Group Ten Metals Inc. (TSX.V: PGE; OTC: PGEZF, FSE: 5D32)

(the “Company” or “Group

Ten”) announces that it has completed a

private placement for aggregate proceeds of $1,200,000 through the

issuance of eight million units at a price of $0.15 per unit. Each

unit consists of one common share of the Company and one half-share

purchase warrant. Each full warrant (a “Warrant”) entitles the

holder to acquire one common share of the Company at an exercise

price of $0.225 per Warrant share for a period of 36 months

following the closing date of the private placement. If the closing

price of the Company’s common shares on the TSX Venture Exchange is

greater than 30 cents per share for a period of 10 consecutive

trading days, the company may elect to accelerate the expiry date

of part or all of the Warrants, at any date that is four months and

one day after the closing date, by giving notice thereof to the

holders of the Warrants. In such case, that portion of the Warrants

would be subject to an expiry date that is 30 business days after

the date on which such notice is given by the Company.

President and CEO Michael Rowley stated: “We are

pleased with the level of interest from new shareholders alongside

the support from our existing shareholders in completing this

private placement. Our newest asset, the Stillwater West Project,

continues to receive significant interest based on the potential

for discovery of large-scale ‘Platreef-style’ PGM-Ni-Cu systems,

based on parallels with the Bushveld Complex in South Africa. The

team has been working hard on both the exploration and corporate

fronts, and we look forward to reporting results in the coming

weeks and months.”

Greg Johnson, Chairman of both Group Ten and the

Metallic Group said: “We are pleased to complete the Group Ten

financing, which was undertaken concurrently with independent

private placements at the two other companies that make up the

Metallic Group, being Metallic Minerals and Granite Creek Copper.

In aggregate, the Metallic Group companies anticipate raising in

excess of $3 million in new financing despite what continues to be

challenging market conditions."

Mr. Johnson continued: "The Metallic Group

founders and team members include a number of highly successful

explorationists formerly with some of the industry's leading

explorers/developers and major producers. Over the past two years

the team has been building a platform of exploration companies

focused on consolidating large brownfields assets adjacent to some

of the industry's highest-grade producers of platinum group metals,

silver and copper. We believe this strategy creates the opportunity

for discovery of large, high-quality deposits in these historic and

politically stable mining districts through the application of new

models and technology by our experienced exploration teams.”

"By acquiring these low political risk, high

potential properties in the low part of the metal price cycle, we

are creating value for shareholders that would not likely be

available during other parts of the cycle. With the acquisition of

these key, district-scale assets complete, our experienced teams

are undertaking a systematic approach to exploration to facilitate

new discoveries in these proven brownfields districts, where

existing road, power and other infrastructure may allow for greatly

reduced capital costs and faster timelines for development when

compared to remote greenfields deposits.”

"Based on the geologic target models for each of

the Metallic Group companies', along with the current depressed

stage of the metal price cycle, we believe that each of the three

companies in the group has the potential for significant growth

over the next several years, through the potential discovery and

advancement of new resources in the Stillwater PGM-Ni-Cu district,

Keno Hill silver district, and Carmacks Copper district. We look

forward to reporting results of our 2018 work programs in the

coming weeks and months."

The proceeds of the financing will be primarily

used on the Company's Stillwater West project and for general

working capital purposes. All securities issued pursuant to

the placement are subject to a statutory four month and one day

hold period from the date of issuance.

The Company also reports that it has granted

450,000 incentive stock options to certain officers and

consultants.

About Group Ten Metals

Inc.Group Ten Metals Inc. is a TSX-V-listed Canadian

mineral exploration company focused on the development of

high-quality platinum, palladium, nickel, copper, cobalt and gold

exploration assets in top North American mining jurisdictions. The

Company’s core asset is the Stillwater West PGE-Ni-Cu project

adjacent to Sibanye-Stillwater’s high-grade PGE mines in Montana,

USA. Group Ten also holds the high-grade Black Lake-Drayton

Gold project in the Rainy River district of northwest Ontario and

the Kluane PGE-Ni-Cu project on trend with Nickel Creek Platinum‘s

Wellgreen deposit in Canada‘s Yukon Territory.

