SFL Sells the 6 Hanovre Building in Paris (2nd arr.) to Générale Continentale Investissements (GCI) and Eternam

April 11 2023 - 12:28PM

Business Wire

The joint venture set up between GCI and Eternam has today

acquired from SFL the 4,600 sq.m. 6 Hanovre building in Paris’s 2nd

arrondissement

Regulatory News:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230411005828/en/

6 Hanovre - SFL

Owned by SFL (Paris:FLY) since 1958, 6 Hanovre is a historic

Paris building located on rue de Hanovre close to the Opéra in the

French capital’s 2nd arrondissement. The 9-storey building, whose

façade is listed in the Inventaire Supplémentaire des Monuments

Historiques, offers 3,000 sq.m. of office space and 1,600 sq.m. of

basement space. Following the departure of Pretty Simple in October

2022, SFL began renovating the façade. This work will be continued

by the buyers, who plan to redevelop the building.

The asset was sold untenanted, in its current condition, for

€58.3 million net.

SFL said, “This sale is in line with SFL’s targeted and

opportunistic strategy, which focuses on investing in very large

office complexes in Paris and disposing of smaller, non-strategic

assets. The transaction is accretive, as the building is

untenanted, and reinforces SFL’s asset values, because the

transaction price is consistent with the property’s most recent

appraisal value.”

Raphael Raingold, Managing Partner of GCI said, “This

acquisition is aligned with our strategic focus on building a

portfolio of exceptional assets particularly well served by public

transport, which need to be redesigned in accordance with the

latest market standards. With our experience and success in the

Opéra district, we are confident that this asset will attract

blue-chip tenants. We are delighted to start a new partnership with

Eternam, a leading real estate company that shares our vision.”

Jonathan Donio, Chief Operating Officer of Eternam said, “This

transaction is an excellent opportunity for Eternam to strengthen

its exposure in the CBD. With its prime location, history and

architecture, the building has all the qualities required to be a

success. We are pleased to be able to bring this property back to

life with GCI, an internationally renowned player in the Paris

office property sector.”

The buyers were advised by C&C Notaires, Archers, Fairway,

BCLP, Europtima, HSF and GALM. SFL was advised by Anne-Hélène

Garnier (Oudot). The transaction was carried out by CBRE under a

joint exclusive mandate with JLL. Financing was provided by Aareal,

which was advised by Allez, and Archers.

About Générale Continentale Investissements

Created in 1975, Générale Continentale Investissements (GCI) is

one of France’s leading commercial property developers and

investors. GCI has invested alongside renowned international

partners in over 1.7 million sq.m. of office and other commercial

property, mainly in Paris, the Paris region, Lyon and London. Its

investments have included renovation projects, new developments and

acquisitions of tenanted buildings.

For more information, visit www.gci-site.com

About Eternam

Eternam is a regulated asset management company which operates

on the whole real estate value chain: collective investment funds,

club deals, investment advisory and residential investments. Its

team of 18 professionals possess strong expertise in sourcing and

structuring commercial real estate transactions, through its

involvement in more than 40 club deals and 10 investment funds in

the real estate and hospitality sectors. In the last five years,

Eternam has invested more than €1.5 billion in equity and currently

manages €700 million.

For more information, visit www.eternam.fr

About SFL

Leader in the prime segment of the Parisian commercial real

estate market, Société Foncière Lyonnaise stands out for the

quality of its property portfolio, which is valued at €8.2 billion

and is focused on the Central Business District of Paris

(#cloud.paris, Edouard VII, Washington Plaza, etc.), and for the

quality of its client portfolio, which is composed of prestigious

companies in the consulting, media, digital, luxury, finance and

insurance sectors. As France’s oldest property company, SFL

demonstrates year after year an unwavering commitment to its

strategy focused on creating a high value in use for users and,

ultimately, substantial appraisal values for its properties.

Stock market: Euronext Paris Compartment A – Euronext Paris ISIN

FR0000033409 – Bloomberg: FLY FP – Reuters: FLYP PA

S&P rating: BBB+ stable outlook

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230411005828/en/

GCI contacts: Raphael Raingold +33

(0)1 56 68 48 00 – raphael.raingold@gci-site.com Press Office: Treize Cent Treize – Alain N’Dong –

+33 (0)1 53 17 97 13 – Presse_GCI@treizecenttreize.fr

Eternam contacts: Amandine Adam:

aadam@eternam.fr

SFL – Thomas Fareng – T +33 (0)1 42 97 27 00 –

t.fareng@fonciere-lyonnaise.com www.fonciere-lyonnaise.com

Flyht Aerospace Solutions (TSXV:FLY)

Historical Stock Chart

From Jan 2025 to Feb 2025

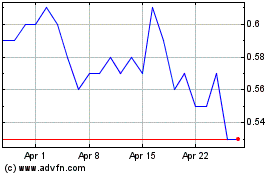

Flyht Aerospace Solutions (TSXV:FLY)

Historical Stock Chart

From Feb 2024 to Feb 2025