Rental income: €111.4m (up 13.7% as

reported, up 10.1% like-for-like) EPRA earnings: €53.2m (up

8.8%) Portfolio value (excluding transfer costs): €7,909m

(down 3.4% like-for-like) Occupancy rate: 99.7% (100%

occupancy for offices) EPRA NTA: €98.7 per share (down

8.1%) EPRA NDV: €98.5 per share (down 9.1%)

Regulatory News:

The interim consolidated financial statements for the six months

ended 30 June 2023 were approved by the Board of Directors of

Société Foncière Lyonnaise (Paris:FLY) on 20 July 2023, at its

meeting chaired by Pere Viňolas Serra. The financial statements

show strong growth in adjusted operating profit, resilient EPRA

earnings and a record occupancy rate of 99.7%, attesting to the

attractiveness of prime Paris office properties and the quality of

SFL's business model. The auditors have completed their review of

the financial statements and issued their report on the interim

financial information, which does not contain any qualifications or

emphasis of matter.

Consolidated data (€ millions)

H1 2023

H1 2022

Change

Rental income

111.4

98.0

+13.7%

Adjusted operating profit*

97.2

78.1

+24.6%

Attributable net profit/(loss)

(177.5)

221.5

EPRA earnings

53.2

48.9

+8.8%

per share

€1.24

€1.14

+8.8%

* Operating profit before disposal gains

and losses and fair value adjustments

30/06/2023

31/12/2022

Change

Attributable equity

4,020

4,379

-8.2%

Consolidated portfolio value excluding

transfer costs

7,909

8,246

-4.1%

Consolidated portfolio value including

transfer costs

8,449

8,823

-4.2%

EPRA NTA

4,233

4,603

-8.0%

per share

€98.7

€107.4

-8.1%

EPRA NDV

4,225

4,644

-9.0%

-9.1%

per share

€98.5

€108.3

Strong revenue growth despite an uncertain

environment

Rental income up 10.1%

like-for-like

Consolidated rental income rose by a strong €13.4 million (up

13.7%) to €111.4 million for first-half 2023 from €98.0 million for

the same period of 2022.

- On a like-for-like basis

(revenue-generating properties, excluding all changes in the

portfolio affecting period-on-period comparisons), rental income

was €8.4 million higher (up 10.1%). Application of rent

escalation clauses contributed €3.9 million to the increase.

However, the main growth driver was the improved occupancy rate for

revenue-generating properties, following the signature of new

leases in 2022 and 2023 (with long‑standing tenants or new clients

such as Balenciaga, Promontoria, Atalante, Ovelo and Infravia),

leading to significant increases in rental income from the Edouard

VII, Washington Plaza and 103 Grenelle buildings in particular.

- Rental income from spaces being

redeveloped rose by a net €0.4 million, reflecting:

- An increase of €9.0 million, due in particular to (i)

the contribution over the entire first half of revenues from the

Biome building (delivered in July 2022 following its complete

restructuring and fully let from the end of 2022 to La Banque

Postale and SFIL), and (ii) new leases signed on several floors

renovated in 2022 and/or 2023, mainly in the Cézanne Saint-Honoré

building (Wendel, LRT, Lincoln International and Patrick

Jouin).

- A decrease of €8.6 million, with part of the retail

space in the Galerie des Champs-Elysées (former H&M store)

vacated during 2022, and the Scope building (formerly Rives de

Seine) previously let to Natixis vacated at the end of September

2022.

- Lastly, the acquisition of the Pasteur

building in April 2022 generated a significant increase in rental

income, partly reduced by the impact of Pretty Simple's October

2022 departure from the 6 Hanovre building, which was sold in April

2023. Together, these movements had a positive net impact on rental

income of €4.6 million.

Operating profit before disposal gains and losses and fair value

adjustments to investment property came to €97.2 million in

first‑half 2023 versus €78.1 million in the year‑earlier period, a

sharp 24.6% increase.

Very resilient portfolio appraisal values

despite the uncertain environment and higher interest

rates

The portfolio’s appraisal value at 30 June 2023 was down 3.4%

like-for-like compared to 31 December 2022, leading to negative

fair value adjustments to investment property of €327.8 million in

first-half 2023. In first-half 2022, fair value adjustments

represented a positive amount of €205.4 million. The higher

capitalisation rates (35 bps on average) and discount rates (40 bps

on average) were partly offset by the visible effects of rent

escalation clauses and rising rental values in Paris for the best

assets.

Net profit/(loss)

Net finance costs stood at €26.1 million in first-half 2023,

versus €13.8 million in the same period of 2022, representing an

increase of €12.3 million. Excluding non-recurring items, the

increase was €11.7 million, reflecting the impact on recurring

finance costs of higher interest rates and the increase in average

debt. After taking account of these key items, EPRA earnings

totalled €53.2 million in first-half 2023, compared to €48.9

million in the same period of 2022. EPRA earnings per share stood

at €1.24 in first-half 2023, up 8.8% from €1.14 in the same period

of 2022. The Group ended the period with an attributable net loss

of €177.5 million, versus a profit of €221.5 million in first-half

2022.

