Iberian Minerals Financing S.A. Launches US$200 Million Senior Secured Notes Offering

September 13 2012 - 6:51AM

Marketwired Canada

NOT FOR DISTRIBUTION IN AUSTRALIA, JAPAN OR THE UNITED STATES

Iberian Minerals Financing SA, a wholly-owned subsidiary of Iberian Minerals

Corp. (TSX VENTURE:IZN) ("Iberian" or the "Company") announces the offering of

US$200 million Senior Secured Notes, due in 2017. Iberian Minerals Corp. is a

diversified base metals company with mining operations in Spain and Peru.

Principal activities are the mining, processing and sale of copper, zinc and

lead concentrates.

Minimum denominations of the Notes will be US$200,000. Application has been made

for the Notes to be included on the official list of the Luxembourg Stock

Exchange and admitted for trading on the Euro MTF market. The Notes will not be

available for sale in any jurisdiction in Canada or to subscribers resident in

Canada.

The funds raised will be used to finance capital expenditures and other

investments for Iberian owned mines and processing operations.

About Iberian Minerals Corporation

Iberian Minerals Corp. is a Swiss corporation involved in mining and development

of base metal deposits in Spain and Peru. The Condestable and Raul Mines,

located in Peru approximately 90 km south of Lima operate at 2.4 million tons

per year producing copper, and associated silver and gold in a concentrate. The

Aguas Tenidas Mine in the Andalucia region of Spain, approximately 110 km

north-west of Seville, operates a 2.2 million tons per year underground mine and

concentrator that produces copper, zinc and lead concentrates that also contains

silver.

Iberian Minerals Corp. has offices in Lucerne (Switzerland), Seville (Spain) and

Lima (Peru). The Company is listed on the TSX Venture Exchange. The Company's

registered office is at Falkengasse 3, 6004, Lucerne, Switzerland. Iberian

Minerals Financing SA is incorporated in Luxembourg.

FORWARD LOOKING STATEMENTS:

This news release contains certain "forward-looking statements" and

"forward-looking information" under applicable securities laws. Except for

statements of historical fact, certain information contained herein constitutes

forward-looking statements. Forward-looking statements are frequently

characterized by words such as "plan", "expect", "project", "intend", "believe",

"anticipate", "estimate", and other similar words, or statements that certain

events or conditions "may" or "will" occur. Forward looking information may

include, but is not limited to, statements with respect to the future financial

or operating performances of the Company, its subsidiaries and their respective

projects, the timing and amount of estimated future production, estimated costs

of future production, capital, operating and exploration expenditures, the

future price of copper, gold and zinc, the estimation of mineral reserves and

resources, the realization of mineral reserve estimates, the costs and timing of

future exploration, requirements for additional capital, government regulation

of exploration, development and mining operations, environmental risks,

reclamation and rehabilitation expenses, title disputes or claims, and

limitations of insurance coverage. Forward-looking statements are based on the

opinions and estimates of management at the date the statements are made, and

are based on a number of assumptions and subject to a variety of risks and

uncertainties and other factors that could cause actual events or results to

differ materially from those projected in the forward-looking statements. Many

of these assumptions are based on factors and events that are not within the

control of the Company and there is no assurance they will prove to be correct.

Factors that could cause actual results to vary materially from results

anticipated by such forward-looking statements include changes in market

conditions and other risk factors discussed or referred to in the section

entitled "Risk Factors" in the Company's annual information form dated March 30,

2011. Although the Company has attempted to identify important factors that

could cause actual actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors that cause

actions, events or results not to be anticipated, estimated or intended. There

can be no assurance that forward-looking statements will prove to be accurate,

as actual results and future events could differ materially from those

anticipated in such statements. The Company undertakes no obligation to update

forward-looking statements if circumstances or management's estimates or

opinions should change except as required by applicable securities laws. The

reader is cautioned not to place undue reliance on forward-looking statements.

Important Regulatory Notice

This announcement does not constitute or form a part of any offer or

solicitation to purchase or subscribe for securities in the United States or any

other jurisdiction.

These materials are not an offer for sale of securities in the United States.

Securities may not be sold in the United States absent registration with the

United States Securities and Exchange Commission or an exemption from

registration under the U.S. Securities Act of 1933, as amended (the "Securities

Act"). The Company does not intend to register any part of the offering in the

United States or to conduct a public offering of Shares in the United States.

The Notes will be offered and sold in the United States only to qualified

institutional buyers in accordance with Rule 144A under the Securities Act and

outside the United States to certain non-U.S. persons in accordance with

Regulation S under the Securities Act.

This document is only being distributed to and is only directed at (i) persons

who are outside the United Kingdom or (ii) investment professionals falling

within Article 19(5) of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (the "Order") or (iii) high net worth companies, and other

persons to whom it may lawfully be communicated, falling within Article 49(2)(a)

to (d) of the Order (all such persons together being referred to as "relevant

persons"). The Notes are only available to, and any invitation, offer or

agreement to subscribe, purchase or otherwise acquire such Notes will be engaged

in only with, relevant persons. Any person who is not a relevant person should

not act or rely on this document or any of its contents.

Neither the content of the Company's website nor any website accessible by

hyperlinks on the Company's website is incorporated in, or forms part of, this

announcement. The distribution of this announcement into jurisdictions other

than Luxembourg may be restricted by law. Persons into whose possession this

announcement comes should inform themselves about and observe any such

restrictions. Any failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction.

In connection with the issuance of Notes, the stabilizing manager may over-allot

the Notes or effect transactions with a view to supporting the market price of

the Notes, in each case at a level higher than that which might otherwise

prevail. However, there is no assurance that such stabilizing manager (or

persons acting on behalf of such stabilizing manager) will undertake such

stabilization actions. Any stabilization action may begin on or after the date

on which adequate public disclosure of the final terms of the offer of the Notes

is made and, if begun, may be ended at any time, but must end no later than the

earlier of 30 calendar days after the issue date of the notes and 60 calendar

days after the date of the allotment of the Notes.

This document is an advertisement for purposes of applicable measures

implementing Directive 2003/71/EC.

Stabilization/FSA

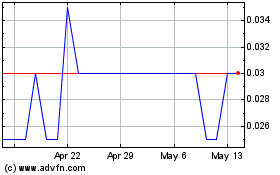

InZinc Mining (TSXV:IZN)

Historical Stock Chart

From Sep 2024 to Oct 2024

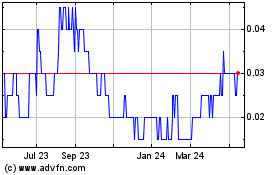

InZinc Mining (TSXV:IZN)

Historical Stock Chart

From Oct 2023 to Oct 2024