Games Global Postpones Initial Public Offering

May 13 2024 - 5:16PM

Business Wire

Games Global Limited (“Games Global” or “the Company”) today

announced that it has postponed its previously announced initial

public offering in the United States. While investor interest was

strong, given the continued positive performance of the Company’s

underlying business and anticipated trajectory following its recent

entry to the U.S. gaming market earlier this year, the Company’s

Board of Directors believes it is in the best interests of its

stakeholders to delay the offering at this time and will continue

to monitor the timing for the proposed offering. The Company will

continue to evaluate all strategic opportunities that align with

the Company’s long-term strategy.

“While we are disappointed not to be entering the public markets

in the near term, meeting with investors during this IPO process

has further cemented our confidence in our strategy and that what

we are building at Games Global is unique,” said Walter Bugno, CEO

of Games Global. “With a strong balance sheet, healthy margins, and

meaningful growth, an IPO at this point in time was an accelerator,

not an absolute necessity, for our business strategy,” continued

Bugno. “Our team remains committed to delivering the most

innovative games on the market. We will continue to monitor the

capital markets going forward and make the appropriate

reconsiderations as to an IPO in the future.”

A registration statement relating to these securities has been

filed with the U.S. Securities and Exchange Commission but has not

yet become effective. These securities may not be sold, nor may

offers to buy be accepted, prior to the time the registration

statement becomes effective. This press release shall not

constitute an offer to sell or the solicitation of an offer to buy,

nor shall there be any sale of these securities in any state or

jurisdiction in which such an offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

In any member state of the European Economic Area (the "EEA")

this announcement, and the offering, are only addressed to and

directed at persons who are "qualified investors" ("Qualified

Investors") within the meaning of Regulation (EU) 2017/1129 (the

“Prospectus Regulation”). In the United Kingdom, this announcement,

and the offering, are only addressed to and directed at persons who

are “qualified investors” within the meaning of the Prospectus

Regulation as it forms part of domestic law in the United Kingdom

by virtue of the European Union (Withdrawal) Act 2018 who (i) have

professional experience in matters relating to investments falling

within Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005, as amended (the "Order"), (ii)

are high net worth entities who fall within Article 49(2)(a) to (d)

of the Order, or (iii) are persons to whom it may otherwise

lawfully be communicated (all such persons being referred to as

"relevant persons"). This announcement must not be acted on or

relied on (i) in the United Kingdom, by persons who are not

relevant persons, and (ii) in any member state of the EEA, by

persons who are not Qualified Investors. Any investment or

investment activity to which this announcement relates is available

only to and will only be engaged with (i) in the United Kingdom,

relevant persons, and (ii) in any member state of the EEA,

Qualified Investors.

The proposed offering will be made only by means of a

prospectus. When available, copies of the preliminary prospectus

relating to this offering may be obtained from:

- J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions,

1155 Long Island Avenue, Edgewood, NY 11717, or by email at

prospectus-eq_fi@jpmchase.com or

postsalemanualrequests@broadridge.com;

- Jefferies LLC, Attention: Equity Syndicate Prospectus

Department, 520 Madison Avenue, New York, NY 10022, by phone at

(877) 821-7388, or by email at prospectus_department@jefferies.com;

or

- Macquarie Capital (USA) Inc., Attention: Equity Syndicate

Department, 125 West 55th Street, New York, NY 10019, or by email

at MacquarieEquitySyndicateUSA@macquarie.com

About Games Global

Games Global is a leading developer, distributor and marketer of

innovative online, casino-style gaming (“iGaming”) content and

integrated business-to-business solutions to iGaming operators in

regulated markets globally based on the size of its studio network.

Games Global has one of the largest networks of exclusive iGaming

content studios, and its 40 in-house and partnered studios have

developed more than 1,300 proprietary games over the past 20 years.

With a market-leading offering including slot games, table games,

video poker, video bingo, progressive jackpots, game show games,

crash games and live casino games, Games Global is a key content

provider to iGaming operators, supporting the rapid growth of

iGaming in regulated markets.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240513132745/en/

Media media@gamesglobal.com

Investors investors@gamesglobal.com

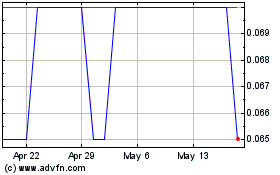

GGL Resources (TSXV:GGL)

Historical Stock Chart

From Nov 2024 to Dec 2024

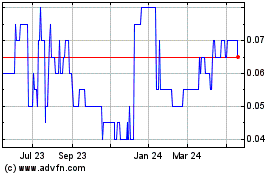

GGL Resources (TSXV:GGL)

Historical Stock Chart

From Dec 2023 to Dec 2024