Occupancy rate at a record high 99.7%

First-half 2023 was a period of sustained

letting activity, with new leases signed with existing tenants as

well as new tenants leading to a record 99.7% physical occupancy

rate. After a year shaped by a deteriorating geopolitical

and economic situation, in first-half 2023 the Paris office rental

market became more selective, with prime assets and those in the

best locations being the most in demand. In this environment, the

Group signed leases on some 29,000 sq.m. of mainly office space

during the period. Lease deals mainly concerned:

- 131 Wagram, with the TV5 Monde lease on

7,200 sq.m. of office space rolled over for 12 years; -

#cloud.paris, with a new lease signed with a luxury goods company

on 9,500 sq.m. of office space; - Edouard VII, with two new leases

signed on a total of 7,200 sq.m. of office space, mainly consisting

of the partial rollover of an existing lease with Klépierre; -

office space in the Washington Plaza, Cézanne Saint-Honoré and 103

Grenelle properties, and - around 850 sq.m. of retail units.

The average nominal rent for the new office leases increased

sharply to €835 per sq.m., corresponding to an effective rent of

€692 per sq.m., for an average non-cancellable period of 8.6 years.

These lease terms attest to the attractiveness of the Group’s

properties.

The physical occupancy rate for revenue-generating properties at

30 June 2023 was a record 99.7% (compared with 99.5% at 31 December

2022). The EPRA vacancy rate was 0.4% (versus 0.6% at 31 December

2022).

A pipeline focused mainly on two major projects representing

a very low risk

Properties undergoing redevelopment at 30 June 2023 represented

14% of the total portfolio. Of the total surface area undergoing

redevelopment, around 83% concerned two major projects:

- Retail space in the Louvre Saint-Honoré

building, which is scheduled for delivery in the second half of

2023 under a turnkey lease on over 20,000 sq.m. signed with the

Richemont group (Cartier). Work on the project was pursued during

the period according to schedule.

- The Scope (formerly Rives de Seine) office

building on Quai de la Râpée in Paris (approximately 23,000 sq.m.),

which was vacated by the tenant on 30 September 2022 and will be

extensively redeveloped. The building permit was issued in June

2023 and site clearance/asbestos removal work has begun, with

delivery planned for 2026.

Capitalised work carried out in first-half 2023 amounted to

€28.5 million, including the above projects for a total of €14.5

million and large-scale renovation of the shell of the Galerie des

Champs-Elysées and complete floors in the Washington Plaza

building.

Purchases/sales – continued strategic refocusing on

Paris

On 11 April 2023, SFL sold the 6 rue de Hanovre building in

Paris (2nd arrondissement) to the GCI/Eternam joint venture for a

net selling price of €58.3 million. The building’s tenant moved out

in October 2022 and the 4,600 sq.m. complex was sold untenanted in

its condition on the transaction date.

Disciplined financing strategy with a strong environmental

focus

Against a backdrop of steadily rising interest rates, during

first-half 2023 the Group obtained an €835 million revolving credit

facility from a pool of ten leading international banks. The

facility includes a margin adjustment mechanism based on the

achievement of three ambitious targets concerning carbon emissions

reduction, environmental certification of assets and Global Real

Estate Sustainability Benchmark (GRESB) rating. The five-year

facility (with two 1-year extension options) will be used to

refinance existing facilities and partially cancel credit lines

expiring in 2025 and 2027. It will strengthen SFL’s liquidity

position, while also extending the average maturity of debt as part

of the Group’s proactive balance sheet management strategy.

Net debt at 30 June 2023 amounted to €2,582 million compared

with €2,438 million at 31 December 2022, representing a

loan-to-value ratio of 30.6%. The average cost of debt after

hedging was 1.9% at 30 June 2023 and the average maturity was 4.0

years. At 30 June 2023, the interest coverage ratio stood at

3.8x.

Lastly, at 30 June 2023, the Group had access to €1,600 million

in undrawn confirmed lines of credit.

Net asset value: EPRA NDV per share down 9.1% at €98.5 after

payment of an exceptional dividend of €4.20 in April 2023

The portfolio’s consolidated appraisal value at 30 June 2023 was

€7,909 million excluding transfer costs, down 4.1% from €8,246

million at 31 December 2022. The like-for-like change was a

decrease of 3.4%.

The average EPRA topped-up Net Initial Yield (NIY) was 3.4% at

30 June 2023, up from 3.1% at 31 December 2022.

At 30 June 2023, EPRA Net Tangible Assets (NTA) stood at €98.7

per share (€4,233 million in total, a decline of 8.1% over the

first half of the year) and EPRA Net Disposal Value (NDV) was €98.5

per share (€4,225 million in total, down 9.1% over the period),

after payment of an exceptional dividend of €4.20 in April

2023.

