Northern Graphite Provides Update on Graphite Prices

September 05 2017 - 9:53AM

Northern Graphite Corporation (“Northern” or the “Company”)

(NGC:TSXV) (OTCQX:NGPHF) reports that the price of large flake (+80

mesh) graphite has increased by approximately 30 per cent over the

last couple months and is again selling for over US$1,000/tonne,

FOB China. European and North American prices are generally

US$50-100/tonne higher. XL flake (+50 mesh) prices have also

risen significantly while smaller flake sizes have experienced more

moderate price increases. It has been reported by Industrial

Mineral Magazine that the supply of large and XL flake graphite is

tight and some speculative investment is taking place.

Gregory Bowes, Chief Executive Officer,

commented that; “While it is still early, this is hopefully the

start of the same upward price trend experienced by the other

lithium ion battery (“LiB”) minerals, lithium and cobalt.

Northern is very well positioned to benefit with an advanced stage

XL flake deposit and a proprietary purification technology that

offers an alternative to the Chinese process which is creating

environmental issues.“

Industrial Minerals Magazine, Benchmark Mineral

Intelligence and Roskill Information Services have all commented on

the situation and should be referred to for additional

information. Reasons cited by these and other sources for

rising graphite prices include:

- Production and supply problems in China due to stricter

enforcement of environmental and safety standards and restrictions

on the use of dynamite in some areas. High purity and large flake

sizes have been particularly affected. Also, production costs

have continued to increase due to environmental regulations, higher

taxes and land fees, labour and power cost inflation and shortages

of ore supply. China is introducing a new environmental tax

in January, 2018 which is expected to have a significant effect on

the graphite industry and has announced its intention to build a

graphite stockpile equal to 80 per cent of annual production by

2020.

- The steel industry is recovering. Global output was up

4.5 per cent in the first half of 2017 and a number of companies

have reported improved financial results. Refractories remain

the largest market for flake graphite and mainly require large

flake sizes.

- Continued strong growth in lithium ion battery demand.

Small flake graphite is used to make LiB anode material because it

has been plentiful and low cost. If LiB demand growth meets

expectations, anode material suppliers will likely have to start

using larger flake sizes and to compete with traditional markets

for supply creating further pressure on prices. Raw material

prices for synthetic graphite LiB anode material are also reported

to be “surging.”

- XL flake production is declining as resources in Shandong

Province, a major source, are being depleted and it has also been

heavily affected by environmental closures.

Heilongjiang Province, the largest producing region, has mainly

smaller flake. The expandable graphite market, which is

largely based on XL flake, is one of the fastest growing along with

LiBs and this is putting additional pressure on prices. Expandable

graphite is used for thermal management in consumer electronics, as

a gasket material in the automotive, petroleum, chemical and

nuclear industries, to make conductive plates for fuel cells and

flow batteries, and as a fire retardant.

About Northern GraphiteNorthern is a Canadian

company that has a 100% interest in the Bissett Creek graphite

deposit located in southern Canada, relatively close to all

required infrastructure. Bissett Creek is an advanced stage

project that has a Full Feasibility Study and its major

environmental permit. Subject to the completion of

operational and species at risk permitting, which are well

advanced, Northern could commence construction early in 2018

pending financing. The Company believes Bissett Creek has the

highest margin, best flake size distribution and lowest marketing

risk of any new graphite project, and has the added advantages of

low capital costs and realistic production levels relative to the

size of the market.

Gregory Bowes, B.Sc. MBA, P. Geo., a Qualified

Person as defined under NI 43-101, has reviewed and is responsible

for the technical information in this press release.

This press release contains forward-looking

statements, which can be identified by the use of statements that

include words such as "could", "potential", "believe", "expect",

"anticipate", "intend", "plan", "likely", "will" or other similar

words or phrases. These statements are only current predictions and

are subject to known and unknown risks, uncertainties and other

factors that may cause our or our industry's actual results, levels

of activity, performance or achievements to be materially different

from those anticipated by the forward-looking statements. The

Company does not intend, and does not assume any obligation, to

update forward-looking statements, whether as a result of new

information, future events or otherwise, unless otherwise required

by applicable securities laws. Readers should not place undue

reliance on forward-looking statements.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For additional information, please contact: Gregory Bowes, CEO (613) 241-9959

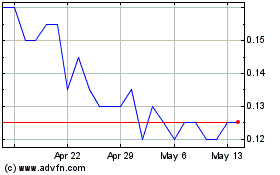

Northern Graphite (TSXV:NGC)

Historical Stock Chart

From Dec 2024 to Jan 2025

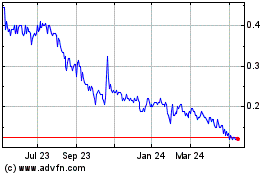

Northern Graphite (TSXV:NGC)

Historical Stock Chart

From Jan 2024 to Jan 2025