Retransmission: Full Metal and Kinross Acquire Gold-Silver Targets in Western Alaska; Drilling Commenced

August 21 2009 - 9:30AM

Marketwired Canada

Full Metal Minerals (TSX VENTURE:FMM) is pleased to announce that the Company

has entered into an agreement to acquire 100% of the mineral rights to the

Russian and Horn Mountain complexes from Calista Corporation, an Alaska Regional

Native Corporation. Surface exploration and diamond drilling has commenced on

the Property.

The 44,500 hectare Russian and Horn Mountain targets are situated in the

Kuskokwim Region of Southwest Alaska, approximately 40 kilometers southwest of

Barrick Gold/Novagold's Donlin Creek Deposits. Gold-silver mineralization occurs

within Late Cretaceous to early Tertiary Age volcanic-plutonic complexes.

Multiple targets on both prospects are currently being explored. Limited modern

exploration has been performed in the area.

The Companies have commenced a 2,000 meter core drilling program, testing

multiple targets primarily at Russian Mountain. Additionally, surface mapping,

sampling and ground geophysics are being completed.

RUSSIAN MOUNTAIN

Russian Mountain is a volcanic-plutonic complex that consists of a

circular-shaped field of intermediate to felsic volcanic units that flank and

overlie a multiphase monzonite to quartz syenite pluton.

Mineralization in Russian Mountain consists primarily of several intrusive

hosted zones of polymetallic Gold-Silver-Copper-Arsenic mineralization with

anomalous amounts of Sb, Sn, Zn, Bi, Pb, W, U, and Co. Six prospects are

currently recognized on the Russian Mountain project; three historic

(Owhat/Louise, Headwall, and Mission Creek) and three recently identified by

FMM/Kinross (Bits, Half-Day, and Mac). There is also evidence for additional

mineralized zones along the ridges and talus slopes of Russian Mt that lack

significant exposure. The exposed mineralized zones range from 1.5 to 10m wide

and have been traced up to 600m (Headwall) along strike before disappearing

beneath talus. Mineralized float can be traced in the talus for up to 2km along

strike of the Owhat and Mission Creek zones, suggesting that mineralization

continues under cover. The Owhat, Bits, Headwall, and Mission Creek prospects

all consist of early zones of tourmaline quartz that are cross-cut by pods of

massive arsenopyrite and/or chalcopyrite.

At the Headwall prospect, seven grab samples were collected over 600m, from

prospect pits along a NW trending zone up to 10m in width. Samples assayed up to

9.28 g/t Au, 428 g/t Ag, and greater than 1% Cu. Six of the samples assayed

greater than 1 g/t Au, three samples assayed greater than 100 ppm Ag, and four

samples assayed greater than 1% Cu. Mineralized quartz-tourmaline float (up to

0.572 g/t Au) collected along strike suggests the zone may continue up to 1 km

to the NW.

At the Owhat prospect, 17 samples were collected from multiple historic prospect

pits and adits over 215m along a northwest trending zone of mineralization.

Widths range from 1.5m - 8.0 meters in thickness. Samples assay up to 15.42 g/t

Au, 604 ppm Ag, and greater than 1% Cu. Quartz, tourmaline and sulfide float can

be traced for up to 200m to the northwest and southeast of the prospect,

suggesting that mineralization continues under cover.

HORN MOUNTAIN

Horn Mountain is a volcanic-plutonic complex located 23 kilometers southwest of

the Village of Crooked Creek, and consists of a circular-shaped field of

intermediate to felsic volcanic units that flank and overlie a multiphase

monzonite to quartz syenite pluton. The volcanic succession is commonly referred

to as the Horn Mountain Volcanic Field (HMVF).

Mineralization at Horn Mountain includes the Saddle Prospect, a two kilometer

long zone of polymetallic Gold-Silver-Copper-Arsenic mineralization with

anomalous amounts of Sb, Sn, Zn, Bi, Pb, W, and Co. Mineralization occurs within

multiple northwest trending zones of tourmaline-quartz veining and within

breccias of up to 30m wide that include weathered sulfides. Cross-cutting

relationships among the veins indicate multiple hydrothermal events.

Highlights of previous grab sampling include: 27.45 g/t Au, 769 g/t Ag, and

greater than 1% Cu. A priority target is the Saddle prospect/zone in which nine

samples assayed over 1.0 g/t Au (up to 27.45 ppm) and where the majority of the

samples over a 2,000 meter strike length were anomalous: Au (greater than 0.025

ppm), Ag (greater than 0.500 ppm), and Cu (greater than 100 ppm).

