonable but no assurance can be given that these

expectations will prove to be correct and such forward-looking

statements in this press release should not be unduly relied upon.

Closing of the private placement could be delayed if Rio Alto

cannot obtain necessary regulatory approvals within anticipated

timelines and will not be completed unless certain conditions

customary for transactions of this sort are satisfied. Forward

looking statements included in this press release are made as of

the date of this press release and Rio Alto disclaims any intention

or obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as expressly required by applicable securities

legislation.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts the responsibility for the adequacy or

accuracy of this release.

Contacts: Rio Alto Mining Limited Anthony Hawkshaw CFO &

Director +1 604 628 1401 or +511 625 9900 tonyh@rioaltomining.com

Rio Alto Mining Limited Alejandra Gomez Investor Relations

604.628.1401 866.393.4493 (FAX) alejandrag@rioaltomining.com

www.rioaltomining.com

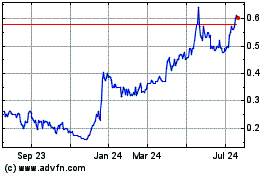

Rio2 (TSXV:RIO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Rio2 (TSXV:RIO)

Historical Stock Chart

From Nov 2023 to Nov 2024