EPRA indicators

H1 2023

H1 2022

EPRA Earnings (€m)

53.2

48.9

/share

€1.24

€1.14

EPRA Cost Ratio (including vacancy

costs)

13.7%

17.9%

EPRA Cost Ratio (excluding vacancy

costs)

12.7%

16.8%

30/06/2023

31/12/2022

EPRA NRV (€m)

4,703

5,104

/share

€109.7

€119.1

EPRA NTA* (€m)

4,233

4,603

/share

€98.7

€107.4

EPRA NDV (€m)

4,225

4,644

/share

€98.5

€108.3

EPRA Net Initial Yield (NIY)

2.2%

2.4%

EPRA topped-up NIY

3.4%

3.1%

EPRA Vacancy Rate

0.4%

0.6%

* Transfer costs are included at their amount as determined in

accordance with IFRS (i.e., 0).

30/06/2023

31/12/2022

LTV

30.6%

27.6%

100%, including transfer costs

EPRA LTV (including transfer

costs)

100%

31.8%

29.2%

Attributable to SFL

36.7%

33.8%

EPRA LTV (excluding transfer

costs)

100%

34.0%

31.2%

Attributable to SFL

39.1%

36.1%

Alternative Performance Indicators (APIs)

EPRA Earnings API

€ millions

H1 2023

H1 2022

Attributable net profit

(177.5)

221.5

Less:

Fair value adjustments to investment

property

327.8

(205.4)

Profit on asset disposals

0.2

0.4

Fair value adjustments to financial

instruments, discounting adjustments to debt and related costs

0.6

0.1

Tax on the above items

(12.0)

(0.7)

Non-controlling interests in the above

items

(85.9)

33.0

EPRA earnings

53.2

48.9

Average number of shares (thousands)

42,879

42,865

EPRA earnings per share

€1.24

€1.14

EPRA NRV/NTA/NDV APIs:

€ millions

30/06/2023

31/12/2022

Attributable equity

4,020

4,379

Treasury shares

0

2

Fair value adjustments to owner-occupied

property

36

35

Unrealised capital gains on intangible

assets

4

4

Elimination of financial instruments at

fair value

(13)

(15)

Elimination of deferred taxes

193

203

Transfer costs

464

496

EPRA NRV (Net Reinstatement

Value)

4,703

5,104

Elimination of intangible assets

(2)

(2)

Elimination of unrealised gains on

intangible assets

(4)

(4)

Elimination of transfer costs*

(464)

(496)

EPRA NTA (Net Tangible Assets)

4,233

4,603

Intangible assets

2

2

Financial instruments at fair value

13

15

Fixed-rate debt at fair value

169

228

Deferred taxes

(193)

(203)

EPRA NDV (Net Disposal Value)

4,225

4,644

* Transfer costs are included at their amount as determined in

accordance with IFRS (i.e., 0).

Net debt API

€ millions

30/06/2023

31/12/2022

Long-term borrowings and derivative

instruments

1,975

2,074

Short-term borrowings and other

interest-bearing debt

636

415

Debt in the consolidated statement of

financial position

2,611

2,488

Less:

Accrued interest and deferred recognition

of debt arranging fees

28

19

Cash and cash equivalents

(57)

(69)

Net debt

2,582

2,438

More information is available at

www.fonciere-lyonnaise.com/en/publications/results

About SFL

Leader in the prime segment of the Parisian commercial real

estate market, Société Foncière Lyonnaise stands out for the

quality of its property portfolio, which is valued at €7.9 billion

and is focused on the Central Business District of Paris

(#cloud.paris, Edouard VII, Washington Plaza, etc.), and for the

quality of its client portfolio, which is composed of prestigious

companies in the consulting, media, digital, luxury, finance and

insurance sectors. As France’s oldest property company, SFL

demonstrates year after year an unwavering commitment to its

strategy focused on creating a high value in use for users and,

ultimately, substantial appraisal values for its properties.

Stock market: Euronext Paris Compartment A – Euronext Paris ISIN

FR0000033409 – Bloomberg: FLY FP – Reuters: FLYP PA

S&P rating: BBB+ stable outlook

www.fonciere-lyonnaise.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230720381483/en/

SFL - Thomas Fareng - T +33 (0)1 42 97 27 00 -

t.fareng@fonciere-lyonnaise.com

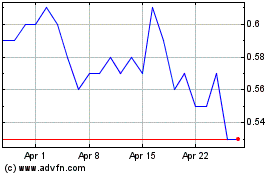

Flyht Aerospace Solutions (TSXV:FLY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Flyht Aerospace Solutions (TSXV:FLY)

Historical Stock Chart

From Feb 2024 to Feb 2025