Terrace Announces Strategic Financing With LG and Convertible Note Offering

March 14 2013 - 2:28PM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES WIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES

Terrace Energy Corp. (the "Company") (TSX

VENTURE:TZR)(OTCQX:TCRRF)(FRANKFURT:2TR) is pleased to announce the following

financing arrangements.

LG FINANCING

The Company has entered into agreements with LG Energy North America LLC

("LGENA") whereby LGENA will subscribe for 20,000,000 common shares of the

Company at a price of $1.50 per share for aggregate gross proceeds of

$30,000,000 (the "Private Placement") and will invest an additional $60,000,000

(the "SPV Financing") into a special purpose entity (the "SPV"), as further

described below, to provide supplemental project financing for new exploration

and development opportunities in the future. LGENA will be a subsidiary of LG

International Corp. of Korea ("LG") on closing of the Private Placement.

The Company has also agreed to purchase a 10% interest in the SPV, valued at

$6,000,000, from LG for 4,000,000 common shares of the Company at a deemed value

of $1.50 each. The parties have agreed to use their commercially reasonable

efforts to complete the SPV Financing and the Company's purchase of its interest

in the SPV within 30 business days of the date on which the Private Placement

closes.

The SPV Financing would be used by the SPV to finance the acquisition of working

interests in new oil & gas prospects generated by the Company. The SPV will be

jointly managed by representatives of the Company and LGENA. The Company would

be granted the ability to earn an additional 20% equity interest in the SPV upon

the SPV meeting certain financial milestones.

Dan Carriere, the Company's Chairman, commented: "We are extremely pleased with

the opportunity to work together with LG to build Terrace Energy into a

significant company. LG's decision to make their first foray into the

acquisition and development of North American oil & gas interests through

Terrace Energy clearly demonstrates the confidence they have placed in our

projects, management and technical teams."

The Company has agreed to pay a 4% fee in respect of the Private Placement on

closing.

On closing of the transactions set out above, LGENA would own approximately

27.5% of the then issued and outstanding common shares of the Company.

The Private Placement and the Company's purchase of a 10% interest in the SPV

are conditional upon, among other things, the execution of definitive

documentation and receipt of TSX Venture Exchange and shareholder approval. The

SPV Financing is conditional upon closing the Private Placement and the

execution of definitive documentation. There can be no assurances given that

such transactions will close.

CONVERTIBLE NOTE FINANCING

In addition to the Private Placement, the Company is also carrying out a

non-brokered private placement of convertible, unsecured promissory notes in the

maximum aggregate principal amount of $25,000,000 (the "Convertible Notes") with

the following material attributes:

Term: 5 years from closing

Interest rate: 8% per annum, payable quarterly

Conversion price: $2.00 per share

The principal amount owing under the Convertible Notes will be due and payable

on the fifth anniversary of the closing date, unless earlier redeemed or

converted pursuant to the terms of the Convertible Notes.

The Company would have the right to convert of all or part of the Convertible

Notes into common shares at any time after 12 months from closing if the market

price of the common shares on the TSX Venture Exchange trades at $2.80 or higher

for a period of 30 consecutive trading days. In addition, the Company would have

a limited right to redeem all or part of the Convertible Notes at any time after

12 months from closing by offering cash equal to 1.08 multiplied by the

principal amount that is called for redemption.

Holders of the Convertible Notes may convert all or part of the outstanding

principal amount of their Convertible Notes at the conversion price at any time

during the term of the Convertible Notes, in accordance with the terms thereof.

In the event of a change of control of the Company where a person acquires more

than 50% of the outstanding common shares of the Company, holders of Convertible

Notes will be entitled to require the Company to redeem the Convertible Notes in

certain circumstances.

The Convertible Notes are non-transferable unless otherwise agreed to by the

Company.

Insiders of the Company may purchase up to a maximum of 10% of the principal

amount of the Convertible Notes issued.

The Company may pay a finders' fee to eligible brokers in respect of a portion

of the principal amount of the Convertible Notes.

The issuance of the Convertible Notes is conditional upon, among other things,

the receipt of final documentation and TSX Venture Exchange approval. There can

be no assurance given that the proposed private placement of Convertible Notes

will close.

The proceeds of the Private Placement and the Convertible Notes would be used to

fund current and proposed financial commitments, including those arising from

the proposed agreement announced on February 26, 2013, if closed, and for

general working capital purposes.

About LG

LG International Corp. is a Korean conglomerate with 147 subsidiaries operating

in over 50 countries with annual sales exceeding US$100 billion. LG has

successfully invested and operated in the oil and gas exploration and production

business outside of North America for over 20 years including current upstream

oil and gas projects in Oman, Vietnam and Kazakhstan.

About Terrace Energy

Terrace Energy is an oil & gas development stage company that is focused on

unconventional oil extraction in onshore areas of the United States. It

currently has two principal properties situated in South Texas with targets in

the "Olmos" and "Eagle Ford" formations and an option to acquire a third

property in Kansas that targets the Mississippian Lime Trend. In addition, it

has entered into a non-binding agreement to acquire an interest in significant

acreage in Southern Texas with targets in four actively explored primarily oil

shale formations (see press release dated February 26, 2013).

ON BEHALF OF THE BOARD OF DIRECTORS

Eric Boehnke, Chief Executive Officer

This news release does not constitute an offer to sell or a solicitation of an

offer to buy any of the Company's securities in the United States. The

securities have not been and will not be registered under the United States

Securities Act of 1933, as amended (the "1933 Act"), or any state securities

laws and may not be offered or sold within the United States or to U.S. persons

unless registered under the 1933 Act and applicable state securities laws, or an

exemption from such registration is available. Any public offering of securities

in the United States must be made by means of a prospectus that contains

detailed information about the Company and its management, as well as financial

statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Terrace Energy Corp.

Eric Boehnke

Chief Executive Officer

604 628-4552

604 687-0885 (FAX)

terrace@terraceenergy.net

www.terraceenergy.net

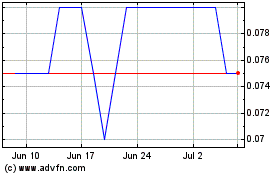

Lahontan Gold (TSXV:LG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Lahontan Gold (TSXV:LG)

Historical Stock Chart

From Jul 2023 to Jul 2024