About Metallic Group of

CompaniesThe Metallic Group is a collaboration of leading

precious and base metals exploration companies, with a portfolio of

large, brownfields assets in established mining districts adjacent

to some of the industry’s highest-grade producers of silver,

platinum group metals and copper. Member companies include Metallic

Minerals (TSX-V: MMG) in the Yukon’s Keno Hill silver district,

Group Ten Metals (TSX-V: PGE) in the Stillwater PGM-Ni-Cu district

of Montana, and Granite Creek Copper (TSX-V: GCX.H) in the Yukon’s

Carmacks copper district. Highly experienced management and

technical teams at the Metallic Group have expertise across the

spectrum of resource exploration and project development from

initial discoveries to advanced development, including strong

project finance and capital markets experience and have

demonstrated a commitment to community engagement and environmental

best practices. The founders and team members of the Metallic Group

include highly successful explorationists formerly with some of the

industry’s leading explorer/developers and major producers and are

undertaking a systematic approach to exploration using new models

and technologies to facilitate discoveries in these proven historic

mining districts.

The Metallic Group is headquartered in

Vancouver, BC, Canada and its member companies are listed on the

Toronto Venture, US OTC, and Frankfurt stock exchanges.

| FOR FURTHER

INFORMATION, PLEASE CONTACT: |

|

| Michael Rowley,

President, CEO & Director |

|

| Email:

info@grouptenmetals.com |

Phone: (604) 357

4790 |

| Web:

http://grouptenmetals.com |

Toll Free: (888) 432

0075 |

Forward-Looking

Statements Forward Looking Statements: This news

release includes certain statements that may be deemed

"forward-looking statements". All statements in this release, other

than statements of historical facts including, without limitation,

statements regarding potential mineralization, historic production,

estimation of mineral resources, the realization of mineral

resource estimates, interpretation of prior exploration and

potential exploration results, the timing and success of

exploration activities generally, the timing and results of future

resource estimates, permitting time lines, metal prices and

currency exchange rates, availability of capital, government

regulation of exploration operations, environmental risks,

reclamation, title, and future plans and objectives of the company

are forward-looking statements that involve various risks and

uncertainties. Although Group Ten believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those in the forward-looking statements.

Forward-looking statements are based on a number of material

factors and assumptions. Factors that could cause actual results to

differ materially from those in forward-looking statements include

failure to obtain necessary approvals, unsuccessful exploration

results, changes in project parameters as plans continue to be

refined, results of future resource estimates, future metal prices,

availability of capital and financing on acceptable terms, general

economic, market or business conditions, risks associated with

regulatory changes, defects in title, availability of personnel,

materials and equipment on a timely basis, accidents or equipment

breakdowns, uninsured risks, delays in receiving government

approvals, unanticipated environmental impacts on operations and

costs to remedy same, and other exploration or other risks detailed

herein and from time to time in the filings made by the companies

with securities regulators. Readers are cautioned that mineral

resources that are not mineral reserves do not have demonstrated

economic viability. Mineral exploration and development of mines is

an inherently risky business. Accordingly, the actual events may

differ materially from those projected in the forward-looking

statements. For more information on Group Ten and the risks and

challenges of their businesses, investors should review their

annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

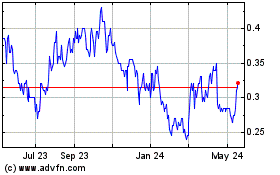

Metallic Minerals (TSXV:MMG)

Historical Stock Chart

From Dec 2024 to Jan 2025

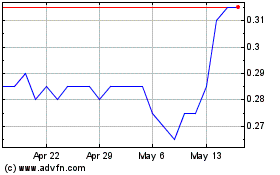

Metallic Minerals (TSXV:MMG)

Historical Stock Chart

From Jan 2024 to Jan 2025