A second, north-south trending zone of anomalous mineralization has also been

identified 2,500 meters south of the Saddle zone, along the eastern ridge of

Whitewing valley. Multiple samples with anomalous gold (up to 9.06 g/t Au),

silver (up to 769 g/t Ag), and copper (up to 0.23% Cu) are noted over a four

square kilometer area. Combined, these zones create a 5,500 by 2,000 meter

north-south trending zone within the central Horn Mountain of anomalous Gold,

Silver and Copper, plus anomalous As, Hg, Sb, Sn, Zn, Bi, Pb, W, and Co.

CALISTA LETTER AGREEMENT

On behalf of the Full Metal/Kinross strategic alliance, Calista Corporation, an

Alaska Regional Native Corporation and Full Metal have entered into a Mining

Exploration License Letter Agreement. The Companies have until December 31, 2009

to enter into a comprehensive mining lease Agreement under the following terms:

Full Metal must incur US$3.5 million in Exploration Expenditures over seven

years ($250,000 first year) pay US$525,000 Advanced Royalty Payments over seven

years ($70,000) first year including signature payment). After seven years, Full

Metal will pay annual $150,000 Advanced Royalty payments until the Commencement

of Commercial Production. Additionally, Full Metal will make annual $7,500

increasing to US$10,000 Scholarship Donations over the life of the Lease

Agreement. Upon Commencement of Commercial production, Full Metal will pay a

1.5% Net Smelter Returns Royalty (NSR) for precious metals, and a 1% NSR for

base metals until commercial Payback is achieved or for five years, whichever

comes first. Afterwards, Full Metal will pay a sliding scale NSR for precious

metal ranging from 2.0% if the Spot London Metal Exchange price of gold is less

than US$600 per ounce, escalating to 4.0% is the price is great than $1,000 per

ounce. After payback, a 3% NSR will be payable on base metal production.

KINROSS - FULL METAL MINERALS AGREEMENT

In 2008, Kinross Gold and Full Metal Minerals entered into a strategic alliance

to explore for gold in certain regions of Alaska (see FMM 2008 - NR #6, February

29, 2008). Kinross and Full Metal have revised the terms of this alliance

whereby for 2009, the Companies will budget US$1.5 million for exploration in

Alaska, where Kinross will fund $1.0 million, and Full Metal funds $0.5 million.

Full Metal has issued to Kinross a promissory note for US$0.5 million, repayable

in July 2010. Full Metal will have the option to repay Kinross in cash or issue

shares for the full amount. Revised participating interest shall be 60% for

Kinross and 40% for Full Metal. The first US$3.0 million on any given property

shall be funded on a 60/40 pro-rata basis. Kinross will have the option to

increase its interest to 75% following the JV expenditure of the first US$3

million by solely funding the next US$10 million in exploration expenditure.

Full Metal and Kinross' 2009 exploration program at the Russian and Horn

Mountain Projects are being performed under the supervision of Robert McLeod,

P.Geo, Vice-President Exploration for Full Metal Minerals, and a Qualified

Person as defined by NI 43-101. Samples are placed in sealed bags and shipped to

ALS-Chemex Labs facility in Fairbanks, Alaska and Vancouver, B.C. A sample

quality control/quality assurance program is in place. Mr. McLeod prepared and

approved the information contained in this release.

Full Metal is a generative exploration company with multiple precious and base

metal projects in Alaska and the Yukon. The Company's Joint Venture Agreements

include Kinross Gold and Freeport McMoRan.

ON BEHALF OF THE BOARD OF DIRECTORS

Michael Williams, President and Director

Some statements in this news release contain forward-looking information,

including without limitation statements as to planned expenditures and

exploration programs. These statements address future events and conditions and,

as such, involve known and unknown risks, uncertainties and other factors which

may cause the actual results, performance or achievements to be materially

different from any future results, performance or achievements expressed or

implied by the statements. Such factors include without limitation the

completion of planned expenditures, the ability to complete exploration programs

on schedule and the success of exploration programs.

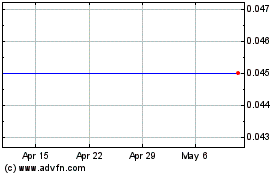

Full Metal Minerals (TSXV:FMM)

Historical Stock Chart

From Jun 2024 to Jul 2024

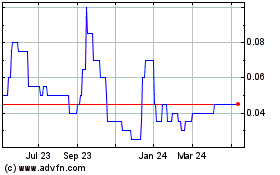

Full Metal Minerals (TSXV:FMM)

Historical Stock Chart

From Jul 2023 to Jul 2024